Actinic Keratosis Treatment Market Outlook:

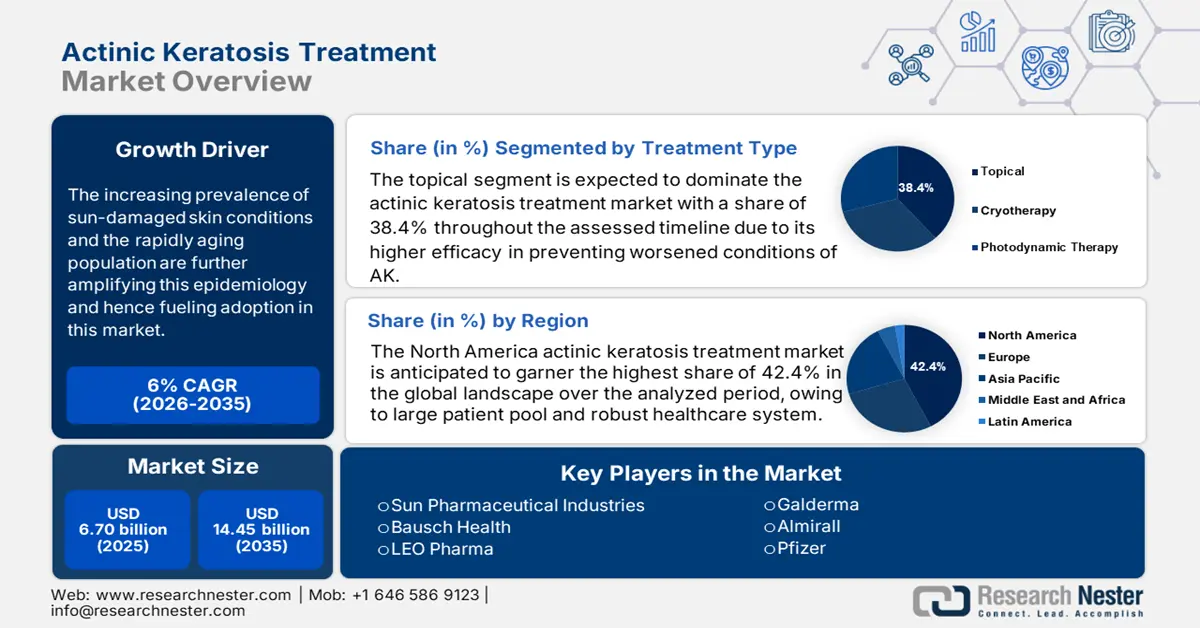

Actinic Keratosis Treatment Market size was valued at USD 6.70 billion in 2025 and is projected to reach USD 14.45 billion by the end of 2035, rising at a CAGR of 6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of actinic keratosis treatment is evaluated at USD 7.05 billion.

The market for global actinic keratosis (AK) treatment is growing robustly due to a number of on-going trends. Treatment advancements are improving efficiency, effectiveness, and ease of use in AK treatment options. Non-invasive modalities such as photodynamic therapy (PDT) are gaining traction for regarding treatment of AK lesions. Innovations in photosensitizers, light delivery, and storage have improved treatment outcomes. Healthcare providers are finding the combination therapy options preferable over standalone treatment. Moreover, the increasing prevalence of sun-damaged skin conditions and the rapidly aging population are further amplifying this epidemiology. The impact of other risk factors, such as genetic disorders, climate change, organ transplantation, long-term outdoor working, and immunosuppression, is also contributing to this expansion in the consumer base for the market.

The market is also seeing an increase in home-based treatments. More patients prefer non-invasive, self-applied therapies, leading to a greater development and implementation of prescription creams. Furthermore, the payers’ pricing in the market varies due to changes in the supply chain, API production output, labor costs, transportation expenses, and regulatory compliance. On the other hand, the consumer price index (CPI) for AK-related treatments was growing, resulting from recent advances in therapeutics. Thus, to minimize this growth in financial barriers, companies are focusing on cultivating localized or multiple raw material resources.

Key Actinic Keratosis Treatment Market Insights Summary:

Regional Highlights:

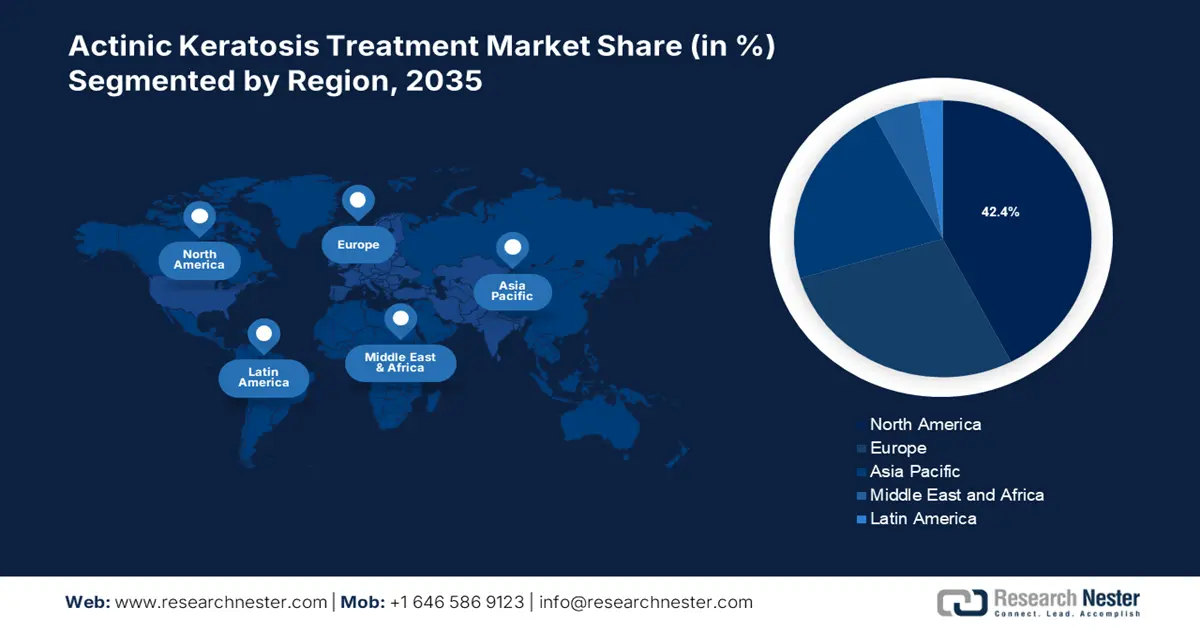

- By 2035, North America is anticipated to command a 42.4% share of the actinic keratosis treatment market, upheld by its substantial patient pool and strong healthcare infrastructure.

- Asia Pacific is projected to record the highest CAGR, reinforced by the rising uptake of advanced diagnostic tools and growing awareness of SCC prevention.

Segment Insights:

- By 2035, the topical segment is projected to command a 38.4% share of the Actinic Keratosis Treatment Market, supported by its proven efficacy, cost-effectiveness, and improved reimbursement accessibility.

- The dermatology clinics segment is forecast to secure a 45.3% share, bolstered by expanding patient preference for specialized care, adherence to clinical protocols, and rising awareness of early AK management.

Key Growth Trends:

- Growing awareness about skin cancer prevention

- Public and private support for innovations

Major Challenges:

- Disparities in financial and commercial aspects

- Low patient awareness and late diagnosis

Key Players: LEO Pharma, Almirall, Galderma, Sun Pharmaceutical Industries, Bausch Health, Pfizer, Novartis, Mylan (Viatris), Perrigo Company, Taro Pharmaceutical, Cipla, Mayne Pharma, Hisamitsu Pharmaceutical, Maruho Co., Biofrontera, Medimetriks Pharmaceuticals, Hikma Pharmaceuticals, LG Chem Life Sciences, Pharmaderm, Duopharma Biotech

Global Actinic Keratosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.70 billion

- 2026 Market Size: USD 7.05 billion

- Projected Market Size: USD 14.45 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 13 August, 2025

Actinic Keratosis Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Growing awareness about skin cancer prevention: As per the International Agency for Research on Cancer, with an expected 1.5 million new cases in 2022, skin malignancies are the most common type of cancer diagnosed globally. An estimated 330,000 new instances of melanoma were detected globally in 2022, and the disease claimed the lives of nearly 60,000 people. As a result, more patients enter the treatment pathway, further increasing market demand. In addition, governments and non-profits are encouraging sun safety practices as an early intervention for skin abnormalities. Along with better access to care and new therapeutic alternatives, this cultural change is supporting ongoing growth in demand in the AK treatment market around the world.

- Public and private support for innovations: Continuous participation and investments from pharma in extensive R&D are leveraging product efficacies and patient adherence in the market. Moreover, the substantial funding from both public and private organizations to accelerate clinical trials is also fueling growth in this sector. For instance, in 2020, the FDA gave clearance to the commercialization of tirbanibulin (Klisyri), which was intended to treat actinic keratosis within just 5 days while maintaining optimum adherence.

- Rising geriatric population and UV exposure: The increasing demographic of geriatric people worldwide is one of the strongest growth indicators for the market. Actinic keratosis is most common among individuals older than 60, there is a steadily increasing pool of potential patients suffering from this condition. This demographic also typically participates more in regular dermatologic checkups, thereby increasing chances for detection. Additionally, a greater understanding of the cumulative nature of UV damage also makes this demographic an ideal sustainment target for growth of the market going forward. As per the World Health Organization, in 2020, excessive UVR exposure resulted in approximately 1.2 million new cases of non-melanoma skin cancers (SCC and BCC) and 325,000 skin melanomas.

Challenges

- Disparities in financial and commercial aspects: The high cost of dermatology procedures is a major hurdle in the actinic keratosis treatment market. Shortage of adequate reimbursement policies and out-of-pocket expenses often limit access to advanced therapeutics. Furthermore, the stringent criteria for maintaining regulatory compliance may also delay product launches and raise the overall pricing, creating hesitation among both new market entrants and consumers in investing. However, the recent developments in this sector are introducing more cost-effective solutions to mitigate this barrier.

- Low patient awareness and late diagnosis: A majority of individuals remain unaware of actinic keratosis (AK). This causes individuals to delay care, allowing lesions to continue unchanged or worsen. Public knowledge around AK's potential for progression to squamous cell carcinoma remains limited. Early stages of AKs are usually asymptomatic, leading to reduced public reporting. Therefore, individuals are diagnosed with actinic keratosis generally only when lesions are visibly swollen. These delays to diagnosis impact early intervention and lead to more complicated and expensive treatment.

Actinic Keratosis Treatment Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 6.70 billion |

|

Forecast Year Market Size (2035) |

USD 14.45 billion |

|

Regional Scope |

|

Actinic Keratosis Treatment Market Segmentation:

Treatment Type Segment Analysis

Based on treatment type, the topical segment is expected to dominate the actinic keratosis treatment market with a share of 38.4% throughout the assessed timeline. The clinically proven efficacy of this subtype in preventing worsened conditions of AK, such as skin cancer, while maintaining its cost-effectiveness is making this segment a priority for consumers and pharma producers. For instance, a study demonstrated that Fluorouracil is capable of targeting and combating precancerous cells with a remarkable range of complete AK clearance, lying between 60.2% and 90.4%. Moreover, the efficiency of this type of therapy in fighting against multiple AK lesions has influenced dedicated organizations to expand their reimbursement coverage, improving accessibility and increasing adoption in this segment.

End user Segment Analysis

In terms of end users, the dermatology clinics segment is poised to hold the largest share of 45.3% in the actinic keratosis treatment market by 2035. With the presence of specially trained professionals and dedicated infrastructure, these clinical settings have become the first point-of-care establishments for personalized dermatology services. Additionally, the perfect alignment of their regular practices with universal protocols and government initiatives is inspiring more patients to invest in this segment. In this regard, the demand for AK treatment from these service providers increased due to the widespread awareness about the importance of early diagnosis and management of this condition in preventing squamous cell carcinoma (SCC) progression.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Treatment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Actinic Keratosis Treatment Market - Regional Analysis

North America Market Insights

The North America actinic keratosis treatment market is anticipated to garner the highest share of 42.4% in the global landscape over the analyzed period. The region’s captivity on the majority proportion of the worldwide patient pool and robust healthcare system are fueling its dominance over others. Particularly, in the sunbelt states, including Arizona, Florida, and California, the residents are more prone to developing this ailment due to heavy UV exposure and rapid aging. Thus, the governing authorities across these demanding marketplaces are implementing favorable policies and initiatives to attract both domestic and foreign pioneers to invest in this field.

The undisputed leadership of the U.S. in the market is primarily fueled by the rising prevalence and mortality of SCC and Federal investments. This country contributes to significant regional revenue generation in this field, which can be testified by the nationwide annual conduct of AK-associated procedures. Moreover, the efforts for maintaining an uninterrupted supply chain to back these emerging segments are fueling growth in this sector.

The AK treatment market in Canada is growing due to a combination of increasing disease incidence rates and an aging population. Furthermore, pharmaceutical advancements, particularly in photodynamic therapy (PDT), are ensuring the efficacy and patient experience of AK treatment. Innovations in public awareness and detection of precancerous lesions are bringing patients into the pathway of treatment. In addition, Canada's well-established healthcare services, consisting of access to dermatologists and reimbursement support for patients, reinforce the adoption and integration of new and effective AK therapies.

APAC Market Insights

Asia Pacific is predicted to register the highest CAGR in the global actinic keratosis treatment market by the end of 2035. The region’s accelerated pace of progress is stimulated by the growing adoption of technologically advanced diagnostic tools and awareness about SCC prevention. In addition, the emerging economies across the Asia Pacific are seeing significant growth in healthcare investment, improved access to dermatological services, and more public awareness around skin health and preventing skin cancers. These developments have resulted in more frequent diagnoses and a greater use of treatment. The region is also experiencing increased demand for non-invasive treatment options, which are attractive due to their established effectiveness and lower rates of adverse effects.

India is emerging as the world’s biggest supplier of essential ingredients and components used in the production of actinic keratosis treatment. Additionally, government-initiated campaigns are spreading knowledge about the available diagnosis and treatment options for AK, propelling wide adoption in this sector across the nation. Their interest in improving public access to the most effective curatives can also be testified by the country’s yearly medical expenditure. Further, the nation is focusing on eliminating the reliance on foreign forces for finished product manufacturing in this field.

China’s market is expected to have a substantial CAGR in the 2024 to 2030 market period. Urbanization and lifestyle cause an expanded number of potential lives experiencing high UV exposure, resulting in a significant increase in their risk for AK. Healthcare capacity is expanding in tandem with income levels, allowing more access to dermatological care for many people looking to receive treatment for AK. Patient and provider preference is an increasing shift toward topical and photodynamic therapy (PDT) instead of traditional surgical therapy.

Europe Market Insights

Europe is showing positive momentum in the global actinic keratosis (AK) treatment market based on a combination of population, clinical, and innovation characteristics. One of the most impactful underlying drivers of market growth is the high and increasing prevalence of AK in northern Europe. In some countries, AK has even become recognized as the most common dermatological disorder. The accelerating demand for a variety of treatment options is now happening within a solid healthcare infrastructure, a supporting economic and regulatory framework. Expansion of treatment options is also contributing to the growth potential for the market. One of the fastest-growing therapeutic segments in Europe is photodynamic therapy. The overall market in the region is also benefiting from increasing public awareness campaigns, a beneficial regulatory context, and equitable investment in dermatology research.

Germany is a primary driver of growth in the actinic keratosis (AK) treatment market in Europe. The growth is driven by the high disease incidence, and the infrastructure for a developed healthcare system. AK is among the most common dermatological diseases that are diagnosed in Germany. Patients in Germany benefit from the widespread access to dermatologists and dermatology clinics, strong reimbursement frameworks, and high levels of public health awareness regarding the importance of preventing skin cancer before it develops into a diagnosis. Furthermore, Germany's investment in dermatological innovation is supported by public service or government funding, ensuring a continuing and stable demand for AK treatments.

France's actinic keratosis treatment market continues to expand, spurred on by more regular detection cases, increased awareness of actinic keratosis. France has a growing elderly population, contributing to high AK incidence. Newer therapies begin to see some endorsement, particularly topical agents and photodynamic therapy. Increasing public education regarding preventative measures, routine dermatological screening, and preventive skin care emerges as a key offering from the dermatologist community.

Key Actinic Keratosis Treatment Market Players:

- LEO Pharma

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Almirall

- Galderma

- Sun Pharmaceutical Industries

- Bausch Health

- Pfizer

- Novartis

- Mylan (Viatris)

- Perrigo Company

- Taro Pharmaceutical

- Cipla

- Mayne Pharma

- Hisamitsu Pharmaceutical

- Maruho Co.

- Biofrontera

- Medimetriks Pharmaceuticals

- Hikma Pharmaceuticals

- LG Chem Life Sciences

- Pharmaderm

- Duopharma Biotech

With the continuous efforts from key players to leverage their potential in delivering the highest quality care and cure, the market is fostering a healthy competency. For instance, LEO Pharma, in collaboration with Almirall, is focusing on the expansion of its existing AK pipeline, including Klisyri for forearms, to grab new revenue opportunities with a wider field of application and consumer base. Simultaneously, the alliance of Sun Pharma and Cipla concentrated on developing value-based generics to reduce the gap in affordability for price-sensitive marketplaces, such as India. On the other hand, in 2024, Biofrontera partnered with Pfizer to invest up to USD 200.2 million to develop innovative hybrid therapies, combining photodynamic therapy and immunotherapy.

Recent Developments

- In June 2024, Almirall attained the supplemental New Drug Application clearance from the FDA for the expanded use of its AK drug, Klisyri, for larger treatment areas (up to 100 cm²). This microtubule inhibitor ointment is available in a 350 mg package size and is a 5-day topical field treatment for actinic keratosis (AK) of the face or scalp.

- In October 2024, the FDA increased the dosage of Biofrontera’s Ameluz Topical Gel approved, 10% from one to three tubes per treatment, for patients undergoing photodynamic therapy (PDT) for actinic keratosis (AK) on the face and scalp. Biofrontera noted that this approval will provide healthcare professionals additional flexibility for patients undergoing PDT.

- Report ID: 1527

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Actinic Keratosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.