Loop Diuretics Market Outlook:

Loop Diuretics Market size was valued at USD 7.3 billion in 2025, and is projected to reach approximately USD 9.9 billion by the end of 2035, rising at a CAGR of around 3.8% during the forecast period, i.e., 2026 2035. In 2026, the industry size of loop diuretics is estimated at USD 7.6 billion.

The global market is growing steadily on account of their pivotal role in managing fluid overload in chronic conditions such as heart failure, renal disorders, and hepatic cirrhosis. As evidence, the September 2023 article from the National Institute of Health revealed that nearly 6.7 million individuals in the U.S. who are aged above 20 are experiencing heart failure, and it is expected to reach 8.5 million by the end of 2030, which is an indication of the strong demand for loop diuretics in the years ahead.

Furthermore, the supply chain reliability, drug usage, and accessibility are fostering a profitable business environment for the market. Testifying to this in September 2024, AHA reported that over the past two decades, the number of adults taking antihypertensive medications in the U.S. rose from 22 million to 55 million. This increase was primarily driven by the loss of patent exclusivity for drugs such as lisinopril, amlodipine, and losartan, which led to more medication fills, hence providing an encouraging opportunity for loop diuretics.

Key Loop Diuretics Market Insights Summary:

Regional Insights:

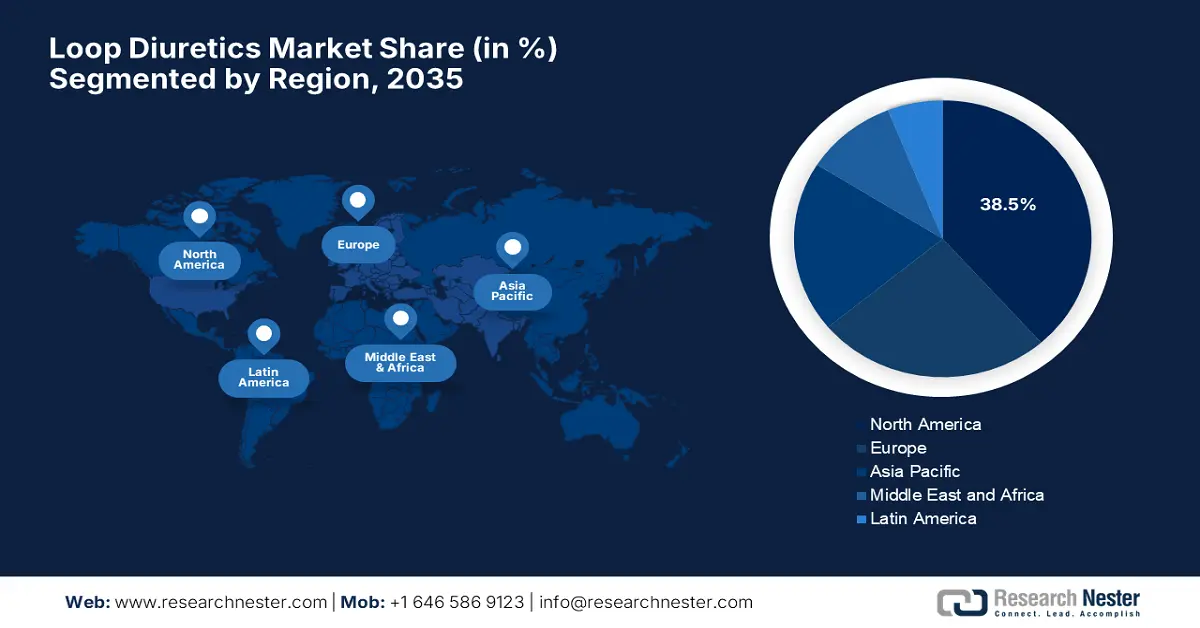

- North America is projected to command a 38.5% share in the Loop Diuretics Market by 2035, arising from higher healthcare expenditures and a surge in government investment.

- Asia Pacific is set to expand rapidly through 2026–2035, supported by increasing rates of chronic diseases coupled with an aging demographic.

Segment Insights:

- By 2035, the oral segment is expected to secure a 65.8% share in the Loop Diuretics Market, underpinned by the convenience for long-term outpatient use and cost-effectiveness under cost-containment strategies.

- The furosemide segment is forecast to capture a 42.4% share by 2035, owing to its widespread utilization in managing acute and chronic edema and hypertension.

Key Growth Trends:

- Growing patient pool

- Continued advancements in drug formulations

Major Challenges:

- Safety concerns

- Availability of alternative therapies

Key Players:Sanofi,Pfizer Inc.,Novartis AG (Sandoz),Teva Pharmaceutical Industries Ltd.,Mylan N.V.,Hikma Pharmaceuticals PLC,Fresenius Kabi,Sun Pharmaceutical Industries Ltd.,Lupin Limited,Aurobindo Pharma Ltd.,Dr. Reddy's Laboratories Ltd.,Cipla Ltd.,Amneal Pharmaceuticals, Inc.,Endo International plc,Bausch Health Companies Inc.,Zydus Cadila,Glenmark Pharmaceuticals Ltd.,Aspen Pharmacare Holdings Limited,Nichi-Iko Pharmaceutical Co., Ltd.,Taro Pharmaceutical Industries Ltd.

Global Loop Diuretics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.3 billion

- 2026 Market Size: USD 7.6 billion

- Projected Market Size: USD 9.9 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 26 September, 2025

Loop Diuretics Market - Growth Drivers and Challenges

Growth Drivers

- Growing patient pool: The products from the market are found to be extremely beneficial for patients affected with conditions such as hypertension, heart failure, and chronic kidney disease, driving constant utilization. As per the article published by the World Health Organization in March 2023, around 1.2 billion individuals aged between 30 and 79 are affected by hypertension, out of which a major portion reside in developing countries.

- Continued advancements in drug formulations: Innovations in terms of drug delivery systems, which include extended-release formulations and combination therapies, are also contributing towards the upliftment of the loop diuretics industry. In July 2024, Vetoquinol reported that Veterinarians can now order UpCard-CA1 (torsemide oral solution), which is a conditionally approved loop diuretic by the U.S. FDA, designed to manage pulmonary edema in dogs with congestive heart failure caused by myxomatous mitral valve disease.

- Escalating aging demographics: As the worldwide population is aging rapidly, this creates a high necessity for therapeutics such as loop diuretics, encouraging more pioneers to make investments in this field. As per the WHO report published in October 2024, 80% of older adults will be residing in low- and middle-income countries by the end of 2050, which denotes a significant global demographic shift. It also stated that between 2015 and 2050, the elderly population over 60 is projected to double, increasing from 12% to 22%.

U.S. Kidney Disease: Key Statistics on Prevalence, Risk, Treatment, Costs 2023-2024

|

Category |

Statistic |

|

Prevalence of Chronic Kidney Disease (CKD) |

35.5 million (1 in 7 adults) |

|

Awareness (CKD) |

9 in 10 adults with CKD are unaware |

|

Risk with Hypertension |

1 in 5 people with hypertension have CKD |

|

CKD by Age |

65+ (34%), 45–64 (12%), 18–44 (6%) |

|

CKD by Race/Ethnicity |

Black (20%), White (12%), Asian (14%), Hispanic (14%) |

|

ESKD Prevalence |

>808,000 Americans |

|

ESKD Risk (Black vs. White) |

4x more likely |

|

ESKD Risk (Hispanic/Native American vs. White) |

2x more likely |

|

ESKD Risk (Asian vs. White) |

1.6x more likely |

|

Medicare Spend (CKD, 2021) |

USD 77 billion (24.1% of spending for 66+) |

|

Medicare Spend per Person (CKD) |

USD 28,162 (vs. USD 13,604 without CKD) |

|

Medicare Spend (ESKD, 2021) |

USD 52.3 billion |

Source: NIDDK

Economic Impact and Cost Statistics of High Blood Pressure in the U.S., August 2025, CDC Data

|

Cost Aspect |

Amount |

Year |

|

Additional annual medical costs for privately insured adults |

USD 2,926 higher than those without hypertension |

2021 |

|

Medicare savings from team-based care, including pharmacists |

Up to USD 900 million |

Over 5 years |

|

Cost savings per person from self-measured blood pressure monitoring |

USD 7,794 |

Over 20 years |

|

Return on investment (ROI) for self-measured blood pressure monitoring |

USD 7.50 to USD 19.34 per USD 1 spent |

Over 10 years |

Source: CDC

Challenges

- Safety concerns: One of the primary challenges in the market is the safety concerns associated with the long-term utilization of these therapeutics. The loop diuretics can cause severe side effects such as electrolyte imbalances, dehydration, and kidney dysfunction, which may lead to complications and reduce patient adherence to treatment. Therefore, it necessitates careful monitoring, hence limiting widespread use among consumers.

- Availability of alternative therapies: This is yet another aspect negatively influencing growth in the loop diuretics sector. The competition emerging from newer drugs with enhanced efficacy is skewing up the utilization rates of loop diuretics. In addition, the exacerbated costs of these therapies and limited awareness in certain groups of patients can also create a restriction in terms of adoption.

Loop Diuretics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 7.3 billion |

|

Forecast Year Market Size (2035) |

USD 9.9 billion |

|

Regional Scope |

|

Loop Diuretics Market Segmentation:

Route Of Administration Segment Analysis

Based on the route of administration, the oral segment is expected to capture the largest revenue share of 65.8% in the loop diuretics market during the forecast timeline. The dominance of the segment is highly attributable to the convenience for long-term outpatient use in managing the complex conditions, and cost-effectiveness. Also, the cost containment strategies under the public and private programs are extremely prioritizing oral formulations to reduce hospitalization costs, hence denoting a positive segment scope.

Type Segment Analysis

In terms of type, the furosemide segment is projected to gain a lucrative share of 42.4% in the loop diuretics market by the end of 2035. The growth in the segment originates from its widespread utilization in managing acute and chronic edema and hypertension. In December 2024, Hikma Pharmaceuticals reported that it had launched multiple presentations of Furosemide Injection in the U.S., which include the first FDA-approved 50mL and 100mL formulations. It can be used for adults and pediatric patients to treat edema caused by heart failure, liver cirrhosis, renal disease, and as adjunct therapy in acute pulmonary edema.

Application Segment Analysis

Based on the application, the hypertension segment is predicted to attain a share of 38.5% in the loop diuretics market during the analyzed timeframe. The growing prevalence and high prescription rates are the key factors behind this leadership. According to the May 2023 NIH article, loop diuretics are effective in treating fluid overload and hypertension but require careful monitoring, and healthcare providers must regularly assess patients’ blood pressure, fluid status, serum electrolytes, and renal function to adjust dosages appropriately, thus denoting a positive market outlook.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Route of Administration |

|

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Patient Demographics |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Loop Diuretics Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 38.5% in the loop diuretics market by the end of 2035. The market growth is driven by the higher healthcare expenditures and a surge in government investment. Testifying to this, the NLM in November 2024 observed that adults with hypertension incurred approximately USD 2,926 more in total annual healthcare costs and USD 328 more in out-of-pocket expenses when compared to those without hypertension. These expenses were due to an increase in inpatient and outpatient expenditures, underscoring the presence of strong potential in this field.

The Canada market is also flourishing owing to a surge in product innovations, regulatory support, and a rise in provincial investments in cardiovascular care. In this regard, Pharmascience Canada in August 2023 launched pms-PERINDOPRIL-INDAPAMIDE, which is a new generic medication for the initial treatment of mild to moderate essential hypertension in adults. The company further stated that this drug combines perindopril erbumine, an ACE inhibitor, with indapamide, a diuretic, which work together to effectively lower blood pressure across all age groups.

Key Statistics on High Blood Pressure in the U.S. (2023)

|

Statistic |

Value |

|

Number of deaths where high blood pressure was a primary or contributing cause in 2023 |

664,470 deaths |

|

Percentage of US adults with high blood pressure (≥130/80 mm Hg or on medication) |

48.1% (119.9 million adults) |

|

Percentage of adults with high blood pressure who have it under control |

22.5% (27.0 million adults) |

|

Percentage of adults with uncontrolled high blood pressure with BP ≥140/90 mm Hg |

45% (37 million adults) |

|

Adults who should be on medication but may not be taking it |

34 million adults |

|

Adults with BP ≥140/90 mm Hg among those needing medication |

19 million adults |

Source: CDC

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the loop diuretics market from 2025 to 2035. This rapid upliftment is readily propelled by increasing rates of chronic diseases, coupled with an aging demographic. Besides, countries across this region are improving healthcare infrastructure, wherein growing awareness among clinicians and patients about chronic disease management is also a few boosting factors for this landscape. Furthermore, regulatory bodies and government programs in major nations are expanding access to essential medications, making loop diuretics more accessible.

India is gaining enhanced traction in the market owing to the combination of high disease burden, product innovations, and economic constraints. In June 2024, Zydus Lifesciences Limited received tentative approval from the U.S. FDA to market Azilsartan Medoxomil and Chlorthalidone tablets, which are used for treating high blood pressure. The company also stated that it is a combination of angiotensin II receptor blocker and a thiazide-like diuretic combination tablets, containing 40 mg/12.5 mg and 40 mg/25 mg doses, will be manufactured at Zydus’s formulation facility in Ahmedabad SEZ-II, India.

Europe Market Insights

Europe is expected to retain its position as the second-largest contributor to growth in the loop diuretics market by the end of 2035. The country’s progress in this field is backed by a surge in demand for oral loop diuretics and patient preference for at-home administration. In September 2025, NIH reported that it analyzed over 71,000 patients who were prescribed loop diuretics without a heart failure diagnosis and found that only 14% underwent HF assessment in the U.K., with 15% diagnosed in a span of five years, underscoring the importance of early diagnosis and specialist care for better outcomes in loop diuretic users.

In the U.K., the loop diuretics industry is expanding notably, especially due to the favourable administrative bodies and the government investments in trials focusing on optimizing dosing strategies to reduce hospital readmissions. In June 2025, the country’s Department of Health proposed increasing the payment rate for newer branded medicines under the statutory scheme from 15.5% to 23.8% starting July 2025, due to higher-than-expected sales growth. Rates for 2026 and 2027 are proposed at 24.7% and 26.4% hence benefiting overall market growth.

Key Loop Diuretics Market Players:

- Sanofi

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Novartis AG (Sandoz)

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Hikma Pharmaceuticals PLC

- Fresenius Kabi

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Aurobindo Pharma Ltd.

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Amneal Pharmaceuticals, Inc.

- Endo International plc

- Bausch Health Companies Inc.

- Zydus Cadila

- Glenmark Pharmaceuticals Ltd.

- Aspen Pharmacare Holdings Limited

- Nichi-Iko Pharmaceutical Co., Ltd.

- Taro Pharmaceutical Industries Ltd.

The competitive landscape of the market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in including novel medicines. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. Furthermore, the firms are also implementing numerous strategies such as mergers and acquisitions, joint ventures, partnerships, and product launches, to enhance their product portfolios and strengthen their market position.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2024, Vetoquinol reported that its UpCard-CA1 (torsemide oral solution) received conditional approval from the U.S. FDA for managing pulmonary edema in dogs with CHF caused by MMVD.

- In October 2022, scPharmaceuticals announced that it received the U.S. FDA approval for its FUROSCIX, which is the first and only self-administered, subcutaneous loop diuretic for at-home treatment of congestion in chronic heart failure.

- Report ID: 3137

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Loop Diuretics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.