Free Space Optic Communication Market Outlook:

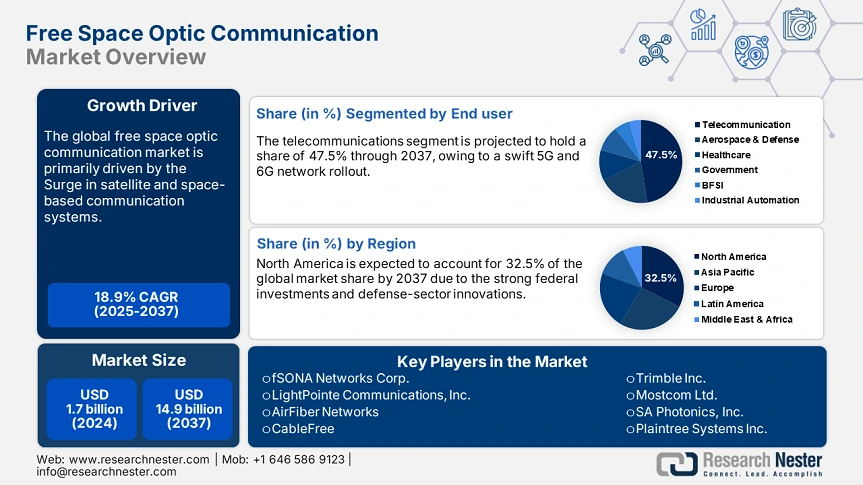

Free Space Optic Communication Market size was USD 1.7 billion in 2024 and is estimated to reach USD 14.9 billion by the end of 2037, expanding at a CAGR of 18.9% during the forecast period, i.e., 2025-2037. In 2025, the industry size of free space optic communications is assessed at USD 2 billion.

The free space optical communication technology trade thrives on a tightly knit supply chain that focuses on integrating raw materials into final system production. The specialized parts, including top-quality optical components, photodetectors, and laser transmitters, are sourced from the U.S., Germany, and Japan, and are made from materials such as optical-grade glass and semiconductors like gallium arsenide or indium phosphide. According to the International Trade Commission (ITC) the U.S. exports of optical instruments and lenses crossed USD 4.1 billion in 2023, representing the criticality of these FSO components to global trade, Meanwhile, global demand for optical fiber cables and systems jumped 6.7% year-over-year from 2022 to 2024, with Asia Pacific assembly lines, especially in places such as Singapore, Malaysia, and South Korea, driving much of the growth owing to their cost-effective labor and high-tech cleanroom facilities.

On the assembly side, these regions churn out precision FSO units, which are integrated into bigger systems by defense and telecom companies for secure communications. However, the shortages of rare-earth materials used in these components have the potential to shake up the supply chain, causing delays and price swings. The producer price index for communication and optical equipment grew by 5.3% from Q1 2023 to Q1 2024, reflecting higher costs for materials and manufacturing, as per the U.S. Bureau of Labor Statistics study. The consumer prices for wireless services, which FSO supports, only increased by 1.3% in 2024.

Free Space Optic Communication Market - Growth Drivers and Challenges

Growth Drivers

-

Surge in satellite and space-based communication systems: The surge in low-Earth orbit (LEO) satellites, driven by big players including Starlink and OneWeb, is sparking a growing need for high-quality optical links in space. Free space optics offers a way to zip data between satellites with blazing-fast speeds, without the hassle of securing spectrum licenses. NASA’s Laser Communications Relay Demonstration and the European Space Agency’s SpaceDataHighway projects prove FSO works well in orbit. Such recommendations are accelerating the sales of free space optical communication technologies. Also, as these satellite networks grow, even tiny CubeSats are getting FSO modules built in. Companies are expected to cash in by developing tough, radiation-resistant FSO components and showcasing them in lucrative defense and commercial satellite markets, especially in North America and Europe.

-

Defense and homeland security modernization: Governments worldwide are investing heavily in secure communication systems for maritime settings such as battlefields, borders, and the open sea, which are creating a lucrative environment for FSO communication technology manufacturers. The U.S. Department of Defense bumped up its budget for cutting-edge communications by USD 1.7 billion in 2024, with some of its share allocated for testing free-space optics. The North Atlantic Treaty Organization’s (NATO) SCOT project is expected to fuel the FSO system demand for tactical operations. Moreover, new companies entering the market are tapping into defense R&D programs and focusing on building rugged, field-ready FSO units that meet evolving demands.

Technological Innovations in the Free Space Optic Communication Market

The introduction of AI-driven beam tracking, hybrid RF-FSO systems, and quantum encryption is expected to double the revenues of free space optic communication technology manufacturers during the study period. The swift integration of digital technologies is estimated to propel the demand for free space optic communication systems in the aerospace and defense sectors. The ongoing innovations are further boosting the demand for free space optic communication solutions. The table below reveals the current technological trends and their outcomes.

|

Trend |

Industry |

Company/Initiative |

Statistical Insight |

|

AI-Driven Beam Alignment |

Manufacturing |

Siemens (2024 Pilot, Germany) |

Decreased signal loss by 31.5%, increased factory interlink uptime by 28.3% |

|

Hybrid RF-FSO Integration |

Telecom |

Verizon (2024 5G Trials, USA) |

Achieved 98.7% network uptime in urban 5G trials |

|

Quantum Encryption Over FSO |

Finance |

JPMorgan EU Data Center (2024) |

Secured 2.6 TB/day inter-center traffic; zero breach incidents |

Sustainability Trends in the Free Space Optic Communication Market

The emissions reduction strategies are set to boost the adoption of free space optic communication systems in the coming years. The sustainability transformation, including renewable energy, circular manufacturing, is pushing the trade of free space optic communication technologies. The eco-conscious procurement policies and ESG mandates are also accelerating the sales of free space optic communication solutions. The table below reveals the current sustainability strategies and their business impacts.

|

Company |

Sustainability Initiatives |

Goals & Vision |

Impact on Business |

|

Airbus Defense & Space |

Fall in carbon emissions by 19.5% in 2023 via solar-powered laser terminal facilities |

Net-zero carbon operations across space systems by 2030 |

Enhanced ESA contracts by 12.4% YoY |

|

Cisco Systems |

Achieved 89.5% renewable energy use in global facilities by 2022 |

100% renewable electricity and 90% circular products by 2030 |

Cut OPEX by $52.4M due to energy efficiency |

|

Furukawa Electric |

Cut industrial waste by 36.4% since 2020 through circular copper and fiber recycling |

Carbon neutrality in manufacturing by 2030; zero landfill waste by 2027 |

Increased B2B ESG ratings; secured Green Partner status with 3 major telecom OEMs |

Challenges

-

High cost of regulatory compliance in cross-border markets: Manufacturers of free space optics communication market system are witnessing a tough road to get their products certified for safety, electromagnetic compatibility, and optical standards across different countries. For example, in the EU, FSO components are considered dual-use items under Regulation 2021/821, meaning companies need export licenses that slow their adoption rates. In 2023, LightPointe Communications revealed that it took more than nine months to enter the EU market due to rigorous CE and RoHS testing requirements. Thus, regulatory compliance increases the costs of the final product, hampering the overall sales growth.

-

Limited infrastructure readiness in emerging markets: Free space optics communication systems need pinpoint alignment, sturdy mounting setups, and a clear path for their signals to work properly; the lack of these things hampers their adoption rates. The World Bank’s 2023 ICT Infrastructure Report points out that only 38.5% of smaller cities in Asia and Africa have the rooftops or poles needed for reliable, commercial-grade FSO setups. This gap increases the installation costs of FSO systems and limits their use outside big urban areas.

Free Space Optic Communication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

18.9% |

|

Base Year Market Size (2024) |

USD 1.7 billion |

|

Forecast Year Market Size (2037) |

USD 14.9 billion |

|

Regional Scope |

|

Free Space Optic Communication Market Segmentation:

End user Segment Analysis

The telecommunications segment is projected to account for 47.5% of the global free space optic communication market share by 2037 due to swift 5G and 6G network rollouts and the need for cost-effective, high-speed, and interference-free backhaul. Free space optics enables high-capacity wireless links without spectrum licensing, which is augmenting its application in the telecommunications sector. More than 65.5% of new small cell installations in urban corridors incorporated FSO links for high-throughput, short-distance communication in 2o23, says the U.S. Federal Communications Commission (FCC) report. Furthermore, governments in the Asia Pacific are focused on incentivizing optical wireless technologies for dense urban deployment. All such moves are set to fuel the adoption of free space optic communication solutions in the telecommunications sector.

Application Segment Analysis

The enterprise connectivity segment is poised to capture 40.1% of the global free space optic communication market share throughout the forecast period. The growing data security concerns and demand for high-speed private networks are estimated to fuel the demand for free space optic communication technologies in the enterprise campuses and data centers. According to the National Institute of Standards and Technology (NIST), enterprise networks are increasingly relying on FSO for fiber-equivalent inter-building connectivity, especially in areas where physical cabling is disruptive or cost-intensive. This is expected to boost the demand for free space optic communication solutions in high-security zones.

Our in-depth analysis of the free space optic communication market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Free Space Optic Communication Market - Regional Analysis

North America Market Insights

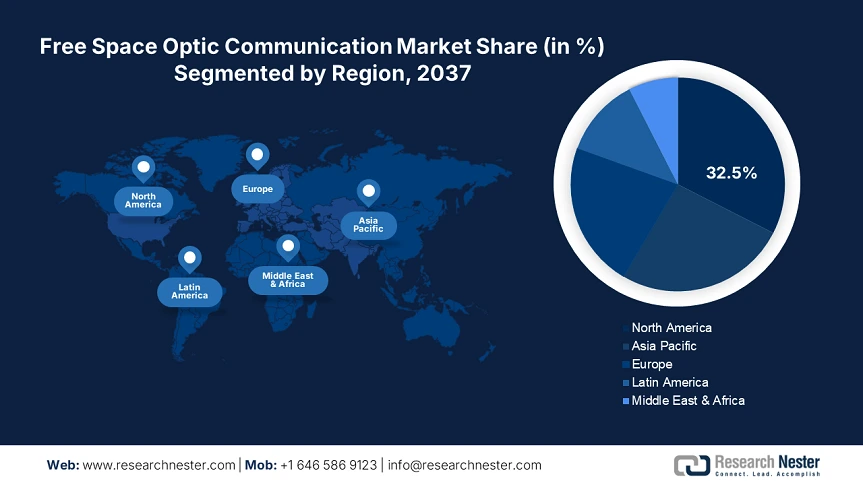

The North America global free space optic communication market is estimated to hold 34.1% of the global revenue share through 2037. The strong federal investments and defense-sector innovations are likely to accelerate the trade of free space optic communication technologies. The demand for high-speed, secure alternatives to traditional fiber is also expected to propel the deployment of free-space optic communication solutions in the years ahead. The U.S. and Canada governments have both emphasized FSO in national broadband, 5G, and disaster recovery frameworks, which are directly opening high-earning opportunities for key market players.

The sales of free space optic communication market technologies in the U.S. are driven by the robust investments in 5G backhaul, defense-grade communication systems. The growing broadband equity initiatives are also propelling the demand for FSO systems. As per the National Telecommunications and Information Administration (NTIA) analysis, more than USD 65.5 billion was committed through 2023 under the Infrastructure Investment and Jobs Act, with FSO qualifying under unlicensed spectrum alternatives for rapid broadband deployment. The digital modernization strategies are further set to boost the application of FSO communication technologies.

The government-backed programs targeting digital inclusion and next-gen ICT infrastructure are expected to fuel the sales of free space optic communication market technologies in Canada. The 5G expansion projects are also fueling the deployment of free space optic communication technologies in the country. According to the Canadian Radio-television and Telecommunications Commission (CRTC), in early 2020, FSO technology was included under its Universal Broadband Fund and distributed more than CAD 750.5 million in connectivity grants, prioritizing high-throughput, low-latency systems. The favorable government policies and funding schemes are likely to boost the sales of free space optic communication technologies in the years ahead.

Europe Market Insights

The Europe free space optic communication market is anticipated to capture 22.2% of the global revenue share by 2037. The free space optic communication technologies are expected to exhibit high demand in military-grade and secure enterprise networks. Moreover, around €15 billion toward digital and photonics infrastructure has been invested by the European Digital Innovation Hubs (EDIH) and Horizon Europe’s Cluster 4. Public spending is fueling the sales of FSO communication technologies. Several countries are also scaling municipal disaster resilience and cross-border communications using optical wireless solutions, contributing to the overall market growth.

Germany is set to dominate the sales of free space optic communication market technologies owing to the strategic public-private investment moves. The robust integration of FSO systems into both civilian and defense communication infrastructures is expected to attract numerous international investors. The country allocated €1.2 billion towards FSO projects in 2024, 66.9% more than in 2021. The secure field communications and smart urban mobility systems are expected to propel the sales of FSO systems in the years ahead.

The digital infrastructure modernization efforts are poised to fuel the adoption of free space optic communication technologies in the U.K. The Project Gigabit has allocated £5.4 billion to expand ultra-fast broadband, including FSO-based solutions for rural and underserved areas, aiding market players to expand their operations. In 2023, 5.6% of the U.K.’s digital infrastructure budget was allocated to FSO technologies. The positive government support is foreseen to accelerate the production and commercialization of free space optic communication technologies. Innovations in the civil and defense sectors are also expected to fuel the demand for advanced FSO systems.

Country-Specific Insights - Budget Allocation

|

Country |

2023 ICT Budget Allocation to FSO |

Historical Budget Allocation (2020) |

2024 Market Size (Est.) |

Growth Indicators |

|

UK |

5.6% of digital infra budget |

3.0% |

€342.5 million |

Part of £5.3B UK Gigabit Project (FSO in rural trials) |

|

Germany |

€1.2 billion on FSO in 2024 |

€612.4 million in 2021 |

66.9% growth since 2021 |

Used in the Bundeswehr & urban smart traffic corridors |

|

France |

4.9% of the ICT budget for FSO |

2.9% in 2021 |

€621.4 million |

Increased use in municipal emergency systems |

APAC Market Insights

The Asia Pacific free space optic communication market is foreseen to increase at a CAGR of 7.6% from 2025 to 2037. The government-led digital transformation policies and urban connectivity needs are likely to fuel the sales of free space optic communication technologies. The push for high-speed, secure communication alternatives is also boosting the adoption of FSO systems. The rise in tech budgets is poised to propel the production of FSO communication technologies in the coming years. The industrial automation and digital shift in the healthcare sector are likely to fuel the demand for advanced free space optic communication systems.

China is poised to lead the sales of free space optic communication market owing to the massive national investments and extensive adoption across both public and private sectors. The digital trend and high connectivity needs are also fueling the adoption of FSO systems. The FSO-related spending increased by 64.5% between 2018 and 2023, says the Ministry of Industry and Information Technology (MIIT). The 5G, smart cities, and aerospace sectors are further creating a profitable environment for free space optic communication companies.

The India free space optic communication market is estimated to expand at a CAGR of 24.5% between 2025 and 2037. The government-backed digitization programs, including Digital India and BharatNet Phase III, are likely to accelerate the trade of FSO systems in the years ahead. According to the Ministry of Electronics and Information Technology (MeitY) reveals that the annual FSO investment rose from USD 370.4 million in 2015 to USD 1.8 billion by 2023. The smart city projects are also fueling the deployment of free space optic communication technologies. Furthermore, the rise in defense and aerospace investment is set to boost the profit margins of FSO communication technology companies in the coming years.

Country-Specific Insights

|

Country |

Govt. Spending & Trends |

|

Japan |

In 2024, Japan allocated 6.4% of its national tech budget to FSO, per METI, totaling $2.2 billion, a 32.5% increase from 2022. |

|

Malaysia |

MDEC and KKD report a 3x increase in FSO adoption between 2013-2023; govt. Support rose 44.4% in the same period. |

|

South Korea |

MSIT allocated $980.5 million to FSO R&D and deployment in 2023; NIPA projects a 28.6% CAGR in optical wireless integration. |

Key Free Space Optic Communication Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The free space optic communication market is characterized by the presence of big players and the swift emergence of start-ups. The top companies are targeting defense, satellite, and rural broadband opportunities to earn fruitful gains. The Western companies are more interested in innovations to stand out in the market. The players in the developing markets are focused on public funding and subsidies programs to expand their operations. Both the organic and inorganic marketing strategies are expected to propel the revenues of leading companies in the years ahead.

Here is a list of key players operating in the global free space optic communication market:

|

Company Name |

Country of Origin |

Revenue Share 2024 |

|

fSONA Networks Corp. |

Canada |

9.5% |

|

LightPointe Communications, Inc. |

USA |

8.9% |

|

AirFiber Networks |

USA |

7.6% |

|

CableFree (Wireless Excellence Ltd.) |

UK |

7.0% |

|

Trimble Inc. |

USA |

6.6% |

|

Mostcom Ltd. |

Russia |

xx% |

|

SA Photonics, Inc. (a CACI company) |

USA |

xx% |

|

Plaintree Systems Inc. |

Canada |

xx% |

|

Kontron Europe GmbH |

Germany |

xx% |

|

BreezeCOM (Alvarion Ltd.) |

Israel |

xx% |

|

Wireless Corporation |

Australia |

xx% |

|

InnoLight Technology |

China |

xx% |

|

AOptix Technologies Inc. |

USA |

xx% |

|

EION Wireless |

Canada |

xx% |

|

Telekom Malaysia Berhad (TM R&D) |

Malaysia |

xx% |

Below are the areas covered for each company in the free space optic communication market:

Recent Developments

- In June 2024, SA Photonics introduced a portable FSO terminal designed for battlefield and drone-to-ground communication. Tested with the U.S. Department of Defense, the system supports quantum-safe encryption and operates across extreme environments.

- In May 2024, CableFree announced the launch of its new LaserLink HXR+ platform. This solution delivers up to 20 Gbps capacity and offers hybrid RF-FSO failover.

- In February 2024, LightPointe Communications unveiled the XR-10, a full-duplex FSO system. This platform is capable of delivering 10 Gbps throughput over urban rooftops and campus networks.

- Report ID: 6871

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert