Hydrogenated Starch Hydrolysate Market Outlook:

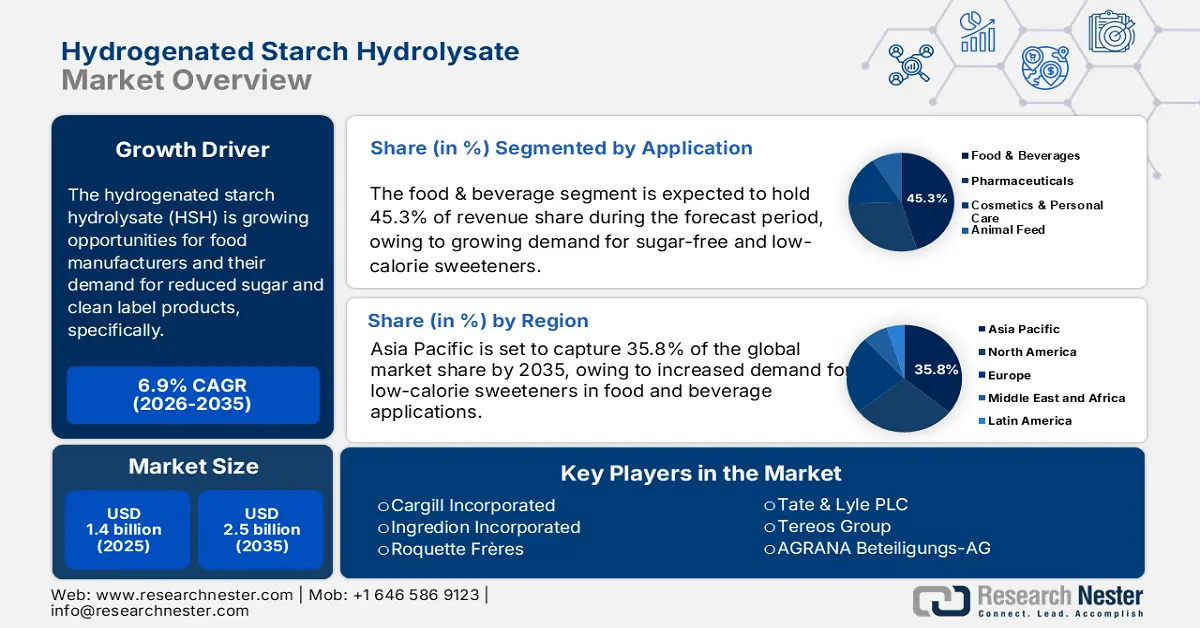

Hydrogenated Starch Hydrolysate Market size was estimated at USD 1.4 billion in 2025 and is expected to surpass USD 2.5 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hydrogenated starch hydrolysate is assessed at USD 1.7 billion.

Hydrogenated starch hydrolysate (HSH) presents growing opportunities for food manufacturers, driven by increasing demand for reduced-sugar formulations and clean-label products that support healthier consumer choices. According to FRED, the producer index for "Starch and Vegetable Fats and Oils Manufacturing" for August 2025 was 176.373, and continues to exhibit price inflation in the upstream market scheduled for future delivery. USDA projects 2025/26 U.S. sugar imports at 2.474 million STRV, highlighting constrained supply and encouraging manufacturers to diversify toward polyol alternatives and proactively adjust supply chains to mitigate potential disruptions.

The movement of goods and the availability of raw materials have a significant influence on commercial HSH supply chains. U.S. imports of polyols show recent volatility, and the USITC reported total erythritol imports (as a proxy for sugar-alcohol trade) for all sources of 70,634 in 2021 and 73,040 in 2022, before falling to 35,023 in 2023, both of which showed variability, including variability attributable to inventory as well. The capacity upstream of feedstock remains significant, e.g. USDA reported U.S. corn exports of around 1.6 billion bushels in 2022/23, sufficient to support cornstarch/glucose syrup inputs. Finally, EPA technical guidance on starch manufacture describes the steps wet-milling, enzymatic hydrolysis, catalytic hydrogenation and drying, which are on the assembly line and which each have their own energy, capital and compliance implications for production planning.

Key Hydrogenated Starch Hydrolysate Market Insights Summary:

Regional Highlights:

- The Asia Pacific hydrogenated starch hydrolysate market is anticipated to hold a 35.8% share by 2035, attributed to the surging demand for low-calorie sweeteners across food and beverage applications.

- North America is projected to secure a 28.7% share by 2035, owing to expanding use of HSH in confectionery, bakery, and oral care industries.

Segment Insights:

- The food & beverage segment of the hydrogenated starch hydrolysate market is projected to account for a 45.3% share by 2035, propelled by rising consumer preference for sugar-free and low-calorie sweeteners in processed foods and beverages

- The syrup segment is anticipated to capture a 35.2% share by 2035, driven by its superior solubility and blending efficiency across diverse food and dairy applications.

Key Growth Trends:

- Functional versatility in food & beverage applications

- Expansion in pharmaceutical and personal care application

Major Challenges:

- Price volatility of raw materials

- Availability of low-calorie sweetener alternatives

Key Players: Cargill Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Roquette Frères, Tate & Lyle PLC, Südzucker AG (BENEO), Tereos Group, AGRANA Beteiligungs-AG, Grain Processing Corporation, Manildra Group, Samyang Corporation, Gujarat Ambuja Exports Limited, Universal Starch Chem Allied Ltd, Malayan Flour Mills Berhad, Sukhjit Starch & Chemicals Ltd

Global Hydrogenated Starch Hydrolysate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: Indonesia, Malaysia, South Korea, Australia, Thailand

Last updated on : 6 October, 2025

Hydrogenated Starch Hydrolysate Market - Growth Drivers and Challenges

Growth Drivers

- Functional versatility in food & beverage applications: HSH has desirable properties such as solubility, neutral taste, humectant character, and texture improvement properties, which make it a great fit for use in baked goods, confections, beverages, dairy products, and ready-to-eat products. According to the USDA's October Crop Production Report, the National Agricultural Statistics Service (NASS) indicated that maize production in 2023-2024 was a total of 15.06 billion bushels, a decrease of 69.5 million bushels from the previous month. With this flexibility, HSH can help manufacturers reduce sugar while maintaining the same properties of form, moisture, mouthfeel, and shelf life. As the demand for clean-label functional products increases, the multifunctionality of HSH will increase its application in the food industry.

- Expansion in pharmaceutical and personal care applications: In pharmaceuticals, HSH can be used as a binder, filler, stabilizer, and excipient, enhancing the palatability and effectiveness of dosage forms. Ingredion STABILITE SD30 is a spray-dried polyglycitol powder with low sweetness, higher molecular weight, and reduced hygroscopicity, dissolving in water to form clear, non-crystallizing syrups up to 75% concentration, serving as a binder, stabilizing aid, and viscosity agent in food formulations. HSH is non-carcinogenic, which is helpful in chewable vitamins or when included in oral formulations. Similarly, personal care products such as moisturizers and cosmetic applications can also take advantage of HSH's humectant and texture improvement properties. These applications further increase the demand for HSH beyond food and beverage applications.

- Rising demand for low-calorie sweeteners: Consumers are becoming more inclined towards reduced-calorie and reduced sugar options because of increased health awareness and obesity awareness. HSH is a polyol-based sugar substitute that yields sweetness with fewer calories than regular sugar, making it a great solution for confectionery, beverages, and baked goods. HSH can be partnered with a diabetic formulation, which further increases its use. According to a WHO report, there were 830 million diabetics in 2022, up from 200 million in 1990. More than 2 million people died from diabetes-related kidney disease in 2021. Additionally, elevated blood glucose was responsible for about 11% of cardiovascular fatalities. Food manufacturers are looking to meet a regulatory and consumer need for healthier options by using HSH, which has resulted in a constant growth in the HSH market.

Emerging Trade Dynamics in Sugar Alcohol

Top Exporting Countries of Mannitol in 2023

|

Country/Region |

Export Value (USD) |

Quantity Exported (Kg) |

|

France |

$136,227,680 |

16,065,500 |

|

European Union |

$91,021,710 |

11,247,100 |

|

China |

$70,177,530 |

22,613,400 |

|

United States |

$41,397,230 |

7,233,580 |

|

Italy |

$20,721,790 |

3,720,900 |

|

Netherlands |

$10,742,710 |

888,526 |

|

Czech Republic |

$7,074,060 |

568,571 |

|

Brazil |

$6,261,100 |

1,610,430 |

Source: WITS

Top Exporting and Importing Countries of Sorbitol in 2023

|

Exporters |

Value (USD Million) |

Importers |

Value (USD Million) |

|

France |

147.0 |

Japan |

58.6 |

|

Thailand |

76.1 |

Poland |

34.2 |

|

China |

36.5 |

Germany |

29.1 |

Source: OEC

Challenges

- Price volatility of raw materials: The HSH market is affected by raw material price volatility (for example, corn starch). In 2021, US corn prices rose 31.2% (USDA ERS), affecting the prices of starch derivatives. These price fluctuations create wild swings in production costs and profit margins for HSH manufacturers, which significantly affect manufacturers in Asia and North America. Rising prices for feedstocks, like corn and sugar, also discourage small industrial stakeholders from committing any capacity CG allocation, slowing any further HSH market expansion despite growing demand in confectionery and pharmaceutical applications.

- Availability of low-calorie sweetener alternatives: The market is faced with restraints from increasing competition as consumers are becoming aware of alternative low-calorie sweeteners (stevia, sucralose, and monk fruit extract). Steviol glycosides, which are about 250-300 times sweeter than sucrose, are the primary source of stevia's sweetness. Stevia's presence in global food and beverage formulations has increased, as per the International Food Information Council, so consumer preference for natural-source zero-calorie sweeteners limits the adoption of sugar alcohol based HSH products, specifically for North American and European functional food applications.

Hydrogenated Starch Hydrolysate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Hydrogenated Starch Hydrolysate Market Segmentation:

Application Segment Analysis

The food & beverage segment is predicted to gain the largest market share of 45.3% during the projected period by 2035, due to growing demand for sugar-free and low-calorie sweeteners in prepared foods, baked goods, and beverages. Hydrogenated starch hydrolysate (HSH) is well-positioned as a risk-free sugar alternative, including FDA GRAS status that allows consumption in food and beverage products. Its accessibility in the food category is strengthened by the trend for health consciousness and diabetic friendly products. Also contributing to lowered sugar consumption, the World Health Organization (WHO) calls for significant reductions in sugar consumption due to obesity and diabetes. Over 890 million adults were living with obesity in 2022, out of the 2.5 billion adults aged 18 and over who were overweight. In a healthy diet, the amount of free sugar consumed should not exceed 10% of total energy intake. For further health advantages, a further decrease to less than 5% of total energy intake is advised.

Form Segment Analysis

The syrup segment is anticipated to constitute the most significant growth by 2035, with 35.2% market share, mainly due to superior solubility and blending capabilities in beverages and food, and dairy products. The liquid nature allows for uniform sweetness to be spread across the product, which enhances the consumer experience. Furthermore, HSH syrup, as a sugar replacement, continues to gain space in the food industry as a qualified low-calorie option, with end users becoming more attracted to healthier substitutes.

Formulation Segment Analysis

The sugar-free products segment is predicted to gain a significant market share during the projected period by 2035, mainly because HSH has mild sweetness, low glycemic response, and exceptional humectant properties that are ideal for various sugar-free confectionery, bakery, and beverage applications. In June 2023, Liquid I.V. introduced Hydration Multiplier Sugar-Free, delivering 5 essential B and C vitamins and triple electrolytes compared to sports drinks, sweetened with allulose instead of sugar or artificial sweeteners. Increased consumer interest in reducing sugar is reinforced by compliance requirements to reduce added sugars in the diet, leading to steady acceptance, thereby ensuring sugar-free products and formulations remain the fastest growing portion of the market.

Our in-depth analysis of the hydrogenated starch hydrolysate market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Application |

|

|

Formulation |

|

|

Functionality |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogenated Starch Hydrolysate Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 35.8% of the market share, due to the increased demand for low-calorie sweeteners in food and beverage applications. China is expected to see growth from rising diabetic populations and health-focused consumers. Japan and South Korea follow in terms of market share, focusing on sugar-free chocolate and confectionery. India and Indonesia show rapid market growth due to urbanization and processed foods. Australia and Malaysia prefer natural sweeteners as alternatives to sugar, but solid performance for HSH is being seen in the pharmaceutical and other specialty industry segments.

China is the leader in the Asia Pacific HSH market with a 35.1% revenue market share in 2023, with growth driven by applications in food & beverages and pharmaceuticals. The diabetic population continues to drive demand for sugar alternatives. The 2021 International Diabetes Federation (IDF) Diabetes Atlas estimates that 140.9 million people in China between the ages of 20 and 79 have diabetes, making up 25% of the world's diabetic population. Overall, the major manufacturers in China continue to expand production capacity. The HSH market is projected to experience growth during the forecast period, in which government health initiatives and the availability of disposable income are driving growth.

China Sorbitol Trade in 2024

|

Exporting Country |

Value (USD Million) |

Importing Country |

Value (USD Thousand) |

|

South Korea |

$2.37M |

France |

$71.9 |

|

Chinese Taipei |

$1.76M |

South Korea |

$20.2 |

|

Malaysia |

$1.44M |

Brazil |

$5.63 |

|

United Arab Emirates |

$1.37M |

Belgium |

$3.7 |

|

Philippines |

$1.35M |

Japan |

$2.5 |

Source: OEC

India’s high-intensity sweetener (HSH) market is growing due to the rising occurrence of lifestyle diseases and demand for low-calorie and sugar-reduced products around the globe. Likewise, ongoing urbanization and the expanding food and beverage sector are driving new product development related to how sweeteners and functional ingredients are used in these products. According to a 2023 study by the Indian Council of Medical Research-India Diabetes (ICMR INDIAB), 10.1 crore people have diabetes. With 743 District and 6,237 Community NCD Clinics, the Government of India's NP-NCD under NHM enhances local healthcare by emphasizing diabetes prevention, early diagnosis, infrastructure, staff training, and population-based screenings. Consumer awareness of health and wellness trends is creating market shifts in the way HSH products are developed and adopted.

North America Market Insights

North America market is expected to hold 28.7% of the market share by 2035, due to its increased applications in the confectionery, bakery, and oral care segments. HSH, along with other sugar alcohols (i.e., polyols), has contributed immensely to the source sugar alcohols market, as outlined by the U.S. International Trade Commission. The leading producers of these polyols are expanding their production facilities to answer the growing demands of sugar alternatives, as many consumers have expressed a preference for low-calorie sweeteners. Importantly, HSH was eligible under the FDA's GRAS (Generally Recognized As Safe) statement for food.

In the U.S., consumption of hydrogenated starch hydrolysate (HSH) is mainly driven by the confectionery and sugar-free gum sectors. For these reasons, HSH is utilized as a safe alternative sweetener, with a low glycemic response recognized by the FDA. During the 2022/23 marketing year, U.S. corn use for glucose and dextrose was the highest of any category, but it was down 11.4 million bushels. Starch use was down 10.7 million bushels. HFCS was down 5.7 million bushels to 409.31 million bushels due to changes in consumer preferences. Total food, seed, and industrial use was 6.56 billion bushels. Exports were over 1.6 billion bushels, which brought total use to 13.77 billion bushels, at an average price of $6.54 per bushel. Also, recognition of the value of health and concerns surrounding obesity has positively impacted consumption in polyols, and companies have been forced to invest in new formulations and product launches to rely less on sugar.

The rising demand for natural, reduced-sugar ingredients across all segments of the food and beverage category is responsible for the growth in Canada's hydrogenated starch hydrolysate market. Within Canada's advanced and innovative confectionery, dairy, and pharmaceutical sectors, HSH provides bulk sweetness, moisture retention, and textural improvement, which constitutes the primary use of HSH in these industries. Governments supportive of initiatives to change eating habits through reforms to their food supply are strong advocates for reformulations to use of polyol-based sweeteners like HSH. Local producers and importers are emphasizing the company's efforts to satisfy local clean-label or sustainable solutions with publicly visible efforts to change the production and marketing of HSH, targeted towards the needs of Canadian manufacturers.

Europe Market Insights

The European market is expected to hold 23.5% of the market share due to its humectant nature and low glycemic index. Increasing consumer demand for sugar-reduction methods and clean-label ingredients assists with continuous adoption. Food and beverage producers utilize the humectant and stabilizing attributes of HSH to bring improved texture and shelf life. Major manufacturers are focusing on clean-label sweeteners and increasing the uptake of HSH in sugar-free gums and chocolates, especially in health-minded markets like Western Europe.

The hydrogenated starch hydrolysate market in Germany is supported by a developed food-processing sector that is driven by a reduced-sugar ideology. Manufacturers use hydrogenated starch hydrolysate in the formulation of confectionery and baked goods to satisfy brand equity around taste, sweetness, and texture. The trends of consumers with a focused health-conscious mindset (and government encouragement to reduce sugar) lend themselves to a broader purpose of hydrogenated starch hydrolysate. Collaboration and outreach at the local R&D level between ingredient suppliers and food brands will continue to provide opportunities for innovative developments in functional and specialty foods.

The hydrogenated starch hydrolysate market in the UK continues to expand with increased demand for low-sugar confectionery and beverages. Health awareness initiatives and reformulation efforts to reduce sugar content by food manufacturers, as well as versatility-of-product development, have led to new opportunities to include hydrogenated starch hydrolysate in a diverse range of formulation opportunities. Hydrogenated starch hydrolysate's ability to serve as a humectant, stabilizer, and bulking agent supports product developments in the bakery, dairy, and snack industries. The continued interest of food manufacturers and end-users within the gluten-free, clean label, and functional ingredient space, as well as domestic food technology innovation efforts, supports an increasingly dynamic and competitive hydrogenated starch hydrolysate market in the United Kingdom.

Relative Sweetness of Sugar Alcohols and Food Energy, Compared to Sucrose

|

Sweeteners |

Sweetness Relative to Sucrose |

Food Energy (kcal/g) |

|

Sucrose |

1 |

4 |

|

Erythritol |

0.8 |

0.21 |

|

Sorbitol |

0.6 |

2.6 |

|

Xylitol |

1 |

2.4 |

|

Maltitol |

0.9 |

2.1 |

|

Lactitol |

0.4 |

2 |

|

Isomalt |

0.5 |

2 |

|

Mannitol |

0.5 |

1.6 |

Source: USITC

Key Hydrogenated Starch Hydrolysate Market Players:

- Cargill Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle PLC

- Südzucker AG (BENEO)

- Tereos Group

- AGRANA Beteiligungs-AG

- Grain Processing Corporation

- Manildra Group

- Samyang Corporation

- Gujarat Ambuja Exports Limited

- Universal Starch Chem Allied Ltd

- Malayan Flour Mills Berhad

- Sukhjit Starch & Chemicals Ltd

The hydrogenated starch hydrolysate market is moderately consolidated, with 3 companies - Cargill, ADM, and Ingredion - claiming approximately half of the global hydrogenated starch hydrolysate market share. Manufacturers are investing heavily in environmentally friendly production processes, capacity added to corn wet milling, and research and development on the reduction of sugar to meet the demand for healthier products in the market. Indian manufacturers are primarily focused on building cost-competitive manufacturing capabilities to supply to the APAC and Middle Eastern regions, while global manufacturers are looking to leverage integrated supply chains, geographic diversification, and formal and informal partnerships to create a competitive advantage.

Some of the key players operating in the market are listed below:

Recent Developments

- In May 2021, Tate & Lyle expanded its PROMITOR Soluble Fiber range by introducing two new liquid variants: PROMITOR Soluble Fiber W, which contain a minimum of 85% fiber and less than 2% sugars and PROMITOR Soluble Fiber 90L, which contains 90% fiber powder ingredient. These innovations aim to simplify fiber incorporation into products like confectionery, beverages, and bars, facilitating sugar and calorie reduction while enhancing fiber content without compromising taste or texture.

- In April 2023, Nestlé introduced a new range of meals called Lean Cuisine Balance Bowls that help support those managing their blood sugar levels. The meals are designed with balanced nutrition and portion control to help with achieving healthy blood sugar levels. This effort is consistent with Nestlé's commitment to provide healthy options for consumers with particular dietary needs.

- Report ID: 2620

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.