Flow Cytometry Market Outlook:

Flow Cytometry Market size was USD 5.3 billion in 2024 and is projected to reach USD 12.5 billion by the end of 2034, growing at a CAGR of 8.8% during the forecast period, i.e., 2025-2034. In 2025, the industry size of flow cytometry is assessed at USD 5.8 billion.

The international market is reinforced by an increase in the patient pool that requires innovative diagnostics, especially for infectious disorders, immunology, and oncology. As stated in the National Cancer Institute (NCI) report, approximately 2.2 million latest cancer incidences have been diagnosed in the U.S. as of 2024, fueling the need for flow cytometry in immunotherapy monitoring and minimal residual disease (MRD) detection. Besides, the World Health Organization (WHO) report has revealed that almost 38.5 million people worldwide were dwelling with HIV as of 2023, further boosting the demand for immune cell profiling. Meanwhile, the U.S. International Trade Commission (USITC) data indicated that medical and pharmaceutical device imports have reached USD 182 billion as of 2023, thus positively contributing to market growth.

Moreover, the aspect of economic indicators, including the producer price index (PPI), has increased to 4.4% year-over-year (YoY) basis, particularly for medical supplies and equipment as of 2024. In addition, the consumer price index (CPI) has also boosted by 4.2% during the same year for clinical laboratory services, which has indicated a surge in high-end user expenses. Besides, research, development, and deployment-based investments continue to be strong, with the National Institutes of Health (NIH) initiating a USD 2.7 billion fund as of 2024, for cancer and immunology research that includes flow cytometry applications, thus suitable for the market development.

Flow Cytometry Market - Growth Drivers and Challenges

Growth Drivers

- Administrative expenditure on precise and diagnostic medicine: The aspect of government-based funding is a significant driver for the market adoption, especially when handling autoimmune diseases, HIV, and cancer diagnostics. For instance, Medicare spending in the U.S. has reached USD 2.1 billion as of 2023 for flow cytometry, which is attributed to an increase in the minimal residual disease (MRD) monitoring coverage for leukemia. Besides, the US FDA’s escalated acceptance pathway has also bolstered advancement, with 17 newest flow cytometry-based IVD evaluations that received clearance in 2024, thus suitable for uplifting the market globally.

- Cost saving and quality enhancement in healthcare services: Flow cytometry has increasingly gained exposure, owing to its increased usability for early disorder identification, which has further diminished hospitalization expenses. As per a study published by the AHRQ in 2022, it has been demonstrated that early leukemia diagnosis through flow cytometry reduced hospitalizations by almost 26%, thereby saving USD 955 million within two years. Besides, hospitals are readily integrating spectral flow cytometry to lower reagent expenses and enhance multi-parameter analysis, thus boosting the flow cytometry sector internationally.

Revenue Potential for Flow Cytometry Manufacturers (2023-2024)

|

Company |

Strategy |

Revenue Impact (2023-2024) |

|

BD Biosciences |

FDA-cleared oncology assays |

+USD 325 million |

|

Thermo Fisher |

APAC production localization |

+USD 154 million |

|

Sony Biotechnology |

AI-powered cytometry systems |

+USD 92 million |

|

Siemens Healthineers |

AI startup acquisition (IVDR compliance) |

+USD 77 million |

Feasibility Models for Market Expansion (2022–2024)

|

Region |

Model |

Outcome |

|

India |

PPP with Ayushman Bharat |

16% revenue growth |

|

Brazil |

Public-health partnerships |

20% test capacity increase |

|

Africa |

UN-funded lab deployments |

USD 30 million new revenue |

Challenges

- Gaps in reimbursement and pricing initiatives: The flow cytometry market is experiencing effective implementation obstacles, owing to a surge in evaluation expenses as well as inconsistent reimbursement policies. For instance, Medicaid in the U.S. covers only 40% of innovative flow cytometry tests, which leaves many patients, especially in immunology and oncology, to undergo USD 250 to USD 550 out-of-pocket expenditure. Besides, emerging economies are equally struggling, which restricts accessibility for low and middle-income patients, thus causing a hindrance in the overall upliftment.

- Interruptions in regulatory decisions: The presence of evolving strict regulations is slowing the entry into the market, especially in regions, including Japan and the EU. For instance, the In Vitro Diagnostic Regulation (IVDR) in the EU has enhanced expenses to USD 2.6 million per assay as of 2023, which unreasonably impacted small-scale manufacturers. Besides, delays increase R&D expenses, along with suspending revenue generation, especially for novel applications, such as CAR-T cell monitoring, thereby creating a negative impact on the market.

Flow Cytometry Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.8% |

|

Base Year Market Size (2024) |

USD 5.3 billion |

|

Forecast Year Market Size (2034) |

USD 12.5 billion |

|

Regional Scope |

|

Flow Cytometry Market Segmentation:

Product Segment Analysis

Based on the product, the reagents and consumables segment is anticipated to garner the largest share of 45.9% in the market by the end of 2034. The segment’s development is fueled by an increase in the need for buffers, staining kits, and fluorochrome-labeled antibodies, particularly in precise immunotherapy and medicine. Besides, penetration in emerging markets, automation in staining systems, and expansion in CAR-T therapies are other factors that are positively impacting the overall segment. For instance, the immunotherapy funding of USD 3.2 billion by the NIH as of 2024 has readily driven the requirement for cytokine and apoptosis recognition reagents.

Technology Segment Analysis

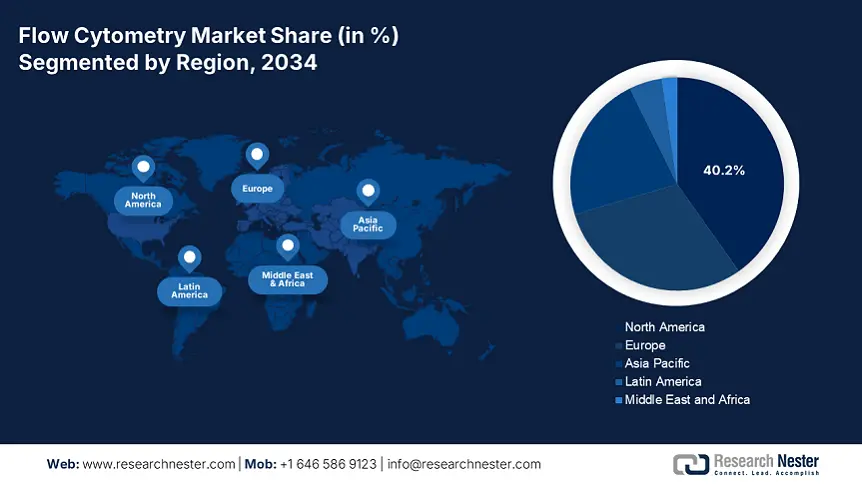

Based on the technology, the cell-based segment is expected to capture the second-largest share of 40.2% in the flow cytometry market during the forecast timeline. The segment’s growth is highly attributed to its significant role in monitoring immunotherapy, cancer research, and conducting single-cell analysis. Other key factors, such as administrative funding, CAR-T therapy expansion, and the rising demand for oncology, are also uplifting the segment. For instance, the National Cancer Institute (NCI) has reported that almost 55% of the latest cancer incidences demand cell-based MRD monitoring, which is readily fueling the segment’s demand.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Technology |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flow Cytometry Market - Regional Analysis

North America Market Insights

North America in the flow cytometry market is considered the dominating region with an expected market share of 40.2%, along with an 8.1% growth rate by the end of 2034. The market’s growth in the region is highly attributed to the U.S., which accounts for 90% of the region’s demand, further fueled by an expansion in Medicare coverage as well as the presence of strong federal funding. Additionally, the region is subject to high cancer cases, with more than 2.5 million cases recorded in 2024, along with an increase in the artificial intelligence (AI) integration, which caters to almost 45% of laboratories currently utilizing AI-based cytometers in the U.S., thus propelling the overall market growth.

The market in the U.S. is gaining increased exposure and is highly driven by government-based research and development, along with effective precision in medicine integration. For instance, the NIH’s USD 3.3 billion budget for immunotherapy as of 2024 has prioritized flow cytometry for CAR-T therapy monitoring. In addition, the 2023 Medicare policy update has increased its coverage for MRD evaluation, which has upsurged the spending to USD 850 million yearly. Therefore, all these factors are effectively responsible for positively impacting the market upliftment.

The flow cytometry sector in Canada is significantly growing, based on cancer research and the presence of provincial healthcare investments. Ontario has readily increased its funding for cytometry by 20% since 2021, and successfully covers over 200,500 patients every year. Besides, Health Canada has made the provision of USD 3.3 billion, which is 8.2% of the overall healthcare budget, for cytometry as of 2023, focusing on hematologic malignancies. Meanwhile, organizations such as Sysmex and Siemens Healthineers are readily dominating the market in the country with a combined share of 55% by integrating public and private partnerships.

North America Market Supply Chain & Trade Facilities (2021-2025)

|

Category |

U.S. |

Canada |

|

Domestic Manufacturing |

65% of reagents produced locally (BD, Thermo Fisher plants) |

33% local production (Siemens, Sysmex facilities) |

|

Imports (Key Sources) |

42% from Germany (reagents), 20% from Japan (optical components) |

51% from U.S., 31% from EU (PMDA-approved reagents) |

|

Exports (Key Markets) |

USD 895 million in cytometers to EU/APAC (2023) |

USD 122 million to Latin America (2024) |

|

Govt. Initiatives |

CHIPS Act (2022) boosted semiconductor supply for cytometers |

Health Canada’s USD 3.3 billion funding (2023) for local API production |

|

Supply Chain Disruptions |

24% price hike for German reagents (2023) |

16% delay in EU imports due to IVDR (2024) |

APAC Market Insights

Asia Pacific in the flow cytometry market is considered the fastest-growing region, with an anticipated market share of 22.3% and a growth rate of 9.4% during the forecast timeline. The market’s growth in the region is highly attributed to local manufacturing processes, government-based precise medical strategies, and a rise in the occurrence of chronic disorders. Besides, there are other key trends, including China’s dominance with 50% of the region’s revenue, driven by administrative approvals and an increase in R&D spending. Additionally, the presence of government programs in India is also fueling the market’s upliftment in the region.

The market in China is increasing with the existence of the NMPA’s USD 3.1 billion investment in R&D as of 2024, along with an estimated 30% growth in regional cytometer production. Besides, the country comprises more than 1.7 million yearly diagnostic incidences as of 2023, which has fast-tracked acceptance for CAR-T monitoring. However, almost 65% of reagent imports, particularly from Germany, have created vulnerabilities in the supply chain. Meanwhile, organizations, including Mindray, have bridged barriers with AI-based systems, thus suitable for the overall market growth.

The flow cytometry market in India is gaining increased traction with the remaining 10% of the region’s revenue share, which usually originates from Ayushman Bharat’s at least 50,200 subsidized tests, along with USD 1.9 billion in yearly government expenditure. In addition, approximately 2.6 million patients have also been driving the market demand in the country since 2023. Besides, Cytek’s USD 50,500 portable cytometers have readily achieved USD 35 million in sales in 2023, which addressed affordability barriers, thereby positively uplifting the market in the country.

Government Investments & Policies for Flow Cytometry (2021-2025)

|

Country |

Policy/Initiative |

Funding (USD) |

Launch Year |

Impact |

|

South Korea |

AI-Based Diagnostic Expansion Program |

125 million |

2022 |

32% labs adopted AI cytometers by 2024 |

|

Nano-Bio Convergence Project |

76 million |

2021 |

Boosted local reagent production by 16% |

|

|

Malaysia |

National Precision Medicine Initiative |

51 million |

2023 |

22% increase in cytometry test capacity |

|

Medical Device Subsidy Scheme |

36 million |

2021 |

520+ compact cytometers deployed |

|

|

Australia |

Medical Research Future Fund (MRFF) Grants |

92 million |

2022 |

Funded 15+ CAR-T therapy trials |

|

Rural Health Cytometry Access Program |

28 million |

2024 |

41% cost reduction for regional labs |

Europe Market Insights

Europe in the flow cytometry market is expected to hold a considerable share of 30.2% during the forecast period. The market’s development in the region is effectively fueled by the presence of EU-based funding strategies, a surge in the aging population, and the existence of precise medicine incorporation. Germany is leading with 35% of the region’s share, which is driven by demand growth and investment. This is followed by the UK, with 30% of the regional share, owing to budget allocation for healthcare services. Additionally, France accounts for 25% of the share in the region, owing to therapy-specific monitoring.

The market in Germany is dominating the region, fueled by € 4.5 billion in federal funding as of 2024, along with the leadership aspect among IVDR-compliant progressions. Besides, the country’s 12.8% demand growth as of 2021 has reflected the strong integration, especially for CAR-T therapy monitoring and cancer diagnostics, with organizations such as Siemens Healthineers achieving 22% of the market share through AI-based systems. Therefore, all these factors are denoting an optimistic outlook of the overall market in the country.

The flow cytometry market in the UK is also gaining increased exposure, which is deliberately supported by 8.5% of the NHS allocation of budget, accounting for £ 1.6 billion as of 2023, particularly for lymphoma and leukemia diagnostics. Besides, the ABPI has reported that there has been an upsurge of 17.5% in CAR-T trials as of 2022, which has effectively fueled the need for increased parameter-based cytometers. Meanwhile, tactical collaborations, including Oxford University’s AI cytometry project, have aimed to diminish expenses by at least 23.5% by the end of 2030, thereby suitable for market development.

Key Flow Cytometry Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is severely united, with the existence of organizations, including Beckman Coulter, Thermo Fisher, and BD, jointly holding a share of 70%. These companies have implemented certain strategies, such as administrative agility, local production processes, and AI incorporation. For instance, Cytek and Sony have successfully leveraged AI to diminish data analysis duration by at least 48%. Meanwhile, Thermo Fisger’s plant in Singapore has reduced expenses by 25% through localized production. Likewise, BD’s FDA-approved HIV assays have enhanced Medicare coverage by approximately 12%, thereby positively uplifting the market globally.

Here is a list of key players operating in the global market:

|

Company Name (Country) |

Industry Focus |

Market Share (2024) |

|---|---|---|

|

BD Biosciences (U.S.) |

Leading provider of clinical/research cytometers (e.g., FACSymphony) |

27% |

|

Thermo Fisher Scientific (U.S.) |

High-throughput analyzers & reagents (Attune, Invitrogen™ antibodies) |

23% |

|

Beckman Coulter (U.S.) |

Cell sorters (MoFlo) & hematology analyzers (DxH 900) |

19% |

|

Agilent Technologies (U.S.) |

Compact cytometers (NovoCyte) for pharma R&D |

10% |

|

Bio-Rad Laboratories (U.S.) |

ZE5 Cell Analyzer for CAR-T monitoring |

9.5% |

|

Sony Biotechnology (U.S.) |

Spectral cytometry (ID7000) & AI-driven data analysis |

xx% |

|

Cytek Biosciences (U.S.) |

Full-spectrum cytometry (Aurora) for multispectral applications |

xx% |

|

Miltenyi Biotec (Germany) |

MACSQuant systems for stem cell research |

xx% |

|

Sysmex (Germany) |

Clinical flow cytometers (XN-Series) for leukemia diagnostics |

xx% |

|

Luminex Corporation (U.S.) |

xMAP multiplexing technology for high-parameter assays |

xx% |

|

BioLegend (U.S.) |

Antibodies & reagents for immunophenotyping |

xx% |

|

Merck Millipore (Germany) |

Guava systems for apoptosis studies |

xx% |

|

Danaher (U.S.) |

Leica Microsystems’ imaging-integrated cytometry |

xx% |

|

Apogee Flow Systems (UK) |

Microfluidic cytometers for nanoparticle analysis |

xx% |

|

NanoCellect Biomedical (U.S.) |

WOLF Cell Sorter for gentle cell sorting |

xx% |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, BD Biosciences successfully unveiled the FACSDiscover S8 Cell Sorter, which effectively integrates spectral cytometry and spatial biology for conducting CAR-T therapy research.

- In March 2024, Thermo Fisher Scientific effectively strengthened its Attune CytPix Flow Cytometer line with AI-powered image investigation, which enables the actual time for tracking cell morphology.

- Report ID: 7892

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flow Cytometry Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert