Keratoconus Treatment Market Outlook:

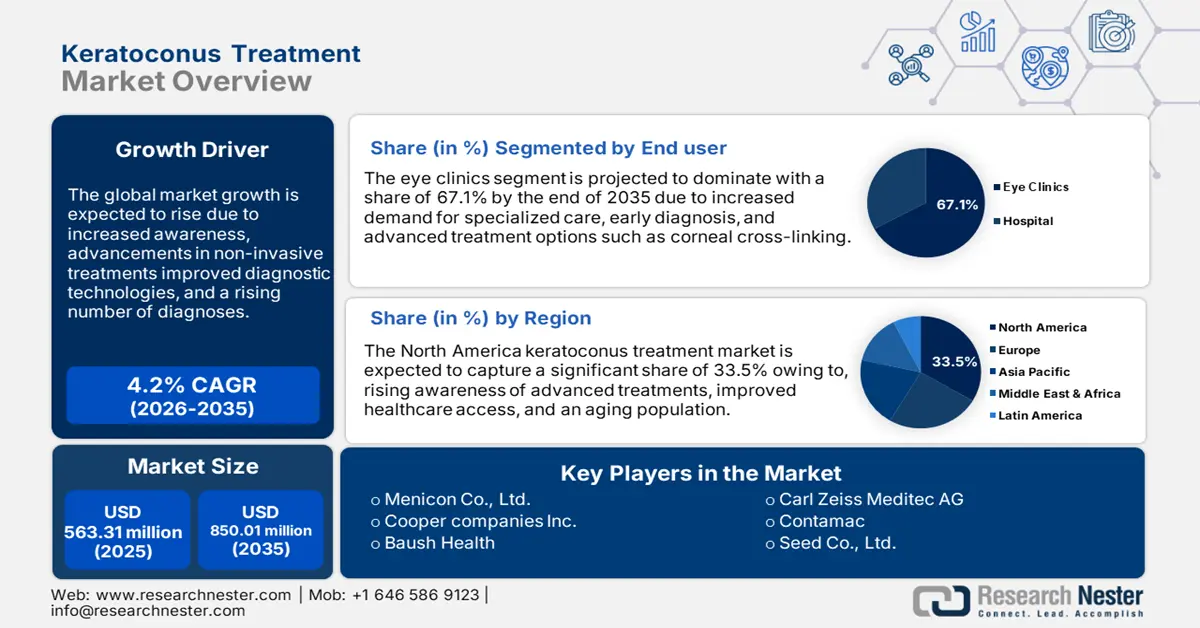

Keratoconus Treatment Market size was valued at USD 563.31 million in 2025 and is set to exceed USD 850.01 million by 2035, registering over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of keratoconus treatment is estimated at USD 584.6 million.

The increasing diagnosis rate of keratoconus, fueled by greater awareness and advancements in diagnostic technologies, is a significant driver of market growth. The American Academy of Ophthalmology reported in March 2024 that keratoconus was 0.04% prevalent nationwide in 2019, from 0.03% in 2016. Prevalence was highest among young adults (18-39 years). As more individuals are diagnosed with the condition, healthcare professionals are able to offer earlier interventions, which are crucial in managing the diseases. This early detection has created a heightened demand for effective treatment options, such as corneal cross-linking, customized contact lenses, and advanced surgical procedures, to slow disease progression and enhance vision outcomes. Moreover, as per the American Academy of Ophthalmology in March 2024, 2019, the average inflation-adjusted lifetime cost of treatment for keratoconus was USD 28,766.69.

Additionally, innovations such as corneal cross-linking (CXL), customized contact lenses, and intracorneal ring segments (ICRS) have revolutionized the treatment of keratoconus by providing non-invasive and effective solutions. For instance, Epion Therapeutics finished a Phase 2 clinical trial for its EpiSmart system in 2021, enrolling 2,258 patients with corneal ectasia. In October 2023, the company started a Phase 3 clinical trial requiring a masked placebo/sham arm to precisely track the advantages of this epi-on CXL therapy over 12 months.

