Germ Cell Tumor Market Outlook:

Germ Cell Tumor Market size was valued at USD 2.1 billion in 2025 and is projected to reach USD 4.2 billion by the end of 2035, rising at a CAGR of 8.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of germ cell tumor is estimated at USD 2.4 billion.

The worldwide market of germ cell tumors is gaining traction as a result of advanced diagnostic technologies, increasing awareness of rare cancers, and the development of targeted therapies. This can be testified by the report from NIH in March 2025 that states that testicular cancer is the most common solid malignancy in young men in the U.S., wherein 90% to 95% classified as germ cell tumors. Besides, the 5-year survival rates are high, at 99% for stage I, 92% for stage II, and 85% for stage III disease. Hence, this underscores the necessity of early and accurate diagnosis and treatment, positively impacting market growth.

Furthermore, ongoing clinical research and investments for continued innovations are yet another asset of this landscape, which are contributing to enhanced treatment outcomes, especially in terms of pediatric populations. For instance, NCI funding for ovarian cancer research reached a total of USD 132 million in 2023, wherein the funding supports research across prevention, early detection, treatment, and survivorship. Therefore, such moves reflect the public sector commitment, research ecosystem strength, and pipeline potential.

Key Germ Cell Tumor Market Insights Summary:

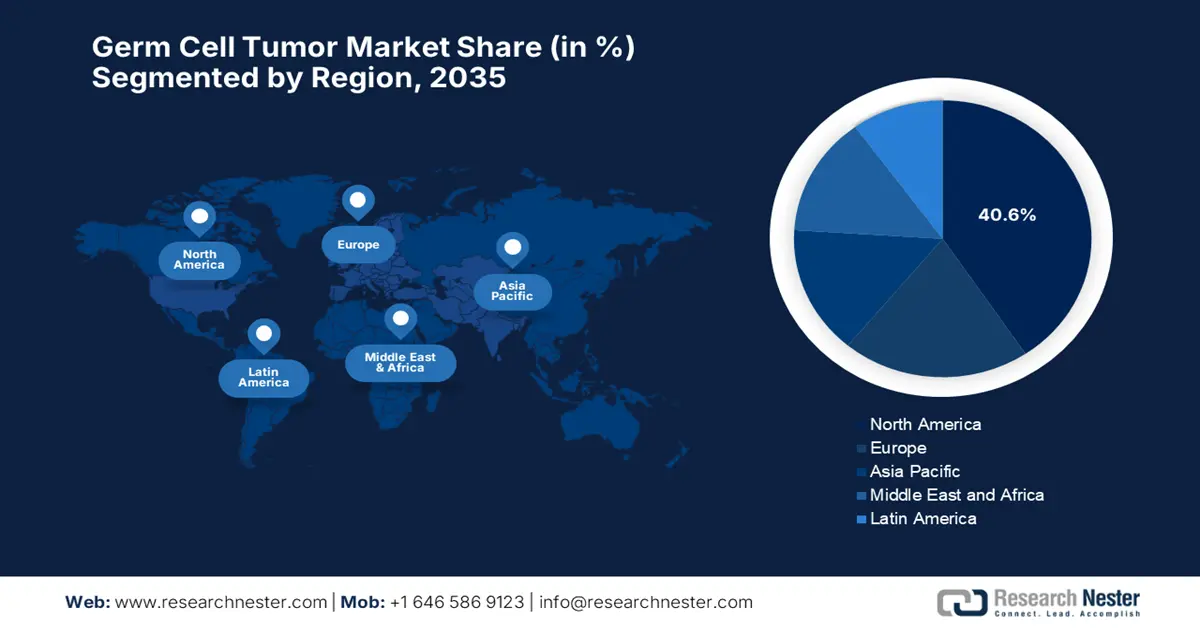

Regional Insights:

- North America is projected to secure a 40.6% share by 2035 in the germ cell tumor market, owing to its advanced oncology infrastructure and strong research collaborations.

- Asia Pacific is anticipated to expand at the fastest pace during 2026–2035, underpinned by rising disease awareness and broader access to innovative therapies.

Segment Insights:

- The testicular germ cell tumor segment is expected to command a 45.7% share by 2035 in the germ cell tumor market, propelled by its higher incidence among the young population.

- The chemotherapy segment is on track to attain a 38.4% share by 2035, supported by its continued role as the gold-standard treatment for metastatic germ cell tumors.

Key Growth Trends:

- Advancements in diagnostic technologies

- Ongoing in clinical trials & research

Major Challenges:

- Limited early detection

- Treatment resistance and relapse

Key Players: Merck & Co. (MSD), Roche, Pfizer, Novartis, AstraZeneca, Eli Lilly, GSK, Sanofi, Bayer, Hetero Drugs, Celltrion, CSL Limited, Hikma Pharmaceuticals, Pharmaniaga.

Global Germ Cell Tumor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 8.8%

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 29 August, 2025

Germ Cell Tumor Sector: Growth Drivers and Challenges

Growth Drivers

- Advancements in diagnostic technologies: The presence of advanced diagnostic tools, such as high-resolution imaging, MRI, PET, and blood-based liquid biopsies detecting circulating tumor DNA, is the primary fueling factor in this landscape. For example, in May 2025, Guardant Health stated that it enhanced its Guardant360 Liquid Biopsy test with new AI-powered multiomic features that reveal detailed tumor phenotypes and subtypes from a simple blood sample. This enables classifying tumor markers, detecting key viruses, even when tumor tissue isn’t completely accessible.

- Ongoing in clinical trials & research: The increasing number of clinical trials is expected to propel the growth of the germ cell tumor market. As per an article by NIH in January 2024, a study of 7,747 cancer clinical trials from the past two decades resulted in a considerable rise in trial registrations by a remarkable 1.5%. The study also found that participants in common cancer trials tend to be younger than the typical patient population, highlighting the need for more age-inclusive enrollment to ensure treatments are effective for all ages.

- Evolution of both targeted and immunotherapies: The amplifying innovations in immune checkpoint inhibitors such as PD-1/PD-L1 blockers, tyrosine kinase inhibitors, and combination therapies are enhancing the effectiveness of GCT management. In September 2024, Oncoheroes Biosciences Inc. announced that it had secured exclusive worldwide pediatric oncology rights for dovitinib, a multi-tyrosine kinase inhibitor, from Novartis. Dovitinib targets proteins overexpressed in bone sarcomas and other pediatric solid tumors, hence suitable for market expansion.

Historical Incidence of Extracranial Germ Cell Tumors (2014-2018)

|

Tumor Site |

Sex |

Age <1 y |

Ages 1-4 years |

Ages 5-9 years |

Ages 10-14 years |

Ages 15-19 years |

|

Extragondal |

Female |

17.7 |

2.1 |

0.1 |

0.1 |

0.7 |

|

Extragondal |

Male |

8.8 |

0.7 |

0 |

0.6 |

2.2 |

|

Gonadal |

Female |

0.6 |

0.7 |

2.1 |

7.6 |

8.3 |

|

Gonadal |

Male |

7 |

2.5 |

0.1 |

1.5 |

36.1 |

Source: NCI

Key Developments Impacting the Germ Cell Tumor Market

|

Strategy |

Year |

Company |

Revenue Impact |

|

Strategic liquid biopsy collaboration |

2025 |

Guardant Health & Pfizer |

Supports development & commercialization |

|

FDA approval of next-gen TKI |

2024 |

Bristol Myers Squibb |

Opens new treatment indication |

|

EMA PRIME designation for CAR-T |

2022 |

BioNTech |

Accelerates regulatory support |

Source: Company Official Press Releases

Challenges

- Limited early detection: The germ cell tumor market is facing persistent obstacles in terms of early detection, especially when they arise outside the testes. Therefore, most of the patients present with nonspecific symptoms, experience delayed diagnosis, making it challenging for wider adoption. The existence of this challenge can negatively impact patient outcomes, underscoring the need for accurate, non-invasive diagnostic tools such as advanced liquid biopsies.

- Treatment resistance and relapse: There has been consistent progress in the survival rates for germ cell tumor patients while treated with chemotherapy, out of which a few develop resistance or experience relapse, particularly in advanced stages. Besides, treatment-resistant germ cell tumors create a significant clinical challenge, this is since therapeutic options become limited and less effective. Therefore, the lack of targeted therapies specifically approved for refractory cases results in poor prognosis and highlights the urgent need for novel drugs.

Germ Cell Tumor Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Germ Cell Tumor Market Segmentation:

Type Segment Analysis

The testicular germ cell tumor segment is projected to gain the largest revenue share of 45.7% in the germ cell tumor market during the forecast duration. The high prevalence of testicular cancer in the young population is the key factor behind this leadership. In this regard, the American Cancer Society estimates that approximately 9,720 new cases of testicular cancer will be diagnosed and 600 deaths from testicular cancer will result by the end of 2025 in the U.S., hence denoting a wider segment scope.

Treatment Segment Analysis

The chemotherapy segment is expected to grow at a considerable rate, with a share of 38.4% in the market by the end of 2035. The chemotherapy remains the gold standard for metastatic germ cell tumors, fostering a favorable business environment. As per a May 2024 ESMO article, a study of 283 patients with relapsed or refractory germ cell cancer found that high-dose chemotherapy plus autologous stem cell transplant showed greater efficacy when used as the first-line treatment. Also, patients receiving HD-CTX first had superior 2-year overall survival, which is 74% vs. 53% and higher response rates 79% vs. 60% when compared to those receiving it after conventional-dose salvage therapy.

End user Segment Analysis

The hospitals segment is anticipated to capture a significant share of 32.5% in the germ cell tumor market during the discussed timeframe. Testifying to this, an NIH article published in August 2025 found that a study at Tikur Anbessa Specialized Hospital in Ethiopia analyzed pediatric germ cell tumor cases, highlighting patterns in a low-resource setting. The study included 91 children, with a median diagnosis age of 4 years and a predominance of mature teratomas in extracranial sites. Also, combined chemotherapy and surgical approaches resulted in favorable outcomes, with 5-year overall survival reaching 85%.

Our in-depth analysis of the germ cell tumor market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Treatment |

|

|

End user |

|

|

Diagnosis |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Germ Cell Tumor Market - Regional Analysis

North America Market Insights

North America in the germ cell tumor market is expected to capture the largest revenue share of 40.6% by the end of 2035. The region’s upliftment in this field is readily propelled by the well-established oncology infrastructure, high awareness of rare cancers, and cross-border research collaborations. In July 2025, MiNK Therapeutics reported a complete and durable remission in a patient with metastatic, treatment-refractory testicular cancer using its allogeneic iNKT cell therapy, agenT-797. Besides, the therapy was well-tolerated with no CRS or GVHD, and donor iNKT cells remained detectable for six months. Further published in Oncogene, the case showed success after failure on platinum chemo, stem cell transplant, and multiple ICIs.

The U.S. remains a constant contributor to growth in the regional germ cell tumor market, which is successfully led by fueled by a robust pipeline of targeted therapies and expanding access to liquid biopsy technologies for tumor monitoring. NeoGenomics in July 2025 introduced PanTracer LBx, which is a blood-based comprehensive genomic profiling test for patients with advanced solid tumors. This noninvasive liquid biopsy test supports therapy selection, clinical trial matching, and monitoring, especially when tumor tissue is unavailable, hence reflecting ongoing innovation in cancer diagnostics.

Canada has gained enhanced traction in the germ cell tumor market, facilitated by the rising national investments in pediatric and rare cancer research, particularly through initiatives like the Canadian Cancer Society and government-funded genomic medicine programs. In January 2023, the country’s government readily made an investment of USD 23 million in pediatric cancer research to establish the Canadian Pediatric Cancer Consortium, which marks the largest investment in pediatric cancer research, hence a positive market outlook.

APAC Market Insights

Asia Pacific in the germ cell tumor market is considered to be the fastest-growing region between 2026 to 2035. The region’s progress in this field is subject to increasing disease awareness and access to innovative therapies. Meanwhile, countries such as Japan, South Korea, and Australia are remarkably benefiting from advanced healthcare systems that adopt global standard-of-care treatments at a rapid pace. Besides, the region is a major focus for clinical research and drug development due to its large patient population, leading to growing efforts to implement more personalized and cost-effective treatment strategies.

China is rapidly evolving in the germ cell tumor market owing to the ongoing healthcare reforms and robust domestic biomedical research and development. Also, there has been an increasing involvement in multinational clinical trials to bring novel therapies to its population. In November 2023, Grand Pharma reported that its ARC01, an mRNA therapeutic tumor vaccine using liposome nanoparticle delivery and TriMix immune-adjuvant technologies, had received acceptance for a Phase I clinical trial in China, encouraging more players to establish their footprint in the country.

India is portraying steady growth in the germ cell tumor market, extensively attributed to a high incidence rate of testicular cancers and constant government efforts to improve cancer care. For instance, in August 2025, the National Cancer Grid of India conducted its 2025 annual meeting at Tata Memorial Hospital, with participation from over 300 cancer leaders, researchers, and advocates from India and 15 other countries. The NCG, funded by India’s Department of Atomic Energy, coordinates more than 380 centers treating 60% of India’s cancer patients on a yearly basis. Notably, NCG secured an average 85% discount on cancer drug prices through negotiations with pharmaceutical companies, significantly reducing treatment costs.

Oncology Clinical Trials Registered in India (2021-2023)

|

Year |

Number of Studies (No.) |

|

2021 |

385 |

|

2022 |

414 |

|

2023 |

268 (up to June) |

Source: ASCO

Europe Market Insights

Europe is likely to retain its position as the second-largest stakeholder in the germ cell tumor market, which is driven by ongoing advances in treatment and improved survival rates. The region also benefits from platinum-based therapies and increasing healthcare investments. In April 2025, Nouscom announced positive Phase Ib/II results for NOUS-209, which is an off-the-shelf immunotherapy that targets tumors with mismatch repair deficiency and microsatellite instability by training the immune system to attack cancerous and precancerous cells. Further, these results support advancing NOUS-209 toward a registration-enabling cancer interception study.

Germany hosts a dynamic landscape of the germ cell tumor market supported by its strong research capabilities. The country also has a relatively higher incidence of testicular cancer, thereby driving consistent demand for effective diagnostic and treatment options. In October 2023, BioNTech presented positive Phase 1/2 data for its CAR-T cell therapy candidate BNT211 targeting Claudin-6 (CLDN6) in advanced solid tumors at ESMO Congress 2023. Results showed an overall response rate of 59% and a disease control rate of 95%, with prolonged CAR-T cell activity in patients receiving CARVac, hence positively impacting market growth.

The germ cell tumor market in Switzerland is also growing at a notable pace due to its huge emphasis on precision medicine and a robust clinical research ecosystem, which supports ongoing development and adoption of innovative therapies. In October 2023, Hedera Dx launched a streamlined liquid biopsy solution that enables hospitals to perform blood-based cancer testing locally, and it deliberately increases access to precision oncology by allowing faster, less invasive tumor profiling for broader patient populations. Further, the platform combines lab reagents with software, making advanced cancer diagnostics more accessible, hence a positive market outlook.

Market Landscape for Germ Cell Tumor Therapies in Europe 2024

|

Factor |

Key Findings |

|

Drug Approval |

All medicines follow one EU-wide (EMA) approval process. |

|

Key Medicines |

The market relies on older, generic chemotherapies (e.g., cisplatin). |

|

Cost of Treatment |

Generic prices can be >90% lower than original brands. |

|

Access Time |

Varies by country: <100 days (Germany) to >3 years (Cyprus, Latvia). |

Source: OECD

Key Germ Cell Tumor Market Players:

- Bristol-Myers Squibb

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co. (MSD)

- Roche

- Pfizer

- Novartis

- AstraZeneca

- Eli Lilly

- GSK

- Sanofi

- Bayer

- Hetero Drugs

- Celltrion

- CSL Limited

- Hikma Pharmaceuticals

- Pharmaniaga

The global germ cell tumor market is extremely competitive, which is remarkably dominated by the U.S. and Europe-based pharmaceutical pioneers such as Bristol-Myers Squibb, Merck, and Roche, which are emphasizing immunotherapy and targeted therapies. Meanwhile, the organizations based in Japan, such as Takeda and Daiichi Sankyo, are focusing on biosimilars and ADCs. Furthermore, the R&D partnerships, expanded indications, and emerging market penetration are a few strategies adopted by the companies to elevate the market progression access in different nations.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2025, Bristol Myers Squibb reported that it received European Commission approval for Opdivo (nivolumab) across different solid tumor indications thereby marking a significant advancement in cancer treatment delivery.

- In March 2025, Cornell researchers reported the effectiveness of a biomarker for detecting malignant testicular germ cell tumors, which are considered the most common solid cancer in young men. The team also stated that this advancement enables earlier diagnosis, improving both treatment outcomes and survival rates.

- Report ID: 5255

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Germ Cell Tumor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.