Osteosynthesis Devices Market Outlook:

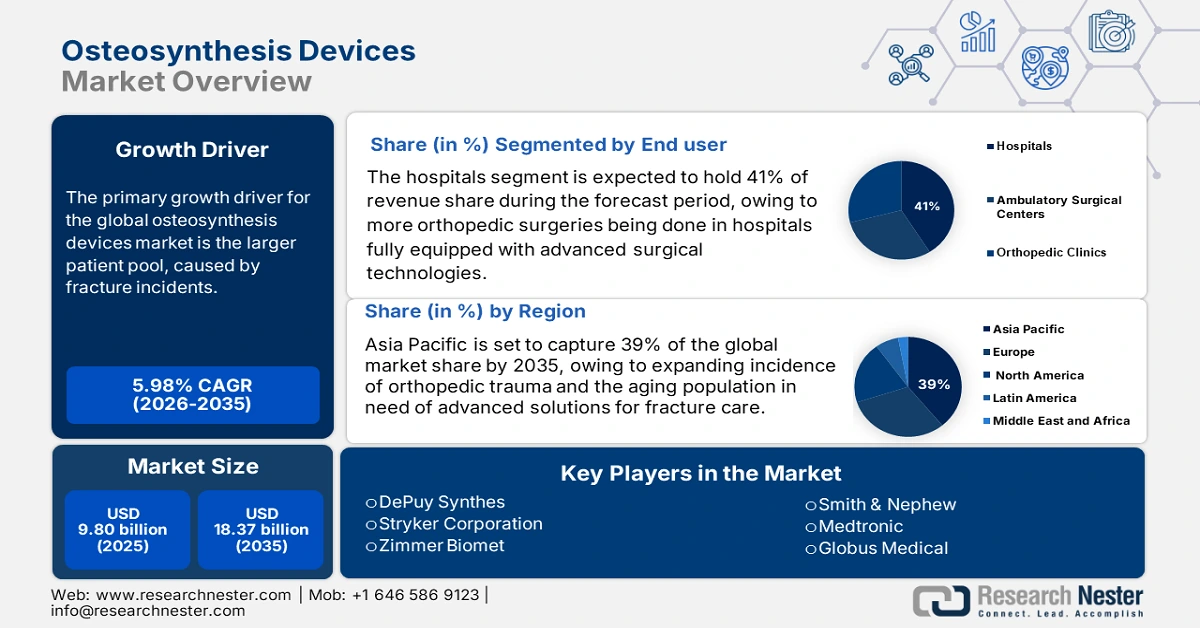

Osteosynthesis Devices Market size was valued at USD 9.80 billion in 2025 and is projected to reach USD 18.37 billion by the end of 2035, rising at a CAGR of 5.98% during the forecast period, i.e., 2026-2035. In 2026, the industry size of osteosynthesis devices is assessed at USD 10.49 billion.

The global market is characterized by a growing pool of patients as the number of fractures increases. According to the International Osteoporosis Foundation, Hip fractures are expected to almost double between 2018 and 2050 as the aging population grows globally. In terms of increase from the 1990 rate, the global rate of hip fractures will likely increase by 240% for women and 310% for men by 2050. The demographic trend underpins increasing demand for internal fixation devices (i.e. plates, screws, and intramedullary nails). Producer and consumer prices have remained stable through the inflation cycle. In terms of R&D, public funding by NIH and the EU Horizon fund offers terrific support. Public government funding has led to advances in implant material sciences, advances in state-of-the-art surgical approaches, and advances in bioresorbable technology.

The most pronounced trend is the increasing demand for minimally invasive orthopaedic efforts, enabling less surgical trauma, more rapid recovery time, and less risk for complications, especially in elderly and/or complex fracture patients. Concurrently, there is a movement toward bioabsorbable implants and customized 3D printing apparatuses that eliminate the necessity for secondary surgeries and clarity with anatomical fit. In addition, we are seeing the developing role of technology involved with a rise in computer-assisted orthopaedic surgery (CAOS), intraoperative navigation systems, and even smart implants that allow for recuperative oversight. Participants are procuring orthopaedic availability with greater precision assurance and reduced return-to-surgery time. Road traffic accidents, sports injuries, and the increasing incidence of age-related fractures continue to climb around the globe.

Key Osteosynthesis Devices Market Insights Summary:

Regional Highlights:

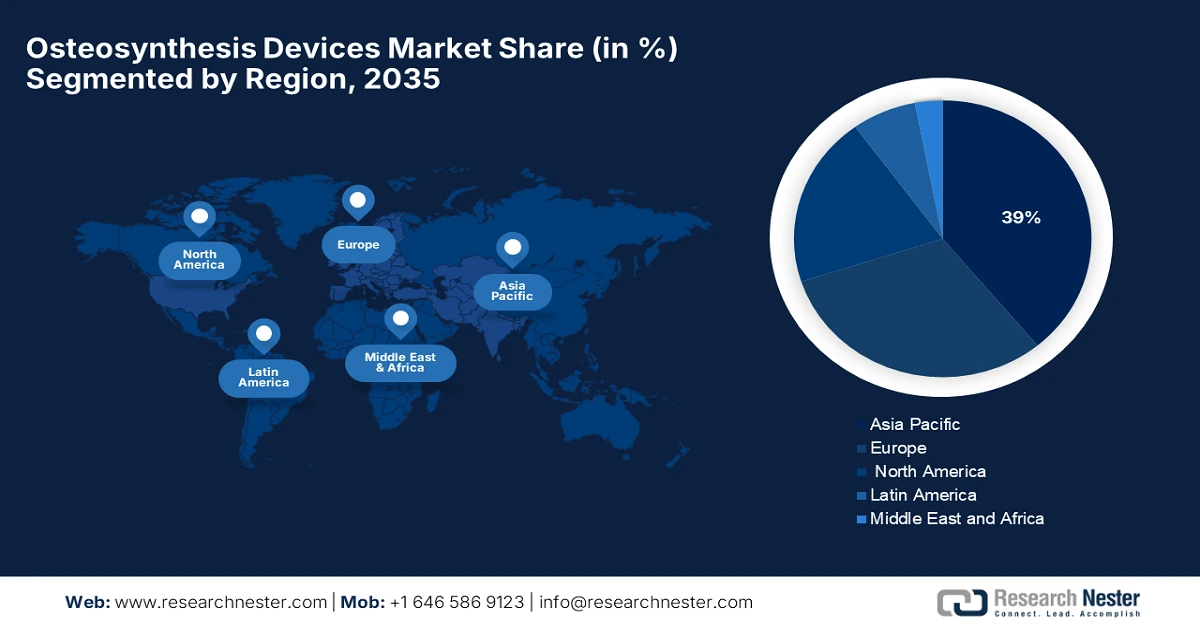

- Asia Pacific is expected to hold a 39% share by 2035, fueled by rapid urbanization, rising orthopedic injuries, an increasing elderly population, and supportive government initiatives for local manufacturing and healthcare innovation.

- North America is projected to capture an 18% share by 2035, driven by sophisticated healthcare infrastructure, advanced reimbursement policies, and strong adoption of next-generation osteosynthesis devices.

Segment Insights:

- The Hospital segment is projected to account for 41% share by 2035, propelled by the rising number of orthopedic surgeries, advanced surgical technologies, and supportive healthcare programs and insurance coverage.

- The Titanium Alloys segment is expected to hold a 35% share by 2035, driven by superior strength, corrosion resistance, biocompatibility, and growing government support for medical innovation.

Key Growth Trends:

- Rising elderly fracture population

- Advancements in biologics, biosimilars & targeted therapies

Major Challenges:

- Pricing restraints and reimbursement barriers

- Lengthy and complex regulatory approvals:

Key Players: DePuy Synthes, Stryker Corporation, Zimmer Biomet, Smith & Nephew, Medtronic, Globus Medical, Arthrex Inc., Life Spine, Inc., MicroPort Orthopedics, B. Braun Melsungen, Orthofix Medical Inc., Intact Bio, Precision Spine, Inc., GS Medical LLC, Olympus Corporation, Nippon Osteo, Meiji Seika Pharma, Kyowa Kirin Medical, Sawai Pharma Medical, Nichi-Iko Biomedical

Global Osteosynthesis Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.80 billion

- 2026 Market Size: USD 10.49 billion

- Projected Market Size: USD 18.37 billion by 2035

- Growth Forecasts: 5.98% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, South Korea, Brazil, Italy, Singapore

Last updated on : 8 September, 2025

Osteosynthesis Devices Market - Growth Drivers and Challenges

Growth Drivers

- Rising elderly fracture population: According to the National Institutes of Health, fragility fractures are more common among older adults. Osteoporotic fractures, which have lifetime fracture risks of 40-50% for women and 13-22% for males, lead to higher mortality rates in men than women. The aging population is a significant factor. These fractures usually require some form of internal fixation (osteosynthesis) using an osteosynthetic device. Older adults, however, are often delayed in their surgeries due to the limitations of reimbursement or complexities related to their health. Publicly funded reimbursement programs such as Medicare pay for fundamental devices but rarely reimburse newer devices using more effective implants. Thus, we have more need with less return; the elderly are in higher demand yet remain underused.

- Advancements in biologics, biosimilars & targeted therapies: Technological advances in drug development capability have resulted in a multitude of biologic therapies that provide highly effective treatment options for complex GI diseases. These targeted therapies use natural mechanisms to act on the disease more predictably. The introduction of biosimilars to the market will allow for increased affordability to facilitate access to a treatable antimicrobial for a larger population. In addition to biosimilars, the ability to further advance therapeutic innovation with oral biologics improves patient compliance and acceptability. Personalized medicine research continues to progress to allow drugs tailored to patients' profiles, resulting in improved treatment success and less trial-and-error in medication management.

- Increased awareness, early diagnosis, and healthcare infrastructure: People’s awareness regarding digestive health and preventive care is improving, which is leading people to seek medical advice at earlier stages of disease. Earlier diagnosis improves the effectiveness of treatment, creates a more widespread and active patient population, and supports the establishment of effective treatment pathways. Health systems across the globe are on a positive trend of increasing diagnostic capacity, particularly in the areas of endoscopy and imaging, which has made possible the more thorough diagnosis of GI disorders that may have previously been underdiagnosed. States and the private sector are also making investments in health care infrastructure, especially in the case of significant potential in emerging economies.

Challenges

- Pricing restraints and reimbursement barriers: Pricing regulations and reimbursement caps are a significant obstacle for manufacturers of osteosynthesis devices worldwide. In Europe, price control stipulations limit the flexibility of manufacturers to sell at competitive prices in the market. This is limiting the rate of market penetration. This imposes restrictions on patients' affordability, delays treatment, and adversely affects the overall growth of the market.

- Lengthy and complex regulatory approvals: Regulatory delays are a major barrier to timely product launches in large markets. In 2022, Japan's updated regulations delayed approvals of osteosynthesis devices by, on average, six (6) months, delaying access to those products for patients and subsequently revenue generation for the manufacturer. In the U.S. specifically, the FDA approval process is extremely complex, and that is before considering clinical data requirements by the leading regulatory body in the EU as well. All of these requirements lead to higher operational costs for the manufacturers and a delay to adopting new innovations. Regulatory issues force manufacturers to engage in planning at a strategic level with regard to varying regional requirements.

Country-wise Overview of Bone Fracture Incidence, Osteoporosis Diagnosis, and Treatment Gaps in Women Over 50

|

Country |

% Women with Bone Fracture after Minor Fall (Age 50+) |

% No Diagnostic Scan after Fracture |

% No Osteoporosis Treatment after Fracture |

% Never Discussed Bone Health |

% Had Diagnostic Scan |

Most Common Fracture Type |

% Height Loss >4 cm (No Fracture) |

|

Japan |

73.3% |

Not specified |

Not specified |

31.3% |

72% |

Wrist (33.1% average) |

6.7% |

|

UK |

60.9% |

Not specified |

Not specified |

51.1% |

43.7% |

Wrist (33.1% average) |

Not specified |

|

Brazil |

21.6% |

Not specified |

52.4% |

Not specified |

72% |

Wrist (33.1% average) |

Not specified |

|

Spain |

Not specified |

Not specified |

58.4% |

31.3% |

Not specified |

Wrist (33.1% average) |

25.7% |

|

South Korea |

Not specified |

Not specified |

Not specified |

Not specified |

72% |

Wrist (33.1% average) |

Not specified |

|

Average (all countries) |

43% |

32.7% |

45% |

31.3% |

63% |

Wrist (33.1%), Spine (20.1%) |

18.2% |

Source: International Osteoporosis Foundation

Osteosynthesis Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.98% |

|

Base Year Market Size (2025) |

USD 9.80 billion |

|

Forecast Year Market Size (2035) |

USD 18.37 billion |

|

Regional Scope |

|

Osteosynthesis Devices Market Segmentation:

End User Segment Analysis

Within the osteosynthesis devices market, the hospital segment is projected to hold the largest share of 41% by 2035. This dominance is supported by the increasing number of orthopedic surgeries that will be made possible within hospital environments with advanced surgical technologies, improved surgical competence, and a host of profitable government healthcare programs and insurance coverage that provides access to these devices. Ambulatory surgical centers and growing orthopedic clinics are slowly emerging; but, they stand no chance against the infrastructure of a hospital. The increasing number of trauma cases and the aging population will continue to secure hospitals as the key end users.

Implant Material Segment Analysis

Titanium alloys are expected to lead the implant material segment with a 35% revenue share by 2035. Their superior strength, corrosion resistance, and biocompatibility make them the preferred choice for most osteosynthesis devices. Government support for medical innovation, coupled with a growing trend toward durable, long-lasting implants drives ample adoption for titanium. Stainless steel and biodegradable materials still serve an important role, but only in niche applications or cost-sensitive environments. The advancements made in alloy technology are also improving performance and reducing costs.

Application Segment Analysis

The trauma and fracture repair segment is forecasted to command the highest share of 32% by 2035 in the osteosynthesis devices market. This growth is driven by the increasing incidence of bone fractures from accidents and sports injuries and an increasing aging population with osteoporosis. The enhancements in clinical pathways and guidelines, with a focus on early intervention, encourage surgical repair with the use of osteosynthesis devices, thus increasing demand. The spinal surgery and joint reconstruction segments continue to grow, but volume is still less than trauma care. Also contributing to the growth trends are ongoing improvements in fixation methods.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

End User |

|

|

Implant Material |

|

|

Application |

|

|

Device Type |

|

|

Implant Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Osteosynthesis Devices Market - Regional Analysis

Asia Pacific Market Insight

Asia Pacific is projected to be the dominant region in the osteosynthesis devices market, expected to hold the largest share of 39% by 2035. The growth of the market is primarily driven by rapid urbanization, the increasing incidence of orthopedic injuries, and the growing elderly population that requires sophisticated fracture care solutions. Initiatives by governments to encourage local manufacturing for supply chains to become more resilient. The region is also expected to grow at a CAGR of 7.2% from 2026-2035, with the expectation that the healthcare infrastructure will increase, insurance continues to penetrate more of the region's population, and the healthcare system will include innovative osteosynthesis technologies.

China plays an important role in the overall Asia Pacific region market, with its government strongly prioritizing modernization of healthcare and the local production of APIs. These investments include modernizing hospital infrastructure and medical device innovation, both of which help to contribute to growth as well as regulatory approvals and marketplace access. In addition, consumers are becoming more aware of healthcare, and the demand for advanced solutions is surging due to China's aging population. Chinese government efforts aimed at promoting domestic manufacturing are adding more strength to the momentum of this industry. The support of partnerships between local companies and other global or international players helps with technology transfer and product development.

For instance, India is expected to capture about a 10.3% share in the Asia Pacific osteosynthesis devices market from 2023 to 2035. This growth is driven by access to healthcare in rural areas, increases in orthopedic trauma cases, and heightened government investment in the manufacture of medical devices. The domestic production capability of the country makes domestic manufacturing more valuable, such as the "Make in India" program, and limits the import of products with the overall goal of reducing costs to consumers. On the other hand, the growth of the private area of health care and health coverage for medical insurance also collectively enhances market penetration. Altogether, India will become a key player in the region's market.

Europe Market Insights

Europe is projected to be the fastest-growing region in the osteosynthesis devices market. The region is expected to hold a significant market share of 21.5% by 2035. The continued growth is influenced by factors such as further investment in healthcare infrastructure, increasing orthopedic injury incidence and government support for access to advanced medical devices. Countries like Germany, France and the UK have been reviewed as countries adopting innovative osteosynthesis options that their health systems would support by good reimbursement policies and emphasis on enhancing patient outcomes.

Germany is expected to take 28.2% of the revenue share of the osteosynthesis devices market within Europe at approximately $6.5 billion by 2035. The osteosynthesis device market is developing quickly in Germany due to the advanced healthcare system and increased investments in surgical technologies that support the orthopedic sector. Furthermore, Germany's nominal DRG-based reimbursement system stimulates the uptake of innovative osteosynthesis technologies, which will allow the market to develop. Germany is also known for its modern healthcare system and a strong infrastructure for innovation in medicine. Overall, this strong consumer commitment and ability to produce new devices translates into a strong domestic demand for osteosynthesis device solutions.

The osteosynthesis devices market in the UK is expected to take a 19.3% share of Europe's total market at approximately $4.4 billion by 2035. This anticipated growth is supported by the NHS's continued investment in orthopedic care as well as the rapid adoption of digital surgery and implant tracking systems. Initiatives aimed at encouraging timely and cost-effective procurement and value-based healthcare have also improved access to more expensive new osteosynthesis products for some patients. Additionally, in some cases, the interactional component of tele-orthopedics is being utilized in rural clinics to help address post-surgical outcomes.

North America Market Insights

The osteosynthesis devices market in North America is capturing a considerable share, projected to hold 18% of the global market and reach approximately USD 9.8 billion by 2035. The growth of the region is primarily attributed to the sophisticated healthcare infrastructure, an increase in orthopedic issues, and a strong reimbursement structure. The U.S. market enjoys access to next-generation devices, which is sustainable due to the large amount of R&D spend and clinical trials on new technologies. Strong reimbursement policies through Medicare and private payers also help patients to access expensive but advanced surgical approaches, leading to market uptake of advanced fixation devices.

In the U.S., which represents roughly 85% of the North American osteosynthesis market, the continuing reimbursement from Medicare and private payors has been a significant factor. Medicare and private payors are critical to ensuring patients are able to afford surgical treatment involving osteosynthesis devices (plates, screws, nails, and fixation systems) in the U.S., as individuals enrolled in Medicare are aged 65 and older - the most common age group benefiting from fracture treatments. Reimbursement programs pay a large portion of the costs associated with surgical procedures, such as hospital stays, surgeon time, and implanted devices.

The market for all osteosynthesis devices in Canada is slowly growing, and is expected to account for about 15% of North America by 2035. The growth in Canada is supported by a publicly funded health care system, ensuring patients have access to orthopedic treatments and devices. Provincial health authorities approve and budget for orthopedic programs, and British Columbia and Ontario are leading Canada in surgical and surgical implant programs. Outpatient surgical centers and ambulatory care services are being built to address surgical wait times for fractures and other orthopedic needs, and the increase the volume of surgeries completed. This will drive demand for osteosynthesis devices.

Key Osteosynthesis Devices Market Players:

- DePuy Synthes

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Zimmer Biomet

- Smith & Nephew

- Medtronic

- Globus Medical

- Arthrex Inc.

- Life Spine, Inc.

- MicroPort Orthopedics

- B. Braun Melsungen

- Orthofix Medical Inc.

- Intact Bio

- Precision Spine, Inc.

- GS Medical LLC

- Olympus Corporation

- Nippon Osteo

- Meiji Seika Pharma

- Kyowa Kirin Medical

- Sawai Pharma Medical

- Nichi-Iko Biomedical

The market is somewhat consolidated. Most these players are focused on developing new robotic-assisted surgical systems, and bioplastics. Others like Arthrex and Globus Medical have emerging technologies under value in minimally invasive surgery and AI-enhanced instruments. B. Braun and Orthofix remained relevant with innovation in plating and screw combinations. In Japan, Kyowa Kirin and Meiji Seika are adapting to export opportunities and requests in the pediatric marketplace.

Recent Developments

- In August 2024, Stryker Corporation launched a Pangea Plating System, which received FDA clearance in late 2023. Variable-angle plating for a range of patient demographics is part of Pangea's extensive and adaptable product. The introduction of the Pangea Plating System represents an important milestone for Stryker.

- In June 2023, Technopolis Moscow Special Economic Zone (SEZ) announced to make room for the manufacturing of orthopedic and reconstructive traumatology implants. Innovative product launches are planned for 2024's fourth quarter. According to Deputy Moscow Mayor for Economic Policy and Property and Land Relations Vladimir Yefimov, the company will localize 30% of the Russian titanium implant market as part of the proposal.

- Report ID: 8076

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Osteosynthesis Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.