Optic Nerve Disorders Treatment Market Outlook:

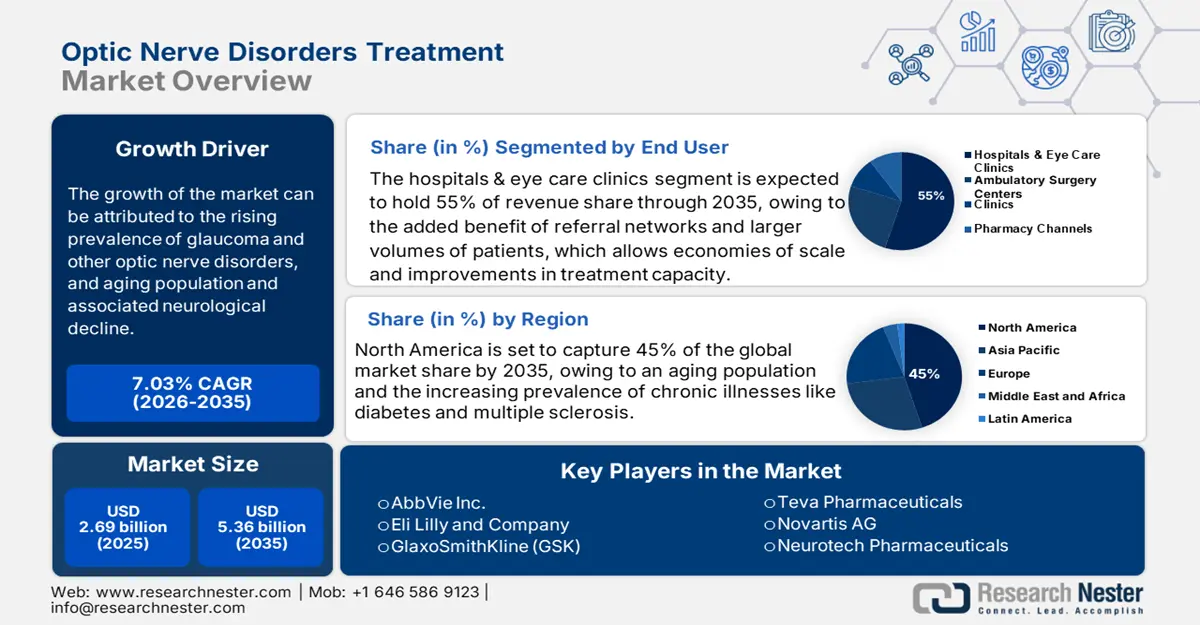

Optic Nerve Disorders Treatment Market size was valued at USD 2.69 billion in 2025 and is projected to reach USD 5.36 billion by the end of 2035, rising at a CAGR of 7.03% during the forecast period, i.e., 2026-2035. In 2026, the industry size of optic nerve disorders treatment is assessed at USD 2.89 billion.

Currently, the treatment landscape of optic nerve disorders is rapidly changing because of various advances in regenerative medicine, gene therapy, neuroprotection, and digital diagnostics. One of the more exciting developing areas is best characterized by the use of gene therapy and epigenetic reprogramming. AAV-based delivery of reprogramming factors has been shown to restore vision in a variety of animal models, which is the first step to reversing vision loss at the cellular level. In addition, regenerative medicine is highly relevant because of its neuroprotective and remyelinating potential in optic neuritis. These have the advantage of being safer and attenuating inflammation.

Minimally invasive glaucoma surgeries (MIGS) are increasingly used practices and procedures. By employing trabecular micro-bypass stents, intraocular pressure can be reduced with fewer complications compared with traditional surgeries, hence improving the improvement of patient outcomes. There are also exciting advancements in diagnostics. Artificial intelligence-based interventions and other technology ("high" resolution imaging like OCT) allow for more effective detection and monitoring of optic nerve health, which in turn allows for earlier interventions and personalized treatments. This is complemented by increased access to optic nerve health via telehealth or other "digital health" techniques. This allows for remote diagnosis, virtual visits, and monitoring, all of which complement a long-term management plan. Exciting treatments are being explored as well, with emerging biologics that promote remyelination and/or nerve regeneration and the ongoing clinical trials that capture this potential.

Key Optic Nerve Disorders Treatment Market Insights Summary:

Regional Highlights:

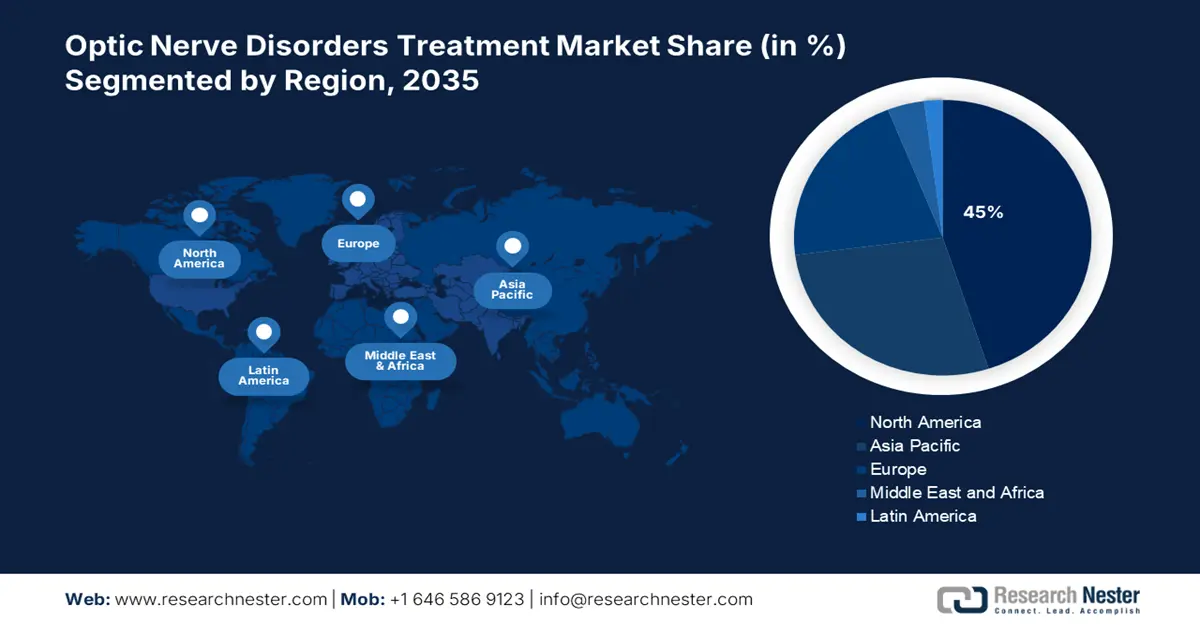

- North America is expected to hold a 45% share by 2035 in the optic nerve disorders treatment market, impelled by supportive regulatory policies and widespread awareness of eye health.

- The Asia Pacific region is projected to witness significant market growth by 2035, owing to improving healthcare access and rising awareness of eye health.

Segment Insights:

- The hospitals & eye care clinics segment is projected to account for a 55% share by 2035 in the optic nerve disorders treatment market, owing to the availability of specialized ophthalmologists and advanced treatment infrastructure.

- The pharmacological treatments segment is estimated to lead the market during 2026-2035, driven by increasing adoption of steroids, neuroprotective agents, and immunomodulators.

Key Growth Trends:

- Rising prevalence of glaucoma and other optic nerve disorders

- Aging population and associated neurological decline

Major Challenges:

- Limited regenerative treatment options

- High cost of advanced therapies and devices

Key Players: AbbVie Inc. (USA), Eli Lilly and Company (USA), GlaxoSmithKline (GSK) (UK), Pfizer Inc. (USA), Teva Pharmaceuticals (Israel), Novartis AG (Switzerland), Neurotech Pharmaceuticals (USA), Bayer AG (Germany), Regeneron Pharmaceuticals (USA), Allergan (an AbbVie company) (Ireland), GenSight Biologics (France), Santhera Pharmaceuticals (Switzerland), Stealth BioTherapeutics (USA), REGENXBIO Inc. (USA), Bausch + Lomb (USA), Santen Pharmaceutical Co., Ltd. (Japan), Alcon Inc. (Switzerland), Sun Pharmaceutical Industries Ltd. (India), Nanoscope Therapeutics (USA), Kubota Vision Inc. (USA).

Global Optic Nerve Disorders Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.69 billion

- 2026 Market Size: USD 2.89 billion

- Projected Market Size: USD 5.36 billion by 2035

- Growth Forecasts: 7.03% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 8 September, 2025

Optic Nerve Disorders Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of glaucoma and other optic nerve disorders: Glaucoma is one of the top causes of irreversible blindness and drives the optic nerve disorders treatment market. According to the Glaucoma Research Foundation, globally, more than 22 million people are expected to have glaucoma. Furthermore, the incidence of optic neuritis, ischemic optic neuropathy, and traumatic optic neuropathy are on the rise. These conditions are progressive and require long-term treatment and care of the optic nerve, leading to a long and active patient population. Increases in the patient population indicate a need for drug and surgical interventions.

- Aging population and associated neurological decline: A major driver is the worldwide growing elderly population, as people aged 60 and older are at greater risk for degenerative ocular and neurological diseases. As people age, the risk of a person being diagnosed with glaucoma, optic neuropathy, and neurodegeneration-related vision loss increases significantly. This aging demographic will continue to increase the market potential for treatments for optic nerve disease, including neuroprotective medications, diagnostics, and surgery. The aging trend is especially high in North America, Europe, Japan, and China.

- Increased adoption of AI-based diagnostics and imaging tools: Artificial intelligence and imaging systems like optical coherence tomography (OCT) and fundus images are enhancing early diagnosis and targeted intervention. AI models are enabling ophthalmologists to recognize early damage to the optic nerve before damage occurs, most clearly in chronic conditions such as glaucoma and interventional models - allowing for early intervention to prevent irreversible vision loss. The contribution of digital diagnosis to clinical workflows promotes the best possible patient adherence and outcome while allowing for the discussion of personalized diagnostic and treatment protocols. Together, this leads to increased utilization of systemic supportive medications and monitoring systems.

Global Causes of Blindness

|

Glaucoma |

12% |

|

AMD |

9% |

|

Corneal Opacity |

5% |

|

Diabetic Retinopathy |

5% |

|

ONCHO |

1% |

|

Childhood Blindness |

4% |

|

Trachoma |

4% |

|

Cataract |

47% |

|

Others |

13% |

Source: WHO

Challenges

- Limited regenerative treatment options: Despite advances, genuine regenerative therapies that support optic nerve damage reversal are still mostly in the realm of experimentation. Most treatments will serve to slow disease progression. Regeneration is not a natural outcome of the optic nerve, which complicates the situation for effective therapeutic breakthroughs. Introductions of curative treatments is also limited by cost of research, difficulties in the clinical trial process, and regulatory hurdles.

- High cost of advanced therapies and devices:Novel therapies, such as gene therapy, stem cell therapies, and high-tech diagnostics like OCT with AI, are costly and typically not included in basic insurance plans. In many cases this denies access to patients in low- and middle-income countries as well as under insured patients in wealthier countries. Consequently, market penetration for such solutions remains very low outside of elite healthcare organizations and has therefore been limited in overall usage.

Optic Nerve Disorders Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.03% |

|

Base Year Market Size (2025) |

USD 2.69 billion |

|

Forecast Year Market Size (2035) |

USD 5.36 billion |

|

Regional Scope |

|

Optic Nerve Disorders Treatment Market Segmentation:

End User Segment Analysis

The hospitals & eye care clinics segment is estimated to account for the largest share of 55% in the optic nerve disorders treatment market over the discussed timeframe. By providing the requisite resources for the diagnosis, management, and treatment of complex optic nerve conditions like glaucoma and optic neuritis, these healthcare facilities can provide the infrastructure to potentiate advanced modalities of therapy, such as intravitreal injections, laser therapies, and even surgical options. This often necessitates the resources of specialized ophthalmologists and sophisticated equipment. Hospitals also have the added benefit of referral networks and larger volumes of patients, which allow economies of scale and improvements in treatment capacity.

Treatment Type Segment Analysis

The pharmacological treatments segment is poised to dominate the optic nerve disorders treatment market during the analyzed period. The predominance of treatment methods is primarily the result of the high use of drug therapies, like steroids, neuroprotective agents, and immunomodulators, treating optic neuritis, glaucoma, and optic neuropathy. Of these available treatment options, pharmacologic are the most non-invasive forms of treatment that are affordable, available, and accessible in hospitals, clinics, and outpatient settings, leading to widespread patient participation. Continuing efforts in new pharmaceutical research and development are seeing novel treatments, such as gene therapy, and drugs as neuroprotective agents, increasing efficacy and patient outcomes.

Disease Type Segment Analysis

During the examined period, the glaucoma segment is expected to hold significant optic nerve disorders treatment market share in the optic nerve disorders treatment industry. More than any other condition in the disease indication, glaucoma accounted for the most considerable market segment in the optic nerve disorders treatment market. This is due primarily to the position as one of the leading causes of irreversible blindness globally. Prevalence across the globe is increasing in the aging population and is expected to continue in expanding treatment options through to 2034. Managed care treatment options for glaucoma range from medication to surgical procedures. The addition of public health initiatives for diagnosis and treatment using early diagnosis and management also provides an increase to the base number of treated patients. Increased awareness and increase of screening programs all provide expanded patient base to seek treatment.

Our in-depth analysis of the optic nerve disorders treatment market includes the following segments:

|

Segments |

Subsegments |

|

Treatment Type |

|

|

Disease Type |

|

|

Route of Administration |

|

|

Drug Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optic Nerve Disorders Treatment Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 45% in the global optic nerve disorders treatment market by the end of 2035. The growth of the optic nerve disorders treatment market is influenced by several key factors. An aging population and the increasing prevalence of chronic illnesses like diabetes and multiple sclerosis contribute to a higher number of optic nerve conditions, such as glaucoma and optic neuritis. The American Diabetes Association's forecast predicts that 38.4 million Americans, or 11.6% of the total population, suffered from diabetes in 2021. The region is home to several major pharmaceutical and biotechnology companies that are actively involved in developing new therapies. Supportive regulatory policies encourage innovation in treatment development. In addition, widespread awareness of eye health, routine screening practices, and comprehensive insurance coverage contribute to strong market demand.

The U.S. is projected to dominate the world optic nerve disorders treatment market due to its substantial healthcare infrastructure, leading presence of major pharma companies, and commitment in terms of research and development funding. The aging population, together with high incidence of diseases like glaucoma and diabetes, provides growth to the market for optic nerve treatments. The FDA is also encouraging new therapies by simplifying the development, approval and availability of innovative therapies. There is also broad awareness, and access to early diagnostics.

Canada is fortunate to have a publicly funded health care system, and with it a high standard of medical care that results in early detection and ongoing treatment of optic nerve disorders. The increasingly aging population is leading to higher numbers of individuals developing vision-related conditions. Government funding and support for innovation in healthcare and working partnerships are allowing Canadians to access innovative treatment options. Increased public awareness and routine screening programs also help support demand.

APAC Market Insights

The Asia Pacific region is likely to see significant growth in the optic nerve disorders treatment market by 2035 for several reasons. The population is large and increasing in age, which has led to more individuals experiencing age-related and chronic conditions. As per the World Health Organization (WHO), approximately 30% of blind and vision-impaired people worldwide reside in the South-East Asia. Governments and health care providers are prioritizing improving access to medical care and even screening programs that will identify optic nerve-related pathologies earlier. There is a positive rise in funding for health care facilities, and there is a growing number of lower-cost prescriptions. As disposable income increases and as awareness increases regarding eye health, there are more individuals seeking help for serious vision conditions.

India is anticipated to exhibit growth in optic nerve disorders treatment market because it has a large population, rising diabetes prevalence, and improved public awareness of vision health. The increase in improved healthcare infrastructure and expanded eye care service offerings in urban and semi-urban areas will assist in making treatments more accessible. The increased availability of low-cost generic medications from local and regional pharmaceutical manufacturers is also assisting. Government-driven comprehensive screening and health programs are allowing the public early diagnosis and prevention efforts of ocular disorders.

China is rapidly aging and has a high burden of chronic diseases, thus is a major impetus for growth in the optic nerve disorders treatment market. The country is investing substantially in healthcare reform. Investments in urbanization, an increase of health awareness, and government-supported medical research are improving public diagnosis and treatment rates for optic nerve disorders. Local pharmaceutical manufacturing innovations and partnerships with global commercial firms are highlighting efforts to import new treatments.

Europe Market Insights

Europe is projected to maintain a prominent stake in the global optic nerve disorders treatment market by 2035. Analysts report that Europe has well-respected healthcare systems and the established medical practices throughout its many countries offer and have well-documented access to quality eye care that aids patients with early diagnosis and ongoing treatment of their disability-related issues. Public awareness of eye health took root, stimulating high rates of patient compliance with check-ups and helping eye care providers check for possible disorders. Numerous companies in Europe have developed treatments to protect nerve cells and the companies are continually working on other treatments to address inherited eye diseases due to optic nerve damage. Regulatory authorities ensure that any new medicine initiated is reviewed or approved continuously without unnecessary delay. In addition, government, international, and private funding foster the research and development of new medical treatments.

The UK has a robust healthcare system (NHS) with specialism that enables people to access outpatient eye care and supports early intervention for optic nerve disease. The increasing awareness in the public and greater public screening programs support the identification and treatment of disease states such as glaucoma in its earlier stages. Additionally, with world-leading research institutions and biotech companies, the UK is being exposed to more complex treatment options endorsed by commercialization. Lastly, the government is a supporter of national and international clinical study groups.

France is likely to be well-established because of its extensive public healthcare system, above-average quality of care, and growing investment in eye health research. France has a larger older adult population, which drives the potential for optic nerve-related conditions. The commercial pharmaceutical sector is engaged with Eyeball Pharmaceuticals and research centers developing drugs across the neuro-ophthalmic spectrum. Moreover, public health initiatives parallelized with the availability of diagnostic tools drive potential for early treatment intervention and continued growth of the sector.

Key Optic Nerve Disorders Treatment Market Players:

- AbbVie Inc. (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly and Company (USA)

- GlaxoSmithKline (GSK) (UK)

- Pfizer Inc. (USA)

- Teva Pharmaceuticals (Israel)

- Novartis AG (Switzerland)

- Neurotech Pharmaceuticals (USA)

- Bayer AG (Germany)

- Regeneron Pharmaceuticals (USA)

- Allergan (an AbbVie company) (Ireland)

- GenSight Biologics (France)

- Santhera Pharmaceuticals (Switzerland)

- Stealth BioTherapeutics (USA)

- REGENXBIO Inc. (USA)

- Bausch + Lomb (USA)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Alcon Inc. (Switzerland)

- Sun Pharmaceutical Industries Ltd. (India)

- Nanoscope Therapeutics (USA)

- Kubota Vision Inc. (USA)

The optic nerve disorders treatment market is highly competitive. Major pharmaceutical companies are investing heavily in research and development of new therapies to address optic nerve degeneration. And biotechnology companies are hoping to leverage innovations in genetic engineering to develop gene therapies to cure certain hereditary optic neuropathies. These companies are investing in developing a number of gene therapies in addition to significant advances made in genetic engineering in both gene delivery and gene editing therapies. Other companies are attempting to expand their offering with generics and low-cost therapies to provide options to patients that are more affordable in developing markets.

Recent Developments

- In January 2025, a study published in the Chinese Medical Journal suggests using artificial intelligence (AI) to discover novel medications for glaucoma.

Researchers investigate the application of AI to discover a possible drug that could transform the way glaucoma is treated in the future. To find compounds that target RIPK3, the scientists used sophisticated AI models, such as graph neural network models and a big language model. - In January 2025, Stoke Therapeutics, Inc. committed to using RNA medicine to restore protein expression by utilizing the body's potential. The company announced that it has partnered with international regulatory bodies to design the Phase 3 EMPEROR study of zorevunersen, which could be the first disease-modifying medication to treat Dravet syndrome. After fruitful discussions with the FDA, EMA, and PMDA, the company has completed the protocol for its EMPEROR Phase 3 research.

- Report ID: 8079

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.