Fiber Optic Component Market Outlook:

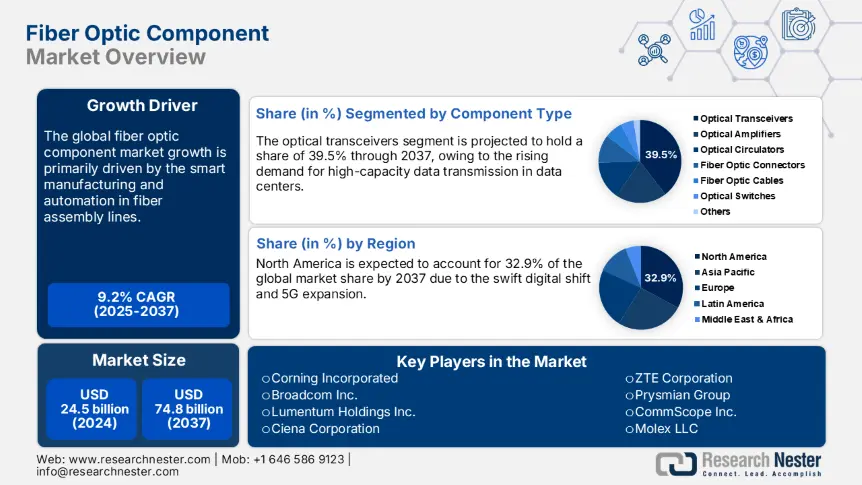

Fiber Optic Component Market size was USD 24.5 billion in 2024 and is estimated to reach USD 74.8 billion by the end of 2037, expanding at a CAGR of 9.2% during the forecast period, i.e., 2025-2037. In 2025, the industry size of fiber optic component is assessed at USD 26.6 billion.

The global fiber optic component market's core is a complex supply chain, influenced by the raw materials such as silica, derived from industrial sand and gravel. As per the U.S. Geological Survey (USGS) in 2023, the global production of silica reached approximately 330.4 million metric tons, with the U.S. contributing a substantial 110.2 million tons, sufficient to keep the optical fiber production lines running smoothly. The consistent supply chain of raw materials is expected to fuel the production and commercialization of fiber optic components in the coming years.

The producer price index for broadcast and wireless communications equipment manufacturing, including optical components, increased by 3.5% between April 2023 and April 2024, underling upward pressure on production costs, according to the U.S. Bureau of Labor Statistics (BLS). Also, the consumer price index for telecommunications equipment reported a year-on-year increase of 2.1%, indicating a moderated pass-through to end users. The continuously evolving demands are likely to propel the overall fiber optic component trade during the forecast period.

Fiber Optic Component Market - Growth Drivers and Challenges

Growth Drivers

-

Smart manufacturing and automation in fiber assembly lines: The smart manufacturing trend is poised to fuel the sales of fiber optic components in the coming years. The National Institute of Standards and Technology’s (NIST) smart manufacturing programs focusing on automation are expected to enhance the production scalability and quality of optical component assembly. Manufacturers are investing in robotics, machine vision, and digital twins for fiber optic component production, owing to the efficiency in reducing unit defect rates by more than 25.4%. Another factor that the rising labor costs are necessitating businesses to invest in Industry 4.0 tools to enhance throughput and precision in photonic assembly.

- Strategic government investments and public-private partnerships: The rising public spending in the ICT sector is likely to contribute to the overall trade of fiber optic components. The national broadband and semiconductor strategies are also set to channel billions into fiber infrastructure. The U.S. CHIPS and Science Act and the BEAD Program’s more than USD 50.4 billion investment are estimated to contribute to accelerate the production of optical network hardware.

Technological Innovations in the Fiber Optic Component Market

The silicon photonics, quantum-secure transmission, and edge computing integration are expected to double the revenues of fiber optic component manufacturers during the projected timeframe. The digital shift is estimated to propel the demand for fiber optic components in the telecom, manufacturing, defense, and finance sectors. The continuous investments in technological innovations are further accelerating the demand for advanced fiber optic solutions. The table below reveals the current technological trends and their outcomes.

|

Technology |

Sector |

Company |

Use Case |

Outcome / Impact |

|

Silicon Photonics |

Data Centers |

Intel + Meta |

800G photonics modules |

30.5% energy savings |

|

Quantum-Secure Transmission |

Finance |

JPMorgan + Toshiba |

Quantum Key Distribution over fiber |

100 km secure trading link |

|

Edge Computing Integration |

Manufacturing |

Siemens |

Real-time analytics using fiber-linked edge nodes |

Decreased latency by 50.5% |

Sustainability Trends in the Fiber Optic Component Market

The strict environmental regulations and climate goals are set to boost the adoption of fiber optic components in the coming years. The renewable energy sourcing and circular economy models are pushing the trade of fiber optic components. The sustainability trend and ESG mandates are also accelerating the sales of fiber optic solutions. The table below reveals the current sustainability strategies and their business impacts in the fiber optic component market.

|

Company |

Sustainability Initiatives |

Goals & Vision |

Impact on Business |

|

Corning Inc. |

10.6% GHG reduction (2023); facility retrofits |

Net-zero emissions by 2050; 30.5% reduction by 2030 |

Enhanced ESG ratings; increased institutional investor interest |

|

Prysmian Group |

51.4% energy from renewables (2022); solar & wind procurement |

100% renewable energy use by 2030 |

6.6% cost reduction in energy-intensive processes |

|

Fujikura Ltd. |

32.5% waste reduction via circular fiber recycling (2023) |

Zero landfill waste in manufacturing by 2030 |

14.3% margin rise in the photonics division |

Challenges

-

High cybersecurity compliance costs: Fiber optic systems in the tech and telecom world have to follow strict cybersecurity regulations set by NIST and ENISA. These polices and rules increase the compliance costs for manufacturers, hampering their profit margins. Cisco shared that in 2023, 15.5% of the cost to set up its optical transceivers for U.S. government projects went just to meeting FedRAMP and supply chain security standards. This hits small vendors hard, as they often don’t have high budgets for federal certifications.

-

Lack of infrastructure readiness in emerging economies: The poor infrastructure is expected to hamper the sales of fiber optic components to some extent in the emerging markets. In some parts of Africa and Southeast Asia, laying fiber optic cables is expensive and slow due to the shoddy trenching systems and a lack of coordinated planning. According to the African Union’s 2024 ICT report, about 40.5% of delays in bringing broadband to rural areas were due to the logistical hurdles in setting up fiber networks. For example, Huawei’s effort to expand broadband in rural Kenya got stuck for eight months as a result of disagreements with local governments over land access rights.

Fiber Optic Component Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

9.2% |

|

Base Year Market Size (2024) |

USD 24.5 billion |

|

Forecast Year Market Size (2037) |

USD 74.8 billion |

|

Regional Scope |

|

Fiber Optic Component Market Segmentation:

Component Type Segment Analysis

The optical transceivers segment is projected to capture 39.5% of the fiber optic component market share through 2037. Optical transceivers are the most sought-after component type owing to the rising demand for high-capacity data transmission in data centers and 5G base stations. According to the U.S. Department of Energy, the average hyperscale data center utilizes more than 20,100 optical transceivers and is estimated to increase by 22% in the hyperscale construction globally through 2030. Furthermore, the government programs, including the NTIA’s Broadband Equity, Access, and Deployment (BEAD) Program of around USD 42.45 billion, are fueling transceiver deployment across U.S. telecom infrastructures.

Application Segment Analysis

The telecommunications segment is estimated to account for 42.1% of the fiber optic component market share throughout the forecast period. The expanding FTTH and deployment of 5G networks are contributing to the increasing application of fiber-optic components in the telecom sector. The Organization for Economic Co-operation and Development (OECD) report reveals that the fiber connections reached 42.4% of fixed broadband subscriptions in 2023, with growth exceeding 10.3% annually in Asia Pacific countries. This highlights that investing in emerging regions is poised to double the revenues of telecom-based fiber optical component producers. Furthermore, the governmental infrastructure plans, such as India’s BharatNet and the EU’s Gigabit Infrastructure Act, are set to drive investments in long-haul and last-mile optical fiber components.

Our in-depth analysis of the fiber optic component market includes the following segments:

|

Segment |

Subsegments |

|

Component Type |

|

|

Data Rate |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiber Optic Component Market - Regional Analysis

North America Market Insights

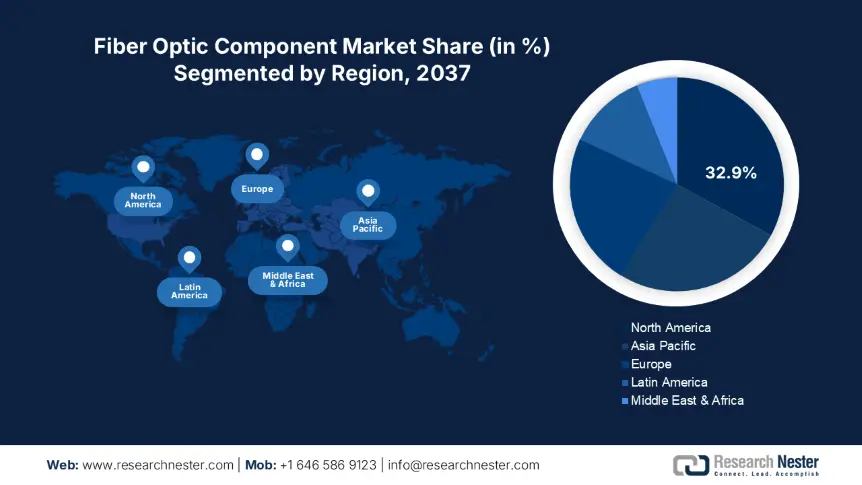

The North America fiber optic component market is estimated to hold 32.9% of the global revenue share by 2037, owing to expansive broadband funding and 5G network deployment. The growing demand for high-speed, low-latency data services is also contributing to the high sales of fiber optic components. The government initiatives, such as the BEAD Program and the Universal Broadband Fund (UBF), are supporting the trade of fiber optic components. Moreover, the rise in smart cities, AI data centers, and edge computing frameworks is set to double the revenues of key players in the coming years.

The sales of fiber optic components in the U.S. fiber optic component market are poised to hold a dominant share owing to the aggressive digital infrastructure policies. The heavy government funding programs and schemes are propelling the adoption of fiber optic components. The BEAD program, backed by USD 42.6 billion, is a key factor significantly supporting fiber rollout in underserved areas. The increasing expansion of 5G communication networks is likely to accelerate the production and commercialization of fiber optic components. The country is also set to hold a leading position in the overseas trade of fiber optic components.

The Canada fiber optic component market growth is expected to be influenced by the universal access goals and investments in broadband expansion. The increasing public funding for activities is contributing to the high deployment of fiber optic components. The Innovation, Science and Economic Development (ISED) agency has allocated more than CAD 3.4 billion through the Universal Broadband Fund to achieve nationwide fiber coverage by 2030.

Europe Market Insights

The Europe fiber optic component market is anticipated to capture 22.1% of the global revenue share through 2037. The EU-wide 5G backhaul deployment and digital sovereignty goals are contributing to the sales of fiber optic components. The broadband infrastructure modernization is increasing the deployment of fiber optic components. The Digital Decade, targeting 100% gigabit connectivity by 2030, is also contributing to the increasing sales of fiber optic solutions. The EU’s Connecting Europe Facility (CEF Digital) €1.7 billion allocation for cross-border fiber projects between 2021 and 2027 is fueling the deployment of fiber optic solutions.

Germany fiber optic component market is set to lead the sales of fiber optic components owing to the robust fiber rollout strategies and industrial digitalization programs. The EU-aligned infrastructure spending is supporting the production and commercialization of fiber optic solutions. The Federal Ministry for Digital and Transport (BMDV) has invested more than €12.5 billion in digital infrastructure between 2021 and 2026, with a significant chunk reserved for fiber backhaul and FTTH deployments. Also, the country witnessed a 42.5% growth in fiber optic component demand from 2021 to 2024, with over €4.0 billion spent in 2024. Such developments are showcasing the profitability of investing in the country.

The full-fiber broadband targets and data center expansion aims are accelerating the trade of fiber optic components in the U.K. According to the Department for Science, Innovation & Technology (DSIT), the country’s Project Gigabit, set to deliver gigabit-capable fiber broadband to 85.5% of UK premises by 2025-end, and 99.5% by 2030, is opening high-earning opportunities for fiber optic component manufacturers. The supportive government policies and funding initiatives are supporting the overall market growth.

Country-Specific Insights

|

Country |

ICT Budget Allocation to Fiber Optic Component |

Market Demand Trend (2021-2024) |

Investment Example |

|

UK |

22.4% in 2023 (up from 17.3% in 2020) |

+38.1% in demand since 2021 |

Openreach: £15.5B FTTP rollout, reaching 25.2M premises by 2026 |

|

Germany |

€4.0B in 2024 (ICT budget share: 25.2%) |

+42.5% demand increase since 2021 |

BMDV pledged €12.3B in digital infrastructure expansion |

|

France |

19.5% (up from 14.9% in 2021) |

+31.4% growth since 2021 |

France Très Haut Débit: €20B invested since 2013 |

APAC Market Insights

The Asia Pacific fiber optic component market is foreseen to increase at a CAGR of 9.1% from 2025 to 2037. The robust national digitalization programs and increasing demand for advanced communication networks are accelerating the deployment of fiber optic components. The government-backed infrastructure projects across countries such as China, India, Japan, and South Korea are anticipated to boost the sales of fiber optic solutions in the years ahead. The swiftly expanding telecommunications, data center, and military & aerospace sectors are further increasing the adoption of fiber optic components. The funding programs and favorable policies are further set to attract international players.

China fiber optic component market is estimated to lead the sales of fiber optic components owing to robust public spending and the digital shift. The Ministry of Industry and Information Technology (MIIT) and China Academy of Information and Communications Technology (CAICT) are driving aggressive broadband, cloud, and 5G expansion policies. In 2024, more than ¥250.5 billion was invested in fiber and 5G integration, leading to high sales of fiber optic components. Also, in 2023, over 1.2 million businesses, especially industrial IoT, autonomous mobility, and national datacenter integrated fiber optic systems.

The India fiber optic component market is expected to expand at a high pace during the study period. The massive digital infrastructure rollouts, especially under Digital India and BharatNet Phase III, are promoting the sales of fiber optic components. The fintech, e-governance, telecom, and defense sectors are set to fuel the deployment of fiber optic solutions in the years ahead. The Production Linked Incentive (PLI) scheme for telecom gear and optical components has attracted more ₹12,000 crore in private investment, which is directly stimulating local manufacturing of fiber optic components.

Country-Specific Insights

|

Country |

Gov. ICT Spending on Fiber Optics (Latest) |

Growth/Adoption Trend |

|

Japan |

18.7% of METI tech budget in 2024 (¥3.2B) |

¥3.2B in 2024 vs ¥2.3B in 2022; growth driven by MIC’s 5G/fiber integration mandate |

|

Malaysia |

MYR 620.3M in 2023 under JENDELA and MyDIGITAL (MDEC) |

3X company adoption from 2013-2023; funding up 62.5% per KKD stats |

|

South Korea |

₩1.5T ($1.3B) in 2023 under the MSIT ICT infra program |

89.5% urban coverage with fiber; NIPA: 23.5% YoY growth in photonics & 5G optical components |

Key Fiber Optic Component Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global fiber optic component market is characterized by the presence of gigantic companies and the increasing emergence of start-ups. American companies such as Corning, Coherent, and Broadcom lead the pack, holding nearly 40.5% of the market with their cutting-edge optical transceivers and passive components. Chinese giants, including Huawei and ZTE, are ramping up production, owing to the massive domestic infrastructure projects. European and Indian firms are targeting strategic acquisitions and forming partnerships to expand their global reach. Furthermore, the Japanese players are carving out their niche through precision engineering and innovation.

Here is a list of key players operating in the fiber optic component market:

|

Company Name |

Country of Origin |

Revenue Share 2024 |

|

Corning Incorporated |

United States |

13.6% |

|

II-VI Incorporated (now Coherent Corp.) |

United States |

10.7% |

|

Broadcom Inc. |

United States |

9.1% |

|

Lumentum Holdings Inc. |

United States |

7.6% |

|

Ciena Corporation |

United States |

6.9% |

|

Finisar (subsidiary of II-VI/Coherent) |

United States |

xx% |

|

Huawei Technologies Co., Ltd. |

China |

xx% |

|

ZTE Corporation |

China |

xx% |

|

Prysmian Group |

Italy |

xx% |

|

CommScope Inc. |

United States |

xx% |

|

Molex LLC |

United States |

xx% |

|

Amphenol Corporation |

United States |

xx% |

|

Sterlite Technologies Ltd. |

India |

xx% |

|

LS Cable & System Ltd. |

South Korea |

xx% |

|

FiberHome Telecommunication Technologies Co., Ltd. |

China |

xx% |

Below are the areas covered for each company in the fiber optic component market:

Recent Developments

- In April 2024, Coherent launched its ICE6 Turbo Coherent Optics, designed for metro and long-haul fiber networks. The platform uses advanced DSP algorithms and photonic integration, delivering 40.4% more capacity per fiber.

- In March 2024, Sterlite Technologies Ltd. announced the launch of its pFTTX programmable fiber access platform. The solution reduces CapEx by 25.5% and OpEx by 40.5%.

- In January 2024, Lumentum Holdings Inc. unveiled its 800G QSFP-DD and OSFP transceivers optimized for hyperscale data centers and AI clusters. The company reported a 19.4% year-over-year increase in revenue in the first quarter of 2024.

- Report ID: 7908

- Published Date: Jul 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiber Optic Component Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert