Nail Care Market Outlook:

Nail Care Market size was estimated at USD 24.9 billion in 2025 and is expected to surpass USD 36.1 billion by the end of 2035, rising at a CAGR of 5.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of nail care is assessed at USD 26.1 billion.

The primary growth driver is the consumer shift towards wellness and self-care, which has elevated nail care from a cosmetic service to an essential component of personal well-being. This trend fuels demand across both professional salon services and the retail DIY segment, as consumers seek products that offer salon-quality results at home. Innovation in product formulations, such as long-wear, gel-effect, and "breathable" polishes, caters to this demand for both performance and nail health, directly driving market expansion and premiumization.

Driven by the social media-powered nail art trend, consumer demand is evolving towards more creative and durable products. This has accelerated industry investment in research and development, specifically for longer-lasting, non-toxic formulations. Although the COVID-19 pandemic significantly disrupted raw material supply chains, leading many companies to expand their production capacity, the overarching trend remains a strong commitment to innovation. Key R&D areas now include product strengtheners and novel application methods to meet heightened consumer expectations.

Key Nail Care Market Insights Summary:

Regional Highlights:

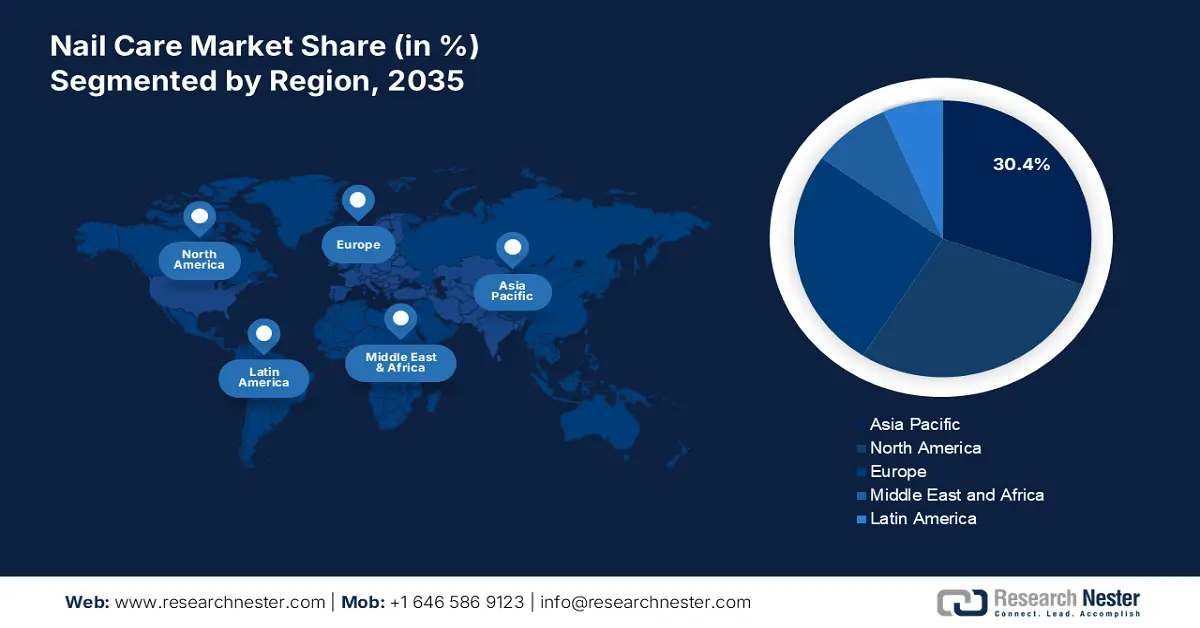

- Asia Pacific region is projected to secure a 30.4% share of the nail care market, supported by rising consumer inclination toward eco-responsible beauty choices and expanding digital influence.

- By 2035, the North American region is expected to command a 28.6% share, underpinned by increasing adoption of long-lasting, non-toxic formulations.

Segment Insights:

- Over 2026–2035, the online retail segment is projected to capture a 42.1% share of the nail care market, stimulated by its convenience, broad assortment, and digital-driven purchasing behavior.

- Nail polish segment is set to attain a 38.1% share, propelled by fashion-centric consumer preferences and advancements in eco-friendly, long-wear formulations.

