Satellite Antenna Market Outlook:

Satellite Antenna Market size was valued at USD 4.1 billion in 2025 and is projected to reach USD 11.2 billion by the end of 2035, rising at a CAGR of 10.4% during the forecast period, i.e., 2026-2035. By the end of 2026, the industry size of satellite antenna is estimated at USD 4.6 billion.

Satellite antennas are made by using parts and materials procured from numerous countries. The raw material includes circuit boards and strong metals, etc. Some of the crucial parts are made in the U.S. and Japan. After the development, these parts are sent to the Southeast Asian region, where antennas are assembled at cheaper costs. However, governments are encouraging companies to bring more production locally. This will help lower the risk of supply delays from the other countries.

Governments worldwide are encouraging companies to invest more in research and development related to space technology. The advent of the latest factory tools and machines is also resulting in the faster development of antennas. The inclusion of automation in assembly steps is cutting the production time. Market players are launching electronically steerable and phased array antennas that are capable of handling high data speeds and lowering the signal loss even in bad weather. Efforts are also being made to develop multiple frequency bands, such as Ku band and Ka band, for commercial internet.

Key Satellite Antenna Market Insights Summary:

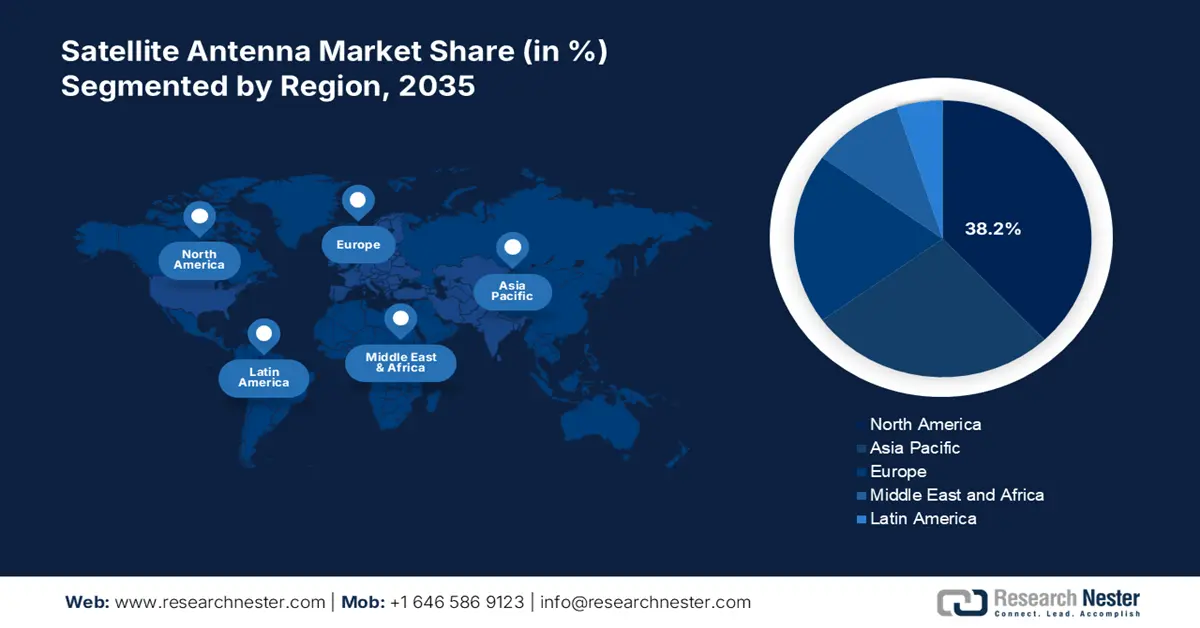

Regional Highlights:

- North America is poised to capture strong momentum in the satellite antenna market during 2026–2035, holding a forecast growth of 38.2% as its expansion is spurred by rising defense expenditure and accelerating LEO satellite deployments.

- Asia Pacific is projected to emerge as the fastest-growing region by 2035, with its advancement fueled by substantial investments from emerging economies and increasing reliance on small satellites for real-time applications.

Segment Insights:

- Military and defense segment is projected to secure 38.2% share by 2034 in the satellite antenna market, supported by escalating SATCOM investments and the intensifying need for secure, anti-jamming communication infrastructure.

- The Ka band segment is anticipated to command 40.2% share by 2034, underpinned by its role in enabling high-throughput satellite connectivity and next-generation low-latency broadband solutions.

Key Growth Trends:

- Expansion of Low Earth Orbit (LEO) Satellite Constellations

- Government investment in defense and security communications

Major Challenges:

- Complex licensing and landing rights restrictions

- Exorbitant initial investment and infrastructure costs

Key Players: Raytheon Technologies, Thales Group, Lockheed Martin, Honeywell Aerospace, Airbus Defence and Space, L3Harris Technologies, Gilat Satellite Networks, Cobham SATCOM, Viasat, Bharat Electronics Ltd (BEL), Kymeta, MEASAT.

Global Satellite Antenna Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.1 billion

- 2026 Market Size: USD 4.6 billion

- Projected Market Size: USD 11.2 billion by 2035

- Growth Forecasts: 10.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Growth During 2026–2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Canada, Australia, Italy

Last updated on : 28 August, 2025

Satellite Antenna Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of Low Earth Orbit (LEO) Satellite Constellations: One of the strongest growth drivers of the satellite antenna market is the constant surge in deployment of the LEO satellite constellations by both private operators and government space agencies. The geostationary satellites remain fixed in one position, while LEO satellites move swiftly in the sky and require antennas that can track their position in real-time. These factors have created a robust demand for numerous satellites with electronically steerable antennas. According to a report published by the Congressional Budget Office in 2023, more than 85.2% of the operational satellites in the world are in LEO.

- Government investment in defense and security communications: The global defense agencies are infusing a humongous budget for satellite communications as part of the modernization programs. For instance, the Department of Defense in the U.S. has invested in incorporating state-of-the-art antennas for reconnaissance and surveillance platforms. The modern antennas in defense ensure unhindered connectivity in oceans or remote battlefields. In April 2025, South Korea launched 4th of 5 planned spy satellites. These steps are ensuring the country’s independent surveillance capacity by increasing the coverage. A similar kind of investment is being India and NATO countries for both humanitarian missions and the battlefield.

- Rising demand for in-flight and maritime connectivity: The demand for satellite antennas has surged due to the rising need for high-speed internet services from cruise operators and airlines. Modern maritime antennas must maintain a stable connection in rough seas while switching between satellites to provide continuous coverage to the crew and passengers. The maritime satellites support the Global Maritime Distress and Safety System, enabling real-time distress calls anywhere at sea. Also, these satellite antennas enable shipping companies to handle fleets and cargo in real time. According to the UN Trade and Development in April 2025, Maritime transport moves more than 81% of the goods traded globally. As the global sea-borne trade is growing, there will be more need for constant communication, which is further fueling the satellite antenna market growth.

Challenges

- Complex licensing and landing rights restrictions: Numerous countries are enforcing landing rights on the companies, requiring foreign operators to obtain local approvals. For instance, Saudi Arabia poses guidelines to foreign satellite operators to establish a local entity or partner, adding 6-12 months to market entry timelines. Other than this, Mexico requires separate regulatory filings, resulting in increased compliance costs.

- Exorbitant initial investment and infrastructure costs: Manufacturing satellite antennas requires significant capital for research and development. Various small and medium enterprises find difficulty in competing with well-established players such as L3Harris Technologies. The high costs limit the innovation and market diversity, favoring the large corporations.

Satellite Antenna Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.4% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 11.2 billion |

|

Regional Scope |

|

Satellite Antenna Market Segmentation:

Application Type Segment

The military and defense segment is projected to garner 38.2% of the market share by 2034. The segment growth is driven by rising geopolitical tensions and significant investment in communication and satellite-enabled radar. The defense departments in various countries have increased SATCOM funding to support the installation of the advanced antenna. In defense, there is a huge requirement for anti-jamming activities and secure mobile communication, which will further fuel the demand for high-performance satellite antennas. For instance, pace posture in Japan is getting a prominent boost with an increase of ten times more funding in the last 5 years for establishing new defense satellites.

Frequency Band Analysis

The Ka band segment is anticipated to garner 40.2% of the share by 2034. The leading position of Ka band stems from the ability to aid high-throughput satellite services. These bands are crucial for the LEO constellation networks and modern broadband services. The higher frequencies render greater data capacity, making it important for the next-generation satellite-based internet. The surge in need for fast and low-latency connectivity in both fixed and mobile contexts is acting catalyst for robust forecast share. Additionally, Ka-band spot beams usually have 10 times more capacity in comparison with the conventional Ku band satellites.

Antenna Type Analysis

The parabolic reflector antenna segment is anticipated to secure more than 40% of the market share by 2034. The growth of the segment can be attributed to the high gain and proven reliability of the long-distance satellite links. Additionally, the parabolic reflector antennas are widely utilized in deep-sea communications and DTH TV services. Additionally, the demand for parabolic reflector antennas is also rising, as it has no moving electronics and a lower risk of failure. Also, these antennas work efficiently with the Ku band, C band, and X band, making it versatile for military radar and consumer broadband.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Antenna Type |

|

|

Application |

|

|

Frequency Band |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Satellite Antenna Market - Regional Analysis

North America Market Insights

The North America satellite antenna market is set to witness staggering growth that is 38.2% during 2026-2035. The growth of the market is driven by rising spending in the defense sector and the increasing LEO satellite deployments. The U.S. is maintaining its leadership in the regional market on account of substantial investments in cutting-edge technologies and infrastructure. The prominent telecom companies, such as Verizon and T Mobile, are amalgamating satellite infrastructure to bring coverage to the dead zones, usually by partnering with the LEO satellite providers. Also, the space budget of the country has reached a historic high, as more than USD 7.1 billion has been allocated for lunar exploration in May 2025. These factors are projected to fuel the growth of the market in the country.

Canada is emerging as a key landscape that is backed by humongous financial input and launch of ambitious projects from both public and private organizations. The country is further advancing GaN-based technology and positioning itself as a hub for next-generation satellite solutions. Additionally, the federal investment in space-based infrastructure, such as the Earth Observation Program, is helping in industrial applications as well as environmental monitoring. Furthermore, the vast geography of the country poses a constant challenge for the terrestrial broadband infrastructure. The demand for satellite antennas has increased as it offers the most efficacious solution to bridge the digital divide.

APAC Market Insights

Asia Pacific is estimated to establish itself as the fastest-growing region in the global market by the end of 2035. Major investments in this sector originate from emerging economies, such as China, Japan, and India. For instance, in May 2025, China launched 12 AI-enabled satellites into LEO to make the global 1st orbital supercomputer network. Additionally, in China, industries such as civil engineering are increasingly dependent on small satellites for harnessing real-time data and sensing. The implementation of the Belt and Road Initiative and Pearl River Delta development involves digital infrastructure that uses satellite connectivity.

India’s accelerated progress in this sector is supported by strong government support for rural connectivity enhancement. Moreover, the country's efforts to escalate the volume of space exploration and the Make in India goals are cumulatively cultivating lucrative opportunities for this merchandise. According to data published by Bharat Shakti in May 2025, 100-150 new satellites are set for launch by 2030. Also, the development in Starlink's regulatory approval showcases the emerging avenues for satellite broadband platforms. These factors are boosting the adoption of antenna systems capable of supporting satellite-based high-speed connectivity.

Europe Market Insights

Europe is expected to establish its significance in the global satellite antenna market between 2026 and 2035, with notable revenue generation. Rigorous R&D investments and participation, coupled with automation initiatives, are strengthening the region's cohort of innovation in this category. The European Space Agency is also supporting various programs to strengthen advanced manufacturing techniques for antennas, such as stereolithography. This helps reduce the weight of the antenna by 50% and lead time by up to 6 weeks. Germany is consolidating its leadership in the European market on account of a stable cash inflow from both defense and commercial applications. The military modernization in the country, such as independent multi-satellite systems, is boosting the demand for advanced antennas.

In the UK, the market is driven by the widespread space sector and increased digitalization of the maritime and aviation industry. In February 2025, 2 innovative projects were awarded USD 2.5 million from the UK Space Agency to steer the country to the leading position of the latest advancements in satellite communications. The government's focus on nationwide resilience and rural connectivity is making satellite a formal part of the UK’s broadband mix. These factors are propelling the market growth during the forecasted period in the country.

Key Satellite Antenna Market Players:

- Raytheon Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thales Group

- Lockheed Martin

- Honeywell Aerospace

- Airbus Defence and Space

- L3Harris Technologies

- Gilat Satellite Networks

- Cobham SATCOM

- Viasat

- Bharat Electronics Ltd (BEL)

- Kymeta

- MEASAT

- Kymeta

The current dynamics of the market is stimulated by strong consolidation, with Raytheon, Thales, and Lockheed Martin collectively controlling over 40.4% of global revenue share. These players are prioritizing innovations, such as phased-array antennas (ESAs) and AI-driven beamforming, to enhance the performance of their pipelines. They are also enhancing their abilities in dual-use civil-military technologies to maintain viability with the latest commercial trends. Moreover, manufacturers and innovators in Japan, such as Mitsubishi and NEC, are advancing LEO-compatible antennas to strengthen their positions in the maritime and aviation industries.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, Global Konet introduced its Dualsat ESA Antenna APP & Compact Terminals. The Dualsat ESA Antenna APP allows a single antenna to simultaneously serve or monitor two satellites—a notable innovation for compact, multi-satellite reception

- In May 2024, Pasternack launched a series of advanced millimeter-wave horn antennas intended for test and measurement applications. These features include dual polarization and waveguide probes, operating across a broad frequency range (22 to 170 GHz).

- Report ID: 7916

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Satellite Antenna Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.