Smart Pulse Oximeters Market Outlook:

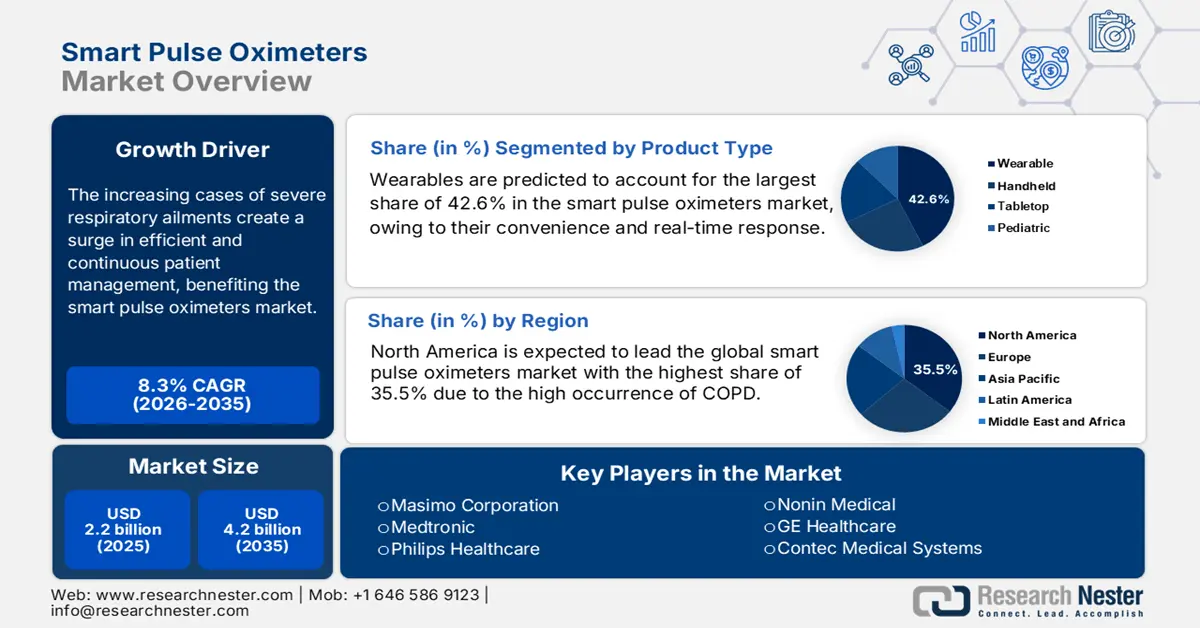

Smart Pulse Oximeters Market size was over USD 2.2 billion in 2025 and is estimated to reach USD 4.2 billion by the end of 2035, expanding at a CAGR of 8.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart pulse oximeters is assessed at USD 2.3 billion.

The increasing cases of severe respiratory ailments, such as chronic obstructive pulmonary disease (COPD) and post-COVID-19 complications, create a surge in efficient and continuous patient management. This is subsequently fueling demand in the market. Predictions made by the NLM indicate that by 2050, the number of COPD cases worldwide to surpass 600 million, rising by 23%. It also mentioned that sub-Saharan Africa is poised to become the most prevalent region of COPD from 2020 to 2050, accounting for a 15.1% occurrence rate and 160 million incidences. This demography is further enlarging with the growing geriatric population (aged 60 and over) around the globe, which is expected to reach 1.4 billion by 2030.

As the epidemiology spreads and the mortality of these ailments increases, the economic burden on both healthcare systems and patients increases. This can be testified by a report from the European Union, which anticipated COPD to cost the world economy INT$4·3 trillion during the timeline from 202o to 2050. It also mentioned that the direct annual expenses on associated patients in Europe range between €1.9 thousand and €10.7 thousand. These figures also signify the inflation in payers’ pricing for treatments, including oxygen therapy, which underscores the essentiality of integrating effective monitoring systems that offer features to enable controlled disease management.

Key Smart Pulse Oximeters Market Insights Summary:

Regional Highlights:

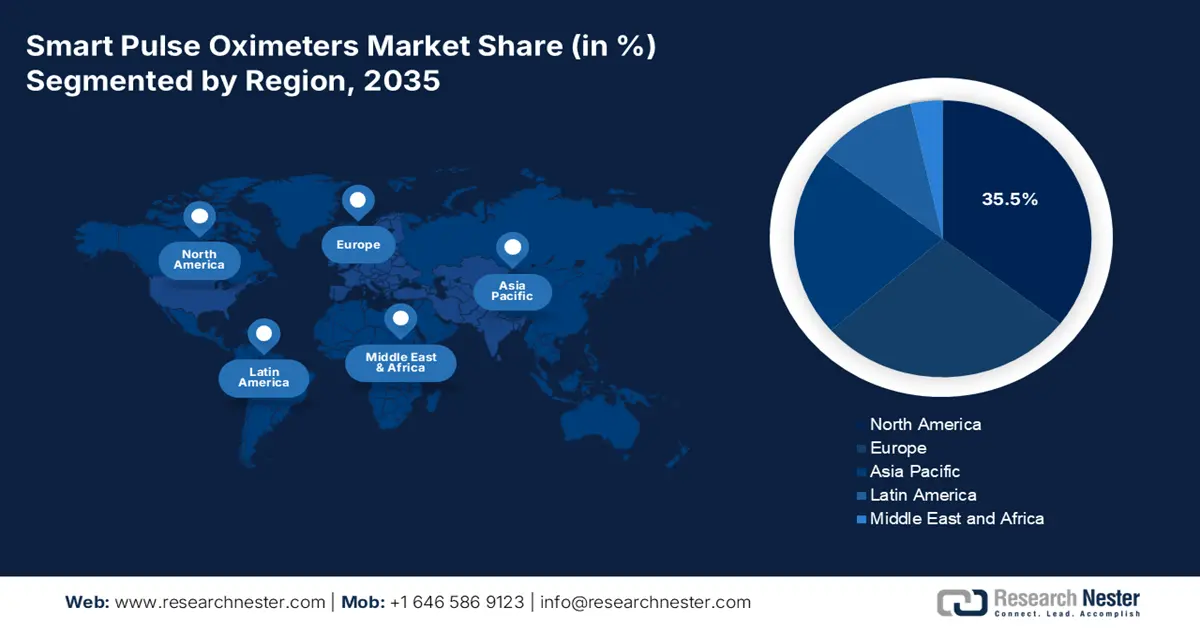

- North America is projected to command a 35.5% share in the smart pulse oximeters Market, supported by an advanced medical device ecosystem and expanding use of digital health technologies.

- Asia Pacific is expected to grow at the fastest pace as rising chronic respiratory disease prevalence and expanding healthcare modernization stimulate adoption.

Segment Insights:

- By 2035, the wearables segment in the smart pulse oximeters market is set to capture a 42.6% share, strengthened by its expanding role in continuous disease management and fitness tracking.

- The home healthcare segment is projected to account for 38.7% of the market by 2035, underpinned by the global shift toward remote patient care.

Key Growth Trends:

- Increased health awareness and focus on preventive care

- Post-pandemic efforts and ongoing preparedness

Major Challenges:

- Cybersecurity & data privacy regulations

- Competition from low-cost devices

Key Players: Masimo Corporation (U.S.), Medtronic (Ireland), Philips Healthcare (Netherlands), Nonin Medical (U.S.), GE Healthcare (U.S.), Contec Medical Systems (China), Smiths Medical (U.S.), Hill-Rom (U.S.), Edan Instruments (China), Mindray (China), Dräger (Germany), Biolight (China), Choicemmed (China), Rossmax (Taiwan), BPL Medical Technologies (India), Schiller (Switzerland), Heal Force (China), Biosensors International (Singapore), Movano Inc. (U.S.)

Global Smart Pulse Oximeters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 28 August, 2025

Smart Pulse Oximeters Market - Growth Drivers and Challenges

Growth Drivers

- Increased health awareness and focus on preventive care: As consumers increasingly prioritize early intervention and prevention, a surge in demand for advanced health monitoring tools is observed worldwide. Moreover, due to providing users the ability to track vital signs proactively, detect early signs of illness, and seek timely medical advice, the smart pulse oximeters sector is thriving. Besides, campaigns arranged by pubic authorities and improved access to online health information have heightened awareness about the importance of oxygen saturation levels, accelerating adoption in this sector. Exemplifying the same, in April 2025, the American Lung Association, in collaboration with Pfizer, started an awareness campaign about respiratory health to combat the widespread of serious lung disease in America.

- Post-pandemic efforts and ongoing preparedness: The COVID-19 strike drastically accelerated utilization in the smart pulse oximeters market across households and healthcare settings. As blood oxygen level became a critical indicator during the pandemic, demand in this sector surged around the globe. Even in the post-pandemic era, health institutions still recommend using these devices to monitor symptoms and recovery, particularly for elderly people. Several medical systems also stockpile these tools to be prepared for such emergencies. For instance, in March 2022, Unitaid allocated $56 million to increase and enhance access to medical oxygen in support of treating severe COVID-19 and other severe illnesses.

- Integration of IoT and wireless technologies: The market is becoming more sophisticated and accessible with the integration of high-end connectivity technologies. These allow seamless data transmission to smartphones, tablets, and cloud-based systems, enhancing the performance and real-time response of products available in this sector. Testifying to such a volume of users, a 2024 Journal of Infection and Public Health unveiled that the demand for internet of medical things (IoMT) in healthcare accounted for $87.62 billion in 2022, which is further estimated to reach $852.88 billion by 2030.

Dynamics of the Historic Patient Pool for the Smart Pulse Oximeters Market

Analysis of Historic Oxygen Therapy Patient Pool

|

Year |

Setting |

Patient Pool/Usage (%) |

Additional Details |

|

2023 |

Emergency Dept, US |

47.5% (Feb), 48.8% (Mar), |

Percent of patients with oxygen orders in ED |

|

42.9% (Apr), 73% (May), 64.6% (Jun) |

|||

|

2016 |

General respiratory wards |

11% reduced to 9% |

Relative decrease of 18% in patients requiring O₂ |

Source: Sacred Heart University Study

Trends in Financial Characteristics of the Market

Oximeter Payer Reimbursement/Pricing

|

Payer/Program |

Policy/Code |

Pricing/Reimbursement |

Year |

Notes |

|

Govt. of India CS(MA)/CGHS |

Direct purchase ceiling |

₹1,200 (~$14.50) per oximeter |

2022 |

Reimbursement for COVID+ patients; ceiling, not unit cost |

|

U.S. Medicare |

CPT Codes 94760, 94761 |

Bundled in E/M, not reimbursed separately |

2025 |

Oximetry payment included with office visits |

Source: CGHS and CMS

Challenges

- Cybersecurity & data privacy regulations: Ensuring compliance with changing data collection and sharing-related protocols is a major hurdle in the smart pulse oximeters market. These devices store and transmit sensitive health data, making them prime targets for cyberattacks, which often elongates the process of acquiring regulatory approvals. However, the implementation of robust data encryption, secure communication portals, and regular software updates is helping manufacturers protect user information and prevent reputational damage.

- Competition from low-cost devices: Devices that are produced by manufacturers in price-sensitive regions may restrict widespread adoption and profit margins for high-end solutions available in the smart pulse oximeters market. These budget-friendly alternatives often attract consumers with their affordability, despite offering limited features or questionable data accuracy. This price-driven competition puts pressure on established brands by limiting investment in innovation and quality assurance.

Smart Pulse Oximeters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Smart Pulse Oximeters Market Segmentation:

Product Type Segment Analysis

Wearables are predicted to account for the largest share of 42.6% in the smart pulse oximeters market over the analyzed timeline. The sub-segment’s dominance is consolidated due to its important role in continuous disease management and fitness tracking. Conditions, such as COPD and sleep apnea, which require 24/7 observation for oxygen levels, are driving adoption in this segment. Moreover, the convenience of wearable oximeters in monitoring seamless and real-time data outside medical settings propels rapid growth in this category. This can further be evidenced by the amplifying value of the smart wearables industry, which is estimated to surpass USD 946.73 billion by the end of 2037.

End user Segment Analysis

Home healthcare is anticipated to comprise 38.7% share of the end-user revenue generation from the smart pulse oximeters market by the end of 2035. The global shift toward remote patient care, particularly in regions with high patient volume and lower density of medical service providers, is the foundational pillar of this segment’s dominance. Besides, the post-pandemic dynamics of the patient pool and healthcare systems increasingly prioritize home-based care to alleviate hospital strain. This can be testified by an article published by the American Hospital Association (AHA) in April 2024, which underscored that 30-40% of all care provided in the U.S. can be moved to the home.

Distribution Channel Segment Analysis

The E-commerce network of distribution is gaining momentum in the smart pulse oximeters market, while showcasing the potential to acquire 25.8% revenue share throughout the assessed period. The emergence of this category is highly attributable to its broad and diverse consumer base, the convenience of online shopping, and the increasing demand for self-care solutions. Such a boost in sales through digital platforms can also be exemplified by the industry value of digital healthcare, which is predicted to cross USD 2.33 trillion by 2034. Moreover, the advantages of easy access to product comparisons, reviews, and competitive pricing are also influencing manufacturers to expand their reach through e-commerce platforms.

Our in-depth analysis of the smart pulse oximeters market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

End user |

|

|

Technology |

|

|

Age Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Pulse Oximeters Market - Regional Analysis

North America Market Insights

North America is expected to lead the global smart pulse oximeters market with the highest share of 35.5% over the discussed tenure. The advanced medical device industry, high awareness of chronic respiratory conditions, and widespread adoption of digital health technologies are the major factors contributing to the leadership. The enlarging epidemiology of COPD cases in the region, which is estimated to increase from 23.4 million to 24.1 million from 2020 to 2050, testifies to the sustainability of the demand base. The region further benefits from strong government support, including favorable reimbursement policies and regulations, which accelerate device approvals and accessibility.

According to the NCHS data, approximately 141.7 thousand people in the U.S. died due to the occurrence of COPD in 2023 alone. It also mentioned that the annual spending on patients with this ailment, aged 45 and over, accounts for $24 billion. This describes the urgent need to make products available in the smart pulse oximeters market more accessible to combat the epidemic. Besides, the recent upgrades in Medicare reimbursement policies are supporting the expansion of this sector by offering extensive financial backing for both patients and medical service providers.

Canada remarkably empower regional augmentation in the smart pulse oximeters market through its publicly funded healthcare system and growing emphasis on elderly care. As the country continues to invest large capital in digital health infrastructure, these devices are increasingly used and prioritized to manage chronic conditions outside of hospital settings. Evidencing the same, in October 2023, the Canadian Institutes of Health Research (CIHR) and its partners assigned a $26.6 million grant to improve healthcare availability for citizens. A notable portion of this amount was dedicated to developing and deploying digital tools to enhance clinical accessibility in underserved areas.

APAC Market Insights

Asia Pacific is estimated to become the fastest-growing region in the global smart pulse oximeters market by the end of 2035. The rising mortality of chronic respiratory diseases, the modernizing healthcare industry, and increasing awareness and availability of self-care products are collectively propelling the region’s pace of progress in this sector. In this regard, an NLM study predicted the number of COPD cases in East Asia and Pacific region to cross 77.2 million by 2050 with a prevalence rate of 8.7%. Besides, rapid urbanization, aging, and the growing middle-class populations in China, India, and Japan are driving demand for affordable and portable medical devices, hence benefiting the sector.

China is a key landscape in the Asia Pacific smart pulse oximeters market, which is supported by its large population, expanding middle class, and rapid digitization of healthcare. The government is also amplifying the country’s capacity in this category by improving patient access to the remote chronic disease management ecosystem. Additionally, the rise of domestic MecTech and medical device industries enhanced the availability of affordable, feature-rich products that are tailored to local needs. Testifying to such dynamics, the International Trade Administration unveiled that the medical device industry in China is expected to account for $48.8 billion by 2026.

India is emerging rapidly in the smart pulse oximeters market with the increasing healthcare awareness, a rising prevalence of respiratory conditions, and expanding access to digital health solutions. Particularly, after the COVID-19 pandemic, the healthcare business in the country boosted significantly, creating lasting demand for at-home diagnostic tools. As evidence, in a 2024 report, the International Trade Administration gave India the recognition of the fastest-growing e-commerce industry in the world, while estimating its value to surpass $136.47 billion by 2026. Furthermore, government initiatives to strengthen primary healthcare and promote telemedicine have further accelerated adoption in this sector.

Country-wise Government Provinces

|

Country |

Allocation / Funding Details |

Description |

Year |

|

Australia |

Medical Research Future Fund (MRFF) for $973 million max grants |

Supporting ongoing medical research and innovation including smart devices |

2024-2025 |

|

India |

Production Linked Incentive (PLI) Scheme for Medical Devices with an outlay of ₹3,420 crore |

Incentives on incremental sales to boost domestic manufacturing of medical devices |

2020-2028 |

|

China |

Tax incentives, including 100% super tax deduction for R&D for manufacturing firms |

Encourages R&D spending, technology upgrade loans, and innovation in the medical device sector |

2022-2024 |

Source: Australian Government, PIB, and INNOTAX

Europe Market Insights

Europe is anticipated to hold the second-largest share in the global smart pulse oximeters market during the timeline between 2026 and 2035. The enlarging geriatric populations and strong focus on chronic disease management are securing consistency in the region’s growth in this sector. Developed countries, such as Germany, the UK, and France, are the leading adopters in this landscape, which is largely supported by government-backed funding toward digital health infrastructure. On the other hand, the region’s stringent regulatory standards ensure high-quality devices, which boost consumer trust and widespread acceptance.

The UK is the growth engine of the Europe smart pulse oximeters market, which is empowered by adequate reimbursement coverage and growing emphasis on remote patient monitoring. The National Health Service (NHS) has actively contributed to this cohort by integrating next-generation medical devices into home care programs, particularly for managing chronic respiratory conditions and post-COVID monitoring. The emergence of connected healthcare tools is also a driving factor in this category, where the number of IoT devices in use across the UK increased to 150 million in 2024 from 2006.

Germany is one of the largest suppliers and manufacturers of the Europe smart pulse oximeters market. The advanced healthcare infrastructure, aging population, and strong emphasis on medical technology innovation are collectively escalating the volume of users nationwide. The country's focus on progressive digital health initiatives, including the Digital Healthcare Act (DVG), also accelerated the integration of smart medical devices into mainstream medical practice. Additionally, high healthcare spending and strong regulatory standards contribute to a robust environment for both domestic and international pioneers.

Current/Expected Demography of COPD

|

Country |

Number of COPD Cases (Million) |

Year |

|

UK |

1.4 |

2022 |

|

France |

2.8 |

2025 |

|

Germany |

7.9 |

2030 (predicted) |

Source: Asthma + Lung UK, NLM, and UBA

Key Smart Pulse Oximeters Market Players:

- Masimo Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic (Ireland)

- Philips Healthcare (Netherlands)

- Nonin Medical (U.S.)

- GE Healthcare (U.S.)

- Contec Medical Systems (China)

- Smiths Medical (U.S.)

- Hill-Rom (U.S.)

- Edan Instruments (China)

- Mindray (China)

- Dräger (Germany)

- Biolight (China)

- Choicemmed (China)

- Rossmax (Taiwan)

- BPL Medical Technologies (India)

- Schiller (Switzerland)

- Heal Force (China)

- Biosensors International (Singapore)

- Movano Inc. (U.S.)

The combined moves of well-established MedTech giants and emerging innovation-focused startups stimulated the commercial dynamics of the smart pulse oximeters market. Global leaders, including Medtronic, Masimo, and Nonin Medical, collectively dominate the competitive landscape with their advanced, clinically validated products and strong global distribution networks. On the other hand, new entrants are leveraging their capabilities in innovations in wearable technology, smartphone integration, and AI-curated health insights to secure a stable position in this sector.

Such key players are:

Recent Developments

- In November 2024, Movano gained 510(k) clearance from the FDA for its wireless, non-invasive, and stand-alone pulse oximeter, Evie Med Ring. It is designed to offer spot checking of oxygen saturation of peripheral arterial hemoglobin (SpO2) and pulse rate of adult users with a condition that might benefit from monitoring.

- In February 2024, Masimo attained approval from the FDA for its medical fingertip pulse oximeter, MightySat Medical, making it available over-the-counter (OTC) direct to consumers without a prescription. It relies on Masimo SET Pulse Oximetry and can be purchased at masimo.com.

- Report ID: 8028

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Pulse Oximeters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.