Rubber Molding Market Outlook:

Rubber Molding Market size was valued at USD 46.76 billion in 2025 and is set to exceed USD 75.44 billion by 2035, registering over 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rubber molding is estimated at USD 48.82 billion.

The automotive industry’s demand for durable high-performance rubber components like seals, gaskets, hoses, and vibration-dampening parts plays a significant role in driving the growth of the rubber molding market. As the automotive sector evolves, particularly with the rise of electric vehicles (EVs), the need for advanced rubber materials has intensified. As per the International Energy Agency, in 2023, about 14 million new electric vehicles were registered worldwide that require lightweight, high-efficiency components to improve performance and energy efficiency. Rubber parts, such as seals for battery enclosures, gaskets for insulation, and hoses for fluid transfer, are critical to meet these requirements. This growing focus on electric and hybrid vehicles has increased demand for specialized rubber molding solutions, further boosting market expansion.

Additionally, the growing demand for eco-friendly materials and recycling in rubber manufacturing is a key driver of the rubber molding market expansion. As sustainability becomes a global priority, manufacturers are increasingly adopting recycled rubber, bio-based materials, and energy-efficient production methods. It is anticipated that the demand for sustainable tire materials will increase in 2024. This shift reduces environmental impact while meeting consumer demand for sustainable products. Governments worldwide are also implementing stricter environmental regulations, pushing companies to innovate and incorporate eco-friendly solutions. These sustainability trends are fostering growth in the rubber molding market as industries prioritize greener alternatives.

Key Rubber Molding Market Insights Summary:

Regional Highlights:

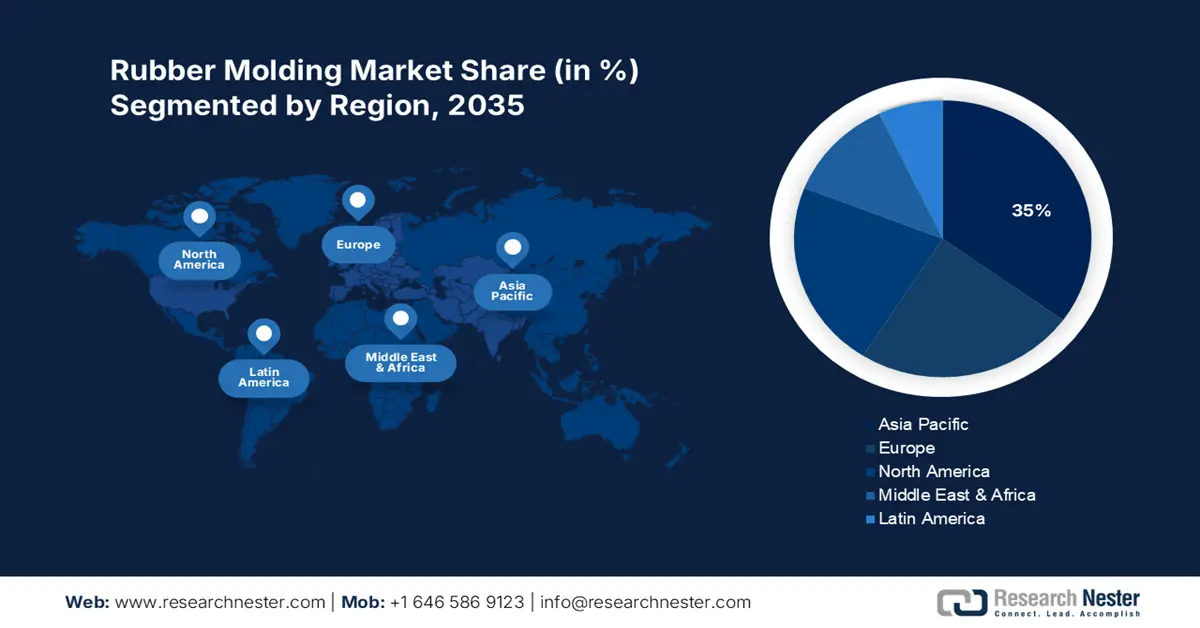

- Asia Pacific's 35% share in the Rubber Molding Market is led by the region's dominance in automotive production and growing demand for electric vehicles and fuel-efficient vehicles, ensuring growth through 2035.

Segment Insights:

- The Automotive segment is poised for lucrative growth by 2035, driven by the rise of electric vehicles and advancements in lightweight, durable rubber parts.

- Ethylene Propylene Diene Terpolymer segment is projected to hold a 56.4% share by 2035, driven by its durability, flexibility, and resistance to heat and weathering in automotive and construction applications.

Key Growth Trends:

- Expansion of Construction Activities

- Demand for healthcare and electronics

Major Challenges:

- High production costs

- Competition from alternative material

- Key Players: Dow Chemical Company, Vuteq USA Inc., Cooper Standard Buildings Inc., DANA Holding Corporation.

Global Rubber Molding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 46.76 billion

- 2026 Market Size: USD 48.82 billion

- Projected Market Size: USD 75.44 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Rubber Molding Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of Construction Activities: With the raid growth of infrastructure projects globally. For instance, 137 low- and middle-income nations' infrastructure projects total more than 10,000, according to the Private Participation in Infrastructure (PPI) Project Database. This increases the demand for rubber-molded products is surging, particularly in construction equipment. These components play a vital role in shock absorption, vibration dampening, and sealing, ensuring machinery longevity and operational efficiency. Additionally, the ongoing wave of urbanization and substantial investments in smart cities are driving the use of advanced construction tools and machinery. This expanding scope fuels the need for durable and high-performance rubber components, cementing their importance in modern infrastructure development.

- Demand for healthcare and electronics: The increasing need for specialized rubber components in medical devices and electronics is driving significant growth in the rubber molding market. In the medical field, rubber components like seals, gaskets, and tubing are essential for ensuring safety, reliability, and durability in devices such as syringes, prosthetics, a diagnostic equipment. Similarly, in electronics, rubber is used for insulation, vibration damping, and protection of sensitive components. As these industries continue to innovate and expand, and the demand for high-quality, precision rubber molded parts will continue to rise, fostering rubber molding market expansion across both sectors.

Challenges

- High production costs: Rubber molding processes, especially those requiring advanced technologies like injection molding, can be expensive due to high material costs, energy consumption, and specialized machinery. These costs may be prohibitive for small or mid-sized companies, limiting their ability to compete. Additionally, fluctuating raw material prices, particularly for high-quality rubber, can lead to unpredictable production expenses.

- Competition from alternative material: Rubber faces competition from alternative materials like plastics, silicones, and thermoplastics, which can offer superior properties such as greater durability, flexibility, or lower cost. In certain applications, these materials can outperform rubber, especially when lightweight or high-strength characteristics are needed, thereby limiting the demand for rubber components in those sectors.

Rubber Molding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 46.76 billion |

|

Forecast Year Market Size (2035) |

USD 75.44 billion |

|

Regional Scope |

|

Rubber Molding Market Segmentation:

Material (Ethylene Propylene Diene Terpolymer, Natural Rubber, Styrene Butadiene Rubber)

By material, the ethylene propylene diene terpolymer segment is anticipated to dominate around 56.4% rubber molding market share by the end of 2035, due to its exceptional durability, flexibility, and resistance to heat, ozone, and weathering. Additionally, it is resistant to steam and polar chemicals and stable at temperatures as high as 150°C. EPDM is widely used in automotive and construction applications, including weatherstripping, seals, and gaskets, where long-lasting performance is critical. Its ability to maintain properties under extreme temperatures makes it ideal for under-the-hood components in vehicles. As demand for high-performance and sustainable materials increases, EPDM continues to gain traction in the market.

End Use (Automotive, Consumer Goods, Healthcare, Electrical & Electronics, Construction)

Based on end use, the automotive segment is established to hold a lucrative rubber molding market share by the end of 2035. The segment’s growth is attributed to its extensive use in vehicle manufacturing. . The growing demand for electric vehicles (EVs) and advancements in automotive technology further drive the need for high-performance rubber materials. From about 4% of all automobile sales in 2020 to 18% in 2023, the proportion of electric vehicles has grown. Moreover, stringent regulations regarding vehicle emissions and efficiency have increased the adoption of lightweight, durable rubber parts. With the global automotive industry’s expression, this segment remains the dominant contributor to the market.

Our in-depth analysis of the global rubber molding market includes the following segments:

|

Material |

|

|

Type |

|

|

End- Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rubber Molding Market Regional Analysis:

APAC Market Statistics

Asia Pacific in rubber molding market is anticipated to hold over 35% revenue share by the end of 2035. The region is a leading hub for automotive production housing major manufacturing. The growing demand for electric vehicles (EVs) and fuel-efficient vehicles has increased the need for high-performance rubber molded components, such as gaskets, seals, and vibration control parts, which are essential for vehicle durability and efficiency.

As a global leader in electronic manufacturing, China requires rubber-molded parts for insulation, sealing, and vibration damping in devices. The growing production of smartphones, wearables, and other electronics drives the demand for precise-engineered rubber components. The expansion of the healthcare sector in China, demands medical-grade rubber molded products used in equipment, devices, and surgical tools. Rising health awareness and government investment in healthcare infrastructure

In India, the government focuses on infrastructure development, including roads, bridges, and smart cities, driving demand for rubber molding products like seals, gaskets, and vibration-dampening materials. Over 2021–2026, the total infrastructure capital expenditure is projected to increase at a CAGR of 11.4%. These components are vital for ensuring structural stability and durability in construction projects. Furthermore, the adoption of advanced technologies like injection molding and 3D printing allows manufacturers to produce high-precision rubber components efficiently. These advancements help meet the growing demand for complex, customer-designed parts across industries.

Europe Market Analysis

Europe has a strong focus on sustainability and encourages the use of recycled and eco-friendly rubber materials. Initiatives promoting the circular economy are driving innovation in rubber molding, ensuring products are environmentally friendly while meeting industry standards for durability and performance. The region’s regulatory frameworks for quality and safety in the automotive, healthcare, and construction sectors encourage the adoption of premium rubber molded components. Manufacturers must comply with strict EU standards, driving the production of high-performance, precision-engineered rubber parts.

Germany has a strong commitment to sustainability and green technology. The environmental and resource-efficient technology market in Germany is estimated to be worth 9% of the global market, and it is projected to increase at a rate of roughly 8% per year until 2030. This has led to increased demand for eco-friendly and recyclable rubber materials in manufacturing. The push for sustainable practices across industries is prompting manufacturers to develop and use more environmentally friendly rubber molding processes and materials, benefiting the rubber molding market’s growth.

The aerospace and electronics sectors in the UK are evolving rapidly, requiring specialized rubber components for insulation, sealing, and protection. With an annual revenue of around £20 billion, the UK leads the European industry and has the biggest aerospace and defense sector outside of the US. These industries rely on rubber-molded products for various applications, including vibration dampening, electrical insulation, and fluid sealing. The expansion of these sectors, particularly in advanced technologies like electric aviation and consumer electronics, is driving increased demand for rubber molding solutions.

Key Rubber Molding Market Players:

- Continential AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RotaDyne Precision Engineering Private Limited

- Dow Chemical Company

- Vuteq USA Inc.

- Cooper Standard Buildings Inc.

- DANA Holding Corporation

- Freudenberg and Co

- Gates Corporation

Key companies in the global rubber molding market are innovating by developing advanced molding technologies like 3D printing and multiple-component molding. HP Inc. announced ground-breaking advancements in metal and polymer 3D printing in November 2024, coupled with significant partnerships that expand the potential of additive manufacturing across several industries. They are focusing on focusing on eco-friendly materials, including recycled rubber, and improving production efficiency. These innovations enhance product performance, reduce environmental impact, and meet the growing demand for high-quality, sustainable rubber components.

Recent Developments

- In April 2024, the Slovakian mold manufacturing expert EMT Púchov s.r.o. was acquired by Continental also, Continental acquired all of the shares of its long-standing supplier. The tire maker and EMT's stockholders, of which Dynamic Design (Romania) is the dominant stakeholder, had signed a separate agreement.

- In March 2021, Dow declared that its first low-density liquid silicone rubber (LSR) for injection molding is generally available to formulators and brand owners in North America and Europe.

- Report ID: 6791

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rubber Molding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.