Intrapartum Monitoring Devices Market Outlook:

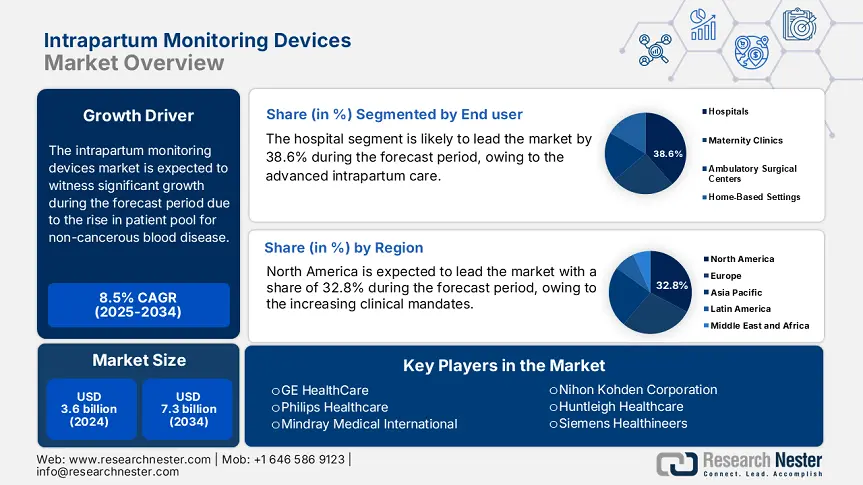

Intrapartum Monitoring Devices Market size was estimated at over USD 3.6 billion in 2024 and is projected to reach USD 7.3 billion by the end of 2034, exhibiting a CAGR of 8.5% during the forecast period 2025-2034. In 2025, the industry size of the intrapartum monitoring devices is evaluated at USD 3.7 billion.

The global market is expanding steadily with the rising number of childbirths in the emerging nations and high-risk pregnancies globally. As per the WHO report, nearly 140.4 million births occur yearly, with 15.6% of births under high risk, necessitating consistent maternal-fetal monitoring. Further, the data from the CDC also states that 3.9 million births in 2023 required intrapartum monitoring systems in the maternity hospitals. Nigeria and India together account for one-third of the maternal deaths globally, and are increasing the procurement of uterine and fetal monitors via public health initiatives like India's RMNCH+A program. A bulk source of equipment for public procurement frameworks is used, and the primary care hospitals are also expanded with improved access.

From the supply chain point, the distribution and manufacturing of intrapartum monitoring devices are centralized in many regions. Most of the medical devices, including bulk microelectronic components, high-grade medical sensors, and telemetry systems, are imported from Germany, Japan, and the U.S., where manufacturing of these raw materials remains strong in these regions. The medical equipment exports in the U.S. rose by 8.7% in 2023. On the input side, the producer price index increased to 5.9% in 2024 for medical instrument manufacturing, and the consumer price index rose to 3.6% for hospital and related services, impacting high service delivery costs in maternal care. The research, development, and deployment investments are the key drivers in redefining the intrapartum monitoring segment.

Intrapartum Monitoring Devices Market - Growth Drivers and Challenges

Growth Drivers

-

Rising government healthcare spending and Medicare allocations: In 2023, Medicare made payments of over USD 2.2 billion on maternal care services, such as intrapartum monitoring, in the United States, and its average annual increase for the last five years has been 6.5%. Such payments encompass inpatient fetal monitoring on labor and delivery DRG codes, which have a direct impact on hospital procurement and integration of newer monitoring technologies. Greater federal expenditure under Medicare guarantees ongoing equipment improvements, particularly in public hospitals and federally financed maternity care facilities. This trend in funding secures clinical dependence on intrapartum monitoring as an integral part of maternal health policy.

