Topical Oxygen Therapy Market Outlook:

Topical Oxygen Therapy Market size was valued at USD 23.5 million in 2025 and is projected to reach USD 33.1 million by the end of 2035, rising at a CAGR of 3.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of topical oxygen therapy is estimated at USD 24.4 million.

The topical oxygen therapy market is continuously growing across different nations, owing to a surge in chronic wounds, technological advancements in oxygen delivery, and reimbursement facilities. According to an article published by the Asian Journal of Dental and Health Sciences in March 2024, chronic wounds affected an estimated 2.2 per 1,000 people, thereby making them a prevalent challenge that needs to be addressed. In addition, certain factors, including neuropathy, prolonged pressure, vascular disease, and poor nutrition, lead to chronic conditions. Besides, as stated in the April 2023 Frontiers Organization report, 21% of oxygen is suitable for healthy individuals, but medical-grade oxygen is essential for suffering patients, thus suitable for the market’s demand.

Furthermore, an increase in the aging population, a sudden shift towards home healthcare services, clinical efficacy, and expansion in emerging nations are also positively impacting the market globally. As per the July 2023 AMA report, 40% of healthcare is always delivered at home based on revolutions in home healthcare models. In addition, 2/3rd of global individuals between 60 years to 79 years mostly prefer to stay home and receive required health and medical services. Besides, it has been estimated that 25% of the overall care expense for Medicare beneficiaries will shift to home-based care without reducing the quality and accessibility, thus denoting a growth opportunity for the market.

Key Topical Oxygen Therapy Market Insights Summary:

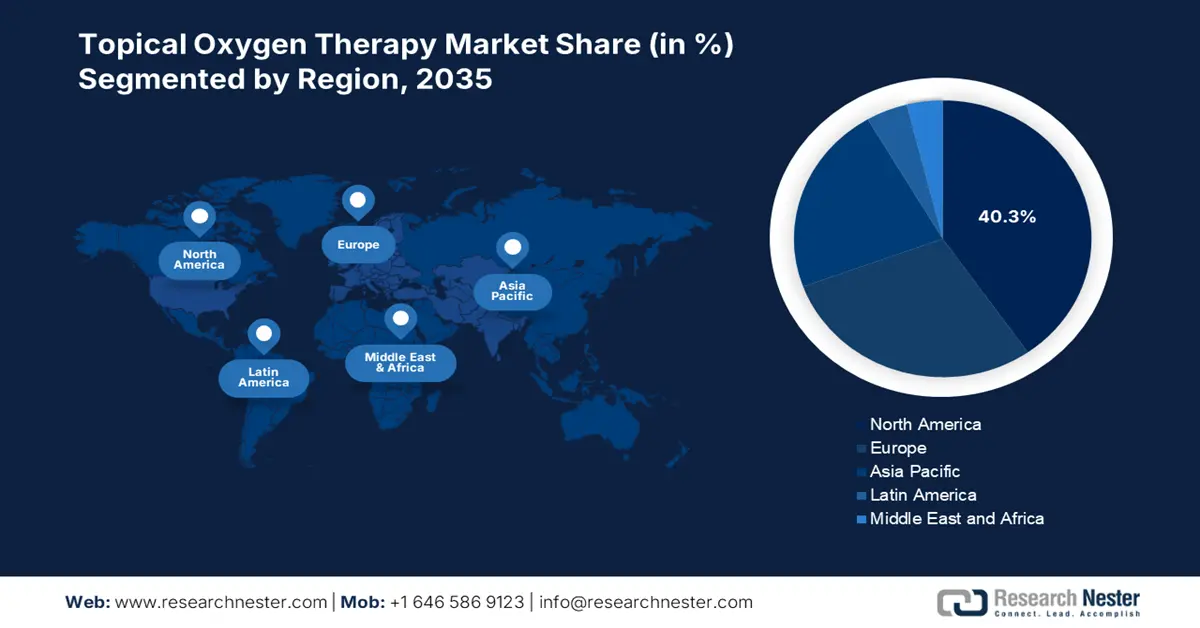

Regional Insights:

- North America is projected to hold the largest share of 40.3% by 2035, driven by robust reimbursement policies, innovation in R&D activities, and a surge in the elderly population.

