Pediatric Perfusion Products Market Outlook:

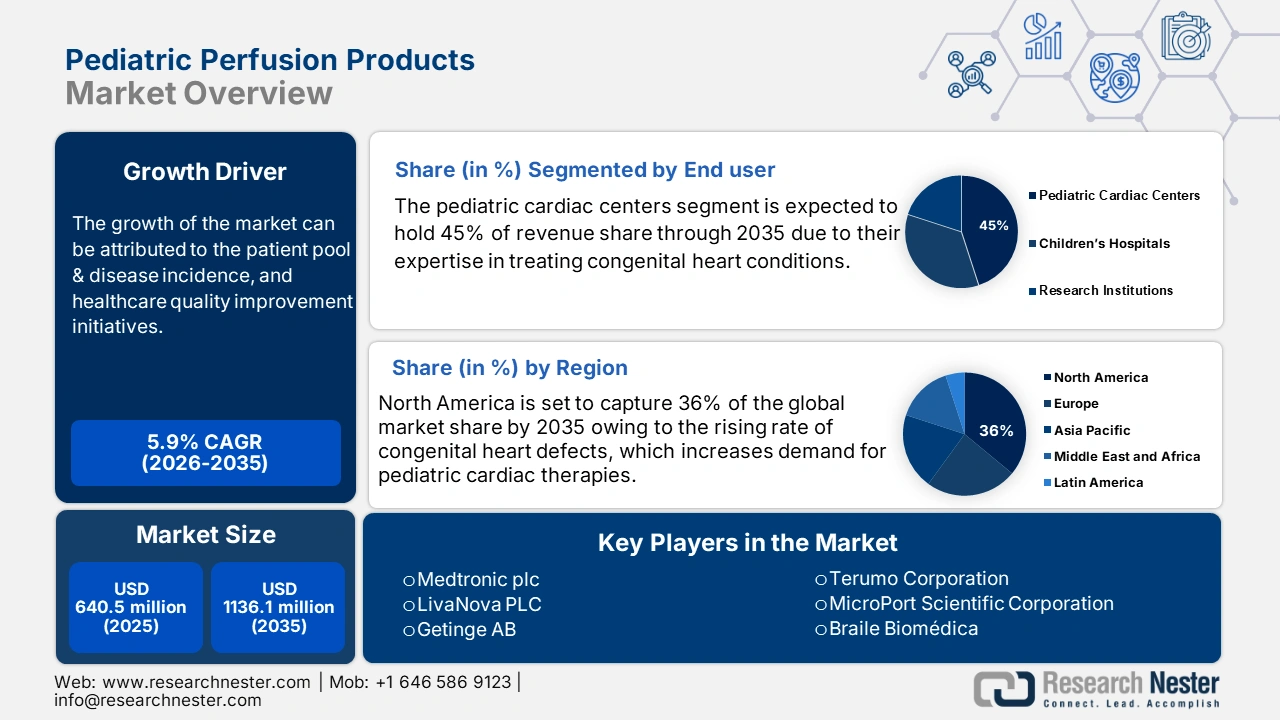

Pediatric Perfusion Products Market size was valued at USD 640.5 million in 2025 and is projected to reach USD 1136.1 million by the end of 2035, rising at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pediatric perfusion products is assessed at USD 678.2 million.

The pediatric perfusion products market is underpinned by a significant and stable patient pool, primarily consisting of infants born with congenital heart defects. The CDC data for October 2024 states that every 15 minutes, a child is born with a heart defect in the U.S. Hence, there will always be a need and demand for perfusion products. Trends in R&D funding indicate greater motivation from the federal government to support pediatric indications. The Pediatric Medical Device Safety and Improvement Act now allows for financial profit and priority pediatric PMA and HDE approval. Furthermore, the FDA has waived the fees and proposed a post-market registry as a way to incentivize pediatric-based information.

Investment in research, development, and deployment (RDD) is critical for advancing product safety and efficacy. Public funding agencies like the National Institutes of Health (NIH) allocate substantial grants to pediatric medical device development. On the trade side, the assembly of pediatric perfusion systems often involves a multi-national process. The raw materials or the components are sourced from various countries. This is impacted in trade data, where U.S. exports of medical equipment in 2024 were USD 27,058 million, indicating a strong international market for advanced medical technology, as per the Censes report in July 2025. On the other hand, the costs of the materials, R&D investment, and regulatory compliance have an impact on the pricing of these life-sustaining products.

