Sleep Supplements Market Outlook:

Sleep Supplements Market size was over USD 8.8 billion in 2025 and is estimated to reach USD 13 billion by the end of 2035, exhibiting a CAGR of 6% during the forecast period, i.e., 2026-2035. The growing issue of insomnia and consumption switch towards natural remedies expanded the current market size with a valuation of USD 10 billion in 2026.

According to the report published by the National Institute of Health, between 50 and 70 million Americans suffer from sleep disorders. Moreover, one in three people does not consistently receive the appropriate amount of undisturbed sleep required to maintain their health. Excessive stress and fast-paced lifestyle, higher digital screen time, and alteration of working shifts are the key factors for low-quality sleep, and create significant demand for sleep supplements. Moreover, consumer behavior is shifting toward natural and plant-based ingredients like valerian root, magnesium, and chamomile to reflect an overall demand for clean-label and holistic health products.

Personalized and multifunctional formulations are also explicitly growing in popularity. These products address the unique sleep cycles and lifestyles of consumers. Functional sleep supplements often include additional benefits, such as stress relief and cognitive benefits. Further, the growth of online sales channels has made sleep-related dietary supplements increasingly accessible to consumers, allowing them to easily research, compare and purchase trial items. In summary, this overall behavior points to a fast-evolving and energetic marketplace focused on natural, personalized, and technology-enhanced options for quality sleep.

Key Sleep Supplements Market Market Insights Summary:

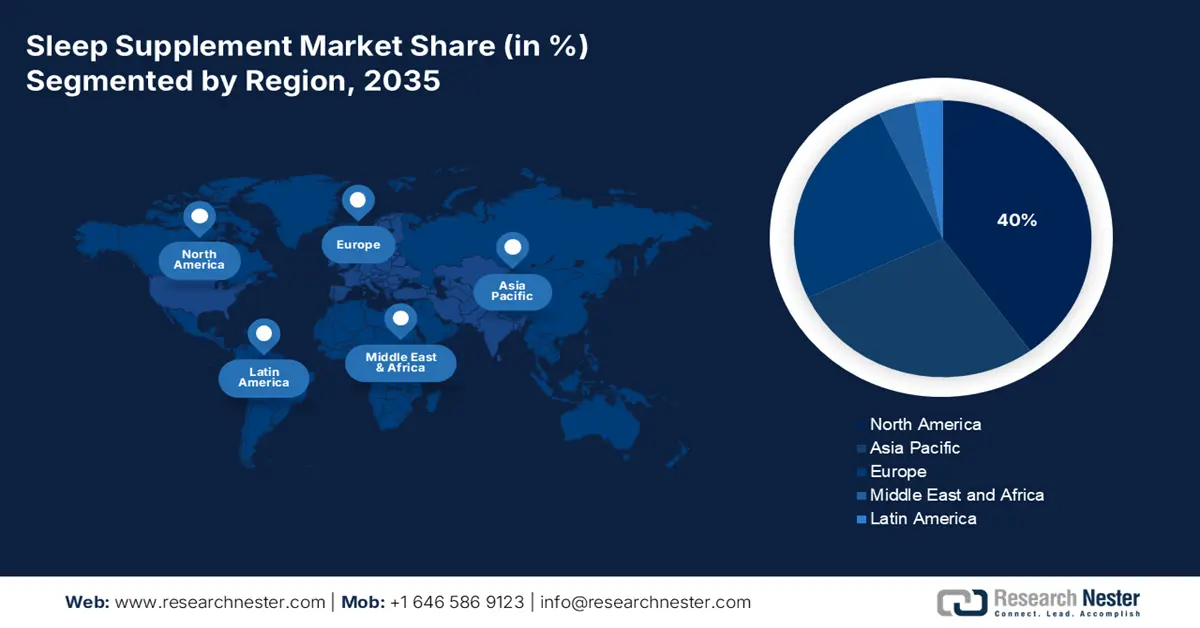

Regional Highlights:

- North America is projected to capture 40% share by 2035, fueled by high prevalence of sleep disorders and a well-established healthcare and wellness system.

- Asia Pacific is expected to hold 28% share by 2035, impelled by urbanization-related stress and increasing sleep disturbances among adults.

Segment Insights:

- Melatonin segment is projected to account for 34% share by 2035, driven by FDA recognition and effectiveness in reducing sleep latency.

- Gummies segment is expected to hold 29% share by 2035, owing to senior-friendly innovation and convenient, appealing consumption.

Key Growth Trends:

- Rising issues of sleep disorders

- Shift toward natural and plant-based products

Major Challenges:

- Price control and reimbursement issues

- Lack of regulatory oversight and standardization

Key Players: Nature Made, Bayer AG, By-Health, NOW Foods, Takeda Pharmaceuticals, Blackmores, Himalaya Wellness, Nutrafol, Pure Encapsulations, PharmaNord, Zarbee’s Naturals, H&H Group (Swisse), Solaray, Life Extension, Amway (Nutrilite), VMS BioMedix, Kyolic (Wakunaga), Dr. Willmar Schwabe, GN Laboratories, Organic India

Global Sleep Supplements Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.8 billion

- 2026 Market Size: USD 10 billion

- Projected Market Size: USD 13 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, France

- Emerging Countries: India, China, Japan, South Korea, Brazil

Last updated on : 21 August, 2025

Sleep Supplements Market - Growth Drivers and Challenges

Growth Drivers

-

Rising issues of sleep disorders: According to a report by HELPGUIDE.ORG, approximately one-third of adults suffer from sleep deprivation, with an estimated 32.8% of adults not getting enough sleep. Further, in the US, between 50 and 70 million people suffer from sleep disorders or disruptions. The increasing incidence of sleep disorders is a major factor behind the growth of the sleep supplements market as more people are looking for non-prescription, over-the-counter ways to help them with sleep problems. Many people would prefer to take an over-the-counter sleep supplement before using a prescription sleep aid because it is a safer, natural, use at your own risk alternative. Sleep supplements are usually based on ingredients like melatonin, valerian root, and magnesium to help people improve the quality of their sleep.

-

Shift toward natural and plant-based products: There is a strong indication that consumers are gravitating toward sleep supplements that contain natural and herbal ingredients. This shift can be tied back to a larger trend of clean-label, plant-based wellness products. Consumers are moving away from synthetic ingredients and pharmaceuticals because of potential side effects and dependency concerns. Natural sleep aids provide a gentler alternative that resonates with those conscious about health and those with sensitivities. As plant-based lifestyles have taken off, the focus on medicinal plants continues to gain traction.

-

Expansion of e-commerce and DTC channels: The expansion of e-commerce and direct-to-consumer channels has provided consumers with unprecedented access to sleep supplements. Consumers can now conduct research, compare products, shop online, and make their purchases, sidestepping traditional retail. Online platforms also create opportunities to enhance products with personalization, based on consumer evaluations and sleep-tracking data. Subscription models, targeted advertising, and influencer marketing help create visibility and legitimacy while leveraging e-commerce and DTC models. Additionally, many consumers have come to prefer purchasing health-related products via online shopping.

Challenge

- Price control and reimbursement issues: The Government tends to control the price of the products, which limits the profit margin for the business. Manufacturing margin is also limited, which has become a major barrier is managing the cost of production and profit-making target for the business. Low Medicare coverage limited accessibility in the concerned market. In addition, with limited innovation or points of differentiation, many brands struggle for shelf space or market share. Constant competition can inhibit smaller brands and their longer-term growth strategies.

- Lack of regulatory oversight and standardization: One of the more significant issues facing the sleep supplements category is inconsistency in regulatory oversight. In many areas of the U.S., supplements are not regulated as strictly as pharmaceutical drugs, leading to a rationale for inconsistency in quality, dosing, and labeling. Consumers are then faced with confusion or skepticism about whether the product will work or be safe to consume. With unsubstantiated claims of effectiveness and undeclared compounds at large in the marketplace, health professionals have reason to be concerned about recommending these products.

Sleep Supplements Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 8.8 billion |

|

Forecast Year Market Size (2035) |

USD 13 billion |

|

Regional Scope |

|

Sleep Supplements Market Segmentation:

Product Type Segment Analysis

Based on product type, the melatonin segment dominates the sleep supplements market and is anticipated to achieve a market share of 34% by 2035. Reliability of the consumers on the melatonin supplements rose with the FDA recognition. According to the clinical trials, sleep latency reduction is successfully achieved with the help of melatonin supplements. Government initiatives through financial coverage helped to raise accessibility. As a supplement, it appears to be more efficacious than many natural supplements for the treatment of insomnia, jet lag, and circadian rhythm disorders by inducing sleep. Part of the reason for its popularity includes the easy access to it.

Form Segment Analysis

In terms of form, the gummies segment leverages the market performance and is expected to accumulate a sleep supplements market share of 29% by 2035. Senior-friendly product innovation gained market attention and leveraged sales performance. Gummies are easy to take, taste good, and require no water and no swallowing pills, which is a boon for children, seniors, and adults. Gummies look and taste like candy, which also promotes regular consumption, improves compliance, and increases satisfaction with the product. Brands are also increasingly developing gummies for the purpose of creating unique products with engaging packaging, flavors, and functional ingredients, such as melatonin, magnesium, and herbs.

Distribution Channel Analysis

By distribution channel, retail pharmacies are the leaders in the sleep supplements market, as they provide access, trust, and convenience for a broad range of consumers. Retail pharmacies are ubiquitous in urban and rural markets, making them the most convenient place to purchase OTC sleep weight loss aids, proper sleep supplements. Retail pharmacies also provide well-known brand credibility and a regulated environment for the pharmacy's customers. There are many well-known and reputable brands, a mix of national brands and private labels, giving consumers access to products at different price points.

Our in-depth analysis of the sleep supplements market includes the following segments:

|

Segments |

Subsegment |

|

Product Type |

|

|

Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sleep Supplements Market - Regional Analysis

North America Market Insights

North America is the dominant region within the global territory of sleep supplements market, and it is anticipated to gain a market share of 40% in 2035. High rates of sleep disorders, an informed consumer base, and a well-established healthcare and wellness system make North America the global leader in the sleep supplements market. Millions of Americans and Canadians suffer from insomnia, sleep apnea, and sleep disturbances caused by anxiety, resulting in a consistent demand for OTC sleep aids. The region has an established supplement culture, with consumers comfortably using natural health products such as melatonin, valerian root, and magnesium. There are also favorable regulations for sleep supplements and many options for retail availability through pharmacies, supermarkets, and online retailers.

The U.S. market possesses robust growth in the sleep supplements market, with an expectation to possess 39% of the global market share by 2035. The U.S. dietary supplement industry has a strong foundation resulting from an established regulatory environment, high levels of consumer confidence, and widespread retail distribution. This demand for products featuring natural ingredients such as melatonin, magnesium, and herbal extracts will continue to be significant. The U.S. also has influential market players, regular product innovation and a strong marketing presence through e-commerce and social media.

The sleep supplement landscape in Canada is seeing solid growth as a result of increased sleep health awareness, rising stress levels, and a shift toward natural health products. According to one study, many Canadians suffer from sleep problems, driven by work, digital screens, and more recently, mental health. As sleep health problems continue to rise, consumers are looking for easy-to-access, non-prescriptive solutions, especially those that are perceived as safe and natural. This has increased the demand for sleep supplements such as melatonin, magnesium, and herbal blends in the Canadian sleep market.

Asia Pacific Market Insights

The Asia Pacific is evaluated as the emerging region in the sleep supplements market with an anticipation of accumulating a market share of 28% by 2035. Rapid switch to urbanization and economic pressure generated stress within aged populations. Sleep issues have increased among adults because of the urbanization stressor and higher screen time. This is the leading growth driver in the market in Asia Pacific. Better research and development introduced innovations to control the cost of manufacturing, which raised the affordability rate for consumers.

China is the leading country in the Asia Pacific that is expected to possess 42% of the regional share in the sleep supplements market by 2037. E-commerce performance is the key growth driver that ensured sales surged in the concerned market. Moreover, the aging population created a profound market in China and leveraged demand for the market. With the increase in health awareness, more people are looking to fine over-the-counter sleep aids. With the government backing health and wellness initiatives, combined with e-commerce dealings in China, these products are now more accessible than ever.

The supplements industry in India for sleep is flourishing as a result of increasing awareness around mental health and stress. This trend is affecting many age groups and is showing a correspondingly wide-ranging impact on sleep. Consumers are slowly moving away from mainly traditional solutions to a growing number of standardized sleep supplements. Coupled with rising disposable income, increased health knowledge, and improved access to health and wellness products through increasingly digital online distribution channels, will drive demand for sleep supplements for some time.

Europe Market Insights

Europe is seen as an emerging region in the sleep supplements market due to a rapid increase in awareness of sleep-related health issues and a cultural shift towards preventive wellness. Over the last couple of years, Europeans have come to understand more that a lack of good-quality sleep contributes to the development of chronic conditions such as anxiety, depression, and cardiovascular disease. This has led to an increased demand for non-prescription sleep aids. In addition, an aging population in many European countries including Germany, Italy, and France, has been linked to an increase in sleep disturbances, yielding a larger audience for sleep products such as supplements.

France has strong growth in its sleep supplements market. As health awareness increases, people are moving away from synthetic medications and toward natural wellness options. With rising stress levels, mostly from urbanites, the problems of sleep disturbances and insomnia are growing, leading consumers to seek out softer plant-based alternatives. French consumers place a strong preference for clean-label, organic, and herbal ingredients such as valerian root, lavender, and melatonin.

The sleep supplements market in Germany is experiencing steady growth due to life expectancy, heightened levels of work-related stress, and a high incidence of sleep disorders. Germans generally trust in the power of natural remedies and phytotherapy, which explains the high popularity of herbal sleep aids in Germany. The country benefits from having a highly regulated supplement market, which entails greater safety standards and significant consumer trust in the market.

Key Sleep Supplements Market Players:

- Nature Made

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG

- By-Health

- NOW Foods

- Takeda Pharmaceuticals

- Blackmores

- Himalaya Wellness

- Nutrafol

- Pure Encapsulations

- PharmaNord

- Zarbee’s Naturals

- H&H Group (Swisse)

- Solaray

- Life Extension

- Amway (Nutrilite)

- VMS BioMedix

- Kyolic (Wakunaga)

- Dr. Willmar Schwabe

- GN Laboratories

- Organic India

The highly fragmented sleep supplements market is experiencing and possession of more than 40%, marked by the top five key global players. The strategic initiatives incorporated by the business to derive a competitive edge include acquisition, regulatory alignment, and implementation of the business model of direct-to-consumer. Nestlé acquired Pure Encapsulation in 2022 to expand their business performance in the concerned market, which positively impacted business growth. Takeda from Japan, on the other hand, gained clearance for the first senior-targeted melatonin that upsurged their sales value in 2023. More than 28% of the U.S. sales of NOW Foods are derived through DTC expansion utilizing the Amazon storefront.

Recent Developments

-

In June 2025, Safety Shot, Inc. announced that it is beginning research and development related to new product lines and will focus on cognitive enhancement and sleep improvement. InvestingPro shows that the stock price is trading near its 52-week low, as it has experienced considerable price movement over the past year.

-

In June 2025, Natrol, the nation's #1 drug-free sleep aid brand, announced the launch of a revolutionary game-changer for athletes and everyday doers: Natrol Sleep & Restore, a brand-new sleep supplement line. The Natrol brand has enlisted star quarterback Josh Allen and sleep expert Dr. Chris Winter to launch its new restorative sleep supplement line, Natrol® Sleep & Restore.

- Report ID: 3014

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sleep Supplements Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.