Portable Leather Polishing Machine Market Outlook:

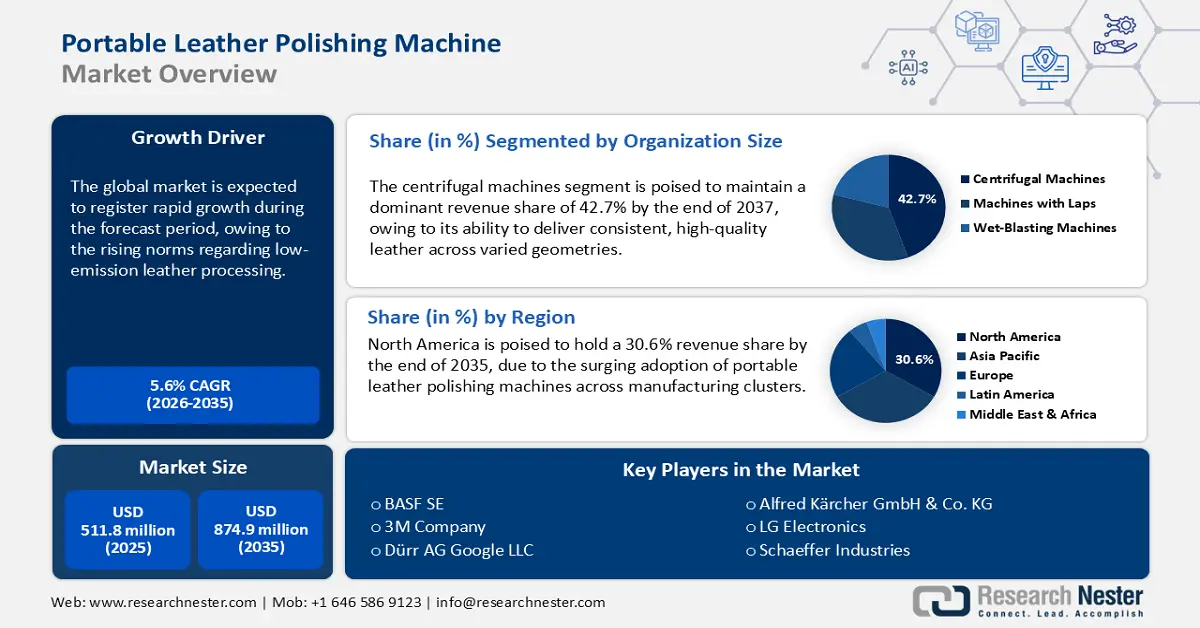

Portable Leather Polishing Machine Market size was valued at USD 511.8 million in 2025 and is projected to reach USD 874.9 million by the end of 2035, rising at a CAGR of 5.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of portable leather polishing machine is estimated at USD 539.9 million.

The modernization of textile and leather goods production lines in APAC and Eastern Europe is a major propellant of the sector’s expansion. The Ministry of Textiles has announced plans to establish seven Mega Integrated Textile Region and Apparel (PM MITRA) Parks, which will require a total investment of Rs. 4,445 crores. These are intended to assist India in achieving "Build resilient infrastructure, promote sustainable industrialization, and foster innovation," which is the 9th Sustainable Development Goal set forward by the UN. With its growing industrial infrastructure, PM MITRA Parks is expected to draw cutting-edge technology and increase foreign direct investment (FDI) and domestic investment in the textile industry. Over 392 billion euros were allotted by the EU to the cohesion strategy for the 2021–2027 programming period. An estimated 226 billion euros were given to the ERDF. In addition to EUR 1.9 billion in particular funding for the most remote and poorly populated areas, EUR 9 billion was allocated for European territorial cooperation. Moreover, the tightening of ESG guidelines has ensured that portable machinery is increasingly favored over large-format polishers.

The supply chain of the leather polishing equipment remains reliant on the availability of materials such as aluminum alloys, abrasives, stainless steel, and electric motors. The economic indices of the portable leather polishing machine can be analyzed via shifts in the Producer Price Index (PPI) and the Consumer Price Index (CPI). The PPI for industrial machinery manufacturing reached 258.440 units in August 2025. As collaborative projects intensify in lightweight and modular machine designs, the demand for portable leather polishing machines is projected to expand by the end of 2035.

Key Portable Leather Polishing Machine Market Insights Summary:

Regional Highlights:

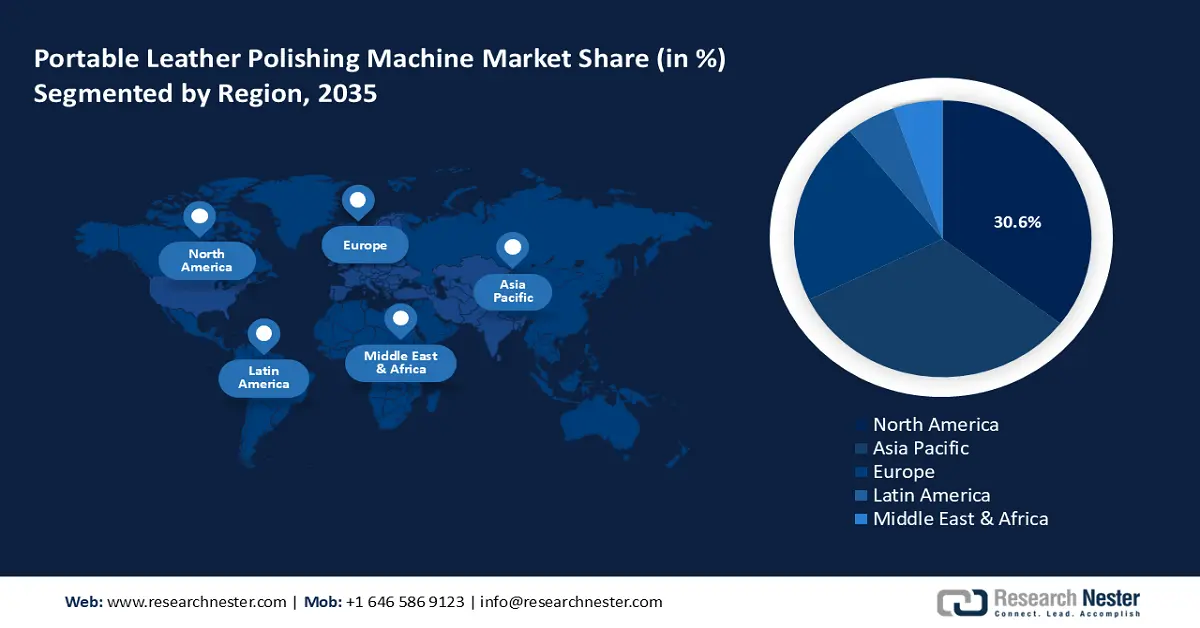

- The North America region is forecast to secure a 30.6% share by 2035 in the Portable Leather Polishing Machine Market, upheld by widespread adoption across footwear and leather-interior applications and nearshoring initiatives ensuring lesser risks to the supply chain.

- The APAC region is set to grow at a 5.3% CAGR during 2026–2035, supported by its large-scale leather export ecosystem and the emergence of dense production hubs functioning as just-in-time export manufacturing systems.

Segment Insights:

- The centrifugal machines segment is anticipated to account for a 42.7% share by 2035 in the Portable Leather Polishing Machine Market, propelled by its ability to deliver consistent, high-quality finishes across varied geometries and the advent of centrifugal units with modular design updates.

- The automatic machines segment is expected to hold a 35.2% share by 2035, supported by an industry-wide shift toward automation to meet international standards and surging demand for export-ready portable leather.

Key Growth Trends:

- Rise in low-emission leather processing norms shaping equipment upgrades

- Demand for high-end fashion products

Major Challenges:

- Lack of standardization in finish quality across decentralized production sites

- Limited battery life and portability constraints

Key Players: BASF SE, 3M Company, Dürr AG, Alfred Kärcher GmbH & Co. KG, LG Electronics, Schaeffer Industries, Samsung Electronics, Milwaukee Tool, Bosch Rexroth AG, Makita Corporation, Hitachi Koki Co., Ltd., TANAKA Corporation, Nidec Corporation, Panasonic Corporation, Fujitsu Limited, Carpet & Polishing Technology Ltd, Apex Polishing Systems.

Global Portable Leather Polishing Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 511.8 million

- 2026 Market Size: USD 539.9 million

- Projected Market Size: USD 874.9 million by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.6% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Italy, Japan

- Emerging Countries: Vietnam, India, Turkey, Mexico, Indonesia

Last updated on : 26 September, 2025

Portable Leather Polishing Machine Market - Growth Drivers and Challenges

Growth Drivers

- Rise in low-emission leather processing norms shaping equipment upgrades: Environmental compliance mandates have intensified the requirement for energy-intensive machinery across the world. The impact has been noticeable in the intensifying demand for portable leather polishing machines. The environmental compliance mandates in the EU, Japan, and South Korea have pushed leather manufacturers to be proactive in phasing out legacy polishing systems. The trends create ample opportunities for the greater adoption of portable polishing machines equipped with low-energy drives.

Additionally, in 2024, the European Commission tightened the VOC thresholds under the aegis of the Industrial Emissions Directive, which has had a noticeable impact on the equipment turnover among leather goods assemblers. A direct impact has been the higher tender approvals for portable systems with modular emission controls in public-funded leather clusters strewn across Italy and the Netherlands.

- Emergence of contract leather manufacturing hubs in Southeast Asia: The decentralization of global leather goods production to economies offering comparatively cheaper manufacturing, such as India, Vietnam, Bangladesh, and Cambodia, has created a fertile ground for the manufacturing of mobile polishing machines that suit the flexible layouts of contract manufacturing zones. A recent trend in an emerging economy, highlighting favorable conditions for greater production, can be found in Vietnam. For instance, India’s export of leather and leather manufactures during 2023-24 accounts for 4.28 billion. The geographic realignment in manufacturing has ensured a sustained transition in the demand for equipment from large centralized polishers to modular machines that are tailored for export-grade finishing.

- Demand for high-end fashion products: The popularity of high-end leather goods, including belts, bags, footwear, and jackets, is increasing the demand for portable leather polishing machines. People want a method for maintaining the quality of their leather products or restoring the looks of their leather goods, which all leads to greater market growth. To achieve a turnover of $47 Bn by 2030, the government of India initiated the Indian Footwear and Leather Development Program (IFLDP) with a budget of INR 1,700 Cr to upgrade the existing infrastructure and provide various incentives to the industries and manufacturing units involved in the sector. India aims to be recognized as a hub to meet the increasing demand for leather products, backed by different sub-schemes.

Emerging Trade Dynamics

Clothing accessories of leather or composition imports in 2023

|

Country / Reporter |

Export Value (USD thousands) |

Quantity (Kg) |

|

Italy |

55,435.73 |

432,410 |

|

European Union (as a bloc) |

49,337.85 |

353,496 |

|

China |

24,547.87 |

1,752,210 |

|

France |

13,228.47 |

92,386 |

|

Spain |

10,268.76 |

83,400 |

|

India |

9,846.16 |

937,337 |

|

United Kingdom |

8,704.76 |

115,131 |

|

Netherlands |

7,549.28 |

523,623 |

|

United States |

5,966.79 |

- |

|

Pakistan |

5,002.16 |

- |

Source: WITS

Challenges

- Lack of standardization in finish quality across decentralized production sites: The consistent shift toward portable polishing systems has bolstered the operational flexibility for small and mid-scale manufacturers. But the transition has also led to inconsistencies in surface finish outcomes. The inconsistencies are particularly glaring when machines vary in design specifications. Moreover, the absence of homogeneous technical standards for portable leather polishing machines has limited integration into export-driven supply chains.

- Limited battery life and portability constraints: While described as portable, many models have limited battery life that restricts continuous operation when working on polishing projects on a large scale. Constantly stopping to recharge or being tethered to the nearest power source can derail smooth workflows. In addition, most weigh enough to impact true portability, which is a particular concern for artists needing to work in confined environments or traveling for holiday accommodation as part of their mobility service. Continuing to strike a performance/brighter battery capacity/lightweight design balance is a technological challenge that has implications for ROI and for overall user experience.

Portable Leather Polishing Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 511.8 million |

|

Forecast Year Market Size (2035) |

USD 874.9 million |

|

Regional Scope |

|

Portable Leather Polishing Machine Market Segmentation:

Type Segment Analysis

The centrifugal machines segment is poised to maintain a dominant revenue share of 42.7% by the end of 2035. Since centrifugal machines are able to deliver consistent, high-quality leather across varied geometries, using controlled rotational force, the profitability of the segment is reinforced. In comparison to machines with wet-blasting and laps units, centrifugal systems are better in precision, which makes them vital in industrial-grade polishing lines for end products such as footwear, upholstery, and fashion accessories. An additional trend supporting the segment’s growth is the advent of centrifugal units with modular design updates.

Operation Segment Analysis

The automatic machines segment is poised to hold a leading revenue share of 35.2% by the end of 2035. The profitability of the segment is associated with an industry-wide shift to automatic machines to negate dependency on operators. Additionally, the automatic machines are especially valuable for OEMs producing for exports due to the ease in meeting international standards. In terms of deployment, producers in Germany and Japan have led the integration into their portable systems. With the greater demand for export-ready portable leather, the requirement for automatic machines in portable leather polishing is expected to expand exponentially throughout the forecast timeline.

End use Segment Analysis

The industrial segment is poised to hold a leading revenue share of 23.2% by the end of 2035, due to high demand from leather manufacturing units, footwear factories, and automotive leather workshops. These settings require efficient, durable, and high-capacity machines to maintain production quality, driving industrial adoption more than textile or consumer goods, which involve smaller-scale or occasional use. Industrial applications ensure consistent market growth. With an expected increase of more than 12%, India's leather and footwear export industry is expected to develop significantly, reaching USD 5.3 billion in the current fiscal year. About 4.2 million people are employed in this labor-intensive sector, which generates about US$19 billion in revenue overall, including US$5 billion from exports.

Our in-depth analysis of the portable leather polishing machine market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Operation |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Leather Polishing Machine Market - Regional Analysis

North America Market Insights

The North America portable leather polishing machine sector is predicted to maintain a leading revenue share of 30.6% by the end of 2035. The regional market’s growth is supported by the widespread adoption of portable leather polishing machines across footwear, automotive leather interiors, and luxury accessory manufacturing clusters. Additionally, the nearshoring initiatives in North America are set to benefit OEMs due to stainless steel and chromium supply chains in domestic or trusted allied countries, ensuring lesser risks to the supply chain.

The U.S. portable leather polishing machine market is estimated to account for a leading revenue share by the end of 2035. A key factor driving the U.S. market is an uptick in contract manufacturing facilities. Under the Customs Modernization Act, U.S. importers of polishing equipment are benefiting from the heightened clearance for finished durable capital goods. Additionally, manufacturers of U.S. machinery are capitalizing on this benefit by expanding localized assembly operations in states with existing leather hubs, such as Michigan, Massachusetts, and North Carolina.

Canada's portable leather polisher market is driven by the growing leather goods industry, particularly in footwear, winter wear, apparel, and accessories. Increased consumer interest in artisanal and handmade products is resulting in more adopters of the product form among smaller manufacturers. Strong retail and e-commerce growth within the country provides an international context for brands rooted in Canadian representation and manufacturing. Focusing on the use of eco-friendly materials while supporting craftsmanship through sustainable practices also adds appeal to new polishing machines and strengthens the consistently strong growth within the leather polishing machine market in Canada

Asia Pacific Market Insights

The APAC portable leather polishing machine market is expanding at a 5.3% CAGR during the forecast period, exhibiting the fastest expansion. The APAC market is characterized by the scale of the leather export-industrial ecosystem. Emerging economies in APAC offer lucrative export opportunities. Vietnam, in particular, has escalated the exports of leather and footwear. Complementing this trend, the Technology Upgradation Fund Scheme has accelerated portable machinery adoption by MSMEs. Due to these trends, a dense cluster of production hubs has emerged in Tamil Nadu (India) and Ho Chi Minh (Vietnam), where portable leather polishing machine units have become a vital component of just-in-time export manufacturing systems.

The China portable leather polishing machine market is poised to exhibit robust growth throughout the anticipated timeline. The Chinese market is fueled by the 14th Five-Year Plan’s emphasis on upgrading MSME infrastructure. Due to the emphasis, polishing machine manufacturers in provinces such as Guangdong and Zhejiang have leveraged subsidies for equipment modernization. The Made in China 2025 agenda has supported manufacturing. Additionally, with the surging demand for export-quality leather, manufacturers driving local demand, the opportunities for local manufacturers are set to be ripe by the end of 2035.

India’s leather industry is a global leader, producing 2 billion sq. ft. of tanned leather annually, meeting 10% of world demand and earning the MODEUROPE color recognition. It is the second-largest footwear producer with 2,065 million pairs yearly, 95% sold domestically, and footwear exports comprising 45% of leather exports. The nation also ranks second in leather garments (16 million pieces) and fifth in leather goods, accessories, saddlery, and harness, contributing 25% of total exports.

Europe Market Insights

The European portable leather polishing machine market is projected to register a major revenue share by the end of 2035. The market is anchored by Italy, France, and Germany, and is favorably impacted by the policy-led sustainable modernization. Dual regulatory mechanisms, such as the EU Machinery Regulation 2023/123, have contributed to enforcing harmonized safety and cyber standards set to be in practice from January 2027. The EU imported EUR137 billion worth of apparel and textiles in 2022 and exported EUR67 billion. In 2022, China, Bangladesh, and Turkey were the top exporters of apparel and textiles to the EU.

The German portable leather polishing machine sector is poised to expand during the forecast period. Additionally, Germany has a strong mechanical engineering base and is aligned with the REACH directive, pushing manufacturers to favor automated and centrifugal polishing units. With the drive to reduce emissions intensifying in Germany, the market is expected to remain profitable by the end of 2035. Global leather article trade hit $92.7 billion in 2023, up 1.18% from $91.6 billion in 2022, and has expanded at an annualized 3.36% rate over the past five years, reflecting steady international demand growth.

Trade Data of Leather Articles in 2023

|

Exporting Country |

Value (USD Billion) |

Importing Country |

Value (USD Billion) |

|

China |

32.1 |

United States |

13.9 |

|

Italy |

13.9 |

Japan |

5.86 |

|

France |

13.0 |

France |

5.47 |

Source: OEC

Key Portable Leather Polishing Machine Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- Dürr AG

- Alfred Kärcher GmbH & Co. KG

- LG Electronics

- Schaeffer Industries

- Samsung Electronics

- Milwaukee Tool

- Bosch Rexroth AG

- Makita Corporation

- Hitachi Koki Co., Ltd.

- TANAKA Corporation

- Nidec Corporation

- Panasonic Corporation

- Fujitsu Limited

- Carpet & Polishing Technology Ltd

- Apex Polishing Systems

The portable leather polishing machine market is poised to remain competitive throughout the anticipated timeline. Key players in the market are adopting varied strategies to expand and maintain their market position. Companies such as BASF SE and 3M hold major revenue shares in the market. Additionally, smaller firms such as Victor Machinery and Apex Polishing Systems are focusing on providing cost-effective solutions to expand their shares in regional markets. The table below highlights the major players in the portable leather polishing machine market:

Recent Developments

- In April 2024, the 3M Company announced the new Automated Leather Polishing System. The new system streamlines the leather polishing process for large-scale industrial applications and is expected to reduce operational time by over 20% in larger factories.

- In February 2024, Dürr AG introduced the EcoPolish system. The new system is designed with sustainable materials and energy-efficient tech to meet the regulatory standards. The product aligns with the industry trends toward sustainability by attracting eco-conscious manufacturers.

- Report ID: 4022

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Leather Polishing Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.