Key Pediatric Perfusion Products Market Insights Summary:

Regional Insights:

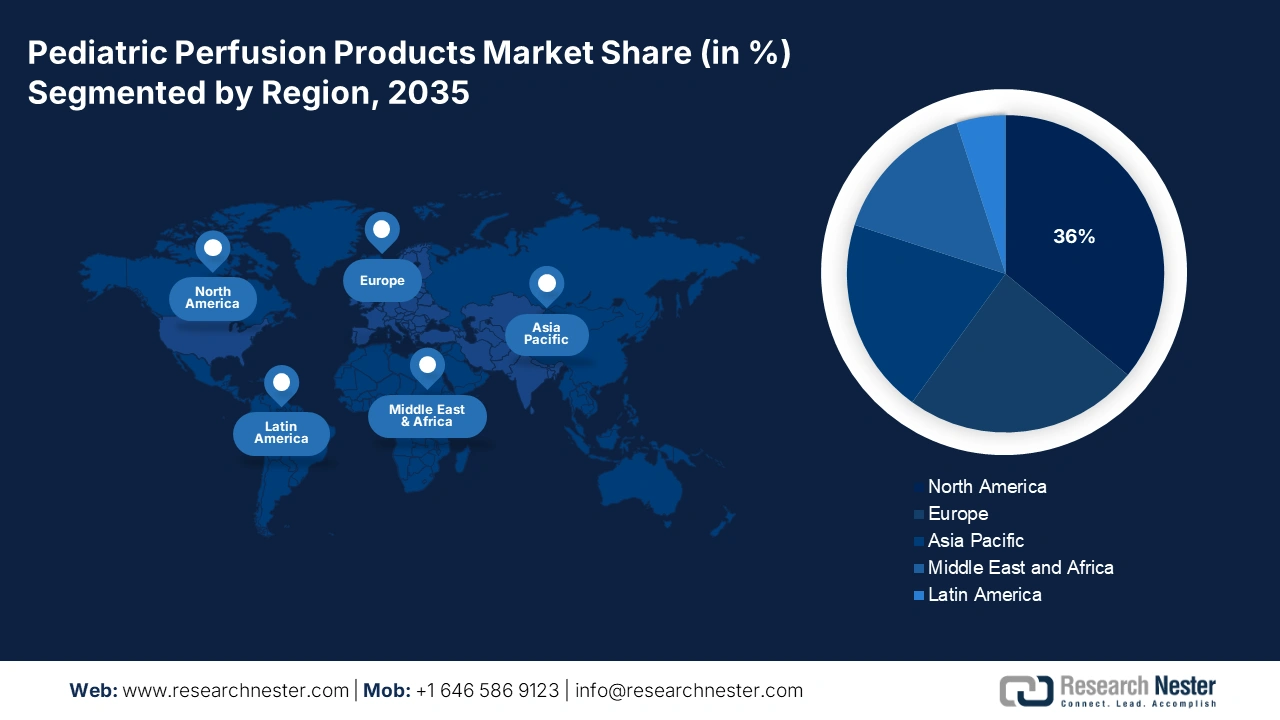

- By 2035, North America is expected to command a 36% share of the Pediatric Perfusion Products Market, upheld by the rising prevalence of congenital heart defects.

- Over 2026–2035, the Asia Pacific region is set to expand at the fastest pace, supported by increasing incidences of pediatric cardiovascular disease and strengthened healthcare infrastructure.

Segment Insights:

- By 2035, the pediatric cardiac centers segment in the Pediatric Perfusion Products Market is projected to secure a 45.0% share, propelled by their expertise in treating congenital heart conditions.

- Over 2026–2035, the pediatric perfusion pumps segment is anticipated to command a 33% share, bolstered by rising rates of congenital heart disease and advancements in pump technology which enhance patient safety.

Key Growth Trends:

- Patient pool & disease incidence

- Healthcare quality improvement initiatives

Major Challenges:

- Pricing restraints imposed by governments and payers

- Market access barriers due to fragmented healthcare systems

Key Players: Medtronic plc,LivaNova PLC,Getinge AB,Terumo Corporation,MicroPort Scientific Corporation,Braile Biomédica,Chalice Medical Ltd.,Xenios AG,Eurosets S.r.l.,Nipro Corporation,MAQUET Holding B.V. & Co. KG.,Senko Medical Trading Co.,Tianjin Medical,Boston Children's Hospital,Vitalcor, Inc.,Andocor,Gish Biomedical, Inc.,JOTEC GmbH,Sorin Group,WeiGo Medical.

Global Pediatric Perfusion Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size:USD 640.5 million

- 2026 Market Size: USD 678.2 million

- Projected Market Size: USD 1136.1 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 6 October, 2025

Pediatric Perfusion Products Market - Growth Drivers and Challenges

Growth Drivers

- Patient pool & disease incidence: Congenital heart defects (CHDs) impact roughly one percent of live births in the U.S. Of these patients, roughly 42 of every 10,000 children in the U.S. are born with ventricular septal defect, requiring pediatric perfusion products, as per the CDC report in October 2024. This explains the predictable rate of demand for pediatric perfusion equipment. While the care furnished to this patient population isn't reimbursed individually under Medicare. CDR indicators and MPFS data show increase in government reimbursement for perfusion-related cardiac procedures in the U.S. over the last few years. Hospital administrators are challenged by the need to divert capital resources toward new and expanded perfusion services.

- Healthcare quality improvement initiatives: The Agency for Healthcare Research and Quality (AHRQ) is a supporting organization of paediatric quality improvement initiatives through the Pediatric Toolkit. The clinical registry has promoted accuracy in data and care impacts that have increased the requests and implementation of consistent perfusion enabling technology. Improved efficiency creates increased capacity, invigorates more procedures executed, and more the regular demand for devices. The AHRQ and FDA guidelines and registries, such as post-market data collection of pediatric heart surgery devices, encourage manufacturers to invest in R&D.

- Company strategies and innovation: Major players in the pediatric perfusion products market are focusing on strategic alliances and product advancements to address the specific requirements of infant and neonatal care. Strategic partnerships with cardiac centers are facilitating access to cutting-edge technologies, while new product releases prioritize miniaturization, enhanced biocompatibility, and compatibility with real-time monitoring systems. The emphasis is on customizing pediatric physiology devices and improving clinical outcomes through innovation.

Number of Perfusionists Present for a Pediatric/Neonatal Case by Region in 2021

|

Region |

One Perfusionist |

Two Perfusionists |

One Perfusionist + Backup |

Other |

|

NA (North America) |

8% |

35% |

55% |

2% |

|

CSA (Central/South America) |

0% |

100% |

0% |

0% |

|

Asia |

11% |

43% |

38% |

8% |

|

OA (Oceania) |

0% |

40% |

60% |

0% |

|

Europe |

23% |

16% |

60% |

0% |

|

Africa |

0% |

50% |

50% |

0% |

Source: NLM December 2022

Challenges

- Pricing restraints imposed by governments and payers: Numerous governments impose price caps and/or reimbursement limits on pediatric perfusion products to help control healthcare costs. For instance, the price caps imposed by EU members' national health agencies limit the profit producers can garner. Many of the pediatric-specific medical devices and drugs are hindered by long and complicated regulatory pathways. This delays access to the broader market.

- Market access barriers due to fragmented healthcare systems: Healthcare payer systems and varied reimbursement policies across countries create fragmentation in the market. Payers and regulators require strong clinical trials in the pediatric population, which involves a lot of time and resources. Many suppliers can't show that the product is safe and effective in the pediatric patient population. This leads to either rejection or limited approval.

Pediatric Perfusion Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 640.5 million |

|

Forecast Year Market Size (2035) |

USD 1136.1 million |

|

Regional Scope |

|

Pediatric Perfusion Products Market Segmentation:

End user Segment Analysis

Pediatric cardiac centers are dominating the end user segment and is expected to hold the revenue share of 45.0% by 2035. The segment is driven by their expertise in treating congenital heart conditions. Such facilities need sophisticated perfusion systems designed to pediatric physiology. The Health Children data in July 2023 states that more than 1,800 pediatric organ transplants occur every year, most of which involve perfusion support. Increasing volumes in surgery and growth of specialized care centers are fueling demand for high-performance perfusion products, making this segment a prime revenue driver in 2035.

Product Type Segment Analysis

Based on the product type, the pediatric perfusion pumps segment is predicted to capture the largest share at 33% in the pediatric perfusion products market over the assessed period. The growth of the pediatric perfusion pump segment is expected to continue increasing due to the rising rates of congenital heart disease and advancements in pump technology, which enhance patient safety. Pediatric perfusion pumps are essential during cardiac surgeries, enabling surgeons to precisely control blood flow for extremely fragile pediatric patients. In addition to that, the market will be supported by hospitals that are upgrading their existing pumps to improved pediatric-specific pumps that do not have the traditional risk of complications associated with extracorporeal circulation.

Technology Segment Analysis

In terms of technology, the disposable pediatric perfusion sets segment is anticipated to hold the highest revenue proportion in the pediatric perfusion products market throughout the discussed timeline. As per the NLM study in December 2022, the disposable component usage is 86% in centers. The move toward disposable perfusion sets is driven by imperatives for infection control and regulatory guidelines for single-use devices in order to help reduce hospital-acquired infections. The World Health Organization (WHO) is focusing on the use of disposables to reduce the risk of contaminating sensitive pediatric populations. Disposables also provide operational efficiencies and lower sterilization costs. This is prompting higher adoption rates around the globe.

Our in-depth analysis of the pediatric perfusion products market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pediatric Perfusion Products Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global pediatric perfusion products market with a share of 36% by the end of 2035. The region is fueled by the rising prevalence of congenital heart defects that affect the birth rate annually in the U.S. Critical trends that improve outcomes for newborn and pediatric patients are technological developments in ECMO systems and smaller oxygenators. Active national bodies such as the American Medical Association (AMA) and the Pharmaceutical Research and Manufacturers of America (PhRMA) are committed to advocating for innovation in pediatric perfusion. Overall, federal government funding, technological innovation, and continued expansion of healthcare infrastructure are what keep North America as the number one market in the world.

The U.S. market is dominated by technological adoption and large government-funded healthcare spending. A primary trend is the rapid integration of miniaturized, low-priming-volume oxygenators, which reduce blood transfusion needs in neonates. According to the CDC, congenital heart defects are the leading birth defect, guaranteeing steady demand. The American Heart Association's September 2025 report says that almost 40,000 babies are born with congenital heart defects. Market growth is further driven by strategic hospital partnerships with manufacturers to develop next-generation ECMO systems and perfusion protocols, focusing on data integration and predictive analytics for improved patient management.

The pediatric perfusion products market in Canada is benefiting from steady growth due to increased federal and provincial investments in healthcare. As per the Canadian Congenital Heart Alliance report in 2025, nearly 1 in 80 to 100 children are born with congenital heart defects. Further, the recent funding announcements in provinces such as Ontario revealed historic funding increases in 2024. This directly benefits pediatric patients required to access cardiac services. The strength of Canada's universal coverage system provides access to healthcare that other countries do not allow. There is a demand for pediatric perfusion products due to increased awareness of congenital heart disease and developments in pediatric cardiac surgery capacities. In addition, the Government of Canada places increased emphasis on the value of pediatric specialty care centers and pediatric training across Canada to promote and strengthen the pediatric workforce.

Trade Data of Medical Devices Including Pediatric Perfusion Products

|

Country |

Import (USD billion) |

Export (USD billion) |

Year |

|

U.S. |

37.7 |

34.8 |

2023 |

|

Canada |

3.74 |

1.29 |

2023 |

Source: OEC 2023

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global pediatric perfusion products market by the end of 2035. The overall market is expected to continue to increase due to the rising incidences of pediatric cardiovascular disease, investments into healthcare infrastructures, and growing government initiatives to improve child health outcomes. As per the WHO report in March 2024, babies born with defects in South East Asia has increased from 4% to 11%. Further, China and India are leading the market due to their vast pediatric populations and increasing investments in specialized cardiac care infrastructure.

