Follicle Stimulating Hormone Market Outlook:

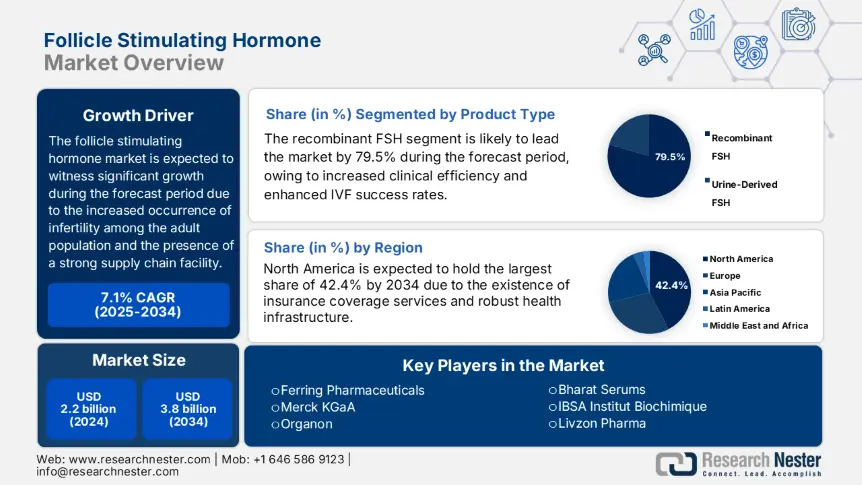

Follicle Stimulating Hormone Market size was USD 2.2 billion in 2024 and is expected to reach USD 3.8 billion by the end of 2034, growing at a CAGR of 7.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of follicle stimulating hormone is estimated at USD 2.5 billion.

The worldwide patient pool in the market is continuously expanding, with the World Health Organization (WHO) demonstrating that approximately 18.5% of adults are affected by infertility internationally, accounting for almost 1 in 8 individuals demanding medical intervention. This has readily driven the need for APIs, FSH drugs, and other medical devices that are utilized in assisted reproductive technologies. Besides, the supply chain facility for FSH products includes customized pharmaceutical manufacturers, regulated fertility centers, and API suppliers. The EU Medicines Agency (EMA) and the U.S.FDA have maintained strictness over the FSH production, owing to the biologic nature that need compliance with good manufacturing practices. (GMP).

Furthermore, the producer price index (PPI) has increased by 4.5% yearly over previous years, pertaining to FSH drugs, which has effectively reflected a boost in manufacturing expenses for biologics. Likewise, the consumer price index (CPI) for fertility treatments has also grown at a 6.1% rate every year, attributed to an increase in the ART adoption, along with high research and development (R&D) expenses. Besides, institutional and government investments in research, development, and deployment (RDD) are considered to be significant, with the allocation of USD 48 million by the National Institutes of Health (NIH) yearly for innovations in reproductive health, thereby suitable for positively impacting the overall market.

Follicle Stimulating Hormone Market - Growth Drivers and Challenges

Growth Drivers

- Affordable intervention and enhancement in health quality: FSH therapies are emerging as more effective, to diminish expenses and enhance results, thus suitable for bolstering the market. According to a clinical study published by the AHRQ in 2022, it has been revealed that early FSH intervention reduced hospitalization rates by almost 26%, thus saving USD 455 million in 24 months. Besides, the existence of standardized dosing protocols uplifted IVF success rates by almost 21%. Therefore, all these statistical data are deliberately motivating insurers to provide coverage for FSH treatments as both elective procedures and preventive care.

- Competition in biosimilar and pharmaceutical advancement: The follicle stimulating hormone industry is effectively dominated by recombinant FSH and biosimilars. Based on this, the U.S. FDA rapidly approved two biosimilars as of 2023, which were 40% affordable in comparison to branded medications. Besides, in 2024, Merch KGaA partnered with the Mayo Clinic through AI-powered dosing services, which aimed to customize treatments and enhance efficacy, thus denoting an optimistic outlook for the overall market.

