Polymerase Chain Reaction Market Outlook:

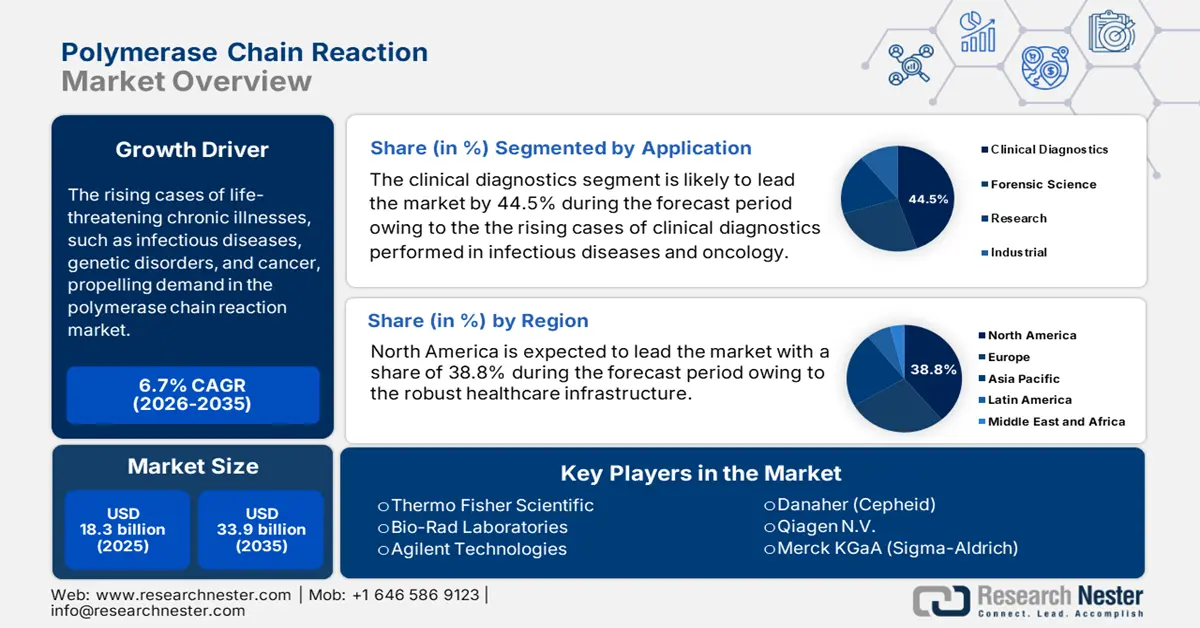

Polymerase Chain Reaction Market size was valued at USD 18.3 billion in 2025 and is projected to reach USD 33.9 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polymerase chain reaction is evaluated at USD 19.4 billion.

The polymerase chain reaction market is driven by the patient pool in infectious disease cases, oncology, and public health surveillance. The NIH publication issued in November 2021 indicates that close to 1.1 million PCR tests have been conducted for COVID-19 and points to the necessity for PCR tests during the pandemic. Nearly 10.6 million people were affected by TB in 2022, where nucleic acid amplification tests are vital for screening and detection, as per the 2025 WHO report. FDA’s IVD policies surges the quality, validation, and postmarket controls for PCR platforms used by clinical labs and manufacturers.

Supply chain resilience for PCR products embraces biologicals (polymerases, RTs), oligos/primers/probes, plastics (tips, tubes, plates), electronics/optics, and assembled instruments. FDA device listing and registration data indicate a wide base of U.S. and foreign facilities for IVD reagents and analyzers, and UN Comtrade trade data indicate extensive cross-border flows in HS 3822 (diagnostic/lab reagents) and HS 9027 (instruments). Further, the OEC report in 2023 highlights, the U.S. is the leader in exporting lab reagents and exported worth USD 108 million in 2023. Specialty enzyme and oligonucleotide import/export dependencies remain; assembly is normally conducted within certified facilities under ISO 13485 and FDA QSR/21 CFR Part 820.

Key Polymerase Chain Reaction Market Insights Summary:

Regional Highlights:

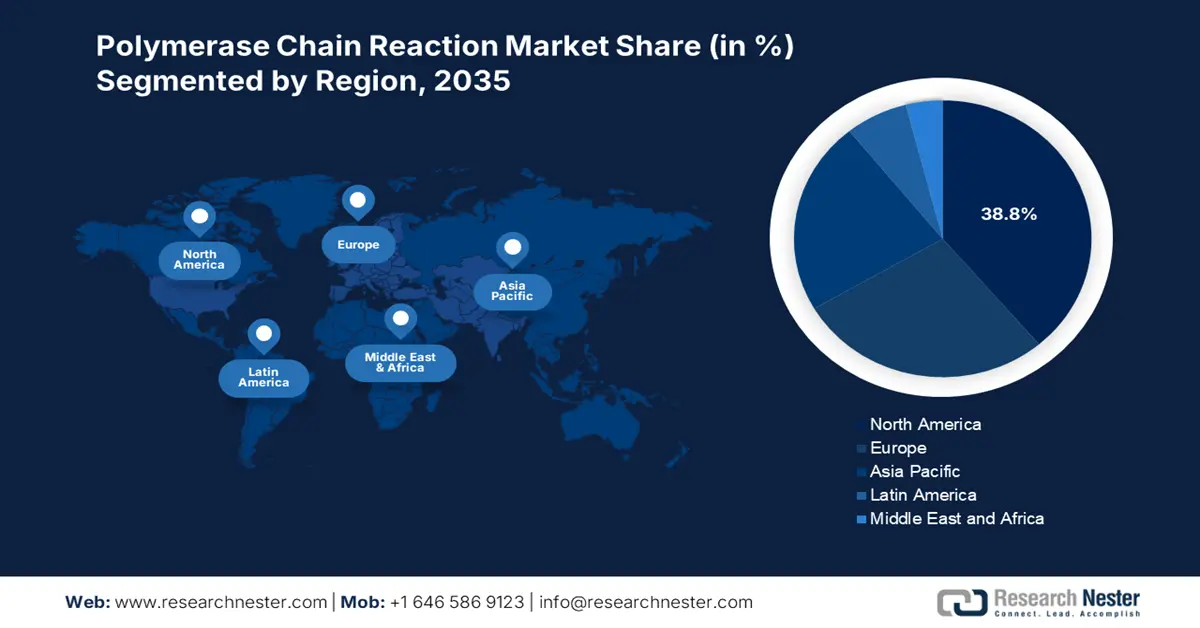

- By 2035, the North America region is projected to secure a 38.8% share in the polymerase chain reaction market, underpinned by its strong healthcare infrastructure, technological maturity, and sustained federal investment.

- By 2035, Europe is anticipated to retain a significant market share, supported by heightened public health spending, IVDR-driven quality enforcement, and extensive EU-funded molecular diagnostics R&D initiatives.

Segment Insights:

- Across 2026–2035, clinical diagnostics are expected to command a 44.5% share in the polymerase chain reaction market by 2035, propelled by expanding pathogen detection needs, oncology-focused PCR utilization, and rising NIH-backed molecular diagnostic integration.

- By 2035, quantitative PCR is set to dominate the technology landscape with a substantial share, sustained by its precision, real-time analytical strength, and increasing adoption in personalized medicine and public health surveillance.

Key Growth Trends:

- Government investments and procurement

- Association with oncology and genomics research

Major Challenges:

- Limitations in worldwide tech-based integration

Key Players: Thermo Fisher Scientific, Bio-Rad Laboratories, Agilent Technologies, Danaher (Cepheid), Qiagen N.V., Merck KGaA (Sigma-Aldrich), Abbott Laboratories, Illumina Inc., Roche Diagnostics, PerkinElmer (Revvity), Becton Dickinson (BD), Promega Corporation, Takara Bio USA (subsidiary), Beckman Coulter (Danaher), Fluidigm (Standard BioTools), Takara Bio Inc., Shimadzu Corporation, Hitachi High-Tech Corp., Eiken Chemical Co. Ltd., Nippon Genetics Co. Ltd.

Global Polymerase Chain Reaction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.3 billion

- 2026 Market Size: USD 19.4 billion

- Projected Market Size: USD 33.9 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 22 August, 2025

Polymerase Chain Reaction Market - Growth Drivers and Challenges

Growth Drivers

- Government investments and procurement: The worldwide shift toward early detection and prevention is pushing global authorities to make PCR a mainstream practice in every healthcare institution and organization. Thus, they are heavily investing in the market to cultivate sufficient resources. In addition, significant funding from the governing bodies, particularly during pandemics or epidemics, is securing a sustainable capital influx in this sector. For instance, the U.S. Medicare spending increased 8.1% to $1,029.8 billion in 2023 and expanded its coverage for infectious disease and oncology testing, stated by the CMS report in June 2025.

- Association with oncology and genomics research: The growing R&D expenditure is the primary growth factors behind the ongoing advancements in the market. For instance, the NIH report in July 2025n NIC had a budget allocation of approximately USD 7.2 billion in 2024, of which a significant share was allocated to cancer genomics, molecular diagnostics, and early detection programs, including liquid biopsy research. Thus, the progress in molecular testing, coupled with the utilization of tech-based production methods, is expanding the pipeline of this sector. In this regard, the FDA reported that automation of assembly lines in this category reduced lead times, enhancing production efficiency and product pricing competency among manufacturers.

- Manufacturers strategies and innovations: Corporate strategies are driving the adoption of PCR. For instance, NIH's RADx initiative (Rapid Acceleration of Diagnostics) allocated more than $1.5 billion to expand PCR technologies, allowing businesses to expand throughput and lower costs. Industry leaders have aligned with hospitals and governments to expand access. Strategic actions include the automation of PCR workflows, as well as liquid biopsy platform integration and point-of-care PCR systems. These innovations minimize the turnaround time and maximize the PCR's utility outside of central labs. Organizations using these techniques witness a growth in market share, hence, making PCR as a valuable diagnostic platform.

Applications of PCR

|

Application |

Use of PCR |

Market / Statistical Data |

Year |

|

Vaccine Development |

|

FDA has approved and authorized for emergency use updated COVID-19 vaccines such as Moderna COVID-19 Vaccine, Novavax COVID-19 Vaccine, and Pfizer-BioNTech COVID-19 Vaccine |

2024-2025 |

|

Clinical Trials |

|

1570 studies are performed including PCR in protocols for diagnostics, biomarkers, or treatment monitoring. |

2023-2024 |

Sources: ClinicalTrials.gov, FDA

Total COVID-19 PCR Tests Performed till June 2022

|

Country |

Tests Performed |

|

U.S. |

912.77 million |

|

India |

857.40 million |

|

Italy |

224.10 million |

|

Ecuador |

2.87 million |

Source: Our World in Data, June 2022

Challenges

- Limitations in worldwide tech-based integration: The financial barriers and lack of infrastructural support in underserved regions often impose difficulties in implementing next-generation technologies in the market. There are several medical settings, particularly in rural regions, that hesitate to adopt AI-driven PCR systems due to limited funding and legacy infrastructure. Consumer trust in these advanced solutions is also sluggish, which may slow the integration of efficiency-boosting technologies, hence restricting future progress in this sector. However, the recent upgrades in regulatory frameworks are fostering an accepting culture for AI in the healthcare industry, showing a potential to mitigate this roadblock.

Polymerase Chain Reaction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 18.3 billion |

|

Forecast Year Market Size (2035) |

USD 33.9 billion |

|

Regional Scope |

|

Polymerase Chain Reaction Market Segmentation:

Application Segment Analysis

In the application segment, clinical diagnostics lead the segment and are poised to hold the share value of 44.5% by 2035. The evidence from the CDC depicts that PCR remains essential to diagnose pathogens like SARS-CoV-2, influenza, and tuberculosis. The use of PCR-related diagnostics in oncology surges the demand further. Additionally, the rise in funding by NIH for research in molecular diagnostics accelerates the technology integration in hospital workflows. This makes clinical diagnostics the most prevalent application in 2035.

Technology Segment Analysis

Under the technology segment, quantitative PCR dominates the segment and holds a considerable share value by 2035. Quantitative PCR is driven by its sensitivity, accuracy, and real-time monitoring capabilities. The FDA evidence depicts that qPCR is a standard test for viral load monitoring (HIV, Hepatitis B/C) and cancer biomarker detection. This test is widely used in food safety, clinical labs and genetic research. As per the NCI, qPCR is the vital test for translational cancer research, providing information on tumor genetics and therapy response. The World Economic Forum report in June 2021 depicts that more than 1.0 billion tests are performed to check COVID-19 using qPCR. Growing reliance on qPCR in personalized medicine and public health surveillance supports its continued market leadership.

Type Segment Analysis

The real-time PCR (qPCR) leads the type segment and is expected to hold the highest revenue share by 2035. The segment is dominated by its extensive uptake in clinical diagnostics, infectious disease surveillance, and oncology research. Based on the CDC report, the qPCR is the key for analyzing pathogen detection and has screened millions of SARS-CoV-2 tests over the past four years. This points out the scalability and precision of real-time qPCR test. Further, the National Institutes of Health (NIH) report in September 2024 indicated that NIH was awarded $27million to expand genomics research where qPCR plays a central role.

Our in-depth analysis of the global polymerase chain reaction market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Product |

|

|

Application |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymerase Chain Reaction Market - Regional Analysis

North America Market Insights

The North America polymerase chain reaction market is expected to capture the largest share of 38.8% throughout the assessed tenure. The presence of a robust healthcare infrastructure, technological advancements, and provincial Federal investments are accumulatively placing this region at the forefront of the global landscape. For instance, the evidence from Statistics Canada report in September 2022 clearly highlights that 1 in 5 people in Canada are tested with PCR during the COVID-19. Furthermore, the favorable updates in reimbursement policies also fuel this field with a stable cash inflow, attracting more participants.

The U.S. is presenting predominant captivity over the regional polymerase chain reaction market with extensive Medicare & Medicaid services and AI-based healthcare integrations. In addition, the country is pledged to the continuous capital influx from both governing and institutional entities, which fosters a diverse and greater profit margin, besides the enlarging patient pool. As per Our World in Data in June 2022, the total number of COVID-19 PCR tests performed in December 2021 was 724.34 million. The U.S. market is also benefitted from extensive NIH-led R&D, including funding for digital PCR innovations.

Import Data of Medical Test kits/ Instruments, apparatus used in Diagnostic Testing

|

Country |

Year |

Imported to |

Product |

Trade Value 1000USD |

|

U.S. |

2021 |

Sweden |

Medical test kits |

692,977.59 |

|

U.S. |

2021 |

Singapore |

Medical test kits |

629,807.09 |

|

Canada |

2023 |

Germany |

Medical test kits |

79,183.87 |

|

Canada |

2023 |

United Kingdom |

Medical test kits |

78,751.44 |

Source: WITS

APAC Market Insights

Asia Pacific is predicted to attain the fastest pace of growth in the global polymerase chain reaction market during the forecasted timeframe. The recent progress in infrastructural development in emerging economies, such as China and India, is propelling the region's propagation in this sector. Ministry of Chemicals and Fertilizers in 2023 has stated that in India over the past 5–7 years, Serum Institute invested ₹100 crores in MyLab to boost PCR capacity. Moreover, a remarkable localized API production capacity and distribution channel network are cultivating a lucrative business atmosphere for both domestic and foreign pioneers.

China is augmenting the polymerase chain reaction market with immense government support and continuous public funding. As per the NLM article published in May 2023, in 2023, in China, nearly 900 million people were infected by COVID-19, and PCR and RAT tests were performed to analyze the status. Further, the country controls the global supply of associated reagents, making China a pivotal landscape for this sector amid offering various business opportunities. The country's strong research capabilities are setting new standards for innovation in this merchandise.

Europe Market Insights

Europe PCR market continues to be robust to 2035, bolstered by continued public health expenditure, IVDR-fueled quality standards, and EU research initiatives. The EU's EU4Health initiative provides €5.3 billion (2021–2027) for reinforcing health systems, lab capacity, and surveillance domains where PCR platforms are central facilitators. Horizon Europe's Health Cluster also subsidizes molecular diagnostics R&D with multi-billion euro calls. EMA and the IVDR regime bolster the clinical performance, post-market monitoring, and supply-chain resilience, aiding provider confidence and adoption. Countries such as France, Italy, and Spain are actively increasing the oncology pathways to integrate PCR for actionable biomarkers, in line with EU cancer and AMR strategies.

Germany’s dominance is highlighted by high laboratory density, robust oncology and programs for infectious disease, and rapid IVDR alignment. EMA guidance and IVDR conformity increases the performance baselines, favoring established suppliers with validated clinical evidence. The country is driven by the oncology companion testing expansion, persistent respiratory/virology screening, and middleware/LIS connectivity that lifts throughput and utilization. Germany’s reimbursement stability and academic-industry consortia accelerate translation of PCR innovations into routine care, keeping utilization and consumables pull-through high.

Key Polymerase Chain Reaction Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Rad Laboratories

- Agilent Technologies

- Danaher (Cepheid)

- Qiagen N.V.

- Merck KGaA (Sigma-Aldrich)

- Abbott Laboratories

- Illumina Inc.

- Roche Diagnostics

- PerkinElmer (Revvity)

- Becton Dickinson (BD)

- Promega Corporation

- Takara Bio USA (subsidiary)

- Beckman Coulter (Danaher)

- Fluidigm (Standard BioTools)

- Takara Bio Inc.

- Shimadzu Corporation

- Hitachi High-Tech Corp.

- Eiken Chemical Co. Ltd.

- Nippon Genetics Co. Ltd.

The current dynamics in the polymerase chain reaction market are controlled by the strategic operations of key players, who are increasingly investing in AI-driven automation, precision diagnostics, and sustainable solutions. For instance, Thermo Fisher Scientific and Siemens Healthineers concentrated their focus on constructing a new pipeline with high-efficiency PCR systems. Similarly, QIAGEN and Samsung Healthcare are integrating AI to enhance the accuracy and scalability of this diagnostic discipline. Moreover, the collective effort of these innovators in establishing a strong foundation of R&D in this field is reinforcing technological advancements and efficiency escalation at a global scale.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, Seegene Inc., announced the advancements in the development of CURECA, which is the next gen system under the development process. The diagnostic device is used to streamline automation in Polymerase Chain Reaction (PCR) testing and laboratory environments.

- In April 2025, Biocartis NV introduced Idylla POLE-POLD1 Mutation Assay (RUO1), which is a fully automated, real-time polymerase chain reaction (PCR) Assay used to detect hypermutated phenotype associated with mutations in POLE and POLD1.

- Report ID: 2327

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymerase Chain Reaction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.