Thoracolumbar Spine Devices Market Outlook:

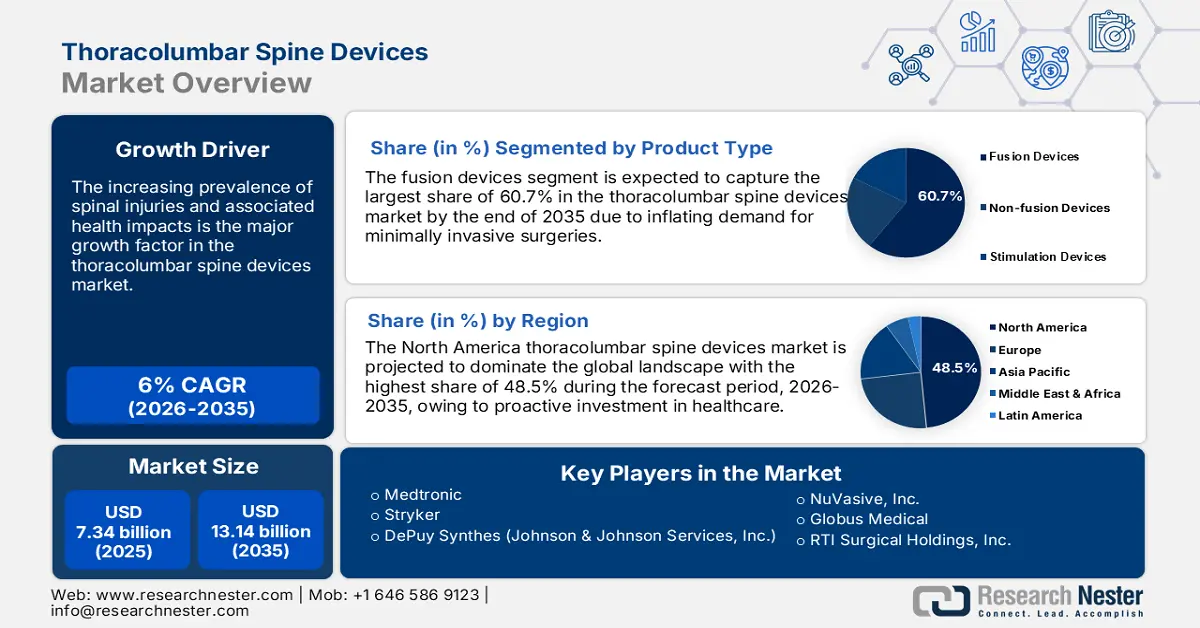

Thoracolumbar Spine Devices Market size was valued at USD 7.34 Billion in 2025 and is expected to reach USD 13.14 Billion by 2035, registering around 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thoracolumbar spine devices is evaluated at USD 7.74 Billion.

The increasing prevalence of spinal injuries and associated health impacts is the major growth factor in the thoracolumbar spine devices market. Cases of traumas and fractures due to accidents, sports, and other heavy physical activities are significantly rising, surging demand for such surgical treatments. According to a WHO report, published in April 2024, around 15 million people in the world were suffering from spinal cord injury (SCI) in the same year. The report further claimed that SCI caused over 4.5 million years of life lived with disability (YLDs) in 2021. This highlights the need for immediate action in upgrading and accommodating healthcare infrastructures to offer uninterrupted treatment.

This further enlarges the thoracolumbar spine devices market, as it serves as a crucial surgical instrument to operate and assist throughout the procedures. Efforts from both higher and lower-income countries to leverage their medical services are also directed toward acquiring high-end medical equipment including thoracolumbar devices. According to the 2023 OEC data, the global medical, surgical equipment, and orthopedic apparatus industry was valued at USD 31.1 billion in Germany alone, increasing by 4.6% from 2022. The report further mentioned the top export destinations to be the U.S., China, Netherlands, France, and Switzerland. This signifies the emphasized production of such tools, indicating a large marketplace for this sector.

Import-Export Data for Medical, Surgical Equipment & Orthopedic Apparatus in Germany:

|

Destination/Origin |

Import |

Export |

|

The U.S. |

USD 5.1 billion |

USD 5.6 billion |

|

China |

USD 1.7 billion |

USD 2.9 billion |

|

Switzerland |

USD 1.8 billion |

USD 1.2 billion |

Key Thoracolumbar Spine Devices Market Insights Summary:

Regional Highlights:

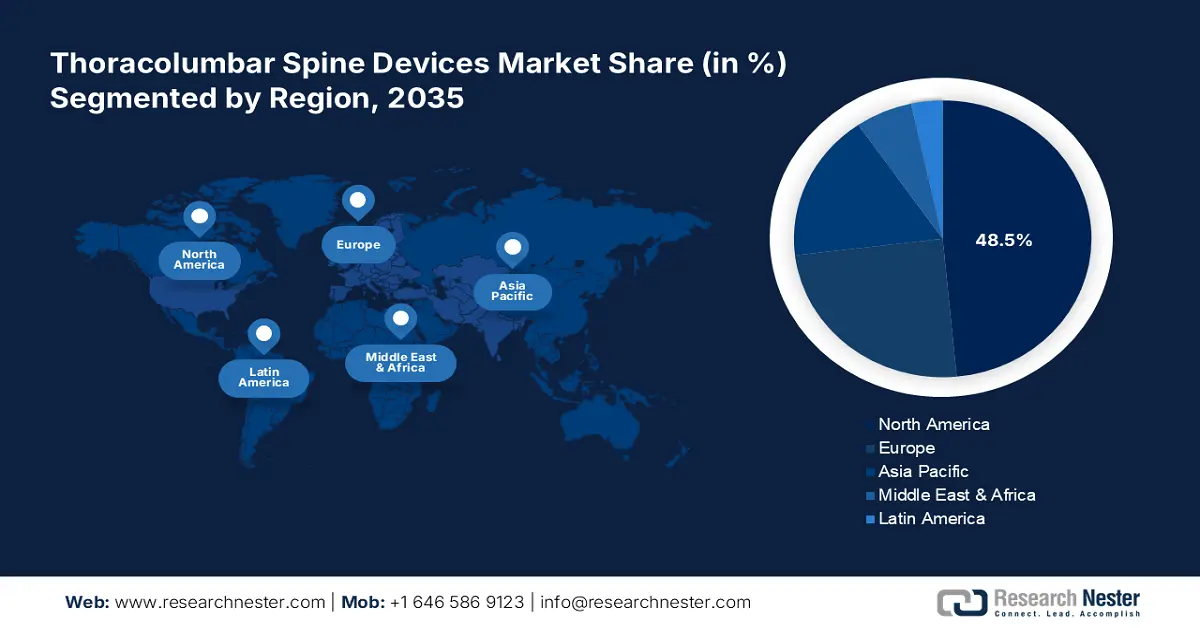

- North America holds a 48.50% share in the Thoracolumbar Spine Devices Market, fueled by investments in advanced surgical techniques and biologics, fostering strong growth prospects through 2035.

- The Asia Pacific region is projected to experience significant growth in the Thoracolumbar Spine Devices Market from 2026 to 2035, driven by lifestyle changes and an aging population increasing spinal disorders.

Segment Insights:

- The Fusion Devices segment is expected to dominate market share by 2035, driven by the adoption of minimally invasive surgeries.

- The Degenerative Disc Disease segment of the Thoracolumbar Spine Devices Market is poised for significant growth from 2026 to 2035, driven by an increasing global aging population suffering from disc degeneration.

Key Growth Trends:

- Advancements in surgical technologies

- Increasing investments in spine surgeries

Major Challenges:

- High surgical expenses

- Concerns about patient outcomes

- Key Players: DePuy Synthes (Johnson & Johnson Services, Inc.), NuVasive, Inc., Globus Medical, Stryker, Medtronic.

Global Thoracolumbar Spine Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.34 Billion

- 2026 Market Size: USD 7.74 Billion

- Projected Market Size: USD 13.14 Billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Thoracolumbar Spine Devices Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in surgical technologies: Technological progress in surgical interventions has remarkably influenced the performance and accuracy of the offerings from the thoracolumbar spine devices market. Penetration of AI and robotics in these procedures has greatly improved patient outcomes, inspiring global leaders to participate in bringing more innovative solutions to the healthcare industry. For instance, in August 2024, DePuy Synthes collaborated with eCential Robotics to develop a proprietary dual-use robotics and standalone navigation platform, VELYS SPINE. The system acquired 510(k) clearance from the FDA, allowing it to be used in spinal fusion procedures.

- Increasing investments in spine surgeries: The thoracolumbar spine devices market is gaining traction by offering elevated reliability during complex surgical interventions. With the growing acceptance and expenditure on spinal surgeries, the demand for advanced medical equipment is inflating. Thus, the expansion of this category subsequently fuels revolution in this sector. According to an NLM report, published in January 2025, venture capital investment in spine surgery accounted for USD 5.3 billion during the timeline 2000-2023. The report further marked the divisional shares of this amount to be 42.6% for nonsurgical devices, 26.3% for surgical devices, and 22.2% for biotechnology.

Challenges

- High surgical expenses: The overall cost of spinal surgery is very high, which can create an economic barrier between consumers and manufacturers in the thoracolumbar spine devices market. Affording essential components such as advanced devices, implants, surgical instruments, and post-operative care often becomes challenging for patients. This may limit the exposure of this sector due to the prohibitively high spending on such treatment. Meanwhile, offering competitive pricing without hampering the quality of the products or procedures can be hard to maintain, restricting market expansion.

- Concerns about patient outcomes: The risk of complications has always been a setback in all surgical industries. Thus, it also impacts the adoption in the thoracolumbar spine devices market due to the concern of patients. It may prevent patients from allowing surgeries in order to cure their spine-related issues. This can further hinder the progress of this sector, considering the conditional participation of these investors. In addition, a delay in intervention due to such hesitance may fail to satisfy the patient’s expectations, harming their trust in these procedures.

Thoracolumbar Spine Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 7.34 Billion |

|

Forecast Year Market Size (2035) |

USD 13.14 Billion |

|

Regional Scope |

|

Thoracolumbar Spine Devices Market Segmentation:

Product Type (Fusion Devices, Non-fusion Devices, Stimulation Devices)

By 2035, fusion devices segment is expected to capture over 60.7% thoracolumbar spine devices market share. Inflating demand for minimally invasive surgeries is driving growth in this segment. According to a report published by NLM, in June 2024, around 210,000 cases of spinal fusion surgeries are registered in the U.S. every year. The numbers are further estimated to rise with the aging population and changing lifestyles. The excellent compliance of fusion devices with these surgical techniques makes them preferable for improved patient outcomes and less recovery time. Moreover, the reduced risk of complications and increased success rates during the procedures are encouraging global leaders to focus on this segment.

Disease Indication (Degenerative Disc Disease, Complex Deformity, Traumas & Fractures)

In terms of disease indication, the degenerative disc disease segment is anticipated to garner greater income for the thoracolumbar spine devices market during the forecast timeline. It is growing with the increased cases of this condition around the world. In addition, the higher risk of being affected among the global aging population is also inflating demand for these surgical devices. According to an NLM article, published in March 2021, the total annual number of diagnosed patients, affected with spinal disc degeneration is 2,653,433. It further states that 30.3%, 23.6%, 19.5%, 14.6%, and 12.0% of these cases are registered for people aged between 65-69, 70–74, 75–79, 80–84, and 85+ respectively. Thus, this segment contributes to a notable part of the sector’s growth.

Our in-depth analysis of the global thoracolumbar spine devices market includes the following segments:

|

Product Type |

|

|

Disease Indication |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thoracolumbar Spine Devices Market Regional Analysis:

North America Market Analysis

In thoracolumbar spine devices market, North America region is predicted to capture over 48.5% revenue share by 2035. Developed countries such as the U.S. and Canada are proactively investing in the improvement of medical service delivery, creating a good distribution channel for this sector. In addition, the adaptive nature of this region for advanced surgical techniques and tools is creating a surge for innovative biologics and medical devices. For instance, in December 2023, ZimVie Inc. received FDA approval for its Vital Spinal Fixation System for use with Brainlab Spine & Trauma Navigation. This combined solution is designed to help surgeons achieve more accuracy and less radiation exposure during spinal surgeries.

The thoracolumbar spine devices market in the U.S. is augmenting regional growth with its well-established healthcare infrastructure. This country is also fostering a lucrative business atmosphere due to its aging population, who have higher possibilities of undergoing spinal surgeries. Thus, more domestic medical suppliers are being globally recognized for their contribution to this sector. For instance, in July 2024, MiRus received Breakthrough Device Designation for its EUROPA Posterior Cervical System from the FDA due to the use of proprietary rhenium alloys in production. This system gained popularity for its efficacy in treating the cervical and upper thoracic spine.

Canada is magnifying its participation in the thoracolumbar spine devices market by making remarkable investments in associated research and development. The country’s desperate efforts to improve patient and surgical outcomes through funding the infrastructure is acting as a financial cushion for this sector. For instance, in February 2022, a project in Canada, called Mend the Gap: A Transformative Biomaterials Platform for Spinal Cord Repair project received a grant of USD 24 million over six-year. They were awarded through the New Frontiers in Research Fund (NFRF) 2020 Transformation stream for developing a new minimally invasive surgical treatment for SCI. Such innovations are further evolving this sector, offering better results.

APAC Market Statistics

Asia Pacific is poised to register a significant growth rate in the thoracolumbar spine devices market by 2035. Unhealthy changes in lifestyle due to rapid urbanization in developing countries such as Japan, China, Australia, and India led to spinal disorders. This is further driving demand for surgical expertise and equipment, subsequently expanding the consumer base for this sector. The forecasted demographics of the aging population in this region also indicate the rise in SCI patient volume, expanding this sector. Moreover, the collaborative efforts of government bodies and healthcare professionals have increased the frequency of spine surgeries in this region, inflating demand in this sector.

India is reviving its position in the thoracolumbar spine devices market by issuing supportive initiatives and reimbursement policies. The country is leveraging its own production to become a good supplier of such medical devices with promotional campaigns such as Made in India. For instance, in 2020, the government of India launched a Production Linked Incentive (PLI) Scheme with a financial outlay of USD 395.9 million for FY 2022-2023 to FY 2026-27. This also offers support manufacturers with a 5% incentive on sales increment of medical devices produced in India.

China, with its manufacturing capabilities and strategic foreign relationships, is positioned at the forefront of the regional thoracolumbar spine devices market. The country is also focused on creating a good marketplace for international participants in the medical device industry, including thoracic systems. According to the International Trade Administration report, published in April 2023, the industry size of medical devices in China is estimated to reach USD 48.8 billion by 2026, exhibiting a CAGR of 8.3%. Another 2019 report estimated the worth of domestic production to be USD 59.0 billion.

Key Thoracolumbar Spine Devices Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson Services, Inc.)

- NuVasive, Inc.

- Globus Medical

- RTI Surgical Holdings, Inc.

- Aesculap, Inc. (B. Braun Melsungen AG)

- Alphatec Spine, Inc.

- Neo Medical SA

Global leaders in the thoracolumbar spine devices market are progressing with technological advancements for globalization. They are heavily investing in this sector to enhance patient outcomes by introducing innovative surgical solutions. In addition, they are fostering financial support from other resources to accelerate their R&D initiatives. For instance, in September 2024, Neo Medical raised a series B funding of USD 68 million to empower its product pipeline in spinal surgery. The company aimed to deploy new technologies to develop new intraoperative solutions, targeting the global thoracolumbar fusion industry, worth USD 7.6 billion. Such key players include:

Recent Developments

- In December 2024, Neo Medical received approval from the European Union’s (EU) Medical Device Regulation (MDR) EU 2017/745 for its whole product pipeline. This established and promoted its products related to spine surgery as the highest quality among medical devices.

- In April 2024, DePuy Synthes announced the launch of its latest posterior thoracolumbar pedicle screw device, TriALTIS Spine System at an Advance Spine Techniques (IMAST) Meeting, in 2024. The system is designed to address unmet clinical needs during complex spine procedures for degenerative, tumor, and trauma.

- Report ID: 7002

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thoracolumbar Spine Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.