Hydraulic Cylinder Market Outlook:

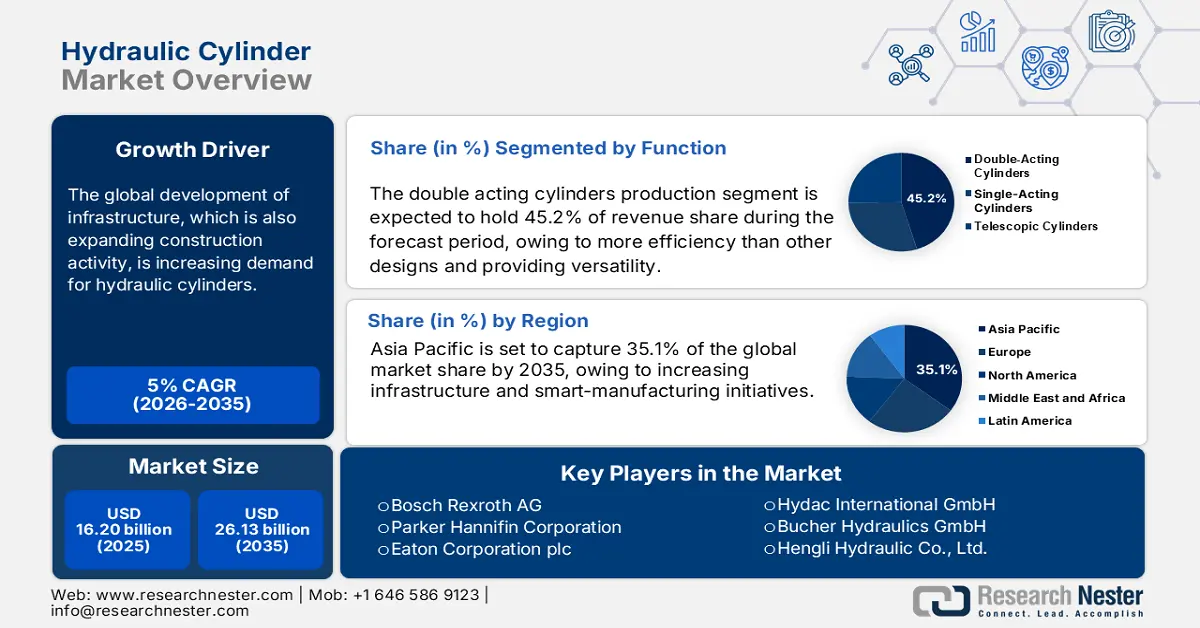

Hydraulic Cylinder Market size was estimated at USD 16.20 billion in 2025 and is expected to reach USD 26.13 billion by 2035, rising at a CAGR of 5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hydraulic cylinder is assessed at USD 16.99 billion.

The global development of infrastructure, which is expanding construction activity, is increasing demand for hydraulic cylinders. The government has also put in place many supplementary mechanisms to enhance the speed of planning, clearances, and implementation of the projects. The National Infrastructure Pipeline (NIP) was unveiled with foresight, planning to have a projected infrastructure investment of approximately ₹111 lakh crore from FY20 to FY25. The main input and raw material commodity for hydraulic cylinders is steel tubing. Most manufacturers are likely to be able to import steel tubing duty-free from Australia and India, among other nations, and under Section 232 with an added industry capacity qualification.

Tariffs on steel have forced manufacturers to produce locally and have modified U.S. manufacturers' assembly lines from hydraulic system assembly into construction firms’ production of industrial cylinders. Burnside America received a funding proposal from the Department of Community and Economic Development (DCED) for a $3.3 million Pennsylvania Industrial Development Authority (PIDA) loan and a $20,000 workforce development grant to train workers.

Key Hydraulic Cylinder Market Insights Summary:

Regional Highlights:

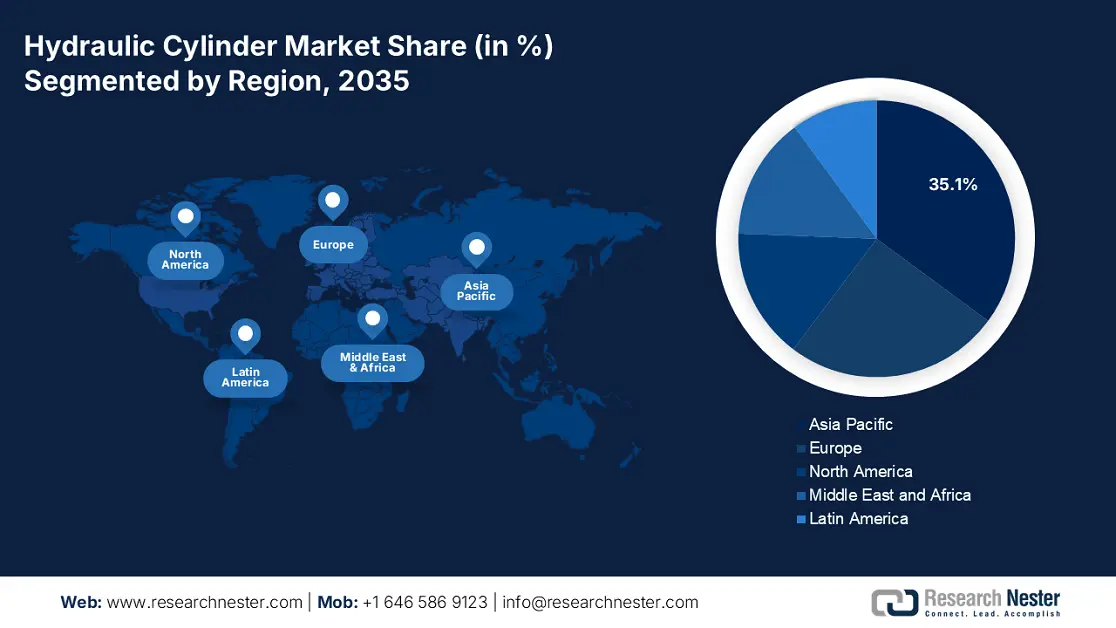

- By 2035, the Asia Pacific region is projected to secure a 35.1% share of the hydraulic cylinder market during 2026–2035, owing to heavy infrastructure programs, equipment upgrades in manufacturing, and rising agricultural mechanization.

- The European market is expected to command a 25.2% share by 2035, sustained by robust manufacturing activity, infrastructure O&M investment, and the shift toward eco-efficient automated hydraulic systems.

Segment Insights:

- The double acting cylinders segment is forecast to account for a 45.2% share by 2035 in the hydraulic cylinder market, propelled by its superior bidirectional force control and versatility in demanding applications.

- The construction segment is anticipated to achieve a 32.1% share by 2035, supported by rising infrastructure spending, urbanization, and increasing demand for high-capacity machinery.

Key Growth Trends:

- Defense and aerospace modernization

- Surging agricultural mechanization

Major Challenges:

- Fluctuating raw material prices

- High maintenance and operational costs

Key Players: Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation plc, Caterpillar Inc. (Hydraulics Division), Wipro Infrastructure Engineering, Hydac International GmbH, Bucher Hydraulics GmbH, Hengli Hydraulic Co., Ltd., Precision Hydraulic Cylinders (PHC), Doosan Hydraulic Machinery Co., Ltd., Osac Engineering Sdn. Bhd., Hannon Hydraulics, Doosan Corporation (Hydraulics Division), HYVA Holding B.V.

Global Hydraulic Cylinder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.20 billion

- 2026 Market Size: USD 16.99 billion

- Projected Market Size: USD 26.13 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Mexico, Brazil, Turkey

Last updated on : 18 August, 2025

Hydraulic Cylinder Market - Growth Drivers and Challenges

Growth Drivers

-

Defense and aerospace modernization: The modernization of global defense programs is increasing the demand for hydraulic cylinders located in weapon systems, aircraft landing gear, and military actuation assemblies. Global military expenditure increased to $2718 billion in 2024, the 10th year of consecutive rises. The world’s 15 largest spenders in 2024 all increased their military expenditure. The global military burden—the share of global gross domestic product (GDP) devoted to military expenditure—increased to 2.5% in 2024. The U.S. Army modernization is a driver of the high demand for high-pressure, small-form hydraulic options, especially mobile defense platforms and aerospace applications that require durable, high-performance hydraulic solutions.

-

Surging agricultural mechanization: The swift rate of mechanization of agriculture in emerging economies is increasing the volume of hydraulic cylinders required for tractors, harvesters, and precision sprayers. By 2028, Latin America and the Caribbean (LAC) will represent more than 25% of the global exports of agricultural and fisheries products, demonstrating the importance of trade openness at the global level. The transition of agricultural output measured in terms of efficiency is significant and is generating strong demand for dependable compact hydraulic systems that can withstand severe environmental conditions.

-

Rising mining and material handling activities: The expansion of the mining sector and large-scale material handling operations continues to be an important contributor to hydraulic cylinder demand. Hydraulic cylinders drive very heavy-duty equipment, for applications such as dump trucks, loaders, drilling rigs, and conveyors - all of which provide efficient load lifting, dumping, and drilling in extreme working conditions. Given this rise in demand for minerals, coal, and metals, the mining industry is growing across the globe. The features of the hydraulic cylinders to withstanding heavy use, handling heavy loads, and allowing for precise control in applications (non-exhaustive) such as deep mining, tunneling, and bulk material transport.

1. Trade Dynamics:

Top Three Exporters f Hydraulic Presses for Working Metal in 2023

|

Country |

Export Value (USD Millions) |

|

China |

204 |

|

Italy |

123 |

|

Germany |

111 |

(Source: OEC)

Top Five Importers of Hydraulic Presses for Working Metal in 2023

|

Country / Region |

Import Value |

|

United States |

$120,930.58 K |

|

Mexico |

$101,899.02 K |

|

European Union |

$83,248 K |

|

India |

$50,241.11 K |

|

China |

$50,038.77 K |

(Source: WITS)

2. Global Trade Values for Hydraulic Presses & Hydraulic & Pneumatic Automatic Controls

Yearly Trade Value (USD) for Selected Hydraulic Product Categories

|

Year |

Product Category |

Global Trade Value |

|

2022 |

Hydraulic presses for working metal |

$698 million |

|

2023 |

Hydraulic presses for working metal |

$822 million |

|

2022 |

Hydraulic & pneumatic automatic controls |

$2.33 billion |

|

2023 |

Hydraulic & pneumatic automatic controls |

$2.56 billion |

(Source: OEC)

Challenges

-

Fluctuating raw material prices: The most significant disruptive costs in raw materials that impacted the hydraulic cylinder market are steel and aluminium. Global economic factors, political trade limitations, and supply chain hassles can all impact raw materials. Price volatility increases costs to manufacturers, reduces supplier margins, and creates pricing uncertainty for OEMs and end users in construction, mining, and industrial applications.

-

High maintenance and operational costs: Hydraulic systems face operational challenges such as fluid leaking into internal parts and working seals, seals wearing out, and pressure too low or too high or varying constantly, which makes it necessary to service them frequently. Servicing is not only downtime, but it increases the total cost of ownership, and some businesses are not likely to pay a higher total cost of ownership in an economic environment that requires tight budgets. Businesses operating hydraulic systems with small and medium-sized enterprises often will not have the ability or opportunity to pay for high-maintenance technology, and slowly, the industry is shifting toward cleaner, more energy-efficient electromechanical options that have lower total lifecycle costs.

Hydraulic Cylinder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 16.20 billion |

|

Forecast Year Market Size (2035) |

USD 26.13 billion |

|

Regional Scope |

|

Hydraulic Cylinder Market Segmentation:

Function Segment Analysis

The double acting cylinders segment is predicted to gain the largest hydraulic cylinder market share of 45.2% during the projected period by 2035, due to more efficiently than other designs, manage bidirectional force when required, and providing versatility when applied in demanding applications. Double-acting cylinders are best suited to areas where industries such as industrial automation, heavy machinery, and aerospace require controlled and precise variation in high forces (i.e., workpieces or products). Their ability to push and pull objects or components without any external means increases operational efficiencies offered by hydraulic presses, mobile machinery, and any type of manufacturing equipment. Industries continue to focus on energy efficiency with solutions that offer high-performance solutions, and will usually select double-acting cylinders, which make them the highest market share.

Application Segment Analysis

The construction segment is anticipated to constitute the most significant growth by 2035, with 32.1% hydraulic cylinder market share, mainly due to rising infrastructure spending, urbanization, and the need for large machinery. Major construction projects like smart cities and transportation (roads, bridges, tunnels, etc.) are among the top priorities for government officials, which has increased demand for hydraulic cylinders on loaders, cranes, and excavators. The increase in renewable energy projects and industrial facilities further fuels demand. Automation in construction is also anticipated to increase, resulting in hydraulic systems that can handle loads and perform optimally for demanding operations required by automation. Specifically, the market for higher load capacities and long parts life is expected to be the fastest growing. This category should protect its market share as one of the higher revenue segments.

End use Segment Analysis

The oil & gas segment is anticipated to constitute the most significant growth by 2035, with 28.2% market share, mainly due to the rising dependent for high-power, long-lasting hydraulic systems for drilling rigs, offshore platforms, and subsea equipment. Hydraulic cylinders are used in challenging environments and provide high force output, controllability, and good service life under extreme pressure and temperature. The level of offshore exploration, deep-water projects, and maintenance of aging infrastructure continues to drive demand and ensures oil and gas remains a primary end-user market.

Our in-depth analysis of the hydraulic cylinder market includes the following segments:

|

Segment |

Subsegments |

|

Function |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulic Cylinder Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 35.1% of the market share, due to heavy infrastructure programs, equipment replacement in manufacturing, and rising mechanization in agriculture. Expect continued expansion 2026–2035 with volume gains concentrated in China, India, and Southeast Asian construction markets. Currently, welded cylinders dominate the product segment, with mill types generating the fastest revenue growth rates.

The China hydraulic cylinder sector is projected to grow primarily due to urbanization and an expansion of the mining sector. China has recently produced the most potent hydraulic cylinder in the world for moving marine piles, among other notable advances in hydraulic cylinder technology. With a maximum push of 5,000 tons, this new creation was unveiled in Changzhou, Jiangsu province. It further indicates that strong government infrastructure investment and rapid movement toward smart manufacturing in the supply chain coincide to create a favorable environment for hydraulic cylinders.

The hydraulic sector in China experienced significant growth in the period between 2020 and 2021, with the market size expanding from €6.6 billion to €9.8 billion in 2021, representing a compound annual growth rate (CAGR) of 6.8 %. The three core product categories for this categorized hydraulic market comprised pumps, valves, and cylinders. The key product categories each made up over 60 % of the value of the overall market in 2021. The hydraulic industry has also benefited from economic recovery measures, including intelligent manufacturing programs. By 2023, the estimated value is expected to exceed €12 billion as the hydraulic industry advances towards climate change issues, energy saving, advanced control, automation, new materials, and intelligentization.

Europe Market Insights

The European market is expected to hold 25.2% of the market share by 2035. The growth of the hydraulic/pneumatic systems market is fuelled by robust manufacturing, continuing infrastructure O&M investment, and moving more towards integrating eco-efficient automated hydraulic systems. There is also strong long-term support from the technological improvements and sustainability targets set by the EU Green Deal across all industrial equipment and mobile equipment applications.

The UK hydraulic-cylinder demand from 2026 to 2035 will be supported by construction, offshore energy (including windfarm installation/maintenance), and industrial refurbishment projects. This channel often spends more in aftermarket when fleets can start to be modernized and when fleet- and equipment-owners would rather minimize downtime, adopting sealed, higher-duty cycles and service contracts instead. Notable growth niches included telescopic cylinders for access and lifting applications and corrosion-resistant finishes for offshore use. In new builds, there tends to be a bias towards suppliers that include integrated diagnostics or field service to achieve recurring revenues during the forecast decade.

European Union Aircraft Under-Carriages and Parts Thereof Imports by Country in 2023

|

Partner Country |

Trade Value (USD thousand) |

Quantity (kg) |

|

United States |

892,980.27 |

5,491,640 |

|

United Kingdom |

631,333.29 |

2,519,700 |

|

Turkey |

86,696.13 |

152,094 |

|

Canada |

74,494.27 |

282,912 |

|

China |

38,713.46 |

323,415 |

|

Singapore |

20,392.09 |

63,877 |

(Source: WITS)

North America Market Insights

The North American market is expected to hold 15.3% of the market share by 2035. The growth in these markets is attributed to growing automation in agricultural, construction, and industrial machinery. Infrastructure bills passed, such as the U.S. Infrastructure Investment and Jobs Act (IIJA), have positively impacted the demand for hydraulic equipment. Original equipment manufacturers (OEMs) are committed to more efficient hydraulic cylinder solutions to meet sustainability guidelines and initiatives. Additionally, Canada’s focus on mining automation will improve local opportunities.

The hydraulic cylinder market in the U.S. is primarily driven by strong demand from the construction, agriculture, and material handling industries, where heavy gear is significantly reliant on hydraulic systems. Furthermore, increased automation in industrial and infrastructure modernization activities are accelerating growth. The demand for energy-efficient and robust hydraulic components is especially important, as companies prioritize sustainability and long equipment lifespans. Hydraulic technology innovations, such as smart cylinders with IoT connectivity, are helping to shape market trends.

Key Hydraulic Cylinder Market Players:

- Bosch Rexroth AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parker Hannifin Corporation

- Eaton Corporation plc

- Caterpillar Inc. (Hydraulics Division)

- Wipro Infrastructure Engineering

- Hydac International GmbH

- Bucher Hydraulics GmbH

- Hengli Hydraulic Co., Ltd.

- Precision Hydraulic Cylinders (PHC)

- Doosan Hydraulic Machinery Co., Ltd.

- Osac Engineering Sdn. Bhd.

- Hannon Hydraulics

- Doosan Corporation (Hydraulics Division)

- HYVA Holding B.V.

The hydraulic cylinder market is highly competitive, with key players such as Bosch Rexroth, Parker Hannifin, and Eaton providing market leadership through strong product portfolios and well-positioned distribution networks. Initiatives to establish particular positioning include vertical amalgamations, aggressive expansion into 'emerging' markets, and investment in products that are smart hydraulics and IoT-enabled cylinders. Sustainability, customization, and after-sales service are increasingly being emphasized over product as business differentiators, leading to shifting competitive landscapes in both mature markets and developing economies.

Some of the key players operating in the market are listed below:

Recent Developments

- In October 2024, Parker’s Hydraulic Pump & Power Systems Division launched the T7G pump for heavy-duty mobile and industrial applications. The T7G provides higher efficiency, low noise, and wide fluid compatibility (including bio-based/HEES fluids). If you are a hydraulic cylinder user, this means less heat load, longer duty cycles, and quieter operation for presses or machine tools.

- In June 2024, Eaton’s PFS 02 sensor exhibits real-time, in-line particle counting and sizing to facilitate predictive maintenance in hydraulic systems. In cylinder-intensive applications (e.g. presses, molding machines, steel mills), detecting wear debris earlier and acting on it can help mitigate unplanned downtime and preserve seal life.

- Report ID: 5211

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulic Cylinder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.