IoT Monetization Market Outlook:

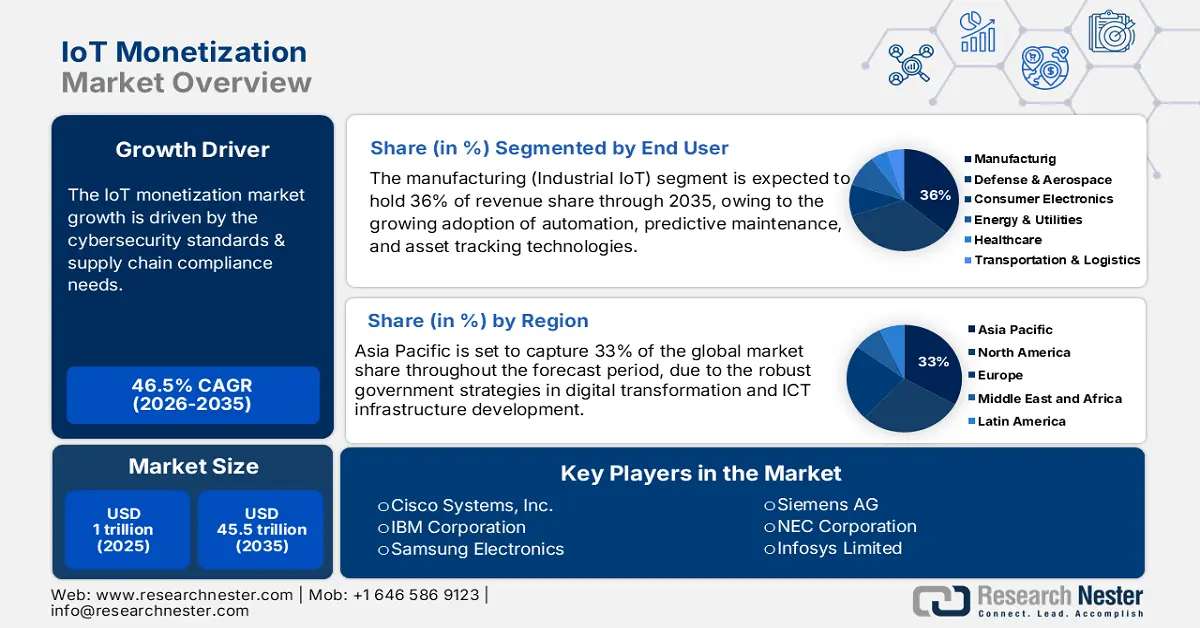

IoT Monetization Market size was valued at USD 1 trillion in 2025 and is projected to reach USD 45.5 trillion by the end of 2035, rising at a CAGR of 46.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of IoT monetization is evaluated at USD 1.4 trillion.

The robust adoption of connected devices in both public and private sectors is driving the sales of IoT monetization market. Manufacturing, healthcare, transportation, and energy enterprises are increasingly employing IoT sensors in their operations to enhance efficiency and decision-making. According to the International Telecommunication Union (ITU), nearly 5.5 billion people, or more than 60% of the global population, were using the Internet in 2024. This number is poised to increase in the years ahead, owing to robust digital transformation. The booming IoT deployment creates vast amounts of machine-generated data, which can be monetized through analytics, subscription services, and application-driven insights. Such trends are opening profitable doors for the key market players.

Industrial manufacturing companies are installing predictive maintenance solutions built on IoT data to reduce downtime and improve overall functions. In consumer markets, connected home devices and wearables are set to open revenue streams via recurring app subscriptions, targeted advertising, and hardware add-ons. Further, telecom operators are leveraging IoT connectivity to bundle data plans with analytics platforms. The majority of end users are increasingly investing in IoT monetization technologies for their business growth. The cross-industry penetration is also expected to drive double-digit CAGR in the monetization segment in the coming years.

Key IoT Monetization Market Insights Summary:

Regional Highlights:

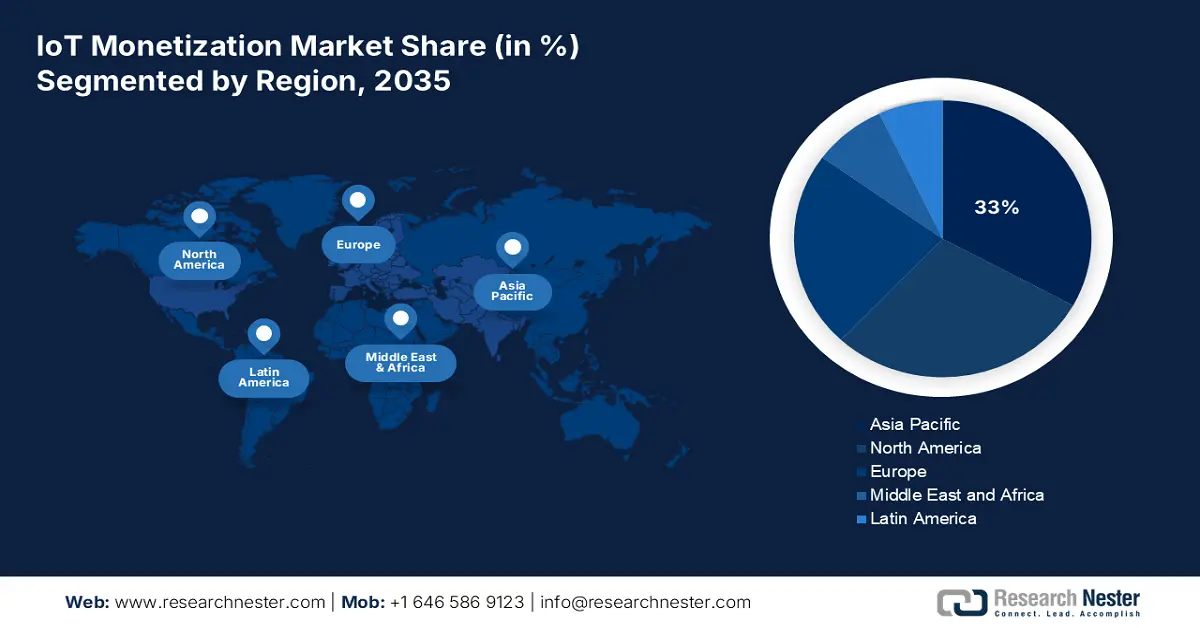

- By 2035, Asia Pacific is expected to command a 33% share of the IoT monetization market, owing to robust government-led digital transformation and ICT infrastructure initiatives.

- North America is projected to witness the fastest growth from 2026–2035, underpinned by substantial government investments in ICT infrastructure and strong enterprise digital adoption.

Segment Insights:

- By 2035, the manufacturing (industrial IoT) segment in the IoT monetization market is poised to capture a 36% share, propelled by increasing deployment of automation, predictive maintenance, and asset-tracking capabilities.

- The 5G network infrastructure segment is set to secure a 33.3% share by 2035, supported by ultra-low latency, high bandwidth, and expanding global 5G rollout.

Key Growth Trends:

- Cybersecurity standards & supply chain compliance

- Industry standards & interoperability

Major Challenges:

- Complex data privacy and protection regulations

- Pricing pressures and revenue model uncertainty

Key Players: Cisco Systems, Inc., Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., IBM Corporation, Samsung Electronics, Siemens AG, NEC Corporation, Infosys Limited, Fujitsu Limited, Telstra Corporation Limited, Keysight Technologies, Tata Consultancy Services (TCS), Dialog Axiata Group, AT&T Inc.

Global IoT Monetization Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1 trillion

- 2026 Market Size: USD 1.4 trillion

- Projected Market Size: USD 45.5 trillion by 2035

- Growth Forecasts: 46.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Singapore, United Arab Emirates, Vietnam

Last updated on : 22 August, 2025

IoT Monetization Market - Growth Drivers and Challenges

Growth Drivers

-

Cybersecurity standards & supply chain compliance: The recently updated NIST Cybersecurity Framework 2.0 (2024) focuses on the area of supply chain governance and risk management. Companies in the utilities and manufacturing sectors have begun to incorporate these frameworks. Increasing compliance for device manufacturers, growing costs, and time-to-market, while rising trust in the IoT services they offer, are fueling demand for advanced IoT solutions. Further, the European Union Agency for Cybersecurity (ENISA) in its Threat Landscape 2023 report discloses that public administration is the top target for cyberattacks, making up about 19% of attacks. Next are individual people (11%), followed by healthcare (8%), digital infrastructure (7%), and then manufacturing, finance, and transport sectors. Such observations directly increase the adoption of advanced IoT solutions to protect organizations' vital data and information.

-

Industry standards & interoperability: There are standards such as IEEE 802.11, 5G, IEC 62443, and the supply-chain integrity guiding framework O TTPS/ISO 20243, which are used to establish guidelines for cross-border interoperability. Technical compliance is the beginning of global deployment, requiring resources to enable the architecture and partnerships. With the recent high-profile incidents, most critical infrastructure organizations align with NIST CSF and IEC 62443. This helps build a demand for secure IoT solutions sporting industrial-grade resiliency.

-

Rising integration of AI and ML: Companies in the monetization space of the IoT industry benefit from AI and ML due to their significant impact. In product development, AI and ML decrease time to market, make product development cheaper, and allow for better customization. In a January 2024 article, NIST researchers and academic partners explain why the NIST Cyber-Physical Systems (IoT) Framework is important for using AI in communication systems. Industry leaders continue to benefit from AI and ML by significantly improving the efficiency in terms of time and money in development activities. In February 2022, Texas A&M University received about USD 1.2 million for a program called the Public Safety Innovation Accelerator Program. This program is a competition focused on using AI and the IoT to improve public safety. Such investment moves are likely to double the revenues of key players in the years ahead.

Challenges

-

Complex data privacy and protection regulations: Rigorous data privacy laws can put compliance at risk. For example, in 2022, some ICT suppliers held back product launches in India by 5 months due to the uncertainty of the data localization requirements, which impacted revenue forecasting. The current trade tensions with the WTO are taking their toll on global supply chains. The 2023 tariffs on semiconductor imports caused at least some suppliers to raise their production pricing by 10-14%. Thus, changing regulations are impacting the final prices of finished products.

-

Pricing pressures and revenue model uncertainty: The IoT monetization market's evolving pricing structures create uncertainty. Small and medium ICT firms in the U.S. cite the high costs of cybersecurity compliance. Broadband access is also limited, and the uncertainty of IoT infrastructure in emerging markets limits the adoption of IoT monetization solutions.

IoT Monetization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

46.5% |

|

Base Year Market Size (2025) |

USD 1 trillion |

|

Forecast Year Market Size (2035) |

USD 45.5 trillion |

|

Regional Scope |

|

IoT Monetization Market Segmentation:

End user Segment Analysis

The manufacturing (industrial IoT) segment in the IoT monetization market is projected to account for 36% throughout the assessed period due to the growing adoption of automation, predictive maintenance, and asset tracking technologies. Governments globally have a vested interest in accelerating smart manufacturing advancements. For instance, the U.S. Department of Energy describes the role of IoT-enabled smart grids and automation in helping factories reduce energy and maximize efficiency. The IIoT is a way for manufacturers to monetize data from connected equipment grounded in operational metrics rather than product value. Importantly, government support and funding for Industry 4.0 initiatives are further expected to catalyze IIoT investment around the world.

Technology Segment Analysis

The 5G network infrastructure segment is anticipated to hold a 33.3% IoT monetization market share throughout the discussed timeline. 5G is fundamental to IoT monetization due to its ultra-low latency, coupled with high bandwidth and massive connectivity. The Federal Communications Commission (FCC) indicates that the rollout of 5G infrastructure fosters additional IoT business models. The expansion of 5G networks and rollout across the Asia Pacific and North America is set to enable more monetization of IoT data across increased connectivity and new service deployments.

Application Segment Analysis

The connected vehicles segment of the IoT monetization market is likely to register rapid growth during the forecast period due to high adoption of embedded connectivity and data-driven services in the automotive sector. The Society of Indian Automobile Manufacturers (SIAM) reported that electric vehicle (EV) registrations in India increased to 1.97 million in the financial year 2024-25, up from 1.68 million in 2023-24, showing a growth of 16.9%. The increasing sales of connected vehicles and the rising shift towards subscription-based infotainment, real-time navigation, and remote diagnostics are further contributing to the high sales of IoT technologies.

Our in-depth analysis of the global IoT monetization market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Technology |

|

|

Component |

|

|

Organization Size |

|

|

Device Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IoT Monetization Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to dominate the global IoT monetization market with a share of 33% through 2035, owing to the robust government strategies in digital transformation and ICT infrastructure developments. Growth of smart city projects, acceleration of AI-enabled IoT ecosystem, and rise in 5G penetration are driving IoT monetization sales. Also, collaboration between public and private sectors and growing public investments into R&D of IoT monetization technologies are helping to fuel overall market growth. In terms of early adopters, the health and manufacturing sectors are further expected to boost the adoption of IoT monetization solutions as they enable real-time data monetization and efficiencies.

China is expected to account for the largest revenue share in the APAC IoT monetization market throughout the forecast period as a result of large investments by the Ministry of Industry and Information Technology (MIIT). The World Economic Forum (WEF) reveals that around 1.698 billion devices were connected to the Internet of Things (IoT) through mobile networks in 2023, which is more than the number of mobile phone users. The government’s focus on IoT integration as a key aspect of smart cities is also contributing to the sales growth. Furthermore, the government expenditure designed to nurture public policy is allowing them to pursue public-private partnerships, accelerating the IoT ecosystem development. These trends and collaboration elements are positioning China as the primary potential market in APAC.

North America Market Insights

North America is poised to register the highest pace of growth in the global IoT monetization market throughout the study period. This is attributed to the heavy government investments in ICT infrastructure. The mature connectivity infrastructure and high enterprise digital adoption are also propelling the sales of IoT technologies. The strong presence of technology giants is also driving the demand for advanced IoT solutions. The growth of connected vehicles, smart grids, and predictive maintenance platforms is further accelerating the trade of IoT monetization systems.

The U.S. IoT monetization market is likely to hold significant revenue share due to its advanced digital economy, early adoption of IoT platforms, and leadership in connected technologies. As per the U.S. Bureau of Economic Analysis, the exports of telecommunications, computer, and information services increased by USD 0.1 billion in January 2025. The increasing trade of ICT solutions is likely to open lucrative doors for IoT monetization companies. The automotive sector is a major IoT monetization driver, with connected vehicle sales growing steadily and automakers generating recurring revenue from software-enabled features.

Europe Market Insights

The Europe IoT monetization market is estimated to garner a notable revenue share from 2026 to 2035. The U.K. government is promoting digital infrastructure upgrade programs and innovation, creating high-earning space for key players. The market in Germany is excellent, with spending billions of euros for significant use of industrial IoT in manufacturing and automotive. The Digital Innovation Hubs program supports IoT R&D and innovation, broadening the capabilities of member states and advancing market growth. Coupled EU policies and funding also lead to an increase in investment in GaN RF devices, making possible 5G and edge computing. A combination of these actions is essential to enhance the digital ecosystem of the EU.

Germany IoT monetization market leads the sales of IoT monetization technologies, owing to the strong industrial IoT adoption and a robust automotive sector. The Industry 4.0 initiatives are also contributing to the rising deployment of automation and IoT systems. The Federal Ministry for Economic Affairs and Climate Action (BMWK) has been actively funding digital transformation projects under programs such as Digital Jetzt and the Industrial Digital Twin initiative, which incentivize enterprises to deploy IoT-enabled solutions and monetize generated data.

Key IoT Monetization Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ericsson

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Samsung Electronics

- Siemens AG

- NEC Corporation

- Infosys Limited

- Fujitsu Limited

- Telstra Corporation Limited

- Keysight Technologies

- Tata Consultancy Services (TCS)

- Dialog Axiata Group

- AT&T Inc.

The global IoT monetization market is highly competitive, owing to the strong presence of mature companies and the increasing emergence of start-ups. Cisco, Ericsson, and Nokia are leading players that have built partnerships with industry partners. Many companies are focused on strategic aims, including identifying countries and collaborations with domestic players to establish strong positions. The emerging markets, such as India and Malaysia, with big market players, including Infosys and Dialog Axiata, and massive digital transformation projects, are set to influence the trade cycle in the years ahead.

Recent Developments

- In October 2024, Honeywell and Google Cloud unveiled a unique collaboration connecting artificial intelligence (AI) agents with assets, people, and processes to accelerate safer, autonomous operations for the industrial sector. This partnership is set to bring together the multimodality and natural language capabilities of Gemini on Vertex AI – Google Cloud's AI platform.

- In September 2024, Qualcomm Incorporated and Sequans Communications S.A. revealed that they had completed the sale of Sequans’ 4G IoT technology to Qualcomm. This move led to the addition of Sequans' 4G IoT technology into Qualcomm’s broad product portfolio

- Report ID: 1747

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IoT Monetization Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.