Key Growth Trends:

- Growing popularity of nail art

- Expansion of professional nail salons

Major Challenges:

- Consumer demand for transparency and ethical practices

- Non-tariff barriers and market access challenges

Key Players: Coty Inc. (Sally Hansen), L'Oréal Group (Lancôme, Essie), Revlon, Inc., Amorepacific Corporation, Orly International, Inc., Manicare Pty Ltd, Lakmé (Hindustan Unilever Ltd.), LVMH (Make Up For Ever), Sally Hershberger (Private Label), COSMAX Inc., Mineral Fusion, K-Beauty Brands (Etude House), Ever Bilena

Global Nail Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.9 billion

- 2026 Market Size: USD 26.1 billion

- Projected Market Size: USD 36.1 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 28 August, 2025

Nail Care Market - Growth Drivers and Challenges

Growth Drivers

-

Growing popularity of nail art: The emergence of nail art as a popular trend, primarily fueled by the advent of social media and influencer marketing, has exacerbated the demand for innovative and unique products in nail care. The demand for nail art is escalating rapidly, driven by social media platforms such as Instagram, TikTok, and Pinterest. These channels allow trends to spread instantly, powerfully influencing consumer purchasing decisions for both services and products. In response, brands are accelerating innovation to introduce unique formulations and a vast array of accessories. This demand is driving brands to ramp up innovation, introducing unique formulations and products for both professional salons and DIY home use. To meet the desire for creative self-expression, the market is responding with long-lasting products, versatile tools, and an expansive range of colors and options.

-

Expansion of professional nail salons: The proliferation of nail salons in urban and semi-urban areas is a key growth driver for the industry. This expansion fuels B2B demand for professional-grade products, including single-use items and branded kits for services like gel manicures and acrylic extensions. Furthermore, salons act as powerful marketing channels, where consumer trial of professional-quality products often translates into at-home purchasing decisions. The growing middle class, with its increased demand for quality services and a heightened focus on hygiene, will continue to propel the growth of both nail salons and the overall professional nail care market.

-

Shift toward vegan and non-toxic formulations: Growing consumer awareness is accelerating demand for vegan, cruelty-free, and non-toxic beauty products. In response, companies are reformulating to phase out harmful ingredients like formaldehyde, toluene, and dibutyl phthalate. This shift is supported by stricter regulatory guidelines in Europe and North America, reinforcing the move toward clean beauty. Ultimately, this focus on ethical and sustainable formulations is a key differentiator in an overcrowded market, helping brands build a positive reputation and align with the larger values of modern consumers.

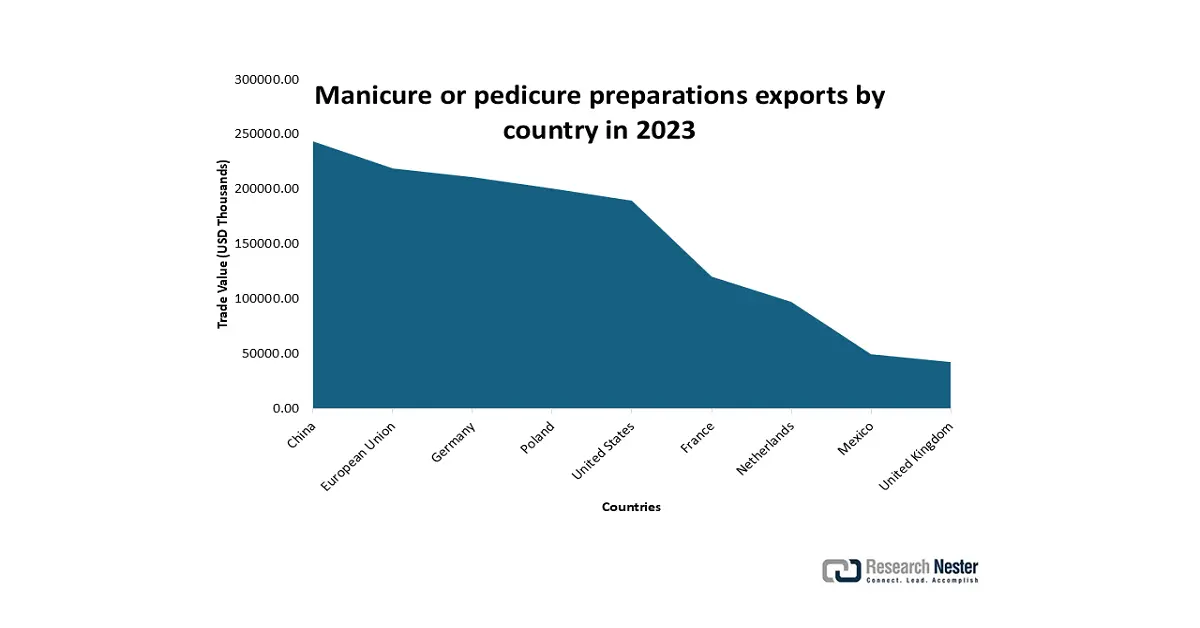

Emerging Trade Dynamics and Market Prospects

The global export market for manicure and pedicure preparations is a primary engine for the professional nail care industry, driving innovation and setting international quality and trend standards. Strong export performance signals robust worldwide demand, compelling B2B manufacturers to scale production and expand their distribution networks. This international trade flow directly influences the supply chain, determining the availability and cost of key raw materials and finished products for salons and distributors. Consequently, tracking these export figures provides critical intelligence for forecasting market growth, identifying emerging trends, and making strategic inventory and investment decisions.

(Source: wits.worldbank.org)

Challenges

-

Consumer demand for transparency and ethical practices: Modern consumers are increasingly prioritizing the ethical and environmental footprint of their purchases, demanding greater transparency across the entire value chain from ingredient sourcing and manufacturing practices to corporate social responsibility. To meet these expectations, brands must invest significantly in clean, sustainable ingredients and overhaul their production processes. This shift is more than a regulatory obligation; as the World Bank notes, with nearly half of all consumers actively seeking brands committed to safety and sustainability, clarifying this commitment is a powerful market differentiator. It fosters agility, builds trust, and creates a structured competitive advantage in an evolving marketplace.

-

Non-tariff barriers and market access challenges: Beyond tariffs, non-tariff barriers (NTBs) such as import licensing, customs procedures, and technical standards can effectively block market entry. These barriers are country-specific and are particularly challenging for nail care products, which must comply with strict labeling and safety requirements. According to the World Trade Organization, NTBs can increase trade costs even more than tariffs. This is evident in the nail care industry, where compliance with diverse regulations can sometimes double the cost of trade.

Nail Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 24.9 billion |

|

Forecast Year Market Size (2035) |

USD 36.1 billion |

|

Regional Scope |

|

Nail Care Market Segmentation:

Distribution Channel Segment Analysis

The online retail segment is predicted to gain the largest market share of 42.1% during the projected period. This is due to convenience, variety, and competitive prices. The COVID-19 pandemic catalyzed the growth of e-commerce and started a trend for online shopping to become a primary channel for nail care products among online shoppers. Furthermore, online shopping grants consumers access to a vast assortment of international brands, detailed reviews, and tutorial content, all of which drive purchase decisions. This is amplified by engaging models like subscription boxes and personalized AI-powered recommendations. Moreover, online sales offer retail brands reduced overhead, which allows for promotional offers on the product.

Product Type Segment Analysis

The nail polish segment is anticipated to constitute the most significant growth by 2035, with 38.1% market share, mainly due to its versatility and the fashion trends it has established, along with the ongoing improvements in colors, finishes, and formulations, including long-lasting and eco-friendly nail polishes. The global demand for nail polish is fueled by two primary factors: increased consumer disposable income and a greater emphasis on fashion consciousness. This demand is further accelerated by the persistent trends in nail art and seasonal styles, which prompt higher consumer spending. Additionally, market innovation is being shaped by a shift toward non-toxic and vegan formulations, a trend that resonates strongly with younger generations who are increasingly mindful of health and sustainability.

End use Segment Analysis

The salons & spas segment is anticipated to constitute the most significant growth by 2035, with 35.2% market share, mainly due to increasing demand in professional grooming, artistic style with artificial nails, and even treatments like paraffin baths, manicures, pedicures, nail enhancements, and nail arts. The segment is poised for growth, driven by consumer demand for high-quality, hygienic, and customized beauty experiences. Fueled by rising disposable incomes, urban lifestyles, and social media trends, clients are increasingly choosing professional services over at-home solutions. This shift not only builds a loyal clientele but also generates significantly higher revenue opportunities for salons.

Our in-depth analysis of the global nail care market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nail Care Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 30.4% of the market share due to changing consumer sentiments towards presumably superior and environmentally responsible options. Increased penetration of digital beauty influencers and social media trends will spur product sales, especially in urban areas. The region benefits from a growing middle class with increasing spending power. Moreover, the rise of e-commerce has dramatically expanded market access, enabling the region to capitalize on new opportunities and accelerate its growth trajectory.

China, the largest APAC nail care market, is expected to see a sharp increase in sales. This is driven by its massive consumer scale, rapid urbanization, an expanding middle class with higher disposable income, and growing consumer awareness. Furthermore, government policies from bodies like the MEE and NDRC are promoting sustainability in the chemical industry, incentivizing a strategic shift towards green innovation and eco-friendly product development that aligns with modern consumer values.

China's Trade in Manicure or Pedicure Preparations (May 2025)

|

Top Export Destinations |

Value (USD) |

Top Import Origins |

Value (USD) |

|

United States |

7.87M |

France |

361k |

|

Mexico |

1.85M |

Japan |

22.2k |

|

Vietnam |

1.70M |

United Kingdom |

21.0k |

|

United Kingdom |

1.37M |

South Korea |

4.31k |

|

Japan |

1.22M |

Netherlands |

3.02k |

(Source: OEC)

North America Market Insights

By 2035, the North American market is expected to hold 28.6% driven by the influence of social media trends, a rising preference for long-lasting and non-toxic formulations, and the integration of nail care into broader wellness routines. The market is highly competitive and innovative, with a significant shift towards vegan, cruelty-free, and eco-friendly products. E-commerce continues to expand access to a diverse range of brands, further propelling the region's market potential.

The U.S. nail care market is a dynamic and mature industry, driven by strong consumer interest in both salon services and at-home manicure solutions. Demand is fueled by beauty trends amplified through social media, a growing preference for gel and dip powder products that offer extended wear, and heightened awareness of ingredient safety and sustainability. The market is highly competitive and innovative, with leading brands focusing on vegan, 15-free+ formulas, and digital tools for shade matching and virtual try-ons. E-commerce and subscription models further enhance accessibility, solidifying the segment's significant role within the broader U.S. beauty and personal care landscape.

Europe Market Insights

By 2035, the European market is expected to hold a 25.9% market share, characterized by a strong consumer emphasis on product safety, sustainability, and premium quality. Driven by stringent EU regulations on chemical ingredients and a rising demand for vegan and cruelty-free products, innovation is focused on long-lasting, non-toxic formulations. The market blends a thriving professional salon culture with a robust at-home segment, influenced heavily by digital beauty trends and eco-conscious purchasing behavior. Western European nations, particularly the UK, Germany, and France, lead in consumption and set trends for the broader region.

Key Nail Care Market Players:

- Coty Inc. (Sally Hansen)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- L'Oréal Group (Lancôme, Essie)

- Revlon, Inc.

- Amorepacific Corporation

- Orly International, Inc.

- Manicare Pty Ltd

- Lakmé (Hindustan Unilever Ltd.)

- LVMH (Make Up For Ever)

- Sally Hershberger (Private Label)

- COSMAX Inc.

- Mineral Fusion

- K-Beauty Brands (Etude House)

- Ever Bilena

The nail care market is highly competitive and fragmented, with many multinational conglomerates at the top. Differentiation happens in innovation in the form of long-lasting, non-toxic, and gel-based nail polish formulations. South Korean brands create trendy, fashion-forward designs and have the ability to roll out rapid product deployment. Various manufacturers continue to pursue mergers, acquisitions, sustainability initiatives, and an overall global presence to satisfy the desire of consumers to become more environmentally aware.

Some of the key players operating in the market are listed below:

Recent Developments

- In September 2024, Olive & June introduced a press-on nail space with their Super Stick Mani, which features ultra-thin adhesive tabs made from low-molecular-weight acrylate for a more natural look and longer wear time. Clinical testing showed the product had an average wear time of seven days, which is about 58% longer than the leading competitors. The wear time of the innovative adhesive and the flexible nail is a new benchmark in the press-on nail industry.

- In September 2024, DefenAge launched the first nail care serum to target nail care at the root with Defensins, which are peptides found in Inneov that trigger LGR6+ stem cells responsible for nail growth. In clinical trials, DefenAge demonstrated a 46% overall improvement in nail surface smoothness, a 24% increase in nail hardness, and a 23% increase in nail growth rate over three months. This has been a large step forward in addressing nail health at the cellular level.

- Report ID: 76

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nail Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.