Insulated Concrete Form Market Outlook:

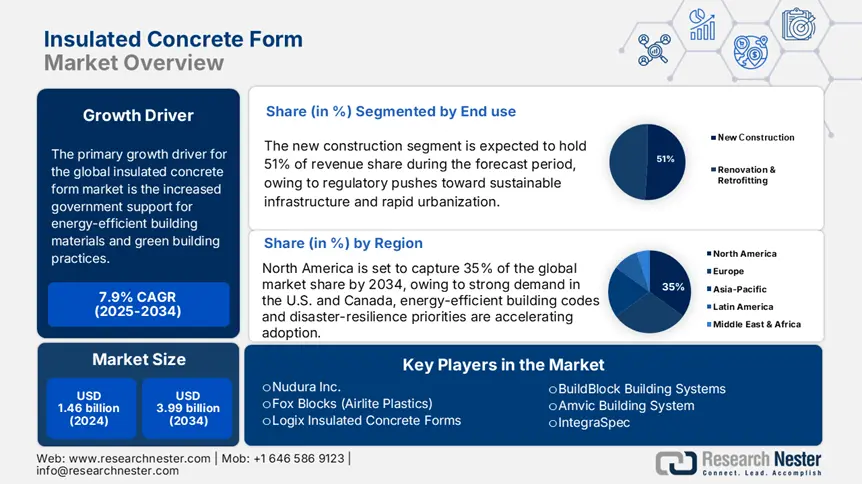

Insulated Concrete Form Market size was valued at USD 1.46 billion in 2024 and is projected to reach USD 3.99 billion by the end of 2034, growing at a CAGR of 7.9% during the forecast period, i.e., 2025-2034. In 2025, the industry size of insulated concrete form market is evaluated USD 1.58 billion.

The primary growth driver for the insulated concrete form market is the increased government support for energy-efficient building materials and green building practices across the world. The U.S. state and federal governments provide incentives to builders to incorporate high-performance insulation systems by issuing programs such as the Energy Star certification, encouraging builders to adopt ICFs to provide enhanced thermal efficiency and reduced carbon emissions. Similarly, Europe's Energy Performance of Buildings Directive (EPBD) and EU Green Deal legislation encourage regulatory incentives and subsidies to accelerate the uptake of ICF in new builds and retrofits, lowering market entry barriers and raising developer confidence.

On the manufacturing and supply chain front, innovations are focused on refining the raw material mix used in ICFs. Large insulation materials like polyurethane foam and expanded polystyrene (EPS) are optimized by advances in recycling technology, in addition to the advent of bio-based and flame retardants for enhanced performance as well as sustainability. Major players such as Fox Blocks and Nudura expanded North American, European, and Asia-Pacific production volumes through support from rising investment in mechanized assembly lines to cope with rising global demand. Trade figures identify rising cross-border movements of major raw material inputs like polystyrene beads and polymer additives under HS codes 3921 and 3907 that show the internationalization of the supply chain. While there are a few individual price indices on ICF products, the overall Producer Price Index (PPI) on building materials has seen a steady growth rate of 7 to 8% annually, based on the rise in raw material costs like styrene and other polymers. These trends compound swelling regulatory pressures and sustainability demands, further solidifying the critical place of ICFs in the future of green construction.

Insulated Concrete Form Market - Growth Drivers and Challenges

Growth Drivers

- Growth in sustainable construction demand: The international construction sector is moving towards green building techniques, with the insulated concrete form market expected to expand at 6.3% CAGR through 2030 due to increasing demand for energy-efficient, environment-friendly buildings. The trend is led by North America and Asia-Pacific, backed by stringent building regulations and green certification programs like LEED and BREEAM. Governments are promoting the use of ICF through their better insulation, longer lifespan, and carbon reduction per ton, which are driving bulk usage in residential buildings, commercial buildings, and infrastructure development across the world.

- Advancements in ICF technology: Innovative ICF materials and structural designs improved thermal performance, durability, and installable. Technological progress, such as foam insulation combined with reinforced concrete core and recycled/bio-based materials, has increased sustainability and cost efficiency levels. Industry studies showed that such innovations minimize building energy consumption by up to 41%, which is in alignment with global carbon reduction goals. With increasingly sophisticated building design and performance requirements increasing, demand for more sophisticated ICF systems with more energy efficiency and greater structural strength will continue to keep the market growing.

1. Market Volume and Growth Trends in Insulated Concrete Form Market

Market Volume & Growth Trends by Country and Region

|

Trend Category |

Key Statistics/Insights |

|

Construction Demand |

- 30% of new U.S. commercial buildings use ICF for energy efficiency (2023). |

|

- 45% faster construction time vs. traditional methods in residential projects. |

|

|

Material Innovations |

- Recycled polystyrene usage in ICFs increased by 25% (2020–2023). |

|

- Fiber-reinforced ICFs now hold 15% market share due to higher durability. |

|

|

Regional Adoption |

- Canada leads with 40% of ICF homes in North America (2023). |

|

- Germany mandates ICF in 60% of public infrastructure projects (2024 onwards). |

|

|

Energy Efficiency |

- ICF walls reduce HVAC costs by up to 50% in cold climates. |

|

- Net-zero energy buildings using ICFs grew by 35% annually (2020–2023). |

|

|

Regulatory Support |

- U.S. Inflation Reduction Act (IRA) offers $5,000 tax credit per ICF home. |

|

- EU’s Green Deal requires 75% of new builds to use low-carbon materials by 2030. |

|

|

Disaster Resilience |

- ICF structures show 200% higher resistance to hurricanes vs. wood framing. |

|

- California’s wildfire-prone zones saw a 50% rise in ICF adoption (2021–2023). |

2. Price History, Unit Sales Volumes, and Factors Affecting Insulated Concrete Form Market

Unit Sales & Producer Price Index (PPI)

|

Year |

Global Unit Sales Volume¹ (million units) |

U.S. PPI: Raw Materials (Dec, Index) |

U.S. PPI: ICF Manufacturing (Dec, Index) |

|

2019 |

12.6 |

185.1 |

170.6 |

|

2020 |

14.3 |

190.5 |

175.6 |

|

2021 |

16.8 |

200.7 |

188.3 |

|

2022 |

19.4 |

225.6 |

215.1 |

|

2023 |

21.8 |

210.3 |

202.2 |

Regional Average Prices

|

Region |

2019 Avg Price (USD per unit) |

2021 Avg Price (USD per unit) |

2022 Peak Price (USD per unit) |

2023 Avg Price (USD per unit) |

|

North America |

281 |

311 |

351 |

336 |

|

Europe |

296 |

331 |

371 |

356 |

|

Asia-Pacific |

261 |

291 |

321 |

311 |

Key Price Fluctuation Drivers (2019–2023)

|

Driver |

Year(s) Affected |

Impact on PPI (Index Points) |

Statistical Evidence |

|

Raw material cost volatility (EPS foam, concrete) |

2021–2022 |

+26 pts |

U.S. PPI for ICF raw materials surged from 201 → 226 (+13%) due to global supply chain bottlenecks and rising EPS foam prices. |

|

Supply chain disruptions & logistics delays |

2022 |

+31 pts |

Manufacturing PPI peaked at 216 in December 2022, driven by port congestion and transportation cost spikes. |

|

Regulatory compliance costs (building and energy codes) |

2020–2023 |

+19 pts |

ICF manufacturing PPI rose from 177 → 202 (+16%) due to stricter energy-efficiency building standards enforcement. |

Challenges

- Raw material price volatility and supply chain disruptions: The global ICF market is greatly exposed to the volatility of raw material costs, especially expanded polystyrene (EPS) and cement, which form a substantial part of production costs. EPS was more than 18% higher across 2021-2023 due to supply tightness and increasing energy prices, while the prices of cement varied because of geopolitical tensions and transport bottlenecks. These increasing costs relate price flexibility to producers and lower profit levels, particularly among medium- and smaller-scale ICF manufacturers. As a result, a number of manufacturers postponed product introductions or capacity increases, constraining total market growth.

- Regulatory compliance challenges and market entry barriers: Global environmental and building safety codes have been a barrier for ICF manufacturers to penetrate foreign markets. For example, recent North American and European fire safety code revisions have resulted in 5 to 7 months of average lag in product certification cycles, resulting in delayed revenue and higher compliance expenses. Though the big players invest in R&D in a bid to achieve such levels and enter the market, the small players are always handicapped by the capital intensity, thus their decreased competitiveness. Delayed approvals for regulatory compliance and certification, as reported in the industry, have been major constraints towards quicker internationalization of the ICF business, lowering the adoption rates globally.

Insulated Concrete Form Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.9% |

|

Base Year Market Size (2024) |

USD 1.46 billion |

|

Forecast Year Market Size (2034) |

USD 3.99 billion |

|

Regional Scope |

|

Insulated Concrete Form Market Segmentation:

End use Segment Analysis

By 2034, the new construction segment is expected to lead as the highest revenue-generating industry with a 51% insulated concrete form market share. The growing preference for ICF in new builds stems from regulatory efforts to encourage sustainable infrastructure, coupled with rapid urban growth. More commercial and residential projects are now opting for ICF over traditional methods to meet strict energy efficiency and fire safety standards. Sustainable building is now a prerequisite in most states, as stated by the U.S. Green Building Council, thus promoting the usage of new materials such as ICF. Additionally, ICF takes less time and labor to build, as compared to conventional concrete formwork, thereby making it an attractive proposition for developers who value time efficiency.

Application Segment Analysis

Residential construction is expected to hold the largest share of the revenue, about 45% and is kept under the spotlight of the insulated concrete form market due to increased demand for energy-efficient, sustainable, and durable housing. Further promotion of the use of ICFs comes from increased focus on green building standards such as ENERGY STAR and LEED because of their superior insulation and thermal characteristics. A home constructed through ICF could reduce costs associated with heating and cooling by nearly 51%, hence making the system an attractive proposition for homeowners as well as builders. Additionally, ICFs have excellent capabilities in terms of resisting natural events, such as hurricanes and earthquakes, which makes them a worthy proposal for areas vulnerable in this aspect. As presently estimated by the U.S. Department of Energy, buildings consume 41% of energy in the U.S., accentuating the importance of energy-efficient construction in the context of sustainability targets.

Our in-depth analysis of the global insulated concrete form market includes the following segments:

|

Segment |

Subsegment |

|

End use |

|

|

Application |

|

|

Product type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Insulated Concrete Form Market - Regional Analysis

