Opioids Market Outlook:

Opioids Market size was valued at USD 23.09 billion in 2024 and is projected to reach USD 26.80 billion by the end of 2034, rising at a CAGR of 2.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of opioids is assessed at USD 23.40 billion.

In the U.S., there were an estimated 51 million adults with chronic pain in 2023. As a result, there is a substantial population of patients utilizing opioids through managed care and hospital systems. In 2021-2022, U.S. outpatient prescription opioid use resulted in 68.1 million prescription fills. Oxycodone and hydrocodone accounted for roughly 74% of the overall expenses. Medicare funded about 38.1% of opioid expenditures. Another consideration is that federal regulations surrounding quotas for APIs may limit the capacity for production. This raises issues around market concentration and supply resilience. Commodity pricing reflects moderate inflation. While there is no specific PPI and CPI data made available for opioid products. RDD investment is evident in FDA and NIH action as well. For instance, the first auto-injector for opioid overdose reversal, Zurnai, was approved in August 2024 after research at scale through NIH.

Opioids Market Growth - Drivers and Challenges

Growth Drivers

- Chronic pain patient volume & hospital admissions: More than 90% of surgical inpatients use opioids while hospitalized. Hospitals are creating opioid stewardship programs and adjunct therapies to reduce risk, as well as costs. The number of Medicare enrollees dispensed naloxone has increased to over 740,000 in 2023. In 2024, the FDA approved the first nalmefene hydrochloride auto-injector. There is an increased demand for overdose-reversal therapies and long-acting antagonists. This has broadened the market potential beyond analgesics.

- Government-funded alternative pain management initiatives: U.S. federal programs like the NOPAIN Act are designed to improve coverage for non-opioid analgesics. There are dental initiatives under Medicare/Medicaid to curb opioid use for post-surgical pain. These changes toward non-opioid pain relief will rewire opioid demand for acute, short-term indications. In 2023, Medicare paid almost USD 17 million for improper opioid-treatment program claims.

Historical Patient Growth & Market Implications

From 2010 to 2020, the worldwide opioid consumption increased and exhibited variance. This trend was particularly pronounced in the U.S., Germany, France, Spain, Australia, Japan, India, and China. For the manufacturers of opioid + D5 (deuterated drug) products, it is imperative to grasp these conditions. Growth in patient populations is fundamentally encouraging. Similarly, areas with rapid growth in both prescribed and consumed opioids may constitute high-yield potential.

|

Country

|

Patients (M) 2010 |

Patients (M) 2020 |

Growth (%) |

|

USA |

2.09 |

3.30 |

+59% |

|

Germany

|

0.49 |

0.80 |

+57% |

|

France |

0.24 |

0.37 |

+50% |

|

Spain |

0.17 |

0.28 |

+62% |

|

Australia

|

0.10 |

0.18 |

+56% |

|

Japan |

0.08 |

0.15 |

+55% |

|

India |

0.04 |

0.10 |

+110% |

|

China |

0.06 |

0.14 |

+112% |

Revenue Opportunities – Statistics Table (2023‑2024)

|

Company & Initiative |

Market Share Δ |

Additional Revenue (USD M) |

|

Indivior: launched new nasal opioid overdose spray in May 2023 |

+3.1% |

37 |

|

Amneal: generic Narcan OTC nasal spray launch Apr 2024 |

+7.6% |

24 |

|

Purdue Pharma: OxyContin specialty promotions post-2023 |

+1.9% |

57 |

|

Emergent BioSolutions: expanded Narcan supply contract |

+10% |

88 |

|

Hikma Pharma: fentanyl citrate injection new dosing Apr 2024 |

+2.3% |

38 |

|

Mallinckrodt: tamper-resistant hydromorphone release 2023 |

+1.8% |

29 |

|

Johnson & Johnson: 72-hour opioid patch Feb 2024 launch |

+2.7% |

52 |

|

Teva: scale generic opioid production (2024) |

+3.9% |

67 |

Challenges

- Pricing caps & rebate structures: In the U.S., pharmacy benefit managers (PBMs) require opaque rebates to inflate list prices. This causes manufacturers to raise launch prices. In Europe, price-cap mechanisms limiting manufacturer margins are harsh. Some companies work with health agencies in 2023 to negotiate distributed launch prices.

- Government-imposed prior authorization: The U.S. payers need prior authorization for buprenorphine and other OUD treatments. This delays access and leads to fewer prescriptions. For instance, a study published in 2021 demonstrated that only 19% of 2.4 million opioid use disorder patients received medication-assisted therapy. Medicaid pays for over 48% of OUD treatment in the U.S. However, because of cost restrictions, it leaves 3 out of 5 patients without any treatment. Manufacturers must show they are cost-effective to obtain formulary placement.

Opioids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

2.1% |

|

Base Year Market Size (2024) |

USD 23.09 billion |

|

Forecast Year Market Size (2034) |

USD 26.80 billion |

|

Regional Scope |

|

Opioids Market Segmentation:

Duration of Action Segment Analysis

Based on the duration of action, the ER / long-acting opioids segment is predicted to capture the largest share at 55% in the opioids market over the assessed period. Extended-release is far in the lead due to long-lasting chronic pain. The requirement for surgical aftercare. Oxycodone, hydrocodone, and fentanyl, long-acting and preferred for continuing pain control in oncology and post-op cases. Estimates by the CDC show that 58% of adults in the U.S. are living with chronic conditions such as cancer or cardiovascular disease. This supports the need for ER opioids.

Application Segment Analysis

In terms of application, the pain management segment is anticipated to hold the highest revenue proportion of 74% in the opioids market throughout the discussed timeline. Opioids continue to be an integral component of pain management for postoperative, cancer, and chronic pain. There are an estimated 300 million surgeries performed worldwide each year. This can account for the continued high utilization of opioids for pain. Opioids are a class of potent analgesics used to manage moderate to severe pain.

Our in-depth analysis of the global opioids market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Duration |

|

|

Application |

|

|

Route |

|

|

Distribution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

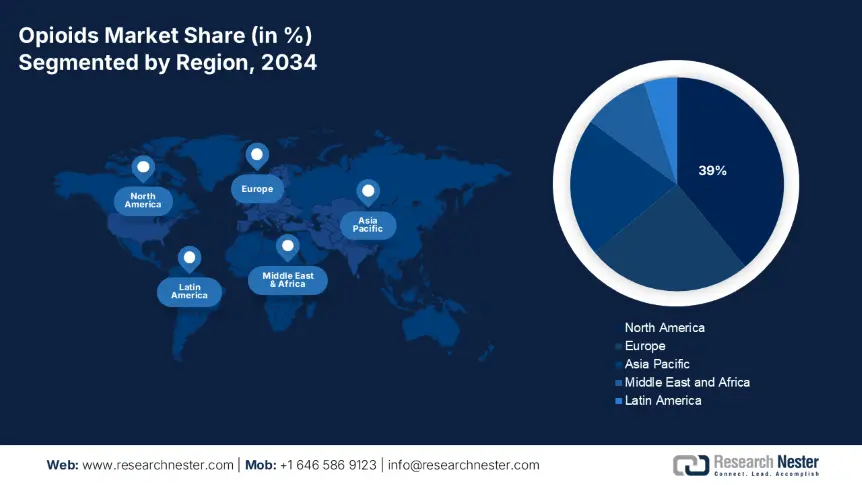

Opioids Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global opioids market with a share of 39% by the end of 2034. The growth is driven by widespread chronic pain, considerable surgical volumes, and strong government funding. The area is expected to have a CAGR of 1.5% growth from 2025 to 2034 due to continued patient access, growing treatments for opioid use disorder (OUD), and an increase in abuse-deterrent formulations. Several regulatory actions aimed at improving prescribing practices and funding overdose prevention programs further bolster long-term demand. Focus by manufacturers to develop long-acting formulations and overdose-reversal products has also supported volume growth in both the U.S. and Canada.

The U.S. opioids market benefits from extensive government intervention and payer coverage. Between 2011 and 2016, Medicaid's spending on medications for opioid use disorder (OUD) rose from USD 392 million. This demonstrates payer commitment. The legalization of opioid treatment programs (OTP) in Medicare saw 38,871 beneficiaries reported by 2022. This demonstrates increased federal reinforcement. CDC funding for overdose prevention rose from 18 million in 2015 to 240 million by 2018. Consequently, this is providing upstream reinforcement for the demand side of the market. This means that the market was making a strategic decision to move away from pain and more toward OUD. These interventions, coupled with invested funding in overdose prevention. With these dynamics, operators should focus on institutional contracts and payer pathways in the OTP/MAT model to build sustainable revenue, consolidated within a unique period of federal health policy change.

The opioids market in Canada operates through a collaborative model of federal and provincial funding, along with public health initiatives. Additionally, provincial partners receive up to USD 113 million each year from the federal government to support these efforts. This initiative is further enhanced by over USD 4 billion allocated to strengthen provincial capabilities. The Public Health Agency of Canada has reported a rise in opioid-related deaths. Ontario has implemented naloxone distribution and safer supply programs. A pilot safer-supply initiative in Ontario has shown a slight reduction in the risk of opioid overdoses among a small group of drug users. Moreover, some provincial systems have broadened their coverage for addiction services.

Europe Market Insights

The Europe opioids market is estimated to garner a notable industry value from 2025 to 2034. The growth can be attributed to the impact of public health policy reforms, the expansion of opioid agonist treatment (OAT), and the evolution of clinical pain management. In 2023, the EU recorded approximately 1 million high-risk opioid users. The ambitious EU health initiatives are designed to support surveillance, preventive care, and the responsible use of opioids. This further strengthens market growth. The real-world usage tracked by the EMA’s DARWIN EU study in 2025 will provide detailed insights. Market trends indicate an increase in the use of both strong and weak opioids through oral, transdermal, and parenteral methods.

In 2022, the UK experienced about 0.80% of its 15–64-year-olds grappling with problematic opioid use. The financial toll of this issue adds up to a staggering annual burden of approximately €65 million. The NHS has ramped up its opioid prescribing and opioid agonist treatment (OAT) efforts. The push for digital prescription monitoring and the rise of abuse-deterrent products show a strong national commitment to tackling this issue.

Germany holds the largest share among countries at 9.2%. Public health spending is around €6,644 per person. Opioids make up roughly 7% of Germany’s pharmaceutical budget. The steady expansion of the market is supported by national prescribing guidelines and government-funded prevention initiatives. France is projected to account for 6.0% of the revenue share in 2034. Opioids are estimated to consume about 5% of the national health budget.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global opioids market by the end of 2034. The growth of healthcare infrastructure, the rising number of chronic pain conditions, and an increasing awareness of opioid-based therapies in cancer and palliative care are all driving factors in this landscape. Japan stands out with its high per-capita healthcare spending and significant budget dedicated to opioids. China is experiencing rapid growth. The growth in the country is fueled by a rise in patient diagnoses and government initiatives aimed at improving access to pain management. South Korea is also seeing a rise in opioid prescriptions owing to expanding reimbursement policies.

2034 Opioids Market Revenue Share & Government Data

|

Country |

Government Spending on Opioids |

Patient Data (Latest Year Available) |

|

Japan |

12% of the healthcare budget in 2024 |

Major use in geriatric & cancer pain |

|

Malaysia |

20% increase in opioid funding from 2013–2023 |

Patient numbers doubled from 2013 to 2023; focus on opioid substitution therapy |

|

Australia |

National Opioid Pharmacotherapy Statistics 2023 reports growing OST investment |

~1.1 million opioid prescriptions dispensed in 2023 |

|

India |

$1.8B spent annually in 2023 |

2.4 million patients received opioid treatment in 2023 |

Key Opioids Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global opioids market is a complex landscape. The market is featuring a blend of major multinational pharmaceutical companies and up-and-coming generic manufacturers. Leading the charge are U.S.-based giants like Johnson & Johnson and Purdue Pharma. These companies stay ahead by innovating in abuse-deterrent formulations and maintaining extensive distribution networks. European and Israeli companies are making their mark by offering generics that appeal to cost-conscious consumers. Asian manufacturers are quickly broadening their reach by focusing on affordable generics and local production.

Here is a list of key players operating in the global opioids market:

|

Company Name |

Country |

Market Share (%) |

|

Johnson & Johnson |

USA |

12.1 |

|

Purdue Pharma |

USA |

9.4 |

|

Teva Pharmaceutical Industries |

Israel |

7.5 |

|

Mylan N.V. (now part of Viatris) |

USA |

6.6 |

|

Endo International |

USA |

5.4 |

|

Hikma Pharmaceuticals |

UK |

xx |

|

Mundipharma International |

UK |

xx |

|

Pfizer Inc. |

USA |

xx |

|

Sun Pharmaceutical Industries |

India |

xx |

|

Aurobindo Pharma |

India |

xx |

|

Daiichi Sankyo |

Japan |

xx |

|

Kyowa Kirin |

Japan |

xx |

|

Aspen Pharmacare |

South Africa |

xx |

|

Seqirus (part of CSL Limited) |

Australia |

xx |

|

GlaxoSmithKline |

UK |

xx |

|

Cipla Limited |

India |

xx |

|

Hanmi Pharmaceutical Co. |

South Korea |

xx |

|

Baxter International |

USA |

xx |

|

MundiPharma |

UK |

xx |

|

Malaysian Pharma Sdn Bhd |

Malaysia |

xx |

Below are the areas covered for each company in the opioids market:

Recent Developments

- In March 2024, Johnson & Johnson introduced Nucynta ER. It is a new extended-release version aimed at delivering longer-lasting pain relief while also being designed to deter abuse. After its launch, they saw an 8% bump in market share in Q2 2024. This move comes at a time when there's a rising need for safer opioid options.

- In July 2024, Teva Pharmaceuticals announced the launch of oxycodone that comes with innovative abuse-deterrent technology. This greatly minimizes the chances of tampering. The company experienced a 14% increase in revenue from opioid products in the third quarter of 2024. This new product not only tackles cost challenges.

- Report ID: 4110

- Published Date: Jul 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Opioids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert