| Global Myopia and Presbyopia Treatment Market Table of Contents 1. INTRODUCTION 2. ASSUMPTIONS AND ACRONYMS 3. RESEARCH METHODOLOGY 4. EXECUTIVE SUMMARY - GLOBAL MYOPIA & PRESBYOPIA TREATMENT MARKET 5. ANALYSIS OF MARKET DYNAMICS 5.1. DRIVERS 5.2. RESTRAINTS 5.3. TRENDS 6. KEY MARKET OPPORTUNITIES 7. INDUSTRY RISK ANALYSIS 7.1. DEMAND RISK ANALYSIS 7.2. SUPPLY RISK ANALYSIS 8. REGULATORY LANDSCAPE 9. IMPACT OF COVID-19 ON MYOPIA & PRESBYOPIA TREATMENT 10. MYOPIA & PRESBYOPIA TREATMENT MARKET OUTLOOK 10.1. MARKET SIZE AND FORECAST, 2018-2028 10.1.1. BY VALUE (USD MILLION) 10.2. MYOPIA & PRESBYOPIA TREATMENT MARKET SEGMENTATION, 2018-2028 10.2.1. BY REGIONS v NORTH AMERICA MYOPIA & PRESBYOPIA TREATMENT MARKET, 2018-2028F (USD MILLION) § MARKET SIZE, 2018-2028F (USD MILLION) § MARKET ANALYSIS § BY COUNTRY o ASSESSMENT OF MACROECONOMIC FACTORS o US & CANADA, 2018-2028F (USD MILLION) v EUROPE MYOPIA & PRESBYOPIA TREATMENT MARKET, 2018-2028F (USD MILLION) § MARKET SIZE, 2018-2028F (USD MILLION) § MARKET ANALYSIS § BY COUNTRY o ASSESSMENT OF MACROECONOMIC FACTORS o UK & GERMANY, 2018-2028F (USD MILLION) o FRANCE & ITALY, 2018-2028F (USD MILLION) o SPAIN & RUSSIA, 2018-2028F (USD MILLION) o REST OF EUROPE, 2018-2028F (USD MILLION) v ASIA PACIFIC MYOPIA & PRESBYOPIA TREATMENT MARKET, 2018-2028F (USD MILLION) § MARKET SIZE, 2018-2028F (USD MILLION) § MARKET ANALYSIS § BY COUNTRY o ASSESSMENT OF MACROECONOMIC FACTORS • CHINA & INDIA, 2018-2028F (USD MILLION) • o JAPAN & SOUTH KOREA, 2018-2028F (USD MILLION) • o AUSTRALIA & MALAYSIA, 2018-2028F (USD MILLION) • o REST OF ASIA PACIFIC, 2018-2028F (USD MILLION) • LATIN AMERICA MYOPIA & PRESBYOPIA TREATMENT MARKET, 2018-2028F (USD MILLION) • MARKET SIZE, 2018-2028F (USD MILLION) • MARKET ANALYSIS • BY COUNTRY • o ASSESSMENT OF MACROECONOMIC FACTORS • o BRAZIL & MEXICO, 2018-2028F (USD MILLION) • o REST OF LATIN AMERICA, 2018-2028F (USD MILLION) • MIDDLE EAST & AFRICA MYOPIA & PRESBYOPIA TREATMENT MARKET, 2018-2028F (USD MILLION) • MARKET SIZE, 2018-2028F (USD MILLION) • MARKET ANALYSIS • BY COUNTRY • o ASSESSMENT OF MACROECONOMIC FACTORS • o UNITED ARAB EMIRATES & SAUDI ARABIA, 2018-2028F (USD MILLION) • o ISRAEL & SOUTH AFRICA, 2018-2028F (USD MILLION) • o REST OF MIDDLE EAST & AFRICA, 2018-2028F (USD MILLION) • 11. COMPETITIVE STRUCTURE • 11.1. DETAILED OVERVIEW • 11.2. COMPETITIVE BENCHMARKING • 11.3. ASSESSMENT OF KEY PRODUCT OFFERINGS • 11.4. ANALYSIS OF GROWTH STRATEGIES • 11.5. KEY COLLABORATIONS AND JOINT VENTURES • 11.6. KEY MERGERS AND ACQUISITIONS • 11.7. RECENT NEWS AND DEVELOPMENTS • 11.8. KEY CLIENTS AND PARTNERS • 11.9. EXHAUSTIVE ANALYSIS ON KEY FINANCIAL INDICATORS • 11.10. COMPANY PROFILES • 11.10.1. TOPCON CORPORATION • 11.10.2. ALCON • 11.10.3. BAUSCH & LOMB INCORPORATED • 11.10.4. NIDEK CO., LTD. • 11.10.5. CARL ZEISS AG • 11.10.6. JOHNSON & JOHNSON VISION • 12. STRATEGIC RECOMMENDATIONS |

Myopia and Presbyopia Treatment Market Outlook:

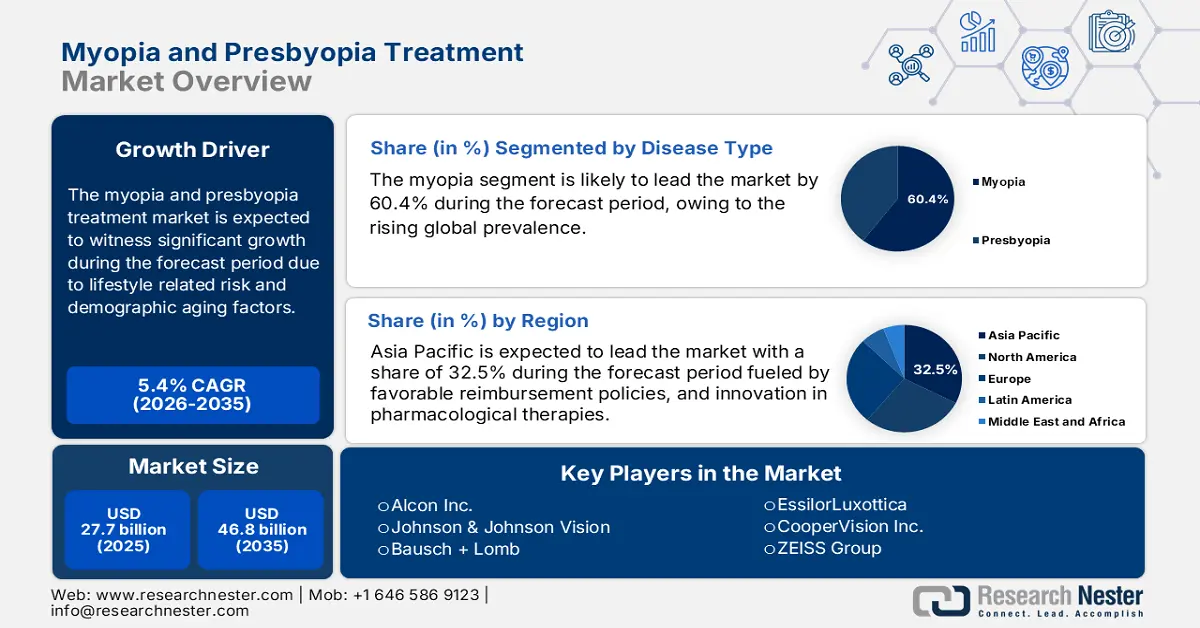

Myopia And Presbyopia Treatment Market size was valued at USD 27.7 billion in 2025 and is projected to reach USD 46.8 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of myopia and presbyopia treatment is evaluated at USD 29.2 billion.

The patient pool of the market continues to expand due to lifestyle-related risk and demographic aging factors. As per the National Eye Institute data released in December 2024, over 150.7 million U.S. citizens are affected by refractive errors such as presbyopia and myopia. Further, the data also shows that presbyopia among adults and children is rising in East Asia. The surge in patient volume is increasing the pressure on the supply chain for both surgical and pharmacological treatments. The U.S., Switzerland, China, Germany, and India are home to most manufacturing and processing centers.

Investment in research, development, and deployment is high, with a major focus on future-oriented technologies. Trade in this industry is marked by the export of finished high-value medical devices from developed countries and the import of parts and generic APIs. For example, according to the OEC report in 2023, the U.S. exports the largest amount of ophthalmic instruments and appliances for a value of USD 1.48 billion. Producer prices of ophthalmic products have experienced inflationary pressures due to the higher R&D expenses and complexities in the supply chain, which are then transmitted along the value chain and have an effect on the consumer price index for products and treatments for vision care.

Key Myopia and Presbyopia Treatment Market Insights Summary:

Regional Highlights:

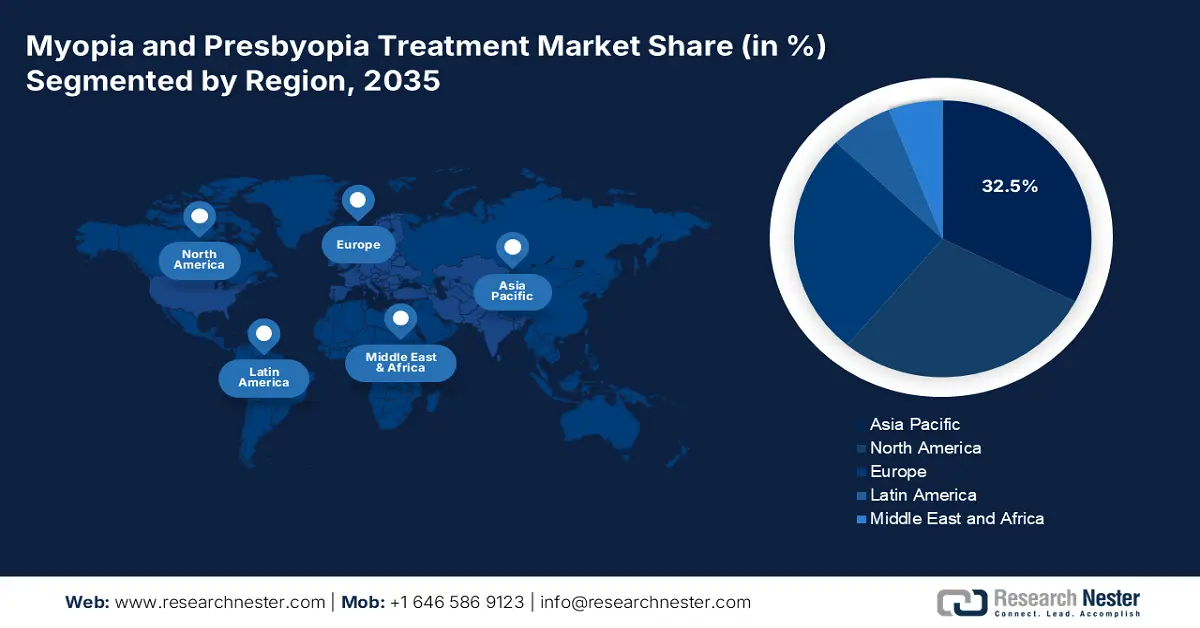

- The Asia Pacific myopia and presbyopia Treatment Market is projected to hold a 32.5% share by 2035, supported by increasing patient volumes, aging demographics, and expanding government healthcare investments.

- North America is anticipated to register the fastest growth by 2035, owing to favorable reimbursement structures, advancements in pharmacological therapies, and a high prevalence of myopia among children.

Segment Insights:

- The myopia segment of the myopia and presbyopia treatment market is expected to capture a 60.4% share by 2035, propelled by the rising global prevalence of the condition, particularly across Asia-Pacific countries such as South Korea, Singapore, and Taiwan.

- The adult age group (18–64 years) segment is projected to dominate the market by 2035, driven by the widespread demand for vision correction solutions addressing both myopia progression and presbyopia onset.

Key Growth Trends:

- Government expenditure on vision correction

- Cost-effectiveness of vitamin therapy in AMD management

Major Challenges:

- Government pricing caps

Key Players: Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb, EssilorLuxottica, CooperVision Inc., ZEISS Group, Hoya Corporation, Carl Zeiss Meditec, SIFI S.p.A., Menicon Co., Ltd., Visioneering Technologies, Shamir Optical Industry, SynergEyes Inc., Haohai Biological Tech, Aurolab, Hanita Lenses, Interojo Inc., Rayner Intraocular Lenses, Appasamy Associates, NOVA MEDICAL PRODUCTS

Global Myopia and Presbyopia Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.7 billion

- 2026 Market Size: USD 29.2 billion

- Projected Market Size: USD 46.8 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, France, Canada, Australia

Last updated on : 2 September, 2025

Myopia and Presbyopia Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Government expenditure on vision correction: The U.S. Medicare is the largest payer for eye disease treatments, paying for 41% of beneficiaries with AMD, cataract, DR, and glaucoma claims. Overall, Medicare spent $10.2 billion on vision-related diseases. These vision-related diseases account for 4% of Medicare Part B and 1% of Part D expenditures, with treatment costs per individual averaging between $360 for cataract and $1,290 for AMD annually, as stated in the CDC May 2024 report.

-

Personal out-of-pocket expenditure on vision care: Nearly USD 4993 is spent annually by every citizen in the U.S. including vision correction stated by NLM report in March 2024. Further, the total financial burden on visual disorder stated in the CDC May 2024 report is $35.4 billion. This expense is covered for both surgical and drug-based treatments for presbyopia and myopia. Despite the challenges in insurance coverage the demand is supported by lifestyle requirements and convenience considerations, which indicate a sustained transition toward self-funded refractive care.

-

Cost-effectiveness of vitamin therapy in AMD management: As per the CDC report in May 2024, the age-related macular degeneration has shown that vitamin therapy such as prophylactic antioxidant vitamins combined with zinc reduces the progression and incidence of AMD. The therapy has minimized the proportion of early AMD patients developing visual impairment for better vision result from 7.0% to 5.6%. while comparing with other treatments, vitamin therapy is more effective in lowering the vision loss and managing AMD and preserving the patient eye sight.

Survey Report on the Prevalence and Trends of Myopia Challenge

|

Parameter |

Study 1 (2022) |

Study 2 (2023) |

|

Participants |

1,285,609 |

1,059,838 eligible; 1,013,206 included (95.6% participation) |

|

Age (years) |

Mean: 11.80 ± 3.07 (range 6-20) |

Mean: 11.57 ± 3.36 (range 5-20) |

|

Gender |

658,516 males (51.2%) |

Male-to-female ratio: 1.11 |

|

High Myopia Prevalence |

2019: 4.48% |

Overall: 1.12% (elementary) |

|

Total Myopia Prevalence |

- |

Whole city-level: 75.35% |

|

Low Myopia Prevalence |

- |

Elementary: 48.56% |

|

Trend Observed |

Prevalence increased with age (11-17 yrs); higher in coastal/southern cities (2.60-5.83%). Rates decreased across all school stages from 2019-2021 |

Prevalence increased with age and grade. Fastest increase at ages 7-9. SE decreased with age/grade |

|

Predictive Factors |

Age, uncorrected distance VA, spherical equivalents |

Age, grade, SE. |

|

Model Performance |

Random forest: Accuracy 0.948, AUC 0.975 |

- |

Source: Frontiers, July 2022, JMIR, March 2023

Historical Data on the Prevalence of Myopia Cases

|

Year |

Affected Population (Billions) |

Prevalence % |

|

2000 |

1.4 |

22.9% |

|

2010 |

2.0 |

28.3% |

|

2020 |

2.6 |

33.9% |

|

2024 |

2.2 |

36% |

Source: WHO, August 2023, THE INTERNATIONAL MYOPIA INSTITUTE 2025

Challenges

-

Government pricing caps: In 2023, nations such as France and Germany imposed strict price caps on eye care treatments under their public health plans, limiting reimbursement levels for pharmacologic therapies like pilocarpine-based eye drops. This dramatically lowered commercial profitability for companies. For example, a company reacted by winning a tiered pricing agreement with French health authorities, securing wider market penetration and boosting the sales. These cost controls through regulation remain to hinder revenue growth in Western Europe.

Myopia and Presbyopia Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 27.7 billion |

|

Forecast Year Market Size (2035) |

USD 46.8 billion |

|

Regional Scope |

|

Myopia and Presbyopia Treatment Market Segmentation:

Disease Type Segment Analysis

Myopia is the leading disease type segment and is expected to hold the share value of 60.4% by 2035. The segment is fueled by rising global prevalence, mainly in the Asia-Pacific region. According to the WOO University report in 2021, nearly 30% of the overall population in the world are myopic. Further, the prevalence of myopia is mostly seen in South Korea, Singapore, Taiwan, and Southeast Asia. This epidemic-scale growth directly fuels the demand for corrective and management treatments, from spectacles to advanced surgical and pharmaceutical interventions.

Age Group Segment Analysis

In the age group segment, the adult age group age between 18 and 64 is projected to hold the dominant share by 2035. This demographic encompasses the vast majority of individuals who actively seek vision corrective solutions for myopia progression and the onset of presbyopia. As per the Indian Journal of Ophthalmology published in August 2022, nearly 80% of the population is suffering from myopia. This data shows the high prevalence of myopia among people in the age range 18 to 64, underscoring early onset and the growing burden of myopia in children and adolescents.

End user Segment Analysis

Ambulatory Surgical Centers are holding the greatest share in the end user, and are driven by their efficiency, cost-effectiveness, and maximum patient preference for outpatient services. Procedures such as cataract surgery (with premium IOLs for presbyopia) and refractive surgeries offer high-tech services in ASCs for the outpatient sector to reduce the healthcare burden costs. This trend is aided by government policies favoring outpatient services to minimize healthcare burdens. The Centers for Medicare & Medicaid Services (CMS) regularly revises reimbursement policies for services in ASCs, promoting their use and fueling market revenue.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Disease Type |

|

|

Treatment Type |

|

|

End user |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Myopia and Presbyopia Treatment Market - Regional Analysis

Asia Pacific Market Insights

The APAC presbyopia and myopia treatment market is anticipated to grow strongly by maintaining the market share of 32.5% at a CAGR of 8.5% through 2035. The region is influenced by rising patient volumes, an aging population, and government spending in the healthcare sector. According to the data of the NLM report of August 2025, Myopia is an international epidemic, and about 80% of population among people aged over 20 years in East Asia population are affected. Advances in laser treatments, drug research, and tele-ophthalmology platforms are transforming patients' accessibility and administration of treatment.

China commands the largest market share of the market in the APAC region and will be estimated to account for a revenue share of 29.2% by 2035. According to the NLM report in May 2024, CNY 1 billion is utilized to enhance the accessibility of eye care services in rural regions. China has made achievements in preventing and treating blindness. Also, in 2023, many individuals have received myopia and presbyopia treatment due to the increased screen usage and the aging population.

Optical Instruments and Appliances Export in 2023

|

Country |

Trade Flow |

Product Description |

Trade Value 1000USD |

|

Japan |

Export |

Ophthalmic instruments and appliances, nes |

370,375.44 |

|

Singapore |

Export |

Ophthalmic instruments and appliances, nes |

247,936.76 |

|

China |

Export |

Ophthalmic instruments and appliances, nes |

153,181.91 |

|

Australia |

Export |

Ophthalmic instruments and appliances, nes |

49,543.30 |

Source: WITS, 2023

North America Market Insights

North America is the fastest-growing region in the myopia and presbyopia treatment market and is expected to hold a significant share by 2035. The market is driven by the favorable reimbursement policies, innovation in pharmacological therapies, and high procedure volumes. The prevalence of myopia in North America is estimated to be up to 42% in children ages 10 to 15 years. The U.S. market is the revenue anchor and is mainly driven by the Medicare and Medicaid expansions. The need for therapy is increasing increased to the rising incidence of visual diseases, which are connected to aging populations and digital screen exposure.

The myopia and presbyopia treatment market in the U.S. is fueled by the systemic reforms of Medicaid and Medicare. The National Eye Institute in May 2024 reports that refractive correction enhances the vision for 150 million Americans. R&D spending focuses on enhanced EDOF/trifocal optics, topical pharmacologic agents for presbyopia/myopia, and stepped-care delivery models that combine optometry and ophthalmology. The U.S. market stands as a global growth driver due to the benefits of emerging therapies and regulatory policies under the FDA for treatments concerning vision.

Europe Market Insights

The Europe myopia and presbyopia treatment market are growing and is expected to hold a considerable share by 2035, with the region's aging population, greater exposure to screens, and government healthcare policies. The rising incidence of uncorrected refractive errors among the elderly and youth populations has led to the prioritization of vision correction therapy. As per the NLM report in June 2025, the cost for myopia treatment in the traditional method is US$32,492/US$22,606. Patterns of digital eye strain and myopia development in children have set in motion early intervention programs in Germany, France, and the UK.

Germany dominates the myopia and presbyopia treatment market in Europe and is expected to hold the extensive market share by 2035. Based on the OEC report in 2023, Germany exports ophthalmic instruments and appliances worth $1.23 billion 2023. The extensive compensation provided by Germany's statutory health insurance system for advanced remedial treatments encourages robust market activity from both domestic and international firms. Germany's statutory health insurance incentivizes uptake of innovative treatments, bolstering demand.

Key Myopia and Presbyopia Treatment Market Players:

- Alcon Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Vision

- Bausch + Lomb

- EssilorLuxottica

- CooperVision Inc.

- ZEISS Group

- Hoya Corporation

- Carl Zeiss Meditec

- SIFI S.p.A.

- Menicon Co., Ltd.

- Visioneering Technologies

- Shamir Optical Industry

- SynergEyes Inc.

- Haohai Biological Tech

- Aurolab

- Hanita Lenses

- Interojo Inc.

- Rayner Intraocular Lenses

- Appasamy Associates

- NOVA MEDICAL PRODUCTS

Asia and the U.S. are competitively strong myopia and presbyopia treatment markets. The leading companies such as Johnson & Johnson Vision, Alcon, and CooperVision, drive the high-end ophthalmic devices and the lens segments. M&A activities like Johnson & Johnson's acquisition of TearScience, regional expansion, and launch of innovative products like MiSight and pilocarpine-based drops are some of the strategic initiatives. Partnerships with organizations in the healthcare segments and inclusion in national reimbursement programs constitute a major source of market growth.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In September 2024, Entod Pharma has announced the launch of DCGI-approved PresVu Eye Drops for presbyopia treatment. The eye drop is specially used to reduce the dependency on reading glasses for individuals affected by presbyopia.

- In April 2024, CooperVision and American Optometric Association launched The Myopia Collective, which is a uniting optometry to advance comprehensive myopia treatment for children beyond simple correction.

- Report ID: 2475

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.