Thalassemia Market Outlook:

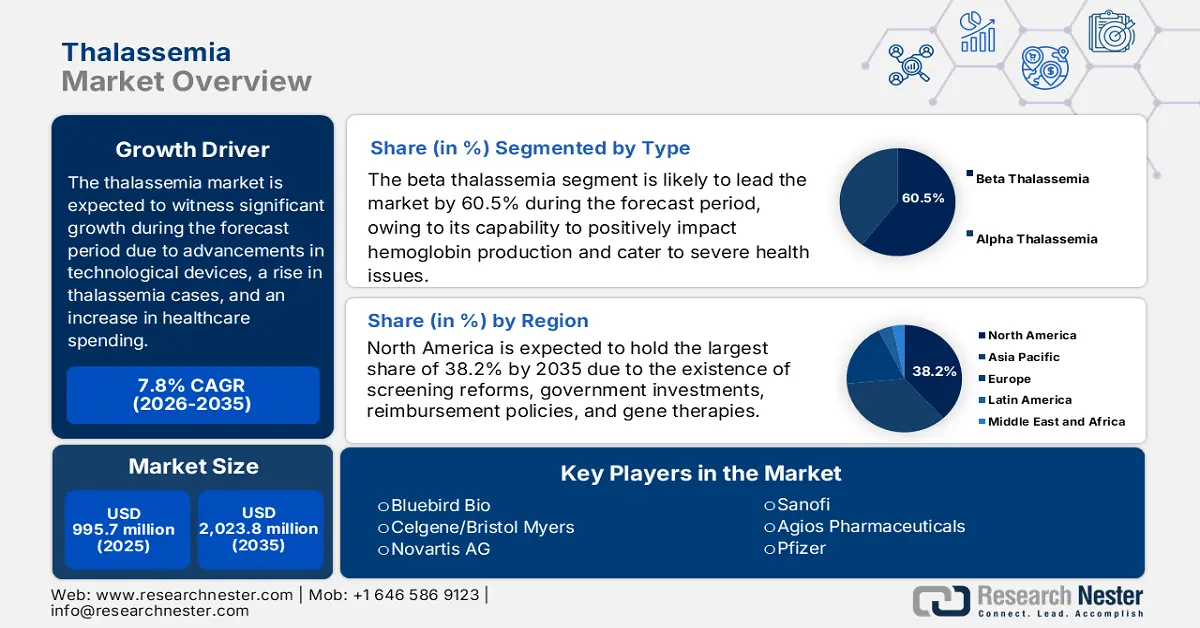

Thalassemia Market size was USD 995.7 million in 2025 and is projected to reach USD 2,023.8 million by the end of 2035, increasing at a CAGR of 7.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of thalassemia is assessed at USD 1,077.3 million.

The worldwide market’s growth is highly driven by factors, including a surge in thalassemia incidences, effective management, innovation in medical technology, an increase in healthcare spending, and the presence of regulatory policies. According to an article published by the MDPI in April 2022, the thalassemia prevalence increased from 0.7 per 100,000 people to 2.7 per 100,000 people in the past 7 years. In addition, the yearly transfusion rate has gradually decreased from 34.7% to 20.6% within the same duration, thereby denoting a huge demand for the market. Besides, continuous research and development activities in this field are also fueling the market across different nations.

Moreover, the aspect of increased awareness and treatment availability is also fueling the market’s exposure globally. As per an article published by NLM in August 2023, the hemoglobin range for mild thalassemia ranged between 6 to 10g/dl, and patients require blood transfusion, especially after surgery, to manage risks associated with thalassemia. Likewise, in the case of moderate to severe thalassemia, the hemoglobin ranges between less than 5 to 6g/dl, along with frequent blood transfusions, chelation therapy, stem cell transplant, gene therapy, genome editing techniques, splenectomy, and cholecystectomy as probable therapies for management, thus suitable for the market’s upliftment.

Key Thalassemia Market Insights Summary:

Regional Highlights:

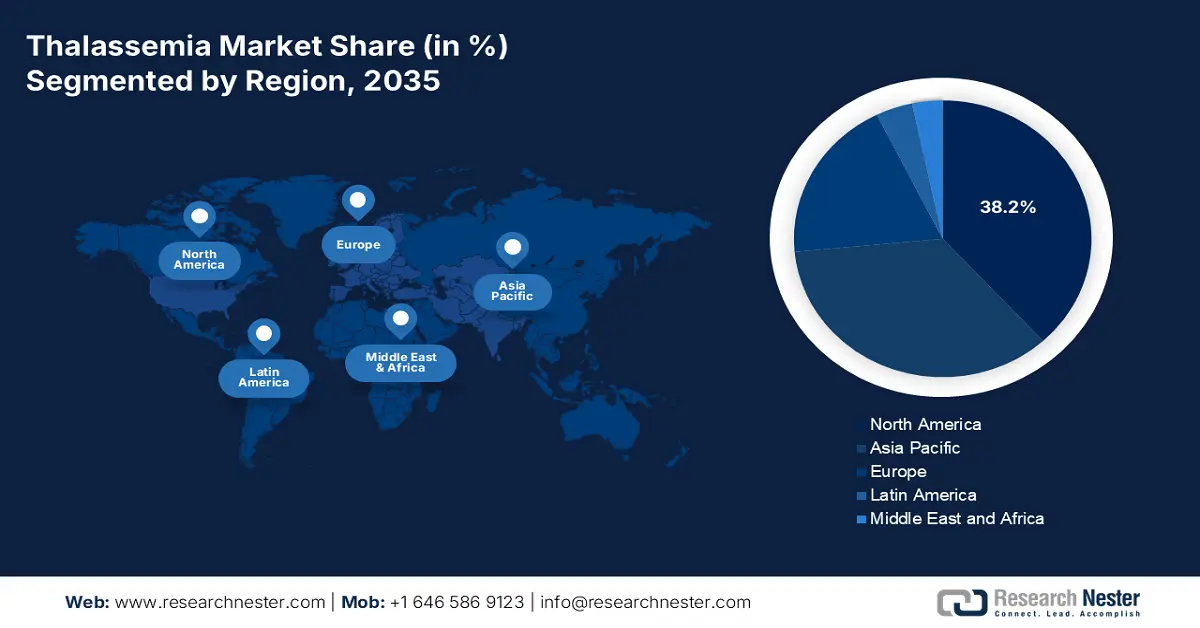

- By 2035, North America is projected to hold a 38.2% share in the thalassemia market, fueled by genetic screening mandates, government funding, and advancements in gene therapies.

- Over 2026–2035, Europe is expected to emerge as the fastest-growing region, driven by regional funding initiatives, gene therapy approvals, and neonatal screening programs.

Segment Insights:

- Beta thalassemia segment is expected to capture 60.5% of the thalassemia market, underpinned by its impact on hemoglobin production and associated critical health conditions.

- The hospitals segment is projected to attain 47.5% share by 2035, driven by its central role in specialized care, blood transfusions, and management of therapies like stem cell transplants and iron chelation.

Key Growth Trends:

- AI-based patient management systems

- Point-of-care genetic testing kits:

Major Challenges:

- Fragmentation in administrative pathways

- Limitation in payer coverage for gene therapies

Key Players: Novartis AG (Switzerland), Bluebird Bio (U.S.), Celgene/Bristol Myers Squibb (U.S.), Sanofi (France), Pfizer (U.S.), Agios Pharmaceuticals (U.S.), Chiesi Farmaceutici (Italy), Dr. Reddy’s Laboratories (India), CSL Behring (Australia), Biocon (India), Sun Pharmaceutical (India), La Jolla Pharmaceutical (U.S.), Medunik (Malaysia), Samsung Bioepis (South Korea), Pharmaniaga (Malaysia)

Global Thalassemia Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 995.7 million

- 2026 Market Size: USD 1,077.3 million

- Projected Market Size: USD 2,023.8 million by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Italy, Australia

Last updated on : 28 August, 2025

Thalassemia Market - Growth Drivers and Challenges

Growth Drivers

-

AI-based patient management systems: The integration of predictive analytics for iron overload monitoring and transfusion scheduling tends to diminish hospitalizations for pilot programs, which is driving the market demand globally. As stated in the March 2024 NLM article, convolutional neural networks are suitable for recognizing and analyzing medical imaging, resulting in 95.7% accuracy. Likewise, recurrent neural networks, along with long and short-term memory networks, are utilized for sequential data analysis, leading to 71.3% accuracy, thereby suitable for the overall market’s growth.

-

Point-of-care genetic testing kits: The availability of approved carrier screening devices has enabled community-based diagnosis, which has expanded early detection in rural locations, thereby uplifting the market internationally. According to an article published by NLM in May 2023, point-of-care testing includes flushing the line by utilizing heparin and successfully removing double the line volume, within a range of 2 to 5 mL. Besides, a 15-minute wait time is suggested after the completion of the blood transfusion, thus denoting its increased exposure in the overall market.

-

Telemedicine for chronic care: This is essential since it has the capability to enhance accessibility, as well as facilitate continuous monitoring, improve patient engagement, and readily support rural patients, all of which caters to the market’s growth across different nations. As per the July 2024 NLM article, telemedicine tends to ensure e-patient consulting service, which readily addresses 53.5% of requests from customers within an average time of 3.7 hours and 7.3 hours for in-person requests. Besides, primary care telemedicine can be achieved by 91.0% through video, 90.5% through telephone, and 86.7% without any visits, thus suitable for the market’s development.

Global Burden of Disease Analysis Revealing Rising Age-Standardized Rates for the Market

Thalassemia Prevalence and Incidence Within 4 Years Through Sociodemographic Index (SDI)

|

Components |

Prevalence |

Incidence |

||||||

|

Age-standardized rates per 100,000 |

Rate change in age-standardized rates |

Counts |

Age-standardized rates per 100,000 |

Rate change in age-standardized rates |

Counts |

|||

|

Global |

1,310,407 |

18.2% |

-0.1 |

119,679 |

1.9% |

-0.2 |

||

|

Low SDI |

139,675 |

9.1% |

0.09 |

19,994 |

1.1% |

0.09 |

||

|

Low-Middle SDI |

336,498 |

16.7 |

-0.01 |

34,869 |

1.8% |

<0.01 |

||

|

Middle SDI |

604,765 |

29.2% |

-0.24 |

50,163 |

3.2% |

-0.31 |

||

|

High-Middle SDI |

192,022 |

21.4% |

0.04 |

12,833 |

2.2% |

-0.03 |

||

|

High SDI |

36,562 |

4.9% |

<−0.01 |

1733 |

0.3% |

−0.14 |

||

Source: NLM, May 2024

RNA Approach Driving the Market Demand

Globally Approved RNA Strategies Between 2022-2023

|

Product Name |

Generic Name |

First Approval Year |

Disease(s) |

Locations in NA |

Originator Company |

|

Gennova COVID-19 vaccine |

COVID-19 vaccine, Gennova Biopharmaceuticals |

2022 |

Infection, coronavirus, novel coronavirus prophylaxis |

India |

Gennova Biopharmaceuticals |

|

Amvuttra |

vutrisiran |

2022 |

Amyloidosis, transthyretin-related hereditary |

U.S., Europe, UK Alnylam |

Alnylam |

|

Moderna Spikevax Bivalent Original/Omicron vaccine |

COVID-19 bivalent original/Omicron vaccine, Moderna |

2022 |

Infection, coronavirus, novel coronavirus prophylaxis |

UK, Canada, Taiwan, Switzerland, Japan, Europe, Australia, South Korea, Singapore, U.S. |

Moderna Therapeutics |

|

Pfizer & BioNTech’s Omicron BA.4/BA.5-adapted bivalent booster vaccine |

Omicron BA.4/BA.5-adapted bivalent booster vaccine |

2022 |

Infection, coronavirus, novel coronavirus prophylaxis |

U.S., UK |

BioNTech |

|

Izervay |

avacincaptad pegol sodium |

2023 |

Dry age-related macular degeneration |

U.S. |

Archemix |

|

Arexvy |

respiratory syncytial virus vaccine, GSK |

2023 |

Respiratory syncytial virus prophylaxis |

U.S., Europe, Japan, UK, South Korea, Singapore, Canada, Australia |

GSK |

|

Qalsody |

tofersen |

2023 |

Amyotrophic lateral sclerosis |

U.S., Europe, Japan, China, Canada |

Ionis Pharmaceuticals |

Source: American Society of Gene and Cell Therapy, 2025

Challenges

-

Fragmentation in administrative pathways: The aspect of diversified global requirements develops inefficiencies for the market entry. Besides, regulatory bodies need separate clinical studies for the ethnic population by adding years to developmental expenses for each drug. The EMA and FDA have differences in standards for orphan drug designation, which has pressured organizations to design numerous trial protocols. This has effectively resulted in disadvantages among small-scale biotech companies, citing poor cost-effectiveness for global filings, which in turn is negatively impacting the overall market.

-

Limitation in payer coverage for gene therapies: There is a revolutionary potential for gene therapies to meet the financial reality, particularly at the reimbursement stage. With an increase in price tags for each and every treatment, payers are integrating strict coverage policies, which is creating a gap in the market growth globally. Besides, Medicaid programs in the majority of U.S.-based cities have readily excluded gene therapies from formularies, owing to constraints in the budget, resulting in a disparity in accessibility, thus limiting the market’s exposure.

Thalassemia Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 995.7 million |

|

Forecast Year Market Size (2035) |

USD 2,023.8 million |

|

Regional Scope |

|

Thalassemia Market Segmentation:

Type Segment Analysis

The beta thalassemia segment in the market is projected to hold the highest share of 60.5% by the end of 2035. The segment’s growth is highly driven by its ability to affect the hemoglobin production, which results in critical health conditions, such as organ enlargement, bone deformities, and severe anemia. As per the February 2024 NLM article, the mean corpuscular volume is 50% to 70% beta thalassemia major and intermedia, followed by 55% to 78% for minor. Besides, the mean corpuscular hemoglobin ranges from 12% to 20% for major, along with 15% to 25% for minor, thereby creating an optimistic outlook for the overall market’s exposure.

End user Segment Analysis

The hospitals segment in the market is expected to garner the second-highest share of 47.5% by the end of the forecast period. The segment’s upliftment is effectively fueled by its pivotal role in providing specialized care, blood transfusions, and diagnosis. Besides, thalassemia treatments are readily administered and managed in hospitals, which is supported by administrative facilities. In addition, there is a continuous Medicaid and Medicare flow in hospitals, especially for stem cell transplants and iron chelation therapy. Meanwhile, emerging nations are depending on public hospitals for transfusions, which is positively impacting the segment’s growth.

Treatment Segment Analysis

The gene therapy segment in the market is anticipated to account for the third-highest share of 33.7% during the projected timeline. The segment’s development is effectively propelled by its transformative approach to potentially aid and cure diseases by directly identifying the underlying genetic cause. According to the November 2023 NLM article, the hematopoietic stem cell gene therapy is readily implemented for inherited blood disorders through which increased levels of engraftment of gene-corrected HSC can be successfully achieved within a range between 25% to 90%, thus suitable for the overall market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End user |

|

|

Treatment |

|

|

Diagnosis Method |

|

|

Drug Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thalassemia Market - Regional Analysis

North America Market Insights

North America thalassemia market is projected to account for the largest share of 38.2% by the end of 2035. The market’s growth in the region is effectively fueled by the presence of genetic screening mandates, government funding, innovation in gene therapies, robust healthcare facilities, and a surge in patient awareness. According to the 2025 American Society of Gene and Cell Therapy report, 74% of non-genetically modified cell therapy trials were initiated during the first quarter of 2025, particularly for non-oncology indications, in comparison to 58% in the fourth quarter, along with 46% in the third quarter of 2024. Besides, 33 latest gene therapies have been approved, out of which a few have been unveiled in North America, suitable for the market’s upliftment.

The thalassemia market in the U.S. is significantly growing, owing to federal budget allocation, expansion in Medicaid and Medicare services, innovation in pharmaceuticals, and an increase in health and medical spending. According to a report published by the Peterson-KFF Health System Tracker organization in April 2025, the healthcare expenditure per capita in the country is USD 13,432, along with the gross domestic product (GDP) is USD 82,697 as of 2023. This denotes an increase of more than USD 3,700 across high-income nations. Therefore, with effective focus on funds for healthcare management, there is a huge opportunity for the market to expand.

The thalassemia market in Canada is also growing steadily due to provincial healthcare investments, public health strategies, research and development for rare diseases, immigrant population impact. As per the December 2024 Government of Canada report, the provision of USD 1.4 billion in funding has been made available to territories and provinces through a 3-year deal to gain accessibility in regard to newly elected and existing drugs for rare diseases, along with diagnostic and screening services. In addition, an ongoing funding of USD 500 million per year has been allocated to ensure future phases of rare diseases.

Approved Gene Therapies Between 2022-2025 in North America

|

Product Name |

Generic Name |

First Approval Year |

Disease(s) |

Locations in NA |

Originator Company |

|

Hemgenix |

etranacogene dezaparvovec |

2022 |

Hemophilia B |

U.S., Canada |

uniQure |

|

Adstiladrin |

nadofaragene firadenovec |

2022 |

Bladder cancer |

U.S. |

Merck & Co. |

|

Casgevy |

exagamglogene autotemcel |

2023 |

Sickle cell anemia; thalassemia |

U.S. Canada |

CRISPR Therapeutics |

|

Elevidys |

delandistrogene moxeparvovec |

2023 |

Duchenne muscular dystrophy |

U.S. |

Sarepta Therapeutics |

|

Lyfgenia |

lovotibeglogene autotemcel |

2023 |

Sickle cell anemia |

U.S. |

bluebird bio |

|

Encelto |

revakinagene taroretcel |

2025 |

Macular telangiectasia type 2 (MacTel) |

U.S. |

Neurotech |

Source: American Society of Gene and Cell Therapy, 2025

Europe Market Insights

Europe in the thalassemia market is considered to be the fastest-growing region, with a share of 19.2% during the forecast period. The market’s development in the region is highly fueled by regional funding initiatives, gene therapy clearances, the availability of neonatal screening programs, and cross-border partnerships. As per the April 2022 NLM article, there has been a record of 57 gene therapy trials in the region, along with the presence of 106 facilities to conduct these trials. Besides, the European Union (EU) comprises more than one approved gene therapy product, while an increase in healthcare spending is also driving the market’s demand in the overall region.

The thalassemia market in Germany is gaining increased traction, owing to government investment, progressive health and medical facilities, increased focus on rare disorders, R&D activities in the pharmaceutical sector, and a surge in immigrant demographics. As per the December 2024 American Society of Hematology report, a clinical study was conducted on 15 patients, wherein 8 received beti-cel after busulfan myeloablative conditioning. In addition, the transfusion independence was achieved within 8 to 59 days, with posttreatment hemoglobin levels ranging between 11.3 g/dL to 19.3 g/dL. Therefore, this particular therapy has been proven to be useful to overcome rare diseases, thus suitable for the market’s growth.

The thalassemia market in the UK is also growing, and factors such as extension in the NHS funding, gene therapy leadership, national screening program, patient advocacy, and Brexit-powered R&D incentives are responsible for uplifting the market in the country. According to a report published by the Association for the Advancement of Blood and Biotherapies in August 2024, the country’s National Institute for Health and Care Excellence has cleared a gene therapy to aid transfusion-dependent beta-thalassemia (TDT), which has affected 460 patients aged over 12 years. Besides, the expense of exagamglogene autotemcel is 1.65 million British pounds per course for treatment, thus positively impacting the market.

Health Spending Per Capita in Europe

|

Countries |

Spending Amount (USD) |

|

Switzerland |

9,688 |

|

Germany |

8,441 |

|

Austria |

7,811 |

|

Netherlands |

7,737 |

|

Sweden |

7,522 |

|

Belgium |

7,380 |

|

France |

7,136 |

|

UK |

6,023 |

Source: Peterson-KFF Health System Tracker Organization, April 2025

APAC Market Insights

Asia Pacific thalassemia market is expected to garner a considerable share of 35.3% by the end of the forecast timeline. The market’s development in the region is propelled by a surge in the genetic prevalence, the existence of government screening programs, gene therapy implementation, along with public and private collaborations. As stated in the May 2023 NLM report, Wilson’s disease (WD), which is one of 14 genetic movement diseases, is quite common, with its presence accounting for 5.9/100,000 in China, 3.8/100,000 in Korea, 11.2/100,000 in Japan, and 1.8/100,000 in Taiwan. Therefore, there is a huge opportunity for the market to flourish in the overall region.

The thalassemia market in India is gaining increased exposure, owing to a massive patient pool, National Health Mission (NHM), state-level strategies, corporate CSR programs, and an expansion in Ayushman Bharat. According to the April 2024 NLM article, the β-thalassemia carrier prevalence in the country is projected to be an estimated 3% to 4%, which indicates a substantial number of carriers, accounting for 30 million to 40 million individuals. Additionally, the β-thalassemia trait prevalence is 3.5%, and it is effectively linked with religious, cultural, and social issues, which are positively impacting the overall market in the country.

The thalassemia market in China is also growing due to centralized funding, the presence of rural health campaigns, a boom in domestic biotechnology, the one-child legal policy, and NMPA fast-track clearances. For instance, in October 2023, Belief BioMed Inc. successfully signed an exclusive cooperation deal with Takeda China in the hemophilia B field by incorporating advanced gene therapy for domestic patients. Besides, Belief BioMed granted Takeda China inclusive rights to effectively commercialize its investigational product, BBM-H901, particularly in Macau China, Hong Kong China, and Mainland China.

Key Thalassemia Market Players:

- Novartis AG (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bluebird Bio (U.S.)

- Celgene/Bristol Myers Squibb (U.S.)

- Sanofi (France)

- Pfizer (U.S.)

- Agios Pharmaceuticals (U.S.)

- Chiesi Farmaceutici (Italy)

- Dr. Reddy’s Laboratories (India)

- CSL Behring (Australia)

- Biocon (India)

- Sun Pharmaceutical (India)

- La Jolla Pharmaceutical (U.S.)

- Medunik (Malaysia)

- Samsung Bioepis (South Korea)

- Pharmaniaga (Malaysia)

The international market is extremely competitive, with the presence of organizations, including Sanofi, Bluebird Bio, and Novartis, collectively leading through gene and iron chelator therapies. Besides, Novartis’ collaboration with NHS England for result-oriented pricing, and Bluebird’s FDA-based clearances are a few strategies that are effectively uplifting the market globally. Meanwhile, firms in Japan, such as Astellas and Takeda, are readily dominating government-based R&D tax incentives. On the other hand, emerging organizations, including Biocon and Dr. Reddy’s, are focusing on biosimilars for affordable markets, which are positively bolstering the market’s exposure.

Here is a list of key players operating in the global market:

Recent Developments

- In January 2025, Vertex Pharmaceuticals notified its reimbursement agreement with NHS England, suitable for sickle cell disease (SCD) patients gaining the CRISPR/Cas9 gene-edited therapy, CASGEVY accessibility.

- In October 2024, Editas Medicine, Inc. declared the achievement of in vivo preclinical proof of concept of hematopoietic stem and progenitor cell (HSPC), along with editing and fetal hemoglobin (HbF) induction, which is engrafted with human hematopoietic stem cells.

- Report ID: 8021

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thalassemia Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.