Haptoglobin Reagent Market Outlook:

Haptoglobin Reagent Market size was valued at USD 161.5 million in 2025 and is projected to reach USD 337.8 million by the end of 2035, rising at a CAGR of 7.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of haptoglobin reagents is evaluated at USD 173.7 million.

The heightened demand for diagnostic tools in clinical settings is the key factor behind the robust growth of the market. Besides, healthcare providers across different nations are adopting biochemical reagents such as haptoglobin for accurate measurement of hemolytic anemia and inflammatory conditions. As per an article published by NIH in September 2023, autoimmune hemolytic anemia occurs in around 1 to 3 individuals per 100,000 on a yearly basis. Also, the studies reveal increased one-year mortality ranging from approximately 14% to 28% depending on subtype and underlying conditions.

Furthermore, JMCP in November 2022 reported that cold agglutinin disease causes a considerable economic burden on healthcare systems, which is due to CAD-associated therapies, blood transfusions, and healthcare resource utilization. It also stated that patients with severe anemia reported amplified costs influenced by increased hospitalizations, outpatient visits, emergency department visits, and transfusion requirements, underscoring the strong necessity for haptoglobin reagents.

Key Haptoglobin Reagent Market Insights Summary:

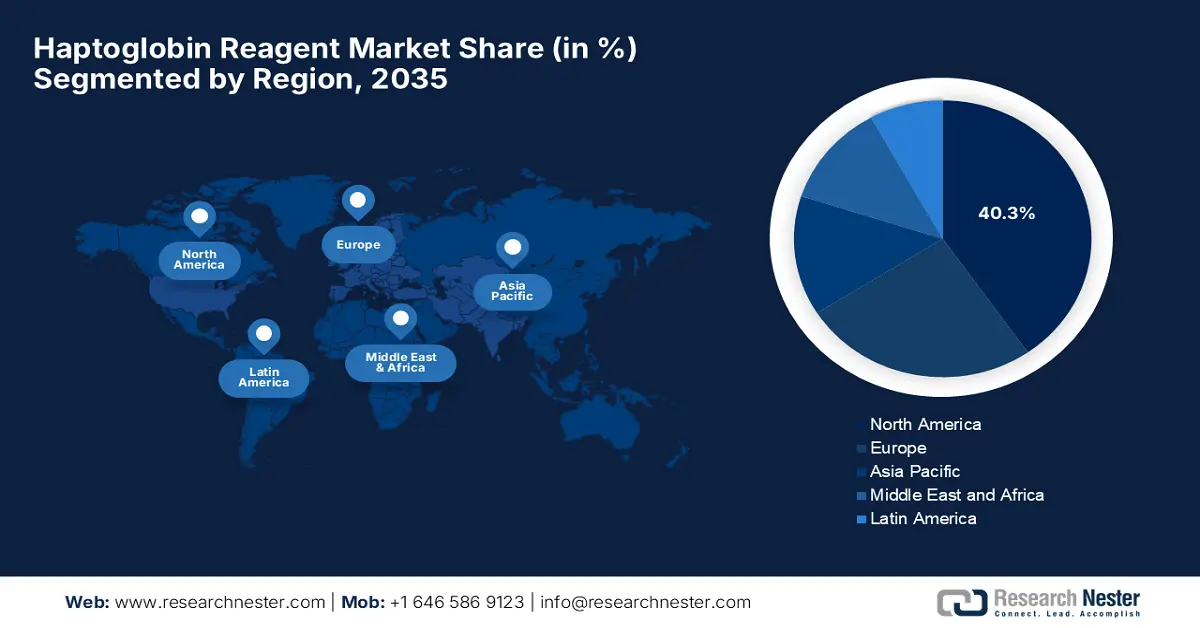

Regional Highlights:

- North America is anticipated to secure a 40.3% share of the haptoglobin reagent market by 2035, supported by reimbursement reforms, elevated healthcare spending, and early diagnostic adoption.

- Europe is estimated to witness steady growth through 2035, owing to rising diagnostic precision demand and increasing investments in personalized medicine.

Segment Insights:

- The liquid stable segment in the haptoglobin reagent market is projected to capture a 60.7% revenue share by 2035, propelled by reduced preparation time, minimized handling errors, and enhanced throughput in high-volume laboratories.

- The clinical diagnostics segment is expected to account for a 50.4% share by 2035, driven by its effectiveness in monitoring liver diseases and inflammatory conditions.

Key Growth Trends:

- Advancements in diagnostic technologies

- Expanding clinical applications

Major Challenges:

- High cost of production

- Limited awareness

Key Players: Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Danaher (Beckman Colter), Thermo Fisher Scientific, Sysmex Corporation, Bio-Rad Laboratories, Randox Laboratories, Werfen, Ortho Clinical Diagnostics, Merck KGaA, Agilent Technologies, Abbkine Scientific Co., Ltd., HORIBA, Ltd., Mindray, Transasia Bio-Medicals Ltd., SD BIOSENSOR, PZ Cormay S.A., Biosystems S.A., Elabscience Biotechnology Inc.

Global Haptoglobin Reagent Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 161.5 million

- 2026 Market Size: USD 173.7 million

- Projected Market Size: USD 337.8 million by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, France, China

- Emerging Countries: India, Japan, South Korea, Malaysia, United Kingdom

Last updated on : 14 October, 2025

Haptoglobin Reagent Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in diagnostic technologies: The innovations in terms of assay techniques and automation in clinical laboratories are making haptoglobin testing highly efficient, sensitive, and easier to perform, thereby driving business in this field. In October 2025, Illumina reported that it had launched BioInsight, which leverages large-scale multiomic data, software, and AI to accelerate life science discoveries. The firm also stated that the innovation will help both researchers and pharmaceutical companies to identify drug targets, understand biological pathways, and develop new therapies.

- Expanding clinical applications: Along with hemolytic anemia, haptoglobin testing is recognized for its utilization in conditions such as liver disease, cardiovascular disorders, and inflammation monitoring. A clinical study by NIH in February 2025 found that fucosylated haptoglobin levels are higher in sepsis patients and promote inflammation by interacting with the macrophage receptor called Mincle, thereby amplifying immune responses. Besides, Fu-Hp also triggers inflammatory cytokine production, hence contributing to sepsis progression, offering a novel therapeutic approach to reduce inflammation.

- Growing healthcare infrastructure: The amplifying investments in laboratories and expanding healthcare infrastructure are remarkably contributing to opportunities for haptoglobin reagent firms. In this regard MoHFW in September 2025 notified that the Union Minister of State for Health and Family Welfare inaugurated the National Virus Research & Diagnostic Laboratory Conclave 2025, thereby highlighting the VRDL network for its critical role in disease detection and health innovation. The program also underscored the launch of an industry-friendly IVD validation portal, the national one health mission, and new regional NIVs to strengthen pandemic preparedness.

Challenges

- High cost of production: This is one of the primary challenges associated with the haptoglobin reagent market since the manufacturing procedure is complex, coupled with stringent quality controls, which contribute to high production costs. These costs can further cause limitations to accessibility and affordability, especially for small-scale organizations. Therefore, the balance of production with cost effectiveness hinders upliftment in this sector.

- Limited awareness: The clinical importance of haptoglobin in diagnosing hemolytic anemia and other conditions has been presented by various prominent organizations; despite this, the market still faces challenges with limited awareness. Most of the clinicians are currently preferring established or routine biomarkers, which can slow down the adoption of haptoglobin reagents, thereby restricting wider utilization.

Haptoglobin Reagent Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 161.5 million |

|

Forecast Year Market Size (2035) |

USD 337.8 million |

|

Regional Scope |

|

Haptoglobin Reagent Market Segmentation:

Formulation Segment Analysis

Based on formulation liquid stable segment is projected to garner the largest revenue share of 60.7% in the market during the discussed timeframe. The dominance of the segment is effectively attributable to the reduced preparation time, handling error, and improved throughput in high-volume laboratories. Therefore, such convenience and integration with automated analyzers make this subsegment extremely preferable. Furthermore, most of the reagent manufacturers are emphasizing the stability and ease of automation as product differentiators.

Application Segment Analysis

In terms of application clinical diagnostics segment is predicted to attain a considerable market share of 50.4% by the end of 2035. The growth in the segment arises from its capability to monitor liver diseases and inflammatory conditions. As per an article published by NWLP in August 2025, haptoglobin binds to free hemoglobin, helping to clear it quickly from the body. The test requires a small blood sample, and results usually take up to a week, underscoring its pivotal role in diagnostic procedures.

Assay Format Segment Analysis

Based on the assay format immunoturbidimetric assays segment is likely to capture a significant share of 40.7% in the haptoglobin reagent market during the analyzed timeframe. They offer good sensitivity, automation, and compatibility, which are the key factors behind this leadership. For instance, in May 2025, ALPCO reported that it had launched the calprotectin immunoturbidimetric assay commercially in Europe and is accepted by the U.S. FDA. The assay assists in the diagnosis of inflammatory bowel diseases like Crohn’s and ulcerative colitis, hence denoting a wider segment scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Formulation |

|

|

Application |

|

|

Assay Format |

|

|

Reagent Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Haptoglobin Reagent Market - Regional Analysis

North America Market Insights

North America leads the industry and is expected to reach a market share of 40.3% by the end of 2035. The region’s market is mainly driven by Canada and the U.S., supported by policy-driven reimbursement reforms, high per capita healthcare spending, and early access to diagnostics. As of the September 2024 CMS article, the total health care spending surpassed a substantial USD 4.9 trillion in the U.S. in 2023, thereby marking a 7.5% increase from the previous year. Also, the healthcare spending currently accounts for 17.6% of the country’s GDP, which denotes the presence of huge investments in health services, diagnostics, and treatment.

The haptoglobin reagent market in the U.S. expands steadily and is aided by robust federal funding and structured insurance frameworks. Demanding market is also supplemented by the elderly population and the occurrence of hemolytic diseases, which keep aggravating the high diagnostic throughput. In April 2024, the article published by NIH stated that securing reimbursement for diagnostic tests in the U.S. requires a strategic approach focusing on coverage, coding, and payment. It also stated that success depends on generating strong clinical evidence and engaging stakeholders to demonstrate the test’s medical necessity and value.

Canada is also maintaining a strong position in the regional market owing to the advancements in healthcare infrastructure and a growing focus on early disease detection and monitoring. Novartis in February 2025 reported that it received Health Canada approval for Fabhalta, which is the first oral treatment for adults with paroxysmal nocturnal hemoglobinuria. The firm further highlighted that this therapy offers enhanced control of red blood cell destruction, thereby addressing unmet needs left by existing treatments, marking a pivotal advancement in managing hemolytic blood disorders in the country.

APAC Market Insights

The Asia Pacific is the fastest-growing region in the haptoglobin reagent market, which is driven by the rising incidence of hemolytic disorders, growing diagnostic infrastructure, and increased government healthcare investments. Countries including China, India, and Japan are the key players in the APAC region, aided by strong policy-driven spending, whereas Malaysia and South Korea are the fastest-growing countries, contributing due to the rising health diagnostics and hospital automation. The region is expanding significantly owing to the advancements in terms of healthcare digitization, integrated diagnostic networks, and bulk reagent tenders.

China dominates the regional market, owing to a rise in government expenditure and centralized procurement by hospitals, and increased national diagnostic coverage under the public healthcare plans in the country. In December 2023, Fujirebio Holdings reported that it signed an agreement with Sysmex Corporation for the mutual supply of reagent raw materials, including antigens and antibodies used in immunoassays, thereby enhancing supply chain resilience and efficiency by leveraging shared raw material assets.

India has a stronger potential in the haptoglobin reagent market deliberately backed by heightened demand for diagnostic testing both in hospitals and laboratories across the country. In December 2025, the country’s government reported that it had taken a few steps to strengthen the country’s diagnostic and epidemic preparedness infrastructure by establishing 163 Viral Research & Diagnostic Laboratories under a Central Sector Scheme, wherein INR 324 crore (USD 38.9 million) was allocated for the same. Of these, 11 labs have been designated regional centers with advanced BSL-3 facilities for detecting high-risk pathogens.

Europe Market Insights

The market is expanding significantly in Europe, driven by the rise in diagnostic precision demand, the aging population, and government investment in personalized medicine. Further, countries like France, Germany, and the UK are leading the regional market due to the early adoption of the immunoturbidimetric and biosensor-based diagnostic platforms. For instance, in March 2023, Hemcheck notified that it received evaluation and distributor orders for its blood and hemolysis-related diagnostic products across several countries in the region, which include France, the UK, Finland, and Iceland, hence denoting a positive market outlook.

Germany accounts for the highest market share in Europe, indicating a well-established diagnostic infrastructure and elevated laboratory test penetration. The country also benefits from a strong focus on early disease detection and monitoring, especially for conditions such as hemolysis and inflammation. Moreover, the country hosts the presence of leading diagnostic companies and ongoing biomedical research, which are providing an encouraging opportunity for continued innovation and integration of reagents like haptoglobin in routine clinical practice.

The U.K. also garnered a huge opportunity in the haptoglobin reagent market, efficiently backed by a well-structured public healthcare system and growing adoption of biomarker-based diagnostics. The country’s government in February 2025 reported that it is committed to improving care for the 3.5 million people living with rare conditions by enhancing early diagnosis, increasing healthcare professional awareness, and ensuring better-coordinated, accessible specialist care, hence making it suitable for standard market growth in the upcoming years.

Key Haptoglobin Reagent Market Players:

- Roche Diagnostics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Siemens Healthineers

- Danaher (Beckman Colter)

- Thermo Fisher Scientific

- Sysmex Corporation

- Bio-Rad Laboratories

- Randox Laboratories

- Werfen

- Ortho Clinical Diagnostics

- Merck KGaA

- Agilent Technologies

- Abbkine Scientific Co., Ltd.

- HORIBA, Ltd.

- Mindray

- Transasia Bio-Medicals Ltd.

- SD BIOSENSOR

- PZ Cormay S.A.

- Biosystems S.A.

- Elabscience Biotechnology Inc.

The market is expanding with players such as Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers. These players are expected to hold the largest market share in the global landscape via high-throughput platforms and automation. Nowadays, companies are actively investing in R&D, AI-integrated diagnostics, and regional partnerships to meet market demand. Further, companies in Asia, including Sysmex, Mindray, and Transasia, are focusing on cost-effective products customized for regional demand. Public healthcare contracts, OEM partnerships, and strategic alliances are important growth facilitators.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Siemens Healthineers reported that it became the first IVD manufacturer to earn the My Green Lab ACT Ecolabel for both reagents and analyzers, certifying over 150 immunoassay and clinical chemistry reagents, including the High-Sensitivity Troponin I and ELF tests.

- In January 2025, bioMérieux announced that it acquired Norwegian startup SpinChip Diagnostics for €138 million (approximately USD 150.2 million) to strengthen its position in point-of-care (POC) diagnostics. SpinChip’s platform delivers high-sensitivity, lab-quality immunoassay results from whole blood samples in just 10 minutes.

- Report ID: 4165

- Published Date: Oct 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Haptoglobin Reagent Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.