In-Vivo Imaging Market Outlook:

In-Vivo Imaging Market size was USD 3.5 billion in 2025 and is anticipated to reach USD 5.5 billion by the end of 2035, increasing at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of in-vivo imaging is evaluated at USD 3.6 billion.

The sustained expansion of the in-vivo imaging market is highly attributed to economic, clinical, and technological factors. These include the existence of multimodal systems, artificial intelligence (AI), along with machine learning, and high-resolution miniaturization. According to a report published by NLM in December 2023 stated that imaging-based clinical studies readily utilized a deep learning-specific AI system and successfully achieved 97.0% sensitivity, followed by 93.4% specificity, and 99.1% area under the curve (AUC). This has been useful in evaluating diabetic retinopathy, thereby suitable for uplifting the overall market internationally.

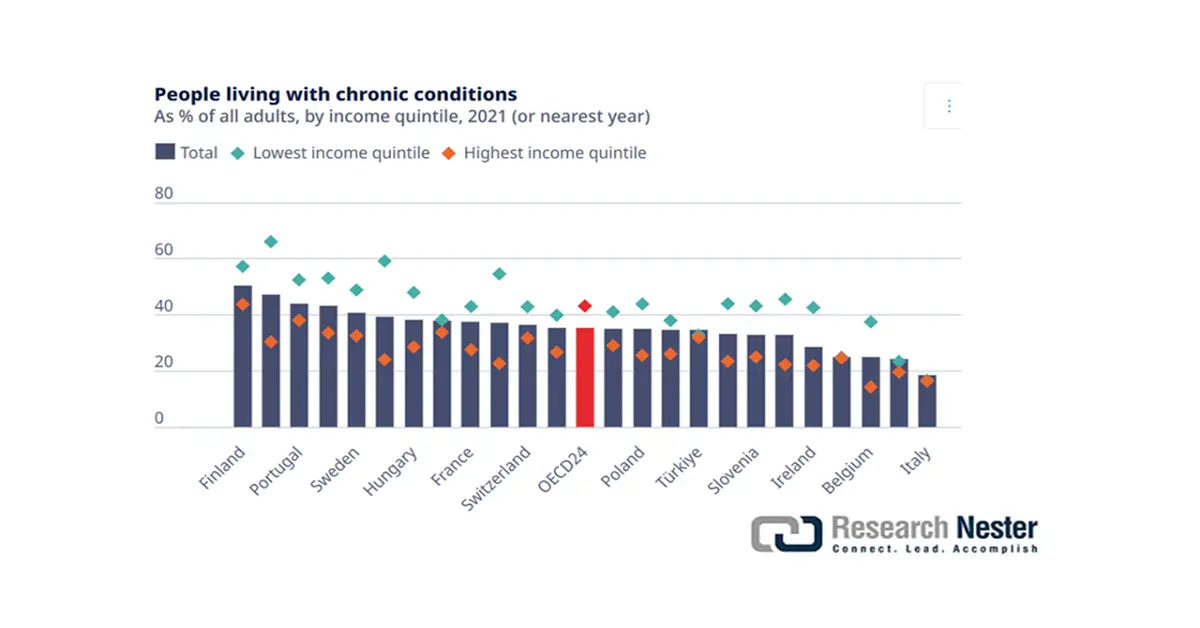

Source: OECD 2023

Moreover, a surge in aging demographics and chronic diseases, along with an escalation in drug development and delivery, are also uplifting the in-vivo imaging market across different nations. As per an article published by the CDC in October 2024, 6 in 10 individuals, particularly in America, have one chronic disease, and 4 in 10 are affected with more than two chronic conditions. Besides, the January 2024 NLM report denoted that the approximate chronic disease expense is projected to increase to USD 47 trillion globally by the end of 2030. Meanwhile, the 2023 OECD report denoted that across 24 countries, over 1/3rd of adults resides with long-term health illness, with more than 2 in Finland, followed by 1 in 4 in Italy, thus driving the market’s demand.

Key In-vivo Imaging Market Insights Summary:

Regional Highlights:

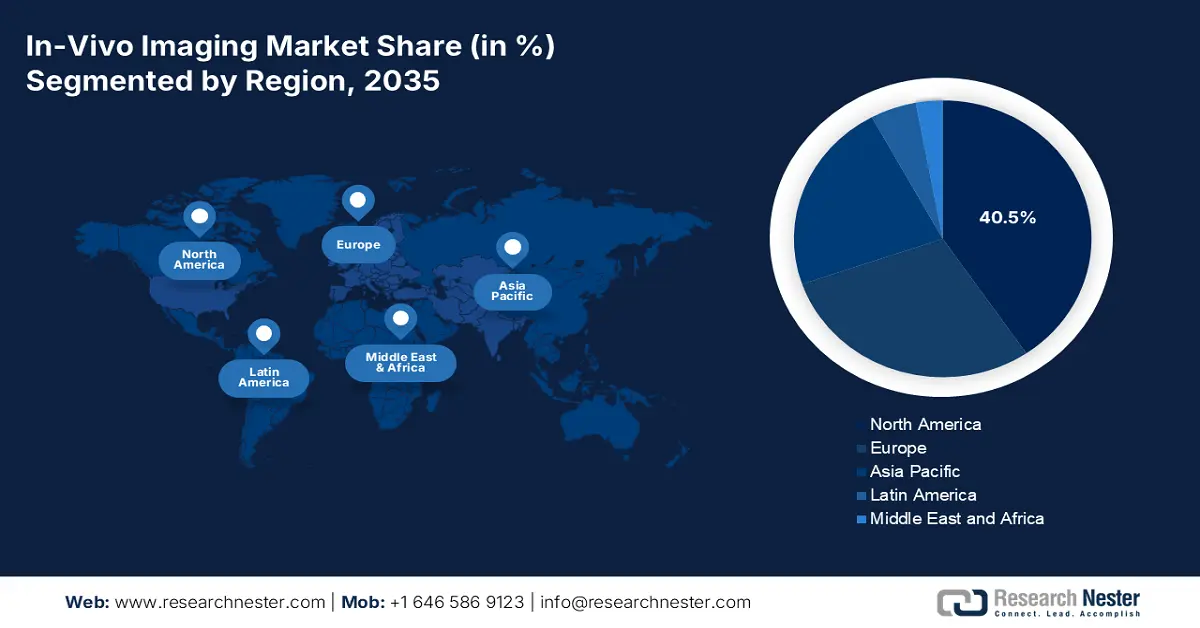

- North America in the in-vivo imaging market is anticipated to secure a 40.5% share by 2035, impelled by early technology adoption and robust R&D ecosystems.

- Asia Pacific is projected to witness the fastest advancement by 2035, underpinned by expanding healthcare modernization and rising medical tourism.

Segment Insights:

- The pharmaceutical and biotechnology companies segment in the in-vivo imaging market is forecasted to capture a 48.5% share by 2035, propelled by its reliance on non-invasive imaging to accelerate drug development and discovery pipelines.

- The cancer research segment is projected to attain the second-largest share by 2035, bolstered by its capacity to improve prevention, diagnosis, and therapeutic precision through deeper biological insights.

Key Growth Trends:

- Rise in theranostics

- 3D bioprinting integration

Major Challenges:

- Heterogeneous and strict administrative approval processes

- Reimbursement and government-based pricing caps

Key Players: Siemens Healthineers (Germany), GE HealthCare (U.S.), PerkinElmer, Inc. (U.S.), Bruker Corporation (U.S.), Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), Miltenyi Biotec (Germany), Agilent Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Mindray Medical International Ltd. (China), Esaote S.p.A. (Italy), Cardinal Health, Inc. (U.S.), Curium Pharma (U.S./France), Lantheus Holdings, Inc. (U.S.), Trivitron Healthcare (India), Magnetic Insight, Inc. (U.S.), Advantage Medical Pty Ltd. (Australia), Samsung Medison (South Korea), United Imaging Healthcare (China), BCF Technology Ltd. (UK).

Global In-vivo Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 5.5 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 27 August, 2025

In-vivo Imaging Market - Growth Drivers and Challenges

Growth Drivers

-

Rise in theranostics: This refers to radionuclide therapy and most preferably radiopharmaceuticals comprising radionuclides for imaging therapy, thereby positively uplifting the in-vivo imaging market. As per an article published by NLM in July 2023, the Phase III ALSYMPCA trial displayed that radium 223–dichloride (223RaCl2) is effectively tolerated and optimized for survival within 14.9 months for aiding arm, and further denoting a 30% risk reduction, thereby suitable for uplifting the overall market across different nations through theranostics implementation.

-

3D bioprinting integration: This is successfully revolutionizing the overall healthcare system by developing patient-specific organs, tissues, and implants, which are readily contributing to the in-vivo imaging market’s growth. As per the December 2022 NLM article, with a surge in innovation, the 3D bioprinting market has been valued at USD 1.7 billion over the past 4 years, which is further projected to increase to USD 1.9 billion by the end of 2025, along with a growth rate of 15.8%, thereby suitable for bolstering the market’s exposure internationally. This upliftment is subject to increased R&D investments, technological progression, and private funding trends.

-

Regulatory pressure on preclinical testing: This driver is suitable for the in-vivo imaging market’s growth, owing to the efficacy and safety of the latest drugs and medical treatments within laboratories. In this regard, the February 2022 NLM article denoted that drug development and delivery have emerged to be a lengthy and expensive process that takes more than 10 to 15 years, along with an average expense of over USD 1 to USD 2 billion for each newly introduced drug. Therefore, this is an essential part of prenatal testing, which in turn is extremely suitable for the overall market development.

2021 Female Infertility Cases Driving the In-Vivo Imaging Market Demand

|

Age Characteristics |

Number of DALYs cases |

The age-standardized DALYs rate/100,000 (%) |

|

15 to 19 years |

6.162 |

0.9 |

|

20 to 24 years |

78,482 |

13.1 |

|

25 to 29 years |

109,615 |

18.6 |

|

30 to 34 years |

142,815 |

23.6 |

|

35 to 39 years |

160,995 |

28.7 |

|

40 to 44 years |

101,535 |

20.3 |

|

45 to 49 years |

1,530 |

0.3 |

Source: NLM, May 2025

Type 1 and 2 Diabetes 2021 Prevalence Among Adults Uplifting the In-Vivo Imaging Market

|

Countries |

Prevalence Rate (%) |

|

Mexico |

16.9 |

|

Chile |

10.8 |

|

U.S. |

10.7 |

|

Spain |

10.3 |

|

Portugal |

9.1 |

|

Costa Rica |

8.8 |

|

Israel |

8.5 |

|

Colombia |

8.3 |

|

Canada |

7.7 |

|

Czechia |

7.1 |

|

Hungary |

7.0 |

|

Germany |

6.9 |

|

Poland, Korea |

6.8 |

|

Japan |

6.6 |

|

Estonia |

6.5 |

|

Australia, Greece, Italy |

6.4 |

|

UK |

6.3 |

|

New Zealand |

6.2 |

|

Finland |

6.1 |

|

Lithuania |

5.8 |

|

Iceland |

5.5 |

|

France |

5.3 |

|

Switzerland |

4.6 |

|

Ireland |

3.0 |

Source: OECD 2023

Challenges

-

Heterogeneous and strict administrative approval processes: The most common gap in the in-vivo imaging market is effectively navigating a complicated international labyrinth of administrative demands. Agencies, such as EMA, FDA, and PDMA, have readily demanded unique and extensive clinical data packages to prove the efficiency and safety. This heterogeneity has pressured manufacturers to operate expensive and parallel submission initiatives, which drastically enhanced R&D and time-to-market expenditure, thereby causing a hindrance in the market’s development internationally.

-

Reimbursement and government-based pricing caps: The aspect of profit margins is critically constrained by government health bodies that have mandated affordable analyses. Agencies, including NICE in the UK and IQWiG in Germany, frequently benchmark the latest imaging technologies against existing reforms, which results in the demand for significant price concessions for ensuring improvements. Besides, reimbursement rates are usually set low, particularly for novel-based applications, which has negatively impacted the in-vivo imaging market globally.

In-vivo Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 5.5 billion |

|

Regional Scope |

|

In-vivo Imaging Market Segmentation:

End user Segment Analysis

The pharmaceutical and biotechnology companies segment in the in-vivo imaging market is anticipated to garner the highest share of 48.5% by the end of 2035. The segment’s upliftment is highly attributed to its extensive dependency on non-invasive imaging to escalate drug development and discovery pipelines. These particular companies are actual investors in ensuring high-end preclinical imaging systems to successfully achieve severe quantitative data on drug biodistribution, pharmacokinetics, treatment efficacy, and target engagement, thereby suitable for boosting the segment for the overall market’s welfare.

Application Segment Analysis

The cancer research segment in the in-vivo imaging market is projected to account for the second-highest share during the forecast period. The segment’s growth is effectively fueled by its ability to enhance cancer prevention, diagnosis, detection, and cure by disclosing the suitable biology of cancer, resulting in efficient therapies and strategies. As per the May 2025 National Cancer Institute, an estimated 2,041,910 new cancer cases have been diagnosed, particularly in the U.S., along with an expected 618,120 deaths to take place by the end of 2025, thus increasing the need for the segment in the market.

Technology Segment Analysis

The magnetic resonance imaging (MRI) segment in the in-vivo imaging market is also expected to steadily grow by the end of the projected timeline. The segment’s development is effectively fueled by its usefulness as an essential diagnostic tool, with the ability to ensure highly detailed images of organs, the nervous system, and soft tissues without the need for harmful radiation. In this regard, the February 2023 MDPI article indicated a clinical study conduction on 87 patients, of which 80% of them received MRI preparation for undergoing the MRI scan without the need for any sedation. This resulted in the success rate to be more than five times, thereby suitable for its integration in the market.

Our in-depth analysis of the in-vivo imaging market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Application |

|

|

Technology |

|

|

Modality |

|

|

Reagents |

|

|

Business Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In-Vivo Imaging Market - Regional Analysis

North America Market Insights

North America in the in-vivo imaging market is projected to emerge as the dominating region by garnering the largest share of 40.5% by the end of 2035. The market’s growth in the region is propelled by early adoption, technological leadership, suitable research and development (R&D), an increase in health spending, microscope sourcing, and a supportive administrative framework. According to an article published by PSNET in March 2023, alerts and alarms are essential while utilizing clinical decision support (CDC) tools, thereby denoting 44.8% overridden alerts and 9.3% inappropriate alerts. Besides, with this installation for technological integration, a 90% accuracy rate was recorded across two facilities, thus suitable for the market’s upliftment.

The in-vivo imaging market in the U.S. is growing significantly, owing to the presence of biotech and pharma organizations, federal research funding, private investments, clinical demands, and a strong supply chain administration. As stated in the January 2024 ITA report, medical devices in the healthcare sector, which is estimated at a valuation of USD 128.1 million, continue to ensure suitable prospects for the country’s exporters. As one of the topmost suppliers, the country readily exports medical devices and has witnessed a 25% growth over the past 3 years, thus denoting a huge opportunity for the market to flourish.

The in-vivo imaging market in Canada is also growing due to health care modernization by the government, publicly funded research activities, focus on affordable and equitable accessibility, the presence of robust research clusters, and aging demographic pressure. As per the December 2024 Government of Canada report, the National Strategy for Drugs for Rare Diseases has been formed and allocated an ongoing funding of USD 500 million each year. The purpose of this fund is to focus on future phases and assist individuals with rare disorder drugs accessibility as per their demand, which creates an optimistic outlook for the market in the country.

Microscopes 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

U.S. |

USD 236 million |

USD 606 million |

|

Canada |

USD 21.5 million |

USD 65.9 million |

|

Dominican Republic |

USD 2.1 million |

USD 1.7 million |

|

Mexico |

USD 1.0 million |

- |

|

Costa Rica |

USD 180,000 |

USD 10.6 million |

|

Guatemala |

USD 104,000 |

USD 1.8 million |

|

El Salvador |

USD 31,800 |

USD 1.4 million |

|

Panama |

USD 12,300 |

- |

Source: OEC, July 2025

APAC Market Insights

Asia Pacific in the in-vivo imaging market is considered to emerge as the fastest-growing region by the end of the projected timeline. The market’s development in the region is highly driven by modernization in healthcare infrastructures, a surge in health spending and insurance coverage, R&D migration in pharmaceutical manufacturing, and the growing medical tourism sector. According to an article published by NLM in February 2023, an estimated 4% to 7% of total gross domestic product (GDP) has been readily invested in the health industry in the majority of the region. Besides, the Open Access Government Organization data report published in July 2025 noted that there will be an increase in the elderly population from 77.4 million over the past 5 years to 173.3 million by the end of 2050.

The in-vivo imaging market in China is gaining increased traction, owing to the existence of the domestic innovation policy, centralized procurement facilities, volume-based purchase activities, rapid expansion in private health industries, and AI implementation as a national priority. As stated in the May 2023 NLM article, with assistance from the government, there has been the establishment of an overall 1,030,935 health and medical institutions in the country, along with the presence of 36,570 hospitals, as well as 977,790 primary-based clinics, thereby suitable for boosting the market’s exposure.

The in-vivo imaging market in India is also growing due to medical advancements, suitable centers for clinical trials and generic drugs, the demand for public health schemes, and tiered healthcare system, and regional manufacturing processes. In this regard, the January 2025 PIB report denoted that over 73 crore (730 million) Ayushman Bharat Health Accounts (ABHA) have been created, along with recording over 5 lakh registered health professionals. In addition, Gujarat, Madhya Pradesh, Maharashtra, Uttar Pradesh, and Rajasthan accounted for 49.1% of total women beneficiaries.

Europe Market Insights

Europe in the in-vivo imaging market is expected to account for a considerable share during the projected timeline. The market’s upliftment in the region is effectively fueled by domestic regulatory funding frameworks, focus on cross-border standardization in healthcare, the existence of public and academic industrial consortia, and quality-based systems. As stated in the May 2025 European Commission report, the World Health Organization (WHO) noted that 12.6 million deaths take place, owing to environmental risk factors, which further account for 20% of deaths in the region. Besides, according to the 2024 OECD report, more than 40% of doctors from Switzerland, Ireland, and Norway, along with over 50% of Irish nurses, were foreign-trained, capable enough to administer and manage health imaging in the region.

The in-vivo imaging market in Germany is steadily growing, owing to regional manufacturing and engineering leadership, hospital investment incentives, an increase in the density of maximal care hospitals, and standard reimbursement procedures. As per the December 2024 NLM article, it is mandatory for any patient over 18 years of age comprising health insurance to pay 10 euros per day to hospitals for meals and accommodation. Besides, as per the 2023 OECD data report, there has been a surge in the country’s health expenditure, amounting to EUR 5,159 per capita. In addition, the public funding share for healthcare over the past 4 years was 85.5%, denoting a rise from 81.1%.

The in-vivo imaging market in France is also growing due to the provision of strategic plans by the National Cancer Institute (INCa), the presence of centralized procurement and planning, focus on healthcare equality, and government-based innovative developments. For instance, as per the 2025 UICC report, 20 million cancer cases have been estimated to take place as of 2022, which is anticipated to increase to 35 million, denoting a 77% increase by the end of 2050. However, to overcome this, the UICC in the country, comprising more than 1,150 members, has focused on partnerships to develop networks, which in turn, is suitable for the overall market.

Medical Instruments 2023 Export and Import in Europe

|

Countries |

Export |

Import |

|

Netherlands |

USD 5.9 billion |

USD 226 million |

|

Germany |

USD 3.1 billion |

USD 3.9 billion |

|

France |

USD 838 million |

USD 436 million |

|

Switzerland |

USD 810 million |

USD 967 million |

|

Belgium |

USD 794 million |

USD 87.2 million |

|

UK |

USD 780 million |

USD 556 million |

|

Ireland |

USD 725 million |

- |

|

Spain |

USD 600 million |

USD 74.5 million |

Source: OEC, August 2025

Key In-Vivo Imaging Market Players:

- Siemens Healthineers (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare (U.S.)

- PerkinElmer, Inc. (U.S.)

- Bruker Corporation (U.S.)

- Medtronic plc (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Miltenyi Biotec (Germany)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Mindray Medical International Ltd. (China)

- Esaote S.p.A. (Italy)

- Cardinal Health, Inc. (U.S.)

- Curium Pharma (U.S./France)

- Lantheus Holdings, Inc. (U.S.)

- Trivitron Healthcare (India)

- Magnetic Insight, Inc. (U.S.)

- Advantage Medical Pty Ltd. (Australia)

- Samsung Medison (South Korea)

- United Imaging Healthcare (China)

- BCF Technology Ltd. (UK)

The international in-vivo imaging market is readily characterized by a combination of advanced small-scale organizations and entrenched multinational conglomerates. Besides, notable strategies include a robust focus on research and developmental activities to pioneer hybrid multimodal systems and AI-powered analytics. Moreover, key players are increasingly integrating tactical acquisitions and partnerships to extend their geographic footprint and technological portfolios, particularly in highly developed nations. Meanwhile, an effective transition towards service-specific business models, such as long-lasting maintenance contracts, along with analytics-as-a-service, are also positively impacting the market’s growth across different nations.

Here is a list of key players operating in the global market:

Recent Developments

- In December 2024, Royal Philips declared an upsurge in clinical decision support with artificial intelligence and smart workflow automation to unveil the CT 5300 system, particularly in North America.

- In November 2024, GE Healthcare and RadNet Forge collaborated with each other to transform imaging systems and escalated the artificial intelligence integration with the utilization of Smart Technology.

- Report ID: 5231

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In-vivo Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.