Medical Device Connectivity Market Outlook:

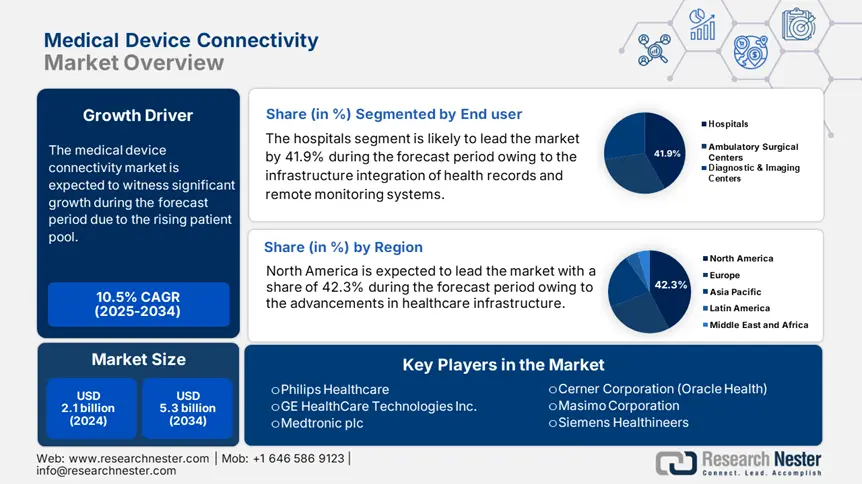

Medical Device Connectivity Market size was over USD 2.1 Billion in 2024 and is expected to reach USD 5.3 billion by the end of 2034, growing at around 10.5% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of medical device connectivity is estimated at USD 2.4 billion.

The global medical device connectivity market is experiencing a measurable transformation due to rising patient pool demands, increasing investments in device interoperability, and supply chain reconfigurations. As per the U.S. Centers for Disease Control and Prevention, nearly 60.4% of elderly people in the U.S. experience at least one chronic illness requiring medical device monitoring. The need for interoperable device infrastructure has grown as a result of an ageing population and rising rates of diabetes and COPD, particularly in hospital and ambulatory care settings. Further, according to the AHRQ report, connected monitoring devices enable remote intervention and reduce adverse events in an outpatient setting.

On the supply chain side, the import of microcontrollers, medical-grade sensors, and communication modules is heavily dependent on import networks. The producer price index rose to 4.4% for electromedical and electrotherapeutic apparatus. Whereas, the consumer price index increased to 2.8% for medical care commodities over the year as of Q1 2025. Further, the technological advancements impact the procurement planning and pricing models of connectivity platform providers. Regarding funding, the National Institutes of Health (NIH.gov) in the U.S. set aside more than USD 1.8 billion in FY2023 for technology-driven care coordination initiatives, such as real-time data transmission systems and connected devices. Further, the market is also driven by streamlined device certification and compliance with regional electronic health record (EHR) protocols.

Medical Device Connectivity Market - Growth Drivers and Challenges

Growth Drivers

- Healthcare quality improvement and cost reduction: As per the SHRQ report, the medical device connectivity implementation within hospital ICUs decreased to 23.5% in adverse events. This reduction minimizes the stay period for patients by 1.9 days and saves nearly USD 1.5 billion in the U.S. over the past two years. The real-time device to EHR integrations enables hospitals to respond faster, by improving patient outcomes and operational efficiency. This focuses on medical technologies for enhanced care delivery and reducing system-wide healthcare costs.

- Government Spending via Medicare and CMS: According to Medicare and CMS, total U.S. federal expenditures on health IT infrastructure, such as the connectivity of medical devices and integration of EHRs, exceeded USD 38.4 billion by 2023. All these investments were fueled by legislative efforts such as the HITECH Act and Interoperability Incentives Program in an effort to update care coordination systems in hospitals and ambulatory environments. These initiatives further grow the national digital health infrastructure, investing in technologies that facilitate real-time data exchange among medical devices and patient records.

Historical Patient Growth & Its Impact on Market Dynamics

Historical Patient Growth (2010-2020) in Key Markets

|

Country |

2010 (millions) |

2020 (millions) |

Growth (%) |

|

U.S. |

8.6 |

15.9 |

90.4% |

|

Germany |

3.8 |

6.6 |

83.2% |

|

France |

3.2 |

5.8 |

89.9% |

|

Spain |

2.1 |

3.5 |

83.6% |

|

Australia |

1.5 |

2.9 |

125.5% |

|

Japan |

4.8 |

8.2 |

79.9% |

|

India |

2.6 |

7.1 |

195.9% |

|

China |

6.4 |

14.5 |

138.5% |

Strategic Expansion Models for Market

Feasibility Models for Revenue Growth

|

Country |

Model Type |

Revenue Growth |

Supporting Initiative |

|

U.S. |

CMS-EHR Integration Incentive |

+13.3% |

CMS Interoperability Rule (2020–2023) |

|

India |

Local Hospital Partnership Model |

+12.6% |

NHM Public-Private Collaboration (2022–2024) |

|

Germany |

Public Sector EHR Upgrade Contracts |

+10.9% |

German Federal eHealth Funding (BfArM 2021–2024) |

|

Japan |

Subsidized Multi-Hospital Deployment |

+9.8% |

Digital Health Reform Act (MHLW 2021–2023) |

|

China |

State-led Hospital Integration Mandate |

+12.1% |

Healthy China 2030 Hospital Tech Plan |

|

Spain |

Regional Health Board Partnerships |

+8.5% |

Red.es Digital Health Infrastructure (2022–2023) |

Challenges

High upfront costs and payer coverage gaps: Medical device connectivity systems require substantial hardware and EHR integration software investment. According to the CDC, only 28.5% of small hospitals in the U.S. realized full interoperability in 2022, primarily because of budget limitations and inadequate CMS/Medicaid reimbursement for upgrading digital infrastructure. This cost related issues is mainly high in rural and under-resourced facilities, where implementation costs may exceed funding. The absence of reimbursement incentives and limited digitized health support also keeps medical device connectivity solutions from widespread usage in these environments

Medical Device Connectivity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.5% |

|

Base Year Market Size (2024) |

USD 2.1 billion |

|

Forecast Year Market Size (2034) |

USD 5.3 billion |

|

Regional Scope |

|

Medical Device Connectivity Market Segmentation:

End user Segment Analysis

Hospitals subsegment leads the market and is expected to have a share of 41.9% by 2034. The hospitals segment is driven by infrastructure integration of health records and remote monitoring systems. As per the HealthIT report, over 96.4% of non-federal acute care hospitals have adopted certified EHR technology in 2023, with a rise in mandates for real-time device data integration in the U.S. Hospital-based integration is also encouraged by the ONC's Interoperability Standards Advisory (ISA), which requires better data transmission across devices and health IT systems.

Component Segment Analysis

Medical device integration software dominates the market and is likely to account for a market share of 37.6% in 2034. Software integration platforms are essential to facilitate efficiency in communication among disparate devices and EHRs. The growth is driven by the increasing complexity of care delivery and requirement for real-time analytics. According to AHRQ, the integration of device data with EHRs has proven to reduce inpatient errors and simplify clinical workflows. Further, the U.S. NIH-supported initiatives, such as the Digital Health Software Precertification Program, have also invested in facilitating safe, scalable device-to-software integration across acute and post-acute environments.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Component |

|

|

Technology Wireless Technologies |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Device Connectivity Market - Regional Analysis

North America Market Insights

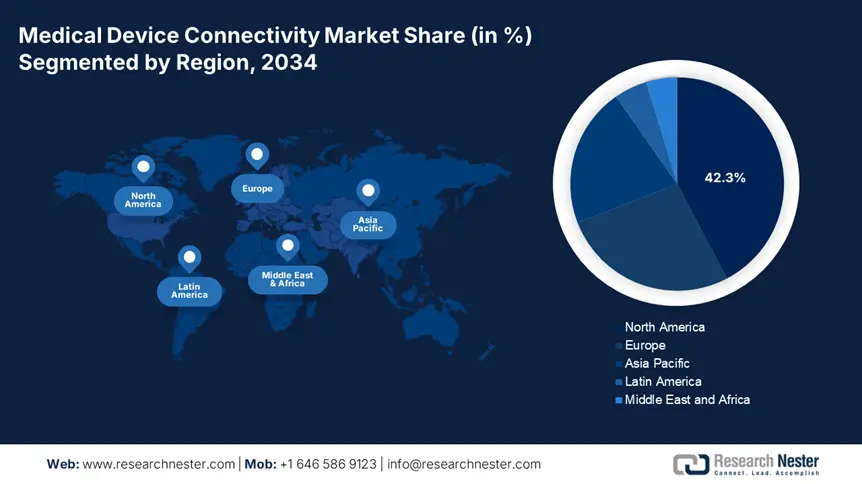

North America is the dominant region in the medical device connectivity market and is expected to hold the market share of 42.3% at a CAGR of 10.8% by 2034. The region is driven by the strong government policy, widespread EHR adoption, and advanced healthcare infrastructure. The region will experience a sustained growth in the forecast period from 2025 to 2034. Federal investments in healthcare interoperability through CMS and Medicare rules have put the United States ahead, while digital health frameworks and federal-provincial cooperation have strengthened uptake in Canada. Further, the increased Medicaid and Medicare support in rising chronic illness prevalence demand real-time monitoring systems for better health care outcomes.

The U.S. market is still on the move, fueled by government investment in healthcare IT and outreach of EHR integration policies. The CDC report indicates that more than 85.4% of U.S. hospitals employ connected medical devices, but just 28.2% of small hospitals have reached complete interoperability because of the cost hurdle. The NIH and AHRQ together funded nearly USD 5.4 billion in health tech innovation in 2023, such as remote monitoring and device integration. Medicaid reported USD 1.6 billion in 2024 towards Medical Device Connectivity treatments, with new reimbursement codes improving access by 10.3%. In contrast, Medicare spending increased by 15.5% from 2020 to 2024, totaling USD 800.5 million, owing to increased device access for geriatric and chronic disease patients. Even with infrastructure lacunas in rural areas, more extensive EHR policies and payer alignment have established the U.S. as the leading market for Medical Device Connectivity.

North America- Government Investment & Policy Funding (2021–2025)

|

Country |

Initiative / Policy |

Focus Area |

Launch Year |

Funding Amount |

|

U.S. |

National Digital Health Strategy (ONC) |

Secure interoperability & device integration |

2022 |

USD 1.5 billion |

|

Telehealth Expansion for Chronic Care Act |

Reimbursement for remote device monitoring |

2023 |

USD 850.6 million |

|

|

Canada |

Canada Health Infoway – ACCESS 2022 Initiative |

Device-EHR interoperability & patient access |

2022 |

CAD 300.3 million |

|

Digital Health and Innovation Adoption Program (DHIAP) |

Provincial funding for connectivity platforms |

2024 |

CAD 420.6 million |

Asia Pacific Market Insights

The APAC is the fastest-growing region in the medical device connectivity market and is poised to hold the market revenue share of 21.2% at a CAGR of 11.6% by 2034. The region has a strong growth and is fueled by increasing chronic disease burden, rapid healthcare digitization, and government investment in health tech infrastructure. Leading economies such as China, India, Japan, South Korea, and Malaysia are spearheading this shift by incorporating cloud-based data sharing platforms, electronic health record (EHR) systems, and real-time monitoring into clinical procedures. Further according to government releases, China and Japan together lead the market by holding 60.2% overall share in the region due to strong and expansive hospital networks. The region has strong telehealth, surging the demand for interoperable devices and cloud-based connectivity platforms.

China is the leading nation and is expected to have a market share of 9.5% by 2034. As per the National Medical Products Administration (NMPA), government expenditure in China on Medical Device Connectivity increased by 15.7% over the past five years, driven by hospital infrastructure enhancements and local health tech manufacturing. In 2023, more than 1.9 million patients received benefit from connected care technology. The Healthy China 2030 plan helped market to drive this trend by focusing on telemedicine and integration of rural hospitals with devices. Both domestic manufacturing and interoperable device certification are encouraged by the policies of the country, facilitating greater public access and less dependency on imports.

APAC- Government Investment & Policy Funding (2021–2025)

|

Country |

Initiative / Policy |

Focus Area |

Launch Year |

Funding Amount / Notes |

|

Australia |

National Digital Health Strategy 2021–2027 (ADHA) |

Health IT & device data integration |

2021 |

AUD 309.4 million (Phase 1) |

|

Japan |

Smart Hospitals Promotion Project (MHLW) |

AI-based device-EHR integration in tertiary hospitals |

2022 |

USD 3.7 billion (till 2025) |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

Nationwide digital health record and connectivity |

2021 |

INR 1,600.8 crore (~USD 200.3 million) |

|

South Korea |

Smart Medical Infrastructure Strategy (MOHW) |

Interoperable device platforms in small hospitals |

2022 |

KRW 400.6 billion (~USD 340.3 million) |

|

Malaysia |

MyHDW & Hospital Digitalization Program (MOH) |

EHR-device data integration & health informatics |

2023 |

MYR 500.7 million (~USD 110.2 million) |

Europe Market Insights

Europe is actively expanding in the medical device connectivity market and is projected to hold the market share of 26.8% at a CAGR of 9.9% by 2034. The market is fueled by robust regulatory frameworks, rising hospital digitization initiatives, and rising investments in EHR integration and real-time patient monitoring. The UK, Germany, and France together are dominating the market in the EU region toward interoperable device systems as they support digital health strategies. Standardized data exchange and infrastructure enhancements are being promoted by the European Health Data Space (EHDS) program, which is backed by health.ec.europa.eu, and these are essential for linked medical devices. Further, nearly 70.4% of hospitals are actively adopting one layer of device connectivity, which is a rise from 54.3% since 2020. This shift impacts the long-term structural reforms, making digital health crucial in healthcare systems.

Germany is the largest stakeholder in the medical device connectivity market and is anticipated to maintain the revenue share of 9.4% in 2034. During 2024, the nation spent more than €4.5 billion for digital infrastructure enhancement under the Hospital Future Act. The law actively funds device-EHR integration, cybersecurity, and cloud solutions for public hospitals. The Federal Ministry of Health (BMG) indicated a 12.6% growth in the demand for connectivity of medical devices between 2021 and 2024, fueled by aging populations and decentralized care systems. The German Medical Association stated that more than 85.3% of hospitals had implemented connected devices in 2023. Further, the active implementation of digital devices in hospitals makes health data standardization and digital reimbursements easier in the country.

Key Medical Device Connectivity Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global medical device connectivity market is driven by the leading players due to their innovation strategies and making the market competitive. Players, including Philips, GE HealthCare, and Medtronic are holding the maximum share due to the early adoption of EHR-integrated platforms and a strong product ecosystem. Many players are aiming for cloud-based software development, strategic acquisitions, and AI-enabled monitoring solutions. Companies in India, Japan, and Australia are using local hospital digitization programs to build cost-effective and scalable device platforms. The market is increasing rapidly with regulatory compliance and interoperability mandates and strategic collaborations.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Estimated Market Share (%) |

Industry Focus |

|

Philips Healthcare |

Netherlands |

9.9% |

Offers advanced patient monitoring systems integrated with IntelliBridge device connectivity solutions. |

|

GE HealthCare Technologies Inc. |

U.S. |

9.6% |

Focuses on EHR-integrated vital sign monitors and CARESCAPE connectivity systems. |

|

Medtronic plc |

Ireland (operational HQ: USA) |

8.7% |

Develops implantable and wearable devices with cloud-based integration capabilities. |

|

Cerner Corporation (Oracle Health) |

U.S. |

8.2% |

Provides hospital-wide EHR systems integrated with device connectivity frameworks. |

|

Masimo Corporation |

U.S. |

6.7% |

Specializes in non-invasive monitoring and connectivity platforms (e.g., Masimo Root). |

|

Siemens Healthineers |

Germany |

xx% |

Manufactures imaging systems and hospital-wide connectivity middleware. |

|

Capsule Technologies (a Philips company) |

France |

xx% |

Offers medical device integration platforms used in over 2,000 hospitals globally. |

|

Drägerwerk AG & Co. KGaA |

Germany |

xx% |

Focuses on critical care device networks and real-time data exchange for ICU settings. |

|

ICU Medical, Inc. |

U.S. |

xx% |

Delivers infusion therapy and interoperability platforms across hospital systems. |

|

Spacelabs Healthcare |

U.S. |

xx% |

Offers modular patient monitors with device integration software (Intesys Clinical Suite). |

|

Hillrom (acquired by Baxter) |

USA |

xx% |

Develops connected beds and mobile vitals monitoring devices. |

|

B. Braun Melsungen AG |

Germany |

xx% |

Provides infusion pumps and associated device connectivity software. |

|

Fukuda Denshi Co., Ltd. |

Japan |

xx% |

Manufactures cardiology monitors and cloud-enabled hospital telemetry systems. |

|

Nihon Kohden Corporation |

Japan |

xx% |

Offers diagnostic and patient monitoring solutions with EMR connectivity. |

|

Connexall |

Canada |

xx% |

Supplies communication and integration middleware platforms for care coordination. |

|

S3 Connected Health |

Ireland |

xx% |

Focuses on digital therapeutics and connectivity strategy for device manufacturers. |

|

eDevice |

France |

xx% |

Specializes in remote patient monitoring and device data aggregation tools. |

|

iHealth Labs Inc. |

U.S. |

xx% |

Offers consumer medical devices with app-based EHR integration. |

|

Trivitron Healthcare |

India |

xx% |

Manufactures diagnostic devices with expanding medical IoT integration capacity. |

|

Vystan Technologies |

Australia |

xx% |

Develops wireless vital sign monitors and hospital integration modules. |

Here are some leading players in the medical device connectivity market:

Recent Developments

- In January 2024, Philips released IntelliVue GuardianSoftware to improve early warning scoring systems via real-time device integration and predictive analytics. The launch increased 6.4% connected care revenue, compared to Q1 2023.

- In April 2024, Masimo launched Radius VSM, a wearable, tetherless vital signs monitor fully compatible with hospital EMRs. The launch resulted 9.4% year-over-year increase in device sales.

- Report ID: 4030

- Published Date: Jul 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Device Connectivity Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert