Project Management Software Market Outlook:

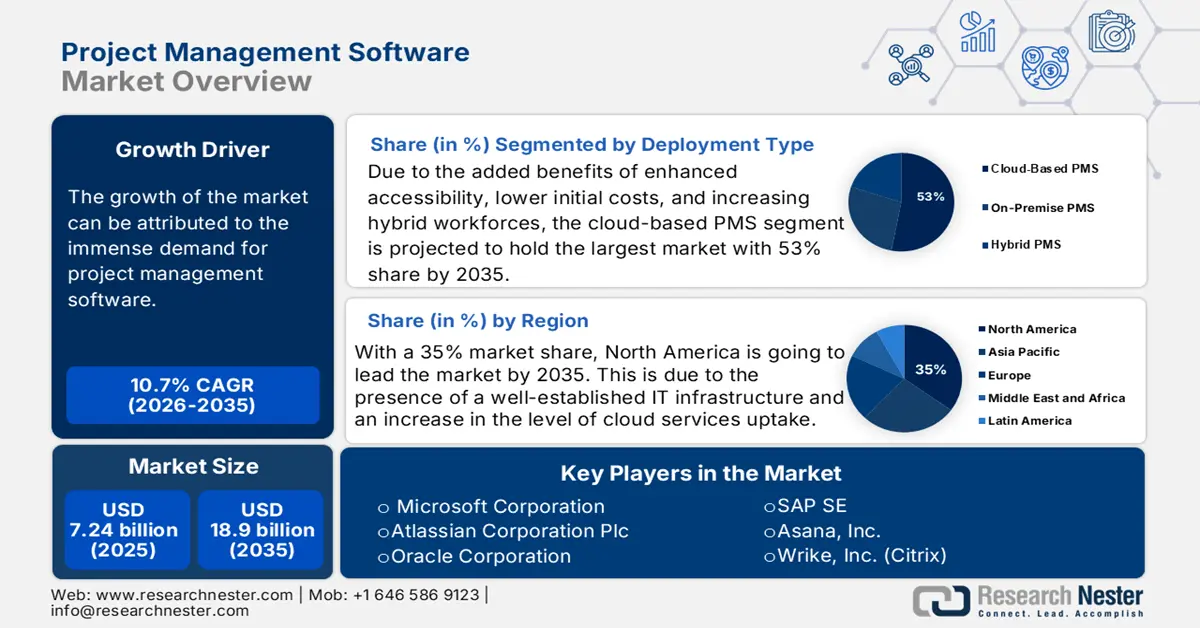

Project Management Software Market size was over USD 7.24 billion in 2025 and is projected to reach USD 18.9 billion by 2035, witnessing a CAGR of around 10.7% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of project management software is evaluated at USD 8.02 billion.

The ubiquitous adoption of the hybrid and remote model of work has propelled the demand for project management software. As the teams are operating across a wide range of geography and varied time zones, organizations require adequate platforms for conducting seamless collaboration and maintaining centralized visibility of the project. The transition towards the flexible work models is acting as a prominent growth-promoting factor, mainly in enterprises to give importance to the digital connectivity and bring transparency in the workflow.

Also, the modern projects are intricate and include numerous stakeholders and have interdependent tasks. Prominent industries such as manufacturing and construction are handling a larger portfolio, propelling the demand for the tools to support advanced planning. the project management software renders organizations the ability to monitor progress and handle multiple initiatives all at the same time. This improves the overall strategic performance and alignment.

Key Project Management Software Market Insights Summary:

Regional Insights:

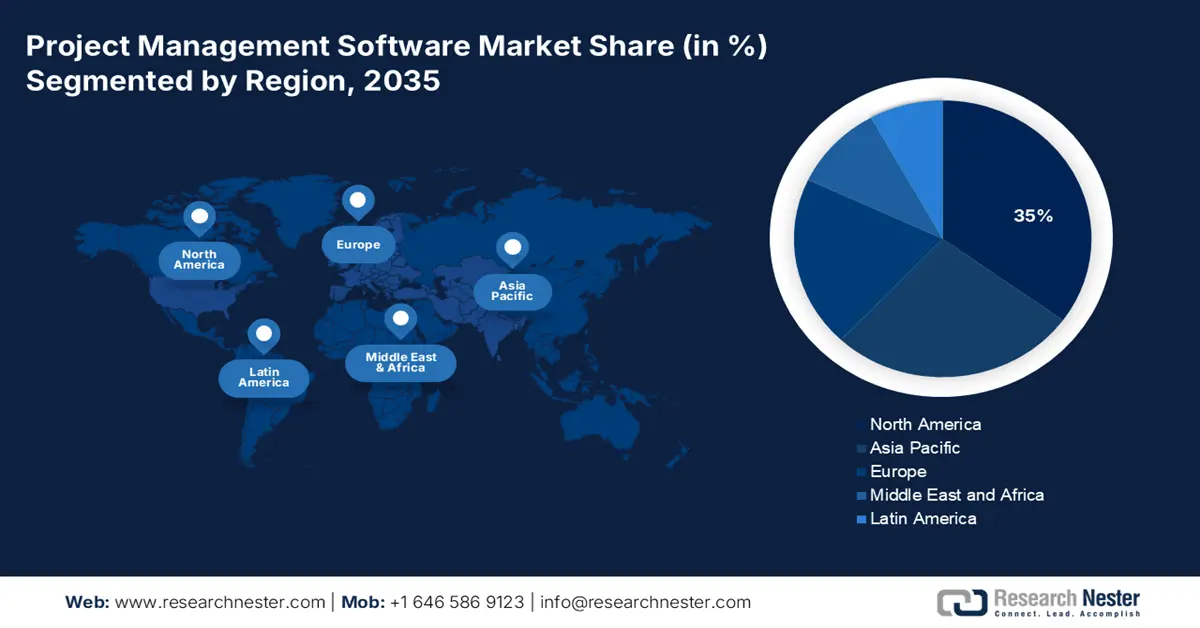

- By 2035, the North America Project Management Software Market is expected to secure a 35% share, underpinned by its strong IT infrastructure and rising cloud service adoption.

- Europe is anticipated to command a substantial revenue share by 2035, supported by cloud migration momentum, EU digitization funding, and evolving remote-work frameworks.

Segment Insights:

- The cloud-based PMS segment of the Project Management Software Market is projected to capture a dominant 53% share by 2035, propelled by enhanced accessibility, lower upfront costs, and expanding hybrid workforces.

- The IT & Telecom segment is set to hold a major revenue share by 2035, reinforced by the sector’s need for efficient resource handling and timely project delivery enabled by advanced PMS tools.

Key Growth Trends:

- Rapid adoption of the cloud-based and SaaS platforms

- Surge in role of AI and automation

Major Challenges:

- Complexity in integration with legacy systems

- Data security and privacy concerns

Key Players: Microsoft Corporation, Atlassian Corporation Plc, Oracle Corporation, SAP SE, Asana, Inc., Wrike, Inc. (Citrix), Smartsheet Inc., Nulab, Inc., Zoho Corporation, Monday.com Ltd., Hancom Inc. and other.

Global Project Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.24 billion

- 2026 Market Size: USD 8.02 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 10.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Singapore, United Arab Emirates

Last updated on : 7 October, 2025

Project Management Software Market - Growth Drivers and Challenges

Growth Drivers

- Rapid adoption of the cloud-based and SaaS platforms: The rapid transition to cloud computing has changed how organizations manage and deploy project management systems. According to data published by the European Government, 42.5% of the enterprises in the EU have purchased cloud computing services. They are also adopting cloud-based solutions based on PMS that offer scalability and accessibility from any location and eradicate the need for high upfront costs. This flexibility and affordability are propelling the adoption across a plethora of industries all across the world.

- Surge in role of AI and automation: The high rate of inclusion of AI and automation is instilling the need for predictive analytics and automated reporting. AI-enabled solutions are capable of forecasting delays and identifying potential risks. According to Stanford HAI, the global corporate AI investment has reached more than USD 252 billion by 2024. Hence, the inclusion of PMS brings automation to lower the repetitive tasks and allows project managers to focus on other crucial objectives. These trends are transforming the market for smarter and data-enabled management solutions.

- Surge in focus on cost efficiency and return on investment, and rising importance of data security: The inclusion of PMS enables organizations to lower costs and enhance efficiency. The ability of software to aptly measure and optimize ROI is an enticing factor boosting the adoption, mainly in various competitive sectors in which productivity significantly affects profitability. Other than this, the organizations in the current world are handling humongous sensitive data, and compliance has become a crucial priority. According to data published by the UK government in October 2025, about 600 companies globally found that the average cost of a data breach reached USD 4.4 million. As PMS is providing encrypted storage and role-based access, various companies are adopting.

Challenges

- Complexity in integration with legacy systems: Numerous organizations are still operating with legacy infrastructure and obsolete business applications, making it very difficult for these companies to integrate PMS. As a result, integration difficulties can slow down adoption and limit the software’s full functionality across departments.

- Data security and privacy concerns: As project management tools increasingly move to the cloud and store sensitive business data, concerns about cybersecurity, privacy, and regulatory compliance have grown. Companies are apprehensive that unauthorized access, data breaches, and weak encryption protocols can expose confidential information, leading to reputational and financial losses.

Project Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.7% |

|

Base Year Market Size (2025) |

USD 7.24 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

Project Management Software Market Segmentation:

Deployment Type Segment Analysis

The cloud-based PMS segment of the project management software market is projected to hold a dominant 53% revenue share by the end of 2035. The growth is driven by the added benefits of enhanced accessibility, lower initial costs, and increasing hybrid workforces. Furthermore, the rising adoption of SaaS models is enabling organizations to scale their operations. The mushrooming integration of AI and analytics into cloud platforms is enhancing risk management as well as decision-making, further augmenting the market demand.

End-user Segment Analysis

The IT & Telecom segment is poised to account for a major revenue share in the market. As various organizations in this sector are handling a myriad of projects such as network expansion to software development, they need impeccable PMS tools to handle resources efficiently and ensure delivery on time. Also, a surge in adoption of remote work and collaboration between multiple departments, companies are adopting cloud-based PMS solutions at a higher rate. The IT and telecom sector continues to remain the leading adopter, encouraging the dominant position.

Application Segment Analysis

The task and management segment is anticipated to garner the highest share by 2035. The growth of the market can be attributed to the rising need for real-time project tracking and automation in workflow. The task and workflow management tools allow managers to easily assign responsibilities and set deadlines. It is also helpful for monitoring the performance with the help of intuitive analytics. A plethora of cloud-based tools, such as Asana, have become crucial in handling daily operations and fostering seamless integration.

Our in-depth analysis of the project management software market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Trade |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Project Management Software Market - Regional Analysis

North America Market Insights

The North America project management software market is projected to account for a leading share of 35% by the end of 2035. A key factor supporting the market dominance is the presence of a well-established IT infrastructure and an increase in the level of cloud services uptake. In Canada, the market growth is propelled by rapid digital transformation and modernization initiatives. Several organizations are handling larger and complex portfolios that necessitate robust PMS capabilities. SMEs, which make a large part of the Canadian economy, are aggressively recognizing the value of PMS/PPM tools to compete efficiently and scale.

The market in the U.S. is witnessing significant growth on the back of rising cloud adoption. Also, the U.S. Army's Enterprise Resource Planning (ERP) modernization plan is introducing PMS modules that will support an organization's ability to track timelines and compliance. Cybersecurity compliance under CISA (Cybersecurity and Infrastructure Security Agency) regulations is also driving the adoption of digital PMS platforms, as governments are looking to only use secure PMS tools and platforms.

Europe Market Insights

Europe is poised to hold a significant revenue share throughout the forecast period. The growth can be attributed to the cloud migration, EU digitization funding, remote work trends, and requisite digital compliance frameworks. In the EU, support for PMS uptake is available through the European Digital Innovation Hubs (EDIHs). In particular, ENISA funding sources have supported secure deployment, particularly in cross-border project execution. There are key industry trends, including AI integration, compliance automation, and modules by sector, that are transforming the PMS landscape. There is accelerated growth in Nordic countries and the Netherlands as a result of strong, multi-state, public-private tech initiatives.

By 2035, Germany is expected to contribute to the highest revenue share in Europe's PMS market. Its leadership position is expected to continue as a result of the comprehensive integration of digital technologies across its industrial and automotive manufacturers, logistics stakeholders, and various public sectors. Additionally, the UK PMS market is poised for continued expansion, driven by technological advancements and evolving work dynamics. Organizations are increasingly investing in PMS solutions to enhance productivity, ensure timely project delivery, and maintain a competitive advantage.

Asia Pacific Market Insights

In the Asia Pacific, the market growth is driven by rising hybrid and remote work models. Also, there is a surge in AI integration and industry-specific infrasture development. In India, the market is driven by a rise in global capability centers as the country hosts more than 55% of the GCCs. Also, various industries are adopting PMS solutions to handle large-scale projects to optimize resource utilization. On the back of these factors, the market is witnessing staggering growth in the country and offering lucrative growth opportunities.

The market in China is propelled by an emphasis on digital transformation, and this shift enables organizations to manage projects more efficiently and scale operations effectively. Prominent companies such as Alibaba and Tencent are investing significant money in AI and committing to cloud computing in the coming years. This instills a need to include PMS platforms to increase automation and decision-making capabilities.

Key Project Management Software Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The project management software market is very competitive and heavily traditional. The market is primarily fueled by major U.S.-based companies such as Microsoft and Atlassian, which maintain significant market shares through continuous innovation with deep ecosystem integrations. European companies such as SAP and Sciforma concentrate on the enterprise market, offering customization and regulatory compliance needed to penetrate regulated industries. Asian companies from Japan, South Korea, India, and Malaysia have also begun to maintain their growth by focusing on product value.

|

Company Name |

Country |

Estimated Market Share (%) |

|

Microsoft Corporation |

USA |

20 |

|

Atlassian Corporation Plc |

Australia |

10 |

|

Oracle Corporation |

USA |

8 |

|

SAP SE |

Germany (Europe) |

7 |

|

Asana, Inc. |

USA |

6.9 |

|

Wrike, Inc. (Citrix) |

USA |

xx |

|

Smartsheet Inc. |

USA |

xx |

|

Nulab, Inc. |

Japan |

xx |

|

Zoho Corporation |

India |

xx |

|

Monday.com Ltd. |

Israel (Europe*) |

xx |

|

Hancom Inc. |

South Korea |

xx |

|

Sciforma |

France (Europe) |

xx |

|

ProjectManager.com |

USA |

xx |

|

Easy Projects |

Malaysia |

xx |

|

Clarizen (Planview) |

USA |

xx |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In September 2025, Atlassian announced its acquisition of DX for approximately USD 1 billion. DX specializes in analyzing engineering workflows and measuring productivity, which will enhance Atlassian's offerings by providing deeper insights into AI investments.

- In December 2024, Asana released AI Studio, a no-code builder that lets teams build workflows with AI agents. The company also launched Smart Chat, which provides AI-driven insights and recommendations from Asana and Slack.

- Report ID: 4176

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Project Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.