Montelukast API Market Outlook:

Montelukast API Market size was USD 5.7 billion in 2025 and is anticipated to reach USD 17.2 billion by the end of 2035, increasing at a CAGR of 13.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of montelukast API is estimated at USD 6.4 billion.

The international market is highly driven by a surge in the burden of chronic respiratory illness conditions, such as asthma and allergic rhinitis. According to an article published by the Global Asthma Report in 2025, nearly 1 in 10 children are affected by asthma, which is the most common non-communicable disease (NCD). In addition, the disease is also common among adults, affecting approximately 1 in 15 adults. Besides, the July 2025 CDC report noted that the yearly physician office visits in the U.S. are 4.9 million, which account for 6.3% of the overall visits. Additionally, the emergency department visits in the country for the disease are 1.4 million, which excludes chronic obstructive asthma.

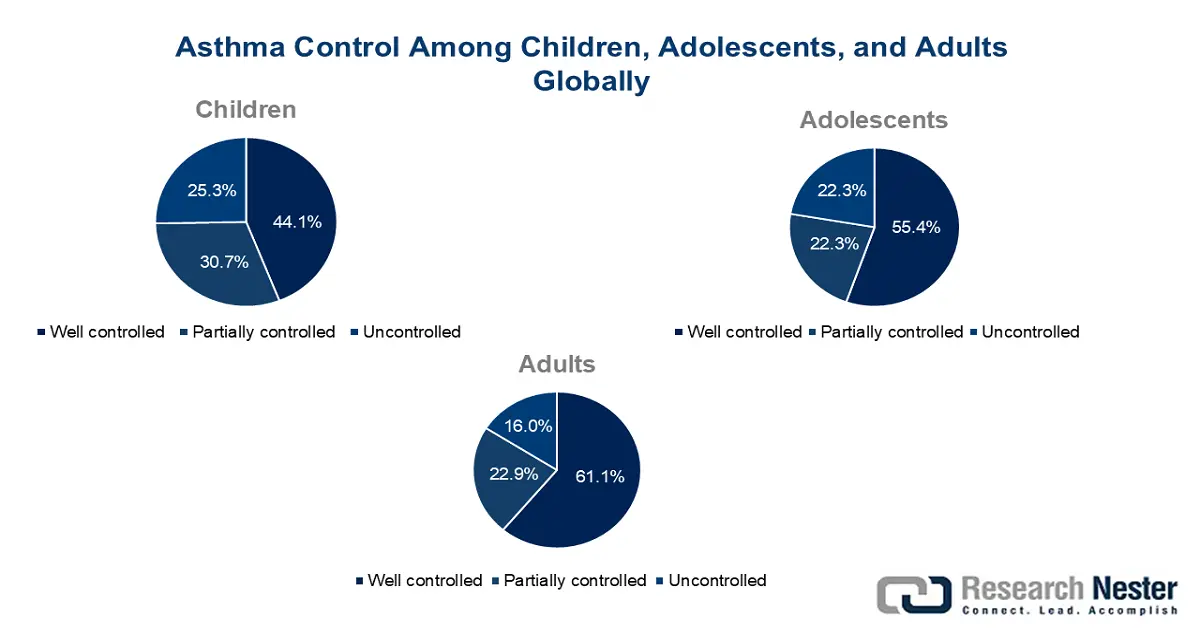

Source: 2022 Global Asthma Report

Moreover, according to the 2022 Global Asthma Report, asthma has been diagnosed by doctors among 6.3% of children across 44 facilities in 16 countries, followed by 7.9% of adolescents in 63 facilities across 25 nations, and 3.5% of adults in 43 centers across 17 countries. Besides, 44.1% of children, 55.5% of adolescents, and 61.1% of adults successfully had their asthma in control. Meanwhile, the API supply chain has readily encompassed quality assurance, intermediate synthesis, crystallization, purification, and raw chemical procurement, which is also driving the montelukast API market globally. The sudden shift in expenses affected formulators and buyers internationally, particularly those relying on imports from India and China.

Key Montelukast API Market Insights Summary:

Regional Highlights:

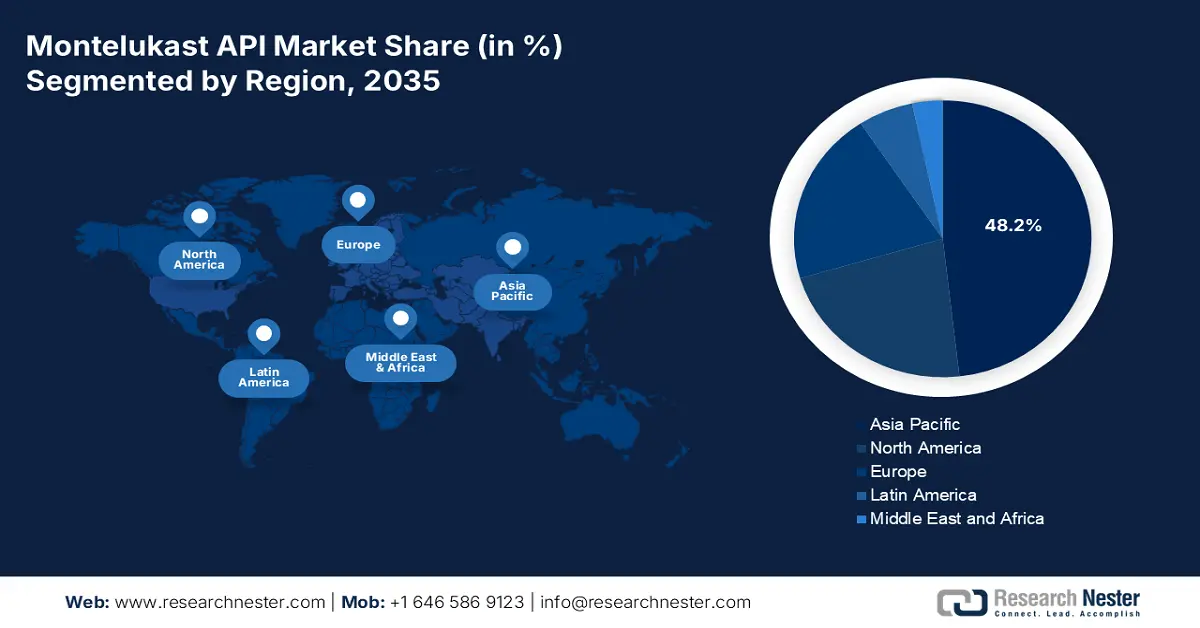

- The Asia Pacific montelukast API market is projected to secure the highest 48.2% share by 2035, supported by robust generic manufacturing capabilities, growing respiratory disease prevalence, and substantial government healthcare funding.

- The Europe region is forecast to register the fastest growth through 2026-2035, owing to an aging population, increasing allergic and asthma incidences, and broader acceptance of generic formulations.

Segment Insights:

- The generic drug manufacturers segment in the montelukast API market is anticipated to hold the dominant 85.8% share by 2035, propelled by the rising availability of cost-effective and safe medications that reduce healthcare expenditures.

- he direct sales (B2B) segment is projected to capture the second-largest share by 2035, impelled by manufacturers’ direct engagement with large-scale consumers such as CMOs and pharmaceutical companies ensuring quality compliance and efficient supply chains.

Key Growth Trends:

- Government expenditure through Medicaid and Medicare

- Cost-effectiveness and improvement in healthcare quality

Major Challenges:

- Restrictions in health and medical coverage

- Labeling restrictions and neuropsychiatric safety concerns

Key Players: Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Cipla Ltd., Aurobindo Pharma Ltd., Dr. Reddy’s Laboratories, Hetero Labs Ltd., Mylan N.V. (Viatris Inc.), Glenmark Pharmaceuticals, Torrent Pharmaceuticals Ltd., Zhejiang Huahai Pharmaceutical Co., Jubilant Ingrevia Ltd., Shandong Binnong Technology Co., Ltd., Apotex Pharmachem Inc., Hanmi Pharm Co., Ltd., Kyowa Hakko Kirin Co., Ltd., Pharmachem Laboratories, Towa Pharmaceutical Co., Ltd., Biocon Ltd., Asahi Kasei Pharma Corp., CCM Pharma (Chemical Co. of Malaysia).

Global Montelukast API Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 6.4 billion

- Projected Market Size: USD 17.2 billion by 2035

- Growth Forecasts: 13.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: Brazil, South Korea, Italy, United Kingdom, Canada

Last updated on : 30 September, 2025

Montelukast API Market - Growth Drivers and Challenges

Growth Drivers

- Government expenditure through Medicaid and Medicare: The aspect of Medicaid and Medicare spending on noncommunicable disease-based respiratory drugs denotes a huge growth driver for the montelukast API market globally. Besides, according to an article published by Medrxiv Organization in June 2024, montelukast achieved the greatest adverse drug reaction (ADR) rate of 15.6 per 100,000. Therefore, this indicates that montelukast tends to display an effective range of system organ class levels and is statistically significant for psychiatric ADR, thus suitable for the market’s growth.

- Cost-effectiveness and improvement in healthcare quality: The aspect of montelukast treatment in mild and moderate asthma cases usually lowers hospitalization and ensures suitable savings in Medicare costs for at least two years, which is uplifting the montelukast market internationally. As per the December 2024 Exploratory Research in Clinical and Social Pharmacy article, the Agency for Healthcare Research and Quality (AHRQ) Medical Expenditure Survey Panel (MEPS) in 2022 indicated that community-based pharmacies provided montelukast in the U.S. to 6.8 million patients. This, in turn, resulted in an upsurge of nearly 2 million patients per year, thus driving the market’s growth.

- Development of notable dosage forms: These are extremely critical in pharmacology since they are able to transform APIs into suitable products that are convenient, safe, effective, and stable for patients, thereby proliferating the montelukast API market internationally. As stated in an article published by NLM in March 2023, montelukast is rapidly absorbed through 10 mg film-based tablet administration, after which the montelukast plasma concentration in adults is achieved in 3 to 4 hours. Additionally, the average bioavailability is 64%, which is suitable for bolstering the overall market’s development.

Asthma Severity Symptoms by Age Group and Country Income Level Driving the Montelukast API Market (2022)

|

Components |

Age 6 to 7 |

Age 13 to 14 |

Adults |

|||

|

Income Levels |

% Severe |

Number of Centers |

% Severe |

Number of Centers |

% Severe |

Number of Centers |

|

Low- to lower-middle |

38.3 |

14 |

53.3 |

19 |

36.2 |

12 |

|

Upper-middle |

47.4 |

22 |

47.9 |

33 |

42.4 |

25 |

|

High-income |

37.8 |

8 |

42.3 |

11 |

36.5 |

6 |

Source: Global Asthma Report

2023 Global Health Expenditure Uplifting the Montelukast API Market

|

Countries |

% of GDP |

|

U.S. |

16.6 |

|

Germany |

11.7 |

|

Switzerland |

11.6 |

|

France |

11.5 |

|

Sweden |

11.2 |

|

Canada, Austria |

11.1 |

|

UK |

10.9 |

|

Australia |

9.8 |

Source: OECD

Challenges

- Restrictions in health and medical coverage: The treatment expense for montelukast is extremely high, particularly in the U.S., along with stringent Medicare coverage. This usually minimizes the patients’ accessibility to standard treatments associated with asthma, thereby causing a hindrance in the montelukast API market internationally. Besides, various regional Medicaid programs are readily focused on cost-effective corticosteroids, leading to montelukast being categorized under preferable drug tiers. Therefore, these challenges reduce the surge in low-income patients witnessing montelukast, allergic rhinitis, and asthma treatment.

- Labeling restrictions and neuropsychiatric safety concerns: The U.S. FDA’s boxed warning, which is the strongest safety alert, preferably for neuropsychiatric events, has a negative impact on the market globally. This usually has necessitated a risk evaluation and mitigation approach, thereby enhancing the administrative burden for pharmacists and prescribers. Besides, a few clinicians might select alternative therapy options, which tends to limit montelukast’s usability to more critical cases and eventually cap its market potential. However, to combat this, API suppliers need to continuously monitor the drug’s safety profile and remain prepared for additional restrictions.

Montelukast API Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.1% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 17.2 billion |

|

Regional Scope |

|

Montelukast API Market Segmentation:

Customer Type Segment Analysis

Generic drug manufacturers segment in the market is expected to garner the largest share of 85.8% by the end of 2035. The segment’s growth is highly driven by the provision of equally accessible and cost-effective safety and suitable medications that can lower expenses for patients and healthcare systems. Besides, as per the March 2023 FDA Government article, 91% of overall prescriptions are filled with generic drugs, with over 32,000 successfully approved by the FDA. In addition, the FDA has displayed that the generic drugs approval was valued at USD 53.3 billion, thus suitable for the segment’s upliftment.

Distribution Channel Segment Analysis

Direct sales (B2B) segment in the montelukast API market is projected to constitute the second-largest share during the forecast duration. The segment’s upliftment is highly fueled by manufacturers directly selling to large-scale consumers, especially to contract manufacturing organizations (CMOs) and pharmaceutical organizations. Besides, the segment’s dominance is also subject to the API procurement nature, which comprises long-term and high-volume supply agreements demanding strict quality assurance, direct technical collaborations, and consistent logistics. Additionally, this particular channel has reduced intermediary margins, permitting tight control and competitive pricing over supply chain integrity.

Application Segment Analysis

Asthma segment in the market is anticipated to hold the third-largest share by the end of the projected timeline. The segment’s development is highly driven by its importance for the market because montelukast is a suitable medication, which has been designed to treat the disease by deliberately blocking leukotrienes. As per the May 2023 CDC data report, the weighted number of asthma cases for children is an estimated 24.9 million, constituting 7.7%. Besides, for adults, the number is 20.2 million, which is 8.0% of the overall cases, thereby suitable for boosting the market internationally.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Customer Type |

|

|

Distribution Channel |

|

|

Application |

|

|

Purity Level |

|

|

Formulation Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Montelukast API Market - Regional Analysis

APAC Market Insights

Asia Pacific market is projected to garner the highest share of 48.2% by the end of 2035. The market’s upliftment in the region is highly attributed to the strong generic manufacturing bases, a rise in challenges in respiratory diseases, and the presence of government healthcare funding. Besides, countries including China, Japan, and India are considered the largest shareholders in the overall region, with India deliberately leading the market as one of the topmost montelukast API suppliers. According to an article published by the World Health Organization in July 2025, noncommunicable diseases account for 55% of all deaths, with half prematurely occurring between 30 and 69 years of age, thus denoting a huge growth opportunity for the market.

The market in India is growing significantly, owing to the aspect of being the largest producer. Along with an emerging consumer of montelukast API. As per an article published by the PIB in December 2024, the pharmaceutical market in the country is valued at USD 50 billion, with the regional consumption accounting for USD 23.5 billion and export valuation of USD 26.5 billion. Besides, botanical products and pharmaceutical medications account for Rs. 4,56,246 crores as of 2023, while 9.2 lakhs people are readily engaged in these sectors, thereby positively impacting the overall market in the country.

China is also developing due to the presence of the National Medical Products Administration (NMPA) overseeing a huge domestic market, government healthcare reforms, expansion in insurance coverage, and an increase in accessibility to chronic disease treatments. As stated in the December 2023 NLM article, noncommunicable diseases account for 88.5% of the total country’s deaths and readily cater to 84.9% of the disease burden. However, to keep a check on this, the country’s present healthcare system has effectively emphasized specialist and hospital-based treatment, which is suitable for boosting the market’s development.

Noncommunicable Diseases and Treatment Prevalence in Asia (2023)

|

Components |

Prevalence/Treatment/Initiatives |

|

Cardiovascular Diseases |

2.9 million |

|

Commitment to SDB 3.4 target |

33% reduction in NCD by 2030 |

|

Tobacco use prevalence |

32% reduction by 2025 |

|

Medication availability |

90% of countries in the region in 50% of health institutions |

|

NCD monitoring |

50% of countries reported suitable technology availability for early detection and diagnosis |

|

Hypertension |

50,000 to 70,000 patients diagnosed in Thailand |

|

Hypertensive and diabetic patients |

75 million in India to undertake care by 2025 |

Source: The Lancet Regional Health - Southeast Asia

Europe Market Insights

Europe market is projected to emerge as the fastest-growing region during the forecast duration. The market’s growth in the region is highly driven by a surge in respiratory disease, an aging population, and expanded generic drug adoption. In addition, the Europe Health Data Space report highlighted that there is a regional rise in allergic rhinitis and pediatric asthma cases, particularly in the South and West parts of the region. Besides, countries such as Germany, the UK, and France are majorly contributing since these are the major consumers that deliberately receive advantages from formulary purchase and centralized drug pricing by public health systems, thus suitable for the market’s development.

The market in Germany is gaining increasing traction, owing to its determination to ensure in-country drug supply resilience under the domestic Pharmaceutical Strategy. In addition, the country also ensures active ingredient stocks and local formulation, along with reimbursement of montelukast under statutory health insurance schemes, which provides universal accessibility. According to an article published by NLM in May 2023, LLC cell migration has been evaluated by fixing migrated cell on lower surface by utilizing 4% paraformaldehyde solution and Leica, which is a light microscope launched by Wetzlar in the country. The evaluation was executed within 30 minutes and constituted a 0.5% crystal violet stain.

The montelukast API market in France is also developing due to the existence of the French National Authority for Health (HAS), which readily determines the reimbursement status for drugs. Additionally, the country has a huge prevalence of allergic rhinitis, while the Ministry of Solidarity and Health has focused on expenditure for long-lasting illnesses, including critical asthma, and deliberately ensured ongoing funding for suitable treatment options. As stated in the April 2024 World Allergy Organization Journal, 80% of patients suffer from rhinitis and 39% from asthma. Besides, over half of the patient population, which is 70.4% are affected with allergic rhinitis, thereby denoting a huge growth opportunity for the market in the country.

North America Market Insights

North America in the montelukast API market is expected to account for steady growth by the end of the projected timeline. The market’s upliftment in the region is highly fueled by the high prevalence of chronic disease, strong reimbursement systems, and increased generic drug production. According to an article published by the AAFA Organization in March 2025, 28 million people in the region, which is almost 1 in 12, effectively suffer from asthma. In addition, 47% of children in the U.S. with this disease are successfully enrolled in Medicaid, while adults enrolled in this reimbursement policy are twice as likely to suffer from the condition in comparison to adults with private insurance.

U.S. market is gaining increased exposure, owing to a surge in asthma and allergic rhinitis cases. This has readily led to an increase in federal and state-level backing for therapies associated with montelukast. As per the September 2023 CDC report, poorly administered asthma results in almost 2 million emergency department visits every year in the country. In addition, the condition accounts for USD 81.9 billion in annual economic expenses, with healthcare expenditure making up to USD 50.3 billion approximately, thus suitable for bolstering the overall market.

The montelukast API market in Canada is also growing, owing to its modification by the presence of a public healthcare system, which is readily focused on universal accessibility and cost containment. Besides, Health Canada’s administrative alignment with global mandates for high-quality API imports is also positively impacting the overall market in the country. For instance, in 2024, GSK Canada allocated a generous funding of USD 100,000 to effectively support Asthma Canada Awareness and Educational Initiatives on critical asthma, shingles, RSV, and CRSwNP. Additionally, the organization also provided USD 17,500 to initiate a collaboration on the Severe Asthma Patient Help Seeking Campaign, which accounted a 10% of the overall revenue.

Guideline-based Asthma Care Coverage in America

|

Guidelines |

2017 |

2022 |

|

Quick relief medication |

23 |

41 |

|

Controller medication |

9 |

29 |

|

Medical devices |

12 |

34 |

|

Allergy testing |

19 |

43 |

|

Allergy immunotherapy |

21 |

42 |

|

Home visits |

4 |

3 |

|

Self-management education |

13 |

28 |

|

Lung function testing |

- |

25 |

Source: CDC

Key Montelukast API Market Players:

- Sun Pharmaceutical Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Aurobindo Pharma Ltd.

- Dr. Reddy’s Laboratories

- Hetero Labs Ltd.

- Mylan N.V. (Viatris Inc.)

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals Ltd.

- Zhejiang Huahai Pharmaceutical Co.

- Jubilant Ingrevia Ltd.

- Shandong Binnong Technology Co., Ltd.

- Apotex Pharmachem Inc.

- Hanmi Pharm Co., Ltd.

- Kyowa Hakko Kirin Co., Ltd.

- Pharmachem Laboratories

- Towa Pharmaceutical Co., Ltd.

- Biocon Ltd.

- Asahi Kasei Pharma Corp.

- CCM Pharma (Chemical Co. of Malaysia)

The global market is extremely competitive, with notable players connected through government strategies and manufacturing facilities. Besides, notable players, such as Aurobindo, Sun Pharma, and Dr. Reddy’s, are readily dominating the market with administrative certifications, as well as cost efficiency. Companies in the U.S. and Europe, including Apotex, Viatris, and Teva, effectively maintain vertically implemented operations and ongoing API quality. Besides, China-based firms are utilizing semi-synthetic methods to boost production, whereas producers in Korea and Japan are concentrating on high-purity APIs, which are suitable for uplifting the market internationally.

Here is a list of key players operating in the market:

Recent Developments

- In April 2025, Sanofi declared that its respiratory pipeline made the latest advancements in asthma, along with standard plans for the current clinical trials in COPD, including phase 2 results for amlitelimab among adults with moderate and critical asthma.

- In April 2024, Teva Pharmaceutical Industries Ltd. and Launch Therapeutics, Inc. announced a clinical partnership to escalate the clinical research program of Teva’s CS-SABA.

- In January 2024, AstraZeneca notified that AIRSUPRA is currently available in the U.S. by prescription since it has achieved the FDA’s approval for aiding or preventing asthma and assisting in combating breathing problems.

- Report ID: 3995

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Montelukast API Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.