The pediatric perfusion products market in India is experiencing rapid growth, fueled by a high birth rate and improving healthcare access. As per Censes of India June 2025 report, the birth per 1000 rate in 2022 is 19.1. New pediatric cardiac units are being established nationwide as part of government programs like the National Health Mission, which is extending the tertiary care infrastructure. The public investment, along with skilled cardiac surgeons, is driving the demand for the essential equipment such as oxygenators and heart-lung machines, making the country dominate the Asia-Pacific region.

China's market is characterized by massive scale and strong government support. The NLM report in September 2023 states that 80.77 per 10,000 births were registered in China with congenital defects. The nation is actively promoting the domestic development and approval of cutting-edge medical devices to treat its huge patient pool with new congenital heart defect cases every year. Significant state investment in hospital upgrading directly feeds into acquiring advanced perfusion technology, making China the largest and most rapidly growing pediatric perfusion products market in the region.

Europe Market Insights

The Europe pediatric perfusion products market is estimated to garner a notable industry value from 2026 to 2035. The growth is driven by a combination of increasing instances of congenital heart disease, increasing investments in infrastructure for pediatric cardiac care. Across Europe, pediatric healthcare has been made a priority by governments, resulting in larger budgets as well as favorable policy frameworks. Germany leads in healthcare costs and is bolstered by a strong medical device manufacturing industry and favorable reimbursement policies. The United Kingdom National Health Service (NHS) continues to invest in advanced pediatric perfusion technologies. The focus by the NHS tends to be toward patient safety as well as cost-effectiveness. The European Union (EU) has recognized the challenges of innovation and investment in pediatric cardiac care.

The pediatric perfusion market in Germany is dominating the Europe market due to a strong medical device industry and high healthcare spending. The decentralized hospital system supports independent investment in cutting-edge technology. Strong quality standards by the Federal Ministry of Health (BMG) and heavy volumes of complex pediatric cardiac procedures provide steady demand for innovative perfusion systems. This blend of manufacturing power, procurement independence, and clinical demand fortifies Germany's leading status.

France's market is also known to have strong central regulation and strategic national planning of health. The market is also prompted by the increasing heart defect cases in the nation and the NLM study in April 2024 states that the incidence of such defects is around 25 per 1,000 births. The government directs investment to specialized pediatric cardiac centers through the Ministry of Solidarity and Health, prioritizing equitable access to high-tech care. This method aids in the development of advanced perfusion products across the country.

Key Pediatric Perfusion Products Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LivaNova PLC

- Getinge AB

- Terumo Corporation

- MicroPort Scientific Corporation

- Braile Biomédica

- Chalice Medical Ltd.

- Xenios AG

- Eurosets S.r.l.

- Nipro Corporation

- MAQUET Holding B.V. & Co. KG.

- Senko Medical Trading Co.

- Tianjin Medical

- Boston Children's Hospital

- Vitalcor, Inc.

- Andocor

- Gish Biomedical, Inc.

- JOTEC GmbH

- Sorin Group

- WeiGo Medical

The pediatric perfusion products market has technologically advanced players from the USA, Europe, and Asia – Pacific. These players innovate their products with safety and customization in mind for better pediatric cardiac intervention outcomes. Enhanced research and development (R&D) capabilities are also utilized through partnerships and mergers. To support cardiovascular intervention contracts, a growing incidence of pediatric cardiovascular disease will only benefit the increasing investments in healthcare infrastructure. A balance between the sophistication of product technology and affordability remains the greatest opportunity for market competitors interested in increasing market share and sustainable growth.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2025, OrthoPediatrics Corp announced a new distribution partnership with MY01, which is an innovative medical technology company planned to focus on transforming the diagnosis of limb perfusion injuries.

- In August 2025, LivaNova PLC announced that the company has initiated the commercial launch of the Essenz which is the Perfusion System in China, the second-largest market for LivaNova heart-lung machines (HLMs) after the U.S.

- In September 2024, Medtronic launched VitalFlow, which is a new Extracorporeal Membrane Oxygenation (ECMO) system used to bridge the gap between bedside care and intra-hospital transport, by providing physicians and clinicians a smarter and easier ECMO experience.

- Report ID: 2686

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pediatric Perfusion Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.