Microporous Materials Market Outlook:

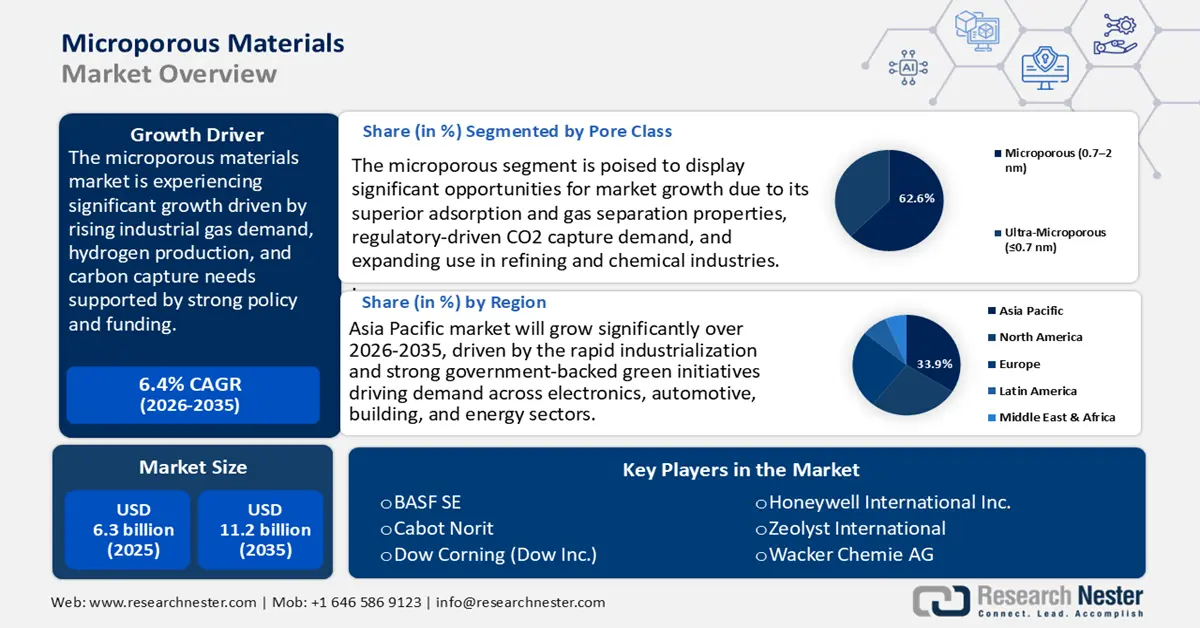

Microporous Materials Market size was valued at USD 6.3 billion in 2025 and is projected to reach USD 11.2 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, from 2026 to 2035. In 2026, the industry size of microporous materials is assessed at USD 6.6 billion.

The global microporous materials market is expected to witness an upward trend during the projected years, primarily driven by the increased demand for industrial gases and carbon management. Public policy and funding frameworks, particularly for low-carbon hydrogen production, sorbent-based carbon capture, and water-treatment mandates, directly reinforce demand for PSA/CMS, zeolite, and activated-carbon materials. The projections of the IEA reflect the growing hydrogen demand with impetus during the 2030s, which implies the need to consider adsorbent beds in permanent demand when cleaning gases. In addition to this, the U.S. Department of Energy point-source carbon capture and OECD/DAC hub programs promise to invest hundreds of millions of dollars in R&D and pilot-scale program deployments that give a manufacturer visibility on the project. DOE estimates capturing and storing 400 million to 1.8 billion tons of CO2 annually by 2050, with funding targeting the testing of emerging technologies under relevant conditions. Moreover, the 2024 PFAS treatment guidance by the EPA recognizes activated carbon as one of its authorized conformity technologies, which broadens institutional procurement pipelines.

Within the supply side, the microporous materials value chain takes advantage of domestic feeds, regional strength in the processing of materials, and international trade in both raw materials and uses. For instance, in 2022, the U.S. activated carbon industry had domestic production accounting for a significant share of apparent consumption, which increased from 496.2 million pounds in 2017 to approximately 570 million pounds in 2022. The industry relies on both domestic producers, such as Norit, Calgon, and ADA, and imports to meet growing demand driven by applications like water purification and air emissions control. The USGS routinely tracks production and trade of zeolites through the yearly mineral statistics, which are publicly reported. In 2023, seven companies operated nine zeolite mines in six states, producing an estimated 84,000 tons of natural zeolites, a slight increase from 77,400 tons in 2022. Domestic sales in 2023 were about 85,000 tons, 6% more than in the preceding year. The leading businesses accounted for about 74% of total domestic production. Apparent consumption totaled sales at 85,000 tons in 2023, with imports and exports each under 1,000 tons. The price range for natural zeolites remained USD 50–300 per metric ton from 2019 through 2023.

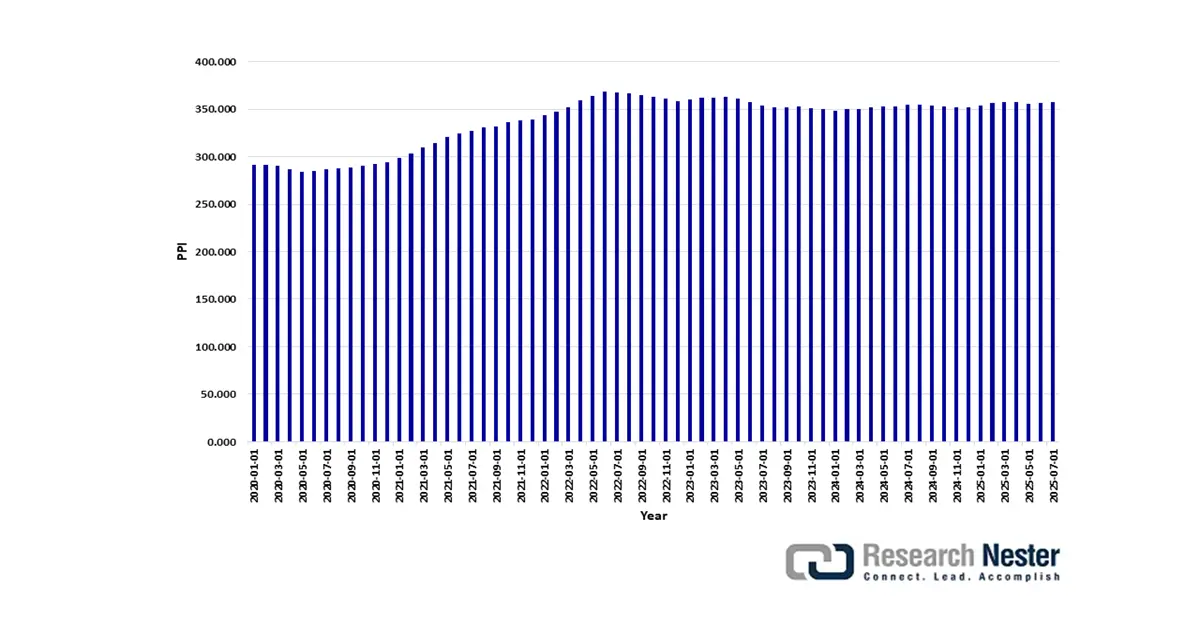

In addition, the PPI of chemical manufacturing products is not separately reported on microporous products, but the chemical manufacturing PPI was also 357.756 in July 2025 (base in December 1984 = 100), and the PPI of industrial gas manufacturing was 276.446 in July 2025 (base in December 2003 = 100). These are reasonable substitutes for the price behavior of micron-sized adsorbents utilized in the extraction of gas.

PPI by Industry: Chemical Manufacturing

Source: U.S. Bureau of Labor Statistics via FRED

Furthermore, the U.S. Department of Energy’s Office of Fossil Energy and Carbon Management announced its intent to provide funding through the Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) Future Growth Grants program to expand CO2 transportation infrastructure. This supports carbon capture projects expected to capture and store 65 million metric tons of CO2 annually by 2030, growing to 450 million metric tons per year by 2040, underpinning large-scale infrastructure buildout to enable decarbonization.

Key Microporous Materials Market Insights Summary:

Regional Highlights:

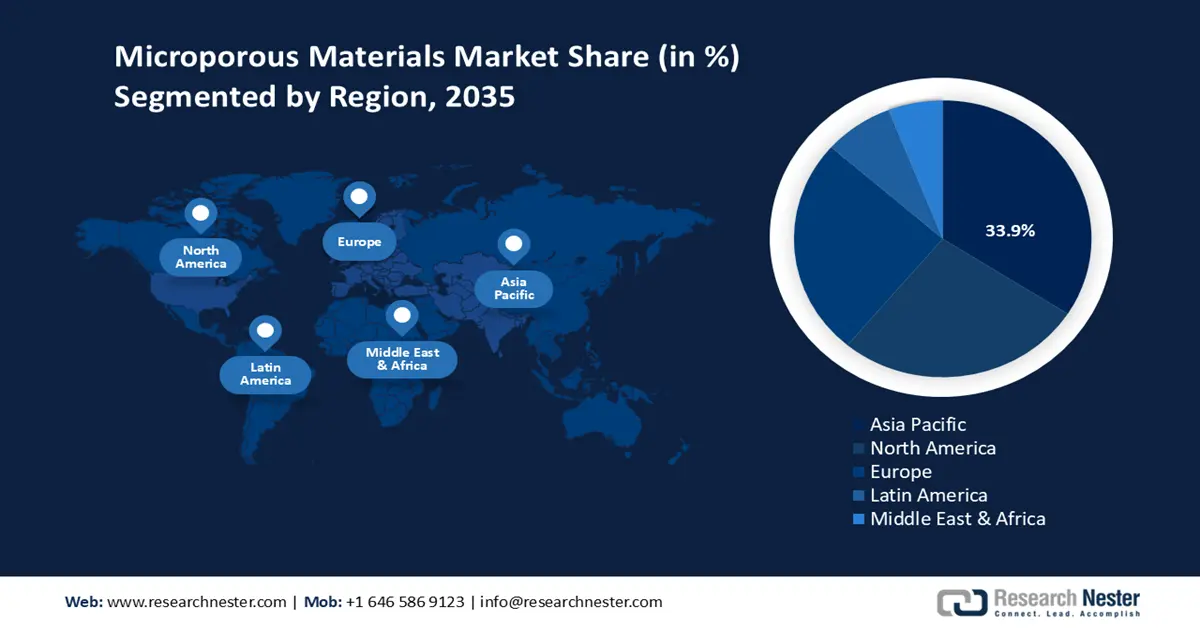

- The Asia Pacific Microporous Materials Market is anticipated to command the largest 33.9% revenue share from 2026 to 2035, fueled by rapid industrialization and strong government support for sustainable manufacturing initiatives.

- North America is expected to account for 26.8% of the market by 2035, bolstered by stringent environmental regulations and large-scale federal investments in clean energy and manufacturing.

Segment Insights:

- The Microporous segment is projected to hold the largest 62.6% share of the Microporous Materials Market from 2026 to 2035, propelled by extensive application in gas separation, adsorption, and catalysis.

- The gas separation & purification segment is anticipated to capture a 38.3% share by 2035, impelled by growing adoption of advanced CO₂ capture technologies using zeolites and metal-organic frameworks (MOFs).

Key Growth Trends:

- Public funding and demonstration projects of carbon capture

- Chemicals regulation / pre-market review cost (TSCA / REACH)

Major Challenges:

- PFAS reporting rule and fines as trade barrier

- Accumulated underloading of forever chemical reporting regulations

Key Players: BASF SE, Cabot Norit, Dow Corning (Dow Inc.), Honeywell International Inc., Zeolyst International, Wacker Chemie AG, Arkema Inc., Solvay, AGC Chemicals Pvt. Ltd., LG Chem, PI Industries.

Global Microporous Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.3 billion

- 2026 Market Size: USD 6.6 billion

- Projected Market Size: USD 11.2 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Brazil, Mexico, Indonesia

Last updated on : 3 September, 2025

Microporous Materials Market - Growth Drivers and Challenges

Growth Drivers

-

Public funding and demonstration projects of carbon capture: Governmentally supported carbon capture projects are a key force in microporous materials demand. The U.S Department of Energy (DOE) has designated USD 1.3 billion under the Carbon Capture Demonstration Projects Program towards speeding of commercial scaling of solid sorbents and advanced separation technology. In January 2025, DOE published its Point-Source Carbon Capture Multi-Year Program Plan, making solid adsorbents a major focus in its R&D future and with an aim of 90% capture efficiency at a cost target of less than USD 40 per metric ton. Such programs directly assist microporous material manufacturers, in particular, zeolites, activated carbons, and new MOFs, by covering initial commercial risk. As increasing numbers of demonstration projects pass to deployment, industrial sorbents demand is expected to increase at high single-digit annual rates through 2035.

-

Chemicals regulation / pre-market review cost (TSCA / REACH): Compliance costs relating to regulations on chemical safety are adding to the operational cost and are affecting the prices of compliant microporous materials. Reflecting the increased cost of administration, the U.S. EPA's 2023 update to the Toxic Substances Control Act (TSCA) raised the new-chemical review fee from $16,000 to $45,000 per submission, a change that impacts manufacturers and other entities seeking market entry. Simultaneously, the European Chemicals Agency (ECHA) proceeded with its proposal to restrict the use of PFAS, which may involve over 10,000 substances in various industries. These regulatory changes drive higher compliance expenditures. Impact assessments indicate that producers of specialty adsorbents serving tightly regulated sectors will experience a substantial increase in operational costs. As a result, suppliers now focus on implementing investments in high-purity microporous materials pre-certified in order to prevent disruption of trade in the U.S. and EU microporous materials markets.

-

Feedstock and trade flows - supply concentrations and dependence on imports: The microporous materials supply chain is based on the stakes placed on mineral feedstocks and activated carbon trade, and government data bring into the limelight trade dependencies. The U.S. natural zeolite production reached 84,000 metric tons in 2023, yet the domestic supply still required import supplementation. This dependence on external sources creates price volatility and supply chain security risks, particularly as demand grows from critical markets like gas purification, LNG dehydration, and PFAS cleanup. In response, manufacturers are increasingly localizing refining and processing operations near feedstock sources to minimize import reliance and build more resilient supply chains.

Import Trends for Microporous Activated Carbon, 2023

|

Country/Region |

Trade Value (1000 USD) |

Quantity (in Kg) |

|

Mexico |

87,441.99 |

18,241,000 |

|

European Union |

73,439.39 |

14,542,000 |

|

China |

50,046.21 |

6,211,490 |

|

Korea, Rep. |

44,224.94 |

3,073,690 |

|

Canada |

36,465.82 |

8,880,660 |

|

Belgium |

32,366.61 |

9,411,210 |

|

Japan |

20,405.59 |

3,167,140 |

|

Germany |

16,256.19 |

3,095,860 |

|

Poland |

10,778.90 |

1,022,280 |

|

India |

9,762.59 |

1,935,090 |

|

Honduras |

8,913.87 |

57,691,100 |

|

Brazil |

8,626.99 |

923,519 |

|

Malaysia |

7,629.17 |

2,037,980 |

(Source: worldbank.org)

Challenges

-

PFAS reporting rule and fines as trade barrier: The PFAS reporting rule under TSCA was adopted by the U.S. Environmental Protection Agency (EPA) in November 2023 and states that manufacturers/importers must submit information on PFAS manufactured or imported from 2011-2022. Violation of non-compliance is subject to civil penalties of USD 48,512/day, per violation, which presents a formidable compliance burden to those chemical manufacturers that use PFAS in microporous coatings or binders. This regulation directly contemplates the cost of reporting and testing, especially to small and medium-sized businesses that are not well-developed in terms of internal compliance structures. The companies engaging in the production of microporous adsorbents face increased trade risk due to incomplete data submission, which hinders microporous materials market entry both globally. This increases the regulatory strictness, which imposes a hindrance on international business, restricting competitiveness and increasing operational costs.

-

Accumulated underloading of forever chemical reporting regulations: The U.S. Environmental Protection Agency’s (EPA) PFAS reporting regulations introduce unprecedented compliance costs across the chemical industry. In its 2023 final economic analysis, the EPA revised the estimated cost of the rule upward from USD 10.8 million to USD 843 million, a dramatic increase that significantly alters cost structures for producers of microporous materials and PFAS-derived products. Affected firms must now invest in extensive data gathering, recordkeeping, and testing covering a 12-year retrospective period. These requirements are likely to compress profit margins, divert investment from innovation in PFAS-dependent applications such as microporous materials, and may lead to supply chain consolidation or market exit by some companies, ultimately disrupting global trade flows.

Microporous Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 6.3 billion |

|

Forecast Year Market Size (2035) |

USD 11.2 billion |

|

Regional Scope |

|

Microporous Materials Market Segmentation:

Pore Class Segment Analysis

Microporous segment is projected to dominate the microporous materials market with the largest revenue share of 62.6% from 2026 to 2035, attributed to its extensive application in gas separation, adsorption, and catalysis. Such biomass materials are good for CO2 capture because they have well-developed pore structures and a large surface area. These materials are highly thermally and chemically stable and are moisture resistant; hence, they can be used in industries. Advanced pyrolysis and activation methods are used to optimize pore size and surface chemistry, which vastly increase their ability to adsorb CO2 and selectivity. Their structural specifications allow selective adsorption of hydrogen, natural gas, and volatile organic compounds (VOCs), which make demands in the refining and chemicals industries. The sub-segment is forecasted to rise at a 6.1% CAGR between 2026 and 2035, representing regulatory-driven uptake and growth in the emerging microporous materials markets in the industrial field.

Zeolite micropores are the key contributor towards the segments’ growth due to their high thermal stability and tunable pore structures, which are required in catalysis, gas separation, and CO 2 capture, and are stipulated mainly in chemical and refining industries. Research conducted by the U.S. Department of Energy estimates that the U.S. produces about 10 million metric tons of hydrogen annually, mostly from natural gas. It emphasizes ongoing research to reduce hydrogen production costs, improve production technologies, and support the development of clean hydrogen to enable the transition toward a low-carbon energy future, leading to the need for zeolite-based hydrogen purification sorbents. Carbon Molecular Sieves (CMS) micropores have a role in the air separation and natural gas separation following natural gas processing, which provides selectivity in adsorption towards other molecules and extensive efficiency in the pressure swing adsorption (PSA) units. Furthermore, the NASA report describes the development of hydrophobic carbon molecular sieves with microporous structures designed for efficient CO₂ removal in space station environments. These sieves exhibit high dynamic capacity, chemical stability, and low contaminant generation, making them suitable for selective gas separation.

Application Segment Analysis

The gas separation & purification segment is anticipated to grow with a substantial revenue microporous materials market share of 38.3% over the forecast period. The U.S. Department of Energy is developing point-source carbon capture technologies that will capture at least 95% of the CO2 in natural gas combined-cycle power plants, economically at the highest possible level of purity. The present-day technology can capture approximately 90% of the CO2 from dilute (approximately 4%) of the flue gases, and research is being carried out to decrease the costs as well as enhance efficiency to be able to roll out the technology on a large scale. In addition, the point-source carbon capture programs established by the EPA have increased the purchase of high-performance zeolites and metal-organic frameworks (MOFs) to capture CO2 at industrial scales owing to high selectivity and capacity. Zeolites have excellent CO2 adsorption at certain conditions, but have limitations such as moisture sensitivity, whereas MOFs can have tunable pore structures and increased capture performance depending on different industrial applications.

The hydrogen purification market is strongly driven by the aim of the low-carbon hydrogen globally, and is expected to experience a demand of 180 MT by 2035. Microporous materials, including zeolites and MOFs, are necessary in pressure swing adsorption (PSA) and membrane systems to produce high-purity hydrogen to power fuel cells and lead to industrial refining. The need to address LNG to achieve pipeline and liquefaction specifications by eliminating CO2, H2S, and moisture drives natural gas separation. High selectivity and efficiency of operation are offered in advanced CMS and zeolite microporous sorbents. Collectively, these two sub-segments are anticipated to rise by a CAGR of 6.4% annually over 2026-2035, aided by both regulatory compliance and growth of the industry, respectively.

Material Segment Analysis

The zeolites segment is projected to grow substantially, with a revenue s microporous materials market hare of 33.8% by 2035, owing to their broad usage in catalysis, gas separation, and environmental cleanup. Zeolite 13X is widely used as a high-performance sorbent in pressure swing adsorption systems to selectively capture CO₂ and recover hydrogen from syngas in refinery operations, as per the U.S. DOE. These materials offer high water affinity and CO₂ selectivity, making them instrumental in large-scale gas separation processes. The benefit of their high thermal stability, the ability to control the pore structure, and achieve a controlled regulatory compliance allows continued application, especially in the chemicals and refining sectors. Zeolites have a CAGR of 5.8% in the field of operation in the year 2026-2035, which indicates a consistent growth in the industry as well as the environmental sector in industrial and environmental applications.

Our in-depth analysis of the microporous materials market includes the following segments:

|

Segment |

Subsegment |

|

Material |

|

|

Pore Class

|

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microporous Materials Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to dominate the global microporous materials market with the largest revenue share of 33.9% during the forecast years from 2026 to 2035. This growth is driven by the fast industrialization and new development of technology within the region. Major industries that create demand include electronics, the automotive, building, and energy sectors. The governments in the area are keen on sustainable development and green manufacturing by funding and policy support. For example, Asia Pacific governments supporting sustainable development and green manufacturing are Singapore's Green Plan 2030, which aims for net-zero emissions by 2050 and focuses on transforming manufacturing toward sustainability with funding, regulation, and incentives.

Similarly, South Korea has undertaken to spend 1.9 billion dollars on green chemistry projects in the next five years (i.e., between 2020 and 2025), which will benefit more than 500 firms to switch to sustainable chemicals. Malaysia has also reported a doubling in the number of chemical firms applying microporous technologies in the last ten years, as well as considerable increases in green chemistry funding. This and other similar initiatives highlight the balanced, concerned approach both in growth and the environment, as the region is expected to be one of the biggest centers of innovation and the use of microporous materials in the Asia Pacific.

The microporous materials market in China is expected to lead the region with the largest share by 2035, due to the government-supported innovations and environmental concerns. The activities of the agencies like the Ministry of Ecology and Environment and the National Development and Reform Commission (NDRC) that support the industry transition by mandating cleaner production methods and enforcing regulations have contributed to a 15% reduction in energy intensity and a 12% decrease in carbon emissions in the industrial sector over recent years. These measures also support China's goal of reaching carbon neutrality by 2060 through cleaner chemical production and sustainable manufacturing practices. China has also maintained its expenditure on sustainable chemistry through the China Petroleum and Chemical Industry Federation to encompass sustainable chemistry within its substantial chemical production industry. Emission and energy conservation, technological upgrade, are stressed, and the government is working toward becoming the most important country in the APAC in the production and innovation of microporous materials.

The Indian microporous materials market is anticipated to exhibit the fastest CAGR in the region, supported by a strong governmental policy and investments. Green chemical programs are run by the Ministries of Chemicals and Fertilizers and the Department of Science and Technology (DST), and funded every year to a steady amount. For example, between 2015 and 2023, India's semiconductor ecosystem attracted enhanced government support, with MeitY approving ₹4,203 crores under the Modified Scheme for Compound/Silicon Photonics/Sensors Fab and OSAT facilities, and by 2024, government-backed semiconductor and display spending had surged by over 350%, reaching ₹6,903 crores, according to MeitY’s Annual Report and Budget allocation data. India is the fastest emerging microporous materials market in the region due to the proactive operations of its industry and government through bodies like the Federation of Indian Chambers of Commerce and Industry (FICCI), which has been progressive toward the production of domestic semiconductors and clean chemicals.

North America Market Insights

The North America microporous materials market is projected to grow substantially with a revenue share of 26.8% over the projected years by 2035, driven by rising industry demand across key industries like aerospace, energy, automotive as well and chemical processing. By 2035, the region’s market is projected to reach USD 4.9 billion 2033, with projections of a 6.2% CAGR between 2026 and 2033. This increase could be due to strict environmental laws and regulation policies that stipulate the implementation of high-performing and environmentally-friendly materials. The federal initiatives, such as the Inflation Reduction Act, the Bipartisan Infrastructure Law, and the CHIPS and Science Act, have greatly increased clean energy and manufacturing investments in North America. For example, investments of over USD 230 billion in energy manufacturing were announced, to achieve well over 920 new or expanded plants and over 200,000 potential clean energy jobs. These programs are provided with tax credits, grants, and loans to facilitate the innovation and domestic manufacture of clean energy technologies such as solar, battery storage, and hydrogen, also strengthening the microporous materials market growth.

Furthermore, the work of public-private partnerships encourages innovation and infrastructure development, which guarantees the supply chain resilience and competitiveness. The comprehensive regulatory control by organizations like the EPA and OSHA adds value to safe chemical manufacturing activities within the region, reaffirming the sustainable nature of the growth environment.

The U.S. microporous materials market is projected to dominate the North American market during the forecast years, owing to widespread government initiatives on clean energy and chemical development. The US government is projected to allocate over 7 billion U.S. dollars in 2022 in aid to clean energy chemical production, with a 22 percent increase compared to 2020. Federal programs from the Department of Energy (DOE) encourage the development of advanced materials and technologies through grants and partnerships, vital for the microporous materials industry. For example, under the Bipartisan Infrastructure Law, Microporous received a USD 100 million DOE award to expedite domestic lithium-ion battery components production, which shows the critical role of federal programs in enhancing innovation and market development. Safety standards and quality standards are also enforced by such regulatory bodies as OSHA and NIST to help with sustainability. Such efforts result in continued innovation, environmental consistency, and a competitive industrial environment of the US chemical market.

The microporous materials market in Canada is also expected to develop over the forecast years, owing to the government policies favoring clean technologies and sustainable chemical production. Between 2020 and 2023, the Government of Canada the Government of Canada increasingly streamlined clean-tech funding via the Clean Growth Hub, which coordinates support across 17 federal departments and agencies to guide innovation hubs and green manufacturing projects through every stage of development. The chemical safety programs, waste management, and low-carbon production work to improve the standards and environmental performance of industries. The federal agencies collaborate with the provincial governments and the private sector to promote infrastructural development and research for advanced materials manufacturing. The efforts will generate a favorable ecosystem that supports innovation and market growth in the Canadian microporous materials market, aligned with national and international sustainability objectives.

Europe Market Insights

Europe’s microporous materials market is predicted to expand at a steady pace, with the revenue share of 25.3% during the projected years by 2035, driven by a high level of industrial demand in countries such as the UK, Germany, France, Italy, Spain, Russia, and the Nordic region. This is stimulated by strict environmental guidelines, the sustainability provisions, and the large implementation of energy optimization, insulation, and filtration systems in chemical processing, automotive, aerospace, and renewable energy sectors. The emphasis on circular economy theories and curbing emissions at the industrial level is also boosting microporous materials market adoption in the region, as well as covering a large amount of research with the backing of our research agencies, such as the European Chemicals Agency (ECHA) and the European Chemical Industry Council (CEFIC).

In 2023–2024, the EU committed €13.5 billion under Horizon Europe to boost research and innovation, targeting climate action, energy resilience, digital technologies, and biodiversity, while also supporting Ukraine’s recovery and strengthening Europe’s innovation ecosystem. There is also firm support of demand with rising investments in Gallium Arsenide (GaAs) and chemicals used in the wafer that are important in manufacturing advanced semiconductor sectors that serve in telecom and defense business in Europe. As of 2023, several semiconductor technologies are quantifiable by their use in driving eco-technologies.

The UK Plan for Chips outlines a strategic increase in investment and innovation focused on semiconductor manufacturing, emphasizing green technologies and sustainable production methods. It highlights government commitments to bolster advanced materials and eco-friendly semiconductor processes to strengthen the UK’s global competitiveness in this sector. The sustainable chemical sector investment in Germany has also hit a high of up to 3.5 billion euros in 2025, and the demand has also grown by 10% since 2021, in green chemical solutions. The Federal Ministry for Economic Affairs and Climate Action (BMWK), alongside the German Chemical Industry Association (VCI), drives significant investments into decarbonization and circular economy initiatives in this sector. The nation also enjoys good collaboration of the private sector with research institutes such as the Fraunhofer Institute of Chemical Technology, which is further boosting innovation and commercialization of microporous materials. The country has strong funding and supportive policies that would see Germany maintain its strong position in the European market.

Key Microporous Materials Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cabot Norit

- Dow Corning (Dow Inc.)

- Honeywell International Inc.

- Zeolyst International

- Wacker Chemie AG

- Arkema, Inc.

- Solvay

- AGC Chemicals Pvt. Ltd.

- LG Chem

- PI Industries

The global microporous materials market is highly competitive, with a combination of well-established multinational corporations as well as regional manufacturers leveraging innovation and sustainability efforts. Company giants such as Kuraray, Sumitomo Chemical, BASF, and Cabot Norit are leading with substantial markets, following a practice of R&D on the enhancement of material performance-based energy savings. Among strategically arranged measures, acceleration of production capacities, acquisitions, and making microporous materials responding to the stringent environmental restrictions in the world are to be highlighted. The joint ventures and licensing of technologies are preferred as a strategic approach, as they assist companies to sustain competitive advantages and reach out to new markets. Japanese firms are especially at the forefront when it comes to specialty microporous films and insulation materials, which are focused on quality and innovativeness. Ongoing investments in advanced manufacturing and digitalization allow the players to minimize costs and make products more customized, with the microporous materials market to grow steadily.

Top Global Microporous Materials Manufacturers

Recent Developments

- In November 2024, Microporous LLC committed to a USD 1.35 billion investment to construct a modern-day manufacturing structure in Pittsylvania County, Virginia. This innovative facility will generate more than 2000 high-paying jobs, which will greatly expand the total battery supply network in the U.S. The plant will be capable of underpinning the manufacture of innovative energy storage ecosystems of energy, which is vital toward the lasting objectives of the country. This strategic move makes Microporous an important partner in driving Economic Independence and clean energy production of America in the future.

- In April 2025, Honeywell launched Honeywell Protonium, a new complex of AI- and machine learning-based applications to maximize the efficiency of green hydrogen production, scalability, and cost. Aernium deploying the technology will be part of the Mid-Atlantic Clean Hydrogen Hub, with the US Department of Energy backing up this initiative. Protonium tackles issues such as intermittency and carbon reduction, improving the performance of the electrolysis by predictive control algorithms and the design of a plant. Designed to make green hydrogen economically purpose, Honeywell supports producers with a firm purpose to fulfill increased energy needs in an eco-friendly way. The portfolio comprises technologies that optimise plant design, electrolyser control, and energy management, which goes further to bolster the interest of Honeywell in energy transition and industrial progressions.

- Report ID: 8047

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microporous Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.