Orthopaedic Navigation Systems Market Outlook:

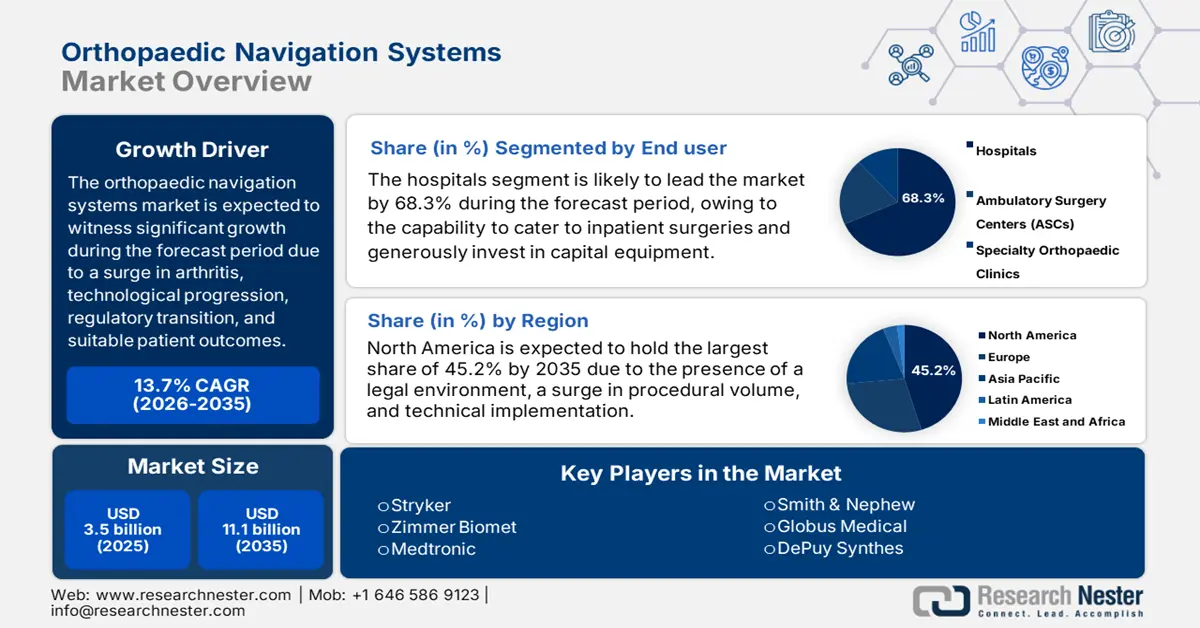

Orthopaedic Navigation Systems Market size was USD 3.5 billion in 2025 and is expected to reach USD 11.1 billion by the end of 2035, increasing at a CAGR of 13.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of orthopaedic navigation systems is assessed at USD 3.9 billion.

The expansion of the market is collectively driven by demographic, technological, economic, and clinical factors that are readily creating a shift from premium to standard care in various surgical environments. These include surgical accuracy, patient outcomes, a surge in the aging population, and technological integration, along with convergence. As per an article published by MDPI in August 2023, Mazor X Stealth, which is the newest version of the Mazor system, constitutes an accuracy rate of 90% to 100% to ensure screw placement in orthopaedics. Therefore, with the presence of such latest devices, the market is projected to gain more exposure globally.

Moreover, the aspect of regulatory and economic transition to value-based care services and an expansion into ambulatory surgery centres (ASCs) are also fueling the market across different nations. According to an article published by the World Health Organization (WHO) in September 2023, almost 1 in 10 patients is severely harmed and over 3 million deaths take place, owing to unsafe care. However, more than 50% of harm, accounting for 1 in 20 patients, is preventable due to standard medications. Therefore, with the presence of a safe health and medical system, necessary measures can be undertaken to combat any harm, which in turn is suitable for uplifting the market.

Key Orthopaedic Navigation System Market Insights Summary:

Regional Insights:

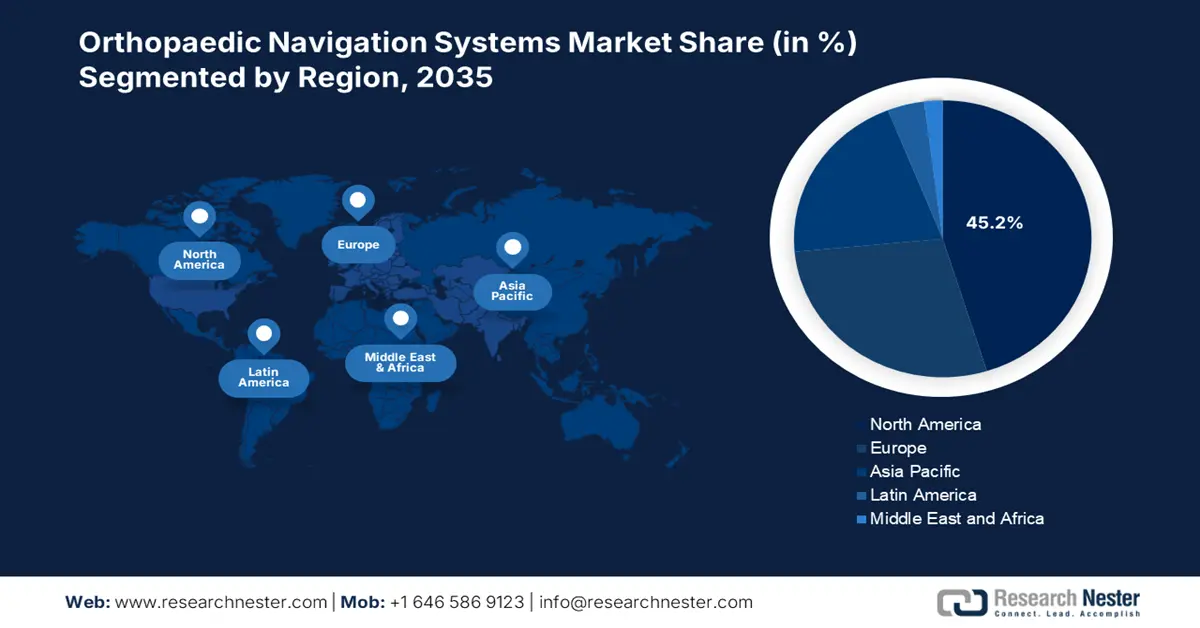

- By 2035, North America in the orthopaedic navigation systems market is anticipated to secure a dominant 45.2% share, supported by rising commercial payer influence, expanding procedural volumes, and accelerated technological integration owing to increasing healthcare expenditure.

- Asia Pacific is projected to grow rapidly through 2026–2035, capturing momentum from extreme market heterogeneity, expanding medical tourism, and swift infrastructure upgrades as stimulated by widening universal health coverage.

Segment Insights:

- The hospitals segment in the orthopaedic navigation systems market is forecast to command a 68.3% share by 2035, strengthened by its central role in handling complex inpatient procedures and robust capital capacity to deploy high-expense navigation platforms as impelled by demonstrated value in navigating intricate clinical workflows.

- The optical navigation segment is set to hold the second-largest share by 2035, advancing through superior accuracy, reduced radiation exposure, improved patient outcomes, and heightened safety protocols as fostered by clinical evidence showing higher first-attempt success rates.

Key Growth Trends:

- Artificial intelligence implementation

- Expansion into outpatient procedures

Major Challenges:

- Reimbursement limitations and budgetary constraints

- Procurement negotiations and price pressure

Key Players: Stryker Corporation (U.S.), Zimmer Biomet Holdings, Inc. (U.S.), Medtronic plc (Ireland), Smith & Nephew plc (UK), Globus Medical, Inc. (U.S.), Johnson & Johnson (DePuy Synthes) (U.S.), Brainlab AG (Germany), B. Braun Melsungen AG (Germany), Corin Group (UK), MicroPort Scientific Corporation (China), Think Surgical, Inc. (U.S.), PerceiveMD (South Korea), Intuitive Surgical (U.S.), Precision OS (Canada), Anika Therapeutics (U.S.).

Global Orthopaedic Navigation System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.9 billion

- Projected Market Size: USD 11.1 billion by 2035

- Growth Forecasts: 13.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 29 August, 2025

Orthopaedic Navigation Systems Market - Growth Drivers and Challenges

Growth Drivers

- Artificial intelligence implementation: The overall market is witnessing significant transformations with the effective integration of AI, thereby resulting in advanced processing and specialized software. According to an article published by Biotechnology Reports in December 2024, the AI adoption in orthopaedic stimulation has readily increased training exercise from 4% to 31%, thus denoting a suitable optimization that ensures a substantial impact on medical training excellence, which in turn is suitable for handling and conducting orthopaedic surgeries.

- Expansion into outpatient procedures: The aspect of outpatient procedures ensures a seamless experience by combining diagnostics, minor processes, and consultations in one place, which positively impacts the orthopaedic navigation systems. In this regard, a clinical study was conducted on 988,436 patients, which was published by NLM in March 2023. In this study, 823,746 underwent outpatient surgery, which was high among cancer patients, catering to 2.4, 1.3 to 2.7 for minimally invasive adrenalectomy, 1.3 to 1.5 for thyroid lobectomy, and 1.2 to 1.4 for breast lumpectomy, thus suitable for the market’s upliftment.

- Surgeon proficiency and training standardization: This is an essential driver for the market, since it improves patient safety, diminishes complications, and ensures optimal outcomes. Besides, as per the June 2025 Frontiers Organization report, approximately 5 billion across different nations constitute the absence of surgical care, while surgical conditions cater for 11% to 30% of the international burden of diseases. Therefore, there is a huge demand to train surgeons and keep them up-to-date with the latest advancements in orthopaedics.

2022 Musculoskeletal Conditions Driving the Market

|

Conditions |

Prevalent Cases |

|

Low back pain |

570 million |

|

Fractures |

440 million |

|

Osteoarthritis |

528 million |

|

Neck pain |

222 million |

|

Amputations |

180 million |

|

Rheumatoid arthritis |

18 million |

|

Gout |

54 million |

|

Other musculoskeletal conditions |

453 million |

Source: WHO

Challenges

- Reimbursement limitations and budgetary constraints: The presence of national healthcare systems readily operates under stringent fixed budgets, thereby developing a zero-sum game for the latest technologies. Besides, a surge in capital expenses of navigation systems must compete with certain priorities, such as basic infrastructure, drugs, and staffing, and in the case of a valuable technology, notable players tend to limit its coverage, thus negatively impacting the market. Meanwhile, the Medicaid coverage is equally strict and fragmented, which leads to more adverse effects on the overall market.

- Procurement negotiations and price pressure: In different markets, governments operate as monopolistic purchasers, which leads to wielding power to lower prices, thereby causing a hindrance in the market. Countries, such as Spain, France, and Italy, have employed strict tender processes and critical pricing strategies, wherein the latest technology expenses have been benchmarked against the current alternatives, leading to premium value ignorance. This, in turn, has developed severe margin pressure, which eventually challenges manufacturers' capability to recoup substantial R&D investments.

Orthopaedic Navigation Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.7% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 11.1 billion |

|

Regional Scope |

|

Orthopaedic Navigation Systems Market Segmentation:

End user Segment Analysis

The hospitals segment in the market is anticipated to account for the highest share of 68.3% by the end of 2035. The segment’s upliftment is highly attributed to its pivotal role as the primary facility to conduct complicated inpatient processes, including spinal fusions and revision joint replacements. Besides, hospitals tend to possess effective capital infrastructure, which is essential to invest in high-expense capital equipment, along with implemented robotic navigation platforms. Meanwhile, they demonstrate the ability to demonstrate value and navigate complicated structures, thereby suitable for the segment’s development.

Technology Segment Analysis

The optical navigation segment in the market is expected to hold the second-highest share by the end of the projected timeline. The segment’s growth is highly driven by increased accuracy and precision, diminished radiation exposure, optimized patient outcomes, and enhanced safety procedures. In this regard, a clinical study was published by NLM in August 2025, wherein 8 goat lumbar spine segments were categorized into the control and navigation groups. The navigation group achieved a success rate of 79.1% at the first attempt, thereby suitable for the segment’s growth.

Application Segment Analysis

The knee segment in the market is predicted to garner the third-highest share during the forecast duration. The segment’s development is highly driven by its ability to ensure mobility, movement, load bearing, and stability. As per an article published by NLM in May 2024, the medial patellomeniscal ligament in the knee constitutes 10% to 15% of restraining force, while the lateral retinaculum ensures 10% of the overall restraining force. Besides, periprosthetic fractures usually occur at the distal femur of the knee, ranging between 1% to 2%, thus bolstering the market’s demand.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Technology |

|

|

Application |

|

|

Type |

|

|

Component |

|

|

Approach |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopaedic Navigation Systems Market - Regional Analysis

North America Market Insights

North America orthopaedic navigation systems market is projected to be the dominating region, garnering the largest share of 45.2% by the end of 2035. The market’s growth in the region is propelled by the aspect of commercial payer influence, the medical and legal environment, an increase in procedural volume, technological adoption, and centralized-specific integration. As per the April 2025 AMA report, there has been a surge in the healthcare expenditure by 7.5% as of 2023, accounting for USD 4.9 trillion, which is higher than the 4.6% rise in 2022, thereby suitable for the market’s growth in the overall region.

The orthopaedic navigation systems market in the U.S. is growing significantly, owing to the presence of reimbursement policies, AI implementation, federal research funding, and the competitive landscape. As stated in the 2025 Arthritis National Research Foundation data report, the organization has been established to provide funds ranging from USD 50,000 to USD 250,000 to support research-based projects for two years. Therefore, with the establishment of such organisations to provide generous funds, there is a huge opportunity for the market to expand in the country.

The orthopaedic navigation systems market in Canada is also growing due to the existence of provincial government stewardship, administrative fund provision, suitable procurement processes, provincial health technology, and cost-effective patient outcomes. According to the November 2023 ITA data report, the medical device market in the country has been estimated to be USD 6.8 billion as of 2022, which is projected to increase at a 5.4% growth rate. In addition, the overall health and medical expenditure in the country was valued at CAD 331 billion in 2022, thereby denoting an optimistic outlook for the overall market.

2022 Diagnosed Arthritis in the U.S. and Osteoarthritis in Canada

|

U.S. |

Prevalence |

Canada |

Prevalence |

|

Adults over 18 years of age |

18.9% |

More than 20 years |

13.6% |

|

Women |

21.5% |

Female |

16.1% |

|

Men |

16.1% |

Male |

11.1% |

|

18 to 34 years |

3.6% |

Mortality rates among females |

8.0 per 1,000 persons |

|

More than 75 years |

53.9% |

Mortality rates among males |

12.3 per 1,000 persons |

|

Income less than 100% of the federal poverty line |

24.7% |

Age-standardized all-cause mortality rate ratios (females) |

1.1 to 1.2 |

|

Income at 400% of the federal poverty line |

16.6% |

Age-standardized all-cause mortality rate ratios (males) |

Around 1.2 |

Sources: CDC, Government of Canada

APAC Market Insights

Asia Pacific orthopaedic navigation systems market is anticipated to emerge as the fastest-growing region during the projected timeline. The market’s upliftment in the region is highly fueled by the aspect of extreme market heterogeneity, the medical tourism centre, and rapid infrastructure development. As stated in the 2023 Asia-based Development Bank Institute data report, there has been an expansion in the universal health coverage from 46% to 61% over the past six years. Besides, the gross domestic product (GDP) in the Republic of Korea surged from USD 1,055.9 to USD 5,817, which also denotes a huge opportunity for the market to expand in the overall region.

The orthopaedic navigation systems market in China is growing steadily, owing to the presence of the Healthy China 2030 strategy, followed by strong support from the government, an increase in sourcing orthopaedic appliances, and an increase in patient volume. As per an article published by NLM in August 2023, the out-of-pocket expenses accounted for 60% of the overall healthcare spending, while 23% of workers from urban areas readily enrolled themselves in social health insurance schemes. Besides, the overall health and medical expenditure in the country reached RMB 7.5 trillion, which is 6.6% of GDP over the past 4 years, thereby creating an optimistic outlook for the market.

The orthopaedic navigation systems market in India is also developing due to the effective adoption of corporate healthcare chains, cost-effective medical devices, and an intense focus on technology to address massive patient volumes. According to the August 2025 Invest India data report, the government has readily approved the Medical Devices Policy, which in turn has envisaged a worldwide share ranging between 10% to 12% in the upcoming 25 years. Besides, the valuation of medical devices export has accounted for USD 3.3 billion between 2022 and 2023, while the share for regional MedTech players is USD 2.5 billion, as of 2023, thus suitable for boosting the market in the country.

Orthopaedic Appliances 2023 Export and Import in the Asia Pacific

|

Countries |

Export |

Import |

|

China |

USD 3.4 billion |

USD 3.9 billion |

|

Singapore |

USD 3.3 billion |

USD 1.0 billion |

|

Malaysia |

USD 1.4 billion |

USD 289 million |

|

South Korea |

USD 713 million |

USD 709 million |

|

India |

USD 355 million |

USD 956 million |

|

Japan |

USD 271 million |

USD 2.8 billion |

|

Philippines |

USD 303 million |

USD 221 million |

|

Hong Kong |

USD 346 million |

USD 537 million |

Source: OEC

Europe Market Insights

Europe in the orthopaedic navigation systems market is expected to account for a considerable share by the end of the forecast timeline. The market’s development in the region is highly driven by the presence of a strict regulatory framework, increased demand for hospitals, cost-effective technologies, and a centralized budgeting system. For instance, in July 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) has declared the latest steps through which patient accessibility for the newest medical technologies can be made available in the overall region, thereby suitable for the market’s exposure.

The orthopaedic navigation systems market in Germany is gaining increased exposure, owing to the aspect of hospital funding system for new technologies, the power of undertaking clinical-based decision-making, and a surge in the procedure volume. According to a survey conducted on 185 heads of department, which was published by NLM in August 2023, 47% of hospitals comprised vacant positions, 33% for board-based specialists, and 89% for junior doctor positions. Therefore, there is a huge opportunity for the market to flourish in the country, with employment facilities for orthopaedic health and medical providers.

The orthopaedic navigation systems market in France is also uplifting due to modernized initiatives proposed by the domestic government, the presence of centralized gatekeeping through the Haute Autorité de Santé (HAS), and price-sensitive devices. As stated in the August 2024 ITA report, there has been a turnover in the regional medical device market, amounting to €37.4 billion as of 2023, while the export turnover was €9.5 billion, constituting almost 25% of the overall market. However, there is an expectation that the market will witness a yearly growth of 2% for the upcoming years, thereby denoting a huge opportunity for the market to boost in the country.

Key Orthopaedic Navigation Systems Market Players:

- Stryker Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zimmer Biomet Holdings, Inc. (U.S.)

- Medtronic plc (Ireland)

- Smith & Nephew plc (UK)

- Globus Medical, Inc. (U.S.)

- Johnson & Johnson (DePuy Synthes) (U.S.)

- Brainlab AG (Germany)

- B. Braun Melsungen AG (Germany)

- Corin Group (UK)

- MicroPort Scientific Corporation (China)

- Think Surgical, Inc. (U.S.)

- PerceiveMD (South Korea)

- Intuitive Surgical (U.S.)

- Precision OS (Canada)

- Anika Therapeutics (U.S.)

The international market is extremely consolidated and effectively dominated by large-scale medtech companies that have successfully implemented navigation into comprehensive implant and robotic ecosystems. Besides, the competitive approach is readily characterized by suitable R&D investment, particularly in tactical acquisitions, AI, and data analytics for emerging technological organizations. This has resulted in focusing on developing proprietary closed-loop systems that tend to lock in consumers’ loyalty through bundled software, instruments, and implants, thereby suitable for the market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, Johnson & Johnson MedTech successfully unveiled next-generation data-based technologies, innovative techniques, and implants across orthopaedic specialities, which include spine, trauma, joint reconstruction, and extremities.

- In March 2025, Zydus Lifesciences Limited effectively entered into a significant negotiation to purchase PAI Partners and Amplitude Surgical’s management, along with 85.6% share of Amplitude Surgical.

- Report ID: 2536

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.