GNSS Simulators Market Outlook:

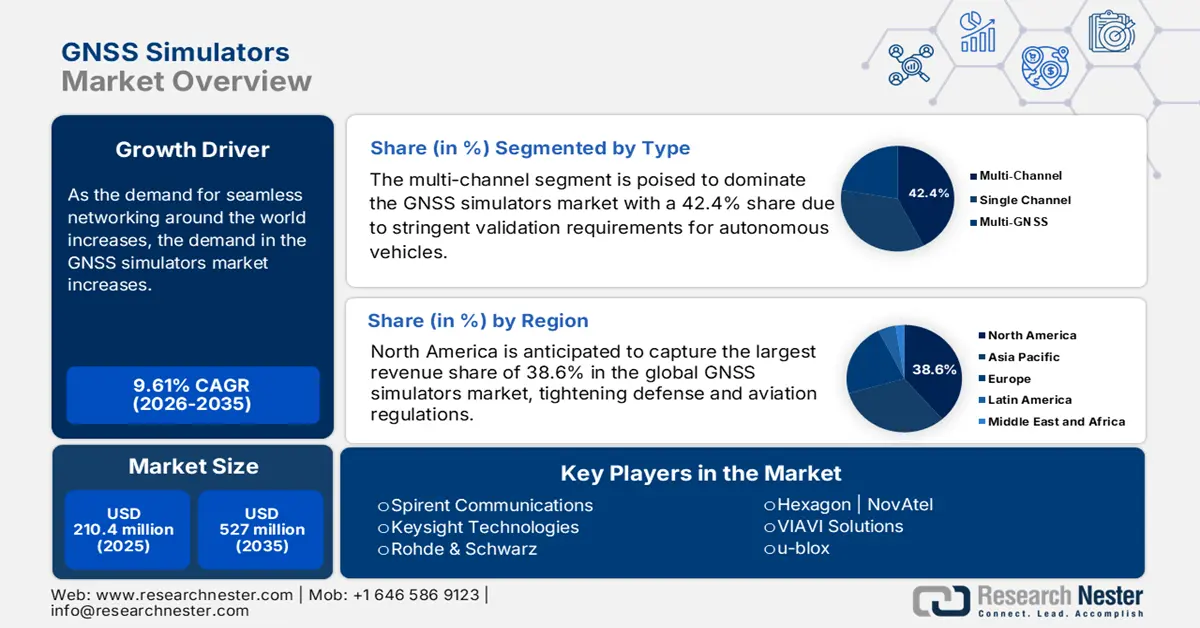

GNSS Simulators Market size was over USD 210.4 million in 2025 and is estimated to reach USD 527 million by the end of 2035, expanding at a CAGR of 9.61% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of GNSS simulators is assessed at USD 230.8 million.

As the demand for seamless networking around the world is increasing, the need for advanced GNSS simulators is escalating. Based on the efficacy in testing and validating environmental conditions, vehicle movements, and signal interferences, this sector is gaining traction. This can be exemplified by the amplifying volume of global trade in such systems. Another key factor driving demand for GNSS simulation is the growth of autonomous systems, including autonomous vehicles, UAVs, and advanced driver-assistance systems (ADAS). Autonomous systems require GNSS simulation to develop credible and realistic verification and safety testing environments. Further interest in developing simulated resiliency to interference, spoofing, and jamming is also driving demand for new simulators capable of emulating these adversarial conditions.

There is also development towards integrating with other sensor systems (e.g., LiDAR, radar, and inertial navigation systems [INS]) through hardware-in-the-loop (HIL) testing that will continue to enable whole world simulation. The market is also shifting towards software-defined simulators, virtualization, and cloud-based testing platforms, which offer improved flexibility and lower costs. Regulatory pressure for aviation, defense, and other initiatives is instituting higher accuracy, integrity, and signal authentication expectations for simulators. GNSS-enabled consumer electronics, IoT devices, and wearables are also growing markets, creating a need for smaller, inexpensive simulation devices. Regionally, the Asia-Pacific is emerging as a high-growth market with deployment of regional GNSS systems and investment in regional testing infrastructure.

Key GNSS Simulators Market Insights Summary:

Regional Highlights:

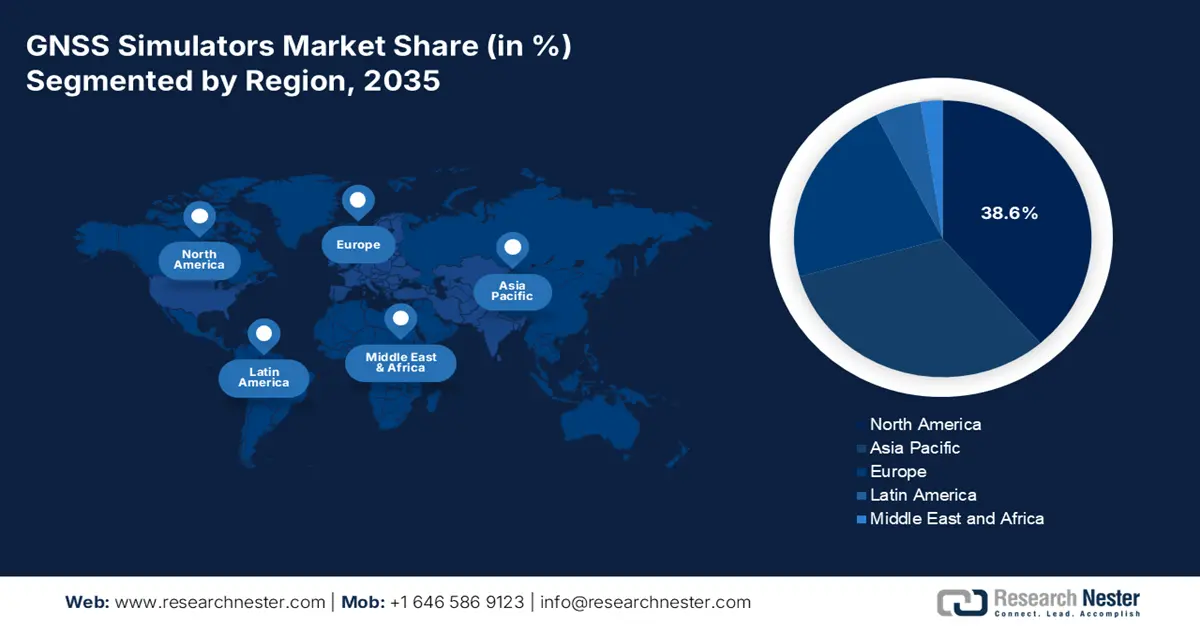

- North America is projected to command the largest 38.6% share of the GNSS simulators market by 2035, owing to tightening FAA and DoD regulations mandating advanced testing capabilities in aerospace and defense sectors.

- Asia Pacific is forecast to witness the fastest growth through 2035, supported by expanding QZSS and Galileo systems, extensive 5G rollout, and accelerating autonomous vehicle advancements.

Segment Insights:

- The multi-channel segment is projected to command a 42.4% share of the GNSS simulators market by 2035, propelled by stringent validation requirements for autonomous vehicles and the growing adoption of 5G synchronization testing compliant with ITU-T G.8272 standards.

- The defense & military segment is expected to capture a 38.8% share by 2035, driven by rising investments in PNT resilience, increased concerns over spoofing and jamming, and the need for advanced simulation of encrypted GNSS signals.

Key Growth Trends:

- Cybersecurity and anti-jamming requirements

- Autonomous vehicle and ADAS proliferation

Major Challenges:

- Concerns about privacy and data security

- Lack of adequate networking infrastructure

Key Players: Spirent Communications, Rohde & Schwarz, Hexagon AB, VIAVI Solutions, Keysight Technologies, Orolia (Spectracom), CAST Navigation, Syntony GNSS, u-blox, Accord Software & Systems, RACELOGIC

Global GNSS Simulators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 210.4 million

- 2026 Market Size: USD 230.8 million

- Projected Market Size: USD 527 million by 2035

- Growth Forecasts: 9.61% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Australia, Italy, Canada

Last updated on : 1 October, 2025

GNSS Simulators Market - Growth Drivers and Challenges

Growth Drivers

- Cybersecurity and anti-jamming requirements: The market is witnessing remarkable compulsion in adoption due to a notable increase in spoofing and jamming threats. As GNSS technology advances into mission-critical applications in aviation, defense, autonomous vehicles, maritime navigation, and as a timing reference for infrastructure, threats from signal interference and nefarious attacks have arisen. Spoofing and jamming will have an impact on positioning accuracy, safety, and the continuity of operations. As a solution to explore these threats, organizations have and are investing in the development of high-fidelity simulators, which allow for the creation of hostile environments under controlled test conditions. GNSS simulators that incorporate simulated threats have become readily available, allowing developers and engineers to evaluate GNSS receiver performance in an intentional signal disruption (i.e., jamming).

- Autonomous vehicle and ADAS proliferation: The rapid penetration of advanced driver assistance systems (ADAS) in the automotive industry is fueling the rapid expansion of the GNSS simulators market. Given that vehicles are becoming more autonomous and reliant on highly accurate position messages, there is an increasing need for rigorous testing of GNSS receivers in a variety of near-real-world scenarios. GNSS simulators are essential for recreating real-world scenario testing in complex urban settings, where GNSS receivers are faced with blocked signals, multipath conditions, tunnels, and physical realities. GNSS simulators present a means of developing an autonomous vehicle's navigation system for vehicle manufacturers and technology developers to validate the accuracy, reliability, and robustness in their navigation systems safely.

- Expansion of multi-constellation and multi-frequency GNSS usage: The adoption of dual GNSS and multi-frequency signals is becoming standard industry practice for improved accuracy, availability, and reliability. GNSS receiver simulators must evolve to accommodate these dual-constellation, multi-frequency GNSS ecosystems to simulate realistic situational test scenarios. As increasing industries use dual-constellation, multi-frequency GNSS for precise position and timing, the need for sophisticated GNSS receiver simulators that can model different GNSS satellite signals quickly progresses to produce significant market growth.

Global New Car Sales by Vehicle Autonomy Level (%) Forecast for 2023, 2025, 2030, and 2035

|

Autonomy Level |

2023 (%) |

2025 (%) |

2030 (%) |

2035 (%) |

|

L0 (No automation) |

53 |

44 |

33 |

24 |

|

L1 |

13 |

13 |

12 |

10 |

|

L2 |

33 |

39 |

42 |

38 |

|

L2+ |

1 |

5 |

13 |

21 |

|

L3 |

- |

- |

1 |

4 |

|

L4 Highway |

<1 |

- |

<1 |

3 |

|

L4 Highway and Urban |

- |

- |

- |

1 |

|

Robotaxis |

- |

- |

- |

<1 |

Challenges

- Concerns about privacy and data security: Tightening regulations on data security, including the GDPR and DPDPA in Europe and India, are imposing unavoidable hurdles for the market. These restrictions upon cross-border test data sharing are also limiting the worldwide expansion of this sector. This can be exemplified by the u-blox facing an 8-month delay during its entrance into India, which was caused by data localization requirements.

- Lack of adequate networking infrastructure: Emerging economies, such as India and Africa, often face adoption barriers for the GNSS simulators market because of their underdeveloped 5G and RTK infrastructure. For instance, GNSS integration in Africa lagged behind global giants by three years on account of slow 5G deployment, as per the Global System for Mobile Communications Association (GSMA). To address this disparity, Spirent collaborated with local telecom providers, such as its partnership with MTN in South Africa, to deploy cost-effective simulator solutions tailored for infrastructure-constrained environments.

GNSS Simulators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.61% |

|

Base Year Market Size (2025) |

USD 210.4 million |

|

Forecast Year Market Size (2035) |

USD 527 million |

|

Regional Scope |

|

GNSS Simulators Market Segmentation:

Type Segment Analysis

The multi-channel segment is poised to dominate the GNSS simulators market with a 42.4% share by the end of 2035. The stringent validation requirements for autonomous vehicles demand large-scale supply of reliable testing solutions and technology advances, which testifies to this leadership. In addition, 5G synchronization testing to gain compliance with the ITU-T G.8272 standard is also pushing service providers to adopt multi-channel GNSS systems. The segment's dominance is further consolidated with real-world efficiency gains, as demonstrated by Spirent's multi-constellation simulators that reduced ADAS calibration time.

Application Segment Analysis

The defense & military segment is estimated to hold the highest share of 38.8% in the market throughout the analyzed timeframe. The growing investments in PNT resilience against electronic warfare threats are the primary growth factor in this category. Due to the increasing dangers of spoofing, jamming, and cyber-attacks, defense organizations need next-generation simulators that can simulate hostile environments while assessing the system's resiliency. Also, military applications rely on encrypted or secured GNSS signals such as GPS M-code and Galileo PRS, which means that specific simulation capabilities are needed. Finally, the ongoing development of defense systems, along with continued government investment in R&D, creates a demand for high-performance simulators.

Component Segment Analysis

Hardware segment generated the largest revenue share, as the physical simulation equipment is central to the majority of GNSS test applications in all industries. Hardware simulators are critical for generating live satellite signals to be fed directly into GNSS receivers for accurate, real-time testing in a controlled environment. Also, hardware simulators include high-value components, such as RF front ends, signal generators, and integrated systems, that are typically responsible for the highest portion of the total cost and, therefore, the largest revenue per unit.

Our in-depth analysis of the global GNSS simulators market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

GNSS Simulators Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the largest revenue share of 38.6% in the market over the assessed tenure. The tightening U.S. DoD and Federal Aviation Administration (FAA) regulations, mandating advanced testing features for the defense and aerospace industries, are amplifying demand in this sector. This can also be testified by major contracts with industry leaders, such as SpaceX, for high-precision simulation solutions. The region is also witnessing AI-assisted price reductions, which are making advanced GNSS testing tools more accessible while maintaining compliance with rigorous regulatory standards.

The U.S. is augmenting dominance over the regional GNSS simulators market on account of rapid defense modernization and 5G networking expansion. The country is home to the GPS (Global Positioning System)-the world’s first and most forensically GNSS, which gives the U.S. a fundamental advantage in the development and implementation of GNSS-related technologies, including simulation tools. Additionally, the U.S. Department of Defense (DoD) and other federal agencies invest significant resources in GNSS testing for secure and encrypted and jam-resistant systems, which generates a continuous need for high-end simulation technologies.

Canada is also establishing a strong foundation to contribute to the continuous growth in the market in North America, as substantial federal investments and telecom mandates act as the pillars for the country in this sector. Canada's growing engagement with global and regional GNSS efforts, specifically working with the U.S. GPS program as well as the European Galileo system, is also creating a need for simulation technologies to verify compatibility, performance, and security. Canada has several companies and research institutions that develop or integrate GNSS-enabled applications in areas including autonomous vehicles, UAVs, precision agriculture, and telecom infrastructure, all of which deal with various levels of simulation.

APAC Market Insights

Asia Pacific is predicted to exhibit the fastest growth by the end of 2035, owing to rapid QZSS and Galileo expansion, 5G deployment, and booming autonomous vehicle development. Several nations in the area- especially, China, India, Japan, and South Korea- are developing and deploying their own regional GNSS systems, thus creating immense demand for simulation tools for the testing and validation of compatibility, performance, and reliability. The automotive industry in the Asia Pacific is also seeing heightened adoption of autonomous vehicles and ADAS technologies, further driving the need for accurate and reliable GNSS signals.

China is estimated to lead the regional market with a 45.6% revenue share by 2034. The country's proprietorship is fueled by its BeiDou-3 global navigation system, which is backed by the investment from the Ministry of Industry and Information Technology (MIIT). Additionally, the massive 5G/6G infrastructure rollout is contributing to the enlarging consumer base for this merchandise. In addition, China has one of the biggest automobile and consumer electronics markets in the world, both of which are increasingly reliant on high-precision positioning for applications such as autonomous vehicles, ADAS, smartphones, wearables, and location-based services. This large and growing need for services related to GNSS simulation provides the capability needed for product validation and safety testing.

India is remarkably benefiting the APAC GNSS simulators market as an epicenter of sustainable demand and tech-based evolutions. The country's indigenous Indian Regional Navigation Satellite System (IRNSS) program is empowering the deployment of Navigation with Indian Constellation (NavIC). Moreover, India's developments in space exploration, telecommunication, and smart cities are also improving GNSS applications. These areas require precise positioning and timing services. These factors motivate the use of GNSS simulators for research and development (R&D), performance improvement, and regulatory and compliance testing. Initiatives such as the Make in India and Digital India programs are at the forefront of stimulating national innovation and the production of GNSS-based products, increasing the need for simulators.

Europe Market Insights

Europe is poised to establish itself as a powerhouse in the market between 2026 and 2035. The region's persistent performance in this sector is highly attributable to the magnifying automotive industry and substantial government investments. Besides, the European Space Agency (ESA) affiliated Galileo program and robust regulatory support is also contributing to the region's progress in this category. In addition, comprehensive R&D investment, technology development, and standardization initiatives, are encouraged by strong support from European space and regulatory agencies. These initiatives create an area for innovation in GNSS simulation and encourage adoption in member states.

Germany is expected to retain dominance over the Europe market with a 28.5% revenue share by 2035. Its leadership in ADAS and defense technologies is backing this regional leadership. Germany boasts globally recognized automotive giants including BMW, Mercedes-Benz, Volkswagen, and Audi, which are invested significantly in autonomous vehicle technology and ADAS systems. The reliable GNSS signal is an essential component, which elevates the importance of high fidelity simulators, for urban, rural and challenging environments testing. Additionally, there is increasing demand for simulators in precision positioning and machine-to-machine communication given Germany's expanding smart mobility and Industry 4.0 ecosystem.

The UK is expected to account for a notable 22.4% revenue share owing to strong emphasis on satellite navigation and smart city initiatives. The UK public sector and private sector have invested considerably in GNSS innovation and security. Their investment focus has been on anti-spoofing and anti-jamming solutions operating sophisticated GNSS simulation capabilities. The UK aerospace sector has many leading companies, including BAE Systems and Rolls-Royce, that are using GNSS simulators to develop and test next-generation avionics and autonomous systems.

Key GNSS Simulators Market Players:

- Spirent Communications

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rohde & Schwarz

- Hexagon AB

- VIAVI Solutions

- Keysight Technologies

- Orolia (Spectracom)

- CAST Navigation

- Syntony GNSS

- u-blox

- Accord Software & Systems

- RACELOGIC

The current dynamics of the GNSS simulators market indicate significant control from pioneers in Japan, who are leveraging their expertise in wireless power transmission (WPT) and precision electronics. Particularly, TDK, Mitsubishi Electric, and Panasonic are enhancing their R&D capabilities in magnetic induction and resonant charging to enhance GNSS testing solutions. On the other hand, global tech firms are utilizing strategic partnerships and standardization goals to strengthen their position in this sector. Moreover, with increasing demand for high-precision GNSS testing in EVs and smart devices, key players are expanding their territory on a global scale.

Here is a list of key players operating in the market:

Recent Developments

- In December 2022, Spirent Communications launched its SimORBIT Software Suite, enhancing multi-constellation GNSS testing with cloud-based simulation for autonomous vehicle (AV) developers. The software reduces testing time by 30.4%, contributing to a 15.6% revenue increase for Spirent in the 1st quarter of 2022.

- In October 2022, Keysight Technologies introduced its UXM 5G+GNSS Test Solution, integrating 5G NR and GNSS simulation for IoT and smart city applications. The solution, compliant with 3GPP Release 17 standards, drove a 12.3% YoY revenue increase during the 1st quarter of 2022.

- Report ID: 7907

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

GNSS Simulators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.