Rib Fracture Repair Systems Market Outlook:

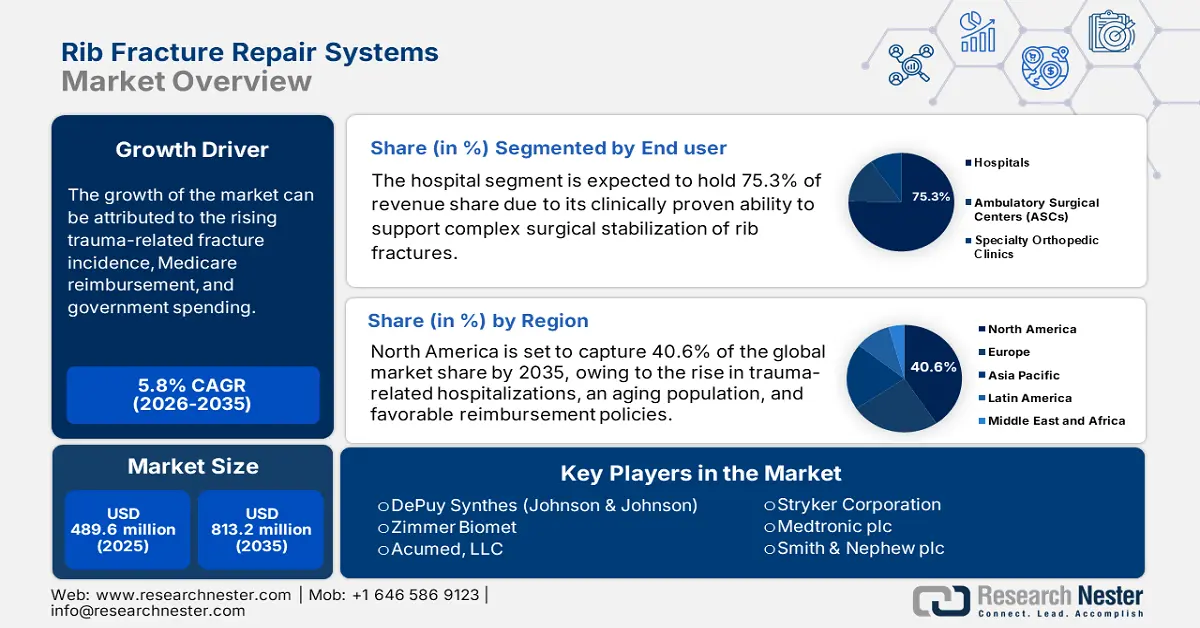

Rib Fracture Repair Systems Market size was valued at USD 489.6 million in 2025 and is projected to reach USD 813.2 million by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of rib fracture repair systems is estimated at USD 518 million.

The market is primarily concentrated on catering to patients with sustained severe thoracic injuries. In this regard, a 2022 study from the University of North Carolina revealed that approximately 66.6% of injured individuals in the world sustain trauma to the thoracic cavity. Another article published by the NLM in the same year disclosed that rib fractures were prevalent in the majority of people aged 60 and above, where the overall 30-day mortality rate of thoracic injury accounted for 11%. Further, in 2024, the NLM found that rib fractures occur among 55% of patients living with blunt chest trauma worldwide. These figures not only underscore the large epidemiology but also highlight its continuous amplification due to rapidly aging populations and increasing cases of underlying comorbidities.

The current dynamics of payers’ pricing in the market largely depend on the supply chain of quality-grade materials, such as titanium, stainless steel, and PEEK, sourced from leading manufacturing countries. Those products or components are typically assembled in facilities based in the U.S. and other developed countries. The general trend of economic primary indicators can be displayed through the consistent increase in the value of orthopedic or fracture appliance shipments around the globe, which stood at USD 12.7 billion in 2023 alone. The business was exhibiting an annualized growth rate of 3.6% over the past 5 years, as per the OEC report.

Key Rib Fracture Repair Systems Market Insights Summary:

Regional Insights:

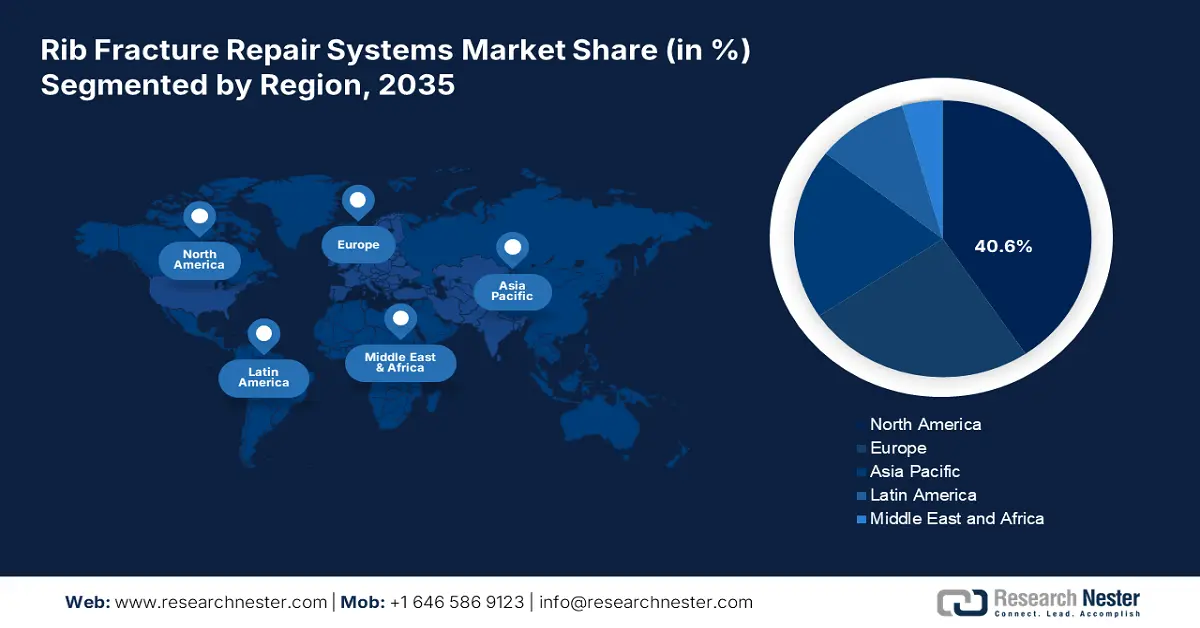

- By 2035, North America is projected to secure a 40.6% share in the Rib Fracture Repair Systems Market, fueled by rising trauma-related admissions and supportive reimbursement landscapes.

- Asia Pacific is anticipated to exhibit the fastest expansion through 2026–2035, underpinned by increasing trauma incidence and strengthening government-backed healthcare initiatives.

Segment Insights:

- Hospitals are expected to command a 75.3% revenue share by 2035 in the Rib Fracture Repair Systems Market, reinforced by their central role in executing complex surgical interventions.

- Plates and screws are set to attain a 55.7% share by 2035, bolstered by their widespread use in achieving stable fixation and optimized healing outcomes.

Key Growth Trends:

- Worldwide shift towards surgical management

- Increasing cases of trauma and accidents

Major Challenges:

- Government-imposed price controls

- Hurdles from premium-pricing and limited payer coverage

Key Players: Stryker Corporation, Zimmer Biomet Holdings, Inc., Acumed LLC, Medtronic plc, B. Braun Melsungen AG, Smith & Nephew plc, KLS Martin Group, Arthrex, Inc., Globus Medical, Inc., Orthofix Medical Inc., Japan Medical Dynamic Marketing, Inc. (JMDM), aap Implantate AG, OsteoMed, Jeil Medical Corporation, Surgival, Auxein Medical, Surgical Holdings, Trauson (part of Stryker), MightyX Medical (Illustrative Example), Able Medical Devices.

Global Rib Fracture Repair Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 489.6 million

- 2026 Market Size: USD 518 million

- Projected Market Size: USD 813.2 million by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 30 September, 2025

Rib Fracture Repair Systems Market - Growth Drivers and Challenges

Growth Drivers

- Worldwide shift towards surgical management: Conservative treatments, such as pain management and respiratory therapy, are increasingly being outperformed by modern approaches of orthopedic interventions. There is multiple clinical evidence that supports the advantages of surgical fixation in reducing pain, facilitating faster mobilization, and lowering complications. In this regard, a 2025 NLM study unveiled that surgical stabilization for rib fractures (SSRF) substantially lowers all-cause mortality compared to conservative management, especially in patients with multiple rib fractures, flail chest, or aged over 60 years. This is prompting both medical professionals and consumers to invest more in the market.

- Increasing cases of trauma and accidents: According to the 2022 NLM findings, trauma is the leading cause of death among people aged under 45 in the world, outnumbering cancer-related deaths among young adults. It also mentioned that 50% of polytrauma patients endure some sort of thoracic injury. Further, in 2025, the NLM again established that chest trauma accounted for 25% of all trauma-related fatalities, where rib fractures represented approximately 50% of these injuries. These figures indicate a high contribution of road traffic accidents, falls from height, crushing forces, and direct violence to the continuous demographic expansion of the market.

- Ongoing advancements in product pipelines: Breakthroughs in technologies and instruments available in the market enhance both efficacy and patient access in overall outcomes. The recent developments of bioresorbable plates, 3D-printed implants, and minimally invasive surgical techniques are attracting greater engagement from consumer and medical settings by delivering better results than conventional methods. Evidencing the same, a 2025 NLM study established that resorbable 3D-printed osteosynthetic plates for repairing rib fractures can deliver decreased inflammatory response, enhanced osseointegration, and bone morphometry within just 2- and 4-weeks in comparison to titanium plates.

Historical Trends in Key Demographics in the Rib Fracture Repair Systems Market

Global Sternum and Rib Fractures: Key Statistics and Trends (1990-2019)

|

Category |

2019 Figures |

Change Since 1990 |

Additional Details |

|

Incident cases (worldwide) |

4.1 million |

43.70% |

Men were affected at considerably higher rates than women |

|

Prevalent cases (worldwide) |

2 million |

64.10% |

Around 70% of incidents were unintentional injuries |

|

YLDs (Years Lived with Disability) |

190,834 cases |

62.40% |

Equivalent age-standardized rates decreased (5.5% to 7.1%) |

|

Proportion of unintentional injuries |

~70% of incident cases |

-- |

Applies worldwide and across all regions |

|

Socioeconomic trends |

High-income regions had the highest rates |

Rates declined by 6.4% to 7.1% since 1990 |

Low-middle and low-income regions had increases |

Trends of Global Trade in the Rib Fracture Repair Systems Market

Export-Import Data for Orthopedic or Fracture Appliances (2023)

|

Country |

Trade Type |

Value (in USD) |

|

U.S. |

Import and Export |

2.6 billion and 2.9 billion |

|

Germany |

Import |

956 million |

|

Netherlands |

Import |

1.0 billion |

|

Switzerland |

Export |

2.0 billion |

|

Mexico |

Export |

2.3 billion |

Source: OEC

Challenges

- Government-imposed price controls: Price caps and regulations create a tricky balancing act in the market for rib fracture repair systems. They might stifle profitability and innovation, which could ultimately slow down the growth of the market. When it comes to emerging markets, price ceilings can squeeze profit margins. For instance, in India, the regulation of orthopedic implant prices has resulted in some products being pulled from the market.

- Hurdles from premium-pricing and limited payer coverage: The high costs of treatment and the limited coverage from public payers are significant barriers to growth in the market. For instance, in the U.S., Medicaid only covers SSRF for patients with flail chest; those with non-flail fractures don’t get any standardized approval.

Rib Fracture Repair Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 489.6 million |

|

Forecast Year Market Size (2035) |

USD 813.2 million |

|

Regional Scope |

|

Rib Fracture Repair Systems Market Segmentation:

End user Segment Analysis

Hospitals are anticipated to hold the highest revenue proportion of 75.3% in the market throughout the discussed timeline. These facilities play a crucial role in treating rib fractures, particularly due to their involvement in conducting complex surgical procedures. Evidencing the same, a 2022 database from a single trauma center registered 36% referrals for ICU during hospitalization with only 4% mortality rate. Besides, the adherence of hospitals to national reimbursement policies is intricately consolidating the forefront position for the segment in this field. On the other hand, in cases of emergency from trauma or accidents, a majority of patients and families opt for these service providers, indicating their sole proprietorship in this sector in terms of end users.

Product Type Segment Analysis

Plates and screws are poised to dominate the market with a 55.7% share by the end of 2035. The widespread adoption of this product is earned through its necessity in stabilization in both simple and complex cases with rigid fixation, proper bone alignment, reduced pain, and faster recovery. Besides, the versatility of these components makes them a gold standard for thoracic surgeons. Furthermore, recent advances, such as low-profile and anatomically contoured plates, are securing the leading position for this subtype in this field over the upcoming years.

Material Segment Analysis

Despite the emergence of bioabsorbable alternatives, titanium is estimated to maintain dominance in the market by capturing a 65.4% share over the assessed timeframe. High compatibility with the human body, corrosion resistance, and a suitable strength-to-weight ratio gained from this material ensure long-term stability and reduced risk of complications. Additionally, titanium implants are non-reactive to advanced imaging techniques such as MRI and CT scans, supporting their efficiency in post-operative monitoring and patient management.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Fixation Method |

|

|

Fixation Type |

|

|

Material |

|

|

Indication |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rib Fracture Repair Systems Market - Regional Analysis

North America Market Insights

North America is expected to capture the highest share of 40.6% in the global market during the analyzed tenure. The continuous rise in trauma-related hospitalizations, an aging population, and favorable reimbursement policies are collectively cultivating a favorable business atmosphere for the merchandise in this region. Particularly, the growing number of thoracic injuries among older adults and patients with COPD is fueling the demand for surgical stabilization systems available in this sector.

According to the 2021 NLM findings, around 22-45 thousand people in the U.S. report rib fractures every year, costing more than an annual USD 469 million. Besides, a 10-year analysis from 2012 to 2021, published by the NLM in 2025, recorded a 52% and 96% increase in the rates of rib fracture incidence (per 100,000 people) and hospitalization across the country. These concerning figures are forcing the national medical system to adopt more advanced surgical tools from the market.

Canada is augmenting the rib fracture repair systems market steadily with massive public healthcare allocations and the growing focus on trauma and orthopedic care for elderly citizens. Particularly, dedicated organizations, including PHAC and BioteCanada, are actively promoting extensive research and early adoption of bio-compatible implants and minimally invasive techniques in this category. This subsequently encourages both domestic and foreign pioneers in this sector to invest in Canada on a larger scale.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global rib fracture repair systems market by the end of 2035. The concerning rise in trauma cases, a rapidly aging population, and supportive government initiatives are imposing favorable changes in the landscape. The region is primarily led by Japan, owing to the robust financial backing from the public authorities and a continuously expanding geriatric demography. Testifying to the same, a retrospective cohort study observed high occurrence rates of new fractures among patients aged 75 and over, accounting for 263 per 1000 person‐years, as per the NLM article published in 2024.

China is witnessing a steady rise in volumes of thoracic surgeries, which is ultimately propelling demand in the rib fracture repair systems market. According to the 2022 annual report from the Shanghai Chest Hospital, the count of these interventions in the facility surpassed a 10 thousand cases per year. Another estimation from the 2021 NLM study revealed that the number of patients in China with rib fractures ranged between 1.5 million and 2.0 million annually. Such a substantial patient population ultimately attracts greater investment in this sector.

India is also making strides in the rib fracture repair systems market with consistent government investments in trauma care infrastructure. The rising number of road traffic accidents and bone-related conditions is also contributing to the country’s growth in this sector by enlarging the consumer base. This is pushing the governing authorities of India to take prompt action to prevent accidental mortality nationwide. Regarding the same, in August 2023, a total of 196 trauma care facilities (TCFs) were sanctioned in government hospitals and medical colleges across the country.

Opportunities Presented by the Key Landscapes

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Switzerland |

2.2 billion |

500.1 million |

|

Netherlands |

1.1 billion |

1.2 billion |

|

Germany |

1.0 billion |

1.3 billion |

|

France |

470.4 million |

721.1 million |

|

Belgium |

323.3 million |

404.0 million |

|

Ireland |

175.2 million |

175.2 million |

|

Italy |

149.4 million |

310.8 million |

|

Spain |

88.1 million |

445.3 million |

|

UK |

85.9 million |

456.7 million |

Europe Market Insights

The Europe rib fracture repair systems market is estimated to garner a notable industry value from 2025 to 2037. This surge is primarily driven by an aging population and robust MedTech advances. In terms of progressive culture, government-led programs like NextGenerationEU and Horizon Europe are heavily investing in extensive medical device-related R&D, translating to massive improvement in the functionality and scalability of the existing product pipeline in this sector. In this regard, a report published by the International Journal of Basic & Clinical Pharmacology revealed that the region-wide annual expenditure on osteoporosis-related fractures can potentially rise from USD 43.0 billion to USD 89.2 billion by 2050.

The UK rib fracture repair systems market is growing steadily, with immense support from the National Health Service (NHS). On the other hand, osteoporosis-related fractures are becoming a severe medical crisis in the country, prompting service providers to accommodate reliable surgical fixation solutions for the enlarging patient population. Furthermore, the nation’s focus on improving trauma care services, alongside investments in advanced orthopedic technologies, also supports substantial growth in this sector.

Germany is a leading supplier of associated devices for the rib fracture repair systems market in Europe. The strong presence of MedTech innovators and manufacturers empowers the country’s significance in this landscape. Its large geriatric population also contributes to a steady expansion in the epidemiology of osteoporosis-related fractures and trauma cases. Moreover, the hospitals, due to being well-equipped with cutting-edge orthopedic technologies and surgeons, are acting as the major investors and growth factor behind the country’s impressive progress in this category.

Orthopaedic or Fracture Appliances, nes Trade by Country (2022)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Switzerland |

2.2 billion |

500.1 million |

|

Netherlands |

1.1 billion |

1.2 billion |

|

Germany |

1.0 billion |

1.3 billion |

|

France |

470.4 million |

721.1 million |

|

Belgium |

323.3 million |

404.0 million |

|

Ireland |

175.2 million |

175.2 million |

|

Italy |

149.4 million |

310.8 million |

|

Spain |

88.1 million |

445.3 million |

|

UK |

85.9 million |

456.7 million |

Source: WITS

Key Rib Fracture Repair Systems Market Players:

- DePuy Synthes (Johnson & Johnson)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Acumed LLC

- Medtronic plc

- B. Braun Melsungen AG

- Smith & Nephew plc

- KLS Martin Group

- Arthrex, Inc.

- Globus Medical, Inc.

- Orthofix Medical Inc.

- Japan Medical Dynamic Marketing, Inc. (JMDM)

- aap Implantate AG

- OsteoMed

- Jeil Medical Corporation

- Surgival

- Auxein Medical

- Surgical Holdings

- Trauson (part of Stryker)

- MightyX Medical (Illustrative Example)

- Able Medical Devices

The rib fracture repair systems market is largely led by major U.S. companies like DePuy Synthes, Zimmer Biomet, and Acumed. These companies together account for more than a third of the global market share. These industry leaders are concentrating on titanium-based, minimally invasive plating systems that have received FDA approval and feature advanced imaging technology. European firms such as KLS Martin and Medartis are focusing on creating high-precision implants. Whereas, countries like South Korea, India, and Malaysia are introducing more affordable options to tap into price-sensitive markets.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, Zimmer Biomet attained CE Mark certification for its intrathoracic rib fixation system, RibFix Advantage, for the thoracoscopic fixation, stabilization, and fusion of rib fractures. It allows a minimally invasive approach compared with traditional open reduction internal procedures.

- In January 2024, Able received 510(k) clearance from the FDA for its Valkyrie RIB System, marking a revolutionary milestone in its cardiothoracic and trauma portfolio. The single-use, PEEK device includes indications for the stabilization and fixation of fractures in the chest wall, reconstructive surgical procedures, trauma, and planned osteotomies.

- Report ID: 3916

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rib Fracture Repair Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.