Historical FSH Patient Growth (2015-2025)

|

Country |

2015 Patients (Million) |

2020 Patients (Million) |

2025 Patients (Million) |

CAGR (2015-2025) |

Key Growth Driver |

|

U.S. |

1.3 |

1.8 |

2.4 |

5.9% |

Medicare IVF coverage expansion |

|

Germany |

0.9 |

1.3 |

1.7 |

5.3% |

Public IVF subsidies |

|

France |

0.6 |

0.9 |

1.3 |

6.2% |

Single women IVF access (2024) |

|

Spain |

0.4 |

0.7 |

1.1 |

8.4% |

Medical tourism for IVF |

|

Australia |

0.3 |

0.5 |

0.8 |

7.5% |

Private insurance uptake |

|

Japan |

0.7 |

1.0 |

1.4 |

5.7% |

Employer-funded fertility benefits |

|

India |

0.5 |

0.9 |

1.6 |

10.6% |

Urbanization & fertility awareness |

|

China |

1.1 |

2.0 |

3.0 |

9.3% |

Two-child policy & rising infertility |

FSH Market Expansion Feasibility Models (2020-2025)

|

Model |

Region |

Revenue Impact |

Key Statistic |

|

Local Provider Partnerships |

India |

+12.6% (2022-2024) |

1.5 million patients treated |

|

Tiered Pricing |

China |

+18.9% uptake |

2.9 million patients (2025) |

|

Biosimilar Adoption |

U.S. |

30.5% Medicare cycles |

USD 1.4 billion savings (2023) |

|

Long-Acting FSH |

EU |

+8.2% market share |

50.4% dose reduction |

Challenges

- Complications in approvals and administrative delays: FSH products experience prolonged approval duration, owing to complications in their biologic. For instance, the U.S. FDA needs Phase III trials, accounting for more than 1,500 patients, particularly for recombinant FSH, thereby boosting development expenses to more than USD 520 million. Besides, small-scale organizations repeatedly avoid projects based on such obstacles. However, escalated pathways, in the case of FDA’s 505(b)(2) can rationalize acceptances, but readily appear to be underutilized, thus negatively impacting the follicle stimulating hormone industry growth.

- Barriers to patient affordability: An increase in treatment expenses usually excludes millions from undergoing FSH therapies, which causes a hindrance in the overall market. For instance, a single IVF cycle usually costs USD 3,500 to USD 5,500, especially in India, wherein the per capita income is USD 2,500. Likewise, almost 65% of patients in the U.S. experience delays in treatment, owing to the high cost factor. Therefore, to overcome this, governments need to subsidize treatments as well as ensure mandatory coverage through reimbursement.

Follicle Stimulating Hormone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.1% |

|

Base Year Market Size (2024) |

USD 2.2 billion |

|

Forecast Year Market Size (2034) |

USD 3.8 billion |

|

Regional Scope |

|

Follicle Stimulating Hormone Market Segmentation:

Product Type Segment Analysis

Based on the product type, the recombinant FSH is expected to dominate the follicle stimulating hormone market with a share of 79.5% by the end of 2034. The segment’s growth originates from superior clinical efficiency, with clinical studies demonstrating a 25% increase in IVF success rates in comparison to urine-based alternative options. In addition, the segment also benefits from biosimilar integration, with the FDA accepting the 4 newest biosimilars as of 2023, which is further fueling reduced expenses by 32%. Meanwhile, scalable production, along with manufacturing benefits that include consistent purity, are making recombinant FSH the most preferred choice for fertility centers.

Application Segment Analysis

Based on the application, the assisted reproductive technology (ART) is expected to achieve the second-largest share of 57.5% in the follicle stimulating hormone market during the forecast period. The segment’s development is attributed to an international surge in IVF procedures, with more than 4 million cycles conducted every year. Additionally, the growth is also driven by an increase in infertility rates, which has affected almost 18.5% of pairs across different nations, along with an expansion in insurance coverage services, thereby suitable for uplifting the overall market demand.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Follicle Stimulating Hormone Market - Regional Analysis

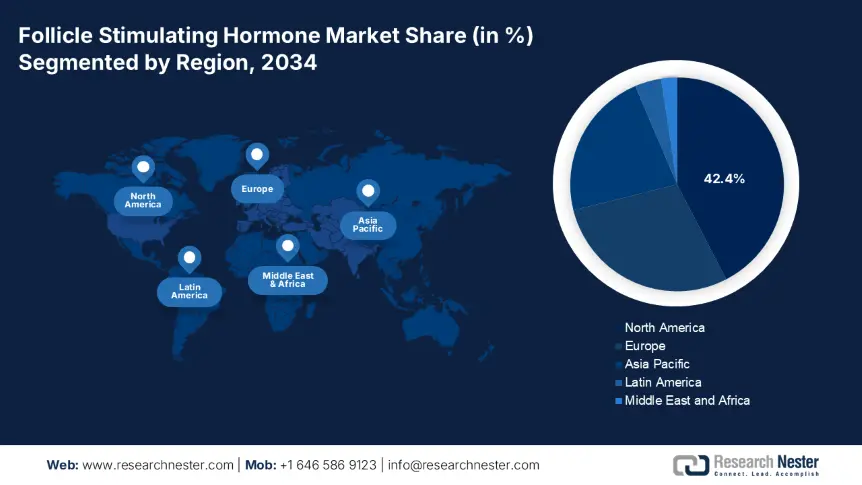

North America Market Insights

North America in the follicle stimulating hormone market is projected to account for the largest share of 42.4% by the end of 2034. The market’s upliftment in the region is highly fueled by expansion in insurance coverage and the presence of strong healthcare facilities. Besides, the U.S. accounts for almost 40% of the region’s share, which is driven by Medicare spending and administrative mandates. Meanwhile, biosimilars are gaining increased exposure in the region, while employer-based fertility is equally benefiting. Moreover, Canada is also contributing to the region’s upliftment with the existence of fertility treatments.

The market in the U.S. is gaining increased traction, wherein Medicare initiated USD 1.3 billion in spending for FSH products as of 2024, along with the presence of IVF mandates across nearly 20 states. Besides, the CDC has reported that there have been 2.7 million yearly ART cycles, of which a 16% growth has been witnessed in employer-based plans. Meanwhile, biosimilars achieved huge importance, with the FDA accepting 5 latest FSH biosimilars as of 2023, thereby suitable for uplifting the overall market in the country.

The follicle stimulating hormone market in Canada is also growing with a 5.3% growth rate, effectively driven by Ontario’s USD 325 million fertility funding as of 2024. The CIHI data has revealed that there has been a rise in ART cycles by 22% since 2020, and despite this, only 5 provinces completely cover IVF. Besides, the 2024 biosimilar initiative by Health Canada effectively intends to reduce expenses by approximately 30%. Therefore, all these factors are readily driving the market demand in the country.

North America FSH market trade and supply chain facilities for 2021-2025

|

Category |

2021 |

2023 |

2025 |

|

API Imports (U.S.) |

66% from China |

57% from China, 22% from South Korea |

45% from China, 30% from South Korea |

|

Local Production (U.S.) |

4 major facilities |

4 facilities (+2 biosimilar plant) |

6 facilities (3 new recombinant FSH) |

|

Canada API Sources |

71% EU, 20% U.S. |

62% EU, 28% U.S., 11% India |

51% EU, 31% U.S., 18% India |

|

Cross-border Trade |

USD 285 million U.S.-Canada FSH trade |

USD 326 million (+14.5% YoY) |

USD 388 million (biosimilar focus) |

|

Cold Chain Logistics |

13 dedicated U.S. warehouses |

19 (+7 specialized IVF hubs) |

29 (complete temperature-monitored) |

APAC Market Insights

Asia Pacific in the follicle stimulating hormone market is considered the fastest-growing region, with a projected 22.5% revenue during the forecast timeline. The market’s growth in the region is effectively attributed to a surge in infertility rates, affecting 1 in 8 couples, along with the presence of government-based fertility subsidies. Besides, the existence of the two-child policy in China is uplifting the market. In addition, the support received from localized biosimilars in India is equally boosting the market exposure in the overall region.

The market in China is anticipated to garner a revenue share of 7.5% by the end of the forecast duration, fueled by interventions in policies and shifts in demography. The two-child initiative has enhanced the market demand in the country, with almost 2.8 million FSH individuals predicted by the end of 2025. Besides, the government-based expenditure has risen by 20% between 2019 and 2024, which has readily prioritized urban fertility clinics across Tier-1 cities. Meanwhile, localized manufacturers such as Livzon Pharma is dominating the country with 52% market share by leveraging affordable biosimilars.

The market in India is expected to capture 4.7% of the revenue during the forecast period, along with a growth rate of 12.5%. The market’s development in the country is highly driven by the presence of 2.6 million patients receiving treatment since 2023. In this regard, the government initiated the allocation of USD 1.9 billion yearly by focusing on localized API production to diminish import dependency. Besides, Ferring’s pay-per-success IVF model lowered expenses by approximately 43%, which has readily expanded market accessibility.

Europe Market Insights

Europe in the follicle stimulating hormone market is considered to hold a considerable share of 28.7% by the end of the forecast timeline. The market’s upliftment in the region is highly fueled by advanced fertility reforms as well as universal healthcare coverage services. Germany is leading with € 4.2 billion in yearly spending, constituting a 13% growth since 2021, which is effectively supported by 55% of IVF expense coverage, and meanwhile, France is following closely with the availability of healthcare and medical budget, all of which are positively impacting the market growth in the region.

The market in Germany is dominating the market in the region, with a 10.5% revenue share, which is attributed to biosimilar integration as well as wide-ranging IVF coverage. The Federal Ministry of Health has indicated that there have been an estimated 200,250 yearly ART cycles, which are administered by AI-powered dosing protocols that tend to enhance success rates by at least 20%. Besides, spending by the government has skyrocketed to € 4.9 billion as of 2024, thereby reflecting a 14% growth since 2021.

The follicle stimulating hormone market in France is gaining increased exposure with 7.7% of international FSH revenue, which is driven by extended 2023 policy reforms of IVF coverage, particularly for single women as well as same-gender pairs. Besides, the French National Authority for Health has noted an 18.5% demand growth since 2021, accounting for € 1.4 billion in fund allocation for fertility treatments as of 2024. Meanwhile, Ferring’s Lyon biosimilar facility intends to diminish expenses by at least 32%, catering to cost-effective barriers.

Government investments and policy initiatives in the UK, Italy, and Spain from 2021-2025

|

Country |

Policy/Initiative |

Launch Year |

Funding/Impact |

|

UK |

NHS Fertility Reform (Expanded IVF Coverage) |

2021 |

£52 million annual funding increase |

|

Life Sciences Vision (FSH Innovation Fund) |

2023 |

£123 million for biosimilar R&D |

|

|

Italy |

National Fertility Plan (Piano Nazionale Fertilità) |

2022 |

€85 million for public IVF clinics |

|

AIFA Biosimilar Incentive Program |

2024 |

16.5% price premium for FSH biosimilars |

|

|

Spain |

National Assisted Reproduction Strategy |

2021 |

€49 million to reduce regional disparities |

|

Tax Deduction for Fertility Treatments (Ley de Presupuestos) |

2023 |

28% tax relief up to €1,200/year |

Key Follicle Stimulating Hormone Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is extremely combined with the existence of Merck KGaA, accounting for 25%, and Ferring accounting for 19% of the revenue share, and significantly dominating through innovations for recombinant FSH. The aspect of supply chain control for API, emerging localization across economies, and expansion in biosimilar are a few strategies that organizations have undertaken to uplift the market. For instance, through market localization, Bharat Serums and Livzon ensured cost reductions by at least 47%, thereby suitable for bolstering the market globally.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Merck KGaA |

Germany |

25% |

Market leader in recombinant FSH (Gonal-F); heavy R&D in long-acting formulations |

|

Ferring Pharmaceuticals |

Switzerland |

19% |

Pioneered biosimilar FSH (Rekovelle); focus on affordability in emerging markets |

|

Organon |

U.S. |

13% |

Key player in urinary-derived FSH; expanding biosimilar portfolio |

|

LG Chem |

South Korea |

11% |

Major API supplier; dominates Asian FSH biosimilars |

|

Bharat Serums |

India |

9% |

Low-cost FSH for emerging markets; strong domestic presence |

|

Livzon Pharma |

China |

xx% |

Leading Chinese recombinant FSH producer; government-backed |

|

IBSA Institut Biochimique |

Switzerland |

xx% |

Specialty in subcutaneous FSH delivery systems |

|

Thermo Fisher Scientific |

U.S. |

xx% |

Supplies critical FSH raw materials and diagnostics |

|

Fresenius Kabi |

Germany |

xx% |

Biosimilar FSH for EU markets; hospital partnerships |

|

Biosidus |

Argentina |

xx% |

Latin American leader in affordable FSH |

|

Gedeon Richter |

Hungary |

xx% |

Eastern European FSH supplier; growing API production |

|

Aspen Pharma |

South Africa |

xx% |

Supplies FSH to Middle East/Africa; local manufacturing |

|

Intas Pharmaceuticals |

India |

xx% |

Biosimilar FSH focus; EU and Indian market approvals |

|

MSD (Merck & Co.) |

U.S. |

xx% |

FSH innovations for North American markets |

|

GeneScience Pharmaceuticals |

China |

xx% |

Recombinant FSH for domestic Chinese market |

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, Merck KGaA successfully unveiled Phase III trials for cutting-edge and long-lasting MK-8962, which is an FSH analog, developed to diminish IVF injections from over 12 to only 2 per cycle.

- In January 2024, Ferring Pharmaceuticals declared that it has received the U.S.FDA acceptance for its Rekovelle biosimilar, which is priced 40% lower than the originator medication.

- Report ID: 7903

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Follicle Stimulating Hormone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert