Recycled Lead Market Outlook:

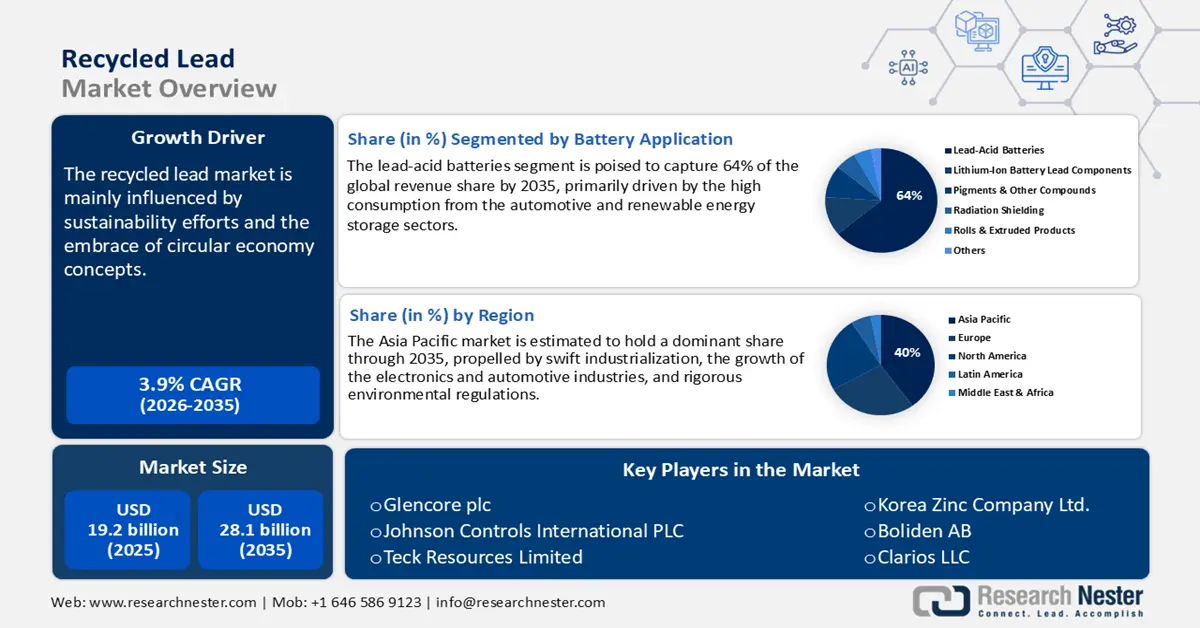

Recycled Lead Market size was valued at USD 19.2 billion in 2025 and is projected to reach USD 28.1 billion by 2035, growing at a CAGR of 3.9% during the forecast period from 2026 to 2035. In 2026, the industry size of recycled lead is estimated at USD 19.9 billion.

The global market for recycled lead is mainly influenced by sustainability efforts and the embrace of circular economy concepts. Governments across the globe are enacting policies to encourage lead recycling, to minimize environmental effects, and to preserve natural resources. For example, the Circular Economy Action Plan of the European Union, which is a component of the European Green Deal, seeks to enhance the utilization of recycled materials in various industries, including the lead sector. The European Commission aims to achieve a 60% recycling rate for municipal waste by the year 2030, highlighting the significance of recycling initiatives. Such initiatives are likely to accelerate the production and commercialization of recycled lead.

The supply chain for recycled lead is defined by the gathering of lead-containing waste, including used lead-acid batteries, cable sheathing, and lead pipes. In 2023, the U.S. exported around USD 110 million worth of scrap lead, while India imported approximately USD 200 million of scrap lead, according to the Observatory of Economic Complexity (OEC). This reflects a robust trade of recycled lead. Manufacturing capabilities are expanding worldwide, with countries such as China and India enhancing their recycling infrastructure to satisfy increasing domestic demand. These advancements are bolstered by investments in recycling technologies and compliance with environmental regulations, ensuring a consistent supply of recycled lead for various sectors.

|

Scrap Lead World Trade, 2023 |

|||

|

Country |

Export in USD Million |

Country |

Import in USD Million |

|

U.S. |

110 |

India |

200 |

|

Australia |

93 |

Spain |

89.4 |

|

U.K. |

83.6 |

South Korea |

66.5 |

|

France |

78.9 |

Belgium |

41.6 |

|

Netherlands |

36.6 |

Germany |

38.8 |

Source: OEC

Key Recycled Lead Market Insights Summary:

Regional Insights:

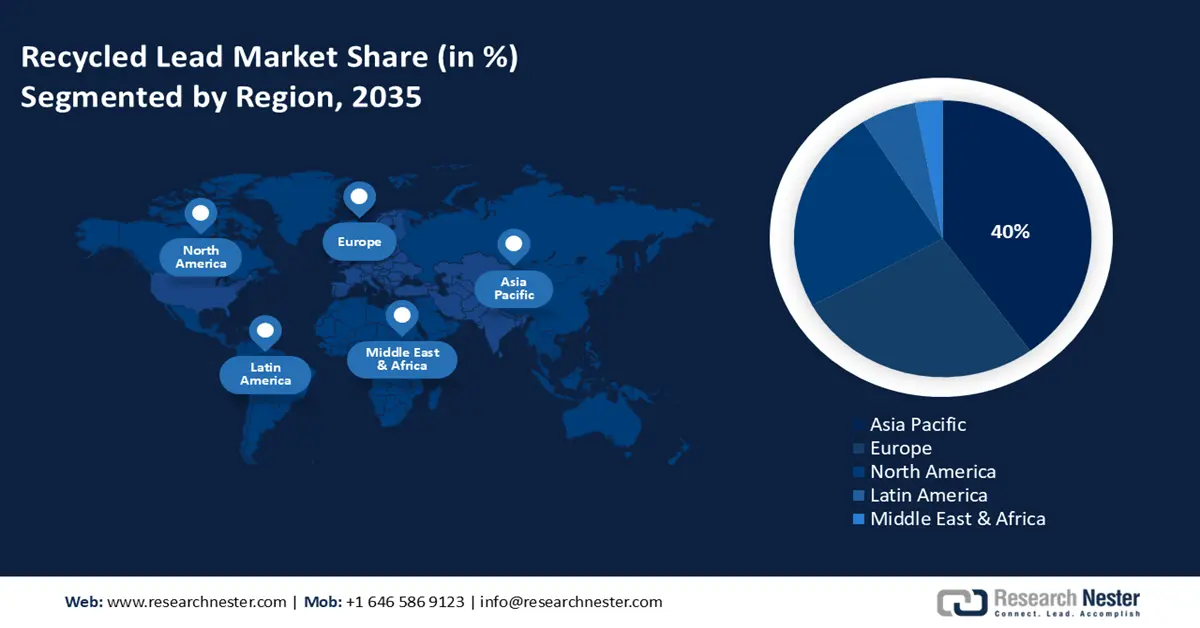

- The Asia Pacific recycled lead market is anticipated to secure 40% share by 2035, propelled by rapid industrialization, growth in electronics and automotive industries, and stringent environmental regulations in key countries.

- The Europe recycled lead market is estimated to hold 27% share by 2035, impelled by strict environmental regulations and supportive funding initiatives fostering circular economy adoption.

Segment Insights:

- The lead-acid batteries segment in the Recycled Lead Market is projected to account for 64% share by 2035, owing to rising demand from the automotive and renewable energy storage sectors.

- The lead-based stabilizer segment is expected to hold 32% share by 2035, driven by stricter chemical safety regulations and cost-effective, lower environmental footprint solutions.

Key Growth Trends:

- Regulatory push for sustainable practices

- Technological advancements

Major Challenges:

- Pricing pressures and volatility

- Market access obstacles

Key Players: Glencore plc, Johnson Controls International PLC, Teck Resources Limited, Korea Zinc Company Ltd., Boliden AB, Clarios LLC, and others.

