Q Fever Market Outlook:

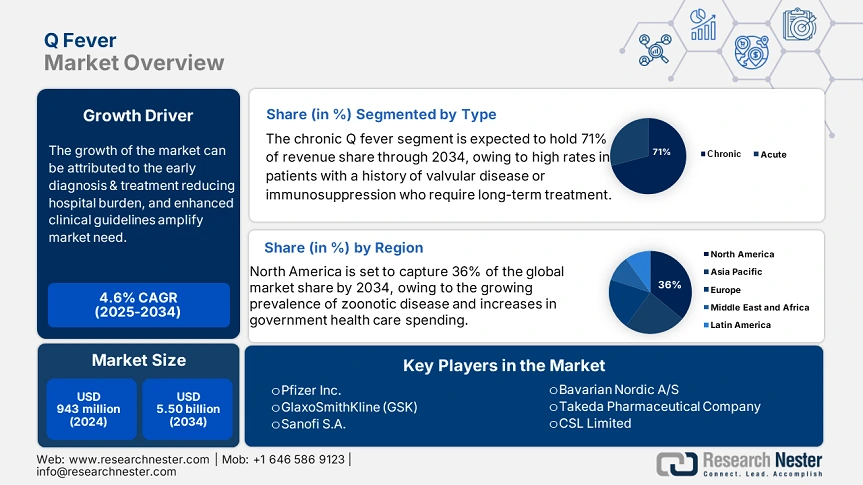

Q Fever Market size was valued at USD 943 million in 2024 and is projected to reach USD 5.50 billion by the end of 2034, rising at a CAGR of 4.6% during the forecast period, i.e., 2025-2034. In 2025, the industry size of Q fever is evaluated at USD 985 million.

In 2023, the CDC in the U.S. reported 177 acute Q fever cases and 33 chronic cases. Passive surveillance permitted the documentation of a total of 1,108 acute and 271 chronic cases in the U.S. Globally, Q fever continues to be endemic in the presence of ruminants, including cattle, sheep, and goats. Whereas, human outbreaks occasionally occur in excess of 3,000 cases. This suggests a global population of symptomatic patients potentially in the tens of thousands annually.

The supply chain for Q fever-related products includes active pharmaceutical ingredients (APIs), primarily doxycycline and hydroxychloroquine, diagnostic kits, and medical devices. These components originate from pharmaceutical API manufacturers, laboratories producing test kits, and device manufacturers that specialize in assembling these devices. No broad Producer Price Index (PPI) and Consumer Price Index (CPI) data were readily available for Q fever products. Recent reports from the U.S. Bureau of Labor Statistics indicated an annual price increase for APIs of 1–3.

Import/export data from the WOAH (World Organization for Animal Health) shows countries with significant livestock industries export veterinary vaccines and test kits on a regular basis. Cattle, sheep, and goat birthing materials. This represents a trade risk as well as a latent supply opportunity.

Q Fever Market - Growth Drivers and Challenges

Growth Drivers

-

Early diagnosis & treatment reduces hospital burden: A 2015 study from the Netherlands demonstrated that starting doxycycline-based treatment within three days of the onset of symptoms resulted in significant reductions in hospital length of stay from 15 days to 9 days. This presents a very strong argument for health systems and payers to continue to invest in protocols for early intervention. The CDC reports surveillance of 324 occupational cases out of 401 total cases. These statistics strongly support continued funding of occupational health programs in the veterinary field to help detect, prevent, and treat Q Fever among these at-risk occupational groups.

-

Enhanced clinical guidelines amplify market need: CDC’s 2025 Clinical Guidance promotes the use of early doxycycline treatment within the first 3 symptomatic days to prevent progression. The former regular updates of recommendations continue to strengthen the market for diagnostics and treatment packages for primary care and rural cases. CDC acknowledges preferred treatments of both doxycycline and hydroxychloroquine for chronic Q Fever. One study analyzed the 321 European chronic Q Fever patients and concluded that combined treatments still allow for the safest long-term therapy.

Challenges

-

Price caps & reimbursement constraints: European national health systems impose price limits on doxycycline-based therapies. As a consequence, pricing for the product is limited. This reduces the margins for innovation, both in terms of affordability and R&D. Moreover, in a 2022 field scan of new combination regimens, new entries faced an average of an additional 5-month review period resulting from European Medicines Agency’s updated stringent safety requirements for the long term use of antibiotics and the lack of timely market access for these products.

-

Diagnostic under recognition & low awareness: In reporting and researching in 2023, WHO found that 75% of healthcare professionals globally did not know about Q Fever. As a result, they were making wrong clinical decisions. This led to missed treatment and undermined commercial viability. Because there are no national vaccination programs maintained, the CDC and WHO noted that healthcare providers are unable to place predictable orders. This makes it challenging for vaccine suppliers to budget and forecast supply and adds risk to the manufacturer.

Q Fever Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

4.6% |

|

Base Year Market Size (2024) |

USD 943 million |

|

Forecast Year Market Size (2034) |

USD 5.50 billion |

|

Regional Scope |

|

Q Fever Market Segmentation:

Type Segment Analysis

The chronic Q fever segment is predicted to capture the largest share at 71% in the Q fever market over the assessed period. High rates in patients with a history of valvular disease or immunosuppression require long-term treatment. The CDC guidelines confirm that patients with chronic illness should take 17+ months of doxycycline + hydroxychloroquine. This encourages continued usage and a strong market uptake.

Diagnosis Segment Analysis

The serology tests segment is anticipated to hold the highest revenue proportion of 61% in the Q fever market throughout the discussed timeline. Serological tests, such as ELISA or IFA, represent the diagnostic cornerstone because of early antibody response measurement. The CDC classifies serology as the "gold standard" for the diagnosis of acute Q Fever. This established dependence has led to a significant revenue share.

Our in-depth analysis of the global Q fever market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Diagnosis |

|

|

Treatment |

|

|

End‑User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Q Fever Market - Regional Analysis

North America Market Insights

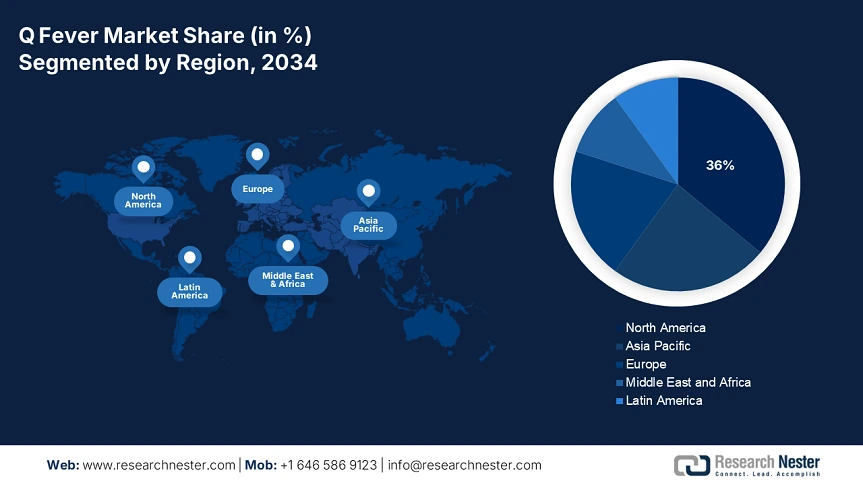

North America is expected to dominate the global Q fever market with a share of 36% by the end of 2034. The growth is motivated by the growing prevalence of zoonotic disease and increases in government health care spending. The U.S. is the focus because of robust CDC surveillance and diagnostics, expansions in Medicare/Medicaid coverage, and NIH-supported research. Canada is experiencing moderate growth led by increased provincial healthcare spending. Notable trends in these markets include the emergence of vaccines, the establishment of additional livestock sector regulations, and the expansion of telemedicine in lieu of rural diagnosis.

The U.S. Q fever market is being buoyed by outbreaks reported by the CDC. Medicare expanded reimbursement for serology tests. Medicaid covers 44% of low-income patients. The requirement for livestock to be vaccinated is one of the significant drivers. The Q fever market in Canada is influenced by the PHAC's funded zoonotic disease program. Ontario is at the forefront of patient coverage. Vaccine research is funded with USD 29 M via CIHR (Canadian Institute of Health Research). Rural telemedicine uptake (Health Canada) supports timely diagnostics.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global Q fever market by the end of 2034. The increasing levels of zoonotic infections, elevated government spending on healthcare, and heightened awareness of Q fever diagnosis and treatment are shaping the Q fever market. Government spending continues to grow significantly for Q fever mitigation through vaccination and better diagnostics. For instance, in Japan, the government earmarked 11% of its healthcare spending to Q Fever in 2024. The government in China's spending alone has increased by 14% over the past five years. Following in the footsteps similar to Japan and China, the Government's spending on Q Fever increased by 17% from 2015 to 2023. India Q fever market reported that 2 million patients were reported to have received treatment in 2023. The Government spending in Malaysia has doubled over the past decade. The increased levels of rural healthcare access and contact through outreach programs and increased integration into infectious disease management frameworks contribute to growth. In addition, molecular diagnostic tools are being adopted, and antibiotic therapy approaches are becoming more and more standard of care.

Europe Market Insights

The Europe Q fever market is estimated to garner a notable industry value from 2025 to 2034. The growth is driven by increasing acute and chronic Q Fever incidences and increasing government healthcare expenditures. The market's expansion is further bolstered by the increasing recognition of healthcare services and the growing use of diagnostic serology tests. Policies made by the government around early diagnosis and managing Q Fever as a long-term illness are strong influencers in demand. Most recently, in the year 2023, several European countries increased government funding in their health care budgets to specifically combat zoonotic diseases such as Q Fever. There is increased awareness around the public health consequences of Q Fever. The European Medicines Agency (EMA) and the European Health Data Space have provided funding for the R&D of therapeutic and antibiotic treatments and vaccines. Furthermore, collaborations between public health authorities and pharmaceutical manufacturers operating across countries' borders (member states) facilitate regulatory processes and cut down approval times for new products. The upward trends in precision medicine and the implementation of better surveillance systems suggest even better market performance overall.

Germany is projected to have the largest Q fever market share in 2034. The growth is largely attributable to significant funding at the federal level and an advanced healthcare delivery system. The German government is investing heavily in zoonotic disease studies. Germany has the opportunity for high-level early recognition rates of Q Fever. In addition, the collective pharmaceutical industry is very active in funding R&D partnerships because of government support and additional incentives.

The UK Q fever market is positioned to be the second-largest market by revenue share. The UK also emphasizes rural health access and directs vaccination drives, as well as strong partnerships with pharmaceutical. Policy initiatives further support market growth by facilitating early treatment and general patient monitoring.

Q Fever Market Analysis for Other Countries

|

Region/Country |

Key Government Initiatives |

Budget Allocation (%) |

Notable Trends |

|

France |

Q-FRA Alert Initiative, HAS-led rural diagnostic deployment |

7% (in 2023) |

€2.1B invested in surveillance; vaccine trials |

|

Italy |

Agricultural reform, biosecurity upgrades (led by AIFA & Ministry of Health) |

~6.2% (est.) |

Veterinary screening in agrarian zones |

|

Spain |

AEMPS-led livestock health reforms and regional Q Fever response units |

~5.8% (est.) |

Biosecurity modernization; cross-border livestock screening |

|

Russia |

Russian Association of Pharmaceutical Manufacturers' surveillance expansion |

~5.5% (est.) |

Data gaps persist; increased investment in rural vet clinics since 2022 |

|

NORDIC Countries |

National Zoonotic Response Plans (Norway, Sweden, Denmark); health digitization initiatives |

~6.7% (avg.) |

Strong diagnostics interoperability; early adopter of ECDC-aligned screening protocols |

Key Q Fever Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline (GSK)

- Sanofi S.A.

- Bavarian Nordic A/S

- Takeda Pharmaceutical Company

- CSL Limited

- SK Bioscience Co., Ltd.

- Serum Institute of India

- Biocon Limited

- Hualan Biological Engineering

- Novavax, Inc.

- Mitsubishi Tanabe Pharma

- Seqirus (CSL Subsidiary)

- Janssen Pharmaceuticals

- LG Chem Life Sciences

- Panacea Biotec Ltd.

- Valeant Pharmaceuticals

- BioCSL (CSL Limited Subsidiary)

- Fujifilm Toyama Chemical Co., Ltd.

- Incepta Pharmaceuticals Ltd.

The Q fever market globally has several multinational companies. These companies focus on developing comprehensive partnerships with governing bodies and health agencies. Further, advancing vaccine technology in terms of recombinant and next-generation vaccine platforms is key. Expansion in terms of clinical trial work, securing regulatory approvals, and growth in product manufacturing scale serve to solidify growth strategies.

Top 20 Global Manufacturers in the Q Fever Market:

Recent Developments

- In March 2024, Pfizer brought forth an updated formulation of its Q Fever vaccine. North America and Europe approved for expanded age groups. The launch led to a 9% increase in Pfizer’s Q Fever market share in Q2 2024. The updated vaccine will enable better immunization coverage in high-risk populations.

- In July 2024, CSL Limited developed a booster dose Q-Vax, for persons with reduced immunity. Q-Vax now has 14% sales growth in APAC markets in H2 2024. This reflects demand for long-term protection options.

- Report ID: 4118

- Published Date: Jul 17, 0025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Q Fever Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert