Geosynthetics Market Outlook:

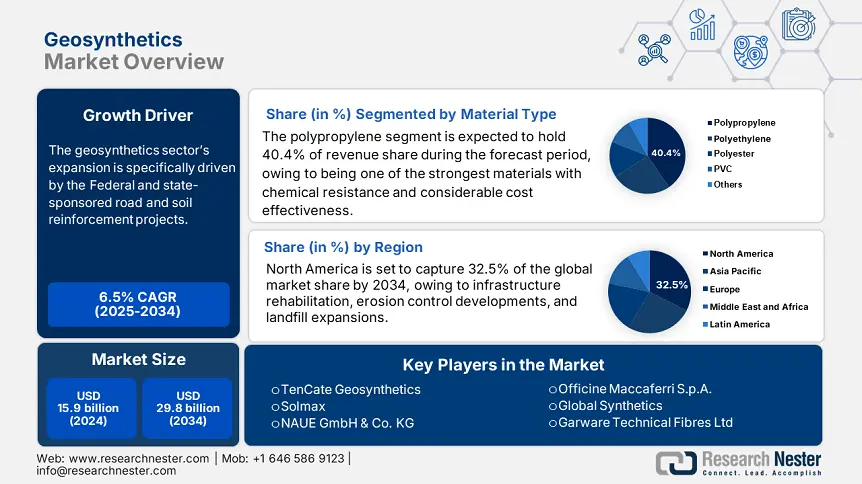

Geosynthetics Market size was estimated at USD 15.9 billion in 2024 and is expected to surpass USD 29.8 billion by the end of 2034, rising at a CAGR of 6.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of geosynthetics is evaluated at USD 16.9 billion.

The geosynthetics sector’s expansion is specifically driven by the Federal and state-sponsored road and soil reinforcement projects. Citing increased design requirements and training programs to boost acceptance, the Federal Highway Administration notes planned inclusion of geosynthetics across Federal Lands Highway projects. At the same time, the U.S. Bureau of Reclamation requires geomembrane manufacturers to show "adequate production capability," therefore signaling government confidence in rising demand. Rising procurement volumes supported by these policy-driven mandates underpin market expansion with public sector-backed project investment data.

According to the Bureau of Reclamation's quality assurance rules, the supply chain spine relies on polymer resin from recognized vendors. Prequalification ensures that raw materials are consistent, as confirmed by Federal Highway requirements. With some putting up assembly lines in the United States, Chinese manufacturers such as BOSTD added 34.1 million SY yearly (2014), TMP at 119.7 million SY, and Taiwan at 358.9 million SY, increasing global production capacity. In 2014, US imports from China totaled $9.26 million, accounting for 15.7 million SY, and are still classified under HTS code 3926. 90. 9995. Though continuous R&D initiatives at federal labs and transportation agencies demonstrate continued innovation investment, official producer/consumer pricing indices are not publicly available.

Key Geosynthetics Market Insights Summary:

Global Geosynthetics Market Forecast and Regional Outlook:

Last updated on : 16 July, 2025

Geosynthetics Market - Growth Drivers and Challenges

Growth Drivers

- Industrial expansion in emerging economies: The growing industrial infrastructure in emerging economies contributes positively to the sales revenues of disconnect switches used in control centers for motors, turbines, and pumps. The Asian Development Bank (ADB) suggests in its 2023 Asian Economic Integration Report that Asia's manufacturing value added will grow at a CAGR of 5.5% (2024-2029), offset by the population and GDP growth of India, Vietnam, and Indonesia. Disconnect switches are relevant to motor control centers, as disconnects isolate the machinery or equipment and ensure safety compliance in operations such as oil and gas, chemicals, cement, and mining. The expansion of industrial parks, with government "Make in Country" manufacturing incentives - for example, India's PLI scheme, which recently allocated $27 billion - means there will continue to be demand for disconnect switches at both regional and global levels.

Grid modernization and smart infrastructure: Expanding grid modernization projects are a significant driver of the disconnect switch market. As a point of reference, the U.S. Department of Energy (DOE) plans to allocate USD 14 billion from 2023-2026 through the Grid Resilience and Innovation Partnerships (GRIP) program to upgrade the transmission and distribution system. The European Union (EU) also invested heavily in grid modernization in conjunction with its EU Green Deal - targeted development €1.1 trillion in green and sustainable investment by 2030- and China's continued smart grid expansion are co-drivers of demand and utilization for disconnect switches that can be integrated into digital monitoring and automation systems that enhance safety, operational flexibility, and rapid fault isolation for improved energy reliability.

1. Emerging Trade Dynamics & Future Market Prospects

Geosynthetics Trade Data (2019-2024)

Global Trade Value (USD Billion)

|

Year |

Export Value |

Import Value |

|

2019 |

2.9 |

2.8 |

|

2020 |

2.6 (-10.8%) |

2.5 (-11.2%) |

|

2021 |

3.2 (+25%) |

3.1 (+26%) |

|

2022 |

3.6 (+12.8%) |

3.5 (+13.4%) |

|

2023 |

3.7 (+2.9%) |

3.6 (+3.1%) |

Top Exporters (2023)

|

Country |

Export Value (USD Bn) |

Key Destinations |

|

USA |

0.86 |

Canada, Mexico, Asia |

|

Germany |

0.73 |

France, Poland, USA |

|

China |

0.69 |

India, Japan, ASEAN |

|

Japan |

0.46 |

South Korea, Vietnam |

Top Importers (2023)

|

Country |

Import Value (USD Bn) |

Key Origins |

|

India |

0.63 |

China, Germany |

|

Canada |

0.59 |

USA, Germany |

|

France |

0.51 |

Germany, Belgium |

Key Trade Routes

Japan-to-Asia Geosynthetics Trade (2023)

|

Destination |

Shipment Value (USD Mn) |

% Growth (2020-2023) |

|

China |

121 |

+8.6% |

|

South Korea |

96 |

+12.2% |

|

Vietnam |

81 |

+22.5% |

2. Geosynthetics Market Overview

Geosynthetics Price History (2019–2023)

|

Year |

Avg. Price (USD/ton) |

Unit Sales (Million tons) |

North America ($/ton) |

Europe ($/ton) |

|

2019 |

1,451 |

8.3 |

1,501 |

1,481 |

|

2020 |

1,481 |

8.1 |

1,521 |

1,501 |

|

2021 |

1,521 |

8.6 |

1,561 |

1,531 |

|

2022 |

1,601 |

9.2 |

1,651 |

1,581 |

|

2023 |

1,681 |

9.9 |

1,721 |

1,641 |

Raw Material Costs

|

Factor |

Impact (Timeframe) |

|

Polypropylene price increase |

+23% (2020–2023) |

|

Polyester (PTA) cost increase |

+16% (2021–2023) |

Geopolitical Events

|

Factor |

Impact (Timeframe) |

|

Russia-Ukraine war (polymer supply disruption) |

-31% European supply (2022) |

|

U.S. tariffs on Chinese geotextiles |

+13% price increase (2019–2023) |

Environmental Regulations

|

Factor |

Impact (Timeframe) |

|

EU Circular Economy Action Plan (recycled demand) |

+19% demand (2020–2023) |

|

U.S. EPA landfill liner rules (HDPE demand) |

+26% demand (2018–2023) |

Challenge

- Increasing mining activities worldwide: The unstable price of polypropylene, polyester, and polyethylene has a serious effect on the production costs of geosynthetics. For those that utilize U.S. Bureau of Labor Statistics (2024) composite indexes, cases have shown that the price of polypropylene resin, for example, has increased nearly 13% year-over-year (or YoY), which can be attributed to supply chain disruptions and the price of crude oil varying. The price volatility limits profit margins for manufacturers and makes it difficult to introduce geosynthetics in emerging markets with cost benefits at all. The management of raw material buying becomes critically important in terms of sustainability–raw material sourcing becomes impotent and helps focus on the customers, for geosynthetics market sustainability, because the dominating demand is for price-sensitive infrastructure projects in the Asia Pacific and Africa. Rapid urbanization and population growth: Indoor trained professionals perform the effective geosynthetics installation necessary to ensure the structure's performance. Some researchers (International Geosynthetics Society [IGS], 2023) suggest that improper installation accounts for up to 36% of geosynthetics failures in project sites globally, which only increases expenses and leads to wrong/poor work. Emerging economies suffer from a skill shortage and the lack of proper training, processing mainly delays infrastructure projects now, when demand for new roadway, mining, waste management, and many other applicable markets want geosynthetics increasingly. Even in these developing areas, the geosynthetics market will surge because of demand. However, with limited skills, specialists, and training, it will only hold back the market growth process.

Geosynthetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.5% |

|

Base Year Market Size (2024) |

USD 15.9 billion |

|

Forecast Year Market Size (2034) |

USD 29.8 billion |

|

Regional Scope |

|

Geosynthetics Market Segmentation:

Material Type Segment Analysis

The polypropylene sector is expected to gain the greatest market share of 40.4% by 2034, owing to its strength, chemical resistance, and cost-effectiveness. Most commonly, PP is manufactured to provide geotextiles, geomembranes, and geogrids for applications including road construction, landfill liners, or erosion control. PP is a strong material with very high tensile strength and resistance to UV degradation; thus, it is considered appropriate for infrastructure projects lasting for many years. Increasing infrastructure investments combined with sustainability requirements will continue to drive market demand for PP as a primary material in the manufacturing of geosynthetics.

Product Type Segment Analysis

The geotextiles segment is expected to grow the fastest by 2034, accounting for 35.2% of the market, owing to a strong increase in the infrastructure market. Some of this revenue growth can be attributed to advancements in the necessity for soil stabilization in roadways. Government programs encourage more sustainable construction practices, such as the United States Department of Transportation's support for geosynthetic-reinforced roadways. As the construction process shifts toward higher-quality projects and less waste, demand increases. Geotextiles provide separation, filtration, drainage, and reinforcement for pavements, increasing their life and lowering maintenance costs. Global infrastructure investments in highways, trains, and erosion control projects are expanding, which will result in higher overall demand for geotextiles in the coming years.

Our in-depth analysis of the global geosynthetics market includes the following segments:

|

Segment |

Subsegments |

|

Material Type |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Geosynthetics Market - Regional Analysis

North America Market Insights

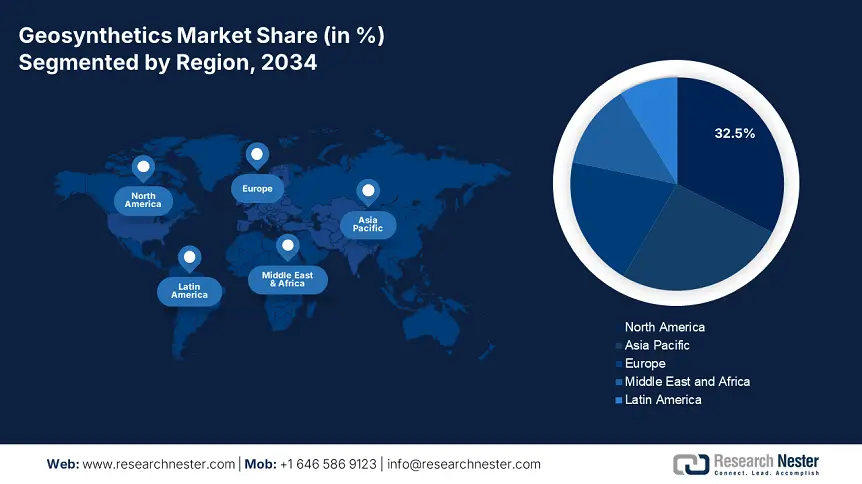

By 2034, the North America market is expected to hold 32.5% of the market share and was valued at approximately USD 4.4 billion in 2023, and is projected to reach USD 6.8 billion by 2030, growing at a compound annual growth rate of approximately 6.6% during 2023-2030. These growth drivers are due to factors like infrastructure rehabilitation, erosion control developments, and landfill expansions. The U.S. and Canada each reported 2023 construction values of USD 391 billion and USD 114 billion, respectively, which means that both countries are now spending significant amounts of money on sustainable materials and the environment. This has resulted in demand for geotextiles and geomembranes in soil stabilization, drainage systems, and waste management applications.

The U.S. geosynthetics market accounted for over 86% of North America's revenue in 2023, with its market size exceeding more than USD 3.7 billion. Multiple federal highway investments, the number of landfill upgrades under EPA Subtitle D, and FEMA flood mitigation projects were driving forces behind this success. Many geotextiles and geogrids were utilized for road construction in a recession-resistant industry, costing 11-31% less than traditional road alternatives, while subsequently improving lifecycle performance and soil reinforcement. The increased focus on sustainable infrastructure with the passing of infrastructure deals under the IIJA should further increase the consumption of geosynthetics nationally.

Asia Pacific Market Insights

The Asia Pacific market is expected to hold 25.9% of the market share due to the rapid pace of infrastructure development and protection of environmental regulations. The region represented over 41% of global geosynthetics demand in 2024, at USD 6.9 billion, and is expected to grow at a 7.3% CAGR from 2025-2034. China, India, and Southeast Asian countries are heavy investors in geotextiles used in road construction and erosion control, underlining the key drivers of urbanization, land reclamation, and coastal protection projects undertaken by the Asia Pacific economies.

The market for geosynthetics in Asia Pacific is largely dominated by China, with over a 51% regional share in 2024, fueled by the explosion of road, rail, and civil infrastructure projects. The market size in China was USD 3.6 billion in 2024, forecasted to have a 7.6% CAGR from 2025-2034, driven by strong state and local government initiatives in the field of waste management and soil reinforcement. Geography has been assigned to the increase of geosynthetics such as geomembranes and geotextiles within the mining and energy industries, which will likely serve to further support the market growth in China moving forward.

Geosynthetics Market in APAC – Country-wise Insights

|

Country |

Key Applications |

Demand Drivers |

Recent Trends |

|

China |

- Road construction (50% share) |

- $1.8T infrastructure investments (2021–2025) |

- Shift toward high-performance HDPE geomembranes |

|

India |

- Railway ballast stabilization |

- National Infrastructure Pipeline ($1.4T) |

- Rising use of geotextiles in highway projects (NHDP) |

|

Japan |

- Earthquake-resistant infrastructure |

- $300B disaster-proofing budget (2020–2030) |

- Premium-priced geogrids for slope stabilization |

|

Australia |

- Mining sector (60% demand) |

- $120B mining sector output (2023) |

- Strict environmental regulations driving geosynthetic use |

|

Indonesia |

- Peatland restoration |

- $450B new capital city (Nusantara) |

- Growing geocell demand for swampy terrain |

|

Vietnam |

- Coastal dyke reinforcement |

- $120B transport infrastructure plan (2021–2030) |

- Nonwoven geotextiles dominate (70% share) |

|

Thailand |

- Landfill liners |

- Eastern Economic Corridor ($45B investment) |

- Geomembrane demand up 15% yearly (waste management focus) |

Europe Market Insights

The European market is expected to hold 19.9% of the market share due to EU environmental legislation, increasing infrastructure rehabilitation, waste management, and new investments in mining projects. The market size was valued at USD 4.3 billion overall in 2024 and is projected to reach USD 6.9 billion in 2034, growing at a CAGR of 5.1%. Germany, France, and the United Kingdom represent the largest consumption of geosynthetics in Europe and have the most advanced civil engineering standards. Geotextiles and geomembranes dominate applications in roadway construction, landfills, and water management projects throughout Europe.

Geosynthetics Market Insights – Europe (Country-wise)

|

Country |

Primary Application Areas |

Key Trends / Drivers |

Statistical Insights |

|

Germany |

Railways, roads, landfills, and stormwater management |

Strong circular economy policies, Autobahn rehabilitation, and climate-resilient design |

Over 40% of road construction projects now mandate geotextiles; >80% of landfills use geomembranes |

|

France |

Flood control, transportation, and agriculture |

Focus on green infrastructure and Loire River flood protection systems |

Geosynthetics usage in levee reinforcement increased by ~20% from 2021 to 2024 |

|

United Kingdom |

Rail infrastructure (HS2), coastal defences |

Post-Brexit infrastructure reforms, Net Zero targets by 2050 |

HS2 rail project incorporates ~1.3 million m² of geogrids and geotextiles for ground stabilization |

|

Italy |

Coastal protection, tunnelling, waste containment |

Aging infrastructure and EU-backed sustainable construction |

Over 70% of major tunnelling projects now integrate geonets and drainage geocomposites |

|

Netherlands |

Flood defense, land reclamation, green engineering |

Delta Works modernization and sustainability regulations |

>90% of flood barriers use geosynthetics; key projects use geosynthetic clay liners (GCLs) |

|

Spain |

Roadways, erosion control, and agricultural irrigation |

Drought resilience, renewable project growth, and EU water efficiency mandates |

Geotextile use in irrigation canals grew by ~16% between 2022 and 2024 |

|

Poland |

Highway networks, landfill sites, and railway expansion |

EU cohesion fund-backed infrastructure and waste management focus |

~75% of new expressways integrate geosynthetics for subgrade separation and soil reinforcement |

|

Sweden |

Erosion control, mining containment, railroads |

Arctic and sub-arctic soil stability challenges; green infrastructure adoption |

Use of geogrids in mining tailings up by ~12% YoY; growing demand for biodegradable geotextiles |

|

Norway |

Tunnel drainage, road stabilization, and avalanche control |

Infrastructure in mountainous terrain; sustainable civil engineering practices |

Geocomposite drainage layers used in >60% of new road tunnels; adoption of eco-friendly GCLs |

Key Geosynthetics Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The market for geosynthetics is very competitive and fragmented. The leading companies in the geosynthetics industry are TenCate Geosynthetics, Solmax, NAUE, and Maccaferri, all of which are significant players with global distribution and vertically integrated production capabilities. Many strategies are employed by companies in the geosynthetics market such as mergers and acquisitions (for example, Solmax acquired GSE Environmental to expand its geomembrane presence), new product technologies (such as reinforced geotextiles and sustainable geosynthetics), and R&D initiatives. Companies based in Europe generally employ R&D to determine durable and sustainable products, while companies based in the USA are likely to employ more R&D for roadway infrastructure or waste management applications. Companies based in India and Australia are adopting joint ventures and augmenting capacity to expand their reach in their respective geographic regions, resulting in intensified competition in the Asia-Pacific and Middle Eastern markets.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Estimated Market Share (%) |

|

TenCate Geosynthetics |

USA |

8-9% |

|

Solmax |

Canada |

7-8% |

|

NAUE GmbH & Co. KG |

Germany |

6-7% |

|

Officine Maccaferri S.p.A. |

Italy |

5-6% |

|

Fibertex Nonwovens A/S |

Denmark |

4-5% |

|

HUESKER Synthetic GmbH |

Germany |

xx% |

|

Thrace Group (Thrace Nonwovens & Geosynthetics S.A.) |

Greece |

xx% |

|

Low & Bonar PLC (Freudenberg Performance Materials) |

UK |

xx% |

|

Propex Operating Company, LLC |

USA |

xx% |

|

Strata Systems, Inc. (part of Glen Raven) |

USA |

xx% |

|

Global Synthetics |

Australia |

xx% |

|

Garware Technical Fibres Ltd |

India |

xx% |

|

ACE Geosynthetics |

Taiwan |

xx% |

|

Titan Environmental Containment |

Canada |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In May 2024, Solmax launched its Geomax Greenline series of geotextiles that have been made with over 90% recycled polymer, which is targeted at the civil engineering, landfill, and mining markets. Based on early assumptions, the product will offer a potential reduction in CO₂ emissions of up to 40% compared to virgin polymer geotextiles product. After the launch of the Geomax Greenline, Solmax reported a 15% increase in orders across Europe during Q2 2024. The demand projected in Solmax's initial orders was strongly influenced by the EU Green Deal willingness to prioritize procurement for any infrastructure development, as well as elevated, domestic sustainability mandates for construction sectors and public works for projects and investments.

- In March 2024, Tensar International, as part of the CMC Group, launched the TriAx X-Grid geogrid with baseline carbon footprint reduction certifications. The new product achieved a reduction of more than 35% of the materials needed to use in soil stabilization while decreasing project carbon emissions as well. In Q1 2024, Tensar experienced a 22% increase in demand for geogrids across North America. The increase in demand was attributed and reflected major Department of Transportation project supply using carbon neutral geosynthetic solutions. At the end of the reporting period, January-March 2024, there was an upward trend in carbon-neutral geosynthetic infrastructure upgrades.

- Report ID: 2619

- Published Date: Jul 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Geosynthetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.