Plastic Modifiers Market Outlook:

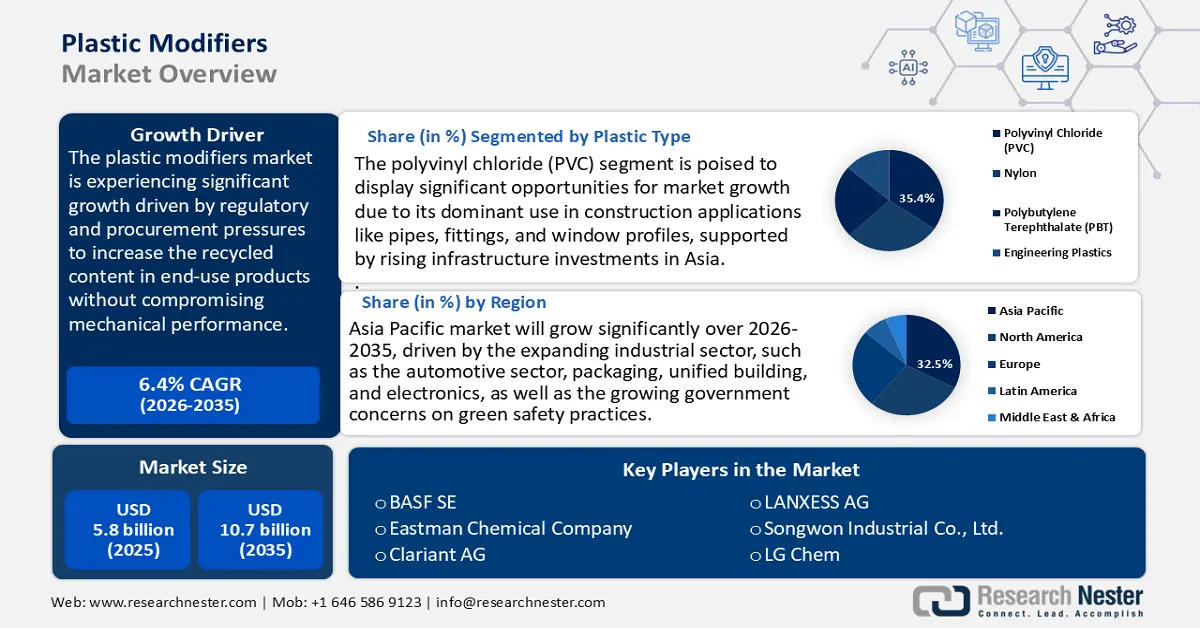

Plastic Modifiers Market size was valued at USD 5.8 billion in 2025 and is projected to reach USD 10.7 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, from 2026 to 2035. In 2026, the industry size of plastic modifiers is estimated at USD 6.2 billion.

The plastic modifiers market is anticipated to witness significant growth over the forecast period, primarily driven by regulatory and procurement pressures to increase the recycled content in end-use products without compromising mechanical performance, as well as the direct requirement for compatibilizers, impact modifiers, and processing aids. The recycling rate around the globe remains low, at approximately 9%, with a significant proportion, 50%, directed to sanitary landfills and 22% mismanaged. This creates a vast quality gap that additives can help close. The U.S. National Recycling Goal seeks to raise the overall recycling rate to 50% in 2030 and, thus, increases demand for formulations that allow higher PCR (post-consumer resin) content.

The development and scale-up of recovery and reuse processes relevant to most modifiers, such as recycling process scale-up and polymer recovery technologies, is funded by the U.S. Department of Energy (DOE) through a USD 125 million Bipartisan Infrastructure Law program focused on battery recycling, reprocessing, and collection. Recent awards in 2023-2024 support increasing consumer participation, improving recycling economics, and enhancing state and local battery collection programs. These initiatives align with scaling up recycling processes and polymer recovery technologies relevant to modifier applications. Commercially addressable opportunity is generated by these policies and funding signals, as modifier suppliers can sell technical packs (modifier + PA + testing) to converters and brand owners seeking to comply with recycled-content or recyclability goals.

Global trade of upstream feedstocks like commodity resins and downstream finished plastic goods plays a key role in driving the demand for plastic modifiers. Plastics and related articles represent a significant category in the multi-trillion-dollar global merchandise trade, as tracked in the UN trade databases commonly used by industries for procurement planning. The OECD Global Plastics Outlook report outlines how production and waste plastics are growing, resulting in ever-deteriorating environmental effects despite policies and efforts by the industry. It points out the necessity of increasing national policies and improving international collaborations to increase plastic lifecycles towards a circularity approach. The report identifies four key strategies to address these challenges: boosting recycled plastics markets, fostering innovation, strengthening domestic policies, and promoting global collaboration. The plastics material and resin manufacturing producer price index has proven to be an excellent industry proxy; it has been faring much better, staying in the low-mid 300 territory between 2024 and the first half of 2025, showing at least some stability after several previous feedstock price fluctuations.

Some of the figures experienced on the index include 316.39 in July 2025, which indicates a relatively stable pricing trend in this sector. Public RDD investments are significant and imminent, as seen in REMADE-institute selections and Congressional budget justifications, where the Institute reported up to USD 10 million in financing to develop and provide unillustrated projects to create and show equipment and tech that could aid recovery, reuse, and recycle, with the mission of industrial-scale material processing to be progressively superior from an energy standpoint. In trade planning and sourcing, national customs and UN Comtrade data can be used to estimate resin import exposure by HS code and partner country when sizing regional goods inventories and assembly-line location.

Key Plastic Modifiers Market Insights Summary:

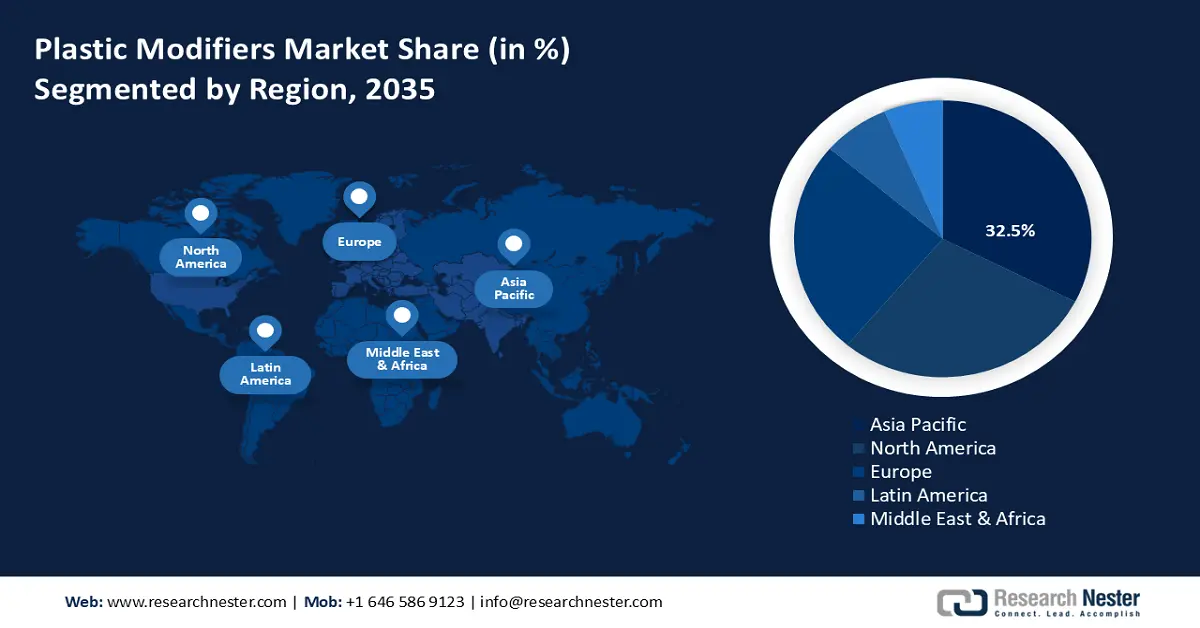

Regional Highlights:

- Asia Pacific plastic modifiers market is projected to dominate with a 32.5% share by 2035, supported by rapid industrial expansion, green chemistry initiatives, and government-backed sustainability programs across emerging economies.

- North America is expected to secure a 28.6% revenue share between 2026 and 2035, propelled by increasing adoption of eco-friendly plastic additives and advanced manufacturing technologies in automotive and construction sectors.

Segment Insights:

- The polyvinyl chloride (PVC) segment is expected to account for 35.4% share of the plastic modifiers market by 2035, fueled by increasing demand in construction applications and regulatory compliance enhancing material durability and performance.

- The automotive parts segment is projected to witness robust growth through 2035, supported by accelerating vehicle light-weighting initiatives and rising adoption of high-performance modifiers that enhance impact resistance and fuel efficiency.

Key Growth Trends:

- New chemical recycling & catalytic technologies

- Volatility of feedstock and energy prices

Major Challenges:

- Delays in China’s new safety measures

- Poor infrastructure in emerging economies

Key Players: BASF SE, Eastman Chemical Company, Clariant AG, LANXESS AG, Songwon Industrial Co., Ltd., LG Chem, Dow Chemical Company, SI Group, Inc., Jindal Poly Films Limited, BASF Australia Pty Ltd, Clariant India Pvt Ltd

Global Plastic Modifiers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.8 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 10.7 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, United Kingdom, Mexico, Indonesia

Last updated on : 3 September, 2025

Plastic Modifiers Market - Growth Drivers and Challenges

Growth Drivers

-

New chemical recycling & catalytic technologies: The advancing technology with chemical recycling is changing the market of plastic modifiers by enhancing the quality of recycled, technology dependency on virgin resins, as well as the increased use of compatibilizers and processing aids. Advanced catalytic depolymerization systems offer promising pathways for chemical recycling of polyethylene and polypropylene by converting these plastics into high-quality monomers suitable for reuse. Recent developments have focused on improving catalyst efficiency, selectivity, and process sustainability at pilot scales. These innovations support enhanced circularity by enabling higher recovery yields of valuable monomers from polyolefin waste streams.

While this superior output minimizes losses in recyclates, downstream converters still require impact modifiers and compatibilizers to effectively blend them with virgin plastic. This technical hurdle contributes to a critical problem: as the OECD Global Plastics Outlook reports, only 9% of global plastic waste is currently recycled. Therefore, developing advanced recycling technologies is not just beneficial but an essential solution that must be urgently found to close the loop. As catalytic innovations increase the scale, the demand side will shift toward modifiers required to work with recyclate-high content blends, allowing the market to maintain its growth rates until 2035.

- Volatility of feedstock and energy prices: Demand for plastic modifiers is linked directly to fluctuations in resin prices that are volatile due to fluctuations in crude oil and natural gas. Feedstock costs can comprise 50-70% of polymer production costs, and sudden fluctuations force compounders to make changes to formulations, in an attempt to balance cost-performance by adjusting modifier loadings. As per the U.S. Energy Information Administration (EIA), the petrochemical feedstock prices are still susceptible to energy shocks, and world energy markets are likely to experience substantial demand growth annually up to 2030.

- Trade, localization, and supply-chain resilience: Global trade imbalances in plastics and petrochemical feedstocks have a direct impact on the plastic modifiers market. The U.S. plastics industry had a USD 4.4 billion resin trade surplus with China in 2023, but a significant USD 14.3 billion trade deficit in plastic products that same year. This trade imbalance is influenced by complex supply chain dynamics, with the U.S. exporting resin and importing finished plastic-containing products. Recent tariff measures and ongoing trade negotiations continue

The result of such concentration in imports is that downstream producers remain susceptible to geopolitical risk, energy shocks, and logistical bottlenecks. Regions are also increasing local compounding and assembly capacity, as in the U.S. plastics industry supported over 1 million jobs and generated USD 519.1 billion in shipments in 2023, according to the Plastics Industry Association’s annual report. Including suppliers, employment rises to 1.55 million with shipments reaching USD 658.2 billion. Plastics manufacturing employment grew 1.1% annually over the past decade, outpacing overall manufacturing growth. Localization necessitates the need to modify chemicals because additives have to be qualified against region-specific types of resins and compliances (e.g., EPA TSCA) at converters.

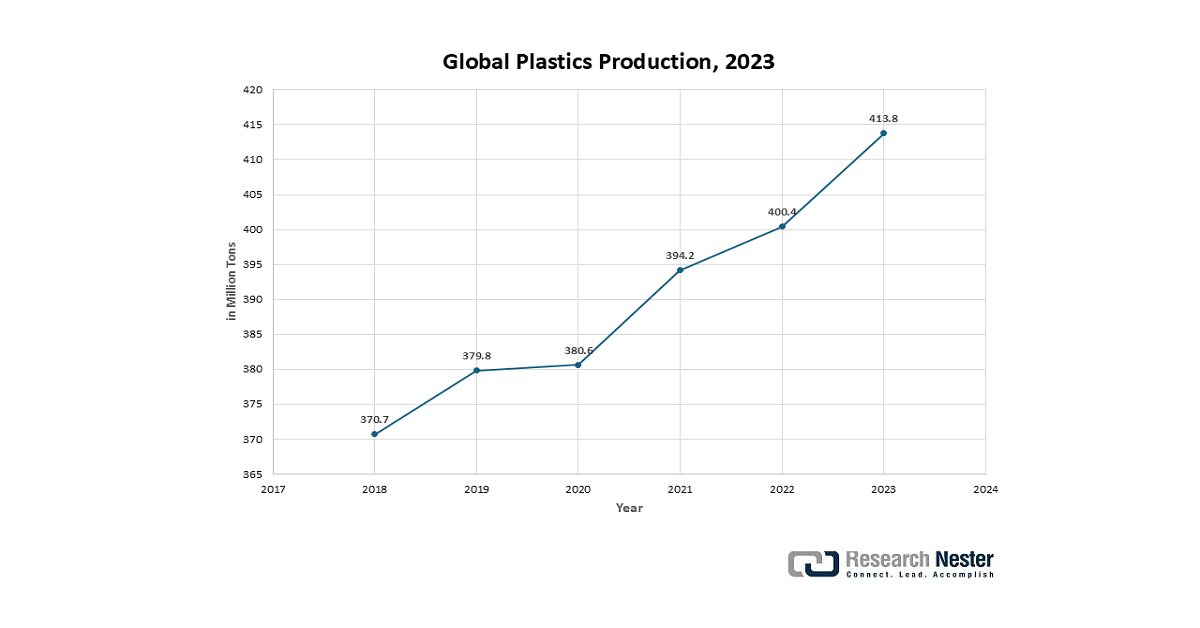

1. Global Plastic Production

The global production of plastics creates the foundational demand for modifiers, which are essential additives that enhance the properties of base polymers. As production volumes rise and diversify into new applications, the need for modifiers to improve material performance, such as impact resistance, flexibility, or durability, grows accordingly. Moreover, increasingly stringent regulatory and sustainability requirements drive innovation and adoption of specialized modifiers, such as flame retardants or biodegradable additives. Thus, expansion and innovation in plastic production directly stimulate the growth and diversification of the modifiers market.

Source: Plastics Europe AISBL

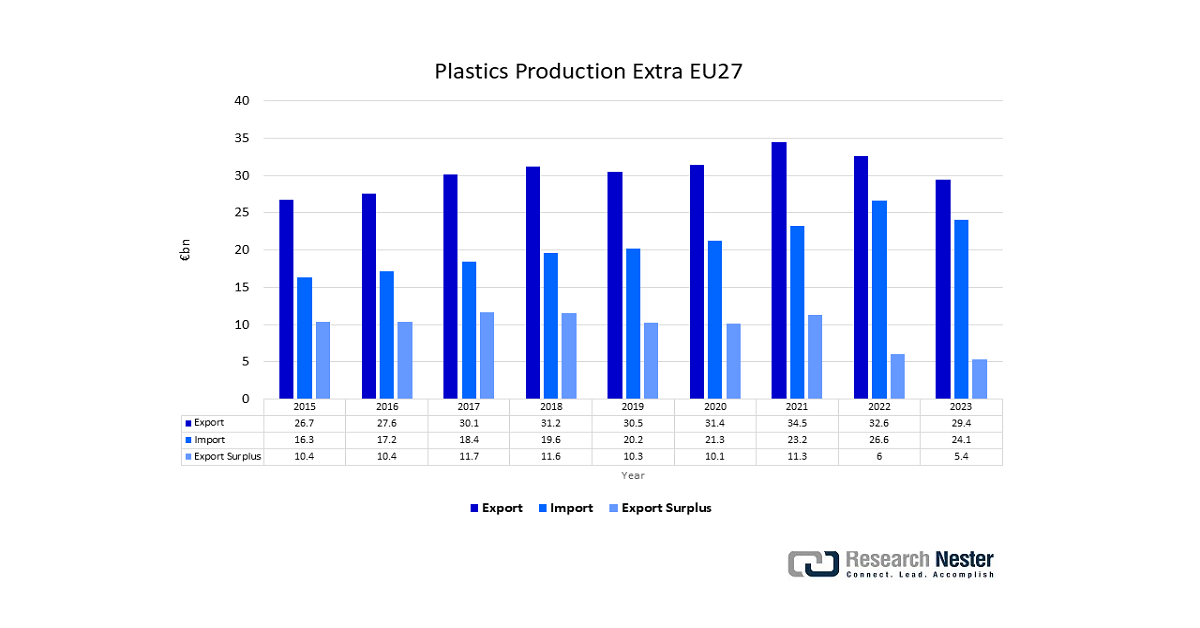

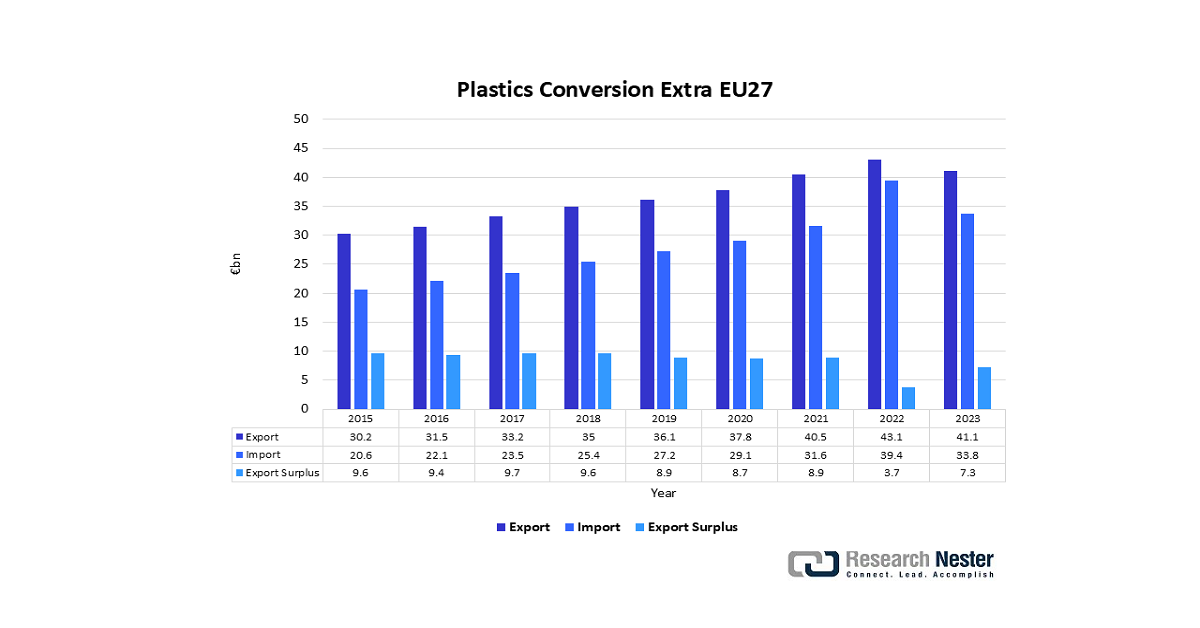

2. Plastic Trade Dynamics (Import/Export)

The global trade of plastics intensifies competition, forcing manufacturers to differentiate their products through enhanced performance, durability, and functionality, all achieved by incorporating specialized plastic modifiers. International standards and regulations, which vary by region, create demand for modifiers that ensure compliance in areas like flame retardancy or recyclability. In particular, Europe’s stringent regulatory environment and cross-border circular economy initiatives drive demand for high-performance, sustainable modifiers. Furthermore, the exchange of technical expertise and materials across borders accelerates the adoption of advanced modifier technologies. Consequently, the dynamics of plastic trade directly stimulate innovation and growth within the modifiers market.

European Plastic Trade, 2023

Source: Plastics Europe AISBL

Source: Plastics Europe AISBL

Challenges

-

Delays in China’s new safety measures: China has strengthened the environmental management of new chemicals by investigating and controlling foreign and domestic chemical products through the Measures of the Environmental Management of New Chemical Substances, which went fully effective in 2021. These regulations imply a lot of risk assessment and listing before marketing new products. On the operational front, the phased bans on single-use plastics and restrictions on non-degradable materials, set to culminate by 2025, have created compliance challenges that extend lead times and disrupt supply chains. These regulatory shifts, combined with stricter import inspections and evolving energy efficiency labelling requirements, are contributing to longer approval and market entry times for plastic materials and related products. To suppliers of plastic modifying products, these regulatory backlogs require a longer time to receive revenues, product launch cycles get disrupted, and they must invest more in compliance required to manage the bottlenecks. The immense significance of these regulations at a global scale is compounded by the fact that China is the biggest manufacturer of chemicals globally.

-

Poor infrastructure in emerging economies: Emerging economies in many regions do not have the infrastructure to handle chemicals, test, and recycle end-of-life chemicals, thereby acting as a restraint to the use of advanced Plastic Modifiers. Approximately 22% of the world's plastic waste is not handled properly due to poor collection and processing facilities, leading to leakage into the environment, open dumping, or burning. Despite global growth in plastic production and waste, only 9% of plastic waste is successfully recycled, highlighting significant gaps in waste management infrastructure. Greater international cooperation and investment in waste management are needed to reduce plastic pollution effectively. The World Bank’s "Trends in Solid Waste Management" report states that the world generates about 2.01 billion tons of municipal solid waste annually, with at least 33% of that waste not managed in an environmentally safe manner.

Waste collection coverage varies widely by income level, with nearly universal collection in high- and upper-middle-income countries, while low-income countries collect only about 48% of urban waste and 26% in rural areas. Regulatory compliance is complicated by a lack of substantial recycling or safety infrastructures, which governments are having a challenging time enforcing compliance on resulting in fragmented regulatory environments that make it risky to introduce or establish consistency on the adoption of plastic modifier products across emerging markets.

Plastic Modifiers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 5.8 billion |

|

Forecast Year Market Size (2035) |

USD 10.7 billion |

|

Regional Scope |

|

Plastic Modifiers Market Segmentation:

Plastic Type Segment Analysis

Polyvinyl chloride (PVC) is expected to generate the highest revenue of 35.4% by 2035 in the plastic modifiers market due to its extensive applications in pipe fittings and profiled construction. Global PVC consumption exceeds 40 million tonnes annually and is growing at about 3% per year, with the construction sector being the largest consumer due to PVC’s use in pipes, window frames, and building materials. Regulatory compliance that PVC satisfies, such as durability and fire-related provisions under EPA 2023 construction materials standards, further boosts demand for PVC-compatible modifiers to improve impact, thermal, and UV performance. Infrastructure investments in the regions, especially China and India, are projected to grow PVC consumption by a substantial CAGR up to 2035, thus ensuring continuous demand for specialised plastic modifiers.

Rigid PVC (uPVC) and flexible PVC (fPVC) modifiers are the leading factors that are driving the growth of this segment of the plastic modifiers market. uPVC modifiers are experiencing a high growth owing to their wide use, particularly in the construction business, like as windows, doors, and piping. Rigid PVC pipes are widely used for plumbing, drainage, and sewage systems, valued for their corrosion resistance, smooth flow, and long service life. Additionally, it serves as an effective substitute for traditional materials in window seals and frames, contributing to energy efficiency and strength in buildings. Its recyclability and relatively low environmental impact further underline its importance in sustainable construction. Flexible PVC modifiers have the highest growth prospect with a demand growth of 5-6% CAGR till 2035, as there is an abundance of electrification and management of water across the Asia-Pacific. The combination of these sub-segment activities is creating a demand to use specialty impact and UV, and thermal stabilizers, which is generating more revenue for suppliers of these modifiers and facilitating industry compliance with EPA and EU building guidelines.

Application Segment Analysis

The automotive parts segment in the plastic modifiers market is projected to grow at a substantial rate by 2035, underpinned by light-weighting and electrification trends. Distributing the vehicle's weight can result in faster and safer handling. In addition, a 10% weight reduction will improve fuel economy by 6-8%, according to the U.S. Department of Energy, because lighter vehicles use less energy when it comes to acceleration. Development of lightweight advanced materials, including high-strength steels, aluminium, magnesium alloys, carbon fiber, and polymer composite materials, enables a weight reduction in vehicle body and chassis of up to 50%, resulting in a significant decrease in fuel consumption. Modifiers improve impact strength in dashboards, bumpers, and under-the-hood parts, as well as improve heating and weather-resistant capabilities. The global automotive use of plastic is projected to surpass USD 42 billion in 2030, an opportunity that faces high growth potential for acrylic impact modifiers (AIM) and other custom additive chemistries.

Interior trim modifiers add lasting, stretchy, impact-resistant properties to dashboards, door panels, and seats. The U.S. Department of Energy (DOE) notes that automotive auto interiors can be lightweighted using advanced polymers and thereby achieve a 6-8% fuel economy improvement per 10% weight reduction. exterior trim & body panel modifiers enhance the weatherability, UV resistance, and impact of bumpers, fenders, and other exterior parts. According to the European Environment Agency (EEA), the growing demand for high-performance modifiers is a direct result of stricter EU regulations on CO₂ and emissions, which require enhanced performance and lighter weighting from polymer-based components in applications like automotive and packaging. These sub-segments will all continue to grow strongly, facilitating acrylic impact modifiers (AIM) uptake and revenue in automotive manufacturing globally in the long term, through 2035.

Type Segment Analysis

The acrylic impact modifiers segment is likely to grow at a plastic modifiers market share of 30% over the forecast years, owing to its versatility to boost the toughness and impact strength of engineering plastics and PVC blends. According to OECD Global Plastics Outlook, less than 9% of the plastic waste used is actively recycled, which requires the use of higher recycled-content polymers with AIM. AIM can also be used in automotive, construction, and film applications, and has been shown to not only increase throughput but also ensure mechanical integrity. The adoption of AIM in the emerging markets, especially in Asia-Pacific, is projected to increase at a 6-7% annual rate through 2026-2035, as a result of growing infrastructure expenditure and the automotive manufacturing, which will guarantee continued revenue to the makers of modifiers.

Our in-depth analysis of the plastic modifiers market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Plastic Type

|

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Modifiers Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to hold the dominant position in the plastic modifiers market with the largest revenue share of 32.5% during the projected years by 2035, owing to the expanding industrial sector, which comprises the automotive sector, packaging, unified building, and electronics, and the growing government concerns on green safety practices and green chemistry developments within the area. For instance, the Green Chemistry project in Vietnam aims at establishing an enabling environment through the acquisition of regulations and incentives that will result in the reduction of the use and release of hazardous chemicals, promoting green growth and sustainability in the industrial sector. It enhances awareness, capacity building, and the introduction of green chemistry practices within the key manufacturing sectors in order to make them environmentally safer and more resource-efficient.

This project is a part of the larger green chemical and clean industrial development in the region. With the upsurge in e-commerce and urbanization, there is an increasing demand for flexible and durable packaging, which gets its performance boosters via plastic modifiers. In addition, the need to develop the bioplastics industry through government incentives that aid in the creation of a circular and sustainable economy, and the utilization of bio-based and biodegradable plastic, is essential. The bioplastics market of India, with an already booming value of USD 447.25 million in 2023, is set to increase at a CAGR rate of 22.1% and be worth USD 1.81 billion by 2030 and USD 3.29 billion by 2033. Funding, regulation, and infrastructural projects are aimed at addressing some of the issues of the market as a means to limit plastic pollution and carbon emissions and encourage innovation in the chemical sector. The region has a bright growth prospect due to technological advances in the field, increasing manufacturing capacities, and favourable regulatory environments, which together perform this role of driving the region's plastic modifiers market forward.

The China plastic modifiers market is predicted to dominate the region in terms of a large market share over the projected period due to its high degree of governmental attention on the sustainable production of chemicals. The Ministry of Ecology and Environment indicated a considerable rise in funding expenditure on green chemical technologies in 2018-2023 to minimize environmental impact and to improve chemical safety. The green finance market of China has significantly expanded in 2023, where green loans reached a value of RMB 30.08 trillion (USD 4.256 billion), which increased 36.5% by the annual rates, and the ratio of the total value of all loans reached 12.7%. The issue of green bonds decreased in volume by 4.4% but retained its legs as an important tool, and by the middle of 2023, outstanding investment in the green industry stood at RMB 1.67 trillion (USD 236.3 billion). China has established an effective national carbon market through the 212 million tons of carbon traded with an annual value associated with USD 2.04 billion.

The National Development and Reform Commission (NDRC) has established policies that aid cleaner production so as to increase the demand for advanced plastic additives that enhance recyclability and durability. More than 1.2 million new businesses have embraced sustainable methods of chemistry by 2023, and this is an indication that industries are changing fast. Since the urbanization and growth of the automotive and electronic industries, high-performance plastic modifiers are in demand, and China contributes the most to the market in Asia.

The India plastic modifiers market is expected to grow with the fastest CAGR from 2026 to 2035, with firm government support. The Ministry of Chemicals and Fertilizers in India is supporting the chemical sector’s growth with an estimated investment of INR 8 lakh crore (approximately USD 107.38 billion) by 2025. India’s chemical market is projected to reach USD 304 billion by 2025, growing at a CAGR of 9.3%. The sector employs about 2 million people and contributes nearly 9.88% to the manufacturing sector’s GVA. In addition, the Ministry of Environment, Forests, and Climate Change has been assigned Rs 3,413 crore in 2025-26, an increment of 9% over the revised estimates of the previous year. Out of the above amount, Rs 854 crore (25%) goes to pollution control, Rs 720 crore (21%) to environment, forestry, and wildlife, and Rs 232 crore (7%) to statutory and regulatory bodies. A budget allocation of Rs 946 crore (28%) has been made to establishment expenditure and Rs 103 crore (3%) to environmental knowledge and capacity building. Government initiatives like the Scheme of Setting up Plastic Parks facilitate innovative, advanced manufacturing infrastructure/technology and additives in plastics. The rising auto, packaging, and building industries, combined with the growing regulatory focus on sustainability, are the market drivers towards high-performance bio-compatible plastic modifiers.

North America Market Insights

The North American plastic modifiers market is expected to grow at a substantial revenue share of 28.6% during the forecast period of 2026 to 2035. The growth can be attributed to the growing demand within the automotive, construction, and electronics industries, where light weighting and improved durability are important considerations. Most modern manufacturing, such as injection molding and 3D printing, can further increase efficiency and allow special plastic additives to be used. Eco-friendly trends are also prominent, as in 2021, the U.S. Environmental Protection Agency (EPA) announced winners of the Green Chemistry Challenge Awards, recognizing innovative green chemistry technologies that address significant environmental challenges. Federal activities also foster the investment in the studies of environmentally friendly plastics, which would ensure further growth in the market.

The U.S. plastic modifiers market is projected to dominate the region and grow significantly during the projected years, attributed to increased demand across different industries such as automotive, construction, and packaging, among others. A vast increase in the popularity of the automotive industry to replace heavy metals with lightweight materials as a way to promote fuel efficiency and curb emissions is also a key contributor to the growing demand for plastic modifiers. For example, the U.S. automotive industry is increasingly using lightweight materials such as high-strength steel, aluminum alloys, magnesium, carbon fiber, and polymer composites to improve fuel efficiency and reduce emissions. A 10% reduction in vehicle weight can lead to a 6%-8% improvement in fuel economy.

These materials can reduce the body and chassis weight by up to 50%, potentially saving over 5 billion gallons of fuel annually by 2030 if used in a quarter of the U.S. vehicle fleet. The manufacturing of plastic parts is also getting better due to improved manufacturing technologies like 3D printing and injection molding, and specialized additives are becoming even more necessary. The market is also catching up with the trend of sustainability, as there is a rising trend of preference for biodegradable and environmentally friendly plastic modifiers. The growth of the plastic modifiers market in the U.S is likely to be on the rise due to government initiatives and regulations that would fuel the consumption of sustainable materials.

By 2035, the plastic modifiers market in Canada is likely to grow at a steady pace with a substantial CAGR of 5.8 % between 2026 and 2030, due to the rise in market conditions is due to the rising demand in different industries such as the automotive, construction, and packaging industries. The surge in the need to come up with lightweight automotive materials that will enhance fuel efficiency and minimize carbon emissions in the automotive industry is one of the key reasons why an appetite to consume more plastic modifiers has emerged in the past few years. Furthermore, advanced manufacturing technologies like additive manufacturing and 3D printing are revolutionizing plastic injection molding in Canada by enabling the creation of optimized, high-performance tooling inserts. These inserts improve mold cooling, durability, and surface finish, leading to higher-quality plastic parts and reduced production times.

Companies like voestalpine leverage specialized powders and precision printing techniques to enhance tool life and performance in plastic injection molding applications. Additionally, sustainability is also shaping the market as the current preference is the biodegradable and environmentally friendly plastic additives. Development of governmental initiatives and regulations to increase the usage of sustainable materials will aid the further rise of your plastic modifiers market in Canada.

Europe Market Insights

The European plastic modifiers market is anticipated to grow at a substantial rate of 25.2% over the forecast years, attributed to stronger environmental compliance and robust demand across industries, including the packaging, automotive, and construction sectors. The UK and Germany are major market players, and they are the major contributors to the revenue of the region. Regulatory focus on lightweighting and the use of recyclable materials has caused an upsurge in the usage of advanced plastic modifiers in the UK automotive industry as well, which has contributed to the growth of the sector. The growing emphasis on fuel efficiency and sustainability in the UK automotive industry has increased the use of lightweight plastics, which now account for around 12-15% of a vehicle’s mass. Plastics like PVC, polypropylene, and polyurethane are widely used for various components due to their lightweight, durability, and recyclability. Plastic injection molding allows the production of complex, high-quality parts with tight tolerances and supports sustainable manufacturing by enabling the recycling of excess materials during production.

Germany plastic modifiers market is also home to one of the largest chemical industries in continental Europe, with initiatives by the Federal Ministry for Economic Affairs and Climate Action (BMWK) so far spending billions on modernising and decarbonising manufacturing. The following government policies contribute to the achievement of eco-friendly plastic modifiers and, hence, make Germany a force in this market. The European Chemicals Agency (ECHA) is prominent in terms of regulation on the compliance of the REACH and CLP regulations to promote greener and safer chemical additives, such as the plastic modifier. Meanwhile, the European Green Deal is financing more projects on sustainable chemical innovation with EUR 1.8 billion offered in 2023 at Horizon Europe, which boosts the expansion of the market and technological improvement. The confluence of regulatory and governmental initiatives and pressure is further increasing the need for high-performance and environmentally compliant plastic modifiers in Europe.

Key Plastic Modifiers Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman Chemical Company

- Clariant AG

- LANXESS AG

- Songwon Industrial Co., Ltd.

- LG Chem

- Dow Chemical Company

- SI Group, Inc.

- Jindal Poly Films Limited

- BASF Australia Pty Ltd

- Clariant India Pvt Ltd

The plastic modifiers market is highly competitive in nature with the presence of established multi-national chemical companies capitalizing on strong research and development abilities, pervasive global manufacturing facilities, and strategic alliances. Leading producers such as BASF SE and Eastman are paying attention to the manufacture of sustainable and green plastic modifiers to meet the stringent environmental regulations. Japanese companies like Adeka and Mitsubishi Chemical Corporation focus on innovation through advanced chemical formulation by specializing in high-performance materials in the areas of automobiles and electronics. There is an increase in the capacity of the South Korean and Indian players, and an enhancement of technological skills to meet the emerging demand in the domestic and regional markets. In general, market leaders focus on sustainable, digital transformation, and capacity growth programs to sustain their competitive edge to address the changing plastic modifiers market demand.

Top Global Plastic Modifiers Manufacturers in the Plastic Modifiers Market

Recent Developments

- In April 2025, Arkema introduced a new range of bio-based acrylic thickeners with up to 30% bio-content and thus introducing an important addition to sustainable chemical additives. These rheology modifiers aid in cost-effective carbon footprint reduction of products by 25 per cent, which makes this modifier quite user-friendly in eco-friendly coating, adhesives, and sealants. The launch is part of Arkema's commitment to the principles of a circular economy through the support of renewable raw materials and increasing the sustainability of products. This launch addresses the shift towards eco-friendly solutions without sacrificing performance and places Arkema in a good position to lead the way in sustainable plastic modifier technologies.

- In November 2024, Clariant introduced Exolit AP 422A, a new generation, melamine-free flame retardant that can be used to pass rigorous fire safety and sustainability regulations. The new solution presents an improved fire performance in a variety of applications, such as intumescent coatings, firestop sealing, and PIR (polyisocyanurate) insulation panels, as well as it removes the presence of melamine that is now considered a Substance of Very High Concern (SVHC). This non-halogenated composition of the product limits the risky nature of emissions, which is consistent with the changing regulatory regimes, including REACH. Manufacturers are able to continue using high fire protection performance with Olit A 422 A to increase chemical compliance and contribute to sustainability efforts.

- Report ID: 8046

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plastic Modifiers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.