CXL strengthens the cornea and halts disease progression, while customized contact lenses offer superior vision correction and comfort. ICRS improves the corneal shape, addressing vision impairments. These advanced therapies enhance patient outcomes and provide long-lasting results, increasing their adoption among a broader range of patients, and propelling the keratoconus treatment market.

Key Keratoconus Treatment Market Insights Summary:

Regional Highlights:

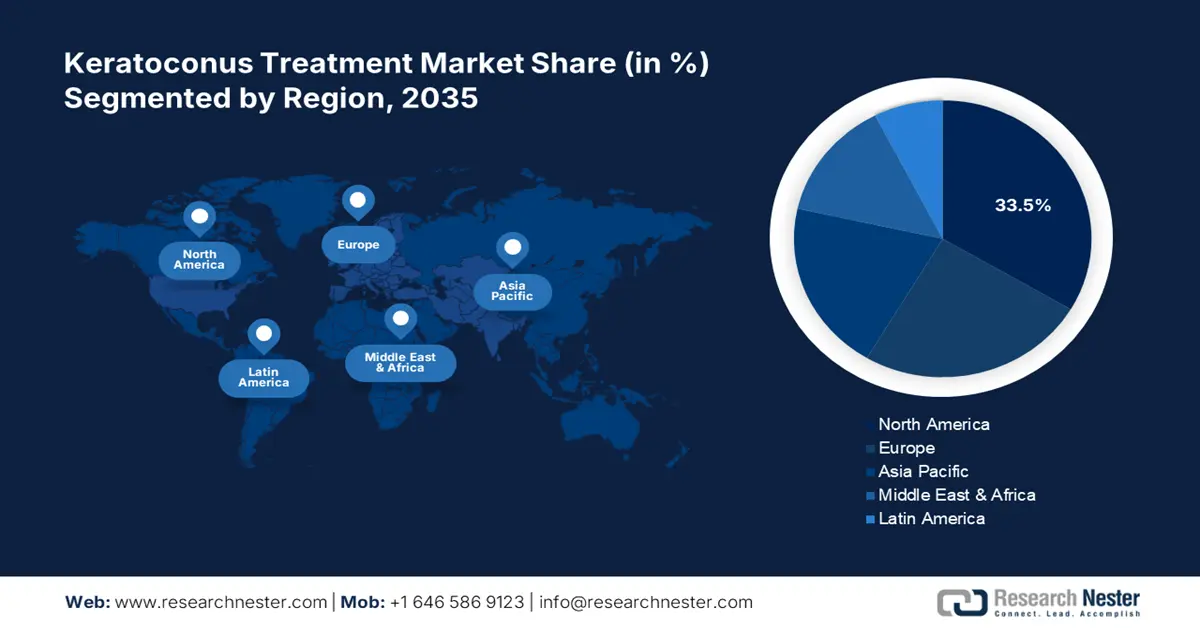

- North America holds a 33.5% share of the Keratoconus Treatment Market, driven by increasing keratoconus diagnoses and advances in treatment technologies, ensuring sustained leadership through 2026–2035.

- Asia Pacific’s keratoconus treatment market is expected to experience rapid growth through 2026–2035, driven by enhancements in healthcare infrastructure and growing keratoconus cases.

Segment Insights:

- The Eye Clinics segment is anticipated to see robust growth by 2035, propelled by increasing demand for specialized care and advanced treatment options.

- The Corneal Cross-linking segment of the Keratoconus Treatment Market is forecasted to hold the majority revenue share by 2035, propelled by its non-invasive nature and effectiveness in halting disease progression.

Key Growth Trends:

- Increasing demand for non-invasive treatments

- Rising geriatric population

Major Challenges:

- High cost of treatment

- Complexity of treatment management

- Key Players: Menicon Co., Ltd., Cooper Companies Inc., Baush Health.

Global Keratoconus Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 563.31 million

- 2026 Market Size: USD 584.6 million

- Projected Market Size: USD 850.01 million by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Keratoconus Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for non-invasive treatments: Patients are increasingly choosing non-invasive and minimally invasive therapies, such as corneal lenses, to manage keratoconus, propelling innovation in the keratoconus treatment market. For instance, in February 2024, Philips unveiled LumiGuide, leveraging Fiber Optic RealShape (FORS) technology to navigate blood vessels with light, offering a safer alternative to X-ray imaging. CXL technology strengthens the cornea and halts disease progression without the need for invasive surgery, while customized contact lenses improve vision comfort and correction. Thus, these treatments are highly appealing to patients seeking safer, more convenient, and less disruptive solutions.

-

Rising geriatric population: The global aging population is contributing to an increase in keratoconus cases, as the condition often worsens with age. Older adults are more susceptible to eye-related issues, and keratoconus can be exacerbated by other age-related vision conditions. According to the CDC as of 2024, 4.2 million people of America aged 40 or older have uncorrectable vision impairment, with this number predicted to more than double by 2030. This growing need for effective treatments tailored to the elderly is driving demand for keratoconus therapies, thus propelling the keratoconus treatment market.

Challenges

-

High cost of treatment: keratoconus treatments, including corneal cross-linking (CXL), customized contact lenses, and surgical interventions, can be prohibitively expensive, creating a significant barrier for many patients. This is especially true in regions with limited healthcare funding, where access to specialized treatments may be restricted. Without adequate insurance coverage or financial support, may individuals be unable to afford these therapies. The resulting financial burden can delay treatment, worsen the condition, and limit the keratoconus treatment market’s overall growth and adoption of advanced therapies.

-

Complexity of treatment management: managing keratoconus can be complex, particularly for patients using customized contact lenses that require frequent adjustments and monitoring. Regular follow-up visits are necessary to ensure the lenses continue to provide optimal vision correction, and patients may need personalized treatment plans, which can be challenging for patients. This complexity increases the risk of non-compliance, potentially reducing the long-term effectiveness of the therapies and hindering successful outcomes.

Keratoconus Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 563.31 million |

|

Forecast Year Market Size (2035) |

USD 850.01 million |

|

Regional Scope |

|

Keratoconus Treatment Market Segmentation:

End User (Hospital, Eye Clinics)

By end users, the eye clinics segment is anticipated to hold over 67.1% keratoconus treatment market share by the end of 2035. The segment’s growth is due to increasing demand for specialized care and advanced treatment options. Eye clinics provide comprehensive services, including early diagnosis, monitoring, and personalized treatment plans like corneal cross-linking and customized contact lenses. According to a WHO report from August 2023, at least 2.2 billion individuals worldwide suffer from near or distant vision impairment. With rising awareness and improved diagnostic technologies, patients are seeking specialized care from trained professionals at eye clinics, driving growth in this segment. The availability of expert services enhances treatment outcomes, boosting market expansion.

Treatment Type (Lenses, Surgery, Colonial cross-linking)

Based on treatment type, the corneal cross-linking segment in keratoconus treatment market is poised to hold the majority revenue share, in the market. This is due to its non-invasive nature, its ability to halt disease progression, and its proven effectiveness in strengthening the cornea. CXL is increasingly favored by both patients and healthcare professionals as it offers long-term benefits and reduces the need for more invasive surgical interventions. According to NVISION Eye Centers in August 2024, success rates indicate increases in visual acuity of over 70% and an average keratometry drop of about 75%. The growing adoption of CXL, driven by positive clinical outcomes, is a key factor contributing to its dominance in the keratoconus treatment market.

Our in-depth analysis of the global market includes the following segments:

|

End user |

|

|

Treatment Type |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Keratoconus Treatment Market Regional Analysis:

North America Market Statistics

North America in keratoconus treatment market is anticipated to hold more than 33.5% revenue share by 2035. The increasing number of keratoconus diagnoses, particularly among young adults, is driving demand for effective treatments. Improved awareness and advanced diagnostic technologies are enabling earlier and more accurate detection, further boosting treatment adoption. Innovations like corneal cross-linking, scleral lenses, and intracorneal ring segments (ICRS) have improved vision correction and slowed progression in keratoconus, encouraging more patients to seek effective treatments.

With an aging population in the U.S., age-related eye conditions such as keratoconus are becoming more common, driving the demand for treatment. As older adults are more susceptible to eye diseases, they seek appropriate treatments to maintain vision quality. New surgical techniques, including implantable contact lenses and keratoplasty (corneal transplantation), are becoming more advanced and effective. The total number of corneal transplants rose from 47,903 in 2015 to 49,143 in 2019, according to a November 2023 NIH publication. These innovations attract patients who require more permanent solutions, thus contributing to keratoconus treatment market expansion.

As awareness of keratoconus increases, more cases are being diagnosed in Canada. The condition's prevalence, though rare, is growing due to better diagnostic techniques and a greater understanding of eye disorders, prompting demand for effective treatments. Advanced treatments such as corneal cross-linking, riboflavin / UV therapy, and innovative contact lenses have improved keratoconus outcomes, enhanced patients' quality of life, and driven market growth.

APAC Market Analysis

In Asia Pacific, the keratoconus treatment market is established to garner fastest market growth over the forecast period. The region reports a substantial number of keratoconus cases, with prevalence rates varying significantly across countries. These figures underscore the growing demand for effective treatments tailored to the diverse populations within Asia Pacific. Moreover, ongoing enhancements in healthcare facilities and services across the Asia Pacific are facilitating better growth in the keratoconus treatment market.

China reports a substantial number of keratoconus cases, leading to increased demand for effective treatments. The government of China focuses on improving healthcare infrastructure and reimbursement policies for advanced medical devices creating a favorable environment for market growth. Additionally, the government of China has set up a healthcare insurance program that benefits over 1.36 billion people and covers nearly 96% of the population as published by the National Library of Medicine in May 2023. ongoing research and development have led to the introduction of innovative treatment options, enhancing the effectiveness and accessibility of keratoconus therapies

India is embarking on significant growth in the keratoconus treatment market due to rising disposable income and healthcare spending. Economic growth has increased disposable, enabling more individuals to seek advanced medical treatments, including those for keratoconus. In January 2024, the International Trade Administration reported that the healthcare sector in India had grown to nearly USD 370 billion in 2022. Further, innovative treatments such as corneal cross-linking and specialized contact lenses have significantly enhanced keratoconus management. Corneal cross-linking stabilizes the cornea, halting disease progression and improving vision. Specialized contact lenses correct refractive errors, offering clearer vision and increased comfort. These advancements provide patients with more effective and personalized therapeutic options, thus propelling the market.

Key Keratoconus Treatment Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Menicon Co., Ltd.

- Cooper companies Inc.

- Baush Health

- SynergEyes

- Carl Zeiss Meditec AG

- Contamac

- Seed Co., Ltd.

- Johnson & Johnson Services, Inc.

- Glaukos Corporation

Key players in the keratoconus treatment market is driving innovation through the development of advanced therapies such as corneal cross-linking, customized contact lenses, and intracorneal ring segments. These companies are also focusing on non-invasive procedures, enhancing patient comfort, and improving vision outcomes. For instance, ZEISS Medical Technology presented cutting-edge surgical techniques and digital innovations at the American Academy of Ophthalmology (AAO) conference, which took place in Chicago from October 19–21, 2024. Research into new technologies is further advancing treatment options, offering patients more effective, long-term solutions for managing keratoconus through AI innovatives. Some of these key players in the keratoconus treatment market include:

Recent Developments

- In October 2024, Glaukos Corporation announced Phase 3 trial success for Epioxa, its next-gen corneal cross-linking therapy, showing significant Kmax improvement in keratoconus treatment at 12 months.

- In November 2022, CooperVision expanded its Speciality EyeCare unit by acquiring SynergEyes, renowed for hybrid lens technologies addressing irregular cornea, presbyopia, and astigmatism, strengthening its global specialty contact lens portfolio.

- Report ID: 6908

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Keratoconus Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.