Global Recycled Lead Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.2 billion

- 2026 Market Size: USD 19.9 billion

- Projected Market Size: USD 28.1 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Malaysia, France, United Kingdom, Brazil

Last updated on : 9 September, 2025

Recycled Lead Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory push for sustainable practices: Governments around the globe are enacting rigorous environmental regulations aimed at decreasing carbon footprints and fostering sustainable industrial practices. These initiatives encourage the use of green chemicals in multiple sectors, motivating companies to invest in environmentally friendly alternatives. For example, the European Green Deal aspires to establish Europe as the first climate-neutral continent by 2050, setting bold objectives for lowering greenhouse gas emissions and advancing circular economy principles. Such regulatory frameworks are increasing the demand for recycled lead as industries strive to meet environmental standards and lessen their dependence on virgin materials.

- Technological advancements: Innovations in bioprocessing, fermentation, and enzymatic processes have significantly improved the efficiency and cost-effectiveness of chemical and material production. Such developments make these products increasingly competitive with conventional alternatives, thus promoting their use in a range of industries. About recycled lead, advancements in recycling technologies are enhancing both the yield and purity of recycled lead, positioning it as a more feasible substitute for primary lead and boosting its demand across various applications. The energy-efficient smelting and hydrometallurgical processes are gaining momentum in recycled lead production.

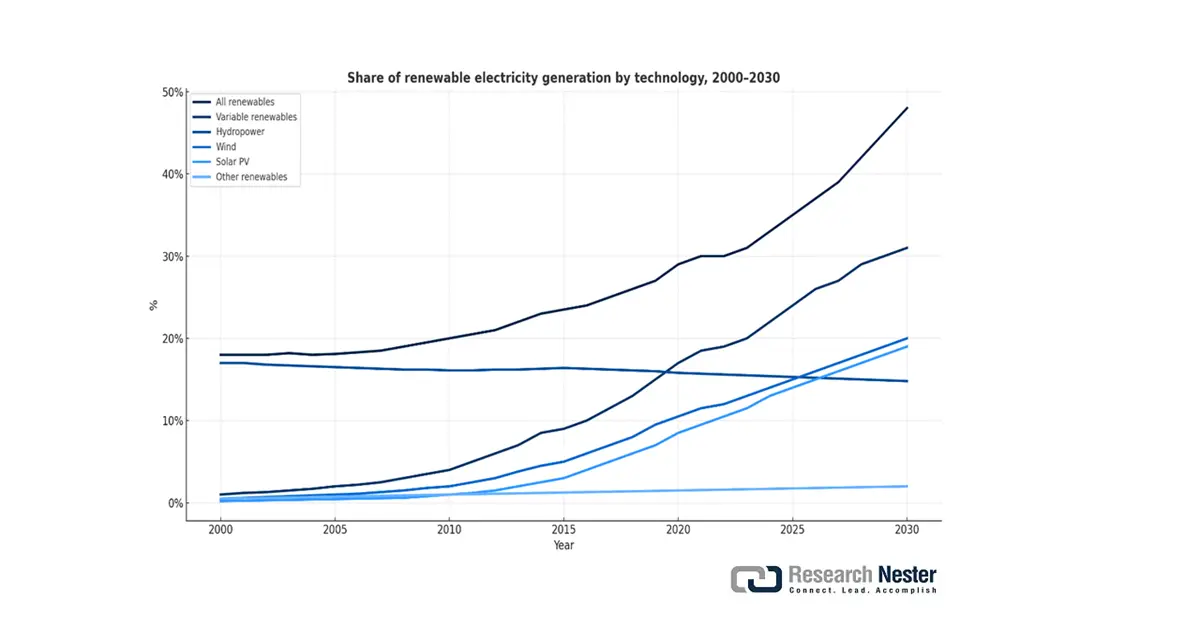

- Increasing role in renewable energy storage: The robust expansion of renewable energy projects is expected to drive a high demand for recycled lead batteries. According to the International Energy Agency (IEA), in 2023, solar power generation increased by a record 320 terawatt-hours, a 25% increase, reaching over 1,600 terawatt-hours. Also, solar power is anticipated to become the top renewable energy source by 2029. The same source also states that the European Union is speeding up solar panel installation due to the energy crisis, adding 61 gigawatts in 2023, which is 45% more than in 2022. This indicates that the renewable energy sector is poised to open a lucrative doors or recycled lead producers.

Source: IEA

Challenges

- Pricing pressures and volatility: The fluctuating costs of raw materials and energy have a substantial impact on the pricing models for recycled lead. They are primarily driven by the disruptions in the supply chain and geopolitical tensions. The volatility in prices creates uncertainty, which in turn discourages investments in recycling infrastructure. Smaller manufacturers are especially at risk, encountering difficulties in obtaining long-term contracts. As a result, the instability in pricing hinders market growth and innovation within the recycled lead industry.

- Market access obstacles: Trade restrictions and tariffs pose significant challenges to the global expansion of recycled lead products. Import tariffs on lead chemicals in major markets hinder the market entry of international suppliers. These obstacles particularly affect manufacturers in developing markets, restricting their ability to compete with local producers. Consequently, market expansion decelerates, and global supply chains become increasingly inefficient. Addressing these trade challenges is crucial for the wider acceptance of recycled lead chemicals.

Recycled Lead Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 19.2 billion |

|

Forecast Year Market Size (2035) |

USD 28.1 billion |

|

Regional Scope |

|

Recycled Lead Market Segmentation:

Battery Application Segment Analysis

The lead-acid batteries are expected to capture 64% of the global market share through 2035. This significant portion of lead recycled into lead-acid batteries is primarily driven by the automotive and renewable energy storage sectors. As reported by the U.S. Environmental Protection Agency (EPA), lead-acid batteries continue to be the most recycled consumer product in the U.S., with a recycling rate exceeding 99%. The rising demand for EVs and backup power solutions, along with government incentives aimed at promoting battery recycling, underpins this growth trend. Furthermore, regulations such as the EPA’s Lead Renovation, Repair, and Painting Rule advocate for proper handling and recycling practices, thereby enhancing market expansion. Also, the Consortium for Battery Innovation forecasts that battery storage is expected to expand by 110,000 megawatt-hours between 2025 and 2030. Lead batteries are set to be the second biggest part of the global rechargeable battery market during this timeframe.

Product Segment Analysis

The lead-based stabilizer segment is projected to hold 32% of the global recycled lead market share by 2035, as it continues to be utilized in PVC production and various chemical processes. The increasing implementation of strict chemical safety regulations worldwide has led to a heightened demand for recycled lead stabilizers, which provide cost benefits and a lower environmental footprint in comparison to virgin lead. The European Chemicals Agency emphasizes regulatory structures designed to minimize hazardous waste, thereby encouraging the use of recycled lead in industrial chemicals. Furthermore, limitations in supply and fluctuations in raw material prices render recycled lead stabilizers a financially feasible option.

End user Segment Analysis

The construction segment is expected to hold a leading market share throughout the study period, owing to its extensive reliance on lead-based products for infrastructure development and building materials. Recycled leads are being increasingly used in the production of roofing materials, pipes, and cable sheathing. The Global Infrastructure Outlook by G20 Initiative discloses that the current infrastructure investment trends are around USD 79 trillion. The booming infrastructure development investments, coupled with urbanization and industrialization, are poised to boost the use of lead solutions.

Our in-depth analysis of the recycled market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recycled Lead Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific recycled lead market is anticipated to secure 40% of the global revenue share by 2035, propelled by swift industrialization, the growth of the electronics and automotive industries, and rigorous environmental regulations. Countries such as Japan, China, and South Korea are intensifying their investments in sustainable chemical processes, enhanced by governmental incentives aimed at promoting green innovation. The increasing demand for GaAs wafer chemicals in the production of semiconductors and energy storage is propelling the growth of the market. Additionally, the growing implementation of circular economy practices throughout India, Malaysia, and Southeast Asia is boosting the demand for recycled lead, with support from government funding and regulatory frameworks that promote eco-friendly chemical manufacturing.

Through 2035, China is projected to command the largest revenue share, fueled by significant industrial growth, governmental focus on sustainable chemical production, and the extensive implementation of recycled lead technologies. Initiatives from the Ministry of Ecology and Environment, along with financial support from the National Development and Reform Commission, have significantly advanced the sector. The country’s vast scale and ongoing innovation in GaAs wafer chemicals establish it as the leading market in the region. Furthermore, the Global Energy Monitor reports that China is leading the world in renewable energy by building 180 gigawatts of large-scale solar power and 159 gigawatts of wind power. This is expected to create a lucrative environment for recycled lead producers.

Europe Market Insights

The Europe recycled lead market is estimated to hold 27% of the global revenue share by 2035. This growth is primarily driven by strict environmental regulations imposed by organizations such as the European Chemicals Agency (ECHA) and the availability of supportive funding through initiatives such as Horizon Europe. The rising adoption of circular economy principles, particularly in Germany and France, is increasing the demand for recycled lead chemicals in the automotive and electronics industries. Furthermore, new policies aimed at waste reduction and the management of hazardous chemicals are further enhancing the demand for recycled lead. The U.K., Germany, and France are at the forefront of investments in cleaner chemical technologies, including GaAs wafer chemicals, which are essential for semiconductor and green energy applications. These countries dedicate hefty portions of their environmental or industrial budgets to sustainable chemical initiatives, highlighting their commitment to environmental compliance and innovation.

Germany is expected to hold the largest revenue share of the recycled lead market in Europe throughout the study period. This leadership is attributed to its sophisticated industrial infrastructure, rigorous environmental regulations enforced by the Federal Ministry for Economic Affairs and Climate Action, and substantial investments in eco-friendly chemical technologies. The robust circular economy policies of Germany, along with favorable funding towards sustainable chemicals, reinforce its position as a market leader. The Federal Ministry for Economic Affairs and Energy states that nearly 80% of the country’s waste and scrap is now recycled. This indicates there is a high use of recycled lead across multiple industries.

North America Market Insights

The North America recycled lead market is expected to increase at the fastest CAGR from 2026 to 2035. This expansion is driven by stringent environmental regulations alongside a rising demand within the automotive and energy storage sectors. Key factors contributing to this expansion include government initiatives that promote sustainable chemical production and improvements in recycling infrastructure. Additionally, regulatory frameworks established by the EPA, along with financial support from the Department of Energy, significantly enhance market growth, especially in the areas of battery recycling and cleaner production technologies.

The U.S. dominates the sales of recycled lead, owing to the increasing registrations of electric vehicles and energy storage systems. The lead-acid battery is being widely used in hybrid vehicles, e-bikes. Additionally, rising investments in renewable energy storage and telecom networks are strengthening secondary lead utilization in the country. Also, the strict rules under the Resource Conservation and Recovery Act (RCRA) make sure that recycling is carefully controlled, contributing to the overall market growth.

Key Recycled Lead Market Players:

- Exide Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson Controls (Clarios)

- East Penn Manufacturing

- Glencore PLC

- Recylex S.A.

- Mitsubishi Materials Corporation

- Umicore

- Korea Zinc Co., Ltd.

- Hindustan Zinc Limited

- Malaysia Smelting Corporation Berhad

- Johnson Matthey PLC

- Gravita India Ltd.

- Australian Lead Manufacturers (ALM)

- Henan Fengyuan Group

- Tianshan Lead & Zinc Industry

The market for recycled lead chemicals is characterized by intense competition, primarily led by companies from the U.S. and Europe that prioritize advanced recycling technologies and sustainability practices. In contrast, firms from Japan and South Korea focus on innovative clean production techniques. Meanwhile, emerging manufacturers in India and Malaysia are capitalizing on cost advantages and a rising domestic demand. Strategic initiatives in this sector include expanding production capacities, investing in environmental compliance, and forming partnerships to seize opportunities in the growing global markets for batteries and electronics. Below is a detailed table listing the top global manufacturers in the recycled lead chemical market, including estimates of their market shares and their respective countries of origin.

Recent Developments

- In June 2024, Umicore unveiled a new product line that emphasizes ultra-pure recycled lead chemicals with lower sulfur content, specifically aimed at electronics manufacturers in Europe. This introduction resulted in a 15% increase in sales of recycled lead chemicals by the third quarter of 2024, indicating a rising demand for materials that meet environmental compliance standards.

- In March 2024, Mitsubishi Materials introduced a cutting-edge recycled lead additive aimed at improving battery longevity and efficiency for automotive uses. The initial uptake in Japan's electric vehicle industry resulted in a 20% rise in market share for six months, bolstered by governmental incentives promoting sustainable energy storage options.

- Report ID: 3012

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recycled Lead Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.