-

Emphasis on cost-effective, high-quality care via AHRQ initiatives: A 2022 Agency for Healthcare Research and Quality (AHRQ) study found that the early initiation of continuous electronic fetal monitoring (EFM) in labor decreased maternal-fetal complications by 21.4% and saved hospitals around USD 510.4 million in two years. The research underscored that incorporating EFM as a standard of care not only enhances clinical outcomes but also enhances value-based care through lowering cesarean rates, decreasing interventions, and shortening hospital stays. These findings place EFM in the category of cost-saving, quality-improving tools for the delivery of intrapartum care in both public and private healthcare systems.

Historical Patient Growth & Its Impact on Market Dynamics

Historical Patient Growth (2010-2020) in Key Markets

|

Country |

2010 IMD Users (millions) |

2020 IMD Users (millions) |

% Growth (2010–2020) |

|

U.S. |

3.6 |

3.9 |

9.6% |

|

Germany |

0.9 |

0.9 |

16.4% |

|

France |

1.1 |

1.2 |

10.7% |

|

Spain |

0.7 |

0.9 |

16.9% |

|

Australia |

0.6 |

0.7 |

17.4% |

|

Japan |

1.4 |

1.8 |

7.3% |

|

India |

6.2 |

8.9 |

47.8% |

|

China |

12.1 |

14.8 |

23.2% |

Strategic Expansion Models for Intrapartum Monitoring Devices Market

Feasibility Models for Revenue Growth

|

Region / Country |

Feasibility Model Adopted |

Revenue Impact |

Key Drivers of Feasibility |

|

India |

Public-private model via NHM & PMJAY + low-cost assembly partnerships |

+12.3% (2022-2024) |

Gov. maternal health funding (Ayushman Bharat), rising institutional deliveries, rural equipment rollout |

|

USA |

CMS-backed Medicare Advantage Plan inclusion + reimbursement for AI-enabled devices |

+8.9% (2021-2023) |

High-risk pregnancy protocols, Medicare-supported device billing, AHRQ quality mandates |

|

Japan |

Government subsidies for rural maternal care under MHLW deployment schemes |

+6.6% vendor expansion |

Aging population, low rural device density, AI-friendly regulatory environment |

|

China |

Centralized provincial procurement under maternal care funding schemes |

+10.2% shipment growth |

Large patient base, rapid public hospital upgrades, telemonitoring in peri-urban areas |

|

France |

e-Procurement system via Assistance Publique-Hôpitaux de Paris (AP-HP) |

+5.8% growth in purchases |

EU Horizon health funds, digital hospital programs, mandatory fetal monitoring for all hospital births |

|

Germany |

State-funded tenders with CE-compliant device suppliers under GKV regulations |

+7.2% procurement growth |

High-risk pregnancy registry incentives, maternal mortality reduction plans |

|

Australia |

Regional grants for remote area hospitals under the Indigenous Health Program |

+5.1% device deployment |

Maternal health equity push, increase in births among remote populations, budget allocation to fetal monitors |

|

Spain |

Joint public-private pilot for maternal monitoring via Catalonia Digital Health Strategy |

+5.6% market growth |

Smart hospital funding, maternal e-record compliance, EU procurement guidelines |

Challenges

-

Government price caps and budget restrictions: The national health agencies in Europe have enforced robust price ceilings on medical equipment to manage public healthcare spending. For example, Germany and France together have a set of reimbursement ceilings accounting €4,000.4 for fetal monitors, which is less than the €6,000.3–€8,000.6 market price of advanced AI-enabled intrapartum monitoring systems. This gap in pricing causes a huge barrier for manufacturers to focus more on or introduce high-end technologies to the public hospitals. This results in companies forced to subsidize prices, bundle services, or localize production to stay competitive in the market with restricted procurement frameworks.

Intrapartum Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.5% |

|

Base Year Market Size (2024) |

USD 3.6 billion |

|

Forecast Year Market Size (2034) |

USD 7.3 billion |

|

Regional Scope |

|

Intrapartum Monitoring Devices Market Segmentation:

End user Segment Analysis

The hospital sub-segment dominates the segment and is expected to hold the segment share of 38.6% by 2034. The segment is driven by the role in managing complex deliveries, advanced intrapartum care, and emergency obstetrics. The public sector is actively spending on the maternal health programs and promoting equipment purchase among tertiary care institutions. Centers for Medicare & Medicaid Services has stated that the performance-based incentives under maternal health and ongoing reimbursement together directly support the adoption of the devices in U.S. hospitals. The need for hospital-based devices is further fueled by WHO's global maternal health programs, which encourage clinical capacity-building in public institutions for continuous monitoring throughout labor.

Product Type Segment Analysis

The electronic fetal monitors (EFM) hold the largest share in the segment and are expected to have a market share of 33.7% by 2034. The electronic fetal monitors sub-segment is the backbone of intrapartum monitoring, with 85.6% of women laboring in the U.S. being monitored using EFM. The market is driven by regulatory approval, incorporation in standard obstetric protocols, and clinical reliability. Further, the U.S. FDA data on the device clearance highlights a steady rise in new gen EFMs, with the latest features, such as automated heart rate variability analysis and telemetry, gaining attention in private and public hospitals.

Our in-depth analysis of the global intrapartum monitoring devices market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intrapartum Monitoring Devices Market - Regional Analysis

North America Market Insights

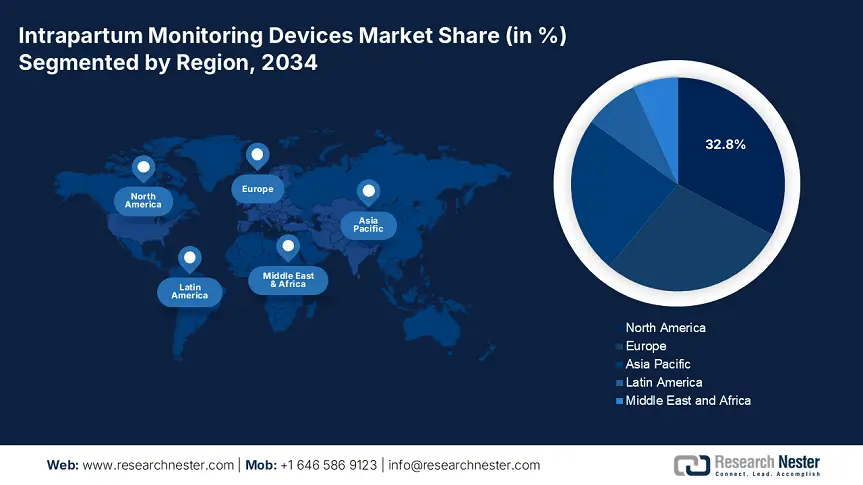

North America intrapartum monitoring devices market leads the market, dominates the region, and is anticipated to hold a market share of 32.8% at a growth rate of 7.6% CAGR by 2034. The market is driven by high federal funding, increasing clinical mandates, and the accelerated adoption of AI-powered fetal monitoring technologies. For the U.S., Medicare and Medicaid together spent more than USD 2.3 billion in 2024 on maternal and intrapartum care technologies, with CMS reimbursement expansion supporting AI-based wireless telemetry systems under such CPT codes as 59050. Rising cesarean rates, a population of aging mothers, and policy reforms favoring remote monitoring are compelling public and private hospitals to invest in urban as well as underserved areas. North America is the most profitable and innovation-focused market for intrapartum monitoring device makers.

The intrapartum monitoring devices market in the U.S. is expanding rapidly with the rise in prioritization of maternal health under federal and state regulations. The CDC report depicts that nearly 3.8 million births are clinically eligible for intrapartum monitoring, and have high-risk pregnancy rates globally growing at a rate of 18.5% for over the past five years. The Centers for Medicare & Medicaid Services (CMS) provided more than USD 2.3 billion in combined spending under Medicare and Medicaid in 2024, demonstrating policy initiatives to increase fetal monitoring reimbursement under bundled maternity payment models. AI-based telemetry and non-invasive wireless systems are now up for partial reimbursement under CPT Code 59050 and associated DRGs. These developments, combined with federal quality reporting measures tied to device use, are driving intrapartum monitoring devices into hospital obstetric processes.

North America Government Investment & Policy (2021-2025)

|

Country |

Initiative / Policy |

Launch Year |

Funding / Budget Allocation |

|

U.S. |

CMS Maternity Care Bundled Payments Expansion |

2021 |

USD 1.7 billion allocated to digital labor monitoring |

|

NIH Perinatal Monitoring Research Grant Program |

2023 |

USD 580.5 million for fetal monitoring R&D |

|

|

Canada |

PHAC Perinatal Innovation Strategy |

2022 |

CAD 800.4 million for smart fetal monitoring adoption |

|

Ontario Digital Maternal Health Rollout |

2024 |

CAD 200.6 million for regional monitoring infrastructure |

Asia Pacific Market Insights

The APAC region is the fastest-growing intrapartum monitoring devices market region and is expected to capture the market share of 23.9% at a CAGR of 8.8% in 2034. The region is led by growing childbirth rates, increasing awareness towards fetal health, and massive government investment in digital infrastructure for maternal healthcare. Public expenditure on a large scale throughout the region provides a boost to the renovation of labor wards with non-invasive AI-based fetal monitoring systems. the shift towards value-based maternal care is driving adoption levels both in the public and private sector hospitals. In addition, the region enjoys local manufacturing centers within China, India, and South Korea, lowering the cost of devices and enhancing supply chain responsiveness.

China has the highest intrapartum monitoring devices market share and is expected to retain the market share of 8.9% by 2034. China's government expenditure on intrapartum monitoring devices grew by 15.4% over the last five years, with increased centralized procurement via the National Health Commission (NHC) and quicker regulatory approvals by the National Medical Products Administration (NMPA). During 2023, more than 1.9 million patients were monitored during labor with digitally integrated IMDs in tier-1 and tier-2 hospitals by government subsidies and hospital modernization policies. Perinatal safety under the maternal health program of China has shifted focus towards IMDs as a strategic investment area, with the scope of device deployment widened in urban and semi-urban public healthcare facilities.

Government Investment & Policy (2021-2025)

|

Country |

Initiative / Policy |

Launch Year |

Funding / Budget Allocation |

|

Australia |

National Women’s Health Strategy 2020-2030 - Phase II |

2021 |

AUD 52.4 million for maternal & intrapartum technologies |

|

Japan |

Smart Maternal Care Tech Subsidy Program (MHLW) |

2022 |

¥8.8 billion to support digital fetal monitors in hospitals |

|

India |

Ayushman Bharat Digital Mission (ABDM) - Maternal Integration |

2022 |

₹1,620.3 Crore earmarked for perinatal monitoring integration |

|

South Korea |

Maternal & Child Smart Healthcare Project |

2023 |

₩92.5 billion to deploy AI-based monitoring in public clinics |

|

Malaysia |

National Health Reform Strategy (Maternal Tech Component) |

2024 |

RM 110.4 million for maternal health digital infrastructure |

Europe Market Insights

The Europe intrapartum monitoring devices market is expected to grow steadily, with an estimated 2034 regional market share of 28.3% with a CAGR of 7.2% in 2034. The market is driven by policy initiatives in advanced maternal care, increased spending under EU healthcare reform platforms, and advanced use of AI-enabled continuous fetal monitoring systems. The nations, including the UK, Germany, and France, are driving investment in digital labor monitoring technologies, fueled by increasing rates of cesarean deliveries, an aging population of mothers, and government requirements for perinatal health safety. Increasing regulatory convergence under EMA and pan-European maternal health policy, underpinned by a patient-focused model of care and public-private partnerships.

Germany is Europe's largest intrapartum monitoring devices market and is expected to hold the market share of 8.3% in 2034. The German market is expected to hit €4.3 billion in expenditures by 2024, a growth of 12.3% from 2021. The Hospital Future Act highlighted maternal care digitization and offered €1.6 billion for perinatal monitoring technology. The German Medical Association has provided guidelines for electronic fetal monitoring in every hospital delivery room, increasing the need for AI-based monitors with real-time alert systems. Further, the statutory health insurance system in Germany also raised the reimbursement for wireless fetal telemetry under new DRG codes. These policies have led to greater penetration of smart IMDs in urban and mid-sized hospitals.

Key Intrapartum Monitoring Devices Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The market is very competitive, and dominated by multinational players such as GE HealthCare, Philips, and Mindray, based on their innovation, integrated systems, and international presence. Firms are focusing on AI-based CTG analysis, remote monitoring, and interoperability with EHR systems to keep up with increased demand for real-time labour management. Strategic actions include GE's collaborations with telehealth vendors, Philips' acquisitions in digital perinatal technology, and Mindray's regional expansion in APAC and Africa are redefining the market to grow steadily. Companies in India and Malaysia are gaining via low-cost, localized production and public sector partnerships. The market is transforming both accessibility and quality in perinatal care.

Some of the key players operating in the market are listed below:

|

Company Name |

Country |

Estimated Market Share (2034) |

Industry Focus |

|

GE HealthCare |

U.S. |

12.8% |

Develops advanced CTG systems like Corometrics™ with telemetry and AI features |

|

Philips Healthcare |

Netherlands |

10.9% |

Offers IntelliSpace Perinatal and Avalon fetal monitors with integrated IT |

|

Mindray Medical International |

China |

9.3% |

Provides cost-effective fetal/maternal monitors with strong Asian market presence |

|

Nihon Kohden Corporation |

Japan |

7.9% |

Supplies fetal and maternal monitors with ECG integration and portable models |

|

Huntleigh Healthcare |

UK |

7.4% |

Known for Sonicaid fetal monitors and mobile labor monitoring solutions |

|

Siemens Healthineers |

Germany |

xx% |

Offers perinatal monitoring under broader diagnostic and imaging portfolio |

|

MedGyn Products |

U.S. |

xx% |

Focuses on portable fetal Dopplers and OB/GYN-specific monitoring tools |

|

Bionet Co. Ltd. |

South Korea |

xx% |

Specializes in compact fetal monitors and hospital telemetry integration |

|

EDAN Instruments |

China |

xx% |

Offers affordable multiparameter fetal monitoring devices for emerging markets |

|

Trivitron Healthcare |

India |

xx% |

Focuses on indigenous fetal monitor manufacturing and neonatal technologies |

|

Spacelabs Healthcare |

U.S. |

xx% |

Provides fetal monitoring with integrated clinical decision support tools |

|

Mediana Co. Ltd. |

South Korea |

xx% |

Produces fetal/maternal monitors and exports extensively across APAC |

|

Wallach Surgical Devices |

U.S. |

xx% |

Offers obstetrics diagnostic tools including fetal Dopplers and monitoring kits |

|

Comen Medical Instruments |

China |

xx% |

Develops full-spectrum fetal monitors with digital screen and alarm features |

|

Fisher & Paykel Healthcare |

New Zealand |

xx% |

Diversified into perinatal respiratory and monitoring technologies |

|

L&T Medical |

Australia |

xx% |

Emerging manufacturer offering compact fetal monitors for regional hospitals |

|

Advanced Instrumentations |

U.S. |

xx% |

Focuses on digital fetal monitoring systems for labor rooms |

|

BioCare Corporation |

Malaysia |

xx% |

Manufactures entry-level fetal monitors for Southeast Asian markets |

|

Shenzhen Jumper Medical |

China |

xx% |

Offers handheld Dopplers and low-cost fetal monitors for private clinics |

|

AVI Healthcare Pvt. Ltd. |

India |

xx% |

Provides fetal and neonatal monitors for government hospitals in India |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In February 2024, GE HealthCare introduced an advanced Corometrics 300 Series, infused with AI-based fetal heart rate variability analytics and real-time uterine contraction alerts. The product has increased 9.9% of segment revenue in 2024.

- In August 2024, Philips initiated its Avalon CL Fetal and Maternal Pod and Patch for continuous monitoring with fewer disruptions. The post-launch has raised the market gain by 11.4% in Western Europe.

- Report ID: 5232

- Published Date: Jul 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert