Psilocybin Assisted Therapy Market Outlook:

Psilocybin Assisted Therapy Market size was valued at USD 3.1 billion in 2025 and is projected to reach USD 11.8 billion by the end of 2035, rising at a CAGR of 15.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of psilocybin assisted therapy is estimated at USD 3.6 billion.

The growing incidence of treatment-resistant mental health conditions and increasing recognition of psilocybin’s therapeutic potential in treating disorders such as depression, anxiety, PTSD, and addiction are the pivotal driving factors for this landscape. This can be testified from the WHO article published in June 2022, which states that approximately 1 out of every 8 people, or around 970 million individuals, live with a mental disorder across all nations. Besides, anxiety affects 301 million people and depression impacts 280 million, including children and adolescents, thereby positively influencing market growth.

Furthermore, the rising investment in psychedelic medicine is also a fueling factor for this landscape, wherein the existence of payer pricing is also fostering a favourable business environment. In this regard IMHO in December 2023 found that that the average annual cost for mental health treatment, including both direct i.e., medications, professional fees, lab tests and indirect expenses transportation, food, and loss of income due to time off work, was approximately ₹72,845 (USD 874.14) per person wherein medication expenses formed the largest portion of direct costs underscoring the urgent need for accessible, affordable mental healthcare.

Key Psilocybin Assisted Therapy Market Insights Summary:

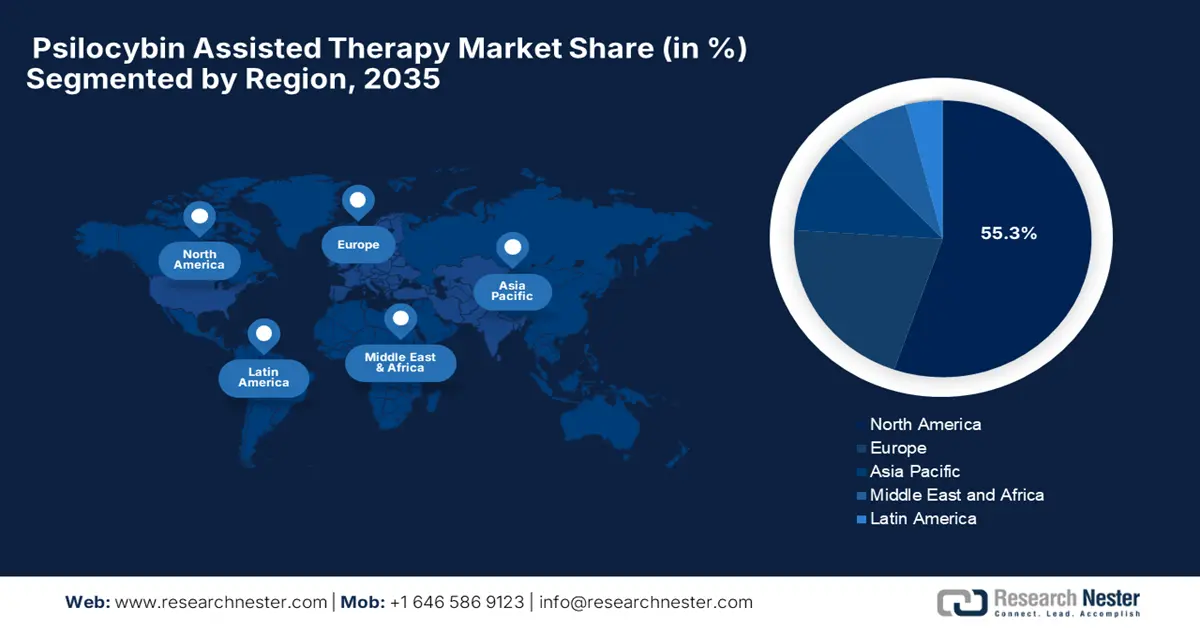

Regional Insights:

- By 2035, North America is anticipated to command a 55.3% share of the Psilocybin Assisted Therapy Market, underscored by rising federal funding, regulatory reforms, and growing clinical acceptance.

- By 2035, Asia Pacific is set to expand rapidly with accelerating adoption of psilocybin-assisted treatments, strengthened by progressive policy shifts, rising mental health prevalence, and increasing regional investments.

Segment Insights:

- By 2035, the psilocybin with psychological support segment in the Psilocybin Assisted Therapy Market is projected to account for a 75.6% share, propelled by its demonstrated efficacy in clinical trials alongside integrative psychotherapy.

- By 2035, the user specialty clinics segment is expected to secure a 60.4% share, reinforced by the specialized, controlled clinical settings and expert staffing required for PAT delivery.

Key Growth Trends:

- Increasing clinical evidence

- Regulatory changes & legalization trends

Major Challenges:

- Policy & regulatory barriers

- High cost and accessibility of therapy

Key Players: COMPASS Pathways plc, Cybin Inc., Mind Medicine (MindMed) Inc., ATAI Life Sciences N.V., Seelos Therapeutics, Inc., Numinus Wellness Inc., Field Trip Health & Wellness Ltd., Usona Institute, Beckley Psytech Ltd., Eleusis Benefit Corporation, Gilgamesh Pharmaceuticals, Psyence Biomedical Inc., Enveric Biosciences, Small Pharma Inc., Tryp Therapeutics, Inc., Bright Minds Biosciences, Lobe Sciences Ltd., Mydecine Innovations Group, Braxia Scientific Corp., Wesana Health Inc.

Global Psilocybin Assisted Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 11.8 billion by 2035

- Growth Forecasts: 15.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Australia

- Emerging Countries: India, Japan, Brazil, South Korea, Netherlands

Last updated on : 30 September, 2025

Psilocybin Assisted Therapy Market - Growth Drivers and Challenges

Growth Drivers

- Increasing clinical evidence: Numerous clinical trials have showcased the promising results for psilocybin in treating mental health disorders, encouraging more players to make investments in this field. For instance, in February 2024, Incannex reported the results from its Phase 2 Psi-GAD1 trial, which showcased that psilocybin-assisted therapy significantly reduced anxiety in patients with generalised anxiety disorder. The psilocybin group saw a 12.8-point drop in HAM-A scores, with 44% of patients responding and 27% achieving remission.

- Regulatory changes & legalization trends: Most of the jurisdictions are legalizing or easing regulations for therapeutic use, which is readily propelling growth in the psilocybin assisted therapy market. In April 2025, the Reason Foundation report stated that multiple U.S. states continued advancing psychedelic reform, particularly around psilocybin therapy. It also stated that a growing number of state legislatures are moving toward facilitated access models, regulated systems allowing supervised psilocybin use for medical or therapeutic purposes, modeled after Oregon’s program, thereby positively influencing market growth.

- Reduced social stigma: The ever-increasing public awareness of mental health and reduced stigma around psychedelics are fostering a profitable business environment in this field. MoHFW in August 2025 reported that the government of India has successfully expanded tele-mental health services through 53 Tele MANAS cells in 36 states/UTs, which handled more than 2.3 million helpline calls. The scheme productively upgraded over 177,000 Sub Health Centres and PHCs to Ayushman Arogya Mandirs, integrating mental health into primary care, thereby denoting a positive market outlook.

Share of Population with Mental Health Disorders by Income Group

|

Category |

Share of Population with Mental Health Disorders (2021) |

|

High-income countries |

16.2% |

|

World |

13.9% |

|

Upper-middle-income countries |

13.6% |

|

Lower-middle-income countries |

13.5% |

|

Low-income countries |

12.5% |

Source: OWID

Key Psilocybin Therapy Clinical Trials and Programs in 2025

|

Company/Institution |

Study/Program |

Key Details |

Notes |

|

Incannex Healthcare |

Phase 2 Trial of PSX-001 (Psi-GAD) for GAD |

Positive results showing significant reductions in anxiety scores; double-blind, placebo-controlled study with 73 participants |

PSX-001 showed rapid, durable effects; strong clinical response and remission rates |

|

University of New Mexico |

REKINDLE Trial – RE104 prodrug |

Testing a synthetic psilocybin-like drug to ease distress from life-threatening diagnoses; Phase 2, double-blind, placebo-controlled |

Targets anxiety and depression in serious illness; shorter psychedelic effect duration |

|

Psyence BioMed |

Phase IIb Trial for Adjustment Disorder in Cancer Patients |

Partnered with Southern Star Research CRO for trial management; double-blind, placebo-controlled, 87 participants |

Focus on mental health in cancer patients; FDA shows positive stance on psychedelic medicine |

Source: Company Official Press Releases

Challenges

- Policy & regulatory barriers: This is one of the most important and considerable challenges for the market, which hinders expansion in almost all nations. There has been a presence of evidence-based results for the therapeutic use of psilocybin, but it remains classified as a Schedule I substance in many countries. Therefore, this classification implies a high potential for abuse and no accepted medical use, which further causes limitations in research, commercialization, and clinical accessibility.

- High cost and accessibility of therapy: This is yet another factor skewing the expansion of the psilocybin assisted therapy market. Psilocybin therapy typically involves lengthy, clinician-guided sessions before, during, and after administration of the compound, which adds to the exacerbated costs on manufacturers. This, in turn, can be unaffordable for many patients, particularly in countries where such therapy is not covered by insurance or public health systems.

Psilocybin Assisted Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.8% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 11.8 billion |

|

Regional Scope |

|

Psilocybin Assisted Therapy Market Segmentation:

Therapy Model Segment Analysis

Based on the therapy model, psilocybin with psychological support segment is projected to garner the largest revenue share of 75.6% in the psilocybin assisted therapy market during the forecast period. The dominance of the segment is attributable to its proven efficacy in clinical trials, allowing adoption by a wider group of the audience. Most of the prominent sources recognize that the therapeutic effect is not from the drug alone but from the combination with preparatory and integrative psychotherapy sessions, which are essential for processing the experience and achieving lasting clinical outcomes, hence denoting a positive market outlook.

End user Segment Analysis

In terms of the user specialty clinics segment, it is expected to attain a share of 60.4% in the psilocybin assisted therapy market by the end of 2035. The complex, resource-intensive nature of PAT, requiring controlled settings and specialized staff, makes this subtype the gold standard to generate revenue in this field. In June 2023, the U.S. FDA released its first-ever draft guidance for clinical trials involving psychedelic drugs such as psilocybin, LSD, and MDMA. Further, psychedelic compounds must meet the same scientific standards as other drugs, denoting the critical role of governing bodies in utilizing these elements.

Application Segment Analysis

Based on the application, the resistant depression segment is predicted to capture a share of 35.7% in the psilocybin assisted therapy market during the analyzed timeframe. The growth in the segment is highly subject to a critical unmet need with limited effective treatments, making it a primary target for clinical development. In November 2022, the Phase 2 trial, published in the NEJM, offers new evidence that a single 25 mg dose of psilocybin, combined with psychological support, can significantly reduce symptoms of treatment-resistant depression, which is a condition where patients have not responded to at least two prior antidepressants.

Our in-depth analysis of the psilocybin assisted therapy market includes the following segments:

|

Segment |

Subsegments |

|

Therapy Model |

|

|

End user |

|

|

Application |

|

|

Source |

|

|

Formulation |

|

|

Patient Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Psilocybin Assisted Therapy Market - Regional Analysis

North America Market Insights

North America is dominating the psilocybin assisted therapy market and is anticipated to hold the market share of 55.3% by the end of 2035. The rising federal funding, regulatory reforms, and clinical acceptance are the key factors behind this leadership. In January 2025, the clinical study by the Journal of Affective Disorders tested a single 25 mg dose of psilocybin in 15 U.S. veterans with severe treatment-resistant depression. The study found that at three weeks, 60% showed significant improvement and 53% achieved remission, wherein effects lasted up to 12 weeks for many, which suggests psilocybin can be efficacious in veterans.

The U.S. psilocybin assisted therapy market is growing due to federal investment, enhanced patient demand, and increased institutional adoption. Testifying to this, CPR in June 2023 revealed that Colorado legalized psilocybin mushrooms and some other psychedelics for adults 21 and older through Proposition 122, passed in November 2022, which began decriminalizing possession, use, and cultivation earlier in 2023. It also stated that a Natural Medicine Advisory Board is working on creating rules to ensure safe, equitable, and culturally responsible access.

Canada is gaining enhanced exposure in the psilocybin assisted therapy market owing to the proactive funding initiatives for psilocybin-assisted therapy and the federal government's investments in research. As evidence in June 2023, the country’s government has invested nearly USD 3 million to fund three clinical trials studying psilocybin-assisted psychotherapy for alcohol use disorder, treatment-resistant depression, and end-of-life psychological distress in cancer patients. Besides, this research aims to evaluate the safety and effectiveness of psilocybin combined with psychotherapy as a treatment option, hence suitable for standard market growth.

Healthcare Expenditures for Treatment of Mental Disorders Among U.S. Adults

|

Category |

Subcategory |

Amount (in billion USD) |

Percentage of Total (%) |

|

Total Healthcare Expenditures |

Adults 18 and older |

USD 106.50 |

100 |

|

Adults 18–64 |

USD 88.40 |

83 |

|

|

Adults 65 and older |

USD 18.10 |

17 |

|

|

Expenditures by Gender |

Females |

USD 61.50 |

57.7 |

|

Males |

USD 45.00 |

42.3 |

|

|

Expenditures by Type of Service |

Ambulatory visits |

USD 44.21 |

41.5 |

|

Prescription drugs |

USD 31.78 |

29.8 |

|

|

Emergency room, hospital stays, home health care, and others |

USD 30.54 |

28.7 |

|

|

Expenditures by Payment Source |

Private insurance |

USD 33.87 |

31.8 |

|

Medicaid |

USD 27.61 |

25.9 |

|

|

Medicare |

USD 20.38 |

19.1 |

|

|

Out-of-pocket payments |

USD 15.62 |

14.7 |

|

|

Other sources |

USD 9.06 |

8.5 |

Source: AHRQ, 2022

APAC Market Insights

Asia Pacific is the fastest-growing region in the psilocybin assisted therapy market accelerated by the progressive policy shifts, rising mental health prevalence, and investments in psychedelic-assisted treatments. India, Australia, and Japan are the predominant leaders in the Asia Pacific region. Japan’s openness in regulatory and integration in clinical practices has aided in institutionalizing psilocybin therapy, whereas with the large patient pool, India has catalyzed domestic manufacturing of psilocybin APIs. The region is shaped by rising acceptance among clinical researchers, unmet mental health needs, and increased funding from ministries of health.

Australia has emerged as the leader in the regional psilocybin assisted therapy market, backed by government support and regulatory shifts, which is establishing greater potential for this sector to revolutionize. In February 2023, the Therapeutic Goods Administration finalized the re-scheduling of psilocybin and MDMA in the Poisons Standard, allowing their controlled medical use. From July 1, 2023, psychiatrists authorized under the TGA’s Authorised Prescriber scheme can legally prescribe psilocybin for treatment-resistant depression and MDMA for post-traumatic stress disorder.

India is experiencing rapid growth in the psilocybin assisted therapy market, extensively supported by healthcare providers who are integrating psychedelic-assisted treatments with psychotherapy and government initiatives. In February 2025, MoHFW reported that the government has prioritized mental health as a major concern, launching programs such as the National Mental Health Programme, Tele MANAS, and the National Suicide Prevention Strategy, which accelerate accessibility, early intervention, and stigma reduction, thereby driving adoption among a wider audience group.

Initiatives and Policies in Advancing Mental Healthcare in India

|

Initiative/Policy |

Description |

Year |

|

National Suicide Prevention Strategy |

Focuses on suicide reduction via early intervention, crisis support, and awareness |

Launched 2022 |

|

Tele MANAS |

National tele-mental health helpline and app providing 24/7 counselling and referrals |

Launched 2022 |

Source: MoHFW

Europe Market Insights

The psilocybin assisted therapy market in Europe is growing rapidly on account of rising mental health prevalence, regulatory leniency, and strategic national health policies. Public-private research collaborations and hospital-based network trials are also incorporated in the region. In August 2025, the PsyPal clinical trial received the enrollment of its first patient at the University Medical Center Groningen. This multi-site, EU-funded study, supported by specialized centers across the region and pharmaceutical partner Avextra Pharma, aims to evaluate psilocybin’s potential to reduce depression and anxiety.

Germany holds the maximum share in the psilocybin assisted therapy market in Europe owing to its robust research ecosystem. For instance, in August 2025, Germany became the first EU country to approve psilocybin therapy for patients with treatment-resistant depression outside clinical trials, under a compassionate use framework. Besides, this program allows adult patients who have not responded to at least two standard antidepressants and cannot participate in clinical trials to access psilocybin therapy at two specialized centers: the Central Institute for Mental Health (CIMH) in Mannheim and the OVID Clinic Berlin.

The U.K. holds a strong position in the psilocybin assisted therapy market, facilitated by the increasing interest in alternative treatments for mental health conditions such as treatment-resistant depression. Besides the growing clinical trials, researchers are exploring the efficacy and safety of psilocybin when combined with psychotherapy, providing an encouraging opportunity for pioneers in this field. These studies are supported by pharmaceutical-grade formulations from companies such as COMPASS Pathways, hence positively influencing market growth.

Key Psilocybin Assisted Therapy Market Players:

- COMPASS Pathways plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cybin Inc.

- Mind Medicine (MindMed) Inc.

- ATAI Life Sciences N.V.

- Seelos Therapeutics, Inc.

- Numinus Wellness Inc.

- Field Trip Health & Wellness Ltd.

- Usona Institute

- Beckley Psytech Ltd.

- Eleusis Benefit Corporation

- Gilgamesh Pharmaceuticals

- Psyence Biomedical Inc.

- Enveric Biosciences

- Small Pharma Inc.

- Tryp Therapeutics, Inc.

- Bright Minds Biosciences

- Lobe Sciences Ltd.

- Mydecine Innovations Group

- Braxia Scientific Corp.

- Wesana Health Inc.

The global psilocybin assisted therapy market is expanding quickly, and competition is heating up in North America, Europe, and the Asia-Pacific. Players are heavily investing in clinical trials, patent creation, and regulatory fast-tracks to offer first-mover benefits. Key players such as Compass Pathways and ATAI Life Sciences lead due to robust pipelines and strategic partnerships. India and Malaysia's emerging players are providing government-sponsored alliances to localize production and reduce costs. Similarly, companies in the U.S. and Canada are expanding clinic networks and improving delivery models. Market differentiation is increasingly influenced by therapeutic focus, AI incorporation, and geographical expansion into mental health underserved areas.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2025, Optimi Health announced the launch of natural psilocybin capsules in Australia for patients with treatment-resistant depression under the country's authorised prescriber scheme.

- In June 2025, Compass Pathways reported that it had achieved a major milestone with its Phase 3 COMP005 trial, reporting a reduction in depression symptoms using a single 25 mg dose of COMP360 psilocybin in patients with Treatment-Resistant Depression.

- Report ID: 4330

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Psilocybin Assisted Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.