Polysulfone Market Outlook:

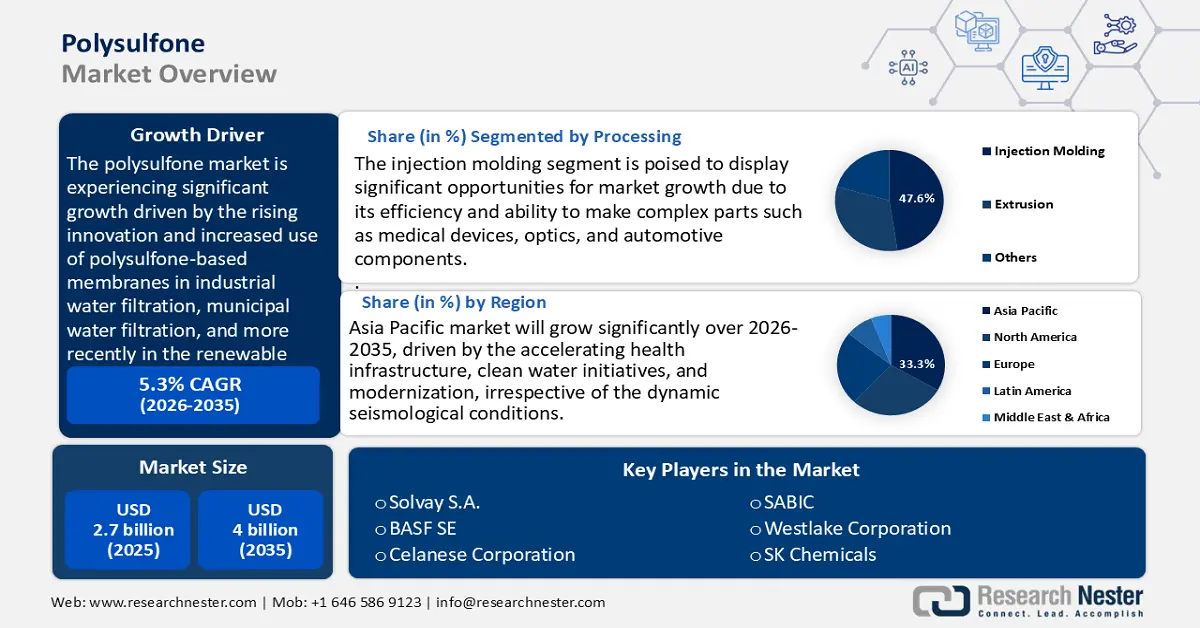

Polysulfone Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 4 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period, from 2026 to 2035. In 2026, the industry size of polysulfone is estimated at USD 2.9 billion.

The polysulfone market is expected to grow significantly, primarily driven by the rising demand for high-performance membranes that fit in water filtration and fuel cell technology. This has been driven primarily by innovation and the rising use of polysulfone-based membranes in industrial water filtration, municipal water filtration, and, more recently, in the renewable energy market, proton exchange membrane (PEM) fuel cells. As supported by government and academic studies, polysulfone offers superior chemical and thermal resistance, which is a core criterion of durable & high-performance membranes. The researchers emphasize the improved fuel cell and filter water uptake, ionic conductivity, and overall performance of polysulfone relative to those of traditional materials. This is encouraging strategic research investments to accelerate the commercialization of advanced polysulfone membranes, with national energy and water infrastructure programs, encouraging innovation and scale-up.

Within the supply chain and manufacturing development, the production of polysulfone is integrated with the global chemical, polymer, and technology supply chain network. Increases in the manufacturing capacity, particularly advanced foaming and membrane technologies, capitalize on more environmentally friendly procedures like supercritical CO2-based foaming, which, in laboratory tests, produced a higher porosity and a reduced amount of utilized volatile organic solvents. In the United States International Trade Commission reporting on synthetic organic chemicals, the U.S. remains a strategic producer and exporter of synthetic polymers and related intermediates, and domestic poly-sulfone is primarily consumed nationally and launches trade. Additionally, in 2024, U.S. chemical production is expected to grow by 2.2% across all segments, with basic chemicals such as petrochemicals, inorganic chemicals, and plastic resins projected to increase by 2.5%, partly driven by stronger exports. Specialty chemical output is anticipated to rise modestly by 0.4%, while agricultural chemicals are expected to grow by 2.6%. Technical divisions funded by the government continue to invest in new standards of measurement and manufacturing to seek new standards of composite applications to reduce the costs and development time on new polysulfone materials.

Key Polysulfone Market Insights Summary:

Regional Insights:

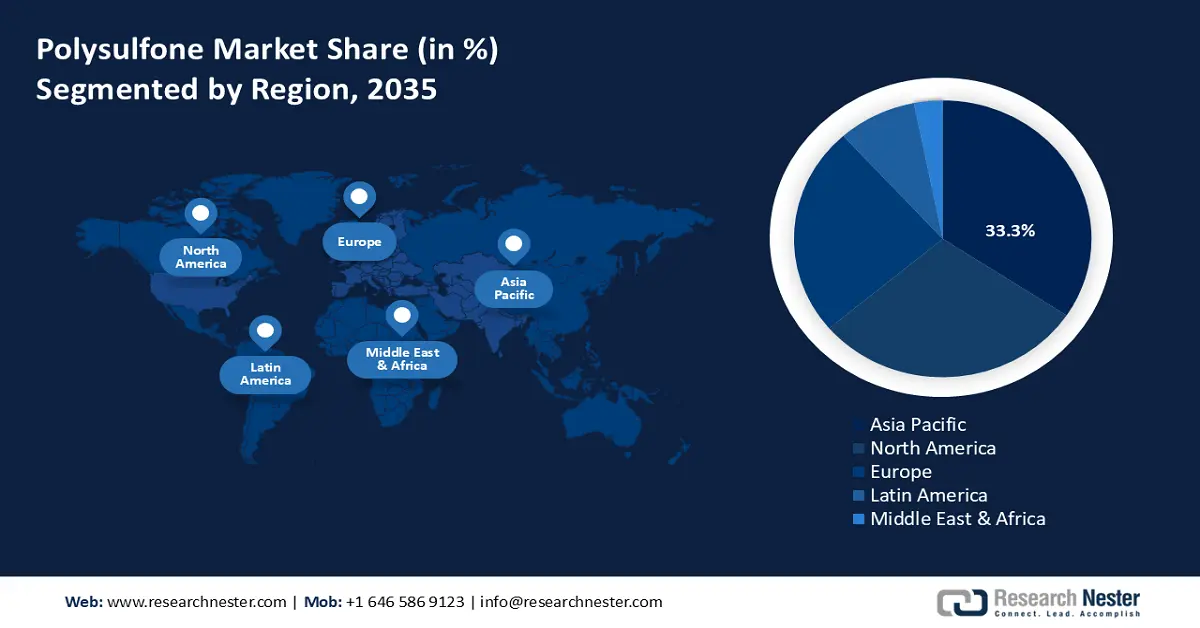

- Asia Pacific is expected to hold a 33.3% share over the forecast period, owing to accelerating health infrastructure, clean water initiatives, and modernization in the Polysulfone Market.

- The North America polysulfone market is projected to reach 28.6% share from 2026 to 2035, impelled by regulatory focus on clean water infrastructure and energy-efficient production.

Segment Insights:

- The injection molding segment is projected to account for 47.6% share over the forecast period, impelled by its efficiency and ability to produce complex parts such as medical devices, optics, and auto components in the Polysulfone Market.

- Polyethersulfone (PESU) is expected to hold a 42.4% share by 2035, driven by strong hydrolytic stability, high-temperature resistance, and extensive applications in water filtration.

Key Growth Trends:

- Medical devices & sterilization standards

- Electrification & electronics thermal demands

Major Challenges:

- Delays in infrastructure & regulatory

- Supply chain disruptions & logistics cost surges

Key Players:Solvay S.A., BASF SE, Celanese Corporation, SABIC, Westlake Corporation, SK Chemicals, Petronas Chemicals Group Berhad, Reliance Industries Limited, Sinopec / China Petroleum & Chemical Corp., Evonik Industries AG, LyondellBasell Industries N.V.

Global Polysulfone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.7 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 4 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Saudi Arabia

Last updated on : 3 September, 2025

Polysulfone Market - Growth Drivers and Challenges

Growth Drivers

-

Water & wastewater build out (membrane demand): Access to safely managed drinking water was lacking in one-fourth of the world population in 2022. Although 57% of the global population had access to safely managed sanitation, two out of every five people have yet to gain access to it, which depicts the persistence of issues in water and sanitation access. The UN also discovered that in order to fulfill the general access of 2030, it needs to meet faster six-fold progress faster than at this point, and as a result of this reason, there is a necessity for advanced treatment technologies. Ultrafiltration and microfiltration are the key membranes that are made of polysulfones, particularly PESU, since they have great resistance to both heat and chemicals, as well as hydrolytic tolerance.

The expansion in investments in municipal water supply and industrial reuse of wastewater water especially in China and India, is adding to the demand for the polysulfone membranes. As an example, in October 2021, Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0 was launched with a total indicative outlay of about 299,000 crore (~USD 36 billion) in the following five years, of which much is dedicated to investing in projects to increase the water supply of cities, sewerage, and the usage of treated water. Increasing regulatory demands of safe water discharge and sustainable reuse have made high-performance polymers inevitable. Any government globally is increasing its water safety commitments, and the growing need to ensure safety standards is furthered by the increasing presence of polysulfones in the backbones of long-term water treatment systems. -

Medical devices & sterilization standards: The Apollo ASTM specification ASTM F702-18 is accepted by the U.S. FDA as a standard specification of the resin polysulfone in the medical field that guarantees manufacturers with a definite regulatory tool to qualify their products. Polysulfone (PSU) is high performance medical-grade plastic with among the best hydrolysis and steam sterilization resistance properties, withstands a full 100 autoclave cycles to 134 o C. It has good strength, toughness, thermal stability (deflection temperature at 174 °C), and resistance to a host of chemicals.

PSU and similar PPSU polymers are commonly utilized in medical applications, including filtration membranes, sterilization containers, and surgical tools, given the above-listed qualities of biocompatibility, durability, and resistance to sterilization without degradation. These properties make PSU durable and suitable for long-term medical applications. The trend towards the use of PSU and PPSU devices in North America and Europe, where sterilization protocols have been the strictest, is going on as the leader. With a globally recognized, regulatory-compliant pathway to safer, greener medical processes, polysulfones are experiencing stronger demand in medical supply chains. -

Electrification & electronics thermal demands: The need for materials is shifting due to global trends of electrification. By 2024, the number of electric cars sold will have surpassed 17 million vehicles, indicating more than 20% of all new vehicle sales in the entire world, and this trend is proceeding at a faster rate. This boom leads to robust use of high-performance engineering plastics in battery packs, connectors, and charging systems, where thermal and electrical stresses will be severe. The ability of polysulfones to withstand high temperatures makes them remarkable in dielectric strength, flame resistance, and resistance to dimensional changes. Ultra-fast charging systems with networks are being rolled out, further contributing to increasing demands in terms of reliable and molecule-pain-resistant plastics.

Challenges

-

Delays in infrastructure & regulatory: In emerging markets, in 2022, China announced new regulations on hazardous chemical safety that resulted in a significant delay before the application of certain polysulfone grades and had a significant impact on supplier responsiveness and availability of the material in the polysulfone market. Lead times in Southeast Asia and portions of Africa (e.g., inadequate temperature-controlled storage and handling of high-performance thermoplastics) push the lead time further, loading up working capital and logistics costs. Such a slow rollout inhibits the adoption of PSU/PPSU/PESU in high-end applications such as water and healthcare, where the guarantee of reliability and time of supply are not negotiable. With the government pressing harder on safety and environmental control, suppliers find they need to update the infrastructure, and in many cases, that results in large-scale capital expenditure: a cost that may not be affordable to small regional suppliers.

-

Supply chain disruptions & logistics cost surges: Global merchandise trade has been significantly disrupted in 2020, with the volume declining by 5.3% since the financial crisis of 2008. These shocks hit niche specialty polymers hardest, such as polysulfones, which are dependent on complicated global supply chains. Container and shipping rate volatilities have soared in the COVID-19 age. Global shipping costs rose by 572% over 19 months, then rose by another 250% in the first seven months of 2024. Logistics inflation has been easily transferred onto the prices of imports, draining the margins of suppliers and end-users. In practice, it has resulted in abrupt cost shocks by polysulfone resin suppliers, making pricing models unpredictable, complicating procurement contracts, and raising the cost of ownership to users in regulated spaces such as medical devices and water infrastructure.

Polysulfone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.7 billion |

|

Forecast Year Market Size (2035) |

USD 4 billion |

|

Regional Scope |

|

Polysulfone Market Segmentation:

Processing Segment Analysis

The injection molding segment is expected to grow with the largest polysulfone market share of 47.6% over the forecast period, owing to its efficiency and ability to make complex parts such as medical devices, optics, and auto components. An average injection-molding facility accounts for around 60% of all energy consumption itself, highlighting the importance of process optimization. Energy demands that are staged in injection molding also highlight a need to improve upon energy use; a single stage in the process, plastication, can alone consume as much as 48% of the total energy. Considering such efficiencies and its capability of yielding high-performance shapes with close tolerances, injection molding is the process that is most viable when working with polysulfones, at least within high-precision industries.

The growing use of polysulfone in the automotive and medical sectors is further driving its demand in the polysulfone market. Japan manufactured 8.99 million vehicles in 2023, reinforcing the importance of precision-engineered, high-performance polysulfone parts in the electric vehicle and under-hood region. On the health front, the U.S. healthcare sector is on its way to the sustainability path, owing to a renewed focus on reprocessed single-use devices (SUDS), which have a 0.8 carbon footprint. Some SUDs can be reprocessed safely, and implementing these procedures and practices can save hospital expenses by 25-40%, realizing a cost savings of approximately USD 465 million by the year 2023.

When proliferated, reprocessing could provide an extra national saving of USD 2.28 billion. As a result of the conducted regulatory advancements, the healthcare industry is likely to further optimize its environmental protection factors without compromising the safety of patients and deflating expenses. The automotive and medical sectors stand out best to take full advantage of the synergy- the volumes, the complications, and the regulatory congruency to ensure that injection molding exists as the best choice in processing polysulfone well beyond 2035.

Polymer Type Segment Analysis

Polyethersulfone (PESU) is projected to grow at a significant polysulfone market share of 42.4% over the projected years by 2035, driven by strong hydrolytic stability, high-temperature resistance, and extensive uses in crucial applications like water filtration. According to a 2024 study, the addition of molybdenum disulfide (MoS 2) nanoparticles to polysulfone membranes not only boosts water permeability but also retains more than 96% of the salt. These membranes possess an improved surface attribute, such as greater hydrophobicity, and can improve desalination performance. Such long-lasting sulfone membranes are essential to developing desalination infrastructure. Polysulfone's dominance in the ultrafiltration and reverse osmosis market is due to its exceptional resistance to degradation and reliability under harsh operating conditions.

Filtration & water treatment and automotive electronics are the leading segments in the polyethersulfone. Global access to safely managed drinking water increased across the world, with the global prevalence totalling 74% in 2024, and indicating the need for sophisticated filtration systems, where PESU membranes are used in ultrafiltration and reverse osmosis systems. Further, according to JEITA, the electronics manufacturing in Japan, which has been boosted by automotive electronics, is predicting a robust growth of 9% in global electronics and IT production in 2024 and 8% in 2025, thus pointing to higher volumes of high-performance polymers stored in E/E parts in cars. In combination, increased expenditure in water treatment and the evolving automotive electronics market activities make PESU dominant in the polysulfone demand by 2035.

Application Segment Analysis

The medical & healthcare application segment in the polysulfone market is likely to expand substantially over the projected years by 2035, with a polysulfone market share of 42.4%. This growth is driven by increased healthcare needs around the globe, as well as material durability requirements. Globally, plastics account for around 3% of global greenhouse emissions, which further underplays the importance of polymers such as polysulfone with a long life cycle and minimal repurchase. In medical applications, polysulfones are popular since they can be sterilized repeatedly (e.g., by steam, gamma), are biocompatible, and can be used in medical devices. This performance, regulatory compatibility, and long-life span entrench polysulfone as a mainstay in the medical application category.

Our in-depth analysis of the polysulfone market includes the following segments:

|

Segments |

Subsegments |

|

Polymer Type |

|

|

Form |

|

|

Processing |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polysulfone Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to dominate the global polysulfone market with the largest revenue share of 33.3% over the projected years, attributed to the accelerating health infrastructure, clean water initiatives, and modernization, irrespective of the dynamic seismological conditions. Regional programs targeting UN Sustainable Development Goal 6 (clean water and sanitation) are predicted to continue to fuel the need to invest at least three times more in sanitation efforts in the region, generating ongoing demand for PESU in ultrafiltration, reverse-osmosis membranes. Simultaneously, in recent years, the Asian Development Bank’s Water Financing Partnership Facility (WFPF) has committed USD 1.42 billion to water projects from 2021 to 2023, benefiting around 9 million people.

In 2023 alone, WFPF-supported projects accounted for USD 626.8 million of the USD 2.83 billion total water sector investments by ADB. These investments advance water security, sanitation, and resilience across Asia, driving demand for high-performance polymer components in water infrastructure. In addition, harmonization initiatives on the training and regulations by the ASEAN Secretariat and the APEC Chemical Dialogue are promoting higher standards of quality and safety regarding polymers, with a preference for the use of advanced sulfone resins. These macro-trends will strengthen the already healthy mid-single-digit CAGR by 2035 outlook in the APAC polysulfone market.

The polysulfone market in China is expected to lead the region with significant revenue share during the forecast years, due to a structural transformation in chemical sector with a high level of environmental regulation leading to consolidation of plants and creating chemical parks while closing the non-compliant facilities, which, in one province, resulted in a 5.7% decrease in the number of companies during periods of enforcement. Such reforms have led to the adoption of materials of higher quality and good stability, such as polysulfone, in downstream applications. The government's 2023 Guiding Catalog for Industrial Structure Adjustment identified fine chemicals, water treatment agents, and electronic materials as strategic targets, which facilitates demand for PESU/PPSU in the filtration and electronic industries.

The creation of national chemical champions by the central governments through both financial incentives and innovation groups also boosts supply consistency and delivery of performance polymers at the country level. By driving out of business small facilities with low compliance rates and transitioning to upgraded facilities, regulation tightening has increased base polymer demand quality and consistency, to the advantage of polysulfone users in medical and infrastructure applications.

India’s polysulfone market is anticipated to grow with an upward trend from 2026 to 2035, driven by innovation through Centres of Excellence (CoEs) within the Department of Chemicals and Petrochemicals, facilitating modernization and sustainable development of chemical processes such as bio-formulas and high-end composites. Green chemistry is being encouraged nationally with branding and regulatory support that target reduced levels of hazardous waste and resource costs- making sustainable engineering polymers increasingly in demand, such as polysulfone. The 2023 IGW symposium connected academic and industry advances to drive the commercialization of cleaner chemical processes- one path towards polymer-scale innovation.

Policies in India under Make in India and investment in petrochemical clusters (PCPIRs) also emphasize localization of high-performance resin manufacturing, such as compounding capabilities required to produce polysulfone that may be used in medical parts and filtration. Combined with institutional R&D support, the promotion of green chemistry and infrastructure investment, the fixed demand of polysulfone in advanced domestic applications is taking shape.

North America Market Insights

The polysulfone market in North America is expected to witness a steady growth of28.6% from 2026 to 2035, owing to the growth in regulatory attention on clean water infrastructure and energy-efficient production. Under the Safe Drinking Water Act (SDWA), authorized under 42 U.S.C. SS300 f et seq., the EPA sets strict, science-based standards of filtration so that individuals can drink clean and safe water. Such enforcement creates a high demand for durable, high-performance membrane material, especially the polysulfone, which is preferred due to its resistance strength and long-term use.

Polysulfone membranes are capable of complying with changing filtration standards, enabling trusted water purification regarding SDWA regulations. Further, the Department of Energy, with the Advanced Energy Manufacturing and Recycling Grants program, which received USD 750 million under the Bipartisan Infrastructure Law, is likely to contribute tangentially to increasing polysulfone processing. In addition to this, federal interests in chemical safety and workplace factors as governed by OSHA stimulate the engineering of resistant polymers, which are durable and have thermally stable characteristics, e.g., polysulfone, in processing vessels and systems.

The U.S. polysulfone market is expected to lead the North American region, due to the presence of strict drinking water treatment regulations under the EPA Safe Drinking Water Act that demand quality filtration materials, enhancing the use of high-quality, durable sulfone-based membranes, such as PESU and PSU. The USD 30 million funding initiative by the U.S. Department of Energy supports the advancement of smart manufacturing and clean energy through circular supply chains. It aims to improve manufacturing productivity, energy effectiveness, and sustainability by integrating advanced technologies like AI and IoT across numerous sectors. The program also underlines workforce development and alliance between industry and research institutions to drive innovation and reduce environmental impact. This initiative positions the U.S. manufacturing sector for a more competitive and sustainable future, further benefiting the processes of polysulfone with the cleaner production pathways.

Moreover, continued chemical safety standards implementation and workplace enhancements by OSHA, including the Hazard Communication Standard and permissible exposure limits under 29 CFR 1910 Subpart Z, emphasize protecting workers from hazardous chemical exposures, increasing the requirement of highly thermally resilient polymers such as polysulfone in equipment parts, and contributing to polysulfone market demand in regulated and performance-intensive products. These regulatory frameworks, together with funding programs, will support a strong mid-single-digit growth outlook on the regional polysulfone market through to 2035.

By 2035, Canada’s polysulfone market is expected to grow at a steady pace, facilitated by effective regulatory guidelines provided by the Chemicals Management Plan (CMP), which has put in place timelines and funding, approximately CAD 296 million between 2021 and 2024-to evaluate and manage polymers and industrial chemicals. This propels safer material rules across industries that rely on polysulfone, such as the health, water, and industrial infrastructures. In addition, the clean tech investment initiatives, including the Net-Zero accelerator with CAD 8 billion offered to decarbonize key industrial sectors, facilitate the use of polysulfone in green production. With such regulatory and funding efforts, the regional polysulfone market can expect stable growth with more focus on sustainability, clean-tech, and safety in the long term until 2035.

Europe Market Insights

Europe polysulfone market is likely to gain traction with around 24% revenue share of the global market, due to the dominance of specialty polymers and advanced polymers in the region. In Europe, the chemical industry recorded sales of 760 billion EUR in 2022, with 1.2 million direct jobs and 67% higher productivity. Stringent REACH regulations have led toward the use of high-quality and traceable materials such as PSU, PPSU, and PESU that are compliant with safety requirements -the quantity of substances of very high concern subject to authorization reduced by 45% between 2010 and 2021. Furthermore, the European Commission has offered stimulus measures in a 2025 action plan on the chemical industry, which includes simplified regulation and fiscal incentives that could cut costs to the sector by at least €363 million a year. All these dynamics of regulation, R&I funding, and structure-induced cost pressures contribute to moderate growth and specialization of polysulfone in Europe. The chemicals industry in the UK is a key economic force, with the investment of £9.8 billion in R&D in 2023. Germany plans green chemical transitions with a package of 4 billion euros in climate protection contracts being assigned to the energy-intensive industries in 2024. The price stability of such advanced polymers as polysulfone can further be supported by these combined R&D and climate-aligned subsidies.

Key Polysulfone Market Players:

- Solvay S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Celanese Corporation

- SABIC

- Westlake Corporation

- SK Chemicals

- Petronas Chemicals Group Berhad

- Reliance Industries Limited

- Sinopec / China Petroleum & Chemical Corp.

- Evonik Industries AG

- LyondellBasell Industries N.V.

The polysulfone market is slightly concentrated with a few leaders in Japan, the US, Europe, and the Middle East. Japanese companies such as Toray Industries, Sumitomo Chemical, Mitsubishi Chemical, Kuraray, and DIC have a substantial market share due to technological skill and innovation of high-performance polymers. Companies including BASF, Solvay, and the Middle Eastern giant SABIC pay a lot of attention to the growth of production capacities and research efforts to ensure the improvement of product grades and sustainability. Meanwhile, US-based companies focus on developed material solutions in the medical and automotive industries. Some of the strategic plans adopted by these players are the expansion of manufacturing capabilities around the world, the development of environmentally conscious products, creating alliances with the aim of innovation, and investment in innovative technologies in chemical recycling processes to meet new emerging needs and current regulations. This wide range in competition and diversity brings about stable development of the polysulfone market and technology across the world.

Top Global Polysulfone Manufacturers in the Polysulfone Market

Recent Developments

- In March 2025, BASF announced the first biomass-balanced polyethersulfone (PESU) in the world, i.e., Ultrason E 2010 BMB. This innovative product combines 50% of fossil raw materials with renewable feedstock made of organic waste, certified using the ISCC PLUS biomass balance methodology. The new BMB grade Ultrason E 2010 with reduced carbon footprint provides the same high performance, quality, and processability as standard grades but with a substantially reduced carbon footprint. It helps customers achieve sustainability targets and goals without them changing manufacturing processes or certification. It offers a big stride toward more environmentally friendly high-performance thermoplastics.

- In April 2023, Solvay introduced the first ISCC PLUS-certified mass-balance sulfone polymers, taking another big stride toward high-performance sustainable plastics. The new products include grades of polysulfone and polyphenylsulfone that are renewable and recycled feedstocks that have been checked by the International Sustainability and Carbon Certification (ISCC) system. The new product line has properties and processing characteristics that are the same as those of conventional materials, and are therefore able to use the same manufacturing procedures, so that customers can reduce their carbon footprint without modifying manufacturing practices. Solvay is launching a focus on automotive, electronics, and healthcare industries, where customers are pursuing sustainability to achieve their objectives of reducing environmental footprint, in line with the latest industry trends.

- Report ID: 8051

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polysulfone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.