Surgical Sealants and Adhesives Market Outlook:

Surgical Sealants and Adhesives Market size is valued at USD 3.1 billion in 2025 and is projected to reach USD 7.5 billion by the end of 2035, growing at a CAGR of 11.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of surgical sealants and adhesives is estimated at USD 3.5 billion.

The global market is growing due to increasing surgical procedures, advancements in biomaterials, and innovation in the market. The need to focus on research and development (R&D) to improve the effectiveness and safety of surgical sealants and adhesives is of utmost importance, as surgical site infections (SSIs) remain a serious concern in global healthcare, bringing increased morbidity, prolonged hospital stays, and more treatment costs. The patient population for these products consists of cases undergoing various surgical interventions where infection prevention is tough. The octyl-2-cyanoacrylate adhesives, such as Dermabond, have a bursting strength up to three times greater than butyl-2-cyanoacrylate adhesives, which highlights their superior mechanical performance and encourages more use in wound closure.

The supply chain aspect in the market requires the international shipment of both raw materials and the finished goods, with the U.S. and a few other nations serving as central nodes in international commerce. In addition, continued investment in R&D, as well as product development and deployment, is necessary to enhance product efficacy and keep up with evolving clinical demands. As per a report by OECD, February 2024, over the last 30 years, global trade in medical devices has increased 7‑fold in value, reaching a total of USD 700 billion in 2022. Additionally, medical device manufacturing innovations and supply chain streamlining have made the distribution and uptake faster globally. Nevertheless, it also underlines the imperative of making supply chains more robust to counteract risks from geopolitical tensions and global disruptions.

Key Surgical Sealants and Adhesives Market Insights Summary:

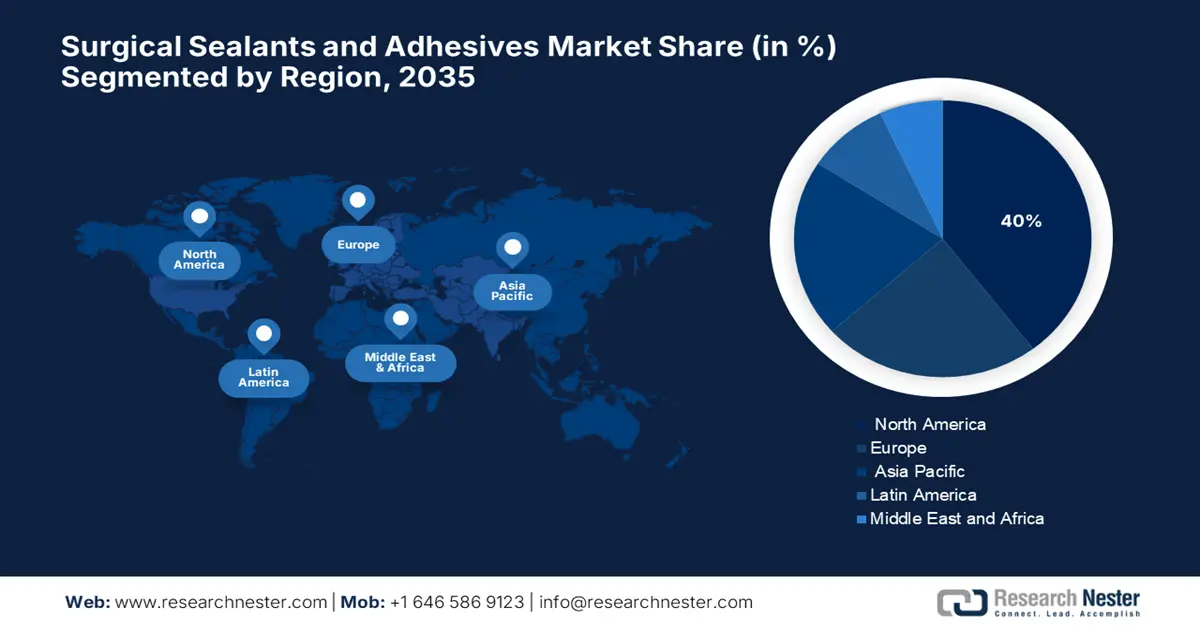

Regional Insights:

- The North America Surgical Sealants and Adhesives Market is projected to capture around 40% share by 2035, supported by favorable healthcare policies and rapid adoption of innovative wound closure technologies.

- Asia Pacific is anticipated to be the fastest-growing region during 2026–2035, propelled by rising regulatory backing for eco-friendly biomaterials and increasing preference for minimally invasive surgical procedures.

Segment Insights:

- The Hospitals and Surgical Centers segment is estimated to account for 35% share by 2035 in the Surgical Sealants and Adhesives Market, impelled by the widespread utilization of advanced hemostatic products in vascular and reconstructive surgeries.

- Surgical Hemostasis is poised to lead the application segment through 2026–2035, fueled by the growing need for precise bleeding control and the integration of fibrin-based and synthetic hemostatic innovations enhancing surgical outcomes.

Key Growth Trends:

- Rising demand for effective and patient-friendly wound closure solutions

- Advancements in biocompatible and elastic synthetic sealants

Major Challenges:

- Stringent regulatory approvals

- High development costs

Key Players: Johnson & Johnson (Ethicon, Inc.), Baxter International, Inc., Becton Dickinson and Company (C.R. Bard), CryoLife, Inc. (Artivion), Medtronic plc, Cardinal Health, Inc., Integra LifeSciences Holdings Corp., Stryker Corporation, 3M Company, Advanced Medical Solutions Group plc, CSL Limited, Ocular Therapeutix, Inc., Sanofi S.A., Sealantis Ltd., Vivostat A/S.

Global Surgical Sealants and Adhesives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.5 billion

- Projected Market Size: USD 7.5 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 8 September, 2025

Surgical Sealants and Adhesives Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for effective and patient-friendly wound closure solutions: The surgical adhesives and sealants market is propelled by increasing demand to substitute conventional sutures. The market volume has increased, reflecting increasing adoption. Furthermore, the need for sealants possessing elasticity and high-strength adhesion in dynamic tissue propels market growth and evolution. As per a report by NLM June 2023, clinicians must comply with established safe dosing protocols of anesthetic drugs such as lidocaine (4 to 4.5 mg/kg), lidocaine with epinephrine (up to 7 mg/kg), and bupivacaine (a single dose of 175 mg maximum or 400 mg in 24 hours). For effective wound healing and patient safety through proper anesthetic use, continue to drive confidence and expansion in this market.

- Advancements in biocompatible and elastic synthetic sealants: The market is growing with the advances in synthetic polymer-based sealants such as PEG- and PU-based sealants, which are biocompatible, have controlled degradation, and show excellent adhesion with elastic compatibility in soft tissue. PEG-based sealants such as Duraseal and Coseal have proven to be clinically successful in neurosurgical and vascular procedures, while synthetic polyurethane adhesives offer variable mechanical performance, fulfilling the need for flexible and efficient wound closure products.

- Advancements in photo-crosslinked fibrin sealants enhancing adhesion and elasticity: Surgical sealant demand is fueled by new photo-crosslinked fibrin sealants with enhanced tensile strength and adhesion. The new sealants exhibit up to five times higher adhesion strength than market-available commercial fibrin products like Tisseel, but cure in a shorter time. Enhanced tensile strength and biocompatibility render such materials ideally suited for most surgical applications. Furthermore, rapid curing controlled light exposure provides more precise surgery and shorter operative time with increased overall procedural efficiency, thereby suitable for the market.

Medical Instruments 2023 Trade Overview

|

Country |

Export Value (USD) |

Import Value (USD) |

|

U.S. |

34.8 billion |

37.7 billion |

|

Mexico |

17.6 billion |

4.6 billion |

|

Germany |

18.4 billion |

13.1 billion |

|

Netherlands |

9.3 billion |

14.1 billion |

|

China |

12.3 billion |

10.6 billion |

|

Japan |

7.2 billion |

6.4 billion |

Source: OEC, 2023

Challenges

- Stringent regulatory approvals: The market suffers from long delays caused by stringent regulatory requirements. Regulators such as the FDA require convincing clinical evidence of efficacy and safety, which delays the approval process. Thus, the market delays the new introductions of products, discouraging small businesses from bringing any product to the market and increasing costs. These regulatory issues slow down the overall adoption process of the new and efficient formulations that could enhance patient outcomes.

- High development costs: Surgical adhesives and sealants development involves huge research, testing, and clinical trials, which are costly. Such high development expenses limit access to highly capitalized firms, which makes start-ups and small companies find it difficult, thus causing a hindrance in the market. This discourages competition and innovation in the market. Additionally, the cost tends to be passed on to healthcare providers, thus lowering the availability of products. As a result, many hospitals, especially in low-resource settings, are unable to regularly stock or adapt newer surgical adhesive technologies.

Surgical Sealants and Adhesives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 7.5 billion |

|

Regional Scope |

|

Surgical Sealants and Adhesives Market Segmentation:

Product Type Segment Analysis

Hospitals and surgical centers are the highest sub-segment in end user segment with a 35% market share in the market. These facilities are key end-users, especially for advanced hemostatic products, such as Glubran 2 and Arista AH, readily used in vascular procedures, including arteriovenous fistula creation and pseudoaneurysm repair. The use of blanket sealants is a marked improvement over tape-headed scarring. As per a report published by NLM in February 2024, out of clinical studies of patients treated with Arista AH after fistula surgery, 96% were discharged within one day. This is a clear indication of the significance the hospitals have in market demand, and at the same time, they maintain surgical outcomes and efficiency.

Application Segment Analysis

Surgical hemostasis is the leading application segment in the surgical sealants and adhesives market, driven by rising demand for effective bleeding control during complex surgeries. Fibrin-based and synthetic hemostatic agent innovations have increased precision and patient safety. The cardiovascular and hepatic surgical procedures, in which blood loss management is important, have increased the usage of such products in advanced surgical centers and hospitals. Moreover, as more surgeons become aware of the benefits of rapid hemostasis in decreasing operative time and post-operative complications, its adoption is becoming widespread.

End user Segment Analysis

Hospitals and surgical centers dominate the end user segment in the surgical sealants and adhesives market due to high procedural volumes, skilled personnel, and access to advanced technologies. A hospital’s medical center usually performs higher-level procedures that require a special type of sealant and wound closure adhesive to control bleeding. With the increase in the development of medical infrastructure and minimally invasive procedures, hospitals lead in adopting the latest hemostatic and adhesive products for surgical care. Additionally, hospitals often have dedicated budgets and regulatory expertise that facilitate quicker integration of innovative surgical products into routine practice.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segment |

|

Product Type |

|

|

Material Composition |

|

|

Application |

|

|

End user |

|

|

Surgical Procedure Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Sealants and Adhesives Market - Regional Analysis

North America Market Insights

The surgical sealants and adhesives market in North America is expected to hold the largest share with 40% market share in the forecast period, owing to favorable government policies for healthcare innovation and the adoption of innovative medical devices. Technologies for wound closure, promoting biocompatible and effective technologies, are driven by market growth. According to a report published by NLM in October 2023, mechanically bioinspired adhesives, such as microneedle arrays replicated from North American porcupine quills, are shown to have favorable progressions, where pull-out tests are found to have 3.5 times higher adhesion force compared with that of available designs.

The surgical adhesives and sealants market in the U.S. is growing due to increasing demand for minimally invasive surgery and improved wound care treatment. Government regulations promoting medical innovations and stringent FDA standards of product performance and quality open up opportunities. Revolutionary technologies, such as North America porcupine quill-inspired microneedle arrays, improve adhesion strength, resulting in improved surgery results. All these factors together make way for the initiation of drastic market development and implementation of new bioadhesive technology by healthcare centers.

The surgical sealants and adhesives market in Canada is growing alongside advancements in tissue engineering and regenerative medicine. As per a report published by Frontier in May 2023, over 25 tissue engineering firms with USD 67 million in revenues, the country is fostering biomaterials and bioadhesive development. Greater clinical trials and support from the government is expected to have the tendency to propel the use of surgical adhesives across different medical applications. The country leads the way in having the highest number of company head offices, which promote sophisticated sealant development.

Polymers Market Growth of Medical PSAs by The American Society of Testing Materials (2025)

|

Material |

Growth Percentage Range (%) |

|

Acrylic |

50 to 60 |

|

Silicone |

20 to 25 |

|

Polyurethane |

10 to 15 |

|

Epoxy |

5 to 8 |

|

PIB |

3 to 5 |

|

Rubber |

3 to 5 |

Source: MDPI June 2025

Asia Pacific Market Insights

The Asia Pacific surgical sealants and adhesives market is anticipated to be the fastest-growing market within the forecast period, due to a rise in regulatory support towards eco-friendly solutions and a growing awareness of healthcare. There is growing demand in Japan, India, and China due to heightened awareness of minimally invasive procedures and a rise in biomaterial technology. The region's high patient base and government efforts to make healthcare more accessible drive the market growth further. Advances in regenerative medicine and tissue engineering also drive growth in higher-end sealants and adhesives in APAC.

The surgical sealants and adhesives market in China is expanding at a rapid rate, fueled by dismal advances in stem cell technology and regenerative medicine. The Chinese market for surgical sealants and adhesives is likely to prosper in the coming years due to this aggressive stem cell research culture, nurturing this growing environment. Increasing awareness amongst physicians about the advantages of surgical sealants and adhesives in reducing complications and improving recovery is key to the commercialization of the market. Support of government agencies such as the National Natural Science Foundation of China (NSFC) and cross-border collaborations also stimulate research and commercialization efforts in this area.

The surgical adhesives and sealants market in India is also witnessing growing demand due to India's growing healthcare infrastructure and rising surgeries. According to the July 2025 IBEF report, the medical device sector of India remains heavily reliant on imports, with 70% to 80% of surgical and other medical devices sourced from countries such as the US, China, and Germany. This high import reliance signals a disconnect between growing demand and domestic supply, offering spectacular growth possibilities for local and overseas producers exporting to this underpenetrated market.

Europe Market Insights

The sealants and surgical adhesives market in Europe is expected to grow steadily in the forecast period. The surgical adhesives and sealants market in Europe is evolving under an improved regulatory environment. Besides, the Europe Commission 2022 stated that the EU Medical Device Regulation (MDR) new rules significantly enhance safety and innovation through stronger controls for high-risk devices, stronger post-market surveillance, and stronger traceability with a single device identification system. It is to be noted that the EU substituted its outdated three directives with new legislation to remain up to the mark with developments over the past 20 years and to provide increased transparency and control on the clinical level.

The sealants and surgical adhesives market in Germany is growing, holding a robust presence in the market in Europe, underpinned by effective regulatory governance by BfArM and the EU MDR regime. The nation's emphasis on patient safety and innovation has been the prime driver of consistent clinical adoption. With a robust health care infrastructure and high-profile product recalls like OMNEX and Coseal tracked by BfArM, Germany is strongly proactive, backing assurance and advancing market maturity for surgical adhesive technologies.

The UK surgical sealants and adhesives market is still growing steadily, fueled by growing demand for newer modalities and technology in surgical wound closure. Effective regulation of manufacturers under the UK Medical Device Regulations by MHRA enables the safety and regulatory requirements. Pressure from the NHS for minimally invasive techniques encourages new adhesive technology adoption as well, while local R&D and academic-industry partnerships drive market growth. Additionally, the emphasis on reducing hospital stay durations and post-operative complications further supports the shift toward advanced sealant solutions.

Key Surgical Sealants and Adhesives Market Players:

- Johnson & Johnson (Ethicon, Inc.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter International, Inc.

- Becton Dickinson and Company (C.R. Bard)

- CryoLife, Inc. (Artivion)

- Medtronic plc

- Cardinal Health, Inc.

- Integra LifeSciences Holdings Corp.

- Stryker Corporation

- 3M Company

- Advanced Medical Solutions Group plc

- CSL Limited

- Ocular Therapeutix, Inc.

- Sanofi S.A.

- Sealantis Ltd.

- Vivostat A/S

A concentrated competitive arena is presented by the surgical sealants and adhesives market, wherein giant players such as Johnson & Johnson, Baxter, and Medtronic enjoy dominance in their areas of operations owing to their massive R&D facilities, M&A, and global distribution. The mid-tier and niche competitors, such as Cohera, Vivostat, and Sealantis, are undertaking targeted innovation in the areas of bioadhesives and their minimal applications. Complementing this, Japan-based chemical companies enable a new-age chemical technology in sustaining regional capabilities and future product diversification prospects across Asia, thus bolstering the market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2024, the LIQUIFIX FIX8 (for laparoscopic use) and LIQUIFIX Precision (open surgery) were launched by TELA Bio, Inc., and were the first adhesive-type devices that have been approved for mesh fixation without penetration into patient tissue.

- In November 2023, Ethicon, part of Johnson & Johnson, started marketing Ethizia, a new hemostatic sealing patch to assist in improved bleeding control during surgeries. An adjunctive hemostat solution has been clinically proven to achieve sustained hemostasis to control bleeding situations.

- Report ID: 8074

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.