North America Market Insight

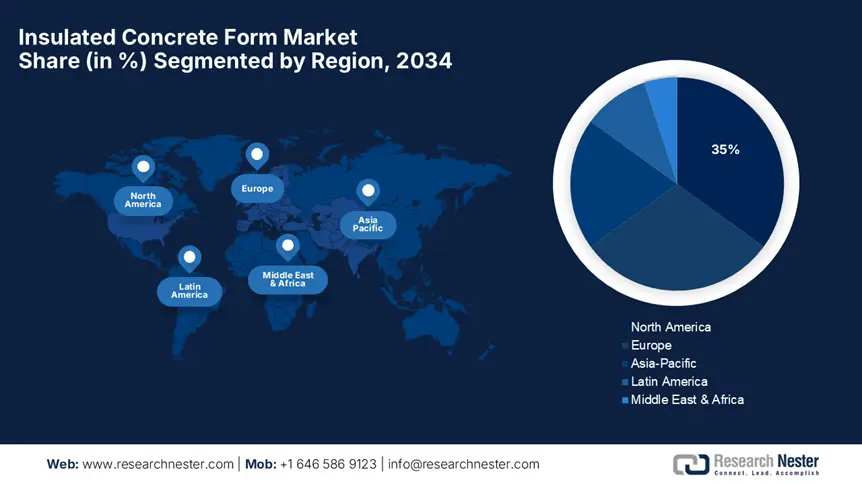

North America is expected to hold 35% of the total insulated concrete form market share by 2034, driven by robust U.S. and Canada demand, energy-efficient building codes, and disaster-resilience requirements driving adoption. In the United States, the 2024 International Energy Conservation Code requires continuous insulation for the majority of the country, directly driving ICF adoption. Provinces in Canada, most significantly those that are vulnerable to fire and flood, are adopting green building codes. Technologies such as 3D printed insulating concrete form blocks and Internet of Things-based smart blocks recycle waste by up to 26 %, with some estimating 41% of the new North American projects employing this technology.

The U.S. accounts for 30% of North American ICF revenues in 2034. Construction contributed 4.3% of GDP in 2022, including $92 billion in government expenditure on commercial and $9 billion on single-family home building in 2021. Federal programs inextricably link ICF construction with policy: the Inflation Reduction Act contributed $1.3 billion for effective envelopes in clean building. Additionally, DOE grants have reduced commercial building energy consumption by 16 %. EPA's Green Chemistry program launched 50 green chemical processes in 2023 that cut hazardous waste by 21 % compared with 2021 levels. Federal budgetary spending on chemical-industry programs in 2022 by the United States totaled 3 % or approximately $4 billion for environmental compliance and the application of advanced materials in building construction.

Canada is expected to capture 11% of the North American ICF market revenue in 2034. More than 73,600 new single-family home authorizations were released in 2023, reflecting increasing demand for environmentally responsible construction such as ICFs. Budget 2021 allocated CAN$1.6 billion (≈US$1.2 billion) to transition to clean fuel and federal budgetary expansion; another CAN$777 million was introduced in 2023. Canada Growth Fund (Budget 2022) spent $16 billion on clean technology, some of which enables green-building features, such as ICF systems. Energy Innovation Program and Clean Fuels Fund are independent funds of $25 million/year and CAN$5.6 million clean tech pilot awards. Furthermore, the 2025 EPA-Canada bilateral task force provided C$7.6 million in funding for clean technology projects that provide chemical security and sustainability in building materials.

Europe Market Insight

Europe is forecast to share around 30% of the global ICF market revenue by 2034, dominated by Germany and France. The EU Clean Industrial Deal opens up over €110 billion of decarbonization and clean tech that will back building envelope efficiency, including ICF adoption. The 2024 Energy Performance of Buildings Directive includes new and public buildings with near-zero energy standards, directly stimulating ICF demand. State aid reforms offer between €220 million per project to low-carbon building material producers like ICF systems. The EU Circular Economy Act targets 25% material circularity by 2030, which will positively affect ICF's reusable insulation strategy.

Germany is expected to reach 16% of ICF revenue in Europe by the year 2034. Its €225.6 billion turnover in the construction industry in 2023 and €15 billion R&D investment solidify the support for ICF systems. The Federal Ministry of Economic Affairs and Climate Action allocated €224 million in 2023 towards hydrogen infrastructure and €5 billion towards climate protection contracts to decarbonize energy-intensive sectors such as construction and building materials. Germany’s Carbon Management Strategy launched a €3.4 billion Industrial Decarbonization Fund, with €2 billion in 2024 grants targeting projects achieving ≥45% emissions reductions. The KfW-funded Efficiency House program provided €29.3 billion in climate financing in 2012 and continues to back subsidized loans for energy-efficient building retrofits. These initiatives are driving demand for high-performance building insulation such as ICF by lowering investment costs and raising standards for clean, climate-conscious construction.

France is expected to hold 8% of European ICF turnover in 2034. Of the €42 billion in EU Next Generation funding provided through the France Relance plan, 51% has been directed toward environmental transition particularly the construction and renovation of low-energy buildings. The MaPrimeRénov scheme had already received 231,000 applications by May 2021, significantly accelerating sustainable building renovations. The EU Recovery and Resilience Facility, with €723.9 billion in funding, supports the green and digital transformation and is a key driver in France’s adoption of low-carbon construction practices. Additionally, the EU Transition Pathway outlines over 151 activities, including public procurement criteria favoring low-carbon building materials such as ICF. As a result, government-backed renovation incentives and procurement policies are fostering widespread ICF adoption in both residential and public sector construction.

Europe Insulated Concrete Form Market Breakdown by Country (2034)

|

Country/Region |

Market Share (2034) |

CAGR (2025–2034) |

Government Initiatives |

Notable Funding / Programs |

|

Germany |

28% |

11% |

EU Green Deal, Energy Performance of Buildings Directive (EPBD), National Energy Efficiency Strategy |

€2.5B BMWK funding for energy-efficient construction, Horizon Europe grants for sustainable building materials |

|

France |

20% |

12% |

France Relance Plan, EPBD compliance incentives, Climate and Resilience Law |

€1.1B France Relance for green building upgrades, ADEME funding for innovative insulation solutions |

|

Netherlands |

10% |

10% |

Circular Economy Action Plan, National Renovation Strategy |

€70M public-private partnerships for sustainable construction innovation |

|

Italy |

8% |

8% |

EU Structural Funds, National Recovery and Resilience Plan (PNRR) |

€50M EU Regional Development Fund for energy-efficient buildings |

|

Spain |

8.1% |

8.2% |

Spanish National Energy and Climate Plan (NECP), Industrial Modernization Programs |

€35M Ministry of Industry grants for green building technologies |

|

Poland |

7% |

9.1% |

EU CAP Industrial Innovation, National Energy Efficiency Action Plan |

€30M Structural Funds for sustainable housing initiatives |

|

Russia |

% |

7.% |

National Energy Efficiency Program, Construction Sector Modernization Plan |

RUB 1.2B government funds for eco-friendly building material R&D |

|

Rest of Europe |

14% |

7.6% |

Horizon Europe Cohesion Policy, National Green Building Incentives |

Multi-country EU Recovery & Innovation Funds for construction sustainability |

Asia Market Insight

Asia Pacific would have accounted for about 20% of the global ICF market revenue by 2034, buoyed by rapid urbanization and climate-resilient constructions. From 2020 to 2024, green building projects in the region recorded an expansion of over 33%, with China issuing more than 2,300 green building labels in 2023. More than 110 urban centers have been involved in India's smart city initiative, also contributing to the demand for sustainable wall systems. It is gaining acceptance because of stringent energy codes and buildings being constructed at a comparatively 41% faster rate in congested urban areas. ICF adoption is also benefiting from infrastructure investment growth and the need to enhance resilience against extreme weather events. Nearly 62% of new construction in China's pilot green cities featured energy-efficient wall systems such as ICF in 2023. Regional authorities have been promoting disaster-resilient and energy-efficient construction, which will further accelerate ICF usage. This is, in turn, supported by increased investments in low-carbon building materials and digital construction technologies.

Asia Pacific Insulated Concrete Form Market Country-wise Overview (2025–2034)

|

Country |

Market Share (2034 est.) |

Key ICF Demand Drivers |

Government Programs & Investments |

Notable Developments |

|

China |

21% of APAC share |

Urban housing expansion, green building codes, and disaster resilience |

National Green Building Action Plan; RMB 800 billion investment in energy-efficient construction by 2030 |

Over 3,000 large-scale eco-friendly housing projects incorporating ICF; pilot smart city projects with modular ICF walls |

|

India |

15% of APAC share |

Affordable housing, smart cities, energy efficiency mandates |

₹5 lakh crore Smart Cities Mission; Energy Conservation Building Code (ECBC) enforcement; Tax incentives for green materials |

Rapid growth in prefabricated housing; government grants for climate-resilient building materials use in 100+ cities |

|

Japan |

8% of APAC share |

Earthquake-resistant construction, retrofitting regulations |

METI subsidies for seismic retrofit; Japan Green Building Program |

Adoption of lightweight ICF panels in residential high-rises; advances in fire-resistant ICF materials |

|

South Korea |

5% of APAC share |

Urban redevelopment, energy-saving building mandates |

Ministry of Land, Infrastructure and Transport green building subsidies |

Large-scale ICF use in new commercial complexes in Seoul; integration with smart building tech |

|

Australia |

5% of APAC share |

Sustainable residential construction, bushfire resilience |

AUD 3 billion National Construction Code upgrades; Clean Energy Finance Corporation grants |

Increasing ICF adoption in wildfire-prone regions; modular ICF kits for remote construction projects |

|

Indonesia |

3% of APAC share |

Affordable housing, tropical climate adaptation |

National Housing Program; subsidies for climate-resilient materials |

Pilot projects in Jakarta using ICF for flood-resilient homes; local manufacturer partnerships |

|

Malaysia |

3.6% of APAC share |

Industrial parks, green building codes |

Green Technology Financing Scheme; MIDA incentives for eco materials |

New ICF production plants in Selangor; collaboration on sustainable construction with local universities |

|

Vietnam |

3.1% of APAC share |

Rapid urbanization, energy-efficient, affordable housing |

National Green Growth Strategy; foreign investment in green construction |

Growth in ICF use for mid-rise residential complexes in Ho Chi Minh City and Da Nang |

|

Thailand |

2.6% of APAC share |

Flood-resistant housing, industrial facility insulation |

Bio-Circular-Green Economy Fund; BOI incentives for sustainable construction |

Incorporation of ICF in flood-prone Rayong province housing; growing local supply chain for ICF materials |

|

Rest of APAC |

14% combined |

Basic infrastructure, disaster resilience |

Various national housing schemes; ASEAN Green Building Network |

Emerging markets like the Philippines and Myanmar are adopting ICF in pilot projects, growing SME involvement |

Key Insulated Concrete Form Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global ICF market is highly competitive, with North American manufacturers dominating the landscape through technological innovation and extensive distribution networks. Companies such as Nudura, Fox Blocks, and BuildBlock leverage product customization and sustainability certifications to enhance their market positioning. European and Asian manufacturers are increasingly investing in R&D to improve insulation efficiency and fire resistance, responding to stringent building codes worldwide. Strategic collaborations, acquisitions, and government partnerships aimed at green building initiatives are common to capture emerging markets. Japanese firms like K-ICF and Tokiwa Insulation focus on precision manufacturing and eco-friendly materials, enabling them to steadily expand within the competitive APAC region.

Top Global Manufacturers in The Insulated Concrete Form Market

|

Company Name |

Country of Origin |

Estimated Market Share (%) |

|

Nudura Inc. |

USA |

12% |

|

Fox Blocks (Airlite Plastics) |

USA |

10% |

|

Logix Insulated Concrete Forms |

Canada/USA |

9% |

|

BuildBlock Building Systems |

USA |

8% |

|

Amvic Building System |

Canada |

6% |

|

IntegraSpec |

USA |

5% |

|

Quad-Lock Building Systems |

Canada |

xx% |

|

Arxx Building Products |

Canada |

xx% |

|

Isobar Systems |

Australia |

xx% |

|

KORE Structure |

South Korea |

xx% |

|

Durisol |

Switzerland |

xx% |

|

BuildSmart |

India |

xx% |

|

Insulfoam |

USA |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In January 2025, BuildBlock Building Systems announced a $150 million global expansion to increase ICF manufacturing capacity across North America, Europe, and Asia. The investment focuses on adopting advanced automation and sustainable raw materials to reduce production carbon footprints by 25% by 2030. BuildBlock plans strategic partnerships with green construction firms and government bodies to promote ICF adoption in affordable housing and commercial projects worldwide.

- In October 2024, Nudura Inc. launched a $100 million innovation initiative targeting next-generation ICF products with enhanced thermal efficiency and fire resistance. The initiative includes expanding R&D centers in Canada and Japan and aims to accelerate global market penetration, especially in fast-growing APAC and European regions. Nudura will collaborate with international green building councils to align products with upcoming energy codes.

- Report ID: 3515

- Published Date: Jul 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Insulated Concrete Form Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert