Mass Flow Controller Market Outlook:

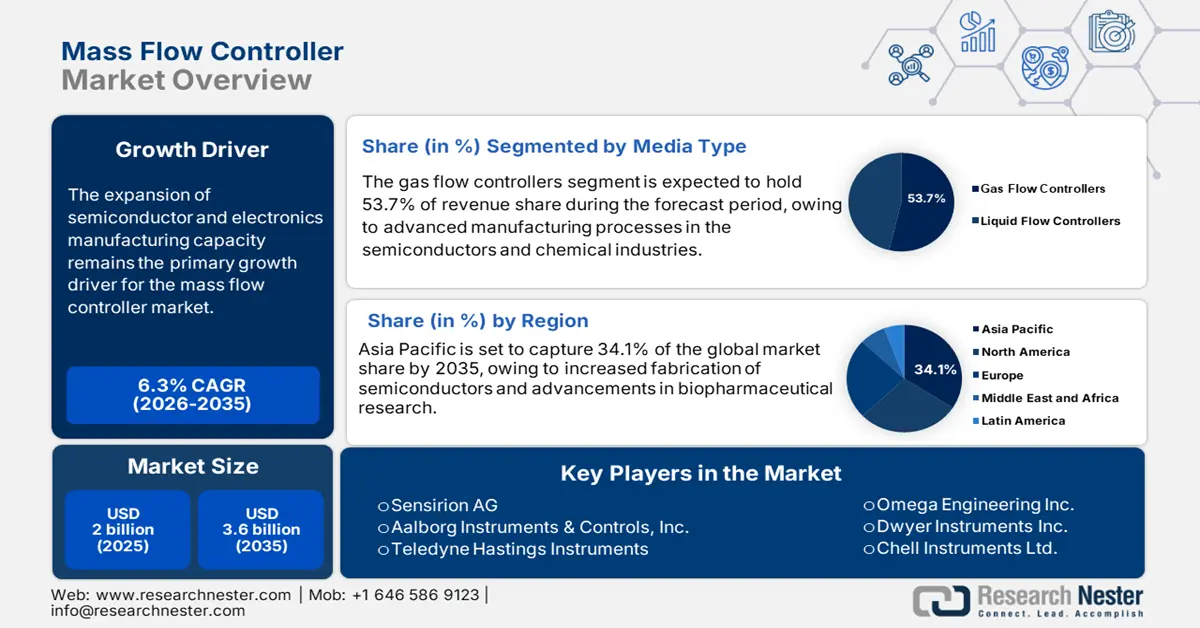

Mass Flow Controller Market size was estimated at USD 2 billion in 2025 and is expected to surpass USD 3.6 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mass flow controller is evaluated at USD 2.1 billion.

The expansion of semiconductor and electronics manufacturing capacity remains the primary growth engine for the market. The Semiconductor Industry Association (SIA) estimates that domestic chip production in the U.S. is expected to increase by 203% over the coming decade, following the enactment of the CHIPS and Science Act. SIA also reveals that the global semiconductor sales reached USD 627.6 billion in 2024, an increase of 19.1% compared to 2023. The mass flow controller is used to properly deliver gases under precise conditions as millions of wafers are processed in fabs.

Further, the mass flow controllers (MFCs) are widely used in the turbine and power industry to precisely and reliably control the mass flow rate of gases. The impeller turbine mass flow meter and twin turbine mass flow meters are also deployed in the food processing, aerospace, petroleum, chemical, water treatment, and power generation sectors. According to the Bureau of Labor Statistics (BLS), the producer price index (PPI) for turbine and power transmission equipment stood at 240.804 in July 2025. This indicates that the increasing trade of turbines and power transmission equipment is creating high-earning opportunities for mass flow controller and meter manufacturers.

PPI Industry Group Data for Turbine and Power Transmission Equipment Manufacturing

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

2022 |

204.037 |

203.961 |

205.127 |

208.839 |

210.546 |

210.961 |

211.363 |

212.430 |

212.474 |

213.256 |

214.091 |

214.681 |

|

2023 |

219.401 |

219.560 |

221.517 |

222.080 |

222.390 |

222.529 |

223.611 |

224.853 |

225.288 |

225.672 |

226.207 |

226.262 |

|

2024 |

229.267 |

229.494 |

229.878 |

230.645 |

230.950 |

231.313 |

232.080 |

232.591 |

232.206 |

232.775 |

233.197 |

233.595 |

|

2025 |

237.008 |

237.803 |

238.430 |

239.767 |

240.204 |

240.356 |

240.804 |

|

|

|

|

|

Source: U.S.BLS

Key Mass Flow Controller Market Insights Summary:

Regional Insights:

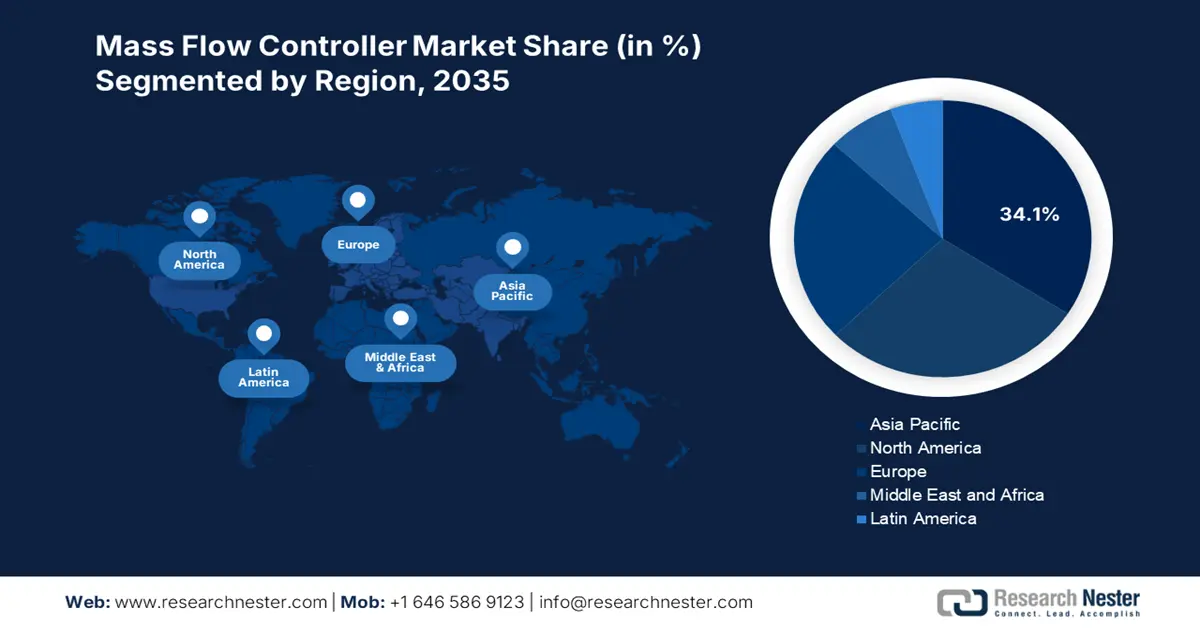

• The Asia Pacific mass flow controller market is projected to hold 34.1% share by 2035, propelled by high semiconductor fabrication, advancements in biopharmaceutical research, and precision chemical manufacturing needs.

• The North America market is estimated to capture 28.7% share during the forecast period 2026–2035, impelled by the strong presence of semiconductor and pharmaceutical industries and supportive clean energy policies.Segment Insights:

• The gas flow controllers segment is projected to account for 53.7% share during the forecast period 2026–2035, driven by the rising demand in semiconductor and chemical industries for precise flow management.

• The semiconductors segment is anticipated to hold a 30.1% share by 2035, owing to the accelerated adoption of AI, IoT, and 5G technologies requiring ultra-pure fabrication environments.Key Growth Trends:

- Rising investments in biotechnology & pharma sectors

- Wastewater treatment and environmental monitoring

Major Challenges:

- High initial cost and integration complexity

- Lack of skilled workforce for advanced flow systems

Key Players: Horiba Ltd., MKS Instruments, Inc., Bronkhorst High-Tech B.V., Brooks Instrument (a division of ITW), Hitachi Metals, Ltd., Sensirion AG, Aalborg Instruments & Controls, Inc., Teledyne Hastings Instruments, Alicat Scientific, Inc. (Halma plc), Burkert Fluid Control Systems, Omega Engineering Inc., Dwyer Instruments Inc., Chell Instruments Ltd., Azbil Corporation, Fujikin Incorporated.

Global Mass Flow Controller Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Singapore, Taiwan, Netherlands, France

Last updated on : 2 September, 2025

Mass Flow Controller Market - Growth Drivers and Challenges

Growth Drivers

- Rising investments in biotechnology & pharma sectors: The pharmaceutical and biotech sectors have been increasingly implementing advanced flow control systems for the production of vaccines, biologics, and drugs. The International Federation of Pharmaceutical Manufacturers & Associations reveals that the pharmaceutical industry spends hefty on research and development, nearly 30% of its resources are focused on innovating new medicines and treatments. This reflects the continuous innovations in the biopharma domain is likely to fuel the sales of mass flow controllers in the years ahead. Further, flow controllers ensure sterile, precise, and reproducible fluid handling, which contributes to their adoption rates. The key adopters of flow controllers are Europe and North America.

- Wastewater treatment and environmental monitoring: Flow controllers are also essential for dosing chemicals and flow control in water treatment systems. The report by the United Nations University states that in June 2025, nearly 52.0% of wastewater was treated worldwide. This directly promotes the adoption of mass flow controllers integrated with smart meters around the globe. Further, the need for near real-time flow monitoring arises from regulatory requirements from governments under the U.S. EPA's Clean Water Act and the EU Water Framework Directive. Municipal and industrial wastewater operators are also looking to upgrade their systems to decrease wastewater contaminants, increase legal compliance, and publicly disclose compliance.

- Shift toward digital & smart MFCs: The global market for mass flow controllers (MFCs) is poised to witness a clear shift toward digital and smart solutions in the years ahead, as industries move beyond conventional analog devices to more connected, data-driven technologies. The IoT and cloud trends are significantly transforming the production of mass flow controllers. According to the International Federation of Robotics (IFR), nearly 4 million robots are used in smart factories globally. Thus, industrial automation is also set to drive the sales of smart mass flow controllers.

Challenges

- High initial cost and integration complexity: Flow controllers, especially digital mass flow controllers (MFCs), require high capital investments. The hefty budgetary requirements are discouraging small manufacturers and start-ups. Additionally, most advanced flow controllers are integrated in legacy systems, which complicates the installation since that legacy equipment has its own calibration methods or even software that is not compatible. These costs are imposing barriers to adoption within emerging economies and among SMEs.

- Lack of skilled workforce for advanced flow systems: Switching from old analog to new digital flow control systems is often tricky, as it requires special technical skills. Workers need to know how to set up digital flow controllers, connect them to software, and link them to the Internet of Things (IoT) for smart communication. The skills gap in the manufacturing sectors delays adoption and increases the cost of services for the sectors deploying advanced flow technologies, especially in the pharmaceutical and semiconductor sectors.

Mass Flow Controller Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

Mass Flow Controller Market Segmentation:

Media Type Segment Analysis

The gas flow controllers segment is projected to hold the largest market share of 53.7% during the projected period, due to the swift need for these technologies in the semiconductors and chemical industries. The flow controllers for gases are key components for plasma-enhanced chemical vapor deposition (PECVD) and etching, both of which are used in wafer fabrication. Thus, the versatility of gas flow controllers is contributing to the increasing sales growth. Also, nitrogen, oxygen, and argon flow control applications are gaining traction, due to the rise of cleanroom processes, where flow rate tolerances are required to be extremely accurate. Overall, the semiconductor manufacturing, pharma & biotech, and energy transition sectors are expected to boost the demand for gas flow controllers.

End user Segment Analysis

The semiconductors segment is anticipated to capture 30.1% of the global market share through 2035, mainly due to the high adoption of AI, IoT, and 5G technologies, where ultra-pure semiconductor fabrication environments are essential. The National Institute of Standards and Technology, in its March 2019 report, states that mass flow controllers are used as part of precursor delivery systems in atomic layer deposition (ALD) and chemical vapor deposition (CVD) processes. Such observations directly increase the deployment of mass flow controllers in the semiconductor sector.

Additionally, the U.S.’s CHIPS Act funding and METI subsidies in Japan serve to supply the components of larger-scale semiconductor manufacturing, specifically stimulating high demand for MFCs in this application space. The report by the Observatory of Economic Complexity (OEC) discloses that Japan exported nearly USD 7.67 billion of semiconductor devices in 2023. This indicates that the increasing semiconductor production is poised to double the revenues of mass flow controllers in the years ahead.

Connection Type Segment Analysis

The direct connection type segment is expected to hold a share throughout the projected timeframe. This is due to its widespread application across industries that demand high accuracy, reliability, and ease of integration. Direct connection mass flow controllers are mainly installed inline with the gas or liquid supply owing to their real-time and highly precise flow measurement capabilities. Semiconductor fabrication, chemical processing, pharmaceuticals, and energy systems are prime end use application areas for direct connection.

Our in-depth analysis of the mass flow controller market includes the following segments:

|

Segments |

Subsegments |

|

Media Type |

|

|

Gas Type |

|

|

End user |

|

|

Connection Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mass Flow Controller Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific mass flow controller market is expected to hold 34.1% of the global revenue share by 2035, as a result of high fabrication of semiconductors, advancements in biopharmaceutical research, and the precision chemical manufacturing needs. The overall demand is set to increase due to supportive government policies and investment in cleaner energy solutions & electronics. Further, its strategic relevance for manufacturing innovation is contributing to the sales of mass flow controllers.

China is expected to hold a dominant Asia Pacific market share through 2035, owing to aggressive investments in semiconductor foundries and the hydrogen energy and pharmaceutical infrastructure sectors. The Made in China 2025 initiative and government support of subsidies for domestic producers are opening profitable space for investors. Further, the demand from electronics and display parent companies has led to an increase in domestic production and fabrication of MFCs and reduced reliance on imports.

The India mass flow controller market is expected to increase at the fastest CAGR from 2026 to 2035. The demand for mass flow controllers is largely driven by rapid advancement in specialty chemicals, bioscience, and chip manufacturing under the PLI Scheme. The rate of establishment of R&D laboratories in the country has increased with a steady turnover of planning and the continued embrace of digital process controls in pharmaceutical and food applications. Further, the expanding chemical sector is driving the deployment of mass flow controllers. The India Brand Equity Foundation (IBEF) states that the FDI inflows in the chemicals sector, other than fertilizers, were calculated at USD 23.2 billion in FY25. This highlights that investing in India is likely to offer hefty returns.

North America Market Insights

The North America market is estimated to capture 28.7% of the global revenue share throughout the study period. The mass flow controller demand is mainly fueled by the strong presence of highly efficient semiconductor and pharmaceutical industries. The evolving government policies around clean energy, biomanufacturing, and chip manufacturing are also contributing to the high sales of mass flow controllers. The U.S. Department of Energy and Innovation, Science and Economic Development Canada indicate that increasing research and development and manufacturing capabilities are set to directly push the adoption of mass flow controllers.

The U.S. market for mass flow controllers is expected to account for the largest revenue share, as firms ramp up investments in semiconductor manufacturing facilities and biopharma research activities. According to a report by SIA, the overall U.S. semiconductor industry’s investment in R&D totaled USD 62.7 billion in 2024. Such developments directly fuel the demand for ultra-high precision flow controllers. The enhancement of the CHIPS and Science Act also contributes to high domestic production of mass flow controllers.

The Canada mass flow controller market is projected to increase at a robust pace owing to the hefty investments flowing toward clean technologies and scaling up of pharmaceutical production. The supportive government policies and funding are likely to fuel the use of mass flow controllers in areas including biomanufacturing and nanotechnology. The growing adoption of automation strategies in both the chemical and energy sectors is further driving high sales of mass flow controllers.

Europe Market Insights

The Europe mass flow controller market is expected to expand at a CAGR of 6.5% from 2026 to 2035. This growth is primarily supported by a high demand from the semiconductor, pharmaceutical, and chemical sectors, governed by strict regulatory policies and R&D needs. The EU Green Deal, investments in digitally controlled automated flow management, and regional incentives that encourage low-carbon technologies are further accelerating the trade of mass flow controllers. The Netherlands, Germany, the U.K., and France are the most investment-worthy markets in the EU.

Germany leads the sales of mass flow controllers, owing to the strong presence of semiconductor manufacturing and chemical processing bases. The expanding renewable energy sector is also contributing to the high deployment of mass flow controllers. The country is positioning itself as a hub for advanced electronics production, supported by state and EU funding for semiconductor fabs. Nearly 28,355 robotic units were installed in the country in 2023, according to IFR. This indicates that the industrial automation trend is boosting the use of robots, which indirectly is propelling the sales of mass flow controllers.

The demand for mass flow controllers in the Netherlands is poised to increase at a high pace, due to the increasing advancements in semiconductor equipment manufacturing. The country’s focus on sustainable manufacturing is also accelerating the sales of smart mass flow controllers. The government’s climate and energy transition goals are further emerging as a significant driver. The digital transformation and smart manufacturing trends are set to accelerate the adoption of next-generation MFCs.

Key Mass Flow Controller Market Players:

- Horiba Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MKS Instruments, Inc.

- Bronkhorst High-Tech B.V.

- Brooks Instrument (a division of ITW)

- Hitachi Metals, Ltd.

- Sensirion AG

- Aalborg Instruments & Controls, Inc.

- Teledyne Hastings Instruments

- Alicat Scientific, Inc. (Halma plc)

- Burkert Fluid Control Systems

- Omega Engineering Inc.

- Dwyer Instruments Inc.

- Chell Instruments Ltd.

- Azbil Corporation

- Fujikin Incorporated

The global mass flow controller market has significant competitive intensity, with large players, including Horiba, MKS Instruments, and Bronkhorst, focusing on semiconductor growth and precision fluid control systems. The Japanese giants are focusing on innovation strategies to introduce next-gen MFC systems targeting the semiconductor market. The U.S. and European companies are leveraging innovation with more automated, modular, and cloud-connected products. Players employ several initiatives aimed at maturing their products, including partnerships, R&D, and mergers & acquisitions.

Some of the key players operating in the market are listed below:

Recent Developments

- In February 2025, Festo announced the launch of the VEFC mass flow controller for precise control of inert gases. The product is especially designed for electronics manufacturing and food production applications.

- In January 2025, HORIBA STEC Co., Ltd. introduced the DZ‑107 ultra-thin mass flow controller. This product increases full-scale flow by around seven times that of previous models.

- In March 2024, Brooks Instruments introduced the high-temperature thermal mass flow controller. This is specifically designed to support solid and liquid precursors required in semiconductor manufacturing.

- Report ID: 5190

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mass Flow Controller Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.