Gunshot Detection Systems Market Outlook:

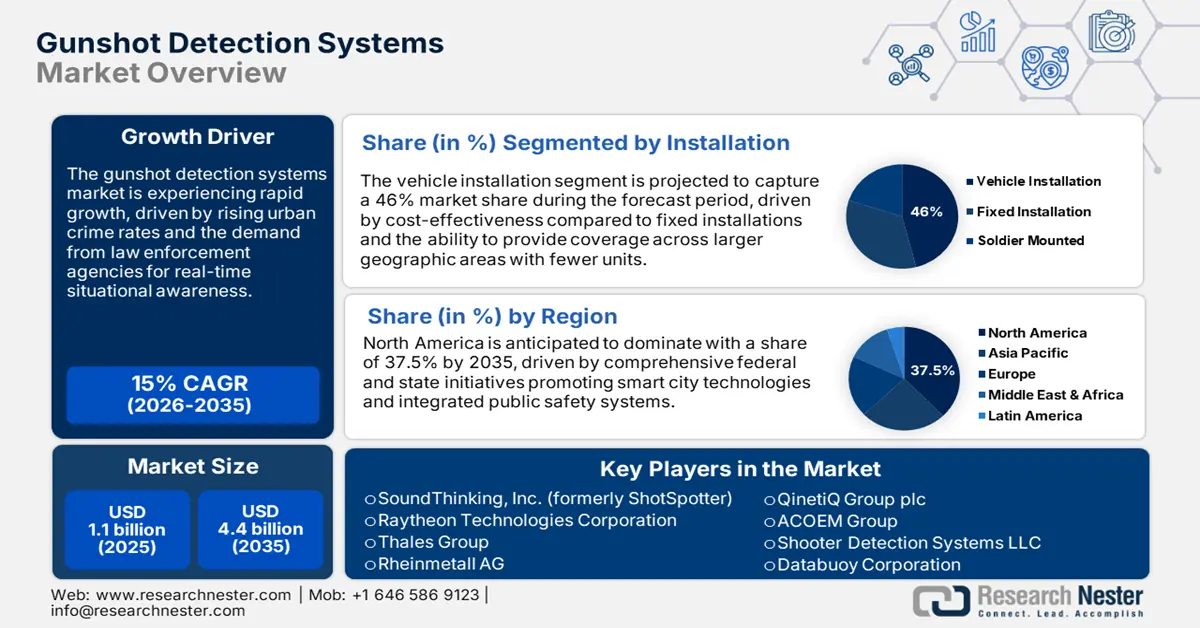

Gunshot Detection Systems Market size is valued at USD 1.1 billion in 2025 and is projected to reach a valuation of USD 4.4 billion by the end of 2035, rising at a CAGR of 15% during the forecast period, i.e., 2026-2035. In 2026, the industry size of gunshot detection systems is estimated at USD 1.2 billion.

The gunshot detection systems market is experiencing rapid growth, driven by growing security concerns in urban areas and institutional buildings. Sophisticated audio sensor technologies and AI-based analytics are transforming threat response capacity with real-time detection and automated emergency response coordination. Counter-terrorism technology development is being driven forward by legislative initiatives that create favorable market conditions for emerging security solutions. In May 2024, senators called on the U.S. Department of Homeland Security to probe federal funding of the ShotSpotter gunshot detection system, addressing doubts about accuracy and surveillance bias in communities. This legislative oversight establishes a framework for accountability in the deployment of security technology, with transparency protections that promote responsible innovation in security solutions and drive market growth.

The latest systems incorporate machine learning models, cloud-based monitoring systems, and integration with existing security infrastructure to offer end-to-end threat management solutions. For instance, the ShotSpotter flagship solution was deployed in four new cities, as well as grew with one existing customer in Q1 2025. SoundThinking reported strong first-quarter results for 2025, with revenues climbing 12% year-over-year to USD 28.3 million. This demonstrates the company's effective platform execution. This trend is indicative of the industry's shift towards comprehensive public safety technology systems that address multiple security challenges, in addition to conventional gunshot detection functions.

Key Gunshot Detection Systems Market Insights Summary:

Regional Highlights:

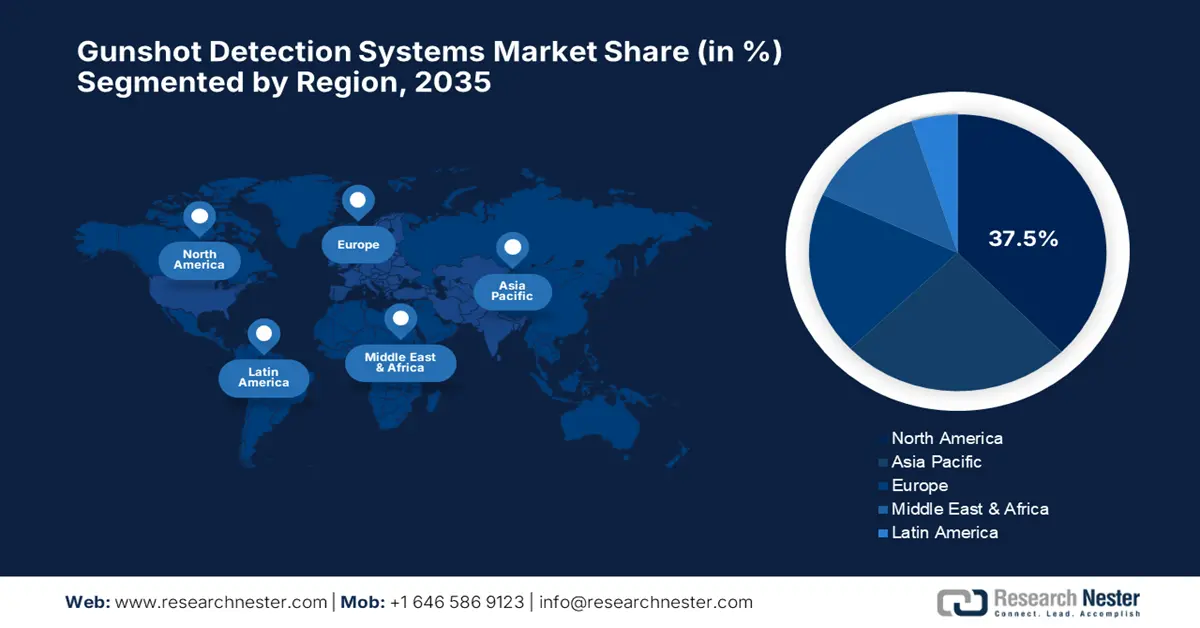

- North America is projected to command a 37.5% share of the Gunshot Detection Systems Market by 2035, owing to its advanced security infrastructure and strong public–private collaboration in safety technologies.

- The Asia Pacific region is anticipated to register a CAGR of 13% from 2026 to 2035, impelled by rapid urbanization and increasing governmental investments in public safety systems.

Segment Insights:

- The vehicle installation segment is projected to account for a 46% share by 2035 in the Gunshot Detection Systems Market, propelled by growing demand for mobile security solutions and the modernization of police vehicles.

- The commercial segment is estimated to hold around a 72% share through 2035, driven by heightened security requirements across offices, schools, and commercial facilities.

Key Growth Trends:

- Technological evolution enhances detection capacities

- Defense cooperation initiatives catalyze global market growth

Major Challenges:

- Increasing regulatory compliance complexity raises implementation barriers

- Complexity in integrating technology across legacy systems

Key Players: SoundThinking, Inc. (formerly ShotSpotter), Raytheon Technologies Corporation, Thales Group, Rheinmetall AG, QinetiQ Group plc, ACOEM Group, Shooter Detection Systems LLC, Databuoy Corporation, Rafael Advanced Defense Systems, Microflown AVISA B.V.

Global Gunshot Detection Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.2 billion

- Projected Market Size: USD 4.4 billion by 2035

- Growth Forecasts: 15% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 September, 2025

Gunshot Detection Systems Market - Growth Drivers and Challenges

Growth Drivers

- Technological evolution enhances detection capacities: Advanced acoustic sensor technologies, as well as artificial intelligence integration, are changing gunshot detection accuracy and response time in diverse deployment scenarios. Current systems utilize machine learning algorithms, edge computing functions, and real-time processing to reduce false alarms while enhancing the accuracy of threat detection. Organizations are designing end-to-end security platforms that incorporate various detection modalities with automatic response coordination systems. In May 2023, the corporate name of SoundThinking was changed to that SoundThinking, Inc., while introducing the SafetySmart Platform, the integrated suite of four data-driven tools that can be used for safe neighborhoods. The rebranding is a reflection of the evolution of the organization from the detection of gunshots to that of a full-range public safety tech provider.

- Defense cooperation initiatives catalyze global market growth: Strategic defence cooperation arrangements and government alliances are bringing new possibilities for gunshot detection technologies deployment in world markets. Alliances facilitate technology swapping, joint development projects, and standardized procurements, which enable rapid market penetration. The UK Government inaugurated the Defence Partnership-India programme office in February 2025, enabling government-to-government defence contracting and the elimination of trade barriers between the UK and India. The cooperation opened the way for Thales' first major deal in supplying MANPADs to Bharat Dynamics Limited, representing a significant strengthening of UK-India defence cooperation.

- Military integration with AI produces advanced detection systems: Defense contractors are transforming traditional hardware manufacturing capabilities by integrating artificial intelligence and autonomous systems into next-generation security platforms. Military applications require sophisticated threat detection systems that can operate in complex environments while providing real-time situational awareness to command and control systems. In July 2025, an analysis of Rheinmetall's AI strategy revealed the company's transformation from a traditional manufacturer to a leader in military AI, achieved through four foundational pillars. The company leverages Europe's re-militarization for funding, maintains an entrenched position as the premier hardware provider, executes an aggressive acquisition strategy, and focuses on open-architecture solutions. Rheinmetall is pursuing dominance as an integrator and platform provider for AI-enabled military capabilities in the land domain for NATO allies.

FBI Crime Trends & Implications for Gunshot Detection Systems (GDS)

|

Crime Category |

Trend (May '24 - Apr '25) |

Implication for the GDS Market |

|

Murder |

-15.3% |

High-Value Deterrent: While declining, homicides often involve firearms. GDS provides critical seconds for emergency response, potentially saving lives and collecting irrefutable evidence, justifying its value in known hotspots. |

|

Robbery |

-13.3% |

Asset Protection: Armed robberies remain a threat to businesses and public safety. GDS can be integrated with business security systems in commercial districts to deter armed crime and ensure immediate police dispatch. |

|

Aggravated Assault |

-5.1% |

Addressing Prevalence: This category often includes non-fatal shootings. As the most common violent crime, it represents a significant volume of incidents where GDS can ensure victims receive aid and evidence is captured. |

|

Motor Vehicle Theft |

-25.1% |

Resource Reallocation: The sharp decline in this category may free up police resources that can be redirected toward addressing violent crime and investigating shooting incidents, creating a larger operational role for GDS data. |

Source: FBI CDE

Challenges

- Increasing regulatory compliance complexity raises implementation barriers: Evolving regulatory requirements across multiple jurisdictions create significant compliance challenges for the deployment and operation of gunshot detection systems. Complex certification processes and ongoing compliance monitoring requirements increase operational costs and implementation timelines. In October 2024, RTX Corporation agreed to pay over USD 950 million to resolve multiple federal investigations involving bribery, government contracting violations, and export control breaches. The settlement included penalties for bribing Qatari officials and defrauding the U.S. Defense Department in procurement contracts, including Patriot missile systems and radar systems.

Complexity in integrating technology across legacy systems: Combining state-of-the-art gunshot detection systems with existing security installations poses formidable technical and operational challenges for end users. Older systems tend to lack standardized communication protocols, real-time functionality, and current cybersecurity models needed to facilitate seamless integration between systems. Companies are required to invest substantial resources in modernizing their infrastructure while maintaining functionality during implementation periods

Gunshot Detection Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2035) |

USD 4.4 billion |

|

Regional Scope |

|

Gunshot Detection Systems Market Segmentation:

Installation Segment Analysis

The vehicle installation segment is projected to capture a 46% market share during the forecast period as demand for mobile security solutions increases and police vehicle modernization projects emerge. Mobile systems are capable of rapid deployment, expanded coverage areas, and tactical mobility that are not feasible in fixed installations. Mobile agencies are investing in mobile gunshot detection systems that are integrated into existing in-vehicle communications and navigation systems. SoundThinking was awarded four new contracts and expansions in August 2024 for ShotSpotter implementations in Illinois and throughout the Chicagoland area, supporting public safety in critical regions. The contracts won new deployments in Elmwood Park, IL, as well as expansions in existing service regions with municipalities that valued these technologies.

Application Segment Analysis

The commercial market is projected to capture around 72% market share through 2035, as office complexes, schools, and commercial premises experience increasing security demands. Gunshot detection is being installed by corporations in large-scale safety initiatives in workplaces as well as in emergency planning initiatives. For instance, Shooter Detection Systems collaborated with Genea Security's cloud-based access control software platform in March 2025 to integrate market-leading gunshot detection with access control functionality. The combination bolsters the critical events response through the integration of detection systems with access control functionalities.

System Segment Analysis

The outdoor market is anticipated to garner a market share of 65% in 2035 due to the rising installation of perimeter security systems and city surveillance projects. Outdoor systems offer broad-area coverage potential, all-weather operation, and connectivity to city-wide security networks, enabling extensive threat detection. Municipal authorities, as well as critical infrastructure entities, are installing outdoor gunshot detection systems to improve public safety as well as emergency communications coordination. ACOEM Security Solutions in February 2025 underscored the ATD (Acoustic Threat Detection) system's ability to capture intruders on camera seconds ahead of attackers looking to drop weapons. The system leverages four decades of combat-proven expertise in acoustic measurement to provide real-time video response through edge processing, as well as direct camera control.

Our in-depth analysis of the global gunshot detection systems market includes the following segments:

|

Segment |

Subsegments |

|

Installation |

|

|

Application |

|

|

System |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gunshot Detection Systems Market - Regional Analysis

North America Market Insights

North America is projected to hold a 37.5% market share during the forecast period. The region has matured security infrastructure, significant government spending on public safety technologies, and robust cooperation between law enforcement agencies and technology companies. North American entities are leading the adoption of state-of-the-art threat detection systems that utilize artificial intelligence, machine learning, and cloud-based monitoring platforms to enhance security capabilities.

In the U.S., law enforcement agencies and security entities are rapidly adopting advanced gunshot detection systems that integrate real-time threat evaluation, automatic emergency response, and advanced situational awareness capabilities. Shooter Detection Systems' Indoor Gunshot Detection System earned the Platinum level honor in the Fire/Life Safety category in Campus Security Today's 2024 Secure Campus Awards in July 2024. The honor includes system performance in education environments and in supporting campus safety campaigns. System success in delivering trusted detection solutions continues in the education sector, confronting security challenges.

Canada market is adopting robust security frameworks and integrated threat detection systems that provide advanced emergency response functions and cross-platform integration. Canada's National Cyber Security Strategy, outlined in February 2025, provides extensive frameworks for protecting digital infrastructure. Meanwhile, Public Safety Canada's Departmental Plan for 2025-26 outlines specific measures to improve community safety practices and modernize public safety institutions through enhanced technology integration. The integration of gunshot detection systems with Canada's current emergency response infrastructure offers prospects for enhanced situational awareness and improved emergency response integration.

Europe Market Insights

Europe is predicted to experience consistent growth from 2026 to 2035, driven by rising security concerns, modernization efforts in the defense industry, and increased collaboration between European Union countries in security technology development. The region's emphasis on whole-of-government security frameworks, technological independence, as well as standardized deployment techniques lays the foundation for the usage of gunshot detection systems. Companies in Europe are investing heavily in incident management systems that prioritize the effectiveness of operations, regulatory compliance, and cross-country interoperability through advanced detection technologies for threats.

Germany security companies and defense contractors are spearheading European use of the latest gunshot detection technologies, utilizing the nation's advanced engineering prowess and precise manufacturing knowledge to deploy sophisticated threat detection systems. In 2025, Germany's High-Tech Strategy 2025 allocated significant resources to civil security research through the Federal Government's framework programme 'Research for Civil Security', which runs until 2023 and engages with artificial intelligence opportunities for security applications. The framework includes two competence centres for robotic systems in hostile environments, where security-relevant autonomous innovations including acoustic threat detection are being developed and transferred into practice.

The UK maintains its position as one of the leader in security technology through progressive regulatory frameworks, strong defense industry expertise, and continued innovation in threat detection technologies. In May 2025, QinetiQ announced preliminary results for the year ended March 31, 2025, reporting revenue of £1,931.6 million with 2% organic growth and underlying profit of £185.4 million despite challenges in the UK Intelligence and U.S. sectors. The company secured a five-year extension of its Long Term Partnering Agreement, worth £1.54 billion, which increased the total order backlog to approximately £5 billion. This strategic growth and significant order backlog solidify the UK's position as a key player in the global security technology landscape.

APAC Market Insights

Asia Pacific gunshot detection systems market is estimated to record a CAGR of 13% from 2026 to 2035, driven by rapid urbanization, increasing security investments, and government support for advanced public safety technologies across diverse regional economies. The region benefits from substantial infrastructure development, a growing middle-class population, and progressive security frameworks that encourage the adoption of threat detection systems. Regional governments are implementing comprehensive security policies while maintaining appropriate oversight and technology standards.

China gunshot detection systems market is leveraging advanced manufacturing capabilities, artificial intelligence development, and comprehensive security infrastructure to build integrated threat detection ecosystems for urban and critical facility applications. China security technology companies are developing indigenous gunshot detection capabilities while partnering with international providers to enhance their technological sophistication. In July 2025, China announced the development of smart cities with comprehensive security systems as part of its broader AI Plus initiative. This aims to effectively combine digital technologies with the country's manufacturing and market strengths to support extensive application of large-scale AI models in smart manufacturing equipment and intelligent infrastructure.

India represents a rapidly expanding gunshot detection systems market driven by government security modernization initiatives, increasing industrial investment, and substantial demand for comprehensive security solutions across urban and industrial environments. In 2025, the India Government's 'Make in India' initiative facilitated the Thales-BDL partnership for domestic MANPAD production, with 60% local manufacturing and technology transfer to support current and future Armed Forces requirements. The initiative strengthens India's defense industrial base while reducing dependency on imports for critical air defense systems.

Key Gunshot Detection Systems Market Players:

- SoundThinking, Inc. (formerly ShotSpotter)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Raytheon Technologies Corporation

- Thales Group

- Rheinmetall AG

- QinetiQ Group plc

- ACOEM Group

- Shooter Detection Systems LLC

- Databuoy Corporation

- Rafael Advanced Defense Systems

- Microflown AVISA B.V.

The gunshot detection systems market is characterized by keen competition among existing defense contractors, security technology specialists, and new technology businesses that continually upgrade their systems through artificial intelligence, machine learning, and integrated threat detection capabilities. Key market players include SoundThinking, Inc. (formerly ShotSpotter), Raytheon Technologies Corporation, Thales Group, Rheinmetall AG, QinetiQ Group plc, ACOEM Group, Shooter Detection Systems LLC, Databuoy Corporation, Rafael Advanced Defense Systems, Microflown AVISA B.V., Mitsubishi Electric Corporation, Sony Corporation, Panasonic Corporation, NEC Corporation, as well as Hitachi, Ltd. These players are spending extensively on research as well as development in order to take advantage.

Strategic alliances, technology integration projects, and platform construction are all redefining competition as businesses look to broaden market reach and access technologies through collaborative innovation. In April 2023, SDS and Alarm.com announced SDS Powered by Alarm.com, a solution that combines SDS's indoor gunshot detection sensors with the fully integrated Alarm.com for Business platform. The solution is targeted for the small to mid-size commercial market segments, enhancing Alarm.com platform abilities while providing service providers with more capable security solutions.

Here are some leading companies in the global gunshot detection systems market:

Recent Developments

- In March 2025, Shooter Detection Systems announced participation in ISC West 2025, showcasing the advanced SDS Perimeter Outdoor Gunshot Detection System and new software upgrades. The company demonstrated both on-premise and cloud-based solutions including SDS Enterprise with georeferenced mapping capabilities and intuitive sensor management interfaces.

- In April 2024, Databuoy Corporation was awarded U.S. Department of Homeland Security SAFETY Act Designation for its SHOTPOINT product line (Indoor, Outdoor, and Vertical) as Qualified Anti-Terrorism Technology. The designation followed thorough evaluation including independent performance testing, operational effectiveness analysis, manufacturing review, and user feedback.

- Report ID: 8048

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gunshot Detection Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.