- Asia Pacific is expected to reach 22.2% share by 2035, impelled by the rising prevalence of chronic conditions among the elderly, growth in healthcare facilities, and medical tourism.

Segment Insights:

- The continuous diffusion oxygen therapy (CDOT) segment is projected to account for 55.7% share by 2035, propelled by its healing capability, direct oxygen delivery to non-healing chronic wounds, enhancing tissue oxygenation, and readily stimulating growth factors.

- The chronic wounds segment is expected to hold 48.3% share by 2035, owing to increased oxygen delivery that supports collagen synthesis, angiogenesis, epithelialization, and infection resistance.

Key Growth Trends:

- Expansion in tele-wound care platforms

- Trauma and military applications

Major Challenges:

- Disruptions in raw material supply chain

- Cost-effective barriers in patients

Global Topical Oxygen Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.5 million

- 2026 Market Size: USD 24.4 million

- Projected Market Size: USD 33.1 million by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Australia

Last updated on : 5 September, 2025

Topical Oxygen Therapy Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in tele-wound care platforms: These platforms are crucial to enhance patient accessibility for ensuring specialized care services, particularly in rural areas, to diminish travel, which is positively impacting the market. According to the April 2023 NLM article, chronic wounds prevalence accounts for 2.2 per 1,000 population, resulting in patients losing a day’s wage for receiving care services. However, to combat this condition, the telehealth adoption facilitates advancement in wound care delivery, which includes hybrid models and training initiatives for chronic wound management.

- Trauma and military applications: The global market plays a critical role in military and trauma settings to reduce hypoxia that tends to damage organs and provide sufficient oxygen for tissue survival. According to the October 2023 NLM report, post-traumatic stress disorder (PTSD) affects almost 30% of veterans, leading to long-lasting occupational, behavioral, and social dysfunctions. To keep a control on this, hyperbaric oxygen therapy (HBOT) constitutes 100% oxygen inhalation, especially at pressures exceeding 1 atmosphere absolute (ATA), thereby suitable for uplifting the overall market globally.

- Sustainability-based innovations: The aspect of sustainability is crucial for the market to provide equal, reliable, and affordable accessibility to life-saving oxygen. This is effectively possible by developing strong healthcare facilities, integrating efficient oxygen utilization, creating sustainable production, and fostering international collaboration. For instance, the August 2022 NLM article noted that the pulse oximetry follow-up rate was 83% for neonates and 81% for children. In addition, the oxygen coverage for hypoxaemic neonates and children was 94% and 88%, thereby uplifting the market’s demand.

Medicare Beneficiaries for Chronic Wounds

Medicare Wound Care Trends (2014-2019)

|

Metric |

Start Period |

End Period |

|

Total Beneficiaries with Wounds |

8.2 million |

10.5 million |

|

Wound Prevalence |

14.5% |

16.4% |

|

Chronic Wound Prevalence (Age <65) |

|

|

|

- Males |

12.5% |

16.3% |

|

- Females |

13.4% |

17.5% |

|

Wound Type Changes |

|

|

|

- Arterial Ulcers |

0.4% |

0.8% |

|

- Skin Disorders |

2.6% |

5.3% |

|

- Traumatic Wounds |

2.7% |

1.6% |

|

Expenditures (Most Conservative Method) |

USD 29.7 billion |

USD 22.5 billion |

|

Cost per Wound Type |

|

|

|

- Venous Ulcers |

USD 1,206 |

USD 1,803 |

|

- Surgical Wounds |

USD 3,566 |

USD 2,504 |

|

- Arterial Ulcers |

USD 9,651 |

USD 1,322 |

|

Expenditure by Service Setting |

|

|

|

- Hospital Outpatient |

USD 10.5 billion |

USD 2.5 billion |

|

- Home Health Agency |

USD 1.6 billion |

USD 1.1 billion |

|

- Physician Offices |

USD 3.0 billion |

USD 4.1 billion |

|

- Durable Medical Equipment |

USD 0.3 billion |

USD 0.7 billion |

Source: Taylor & Francis Online, July 2023

Needles, Catheters, and Cannula Sourcing Driving the Topical Oxygen Therapy Market

2023 Import and Export Data

|

Countries |

Import |

Export |

|

United States |

USD 7.6 billion |

USD 6.9 billion |

|

Ireland |

- |

USD 4.4 billion |

|

Mexico |

- |

USD 4.3 billion |

|

Netherlands |

USD 4.9 billion |

- |

|

Germany |

USD 2.7 billion |

- |

Source: OEC, July 2025

Challenges

- Disruptions in raw material supply chain: The presence of COVID-19 aftershocks and geopolitical tensions continues to disrupt severe supplies, thus negatively impacting the market. For instance, medical-grade silicone tends to witness volatility in yearly pricing strategy, which is majorly sourced from China. Besides, the Epifix production was halted, owing to a shortage in Taiwan-based silicone. However, organizations are initiating payments for dual sourcing, based on which there is an increase in expenses, along with rapid delivery.

- Cost-effective barriers in patients: The existence of catastrophic out-of-pocket expenses creates havoc in treatment facilities, which has caused a hindrance in the market. In addition, the aspect of increased oxygen therapy cost is also affecting people globally, with less than half of the people from developed countries facing the same situation. However, India has readily exemplified this issue by subsidizing oxygen therapy at an affordable pricing, particularly for patients from rural locations, residing far away from treatments facilities.

Topical Oxygen Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 23.5 million |

|

Forecast Year Market Size (2035) |

USD 33.1 million |

|

Regional Scope |

|

Topical Oxygen Therapy Market Segmentation:

Product Segment Analysis

The continuous diffusion oxygen therapy (CDOT) segment in the topical oxygen therapy market is projected to garner the largest share of 55.7% by the end of 2035. The segment’s growth is highly driven by its healing capability, direct oxygen delivery to non-healing chronic wounds, enhancing tissue oxygenation, and readily stimulating growth factors. As stated in the December 2023 Journal of Surgical Research report, a clinical study was conducted on 16 participants undergoing bilateral reduction mammoplasty (BRM). With the CDOT integration, the protocol delivery rate was 93.7%, along with a device accessibility rate of 85.4%, 78.2% ease of usability, and 77.7% usefulness, thus suitable for the overall segment.

Application Segment Analysis

Chronic wounds segment in the topical oxygen therapy market is expected to hold the second-largest share of 48.3% during the projected timeline. The segment’s development is effectively fueled by an increase in oxygen delivery, ensuring collagen synthesis, angiogenesis, epithelialization, and infection resistance. As per the July 2023 NLM article, an estimated 18.6 million people globally readily suffer from diabetic foot ulcers, with 1.6 million people from the U.S. Additionally, this particular ulcer tends to precede 80% of lower extremity amputations in people with diabetes, therefore, enhancing the market’s demand internationally.

End user Segment Analysis

The hospitals segment in the topical oxygen therapy market is anticipated to hold the third-largest share of 40.7% by the end of the projected duration. The segment’s upliftment is extremely propelled by an increase in patient volumes, Medicare reimbursements, an innovative wound care facility, and regulatory-approved fuel implementation. For instance, the Medicaid in the U.S. covers FDA-approved devices, while G-BA guidelines in Germany ensure in-hospital oxygen therapy coverage. Besides, the sudden shift towards outpatient wound clinics, as well as hybrid telemedicine models, is also bolstering the segment in the market.

Our in-depth analysis of the global topical oxygen therapy devices market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

End user |

|

|

Wound Type |

|

|

Technology |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Topical Oxygen Therapy Market - Regional Analysis

North America Market Insights

North America in the topical oxygen therapy market is projected to emerge as the dominant region, with the highest share of 40.3% by the end of 2035. The market’s growth in the region is highly attributed to the presence of robust reimbursement policies, innovation in research and development (R&D) activities, and a surge in the elderly population. According to an article published by NLM in June 2023, the provision of USD 32 million investment in the region’s healthcare has successfully saved millions of lives. Additionally, there have been advancements in medical specialization, with 90% of graduating internal medicine residents, particularly in the U.S., thereby suitable for the market’s upliftment.

The market in the U.S. is significantly growing, owing to expansion in Medicaid services, wound care demand for military, private insurance coverage, and an increase in obesity and diabetes rates. According to the May 2024 CDC report, 38.5 million people across overall age categories, accounting for 11.6% of the population, are affected by diabetes. Additionally, 38.1 million adults, aged more than 18 years, catering to 14.7% of adults in the country, were affected by the disease. Therefore, the utilization of topical oxygen therapy assists in healing diabetic conditions, which is positively impacting the overall market.

The market in Canada is also growing due to efficiency in the single-payer system, provincial health priority, indigenous health programs, and cold climate impact. As per the November 2024 Obesity Canada data report, the inaction expense of aiding obesity has increased by USD 27.6 billion, which is 20% more than the previously estimated cost. Besides, 1 in 3 people in the country reside with obesity, and there has been a staggering increase in both direct and indirect expenses. Therefore, with a surge in expenses for chronic condition treatments, there is a huge opportunity for the market to flourish in the country.

Diabetes and Obesity 2021 Rates in The U.S. and Canada

|

Diabetes in the U.S. |

Obesity in Canada |

||

|

Characteristics |

Diagnosed (%) |

Characteristics |

Percentage |

|

Overall |

11.3 |

Adults with BMI |

29.5 |

|

Men |

12.6 |

Overweight BMI |

35.5 |

|

Women |

10.2 |

Combined overweight and obesity |

65 |

|

White, non-Hispanic |

11.0 |

Men |

39.7 |

|

Black, non-Hispanic |

12.7 |

Women |

31.3 |

|

Hispanic |

11.1 |

Prevalence among the youngest and oldest |

22.5 and 21.2 |

Sources: CDC, May 2024; Government of Canada, June 2025

APAC Market Insights

Asia Pacific in the market is projected to be the fastest-growing region, accounting for a share of 22.2% by the end of the forecast duration. The market’s development in the region is subject to an increase in chronic prevalence among the elderly population, suitable growth in healthcare facilities, and the presence of medical tourism. According to the April 2023 NLM article, the region is predicted to witness a surge in the elderly population to 4.9 billion by the end of 2030. In addition, technological innovation has been extended in healthcare services, along with care facilities accessibility, which is positively impacting the overall market.

The market in China is gaining increased exposure, owing to the Health China 2030 strategy by the government, a boom in regional manufacturing, division in urban and rural health, focus on elderly care, and road medical exports. According to the 2023 World Integrated Trade Solution report, the top exporters of medical oxygen to the country were Hong Kong, accounting for USD 350,840, followed by USD 14,520 from the U.S., USD 11,840 from the Europe Union, USD 9,870 from France, and USD 4,300 from Korea. Besides, the 2022 Forum of Federations report denoted that the health expenditure GDP is 3.7% for rural locations in the country, thus suitable for the market’s development.

The topical oxygen therapy market in India is also growing due to expansion in Ayushman Bharat, medical device availability, conventional medicine adoption, and telemedicine integration. As per the June 2025 PIB report, Ayushman Bharat’s Pradhan Mantri Jan Arogya Yojana (PM-JAY) scheme targeted 40% of the country’s population, effectively covering 12.3 crore (123 million) families, of which 55 crore (550 million) readily benefited. Besides, the Ayushman Vay Vandana scheme covers 58 lakh (580 million) senior citizens, with over 2.6 lakh (2,983) treatments for ₹496 crore (approximately USD 57 million), thus driving the market’s demand.

Europe Market Insights

Europe in the topical oxygen therapy market is expected to account for a considerable share of 29.1% during the forecast period. The market’s development in the region is propelled by aging demographics, the presence of Health Data Space, administrative harmonization, and expansion in telehealth care. According to the April 2022 Digital Europe Organization article, more than 700 million digital health certificates have been issued, owing to the validation and cross-border verification of individual health data. Besides, almost 2.5% of regional and national health budgets are allocated for digital health, thereby denoting a huge growth opportunity for the market.

The topical oxygen therapy market in Germany is steadily growing, owing to the existence of strong reimbursement policies, an increase in technological adoption, government-based R&D incentives, and private insurance coverage. As per the September 2022 NLM article, the German Digital Healthcare Act (DVG) has readily fast-tracked the Digital Health Applications (DiGA) prescription for over 73 million people, effectively insured under the statutory health insurance scheme in the country. Besides, with an increase in DiGA expenses, accounting for 400 euros per quartile, the market’s exposure in the country is gradually surging.

The topical oxygen therapy market in the UK is also growing due to NHS prioritization, innovations in tariff, post-Brexit regulatory agility, artificial intelligence (AI) implementation, along with R&D activities in the private sector. According to an article published by the House of Commons Library in July 2023, the Secretary of State for Health and Social Care’s oral statement on the NHS Long Term Plan notified an increase in NHS England’s yearly allocation by 3.4%. Besides, the Autumn Statement 2022 provided £8 billion as additional funding for the NHS in the country, thereby creating an optimistic outlook for the overall market.

Healthcare Expenditure in Europe as per 2024

|

Countries/Components |

€ Million |

€ per Inhabitant |

PPS per Inhabitant |

% of GDP |

|

Germany |

488,677 |

5,832 |

5,317 |

12.6 |

|

France |

313,574 |

4,607 |

4,302 |

11.9 |

|

Italy |

175,719 |

2,987 |

2,945 |

9.0 |

|

Denmark |

36,067 |

6,110 |

4,154 |

9.5 |

|

Spain |

131,114 |

2,745 |

2,814 |

9.7 |

Source: Eurostat, November 2025

Key Topical Oxygen Therapy Market Players:

- 3M Health Care (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smith & Nephew (UK)

- ConvaTec (UK)

- Mölnlycke Health Care (Sweden)

- Integra LifeSciences (U.S.)

- Coloplast (Denmark)

- Cardinal Health (U.S.)

- AOTI (Ireland)

- EO2 Concepts (U.S.)

- Medline Industries (U.S.)

- B. Braun (Germany)

- HARTMANN GROUP (Germany)

- Lohmann & Rauscher (Germany)

- PolyNovo (Australia)

- Axio Biosolutions (India)

The international topical oxygen therapy market is severely competitive, with the presence of key players, including Nephew, Smith, and 3M, collectively dominating with a considerable market share. Meanwhile, niche players, such as EO2 Concepts and AOTI, are focused on innovation. Besides, mergers and acquisitions, FDA and CE approvals, expansion in emerging markets, and partnerships are a few strategies that other organizations have readily adopted to contribute to the market’s growth. For instance, the partnerships between the NHS and Mölnlycke have resulted in AI-based oxygen dressings, while Coloplast made an expansion in its services by developing manufacturing facilities in India, thereby suitable for the market’s upliftment.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, Mölnlycke Health Care successfully agreed to acquire P.G.F. Industry Solutions GmbH, with the intention to execute its position as one of the global leaders in providing wound care solutions.

- In December 2024, Niterra Ventures Company entered into a partnership with Neoplas Med GmbH to make advancements in healthcare globally by initiating an investment of USD 18 million to escalated the global expansion.

- Report ID: 8057

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Topical Oxygen Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.