Feed Mycotoxin Detoxifiers Market Outlook:

Feed Mycotoxin Detoxifiers Market size was estimated at USD 2.49 billion in 2025 and is expected to surpass USD 4.55 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of feed mycotoxin detoxifiers is evaluated at USD 2.65 billion.

The main driver is rising livestock production and tighter feed-safety regulations. FAO reports that the 2023 global production of chicken, pig, and beef meat totaled 321 million tons, while compound-feed throughput has expanded along supply chains. Facilities that are covered by FSMA regulation must follow CGMPs and adopt preventive controls on their animal food, which increases the routine incorporation of detoxifying additives where risk is identified in their hazard analysis. FAO has also long indicated that the world's food crops are affected by mycotoxin contamination, which also reveals the likelihood of sustained exposure in the feed supply chain.

Trade and manufacturing dynamics are generally supportive, with core inputs used in binders/adsorbents mostly imported. The U.S. exported about 800,000 t of bentonite in 2023, while the U.S. reported near 85,000 t of natural zeolites, with animal feed among the highest uses. Generally, assembly lines mill/activate mineral substrates, blend with organic actives, and package premixes in compliance with controls. Combined, these controls and the continuing availability of bentonite/zeolites support a reliable cross-border supply of detoxifier formulations and contract manufacturing.

Key Feed Mycotoxin Detoxifiers Market Insights Summary:

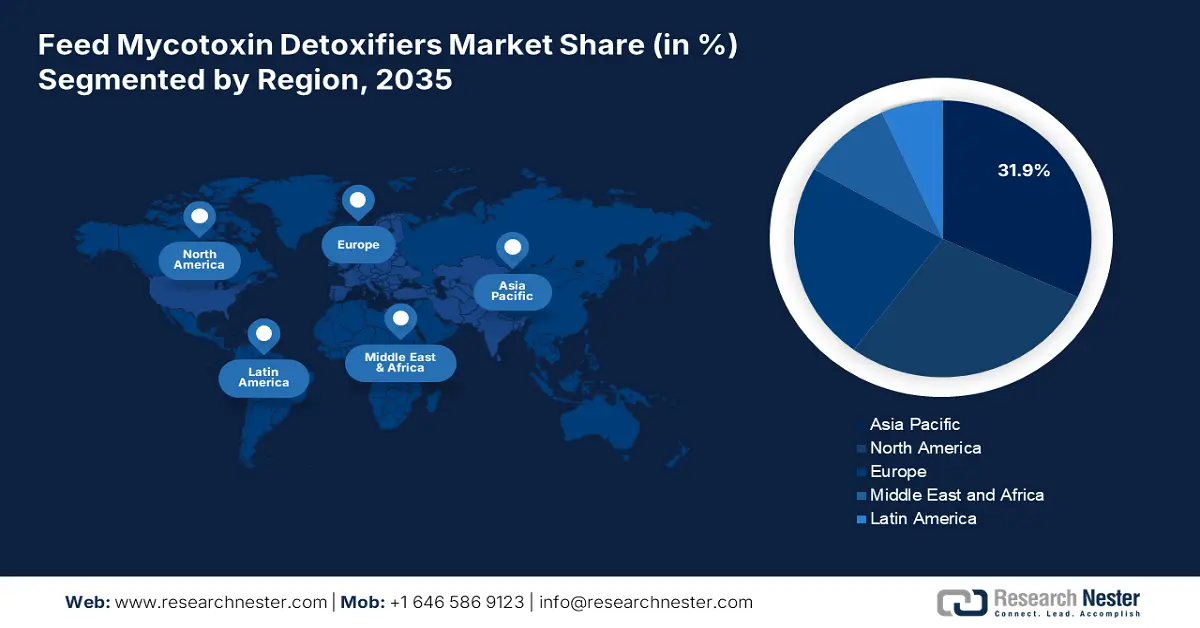

Regional Insights:

- Asia Pacific: By 2035, the Asia Pacific Feed Mycotoxin Detoxifiers Market is projected to hold 31.9% share, driven by increasing livestock production and stringent feed safety regulations.

- North America: The North American market is expected to capture 28.3% share by 2035, owing to FDA regulations on mycotoxin limits in animal feed.

Segment Insights:

- Dry Segment: The dry segment in the Feed Mycotoxin Detoxifiers Market is projected to account for 60.2% share by 2035, owing to its ease of integration into feed, superior storage stability, and extended shelf-life.

- Clay-Based Binders Segment: The clay-based binders segment is anticipated to capture 45.3% share by 2035, propelled by its ability to adsorb mycotoxins in the gut effectively.

Key Growth Trends:

- Rising feed consumption

- Increasing mycotoxin contamination due to climate change

Major Challenges:

- High regulatory compliance costs

- Ineffectiveness against multiple mycotoxins

Key Players: BASF SE,Cargill, Incorporated,Novus International, Inc.,Alltech, Inc.,Biomin Holding GmbH (DSM),Nutreco N.V.,Kemin Industries, Inc.,EW Nutrition GmbH,Olmix Group,Impextraco N.V.,Bayer CropScience (Animal Nutrition),Neovia Group (ADM),Bentoli AgriNutrition,Anfomed India Pvt. Ltd.,Bioproton Pty Ltd

Global Feed Mycotoxin Detoxifiers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.49 billion

- 2026 Market Size:USD 2.65 billion

- Projected Market Size: USD 4.55 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.9% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, India, Japan, United States, Canada

- Emerging Countries: Brazil, Mexico, Vietnam, Thailand, Indonesia

Last updated on : 9 September, 2025

Feed Mycotoxin Detoxifiers Market - Growth Drivers and Challenges

Growth Drivers

- Rising feed consumption: Following a slack in 2023, the world's feed production increased from 1.380 billion metric tons (mt) (+1.2%) to 1.396 billion mt in 2024 by all livestock species, reacting to increasing demand from growth in meat and dairy consumption. With feed producers focusing on feed quality and contamination, feed producers are adopting feed detoxifiers to ensure animal health, animal productivity, compliance with trade standards in the livestock industry, and long-term demand growth.

- Increasing mycotoxin contamination due to climate change: Increasing temperatures and humidity will influence the global prevalence of mycotoxins. The Food and Agriculture Organization of the United Nations (FAO) research stated that global crop products had a mycotoxin contamination percentage that reached up to 25%, with nearly 2% resulting in a total impairment of nutritional and economic characteristics. Mycotoxin contamination could signify economic loss of tens of billions of U.S. dollars in agriculture and industry around the world. With the economic losses associated with contaminated feed slightly fueled, the relatively consistent market demand.

- Rising global livestock production: The increased demand for livestock products such as meat, milk, and eggs has increased global production of livestock, and as per FAO projections, global meat production will exceed 377 million tons by 2031, requiring safe inputs of feed. The greater the density of livestock production, the potential risk of feed contamination. Therefore, mycotoxin detoxifiers are considered an essential feed additive to maintain animal health and productivity. The pressure to ensure quality animal protein for human consumption is what drives the implementation of mycotoxin binders and biodegrades in intensive farming systems and the continued reduction of losses associated with feed spoilage.

Exports of Bentonite

Exports of bentonite play a key role in driving the feed mycotoxin detoxifiers market by supplying a critical raw material used in toxin-binding additives. Bentonite’s high adsorption capacity makes it effective in neutralizing harmful mycotoxins in animal feed, improving livestock health and productivity. As global demand for safer, high-quality feed rises, bentonite exports support the expansion of detoxifier manufacturing. This trade flow strengthens supply chains and enables broader adoption of mycotoxin control solutions across regions.

Top Exporters of Bentonite (2023)

|

Country / Region |

Export Value (US$ ‘000) |

Export Quantity (Kg) |

|

United States |

186,249.95 |

785,180,000 |

|

Turkey |

163,018.62 |

1,111,300,000 |

|

China |

116,504.44 |

371,758,000 |

|

India |

90,786.59 |

1,560,420,000 |

|

Netherlands |

76,155.77 |

163,543,000 |

|

European Union |

52,738.11 |

243,836,000 |

|

Italy |

42,407.67 |

276,004,000 |

|

Czech Republic |

35,019.86 |

145,106,000 |

|

Germany |

28,580.95 |

58,230,900 |

|

Spain |

26,604.67 |

71,373,100 |

Source: WITS

Growing Pig and Poultry Fat Demand

Top Exporters of Pig and Poultry Fat (2023)

|

Exporter (Reporter) |

Trade Value (USD thousands) |

Quantity (Kg) |

|

European Union |

275,660.56 |

180,002,000 |

|

Spain |

194,301.26 |

126,494,000 |

|

Germany |

140,532.42 |

120,871,000 |

|

Netherlands |

80,313.98 |

54,855,700 |

|

Canada |

79,074.08 |

47,709,500 |

|

Poland |

70,309.91 |

57,546,700 |

|

Italy |

55,985.44 |

38,009,900 |

|

France |

34,682.82 |

27,898,900 |

|

Belgium |

34,230.44 |

20,535,600 |

Source: WITS

Challenges

- High regulatory compliance costs: Excessively stringent safety standards from agencies like the European Food Safety Authority (EFSA) and the FDA (U.S.) increase approval time and costs. EFSA, for example, instituted new regulations specific to feed additives that increased compliance costs for detoxifier manufacturers by 16-21%. Increased regulation delays product launches and market agility, weakening smaller companies' ability to compete for innovation and market access (the resource pools of multi-national companies help them meet extensive dossier, residue studies, and produce more if necessary).

- Ineffectiveness against multiple mycotoxins: Most single-action detoxifiers are typically not effective against the toxicity of mycotoxins that occur together. Current products only focus on aflatoxins, while fumonisin and DON, and ochratoxins are often of limited effectiveness. This limits the confidence of users in the product, and the market needs evidence of efficacy, in the form of multi-mycotoxin solutions, from development and in vivo trial work, which is time-consuming and difficult to develop.

Feed Mycotoxin Detoxifiers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 2.49 billion |

|

Forecast Year Market Size (2035) |

USD 4.55 billion |

|

Regional Scope |

|

Feed Mycotoxin Detoxifiers Market Segmentation:

Form Segment Analysis

The dry segment is projected to capture the largest feed mycotoxin detoxifiers market share, 60.2% by 2035, driven by its ease of integration into feed, superior storage stability, and extended shelf-life compared to liquid forms. Liquid or suspension-based products, often used in premixes, face challenges like sedimentation and inconsistent distribution. Dry formulations are especially favored in the poultry industry, where uniform dosing across feed batches is critical. This preference underscores the practicality and reliability of dry solutions in large-scale feed operations.

Type Segment Analysis

The clay-based binders segment is anticipated to constitute the most significant growth by 2035, with 45.3% feed mycotoxin detoxifiers market share, mainly because it prevents absorption by adsorbing mycotoxins in the gut, including bentonite and hydrated sodium calcium aluminosilicate (HSCAS). Biotransformers (enzymes, bacteria) would break down toxins into non-toxic metabolites. Clay-based binders are favored on account of their cost-effectiveness, regulatory approvals (from FDA/EFSA), and efficacy against aflatoxins.

Livestock Segment Analysis

The poultry segment is anticipated to constitute the most significant growth by 2035, with 25.3% feed mycotoxin detoxifiers market share, due to a rapid production cycle, lower feed conversion ratio, and rising global demand for affordable protein. According to FAO, poultry meat output has expanded faster than other livestock segments, supported by efficient breeding and processing systems. Swine and ruminants follow with steady contributions, while aquaculture continues to grow but remains comparatively smaller in overall market share against the expanding poultry industry worldwide.

Our in-depth analysis of the feed mycotoxin detoxifiers market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Livestock |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Feed Mycotoxin Detoxifiers Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 31.9% of the feed mycotoxin detoxifiers market share due to increasing livestock production and severe regulations centered on feed safety. High contamination rates of mycotoxins in companion and livestock feed, especially due to humidity and heat, are responsible for boosting the demand for detoxifiers. Southeast Asia has some of the largest mycotoxin contaminations in its animal feed and, as a result, will require an increased level of detoxification. China, India, and Japan will continue to consume the largest volumes of feed mycotoxin detoxifiers since these countries have many intensive animal and aquaculture feed applications primarily linked to poultry, swine, and aquaculture products.

China takes the largest share of the feed mycotoxin detoxifiers market in the Asia Pacific. Greater awareness of aflatoxin and deoxynivalenol threats and government policies are encouraging feed quality, which boosts demand and use of feed mycotoxin detoxifiers. Additionally, the Ministry of Agriculture, feed safety, and increased consumption of animal protein in China are all enabling customer buying decisions and will result in greater feed mycotoxin detoxifier usage by swine and poultry feed industries within the country. Moreover, in China, the farmers' grain reserves make up approximately 50% of the country’s total grain production (around 250 million tons). Based on a sample survey from the National Food and Strategic Reserves Administration of China, the average loss rate of stored grain is roughly 8% (40 million tons), with roughly 30% due to mycotoxin contamination being the major contributor.

North America Market Insights

The North American feed mycotoxin detoxifiers market is expected to hold 28.3% of the market share by 2035, due to the FDA regulations regarding mycotoxin limits in animal feed, eliminating the risk of profit of providing detoxifiers to detoxify feed in order to promote livestock health. As the demand for livestock continues to rise amid concerns raised over the safety of animal feed. The primary categories of consumption on livestock feed products are expected to be found in poultry and swine feed markets, with healthy consumption growth projected for both regions in the United States and Canada.

In the U.S, growth for feed mycotoxin detoxifiers is based upon the enforcement of regulations from the FDA and USDA that deal with (for example) mycotoxins like aflatoxins and fusarium toxins that can exceed safe levels in feeds that contain corn. The growth of feed mycotoxin detoxifiers in the U.S. is spurred on by greater investment into feeding safety technologies, as well as advances in toxin binders by leading manufacturers of feedstuffs across the nation. The clay minerals, especially bentonite, are widely used in feed mycotoxin detoxifiers due to their strong binding capacity, reducing toxin absorption, protecting livestock health, and improving productivity.

U.S. Clay Production

|

Clay Type |

2020 |

2021 |

2022 |

2023 (estimated) |

|

Ball clay |

985 |

1,080 |

1,030 |

1,000 |

|

Bentonite |

4,250 |

4,580 |

4,580 |

4,700 |

|

Common clay |

12,900 |

12,700 |

12,700 |

13,000 |

|

Fire clay |

635 |

675 |

622 |

660 |

|

Fuller’s earth |

1,980 |

2,130 |

2,160 |

2,300 |

|

Kaolin |

4,640 |

4,360 |

4,340 |

4,400 |

|

Total |

25,400 |

25,600 |

25,500 |

26,000 |

Source: USGS

Europe Market Insights

The European feed mycotoxin detoxifiers market is expected to hold 24.1% of the market share by 2035, due to strict regulations in the EU on the safety of animal feed and the subsequent use of mycotoxin binders and mycotoxin modifiers. This market is expected to grow due to increased demand for high-quality meat, dairy, and preparations of poultry, alongside heightened awareness of mycotoxin contamination risks. Climate variability is intensifying these concerns, pushing producers and consumers to adopt effective feed mycotoxin detoxifiers to ensure food safety, livestock health, and sustainable production practices.

Preparations of Poultry (2023)

|

Country / Region |

Export Value (USD thousand) |

Quantity (kg) |

|

United Kingdom |

139,067.00 |

27,636,700 |

|

Germany |

1,041,885.93 |

205,057,000 |

|

France |

400,441.20 |

67,037,100 |

|

Italy |

106,628.38 |

22,336,300 |

|

Spain |

141,924.83 |

29,214,800 |

Source: WITS

Key Feed Mycotoxin Detoxifiers Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill, Incorporated

- Novus International, Inc.

- Alltech, Inc.

- Biomin Holding GmbH (DSM)

- Nutreco N.V.

- Kemin Industries, Inc.

- EW Nutrition GmbH

- Olmix Group

- Impextraco N.V.

- Bayer CropScience (Animal Nutrition)

- Neovia Group (ADM)

- Bentoli AgriNutrition

- Anfomed India Pvt. Ltd.

- Bioproton Pty Ltd

The feed mycotoxin detoxifiers market is extremely competitive, with a number of multinational companies taking the top positions with meaningful global shares in the market by offering strong distribution networks and product offerings. Companies are making their strategic moves that are being powered by investment in research and development to create multi-functional detoxifiers for aflatoxins, ochratoxins, and fumonisins together. Companies like Alltech and Novus are expanding their footprint in the Asia-Pacific region, but by using partnerships and local manufacturing to lower overall costs and gain market share. When it is put all together, innovation, geographical expansion, and other acquisitions are shaping the market's competitive landscape.

Some of key players operating in the feed mycotoxin detoxifiers market are listed below:

Recent Developments

- In July 2024, Cargill Animal Nutrition launched an improved range of mycotoxin solutions for all species of animals, including aquaculture. Planning included feed additives, biosecurity, and farm-digital technologies, which basically developed detoxifiers into broader associated farm management systems. While measurement of adoption is in its infancy, it reflects the prevalent strategy for regional growth, as the Asia-Pacific is already encapsulating an estimated 49% of value by 2023 through this entry into the marketplace.

- In June 2024, Adisseo launched MycoMan, a data-driven integrated mycotoxin risk management system used together with the predictive risk model from Syngenta's Qualimetre. This online real-time risk assessment of contamination helps the industry face the rising demands for proactive contamination risk management within all aspects of the feed value chain. The more mycotoxin detoxifier strategies are adopted, the quicker and deeper they will influence feed formulation decisions across Europe, North America, and Asia in the context of advancing digital-precision farming.

- Report ID: 2315

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Feed Mycotoxin Detoxifiers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.