Fish Protein Hydrolysate Market Outlook:

Fish Protein Hydrolysate Market size was valued at USD 383.6 million in 2025 and is anticipated to exceed USD 659.6 million by the end of 2035, registering over 5.6% CAGR during the forecast period i.e., between 2026-2035. In 2026, the industry size of the fish protein hydrolysate is assessed at USD 405.1 million.

The growth of the fish protein hydrolysate market is mainly influenced by the demand from the aquafeed and functional food sectors. The rising use of fish processing by-products derived from tilapia, shrimp, salmon, and herring further enhances protein recovery and nutrient recycling from these fish species. Government-funded aquaculture research initiatives underline the increased efficiency of FPH in improving feed conversion ratios, ensuring sustainability in the supply chain, and reducing greenhouse gas emissions. There has been increased research and development related to FPH for advanced fractionation and debittering.

Supply chains are predicated on by-product availability from pelagic and aquaculture species, helped by increased processing capacity operating facilities currently employed in North America and Europe. Trade classification also systematized fish protein concentrates, while the Producer Price Index for uncooked fish products experienced a steady increase, indicating stable upstream costs of manufacturing. The new generation of use cases of off-the-shelf enzymatic extraction systems now better facilitate export-enabling processing capable of competing in all global trade routes.

Key Fish Protein Hydrolysate Market Insights Summary:

Regional Highlights:

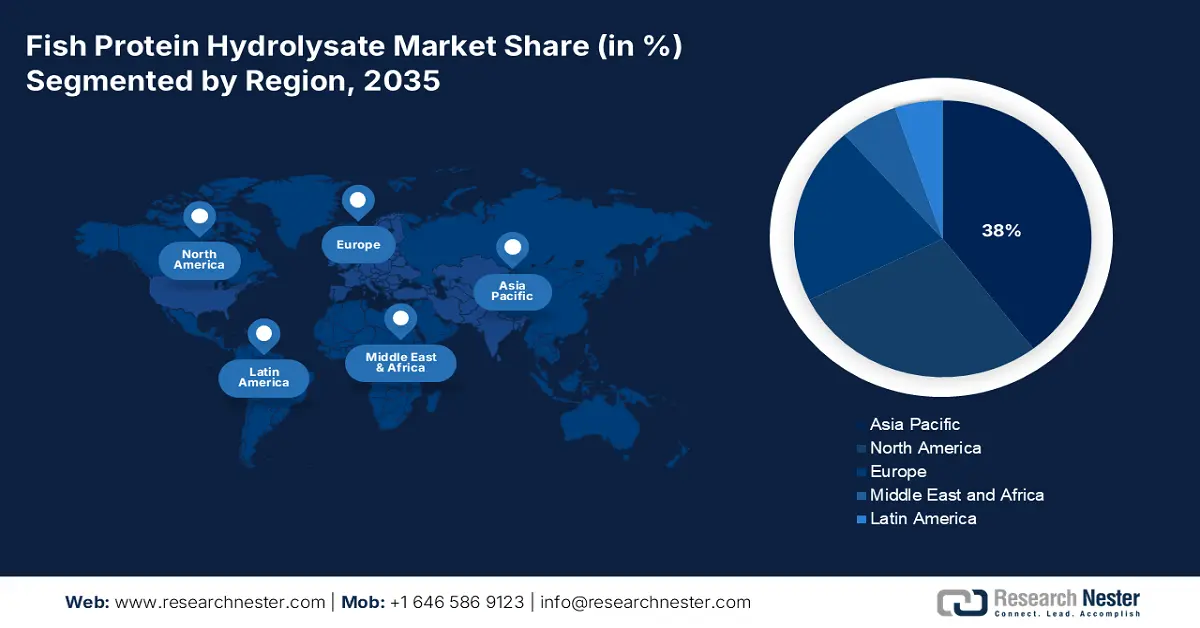

- By 2035, the Asia Pacific fish protein hydrolysate market is expected to hold a 38% share during 2026–2035, supported by expanding use of seafood byproducts, increased aquaculture production, and the acceptance of sustainable chemistry.

- The North America fish protein hydrolysate market is anticipated to secure a 23.6% share by 2035 as it benefits from rising adoption of sustainable protein supplements in aquaculture, pet food, and nutraceuticals.

Segment Insights:

- During 2026–2035, the animal feed segment in the fish protein hydrolysate market is projected to capture a 48.7% share by 2035, fueled by sustainability initiatives, fishmeal replacement efforts, and improved protein efficiency in aquatic animal production.

- The fish waste segment is projected to achieve a 46% share by 2035, supported by intensifying circular economy models and zero-waste marine processing.

Key Growth Trends:

- Rising demand in animal feed and aquaculture

- Growing adoption of the agrochemical formulations

Major Challenges:

- Trade barriers and WTO-reported tariff disputes

- High pricing pressures in competitive feed markets

Key Players: Bio-marine Ingredients Ireland Ltd., TripleNine Group, Copalis Sea Solutions, Scanbio Marine Group, Fisco Inc., Hofseth Biocare ASA, SOPROPÊCHE, Marutham Bio Age Pvt. Ltd., Great Pacific BioProducts, Ocean Harvest Technology, Taian Health Chemical Co., Ltd., Kemin Industries South Asia Pvt. Ltd., Bio-Marine Biotechnology Australia, Daesang Corporation

Global Fish Protein Hydrolysate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 383.6 million

- 2026 Market Size: USD 405.1 million

- Projected Market Size: USD 659.6 million by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Indonesia, Vietnam, Norway, South Korea, Brazil

Last updated on : 20 August, 2025

Fish Protein Hydrolysate Market - Growth Drivers and Challenges

Growth Drivers

-

Rising demand in animal feed and aquaculture: Fish protein hydrolysate (FPH) is emerging as a powerful option in animal feed and aquaculture due to its high digestibility and nutritional properties. According to the American Feed Industry Association in 2023, livestock, poultry, and farmed aquaculture in the U.S. consumed nearly 284 million tons of safe, high-quality, and nutritious feed. FPH is a sustainable and coherent protein source and has favorable use cases in the feed industry. Furthermore, upgradation in enzymatic hydrolysis and fractionation technologies is enhancing consistency of the product, lowering bitterness, and enabling tailored formulations for specific species and growth stages.

-

Growing adoption of the agrochemical formulations: In fertilizer markets, the use of fish protein hydrolysate would cover the use of nitrogen in closed circular economies and the use of amino acids in sustainable farming practices. When the FPH is mixed with liquid or other soluble agrochemicals, it functions as a soil enhancer owing to its richness in amino acids. Various new-age companies are actively amalgamating FPH into their products as an initiative for the organic and sustainable farming initiative. According to data published by IFOAM - Organics International in 2022, 96.3 million hectares of land were under organic management. These factors are propelling the fish protein hydrolysate market growth during the forecasted period.

-

Increase consumption of the nutraceutical applications: The human nutrition sector is witnessing burgeoning interest in marine-based protein hydrolysates due to their bioactive properties. The inclusion of the FPH peptides has illustrated several benefits, such as muscle recovery, anti-inflammatory, etc., making them adequate as a functional food. According to a survey conducted by the National Institutes of Health in 2023, in the U.S., more than 51% of people take at least one dietary supplement. Also, with the increasing worldwide inclination for clean-label and protein-enriched diets, nutraceutical companies are widely spreading their product portfolios to include FPH in powders, capsules, and ready-to-drink formulations.

Challenges

-

Trade barriers and WTO-reported tariff disputes: A plethora of non-tariff barriers were reported in 2022 as non-compliance with regulations about the traceability of marine resources. This led to refusals of fishery product imports from Southeast Asia into the EU. As a result, even though a product may have ISO 22000 certification, which assures some safety, it can still be delayed for customs clearance or rejected upon arrival. Norway-based Biomega Group turned these challenges into an opportunity by adopting blockchain-based traceability systems. The company managed to move faster through customs while expanding its export opportunities to the Netherlands and Sweden.

-

High pricing pressures in competitive feed markets: FPH can easily compete directly with low-cost alternatives, e.g., soy protein and fishmeal. In competitive markets such as aquafeed, where price sensitivity is high, these elevated costs can limit adoption unless supported by clear performance advantages or regulatory incentives. Also, sensory limitation is particularly problematic in functional foods, beverages, and nutraceuticals, where consumer acceptance depends on palatability.

Fish Protein Hydrolysate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 383.6 million |

|

Forecast Year Market Size (2035) |

USD 659.6 million |

|

Regional Scope |

|

Fish Protein Hydrolysate Market Segmentation:

Application Segment Analysis

The animal feed segment is predicted to gain the largest fish protein hydrolysate market share of 48.7% during the projected period by 2035. The growth of the market can be attributed to the sustainability initiatives, fishmeal replacement, and protein efficiency improvement in aquatic animal production. The increasing global demand for animal-derived protein, driven by rising population growth, has remarkably propelled the need for functional food ingredients. FPH is a highly accessible and nutrient-dense protein source, which is rich in essential nutrients and adequate to feed livestock and aquaculture species.

Source Segment Analysis

The fish waste segment is projected to garner the most significant growth by 2035, with 46% fish protein hydrolysate market share. The growth of the market can be attributed to the rising emphasis on circular economy models and zero-waste marine processing. Government organizations, particularly the U.S. Department of Agriculture, are sponsoring programs to encourage industry to utilize whole marine biomass. USDA's BioPreferred Program supports the aspiration to convert seafood by-products into bio-based commercial products, such as FPH. These sustainability initiatives are driven by a reduction in raw material costs and focus on global environmental compliance, rendering fish waste the best commercially viable product source.

Form Segment Analysis

The powder segment is anticipated to constitute 58% of the share by 2035. The fish protein hydrolysate market growth can be prescribed to the ease of storage and transport, resistance to spoilage, and superior compatibility for the developing nutraceutical formulations. Additionally, powder form is perfect for retaining the nutritional integrity of bioactive peptides during processing and storage. This ensures congruous quality and efficacy in a variety of applications, such as aquaculture feed and sports nutrition products. The lesser transportation costs per unit of protein and adaptability in both dry and reconstituted uses continue to foster adoption across high-growth markets. These factors are propelling the segment growth during the forecasted period.

Our in-depth analysis of the global fish protein hydrolysate market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Application |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fish Protein Hydrolysate Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific fish protein hydrolysate market is expected to hold 38% of the market share due to expanding use of seafood byproducts, increased aquaculture production, and the acceptance of sustainable chemistry. Countries like China, India, and Indonesia consume the most fish feed, which stimulates market growth and the development throughout the region, while South Korea, Malaysia, and Japan support bio-based innovations through national circular economy and R&D initiatives. The market in China is propelled by rising demand for aquaculture feed and pet nutrition. The country is the largest contributor to worldwide aquatic food availability, keeping the feed volume high. According to data published by the Food and Agriculture Organization, there are 20,276 different species living in the country’s marine environment.

India is witnessing prominent growth in the coming decade. The growth of the fish protein hydrolysate market can be attributed to government-led modernization initiatives and increasing demand for nutritious products. The country’s flagship program, Pradhan Mantri Matsya Sampada Yojana (PMMSY), is to modernize fisheries and upgrade productivity. According to the Government of India data in February 2025, the country remains the 2nd largest fish-producing country with 8% share in the global production of fish. Also, the country is grappling with widespread protein deficiency, and FPH renders a potent source capable of augmenting the market growth.

North America Market Insights

The North America fish protein hydrolysate market is anticipated to garner 23.6% of the share, driven by rising demand for sustainable protein supplements in aquaculture, food for pets, and nutraceuticals. In the U.S., the market growth is gaining maximum momentum, driven by burgeoning demand for high-quality protein alternatives in aquaculture feed. Also, there is increased demand for premium pet food products that are augmenting the usage of fish-derived protein. According to data published by the American Pet Products Association in 2025, more than 94 million households in the country own a pet.

Similarly, the fish protein hydrolysate market in Canada is powered by consumer inclination for sustainable food and supplements. The cod and herring cold-water fisheries in the country are providing an abundant source for procuring raw material for manufacturing high-quality hydrolysates, streamlining the supply chain stability. Additionally, the data published by the Canadian Institute of Food Safety in February 2025, 64.2% of the shoppers are inclined to opt for the brand for better ingredient transparency. The mushrooming interest in clean-label and natural supplements is supporting the market growth in the country.

Europe Market Insights

Europe market is set to register significant revenue owing to growing demand for sustainable protein sources across animal feed, nutraceuticals, and functional foods. A plethora of projects are promoting the usage of fish byproducts and regulatory support. Additionally, due to robust research and development strategies and government support, Germany is emerging as the largest growth-acquiring in the region. Germany's leadership is further cemented by its sophisticated biotech industry and stringent sustainability regulations. The data published by the Government in 2021 stated that more than 18,310 tonnes of fish were produced in the aquaculture business in the country.

The Netherlands is projected to garner significant traction owing to the strong commitment of the country to the circular economy and integrating ultra-modern aquaculture strategies. The country is home to a global powerhouse in fish feed, Nutreco, which derives innovation in the ingredients of the feed. Together, these structural benefits —a supportive innovation ecosystem, regulatory incentives, and sustainable feed demand—are propelling the growth pathway of the FPH market in the Netherlands. Also, under the Dutch National Protein Strategy, the country is endeavoring by 2030 to achieve an equivalent split for the consumption of animal and plant-based protein.

Key Fish Protein Hydrolysate Market Players:

- Bio-marine Ingredients Ireland Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TripleNine Group

- Copalis Sea Solutions

- Scanbio Marine Group

- Fisco Inc.

- Hofseth Biocare ASA

- SOPROPÊCHE

- Marutham Bio Age Pvt. Ltd.

- Great Pacific BioProducts

- Ocean Harvest Technology

- Taian Health Chemical Co., Ltd.

- Kemin Industries South Asia Pvt. Ltd.

- Bio-Marine Biotechnology Australia

- Daesang Corporation

The fish protein hydrolysate market is fairly consolidated worldwide, with European companies like Bio-marine Ingredients Ireland, TripleNine Group, and Scanbio Marine Group controlling the value chain through sustainable sourcing and cutting-edge enzymatic processing; FPH is being incorporated into functional food and aquaculture solutions by U.S. company Cargill and Germany-based Symrise; strategic moves include vertical integration, joint ventures, and research and development in value-added applications like animal feed and nutraceuticals; new entrants in Malaysia and India are using low-cost production and government incentives for the bioeconomy to enter international markets; competition is getting fiercer as companies vie for certifications, sustainable branding, and proprietary hydrolysis technologies.

Here is a list of key players operating in the fish protein hydrolysate market:

Recent Developments

- In February 2025, Hofseth announced a strategic partnership with Symrise to scale its enzymatic hydrolysis capacity. Symrise provided financing and exclusive distribution arrangements for certain marine ingredient brands. This is an investment/strategic alliance that expands production and market reach rather than an acquisition.

- In February 2024, OmegaHealth Labs launched a new fish protein hydrolysate-based supplement aimed at improving joint health and reducing inflammation. The product leverages the bioactive peptides from fish proteins to promote faster recovery from musculoskeletal injuries.

- Report ID: 4765

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fish Protein Hydrolysate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.