Transcriptomics Technologies Market Outlook:

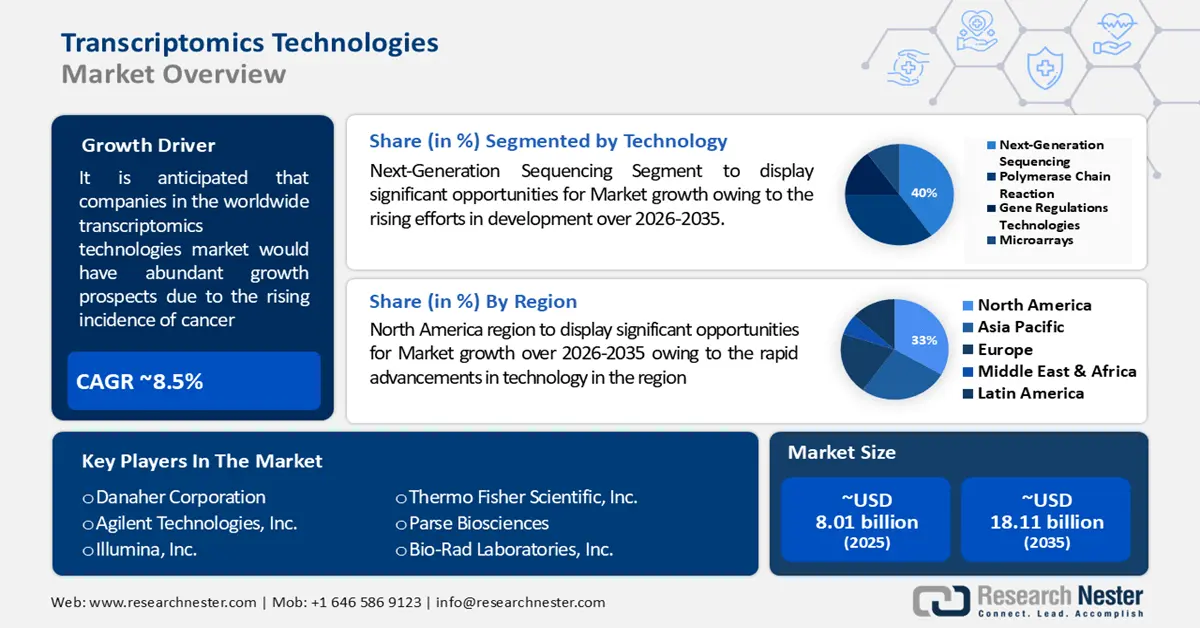

Transcriptomics Technologies Market size was over USD 8.01 billion in 2025 and is poised to exceed USD 18.11 billion by 2035, witnessing over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transcriptomics technologies is estimated at USD 8.62 billion.

It is anticipated that companies in the worldwide market would have abundant growth prospects due to the rising incidence of cancer. The American Cancer Society projects that in 2019, there will be 606,880 cancer-related deaths in the United States and 1,762,450 new instances of cancer identified.

In addition to these, the ongoing enhancement of the healthcare infrastructure and the growing investments in research & development are giving the market a significant boost in growth. The necessity for drug research and development is underscored by the global incidence of diseases including diabetes, hepatitis B, and cancer, which is also a major factor propelling the transcriptomics technologies market.

Key Transcriptomics Technologies Market Insights Summary:

Regional Highlights:

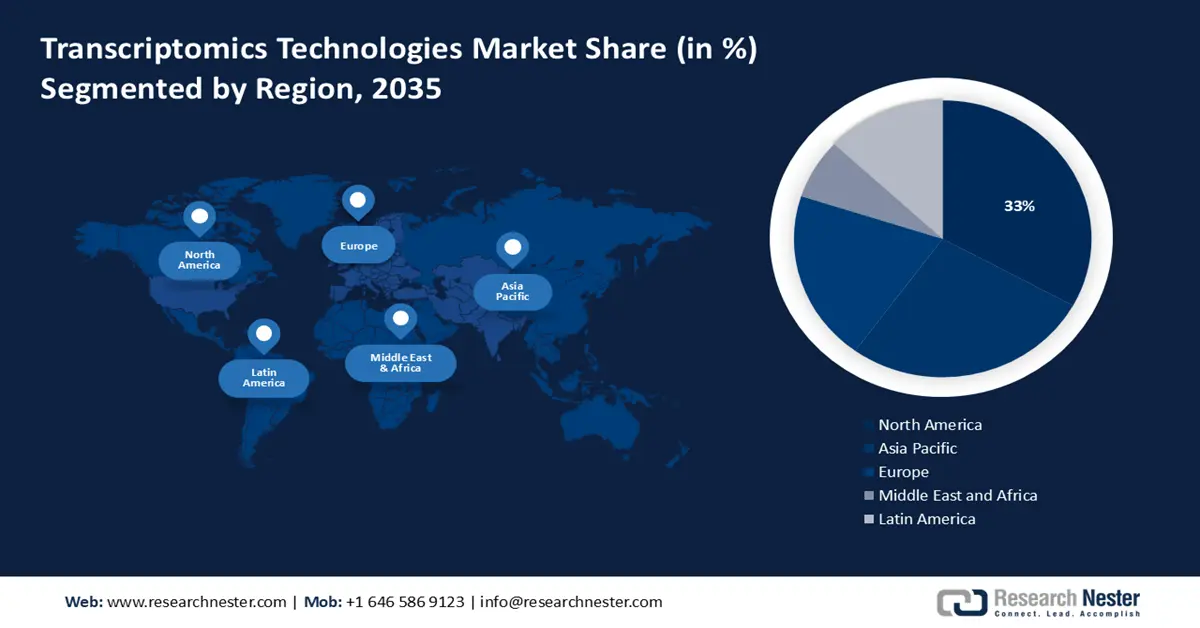

- North America transcriptomics technologies market will hold more than 33% share by 2035, attributed to technological advancements and expanded drug discovery practices.

- Asia Pacific market will achieve a 27% share by 2035, driven by the rising demand for RNA-based NGS in biotechnology.

Segment Insights:

- The next-generation sequencing segment in the transcriptomics technologies market is anticipated to experience robust growth through 2035, driven by advancements in sequencing technology and its broad applications.

- The drug discovery & research segment in the transcriptomics technologies market is anticipated to see significant growth through 2035, attributed to increased funding and demand for medication research.

Key Growth Trends:

- Growing Emphasis on The Creation of Bioinformatics Services and Tools

- Manufacturer Activities in Next-Generation Sequencing and Technological Improvements

Major Challenges:

- Consequences of incorporating transcriptome and genome data from RNA sequencing into mechanistic models of signalpath

- COVID-19 may have an effect on the world transcriptomics technologies market.

Key Players: Danaher Corporation, Agilent Technologies, Inc., F. Hoffmann-La Roche AG, Illumina, Inc., Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Pacific Bioscience of California, Inc., BioSkryb Genomics, Agilent Technologies Inc., Parse Biosciences.

Global Transcriptomics Technologies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.01 billion

- 2026 Market Size: USD 8.62 billion

- Projected Market Size: USD 18.11 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Transcriptomics Technologies Market Growth Drivers and Challenges:

Growth Drivers

- Growing Emphasis on The Creation of Bioinformatics Services and Tools- The growing emphasis on the creation of bioinformatics tools and services portends well for the worldwide transcriptomics technologies industry. Research institutes, corporations, and academic institutions are under pressure to build complex and dependable software to handle the abundance of research data due to the growing number of research and development operations. Thus, there are numerous chances for software and life science enterprises to create cutting-edge bioinformatics instruments. Because of all these variables, the opportunity in the worldwide transcriptomics technologies market was estimated to be worth USD 2.55 billion in 2015. It is expected to generate revenue from 2013 to 2019, reaching USD 4.62 billion by that year.

- Manufacturer Activities in Next-Generation Sequencing and Technological Improvements- Individual cell profiling has become standard procedure in research labs across the globe because to the quick decline in cost and advances in next-generation sequencing. The field of single-cell transcriptomics, which involves single-cell RNA sequencing (SC-RNA-seq), holds great promise for revealing the unique foundation of human existence. Single-cell transcriptomics provides a more comprehensive understanding of the well-known heterogeneity of cells at the individual level. Over the course of the forecast period, the launch of new microarrays is anticipated to fuel the expansion of the global transcriptomics technologies market. Agilent Technologies Inc., for example, introduced Agilent GenetiSure Cyto microarrays for prenatal and postnatal research in March 2020.

Initiatives to promote personalized treatment are also anticipated to accelerate market expansion. - Growing Automation and Personalized Medicine Needs to Drive Market Demand- Technological advancements and improvements have led to an increase in automation, and these characteristics are important for transcriptome analysis techniques like SAGE and nucleic acid amplification. The employment of the aforementioned technologies in the study of gene expression will further contribute to the development and utilization of RNA interference and sequencing technologies. A significant actor in the technology industry, next-generation sequencing was brought about by the increase in demand for targeted and whole RNA sequencing. Rising demand for customized medications and accelerating improvements in healthcare infrastructure are expected to drive the expansion of drug discovery and research during the projected period, which will eventually drive the growth of the worldwide transcriptomics technologies market .

Challenges

- Consequences of incorporating transcriptome and genome data from RNA sequencing into mechanistic models of signalpath- While RNA-seq genomics is highly versatile, it has two significant limitations. Firstly, the genomic data present in the RNA-Seq reads is typically not utilized. Nevertheless, it is possible to extract genomic variants from such sequences that might hold vital information regarding the operation and possible activity of the resulting proteins in the many processes in which they take part. It is commonly recognized that RNA-Seq has certain difficulties when it comes to calling DNA variants. Lowly expressed genes should be considered for two main reasons. As a result, variant calling is more difficult in such areas, and allele-specific gene expression may limit the identification of heterozygous variants.

- As technology has developed, there has been a rising concern about the complexity of the data when transcripts are analyzed using sequencing platforms.

- COVID-19 may have an effect on the world transcriptomics technologies market.

Transcriptomics Technologies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 8.01 billion |

|

Forecast Year Market Size (2035) |

USD 18.11 billion |

|

Regional Scope |

|

Transcriptomics Technologies Market Segmentation:

Technology Segment Analysis

Based on technology, next-generation sequencing segment in the transcriptomics technologies market is anticipated to hold 40% of the revenue share during the forecast period. Higher sensitivity to identify low-frequency variants, quicker turnaround times for large sample volumes, increased throughput with sample multiplexing, and the capacity to sequence hundreds to thousands of genes or gene regions at once are among the advantages provided by next-generation sequencing techniques. Furthermore, the segment's growth is being driven by the rapid advancements in technology that allow for the investigation of the cellular transcriptome from several perspectives, the expansion of NGS's application areas, and the growing outsourcing of sequencing technologies. There is now a significant amount of sequencing data available at a reasonable cost because to recent advancements in next-generation sequencing technologies. Studies on transcriptomics and genomes have been transformed by it. Global total revenues were estimated to be 4.2 billion dollars in 2016, and estimates indicate that by 2025, this figure will rise to around 23 billion dollars.

Application Segment Analysis

Based on application, drug discovery & research segment in the transcriptomics technologies market is anticipated to hold 30% of the revenue share during the forecast period. Segment is anticipated to stay in the lead during the projection period due to a growth in the number of product approvals and a rise in the demand for medication research. Growing private and public funding for research, along with R&D investments by pharmaceutical and biotechnology companies, are anticipated to drive industry growth because of the rigorous genomics and proteomics R&D initiatives and the application of RNA sequencing technologies in analytical research. For instance, the publication states that genome-based detection rates for several Mendelian illnesses will reach a ceiling of roughly 50% in 2021.

Our in-depth analysis of the global transcriptomics technologies market includes the following segments:

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transcriptomics Technologies Market Regional Analysis:

North American Market Insights

Transcriptomics technologies market in North America region is predicted to hold largest revenue share of about 33% during the forecast period. The growth of the market is due to the rise in technological advancements and the expansion of drug discovery practices within the healthcare industry. The market expansion in North America is propelled by the existence of prominent industry participants such as Agilent Technologies and Thermo Fisher Scientific. The market for transcriptomics is being driven in North America by the increasing number of people suffering from infectious diseases, chronic illnesses, and cancer, as well as the growing need for innovative therapeutic options in research, diagnostics, and synthetic biology. According to CDC estimates, six out of ten persons in the US presently suffer from a chronic illness like diabetes, heart disease, or cancer. Heart disease and cancer combined account for around 38% of all deaths in the United States, making chronic diseases one of the main causes of death.

APAC Market Market Insights

Transcriptomics technologies market in Asia Pacific region is projected to hold second largest revenue share of about 27% during the forecast period. Transcriptomics is a rapidly expanding market in the APAC due to the rising demand for RNA-based NGS. Moreover, because of the technical advancements in biotechnology and pharmaceuticals in emerging countries like China and India, the transcriptomics technologies market in the Asia Pacific region is anticipated to rise over the forecast period.

Transcriptomics Technologies Market Players:

- Danaher Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche AG

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Pacific Bioscience of California, Inc.

- BioSkryb Genomics

- Agilent Technologies Inc.

- Parse Biosciences

Recent Developments

- May 2022: Launching Early Access Program (EAP) for ResolveOME, a unified single-cell workflow that amplifies the entire transcriptome and genome from the same cell. BioSkryb Genomics is a biotech company that develops advanced single-cell analysis tools. The necessity to divide up the source material or analyze different datasets was removed by this unification. Applications for the EAP will be accepted from businesses and researchers at the Advances in Genome Biology and Technology (AGBT) 2022 General Meeting, which will be held in Orlando from June 6–9. First access to BaseJumperTM, a bioinformatics platform for sorting, analyzing, and interpreting very large single-cell analysis data sets, and BioSkryb's ResolveOME technology will be granted through the EAP.

- January 2022: Parse Biosciences, a company that offers single-cell sequencing solutions to researchers, announced a partnership with Research Instruments Pte Ltd to supply Parse's Nuclei Fixation Kits, Cell Fixation Kits, and Evercode Whole Transcriptome Kits (WTKs) to Southeast Asian and Singaporean markets. As per the mutual agreement, Research Instruments has been designated as the distributor for Singapore, Thailand, Malaysia, and Vietnam of the Parse product line.

- Report ID: 5982

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transcriptomics Technologies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.