Organic Chemicals Market Outlook:

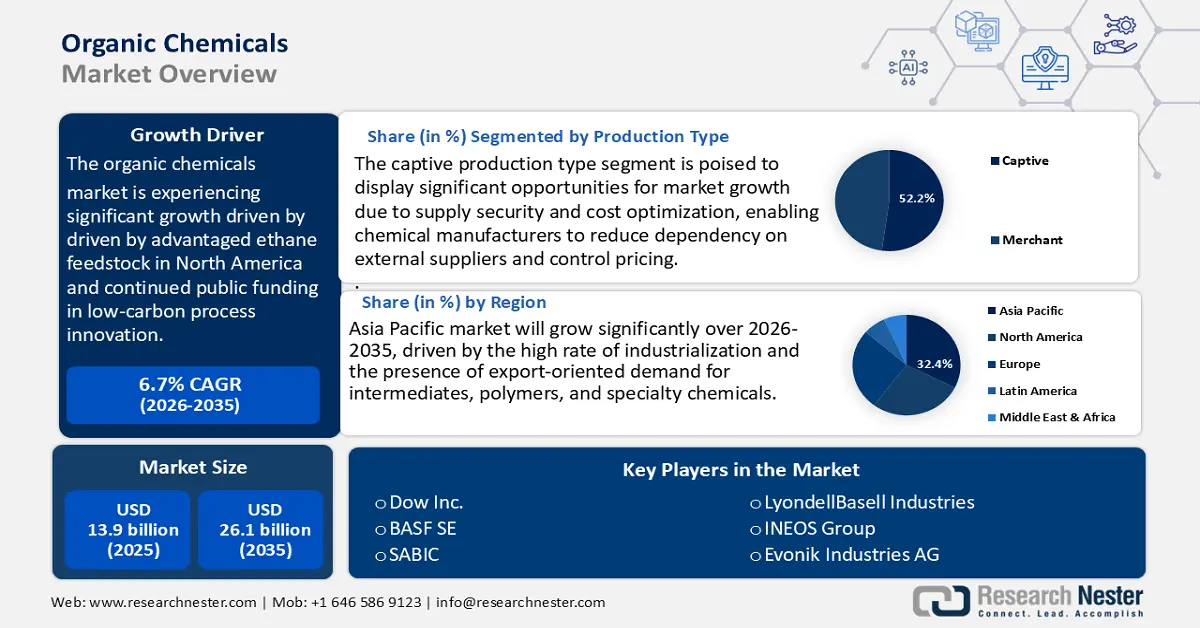

Organic Chemicals Market size was valued at USD 13.9 billion in 2025 and is projected to reach USD 26.1 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, from 2026 to 2035. In 2026, the industry size of organic chemicals is estimated at USD 15.2 billion.

The global organic chemicals market is projected to experience substantial growth, fueled primarily by North America's access to cost-advantaged ethane feedstock and sustained public investment in low-carbon process innovation. On the feedstock side, the EIA's Short-Term Energy Outlook projects that U.S. crude oil production averaged 13.4 million barrels per day in 2025. Additionally, natural gas prices are expected to rise, and electricity demand is projected to grow, driven by commercial and industrial sectors. These trends point to a dynamic energy market with evolving supply and demand balances through 2026.

At the same time, public RDD is ramping up route diversification and decarbonization, as the U.S. Department of Energy announced USD 171M (Jan 2024) in 49 industrial decarbonization projects, USD 83M (Jan 2024) to energy- and emissions-intensive companies, and numerous BETO calls, including USD 12M in integrated biorefineries (2024). As global trade momentum stabilizes, merchandise trade volume grew by 2.6% in 2024 and 3.3% in 2025. This rebound is expected to stimulate cross-border flows of intermediate and finished chemical products, supporting broader capacity absorption across supply chains. Chemical production grew modestly by 0.3% in 2025, with agricultural and consumer chemicals showing gains while basic and specialty chemicals faced pressure.

Inventory and production capacity build-out, trade, and price index are the supply chains. Ethane-driven cracking and locally-focused cluster builds are an ongoing shift in upstream supply chains. The OPaL petrochemical complex in Dahej, Gujarat, covers 5 square kilometers and has capacities of 1,1100 KTPA of ethylene, 400 KTPA of propylene, 14 lakh tons of polymers, and 5 Lakh tons of chemicals. Its unique dual-feed cracker incorporates technologies from global leaders and provides feedstock flexibility with stable supplies of C2-C3 gases and naphtha via a dedicated 97 km pipeline from ONGC-Hazira. Strategically located near Dahej Port, OPaL benefits from excellent connectivity to both domestic and international markets, supporting its vision, which is aligned with India’s “Atmanirbhar Bharat” initiative, to lead in the petrochemicals sector.

U.S. exports of ethane and ethane-based petrochemicals have surged by 134% since 2014, reaching significantly elevated levels. Near-term export growth is expected to remain strong, though potentially tempered by recent licensing requirements for trade with China. The July 2025 Producer Price Index (PPI) release from the Bureau of Labor Statistics (BLS) indicates moderate price growth within the intermediate goods segment. This trend is consistent with the relatively subdued Consumer Price Index (CPI) for housekeeping supplies, suggesting limited pass-through of upstream cost pressures to end consumers in key demand verticals.

Key Organic Chemicals Market Insights Summary:

Regional Highlights:

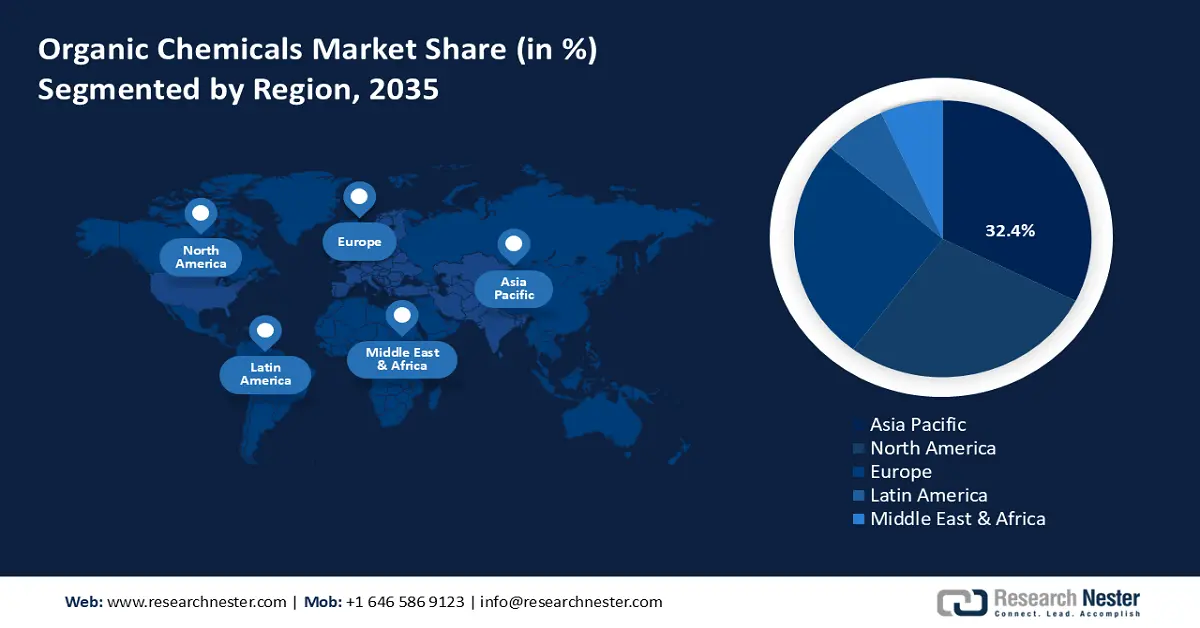

- By 2035, the Asia-Pacific region is projected to secure a 32.4% share in the organic chemicals market, supported by rapid industrialization and strong export-oriented demand.

- By 2035, North America is expected to account for a 27.9% revenue share, sustained by expanding sustainable production practices and stringent environmental standards.

Segment Insights:

- The captive production type segment is estimated to hold a leading 52.2% share by 2035 in the organic chemicals market, upheld by investments that enhance supply security and reduce emissions.

- The basic petrochemicals segment is forecast to capture a 41.4% revenue share during 2026–2035, bolstered by abundant natural gas-based feedstock availability.

Key Growth Trends:

- Organic chemical catalytic process innovation

- Enlargement of chemical recycling

Major Challenges:

- Regulatory complexity and uncertainty

- Market access barriers

Key Players: Dow Inc., BASF SE, SABIC, LyondellBasell Industries, INEOS Group, Evonik Industries AG, Celanese Corporation, Eastman Chemical Company, LG Chem Ltd., Reliance Industries Limited, Petronas Chemicals Group, Akzo Nobel N.V.

Global Organic Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.9 billion

- 2026 Market Size: USD 15.2 billion

- Projected Market Size: USD 26.1 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (32.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 29 August, 2025

Organic Chemicals Market - Growth Drivers and Challenges

Growth Drivers

-

Organic chemical catalytic process innovation: New catalytic processes, as well as new green synthesis techniques, have significantly enabled the production of organic chemicals to be more efficient, with assumptions of catalytic processes increasing efficiency. These technologies significantly reduce energy consumption and minimize waste generation, enabling manufacturers to lower operational costs while simultaneously complying with stringent environmental regulations. A wide range of R&D activities with government departments, national laboratories, and industry members underlie such breakthroughs. Consequently, the U.S. Department of Energy has funded numerous initiatives focused on enhancing catalyst durability and selectivity. These advancements directly improve catalytic productivity and support more sustainable chemical manufacturing. By adopting such green production methods, manufacturers not only ensure compliance with global environmental regulations but also position themselves strategically to meet growing consumer demand for eco-friendly products.

-

Enlargement of chemical recycling: Chemical recycling has emerged as a significant organic chemicals market force in terms of the conversion of plastic waste and other organic materials into valuable feedstocks. This practice lessens the dependence on totally unused fossil resources and decreases the carbon footprint of chemical manufacturing substantially. There has been an increased investment in chemical recycling facilities and technologies worldwide as they are backed by sustainable regulations and circular economy policies. In alignment with these goals, chemical production data highlighted by the U.S. Environmental Protection Agency (EPA) underscores a concerted effort to integrate advanced recycling technologies. This initiative is driving a profound transformation of conventional supply chains into more sustainable and circular systems. For instance, the U.S. EPA’s 2020 Chemical Data Reporting shows that the top 10 sectors accounted for more than 98% of total reported chemical production volume, with Petroleum and Coal Products Manufacturing and Chemical Manufacturing contributing 64% and 14%, respectively.

The top 50 chemicals represent nearly 64% of the total production volume, with major chemicals like sulfite liquors, petroleum residues, and kerosene reaching production volumes of over 100 billion pounds annually. The adoption of recycled feedstocks enables manufacturers to mitigate volatility in raw material pricing and ensure compliance with evolving environmental regulations. This dual advantage enhances the resilience and long-term viability of the organic chemicals market. Furthermore, the integration of recycled materials catalyzes innovation, opening new avenues for sustainable product development and differentiation.

-

Improved funding of research: There is a greater research and development (R&D) funding evolving in the organic chemicals market. The U.S. Department of Energy puts in more than USD 36 million each year on initiatives aiming at energy-efficient chemical synthesis, cleaner feedstock, and better catalytic processes. These funds support joint efforts between governmental laboratories, universities, and corporations in the production of new environmentally friendly solvents and chemicals, as well as the production of greener chemical manufacturing components. The result of this long-term RDD initiative is the commercialization of even highly sophisticated organic chemicals at a faster rate and within the strict, ever-increasing environmental regulations, as well as responding to the needs of the market in a way that maintains sustainability.

Production Volume Trends

U.S. Chemical Production Volumes (% year-over-year)

|

Segment |

2023 |

2024 |

2025 |

|

Total Chemicals (ex., pharma) |

-1.3 |

2.2 |

1.9 |

|

Agricultural Chemicals |

-0.7 |

2.6 |

0.9 |

|

Fertilizers |

-0.2 |

2.0 |

1.5 |

|

Crop Protection |

-1.8 |

3.0 |

0.5 |

|

Consumer Products |

3.3 |

2.5 |

1.5 |

|

Basic Chemicals |

-1.7 |

2.5 |

2.1 |

|

Inorganics |

1.2 |

1.6 |

2.3 |

|

Bulk Petrochemicals & Organics |

-3.7 |

3.0 |

2.5 |

|

Plastic Resins |

2.5 |

2.9 |

1.7 |

|

Synthetic Rubber |

-15.5 |

-3.6 |

-1.0 |

|

Manufactured Fibers |

-8.4 |

-2.1 |

-1.9 |

|

Specialties |

-3.9 |

0.4 |

2.1 |

|

Coatings |

-2.1 |

0.6 |

3.7 |

|

Other Specialties |

-4.7 |

0.3 |

1.4 |

|

Pharmaceuticals |

6.0 |

2.7 |

2.1 |

|

Chemicals and Pharmaceuticals |

1.3 |

2.4 |

2.0 |

(Source: American Chemistry Council)

Global Chemicals Production Volumes (% year-over-year)

By Country/Region

|

Country/Region |

2023 |

2024 |

2025 |

|

World Chemicals Output |

0.3 |

3.4 |

3.5 |

|

North America |

-2.3 |

2.2 |

2.3 |

|

Latin America |

-2.3 |

2.4 |

2.3 |

|

Europe |

-8.3 |

3.2 |

3.1 |

|

Former Soviet Union (FSU) |

3.6 |

3.8 |

3.4 |

|

Africa & Middle East |

4.4 |

2.4 |

3.1 |

|

Asia/Pacific |

3.5 |

3.9 |

3.9 |

(Source: American Chemistry Council)

By Segment

|

Segment |

2023 |

2024 |

2025 |

|

World Chemicals Output |

0.3 |

3.4 |

3.5 |

|

Agricultural Chemicals |

0.3 |

4.4 |

3.2 |

|

Consumer Chemicals |

1.3 |

2.9 |

3.1 |

|

Basic Chemicals |

-0.5 |

3.3 |

3.4 |

|

Organics |

-2.2 |

2.9 |

2.8 |

|

Inorganics |

-1.7 |

4.0 |

3.9 |

|

Synthetic Materials |

2.3 |

3.0 |

3.6 |

|

Speciality Chemicals |

1.4 |

3.3 |

3.6 |

|

Coatings |

2.7 |

3.5 |

3.2 |

|

Other Specialities |

0.4 |

3.3 |

3.8 |

(Source: American Chemistry Council)

Challenges

-

Regulatory complexity and uncertainty: Organic chemicals manufacturers have to endure a lot of challenges in trying to meet regulatory requirements that differ across jurisdictions. The REACH regulations of the EU or UK REACH, and the recent chemical safety regulations in China, are complex and prone to consistent updates due to their continuously accruing nature. In 2021, the U.S. Environmental Protection Agency (EPA) administered strict control measures on organic chemicals that use per- and polyfluoroalkyl substances (PFAS). For example, the ATRm consultation in the UK in 2024 has created uncertainty over registration timelines and standards of compliance, forcing companies to devote a substantial number of resources to continuous regulatory compliance without any certainty. This is unpredictable, which slows the launch of a product, and it also raises the costs of compliance.

-

Market access barriers: Market participants generally find their way into emerging markets choked with the non-tariff hurdles posed by sanitary, phytosanitary, and environmental policies. International trade agreements like the WTO’s Government Procurement Agreement (GPA), NAFTA, and the FTAA support “green” procurement by mandating transparency, fairness, and non-discrimination in government purchasing. These agreements encourage the use of international standards and allow procurement managers to select environmentally preferable products based on processes and production methods, facilitating the growth of green markets while balancing trade rules. Although WTO arrangements have been established to minimize trade barriers, limited compliance capabilities at the local level and rapidly evolving standards continue to hinder exporters. Moreover, in a 2024 OECD report, these barriers lowered export levels by up to 15%, which affects global supply chains by leading to the inability to adopt widely organic chemical products due to slow harmonization of regulation processes, a problem which compels firms to undertake varied approvals of the same products across a variety of jurisdictions, which adds to time to market and expenses.

Organic Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 13.9 billion |

|

Forecast Year Market Size (2035) |

USD 26.1 billion |

|

Regional Scope |

|

Organic Chemicals Market Segmentation:

Production Type Segment Analysis

The captive production type segment is projected to dominate the organic chemicals market with the highest share of 52.2% during the projected years. This is an in-house production of large chemical manufacturers that supply chemicals to their own internal needs, maintaining supply security and control of the cost. The EPA has noted that the presence of diesel odors in cities has largely been eliminated, as captive operators have made substantial investments in clean technologies that comply with the Clean Air Act, thereby minimizing emissions while enhancing production efficiency. Captive producers are aligned with this investment to meet high environmental criteria and, at the same time, compete in a more regulated atmosphere in the market.

The products that undergo petrochemical derivation, such as organic chemicals (PET) and ethylene glycol, are mostly manufactured by the large corporations as a means of reliability in supply and quality. Such a captive model facilitates cost efficiencies and provides regulatory compliance, particularly in response to the stringent regulations of the EPA Clean Air Act that require the installation of advanced pollution controls and monitoring of emissions at production sites. Pharmaceuticals and agrochemicals manufacturing ingredients like intermediates and solvents, such as methanol, ethanol, and acetic acid, are also needed. The captive producer maintains cost control by having a constant supply of feedstocks when markets are fluctuating.

Source Type Segment Analysis

The basic petrochemicals segment in the organic chemicals market is expected to grow at a significant revenue share of 41.4% from 2026 to 2035. As per the U.S Energy Information Administration, U.S dry natural gas production rose to 116.8 billion cubic feet per day on an average basis in Q2 2025, a 4.7-billion-cubic-foot increase over the prior year. The supply will continue to range between 115 and 116 billion cubic feet per day until 2026 as Permian, Appalachia, and Haynesville are the key regions. This is a strong composite facilitating the rising production of ethane and other liquids of natural gas, vital products of the petrochemical sector. Such a high availability of feedstock also supports a projection of 3.5% CAGR of basic petrochemicals till 2035.

Olefins, mostly ethylene and propylene, are crucial intermediates that are applied in the manufacture of plastics, synthetic fibers, and solvents. In addition, according to the U.S. Energy Information Administration’s Short-Term Energy Outlook, the Henry Hub natural gas spot price is expected to rise from an average of USD 3.20/MMBtu in July 2025 to USD 3.90/MMBtu in the fourth quarter of 2025 and USD 4.30/MMBtu in 2026. Natural gas production is projected to remain relatively flat amid increasing U.S. liquefied natural gas exports. This price and production outlook support the continued availability of natural gas liquids, crucial for petrochemical feedstocks. Aromatics are used in the production of synthetic resins, adhesives, and dyes, the global demand of which is expected to increase steadily because of the growing end-use organic chemicals markets such as automotive and electronics.

Application Segment Analysis

The plastics and polymers segment in the organic chemicals market is likely to grow at a steady revenue share of 40.3% over the forecast years. The International Energy Agency (IEA) anticipates polymer demands to grow at an average rate of 3.2% by 2030 on the back of the packaging, construction, and transport sectors, particularly in the Asia-Pacific region. The organic chemicals market is growing at an accelerated rate due to innovations in terms of recyclable polymers and bio-based polymers that are countering environmental concerns as well as regulatory pressures, hence improving the sustainability level of adoption.

Our in-depth analysis of the organic chemicals market includes the following segments:

|

Segment |

Subsegments |

|

Source Type |

|

|

Production Type

|

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Chemicals Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia-Pacific region is projected to dominate the organic chemicals market with the largest revenue share of 32.4%, attributed to the high rate of industrialization and presence of export-oriented demand for intermediates, polymers, and specialty chemicals. The chemical industry is valued at USD 220 billion in 2023 and accounts for about 7% of the GDP, but its global value chain is only 3-3.5%. A NITI Aayog report sets a target of 5-6% world share by 2030 with an objective of net-zero imports and USD 1,000 billion sector value by 2040. Key interventions recommended include establishing world-class chemical hubs, improving port infrastructure and logistics, introducing Opex subsidies, boosting R&D, and fast-tracking clearances.

Green chemistry initiatives and sustainable production practices are ramping up as governments in APAC invest millions of dollars in the establishment of energy-efficient and non-carbon-emitting chemical manufacturing. Technology is also being used in the region to better enable chemical industry processes, including the electrification of processes and the use of chemical recycling to increase efficiency and cut emissions in the organic chemicals market.

China organic chemicals market are predicted to lead the Asia Pacific region from 2026 to 2035, driven by intense basic-chemicals integration, coastal cracker investments, and policy-driven upgrading. The China Petroleum & Chemical Industry Federation cites a 2023 forecast of main-business revenue at CNY 15.95 trillion of chemicals, highlighting the base to produce intermediates and polymers. The expansion policy leverages carbon peaking, VOCs controls, and green manufacturing, which also play roles to shift production toward assets that are energy and emission-efficient, and, congruently, these policies benefit large, integrated complexes. Domestic and JV refineries provide resilient olefins-to-polymers chains due to petrochemical feedstock availability and export-oriented downstream sectors (packaging, consumer durables, autos, solar) stabilize offtake. Collectively, these basics maintain the APAC revenue anchor in China through 2035, depending on the scenario, baselined at no increase in utilization recovery and incremental debottlenecking, compared with a net overbuild of greenfield assets.

The organic chemicals market in India is expected to grow with the fastest CAGR in the APAC, during the projected years, owing to the country’s world-leading policy certainty, capacity pipelines, and investment openness. The Government of India allows 100% FDI under the automatic route in the organic chemicals market (except for a few hazardous chemicals). Over recent years, the sector has seen significant FDI inflows, with ₹6,300 crore in FY 2020-21, ₹7,202 crore in FY 2021-22, and ₹14,662 crore in FY 2022-23, reflecting strong growth and investment catalyzing new intermediates and polymer capacities. On the supply side, policy support-including the annual statistical compendium, PCPIR initiatives, plastic parks, and quality-control orders-collectively encourages import substitution and enhances export competitiveness. Downstream, key end-use sectors such as packaging, textiles, pharmaceuticals, and automotive remain structurally underpenetrated, implying high income elasticity of demand for organic chemicals as these industries expand. Coupled with ongoing logistics improvements and refinery-petrochemical integration aimed at feedstock diversification, India is positioned to be the fastest-growing organic chemicals market globally from 2026 to 2035.

North America Market Insights

The North American organic chemicals market is anticipated to grow at a significant revenue share of 27.9% over the forecast years by 2035, attributed to the development of sustainable production and intensive environmental standards. The region is experiencing a stable growth, with an estimated CAGR of the rate of about 3.2% by the year 2035 due to the need in the world of pharmaceuticals, automotive, packaging, and electronics industries. The U.S. EPA Green Chemistry Challenge Awards are presented to outstanding green chemistry technologies and to grassroots chemists doing noteworthy work to develop cost-effective environmental and health benefits. To date, the program has helped save 830 million pounds of harmful chemicals and solvents, 21 billion gallons of water a year, and prevented a full 7.8 billion pounds of carbon dioxide equivalent emissions annually. Nominations open for the 2025 awards have concluded, and will be announced in the fall of 2025. Moreover, there has been a massive increase in federal investments in clean energy, with greenfield foreign direct investment (FDI) in the U.S. renewable energy industry reaching USD 26.2 billion and 2023, more than doubling the amount in 2022 of USD 9.7 billion. These have been complemented by federal support and state policy that has made the U.S. a priority for clean energy capital investment, particularly in solar and wind.

Further, clean energy FDI programs such as SelectUSA have supported USD 64 billion in FDI since 2021, which has brought new infrastructure and technology deployment to the economy. Chemical safety and standardization establish regulatory oversight, promoting superior performance efficiency and employee safety with accrediting agencies like OSHA and NIST. The close interaction that continues to exist between public agencies and industry stakeholders has resulted in a resilient and environmentally responsible organic chemicals market in North America, and this provides it with the potential to achieve continued growth and global competitiveness.

The U.S. organic chemicals market is expected to maintain its dominant position in the North American chemical industry throughout the forecast period. The sector, which includes organic chemicals, is a cornerstone of the U.S. economy, generating $486 billion in annual output and directly employing over 529,000 people. When accounting for indirect and induced effects, its total employment impact exceeds 4.6 million jobs, contributing significantly to more than 25% of the U.S. GDP.

This leadership position is maintained despite evolving regulatory pressures. For instance, the U.S. Environmental Protection Agency (EPA) has implemented New Source Performance Standards (NSPS) targeting synthetic organic chemical manufacturing plants. These regulations aim to limit emissions of volatile organic compounds (VOCs) and other hazardous pollutants, compelling producers to make substantial capital investments in emissions control technologies or pursue product reformulation to ensure compliance. Meanwhile, DOE data pinpoints the chemical sector as the second greatest industrial energy user-driving an increased focus on efficiency and alternative materials-including a place in DOE Industrial Decarbonization funding with over USD 136 million for 66 projects. With the growth in organic chemical industries, sustainability, precision manufacturing, and better environmental performance are becoming central themes in reformulating organic chemical production strategies throughout the U.S. organic chemicals market.

Canada’s organic chemicals market is expected to grow at a steady pace by 2035. The industrial chemicals industry in Canada is worth CAD 74.9 billion in manufacturing shipments in 2023, of which the industrial chemicals sector itself is worth CAD 31.9 billion and exports about CAD 24.6 billion of those totals. Employment: Employment directly in 2023 is expected to be 93,300 people, and each direct employment is estimated to translate into an addition of five jobs in the rest of the economy. The government policy is particularly important in green chemicals; the Chemical Management Plan under CEPA, both the new and existing materials used have to be subject to the green chemicals policy, which does not endanger the environment and is innovative in its use. Competitive energy costs, as well as the federal commitment to cleaner processes, have ensured that Canada continues to increase organic chemical manufacturing, which has benefited from natural resources and regulatory best practices.

Europe Market Insights

The European organic chemicals market is predicted to witness an upward trend from 2026 to 2035, despite being under pressure in terms of energy cost pressures and capacity reduction. Innovation Fund As part of the EU Green Deal, the EU Innovation Fund is committed to financing large-scale decarbonization initiatives up to 2023. For example, the Innovation Fund, which operates under the EU financial plan, allocated over 3.6 billion Euros as a grant in 2023 to scale up projects relating to energy-intensive industries, hydrogen, renewable energy, and manufacturing parts of storage energy and renewables.

The projects help in decarbonization technologies in industries such as chemicals and refining, with emphasis on pioneering technologies in olefin and intermediates production. The fund has already assisted in the preparation of 41 project agreements, helping Europe to transition to industrials. In the UK organic chemicals market, the UKRI SSPP Challenge awarded 60m to further develop more sustainable chemistries used in packaging systems, such as cleaner solvents and performance additives. Germany organic chemicals market had 112 billion in shipments of the chemicals-pharma during the first half of the year 2024, even as there is a transition in the supply of energy. Collectively, these geographies are advancing the quest of decarbonization, regulatory paradigm dynamics, and value-chain realignments, making Europe, the UK, and Germany the best candidates in sustainable organic chemicals market.

Key Organic Chemicals Market Players:

- Dow Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- SABIC

- LyondellBasell Industries

- INEOS Group

- Evonik Industries AG

- Celanese Corporation

- Eastman Chemical Company

- LG Chem Ltd.

- Reliance Industries Limited

- Petronas Chemicals Group

- Akzo Nobel N.V.

The organic chemicals market is moderately fragmented, where major organic chemicals market players follow the concept of innovation, sustainability, and geographical expansion strategies to hold a competitive edge in the global market. Known players allocate abundant resources in R&D to create bio-based and ecologically friendly products with the lowest impact on the environment to address regulatory obligations. Strategic mergers, acquisitions, and partnerships are usual to expand their product lines and venture into new markets. Japanese companies use developed technologies and powerful state support to constantly innovate, keeping their world market positions very high. The competition in the organic chemicals market is characterized in such a way that companies focus on sustainability, digitalization, and supply chain resilience in order to fulfil the new demands of end-users in pharmaceuticals, automotive, and electronics.

Top Global Organic Chemicals Manufacturers in Organic Chemicals Market

Recent Developments

- In August 2025, Vipul Organics shipped its initial business order of a new-fangled organic intermediate that was specifically designed to support the automobile industry, leading it in spirit into the fusil brandish of specialty chemicals. The consignment was of around Rs. 1 crore value, making Vipul an innovative company in green automotive chemistry solutions. The intermediate will address the expanding demand for higher-performance or sustainable materials in the automotive industry manufacturing operation, and help the company move along the growth plan and explore export opportunities. This launch epitomises Vipul's making a crucial action to enhance its market share in high-value end-use markets and orientation towards sustainable chemistry.

- In March 2025, BASF introduced three natural-based personal care ingredients, Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA to meet the product needs of cosmetics and personal care formulations as biodegradable alternatives. Such products are in response to growing consumer interest in sustainable and eco-friendly beauty products. This product helped BASF gain market share in the personal care organic segment by 18% especially within the EMEA region. It signals a significant process improvement made by BASF towards optimizing its manufacturing processes to meet its sustainability goals and reflect its commitment to green chemistry as a cutting-edge approach in moving business towards cleaner production processes.

- Report ID: 8034

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.